Why You Should Buy & Store Gold & Silver in New Zealand

Buy & Store Gold & Silver in New Zealand

While Singapore is arguably the best country in the world in which to buy and store gold & silver bullion, BullionStar has now also added New Zealand to our suite of locations for buying and storing bullion.

New Zealand is a great precious metals jurisdiction that complements Singapore, and adding New Zealand will offer local and international customers alike a great choice.

Like Singapore, New Zealand regularly ranks at the very top of global country rankings on metrics such as business friendliness, economic freedom, rule of law, property ownership rights, low levels of corruption, personal freedom, and monetary freedom. These rankings demonstrate that New Zealand is a safe and secure jurisdiction suitable for bullion storage.

Buy Gold & Silver in New Zealand for Local Pick-up or Shipping

Local New Zealand residents are able to place orders for personal collection/pick-up in Wellington, New Zealand or for courier shipment within New Zealand.

It’s just as easy to buy and personally collect your bullion from BullionStar New Zealand as it is from BullionStar Singapore.

To view what gold and silver bullion you can buy from BullionStar New Zealand, select New Zealand in the dropdown box to the right of “Show Products in" towards the top right hand side of the desktop website or on the location icon on the mobile website.

Buy Gold & Silver in New Zealand for Storage

BullionStar now allows you to geographically diversify your bullion vault storage across what are arguably two of the safest and most secure jurisdictions worldwide for bullion storage, Singapore and New Zealand.

BullionStar offers the same products for storage in New Zealand as for personal collection or courier delivery. See the screenshots above for how to view the products BullionStar offers for sale in New Zealand.

When you buy and store your bullion bars and bullion coins with BullionStar in New Zealand, it is identical to buying and storing bullion with us in Singapore. Your transaction counterparty is BullionStar and you have full online control of your bullion using the same account across both locations. With your BullionStar online account, you can buy, store, audit or physically withdraw your bullion from storage at any time.

Why is it a Good Idea to Diversify your Bullion Storage?

While home storage of precious metals is an option, the high value content of gold bars and gold coins and silver bars and silver coins means that home storage will always be a security risk. When storing bullion in your home country or in a particular country, there is also locational or jurisdictional risks such as:

Confiscational Risk – The risk that governments will confiscate your precious metals.

Investment Prohibitions – The risk that governments will outlaw precious metals ownership.

Imposition of Capital Controls – The risk that capital controls are imposed on moving currency and precious metals across borders.

Imposition of Reporting Requirements – The risk that precious metals transactions and holdings must be reported to authorities.

Political Instability – The risk of unforeseen political instability in a previously politically stable territory.

All of the above-mentioned risks have turned into reality many times in many countries, especially in some of the world’s most advanced economics, both in living memory and in the recent past. As Western governments and central banks now struggle with ongoing financial crises, they are resorting more and more to financial repression and intervention in their domestic banking and financial sectors, including more stringent reporting requirements.

Many investors and savers in precious metals make the decision to buy and hold gold, silver and platinum as part of their overall investment strategies, i.e. they diversify their investments across various investment assets classes including physical precious metals.

Since physical precious metals are tangible and valuable assets, they need to be stored somewhere that is secure and safe. Locational and jurisdictional diversification of precious metals storage can therefore be viewed as a logical extension of the investment diversification process, a further step in your wealth preservation and protection strategy.

By diversifying across the jurisdictions in which you have your precious metals stored, you are further diversifying away the same risks that brought you to purchase precious metals in the first place.

Bullion Vault Storage Jurisdictions & Suppliers

To store your precious metals in a safe and secure location, you will need to choose jurisdictions that have some or all of the following characteristics:

– A politically stable jurisdiction

– A country with a strong rule of law

– A jurisdiction with strong property ownership rights

– A safe jurisdiction with low crime rates

– A country that has the least corruption possible

– An economy which ranks highly in global country rankings for ease of doing business

A safe and secure precious metals storage jurisdiction will also ideally offer:

– Little or no reporting requirements of precious metals holdings to governments or central banks, either domestic or foreign.

– A government which is supportive of the bullion industry and of bullion storage within its territory.

– A jurisdiction in which there are no sales taxes or other taxes on bullion.

– Developed infrastructure for bullion storage and bullion transactions.

Once the jurisdictional and geographical diversification choices have been made, you will still need to consider vaulting infrastructure, and the ease of using a precious metals storage provider if your bullion is to be safe and secure. A bullion vaulting provider must therefore also offer the following:

– Be outside the banking system, with privately owned vaults

– Offer strong and secure vaults with high security

– Fully allocated bullion

– Full insurance of your precious metals for all risks

– Offer a range of different precious metals auditing methods

Offshore Bullion Storage in New Zealand

Why is New Zealand a good jurisdiction in which to buy gold and silver bullion for geographic diversification purposes? Like Singapore, New Zealand regularly ranks at the very top of global country rankings for precious metals investors relevant metrics, such as follows:

Economic Freedom – New Zealand, along with Singapore, is one of the most economically free nations in the world. In the latest Index of Economic Freedom (2019), which ranks 180 countries globally, New Zealand ranked at the very top of the table along with Singapore and Hong Kong as the most free economies in the world. This index measures economic freedom and liberty across the metrics of open markets (including financial freedom), regulatory efficiency (including monetary freedom), and rule of law.

Business Climate – Similarly, the latest World Bank’s Ease of Doing Business rankings (2018) rank New Zealand in first place as the easiest economy in the world in which to do business, marginally ahead of Singapore in second place. These rankings, which cover 190 economies worldwide, include such measures as enforcing contracts, paying taxes, and trading across borders.

Rule of Law – In the World Justice Project’s Rule of Law Index (2019), New Zealand was ranked among the top countries in the world in the overall rankings, as well as the highest ranking in the East Asia and Pacific region. This Rule of Law Index measures nations across such factors as order and security, absence of corruption, and regulatory enforcement.

Lack of Corruption – In the latest annual ranking of Transparency International’s Corruption Perceptions Index (2018), which ranks 180 countries by their perceived levels of public sector corruption, New Zealand is ranked the second least corrupt country in the world.

Safe and Stable – New Zealand is also one of the most stable democracies in the world with a parliamentary democracy based on the British model. In the 2019 Global Peace Index, an index which measures political stability and the safest countries in the world in which to live, New Zealand ranked second highest in the entire world.

Property Ownership Rights – New Zealand has a stable legal system with an independent judiciary based on English law in which legal contracts are secure and in which property rights are strongly protected.

Geographic Location – New Zealand has a unique geographic location in that it is an island nation in a remote location and a country with few near neighbours. New Zealand has no major neighbours at all except for Australia. It is therefore safe to say that no country on the globe is further away from the trouble spots of the world than New Zealand. This contributes into making New Zealand an ideal location for international precious metals storage diversification.

Tax-Free Bullion – There are no taxes for international customers on bullion in New Zealand. New Zealand has no sales taxes for bullion, no import or export taxes, and no Capital Gains Tax.

No Reporting Requirements – There are no reporting requirements when buying or holding precious metals with BullionStar in New Zealand.

Central Banking – Leading by Example

Central banks are responsible for the safekeeping of some of the world’s largest strategic gold holdings and are a prime example of locational diversification in practice.

Many central banks explicitly employ geographic diversification in their gold storage policies and hold their gold reserves in vaults across multiple jurisdictions and locations. Central banks implement these storage policies precisely so as to mitigate economic and political risks and to avoid the concentration risk of one storage location.

For example, in its investment policy document, the Swiss National Bank (SNB), which holds its 1,040 tonnes of gold across Switzerland, London (Bank of England) and Canada, explains that “gold is stored in multiple locations for reasons of risk diversification, in other words to improve security”.

Likewise, in neighboring Austria, the country’s central bank, the OeNB, recently revised its gold storage policy so as to “mitigate the risks from substantial crisis situations” and now holds its 280 tonnes of gold across three vault storage locations in Austria, London and Switzerland, in a 50%, 30%, 20% allocation, respectively. The OeNB revised its storage policy after it had “evaluated the concentration risk of its gold holdings and decided to increase the degree of diversification of its storage facilities”.

In a similar manner, Germany’s Bundesbank, the world’s second largest sovereign gold holder with nearly 3,400 tonnes, repatriated a large quantity of gold to Germany as part of its gold storage diversification policy, and now holds its gold across three locations in Germany (50%), New York (37%) and London (13%).

BullionStar’s Vault Partner – New Zealand Vault

In New Zealand, BullionStar has teamed up with operating vault partner, New Zealand Vault, a highly-regarded locally owned company which has been in operation since 1931.

The impressive vault in which BullionStar’s and BullionStar’s customer owned bullion is stored is built with 600 mm thick monolithic walls using strengthened high density concrete exceeding Class III standards. Although originally built by Bank of New Zealand, the vault is privately-owned and independent of the banking sector. The vault is equipped with multi-security surveillance features like motion detectors, surveillance cameras and seismic detection, and is monitored 24/7. All BullionStar customer owned bullion is stored on an allocated basis.

Insurance – All BullionStar customer owned bullion in New Zealand is fully insured against all risks by Chubb Insurance. The bullion is covered by the same comprehensive insurance policy as bullion stored with BullionStar in Singapore as apparent from our Evidence of Insurance Certificate.

Auditing – All BullionStar customer owned bullion in New Zealand is regularly audited internally as well as externally. Independent third party audits are conducted bi-annually by Grant Thornton, one of the world’s leading assurance and auditing companies. Customers can furthermore conduct physical customer audits and verify their holdings directly in BullionStar’s system through the Live Audit Report.

Conclusion

The addition of bullion storage in New Zealand now offers BullionStar customers the choice of two of the safest and most secure jurisdictions in the world in which to store precious metals. Geographically located in one of the safest areas of the world, in a stable jurisdiction with strong property rights and a strong rule of law, New Zealand is ideally positioned to complement Singapore for customers looking for bullion storage alternatives and for customers looking for geographical precious metals storage diversification.

BullionStar customers can use the same BullionStar account and same online platform for bullion storage in New Zealand and in Singapore.

Similar to the world’s leading central banks which store gold in multiple locations for reasons of risk diversification, BullionStar customers can now employ locational diversification of precious metals storage across two of the world’s safest and most secure locations as a means of preserving their wealth and minimizing the risks to their precious metals holdings.

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Why a Powerful Silver Bull Market May Be Ahead

Why a Powerful Silver Bull Market May Be Ahead

What’s Driving Gold to All-Time Highs?

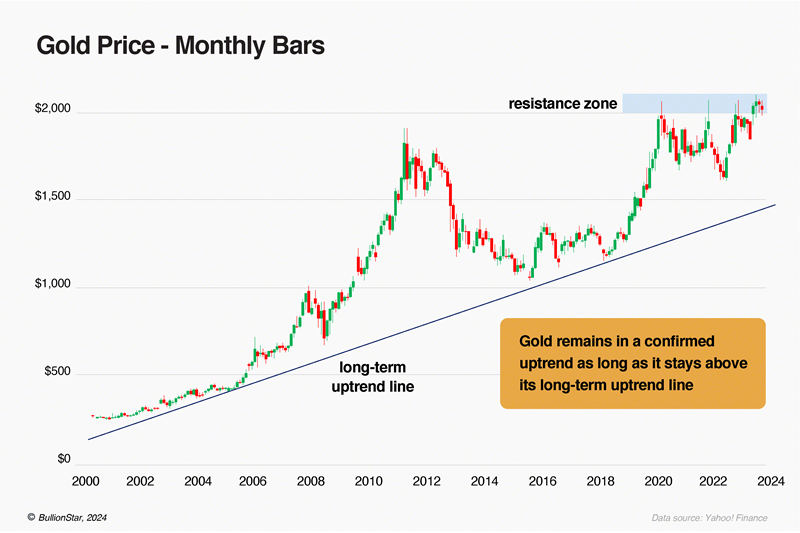

What’s Driving Gold to All-Time Highs?

What You Need to Know About Gold's Long-Term Bull Market

What You Need to Know About Gold's Long-Term Bull Market

BullionStar Financials FY 2023 – Year in Review

BullionStar Financials FY 2023 – Year in Review

Year of the Dragon: Surge in Singapore's Gold & Silver Sales

Year of the Dragon: Surge in Singapore's Gold & Silver Sales

BullionStar

BullionStar 10 Comments

10 Comments