Europe’s INSTEX Payments Channel Won’t Help Iran

Since they were implemented last November, U.S. economic sanctions against Iran have been remarkably effective. Iranian oil exports have plummeted to 1.1 million barrels per day (bpd) from around 2.5 million bpd in April 2018, the month before President Trump announced the U.S. withdrawal from the Joint Comprehensive Plan of Action (JCPOA), otherwise known as the Iran Nuclear Deal.

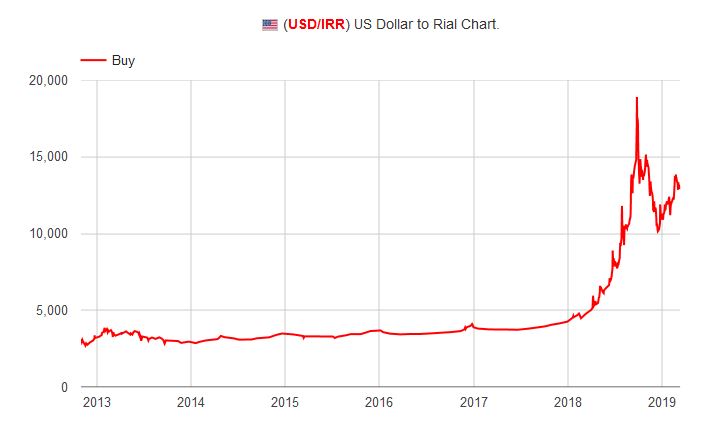

Because crude oil is Iran’s key export, the Iranian economy has been thrown into reverse and the Iranian rial has plummeted. Below is a chart of the U.S. dollar in terms of rials.

Most of the world’s nations disagree with Trump’s sanctions and are doing their best to hew to the terms of the JCPOA. In response, three European nations – the UK, Germany, and France – recently unveiled a special payments mechanism that is intended to help lessen the isolation that has been imposed on Iran thanks to sanctions. Unfortunately, an alternative payment mechanism won’t serve as much of a counterbalance. The forces that Trump’s sanctions harness are just too strong to counter.

Surprisingly successful

When the first round of Iranian sanctions was launched by Barack Obama during his presidency, he was careful to secure buy-in from the UN and other nations such as Russia and China. Trump has not been as cautious. Rather than seeking the cooperation of the rest of the world, Trump unilaterally deserted the Joint Comprehensive Plan of Action, an agreement reached in 2015 which removed Obama’s sanctions on Iran in return for limits on Iran’s nuclear program. The remaining signatories to the JCPOA have chosen to stay faithful to the deal.

Given the lack of support from these signatories (which include Germany, the UK, France, Russia, and China) Trump’s sanctions seemed destined to have more leaks than Obama’s. Many speculated that Iranian crude oil exports would not be crimped. But this hasn’t been the case. In less than a year, Iran has been crippled.

As the steward of the euro, the world’s second most important currency, Europe poses the biggest impediment to a successful U.S. sanctions campaign. Even as Trump’s sanctions closed the door to traditional U.S. dollar denominated oil payments, Euro-denominated oil payments channels would spring up to take their place.

Last October, for instance, leaders of France, Germany, and the UK announced plans to introduce a special purpose vehicle (SPV) to “assist and reassure" businesses that engage in Iranian trade. Not only would this SPV allow for trade in crude oil, but it would also let other nations like China and Russia participate. I blogged about the SPV here.

Enter INSTEX

This January, the October 2018 announcement was formalized with the introduction of the Instrument in Support of Trade Exchanges, or INSTEX. INSTEX, which is not yet operating, is based in Paris and uses the address of the French Ministry of Economy and Finance. Per Fisher, a former banker at Germany’s Commerzbank, has become INSTEX’s President, while Sir Simon McDonald, Permanent Under-Secretary at the UK Foreign and Commonwealth Office, has been appointed as chairman of the INSTEX supervisory board. For the time being France, Germany and the U.K. are the sole shareholders. But other European nation’s are expected to join, including Italy which is currently kicking the tires.

E3 Heads of Missions welcome INSTEX’s president, Per Fischer, to Tehran. Important step to discuss with Iranian counterparts how to make the EU-Iran trade mechanism operational pic.twitter.com/lsGxUytEZz

— MichaelKlorBerchtold (@KlorBerchtold) March 11, 2019

Although many details remain forthcoming, INSTEX is a pale version of what it was originally promised to be. Whereas the original October announcement described a channel that was open to Iranian oil exports, INSTEX is limited to trade in non-sanctioned goods such as pharmaceuticals and food. Only European trade qualifies; companies based in China, India, and other nations are excluded. This significantly crimps the scope of trade that can be facilitated.

The press release for INSTEX hints that at some point the channel will be opened up to crude oil and foreign businesses. However, the U.S.’s adoption of what I’m going to refer to as a us-or-them sanction strategy is watertight. Even if it is the case that INSTEX’s mandate is eventually broadened, the payments channel simply won’t get much use.

Us-or-them

In our interconnected world, any country X can economically isolate country Y if X’s place in the global economy is sufficiently large relative to Y, and it is willing to issue an us-or-them threat to all other countries.

Us-or-them is a school yard tactic whereby a popular bully manages to isolate a less popular child by declaring that all other children must choose either the bully or her target as a friend. Since ending their relationship with the popular child is the costlier option, most will desert the less popular child.

The Chinese have successfully used us-or-them in a diplomatic context to isolate Taiwan, for instance. China has a policy of immediately ending its relationship with any nation that sets up diplomatic relations with Taiwan. Since China is by far the most important country, most nations have chosen to end official relations with Taiwan.

Australia vs Papua New Guinea

The U.S. is playing an us-or-them economic game against Iran. But in theory, us-or-them can be played by much smaller nations too. All that is needed is an asymmetry in size. A relatively small country X – say Australia – can economically isolate a much smaller country Y, say Papua New Guinea.

Imagine that Australia were to announce that any individual or firm that engages in trade with Papua New Guinea can no longer do business in Australia. Papua New Guinea’s imports amounted to just $3.6 billion in 2017, a fraction of Australia’s $199 billion in imports. Given the threat of no longer being able to sell into the much larger Australian market, most businesses will stop selling to Papua New Guinea.

The same goes for exports. Australia exported $243 billion in 2007, almost 50x more than Papua New Guinea. This means that global supply chains are much more reliant on Australian goods & services than Papua New Guinean ones. Given an all-or-none choice between buying from only one of these markets, most will choose the larger market.

Executives that must choose between the Papua New Guinea and Australia will not only base their decisions on the basis of their firm’s bottom line but also on more personal motives. If they choose to orient their company towards Papua New Guinea, an executive’s future work opportunities will be crimped since any job requiring interaction with Australian entities will be closed to them. The executive will never be able to travel to Australia again lest they be arrested. This means forgoing all Australian medical procedures, education opportunities for children, and tourism. Since Australia offers more of these opportunities than Papua New Guinea by virtue of its size, an executive’s choice will naturally be biased towards Australia.

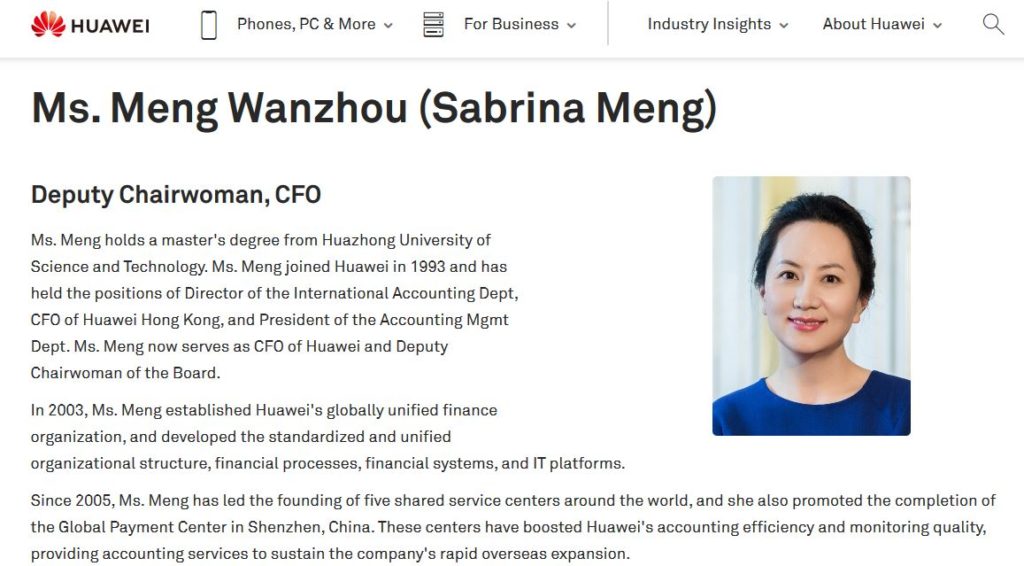

The recent arrest of Meng Wanzhou, chief financial officer of Chinese communications giant Huawei, is a good example of the sort of personal risk an executive must consider if they are going to choose the side of the less powerful in an us-or-them economic conflict. In 2010, Meng allegedly used a Huawei subsidiary to evade Obama’s round of sanctions against Iran. She was recently arrested in Vancouver at the request of the U.S. Justice Department. Depending on the outcome of her extradition case, she may be sent to the U.S. to face trial.

The ability to leverage the relatively superior size of their imports and exports gives countries X (like Australia) a significant degree of control over global executives. So even though a country like Australia doesn’t have the U.S.’s advantage of a global reserve currency, it can still bully nations that are smaller than it into economic isolation. The U.S. stands out relative to other countries for two reasons. Whereas everyone can play us-or-them economic isolation games, the U.S. is one of the few nations that has actually chosen to go down this path. Second, its massive size allows the U.S. to bully relatively large nations, like Iran, whereas Australia is limited to much smaller fish.

To sum up

It should now be apparent why INSTEX can never really contribute to cushioning the burden of U.S. sanctions. Even if INSTEX eventually provides a means to pay for Iranian crude oil, the huge penalties involved in choosing Iran over the U.S.means there won’t ever be any real demand to make payments to Iran.

Businesses would not only have to forgo selling into the U.S., but would also have to give up relationships with U.S. suppliers. Executive of these companies would have to face the possibility of no longer being able to send their kids to Ivy league schools, travel to New York for holiday, or seek medical care at Johns Hopkins or the Mayo Clinic. INSTEX will always be like one of those neat-looking tools that everyone has on their shelf, but never uses.

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 7 Comments

7 Comments