Money as a Measuring Stick

This blog post is a guest post on BullionStar’s Blog by the renowned blogger JP Koning who will be writing about monetary economics, central banking and gold. BullionStar does not endorse or oppose the opinions presented but encourage a healthy debate.

Imagine if the world’s metre sticks all grew or shrunk a bit each year. That would make for a confusing system of weights and measures, wouldn’t it? Well, that is exactly what happens with money.

We have been measuring the world around us for thousands of years. Units like feet and cubits have been used for distances, pounds and kilograms to measure weight, and dollars and yen to measure economic value. Measuring value, however, is by far the most complicated of the measurements that must be taken. This is because – unlike the other units – the various items that have been used to represent dollars and yen are constantly fluctuating in value.

The British Pound, or lb

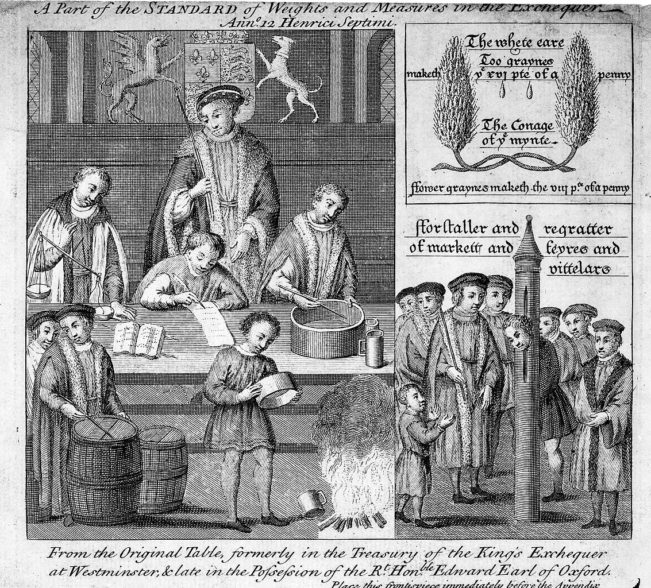

Monetary units have always been closely tied up with units of weight. For instance, the word “pound" has been used to describe both the British monetary unit (£) and the weight (lb). The pound weight was originally based on wheat. In 1266, King Henry III decreed that the British unit referred to as the grain should be defined as the weight of a corn of wheat “well dried, and gathered out of the middle of the ear." Thirty-two grains were to be equal to a pennyweight, twenty pennyweights equal to an ounce, and twelve ounces added up to a pound. So the early English pound, otherwise known as the Tower pound, was comprised of 7,680 “well-dried" grains from the middle of an ear of wheat.

The Tower pound wasn’t the only pound weight used in England. The Troy pound, used for gold and silver, contained 5,760 grains, while the Merchant pound was made up of 6,750 grains. To add to the confusion, the avoirdupois pound would contain 7,000 grains.

The Exchequer Standard

Although the grain unit served as the basis for weights, people didn’t go about their regular business of measuring the weights of things by counterbalancing them against tiny grains of wheat. Imagine how awkward it would be to go to the local market to ask for an ounce of meat! The butcher would have had to count out 640 grains and then counterbalance them on a scale against the hunk of meat, an arduous process that would have brought the gears of trade to a near halt. Buyers would have been constantly accusing sellers of not using appropriately dry grains, adding to the confusion.

Instead, the butcher would have owned a set of standardized metallic weights for making measurements. A customer could trust that the butcher’s weights were accurate because there was a carefully-adjudicated process in place for verifying weights and measures. At the core of this process were the monarch’s assayers, who had created a number of official metal weights that corresponded to an appropriate number of “well-dried" grains of wheat. These “standard weights", manufactured in 1496 under the reign of Henry VII, were safely stored at the Exchequer in London.

An Invariant Pound

What underpinned the reliability of the pound measurement was thus the existence of a near-perfect physical representation housed in the Exchequer. As long as these standard weights were properly stored, they would stay accurate for centuries, apart from a bit of oxidation and wear & tear.

Today, the British standard weights are housed at the National Physical Laboratory (NPL). The pound has long since lost its relevance, the UK having adopted the metric system. The NPL’s most important standard weight is known as Kilogram 18, the very basis of the UK’s entire mass scale. It is stored in a controlled environment in the lab’s basement. The video below, made by the NPL, shows Kilogram 18 and explores the idea of defining weight by an actual physical artifact.

Although the troy pound is no longer an official measurement, the troy ounce continues to be authorized as a measuring unit for precious metals. To meet the public’s need for calibrating their own weights, the NPL maintains a standard set of ounce troy weights (see pdf). The NPL’s troy weight probably isn’t that different from the one housed many centuries ago at the Exchequer.

The British Pound, or £

Having dealt with units of weight, let’s return to monetary units. One way to create a monetary measuring stick is to have some commodity – say gold dust – serve as the standard. Under this sort of monetary standard, prices of goods and services would be set in terms of ounces of gold dust. If a horse dealer prices his horses at one ounce, for instance, then a buyer would have to pour enough gold on one end of a scale so that it counter-balanced a one-pound weight at the other end. With this measurement completed, the transaction can be consummated.

Whereas the pound weight standard was extremely stable thanks to the reference weights stored in the Exchequer, a gold-ounce monetary standard would be relatively volatile. For instance, one might imagine the horse dealer pricing his horses at 1-ounce today but 2-ounces next year—not because the horses’ real value had changed, but because the value of gold dust itself had fluctuated.

Enter Coinage

Gold dust is difficult to handle, each measurement taking a fair amount of time to complete. Another problem is that gold is often diluted with other materials, but only a trained expert can tell that the mixture isn’t pure. We developed coinage to solve these challenges. By fusing gold or silver powder into a set of discs with discrete denominations, storing and handling was made infinitely easier. Instead of weighing the coins, they could simply be counted out at their face value. And since coins had the king’s seal of authenticity, users had at least some assurance that the discs in their wallets contained unadulterated amounts of precious metals.

But the development of precious metals coinage introduced a new measuring problem: debasement. At first, the pound weight (lb) and pound monetary value (£) were perfectly aligned. Anyone could bring a pound weight of silver to the London mint and get 240 pennies in return, and because the pound sterling was officially defined as 240 pennies, one pound of silver was equivalent to £1.

In 1247, Henry III decided to coin a pound weight of silver into 242 pennies instead of 240, at which point the pound sterling and pound weight parted company. The amount of pennies cut from a pound steadily increased over the centuries so that by the mid-1500s, a pound of silver was being turned into 720 pennies. Since it takes 240 pennies to make a pound, a pound of silver was now worth £3. Put differently, the pound sterling monetary unit (and its subdivisions the shilling and penny) contained one-third the silver it originally did. So while coins might have been more convenient than gold dust, they didn’t fix the measurement problem.

Debasements of the coinage were typically (though not always) undertaken by monarch as a revenue-enhancing measure, especially during wartime. When the gold and silver content of the coins was reduced, any member of the public could bring their existing full-bodied coins to the mint to be recoined into a greater quantity of coins. Until the prices of goods and services had adjusted, owners of fresh coins could buy more goods and services than people with old coins. To take advantage of momentarily cheap prices, the public flocked to the mints. Since the king or queen earned a toll on the amount of raw gold and silver passing through the mint, the debasement led to a one-time increase in their income.

Fiat Money: Either an Ideal or Awful Measuring Stick

When it comes to serving as society’s measure of economic value, fiat money is both Jekyll and Hyde. By fiat money, I mean non-redeemable paper banknotes and central bank deposits of the sort that all nation’s currently use. As the mild mannered Jekyll, fiat money effectively solves the mis-measurement problems described above. But as the evil Hyde, fiat money has often been history’s worst monetary measuring stick.

To see the Hyde side of things, we only need to look to history. Even though gold and silver coins failed to serve as ideal measuring sticks, their rate of debasement has been relatively slow. For instance, it took three centuries for the English pound sterling to lose two-thirds of its value. The Venezuelan bolivar, meanwhile, is currently falling by that amount every few weeks. When a national government finds that its finances are deteriorating, a central bank that issues irredeemable money serves as a tempting source of funds. The printing of banknotes and key-stroking of deposits takes far less effort than a debasement of the coinage.

The Jekyll side of the story is that a well-managed fiat currency can become a perfect measure of economic value. Earlier in this post, a new mining technology led to a glut of gold on the market, driving the price of gold coins and dust down, and the prices of everything else higher. Fiat money is not a commodity, nor convertible into one, so the economy’s price level can’t be dictated by developments in one small and far-flung market.

To create a perfect monetary ruler, a central bank begins by compiling data on the price of an average consumer basket of goods. To keep the price of this basket constant, it satisfies all sudden increases in the demand for money that would otherwise cause the price of the basket to deflate, and reduces the supply when a fall in demand for money would otherwise cause inflation. In other words, the central bank ensures that the purchasing power of the average consumer’s cash and deposit balances never varies.

In Closing…

So while fiat money is an improvement on gold and silver coins as a measure of economic value, it is simultaneously a retrogression. The key factors in determining whether a fiat currency will be an improvement or retrogression depends on how well it is managed by central bankers and whether the state’s finances are healthy. An incompetent manager of the currency won’t succeed in stabilizing the basket of consumer prices, even if the state is in fine fiscal form. If the state is desperate for funds, say because it is fighting a war, there is a good chance it will sacrifice the measuring stick function of fiat money in order to use the central bank as a financing arm of the war effort. And because central bank money is so much easier to create than commodity money, a fiat measuring stick is likely to get much more bent out of shape than a commodity-based measuring stick.

The pound weight was rock solid for centuries. It is hard to imagine that the pound sterling, whether in fiat or coin form, can ever be as stable.

Sources

Carl Ricketts and John Douglas, Marks and Marking of Weights and Measures of the British Isles [source]

Norman Biggs, Coin-weights in England up to 1588 [source]

William Ashworth, Metrology and the State: Science, Revenue, and Commerce [source]

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 3 Comments

3 Comments