Crude Oil & U.S. Dollar & Gold

In the midst of upwards trending oil prices a decade ago, a US senate committee recommended actions to curb the high oil price to mitigate the negative effect on growth.

Ok, great, the oil price went from north of USD 140 in 2008 to around USD 30 now.

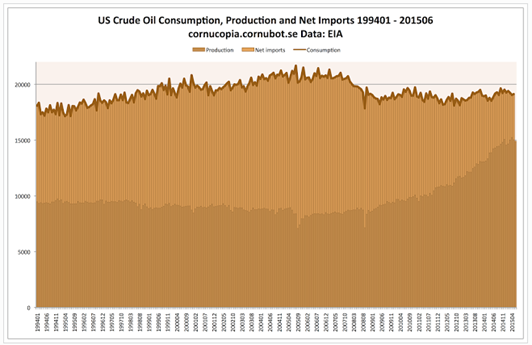

But now, mainstream economists are disappointed that the sliding oil price hasn’t had much positive effect on growth and instead tell us that a decreasing oil price is a double-edged sword at best and a threat to the US economy at worst. This despite the US being a net importer of oil, importing about 20 % of its oil consumption.

Source: Cornucopia

According to most mainstream economists, a fall in prices, oftentimes mislabelled as deflation, is a horrific thing that must be avoided at all costs.

Before countering the deflation scare, let us first establish that deflation by definition is a shrinkage in the money supply whereas price deflation is the resulting effect of the general price level for goods and services when the money supply decreases.

The mainstream economist argument is that price deflation is bad because people are said to hold off consumption anticipating even lower prices in the future. Really?

Do people hold off their oil consumption because of falling prices? Do people hold off their consumption of food if prices are anticipated to fall? Are people waiting to buy a mobile phone if the price of the product is anticipated to decrease in the future?

Global oil production has increased, with a corresponding price decrease, in recent years due to innovative technological advancements.

The decreasing price of oil is, despite its negative short-term effects on the producers, a positive event enabling the economy to operate more efficiently. Less resources and costs are needed to produce and consume 1 litre of oil today compared to a year ago. The resources liberated from the increased efficiency can instead be put into something else and thus increase productivity further.

US Dollar

We already know that the banking system is inherently incentivizing reckless debt behaviour to the extent that banks have got to increase their balance sheet continuously, for the fractional reserve based monetary system not to collapse.

Savings used to be the backbone of an economy. With savings, it was possible to accumulate capital used for investments. Nowadays, savings has nothing to do with investing as the money is simply created out of thin air as debt by commercial banks and called capital.

Today, debt, and particularly US Dollar denominated debt, is used as a store of value around the world. This skews everything.

A strong US Dollar is to be expected in such a system.

The US Dollar will continue to strengthen until… it collapses.

The US has been running a trade deficit for some four decades by now and has in the process accumulated a humongous national debt.

How is that even possible?

According to Economics 101, the currency of a country running perpetual trade deficits is supposed to depreciate to balance the trade. With a depreciating currency, imports will be more expensive and exports will be cheaper for others to buy. The trade deficit will thus decrease.

This doesn’t happen in the US though. Why?

The reason is that the value of the US Dollar, functioning as a reserve currency, is dictated by the (savings) demand for the US Dollar in the rest of the world. The US doesn’t have a choice on whether to run a trade imbalance or not. It’s the net producing countries (read China) exporting to the consuming countries (read USA) that is dictating to what extent the US can utilize the exorbitant privilege of issuing debt in the world’s reserve currency.

It’s the demand of the US Dollar as a reserve currency that sets the pace. For the US Dollar to function as a reserve currency, the US is required to run trade deficits for the purpose of distributing US Dollars to the net producers/savers.

When savers save in the same medium as is used for the Medium of Exchange, a collapse always follows the monetary expansion when the debt savings are undone. The trigger point of this may very well be when the flow of physical gold dries up. Freegold is instructive in explaining the mechanism that is likely to correct the current imbalance between the paper world and physical world.

The Prudence of Saving in Gold

Following a collapse of our monetary system, it will be vital to own gold as a store of value. Paper assets will no longer matter. For us to get a glimpse at life beyond this transition, India may provide a good example since basically the whole population are avid gold savers.

In India, people have protected their wealth with gold over generations. For Indians, gold is an asset class that bridges inequalities by giving individuals a shot at protecting themselves against foolish government policies. The government does everything in their power, with the Indian trade deficit as their go to excuse, to have people surrendering their gold. The government has introduced a gold monetization scheme, there’s gold import duties, documentation requirements for buying gold and campaigns to convince people to open bank accounts.

Who’s right? The government or the people?

Let’s compare the track record of the Indian Rupee versus Gold. At the start of 1960, 1 gram of gold cost 5.37 Indian Rupees. On 1 February 2016, 1 gram of gold cost 2,443.59 Indian Rupees excluding the premium stemming from the 10 % import duty. The Indian Rupee as measured in gold has thus lost about 99.8 % of its value since 1960.

Indians don’t expect the government to take care of you from cradle to grave, they realise that they need to save to educate their children and to look after their aging parents and themselves when retiring.

Isn’t the world upside down when prudent savers have to fight the government’s reckless policies to keep their wealth?

When fiat money hyper-inflates, paper gains or paper deficits will no longer matter. Owning physical gold will.

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Gold, Geopolitics, and the Global Financial Realignment: Insights from Dr. Nomi Prins

Gold, Geopolitics, and the Global Financial Realignment: Insights from Dr. Nomi Prins

Silver’s Breakout and What It Signals for Gold: Florian Grummes on the Metals Market Shift

Silver’s Breakout and What It Signals for Gold: Florian Grummes on the Metals Market Shift

The Big Long: Gold’s New Chapter – A Conversation with Ronald-Peter Stöferle

The Big Long: Gold’s New Chapter – A Conversation with Ronald-Peter Stöferle

How to Tell If Gold Is Real – What You Need to Know About Fake Gold, Testing Methods, and Trusted Dealers — A 2025 Guide

How to Tell If Gold Is Real – What You Need to Know About Fake Gold, Testing Methods, and Trusted Dealers — A 2025 Guide

Is It Too Late to Buy Gold in 2025? 7 Signs Pointing to Gold’s Next Major Rally

Is It Too Late to Buy Gold in 2025? 7 Signs Pointing to Gold’s Next Major Rally

BullionStar

BullionStar 6 Comments

6 Comments