A New Era of Digital Gold Payment Systems?

This blog post on BullionStar’s Blog is by blogger JP Koning who writes about monetary economics, central banking and gold. BullionStar does not endorse or oppose the opinions presented but encourage a healthy debate.

Back in the days when we had metallic monetary standards, people often used gold & silver coins for payments. Not these days. Many people still like to hold precious metals. But few use them to make payments or transfers.

Since the rise of the internet in the 1990s, however, entrepreneurs have tried to re-boot gold as a payments option, albeit in digital form. The most recent reincarnation? Blockchain gold payments systems.

Blockchain gold emerges from the same tradition as Bitcoin. Bitcoin records ownership of bitcoin tokens by using a decentralized database, or blockchain. Bitcoin hasn’t succeeded in becoming a popular way to make payments, primarily because the price of bitcoin tokens is notoriously volatile. But blockchains can also be used to record claims on more stable things, like U.S. dollars, yen, euros, or gold. These stable-value blockchain tokens are known as stablecoins.

Stablecoins have proliferated over the last four or five years, the most popular being Tether, which is pegged to the U.S. dollar. Digix and Pax Gold are two of the more popular gold stablecoins.

In this post I’ll explore a bit of the history surrounding digital gold payments systems. Will the new blockchain-based versions make gold payments popular again?

E-gold: First digital gold network

The history of digital gold currency starts long before the blockchain era. In 1996, Douglas Jackson founded a metal-based payments network called e-gold. E-gold custodied gold in vaults in London, Florida, and elsewhere on behalf of its clients. It allowed users to exchange gold-denominated digital claims among each other. Merchants could integrate e-gold as a payments option. A raft of competing gold payments networks soon emerged including James Turk’s GoldMoney, eBullion, and Pecunix.

According to the now defunct Global Digital Currency Association (GDCA), by 2006 the amount of gold payments that these platforms were processing amounted to around $10 billion. That’s not bad, although it significantly lagged PayPal which was processing around $37.8 billion in payments in 2006.

For those interested in the history of digital currency, check out the archive of DGC Magazine, which covered the digital gold industry: https://t.co/Xwm3EzrjOu

The same November 2008 issue that recorded the ending days of Douglas Jackson’s e-Gold also had an article on bitcoin. pic.twitter.com/afONRP8H4K

— John Paul Koning (@jp_koning) November 15, 2019

The November 2008 e-gold special issue of DGC Magazine can be accessed here. The 2000s digital gold boom ended poorly. E-gold, by far the biggest of the gold payments networks, was indicted by the US Department of Justice in 2007 for abetting money laundering, among other allegations. Jackson, e-gold’s founder, had long allowed anonymous users to sign up to make payments. This made e-gold became a popular means for carders, criminals who steal credit card information, to get paid for their wares.

Next up, GoldMoney

After e-gold’s owners settled with the government in 2008, the site was gradually wound down. GoldMoney, the second largest gold payments platform, had always maintained stricter customer approval standards than e-gold. It continued to operate its payments network for a few more years. But GoldMoney withdrew its metal payment facilities in January 2012, blaming ”insignificant” demand for metal transactions relative to the high costs of complying with anti-money laundering regulations.

In 2015, GoldMoney was bought and integrated with new entrant BitGold. The GoldMoney name was adopted for branding purposes. BitGold, or GoldMoney 2.0, reintroduced global consumers to gold-as-payments. Clients of the contemporary GoldMoney can currently make person-to-person metal payments among each other (in qualifying jurisdictions) and it is possible to link a prepaid debit card to the account.

Looking through GoldMoney’s literature, I haven’t been able to find the dollar value of transactions processed across its platform.

Blockchain gold

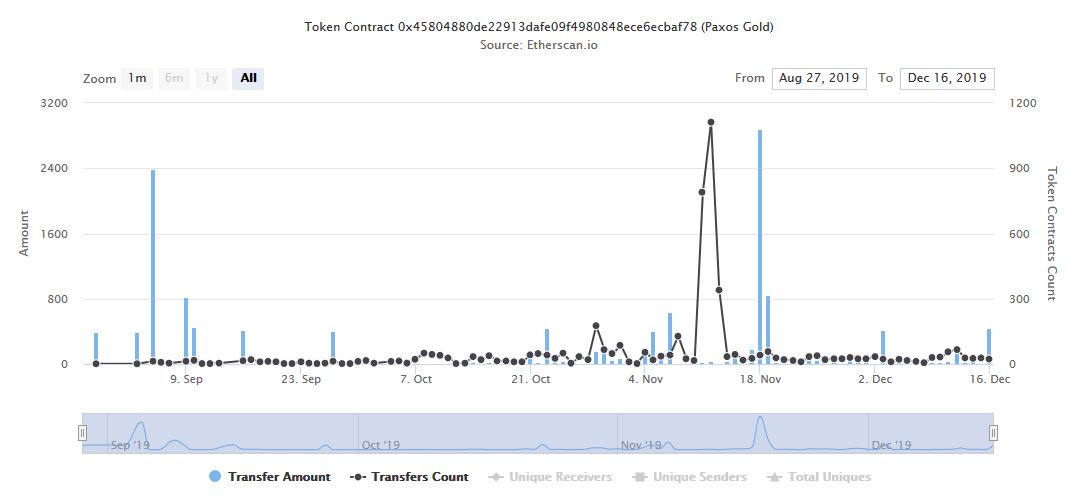

Zoom forward in time to 2018 and the first gold stablecoins began to emerge. The largest currently appears to be Pax Gold, a relative newcomer which has around $12 million in gold-backed tokens issued. Digix, an earlier competitor, has $5 million tokens outstanding.

Blockchain gold providers like Pax Gold and Digix operate along the same principle as e-gold and GoldMoney. Gold is stored in a vault on behalf of clients. And users can trade titles to this gold among each other.

So what are the big differences between blockchain gold and its non-blockchain payments competitors? The latter uses a centralized method of tracking changes in underlying gold ownership. The upstarts use a decentralized method.

Say that someone wants to use GoldMoney to make a metal transfer to another person. The request gets dispatched to a single GoldMoney server for processing. But when a Pax Gold transfer is requested, it is broadcast to a dispersed network of “miners", or processors, that compete to verify the transaction and update the blockchain. Pax Gold is hosted on a specific blockchain, Ethereum, which is stored on computers all over the world. These computers run software that ensure that all processors are working off of the same version of Ethereum.

In practice, this means that in certain situations blockchain gold payments will be more robust than centralized payments. If its computers are temporarily down, say because of a disaster, a centralized gold payments network can’t process a transfer request. But blockchain gold networks have many processors so it is likely that a payment request can be expedited by at least one of them.

Decentralization comes with a drawback. A payments network that relies on a single centralized processor doesn’t have to worry about coordinating with other processors. Blockchains, on the other hand, must be able to achieve consensus about the state of the network over a multitude of processors. This means inserting extra energy-intensive steps. And so blockchains will always be much slower than centralized payments.

Know-your-customer, or not?

Ever since e-gold was indicted, chastened centralized gold payments networks like GoldMoney have gone to great pains to comply with all the rules that govern payments. These cover anti-money laundering, combating the financing of terrorism, and requirements to check users against lists of sanctioned individuals.

Everyone who applies for a gold payments account has to provide a government-issued ID. Unlike the wild days of e-gold, anonymity is no longer tolerated on centralized gold payments platforms.

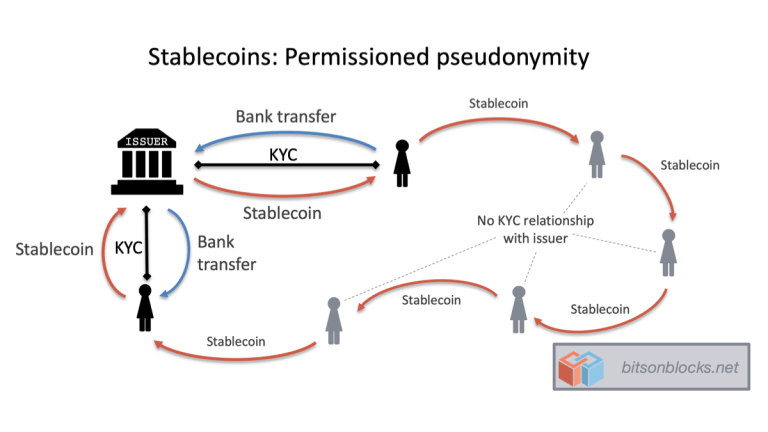

Not so with stablecoins. Stablecoin issuers, the gold ones included, usually only gather their customer’s identity at the entrances and exits to the network. So if a stablecoin owner wants to go directly to the issuer to cash out their stablecoins, they will be asked to be identified. But as long as customers are content to pass on their tokens to other customers, they are free to do so without providing any sort of identifying information.

Antony Lewis explains how this works in a very readable blog post. Below is an illustration Antony uses to show how stablecoins design their know-your-customer (KYC) processes.

Given this setup, the costs that gold stablecoin networks incur to comply with anti-money laundering regulations are probably lower than the costs incurred by traditional gold payments networks. After all, it is cheaper to identify just a few users who want to sporadically redeem their tokens than everyone on the network.

However, this means that a large chunk of the payments flowing over stablecoin networks is relatively anonymous. Won’t regulators get concerned? As Antony points out, stablecoin issuers may be able to make up for a lack of information about their pseudonymous customers by constantly monitoring flows over the blockchain. If they spot anything suspicious, they can freeze the offending address.

But if regulators are uncomfortable with this amount of anonymity, stablecoin issuers may eventually be forced to acquire the identity of all users, not just those on the outskirts of the network. At which point there will be a much smaller difference between centralized and decentralized gold payments networks.

A new golden-era?

Which gets us to our final topic. Will these new blockchain-based gold payments systems make gold payments popular again?

Gold stablecoins certainly make it easier for people to make digital gold transfers. Users needn’t go through a cumbersome know-your-customer process.

However, I doubt that there is a very big demand make payments with gold, even among fans of the yellow metal. One of the main reasons that people want to hold gold is to enjoy price appreciation. A buyer typically has some sort of magic number in their head that they want to reach, and a time-frame for achieving it. Gold is also commonly held as a hedge against some fairly unpleasant future scenarios. Spending away one’s gold, say, to buy groceries interferes with these two functions. It could mean missing out on a big price jump or going without a hedge when something bad happens.

So for now, I don’t see gold payments taking off.

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 1 Comments

1 Comments