India Quietly Accumulating Large Quantities of Gold

While large one-off central bank gold purchases get a lot of media attention and the same is true for central banks accumulating gold reserves over a two or three month period, sizeable accumulation of gold by central banks on a month in, month out basis, with the exception of the Chinese and Russian central banks, tends to go almost unnoticed.

A prime case in point is the gold buying strategy of India’s central bank, the Reserve Bank of India (RBI), which almost under the radar, has now become one of the world’s biggest and most consistent central bank gold buyers every year for the last four years.

Starting in early 2018 and up to the end of August 2021, over that time the RBI has added a staggering 166 tonnes to it’s strategic gold reserves, and now holds a claimed 724.24 tonnes of gold, making India the 9th largest sovereign gold holder in the world, well ahead of the Netherlands (in 10th place), and within shouting distance of Japan (8th place).

Arguably, this stealthy gold accumulation by the Indian official sector is now becoming more apparent since two of the big guns that are normally active in the central bank gold buying market, the central banks of Russia and China, are currently ‘taking a break’.

According to it’s official figures, China (via the People’s Bank of China) last added to it’s monetary gold reserves in September 2019, leaving it with a unchanged official total of 1948 tonnes of gold since then. This is notwithstanding the fact there is widespread skepticism about the real size of China’s sovereign gold reserves.

Additionally, the Russian Federation (via the Bank of Russia) officially stopped buying gold in the domestic Russian market at the end of March 2020 and actually made an official announcement about this hiatus at the time. Due to this pause since March 2020, Russia’s official gold reserves have essentially remained unchanged except for some tiny adjustments, and Russia currently claims to hold 2,294.5 tonnes of monetary gold.

With these two gold buying giants now officially “off the grid”, the gold buying activities of the Indian central now come into sharper focus.

India’s central bank, Reserve Bank of India (RBI), continues to buy gold, adding another 13 tonnes during August. The RBI now holds 724 tonnes of gold reserves. YTD, RBI has added 47.66 tonnes, and since 2018 has added 166 tonnes. See RBI table attached https://t.co/On9GhlT8VI pic.twitter.com/9KZwfZ3gDh

— BullionStar (@BullionStar) September 23, 2021

The Details

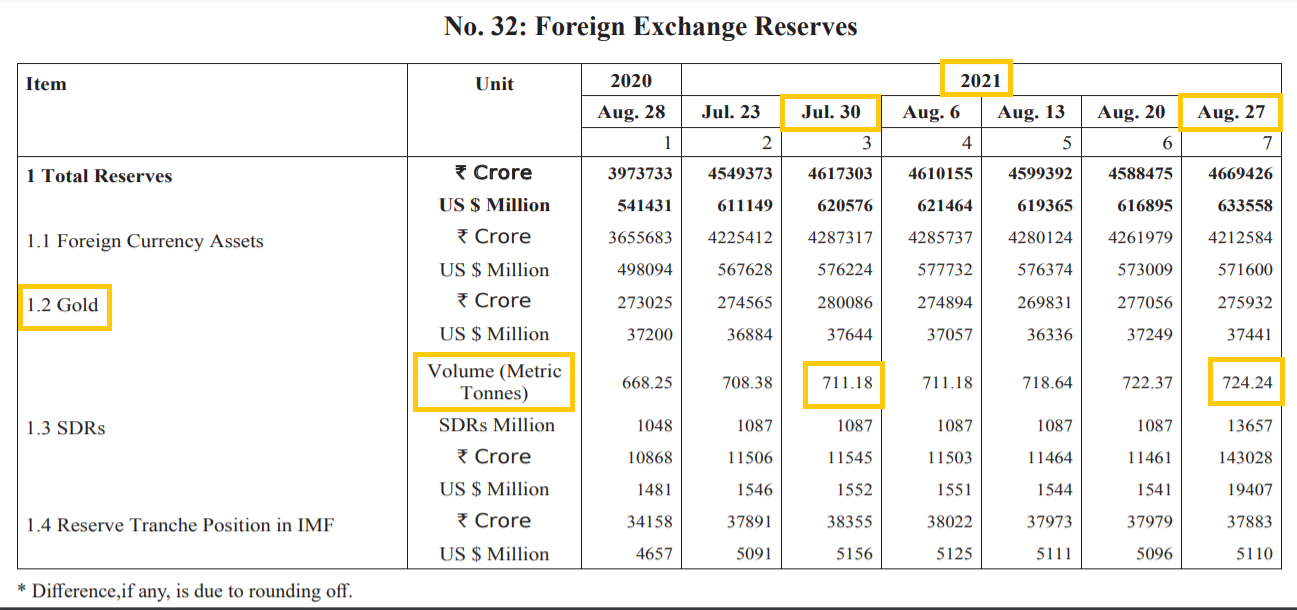

According to the Reserve Bank of India’s latest FX Reserves report dated 16 September 2021, the RBI, as of 27 August, held 724.24 tonnes of gold. See report online here and in pdf here. Compared to the same report from 30 July 2021 when the RBI held a total of 711.18 tonnes, this shows that the RBI added 13.06 tonnes to it’s gold reserves during August 2021.

Prior to August, the RBI had already purchased a combined 34.6 tonnes of gold during five months of 2021 (in February, March, May, June and July). Adding the 13.06 tonnes of gold that the RBI bought in August, this means that so far in 2021, the Indian central bank has bought 47.66 of gold, which on an annualized basis would be 71.5 tonnes, and would be more than the gold buying totals of Hungary (63 tonnes bought in March), and Brazil (62.3 tonnes bought during May, June and July). See “Hungarian central bank boosts its gold reserves by 3000% in less than 3 years” and “Brazil’s Central Bank refuses to answer any questions about its Gold Reserves”.

RBI – Consistent Gold Buyer since 2018

This sizeable gold buying by the Indian central bank in 2021 is not a one off, and it continues a trend that began in early 2018. The following statistics come from World Gold Council (EGC) data (which itself is based on IMF data that each central bank submits to the IMF (on a voluntary basis)).

During 2018, the RBI accumulated a total of 42.3 tonnes of gold, with gold purchases claimed to be made in each of the 10 months from March to December 2018.

The following year in 2019, the RBI was again a substantial buyer of gold, adding a total of 34.5 tonnes during seven of the twelve months (each month from January to April, and again in each month between October and December).

During 2020, the RBI bought another 41.7 tonnes of gold, again by pursuing the ‘buy often and consistently’ strategy, adding gold to it’s reserves in each month except for January and September.

Therefore, over the three years of 2018 – 2020 inclusive, the Reserve Bank of India purchased 118.5 tonnes of gold. Adding the 47.66 tonnes of gold purchased so far in 2021 (up to the end of August), this means that since early 2018, the RBI has bought a whopping 166.16 tonnes of gold.

You will also see that the 47.66 tonnes bought by the RBI so far in 2021 (up to month 8) is more than the total amount of gold that the RBI bought in each of 2018, 2019 and 2020. So far in August 2021, the RBI has been buying an average of 6 tonnes of gold per month, compared to buying an average of 2.5 tonnes per month in each of 2018 and 2020, and an average of 2.9 tonnes per month in 2019. So not only is RBI’s gold buying consistently happening in most months, the quantities of gold that the RBI is buying each year are accelerating,

Additionally, given that the RBI purchased gold in each of 10 months of 2018, in each of 7 months of 2019, and in each of 10 months of 2020, and has purchased gold in 6 of the 8 months so far this year, we should therefore expect further gold buying by the Indian central bank in at least one or two (or maybe even all) of the remaining months of 2021.

Whichever way you look at it, the total amount of gold accumulated by the RBI since early 2018 is sizable and ranks up there among the top central bank gold buying nations.

Between 2020 and year-to-date 2021, the Indian central bank has purchased a combined 89.4 tonnes of gold, which is just marginally less than the largest central bank gold buyer over that same period, the Bank of Thailand, which bought 90.2 tonnes. See “Thai central bank leads pack, buying 90 tonnes of gold over April and May”.

Over the period from the beginning of 2019 up to year-to-date 2021, the Reserve Bank of India has added 123.9 tonnes of gold. This is second only to Russia’s 182 tonnes of gold buying over that same period, and more than Poland’s 100 tonne gold purchase over the same timeframe (see “Poland joins Hungary with Huge Gold Purchase and Repatriation”)

Over the period from the start of 2018 through to year-to-date 2021, in which the Indian central bank accumulated 166.2 tonnes of gold, this is third only to Russia’s huge gold buying over that period (456.7 tonnes) and not too much less than Turkey’s claimed 209.7 tonnes of gold buying over the same timeframe. For the rationale on Russian and Turkish central bank gold purchases, see “Turkey and Russia Highlight Gold’s Role as a Strategically Important Asset”.

Where is the RBI Gold Held?

The 166 tonnes of gold purchased by the Indian central bank since 2018 is also nearly as much as the 200 tonnes of gold that India claimed to have bought from the International Monetary Fund (IMF) in October 2009, in what the IMF called an ‘off-market’ transaction. There is little information known about how this sale by the IMF to India was transacted and, like everything in the central bank gold market, the real details remain secret. See “IMF Gold Sales – Where ‘Transparency’ means ‘Secrecy’” for more details on the IMF gold sales.

So where is the RBI’s 724.24 tonnes of gold held? This is where it gets interesting.

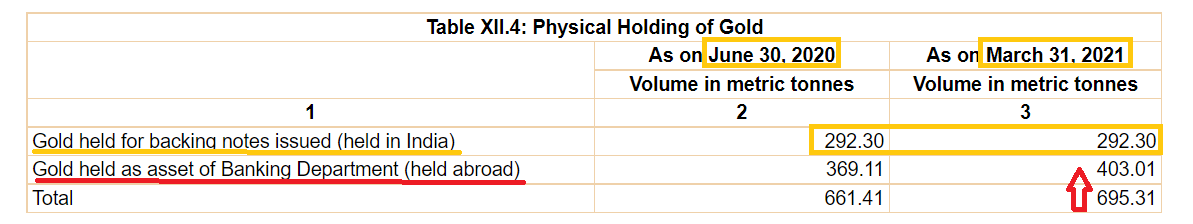

From the RBI Annual report for 2021 (up to March 30, 2021), we see that of the RBI’s claimed gold holdings, “292.30 metric tonnes is held as backing for notes issued and shown separately as an asset of Issue Department”, while the rest “is treated as an asset of Banking Department”.

However, the gold held by the Banking Department and the gold held by the Issue Department are both classified as part of the RBI’s foreign exchange reserves, along with foreign currencies, and IMF SDRs.

Table XII.4 of the 2021 RBI annual report also illustrates these two components of the RBI’s gold holdings, where, from year to year, an unchanged 292.30 tonnes is classified as “Gold held for backing notes issued (held in India)”, while the rest of the gold holdings are classified as “Gold held as asset of Banking Department (held abroad)”, which as of 31 March 2021 amounted to 403.01 tonnes.

The gold which the RBI holds in India is actually held in the vaults of the RBI’s building in Nagpur, in the state of Maharashtra. See below for more on the RBI’s gold vaults in Nagpur.

Turning to the latest half-yearly RBI “Report on Management of Foreign Exchange Reserves”, dated 12 May 2021, we find in section I.6. “Management of Gold Reserves”, that the RBI gold that is held abroad (outside India), is held at the Bank of England and with the Bank for International Settlements (BIS).

“I.6. Management of Gold Reserves

As at end-March 2021, the Reserve Bank held 695.31 metric tonnes of gold. While 403.01 metric tonnes of gold is held overseas in safe custody with the Bank of England and the Bank of International Settlements (BIS), 292.30 tonnes of gold is held domestically.”

Interestingly, the previous version of this “Report on Management of Foreign Exchange Reserves”, dated 8 December 2020, also mentioned that some of the RBI’s gold was in the from of gold deposits (in other words gold loans to bullion banks), as the wording says:

“As at end-September 2020, the Reserve Bank held 668.25 tonnes of gold (including gold deposits of 9.04 tonnes). While 366.91 tonnes of gold is held overseas in safe custody with the Bank of England and the Bank of International Settlements (BIS), 292.30 tonnes of gold is held domestically.”

Of the RBI’s two components of gold, the 292 tonnes attributed to the RBI’s Issue Department has been constant since at least 2002, save for a few tiny additions over the years due to an increase in gold coin holdings.

While it’s not clear where the RBI purchased 166 tonnes of gold over 2018-2021, the fact that all of this increase is held abroad and the fact that all of RBI’s gold stored internationally is with the Bank of England and the BIS, then it’s logical to conclude that the RBI’s gold purchases over 2018-2021were at the Bank of England in London, or via gold transactions with the BIS, or both.

Note that the BIS maintains gold storage accounts in Berne with the Swiss National Bank (SNB), in London at the Bank of England, and in New York with the Federal Reserve Bank of New York (FRBNY). As the BIS states on it’s website under banking services (for central banks):

“Gold location exchange, safekeeping and settlement: loco London, Berne or New York”

So any reference to the BIS holding RBI gold either means that the RBI has lent gold out to bullion banks using the gold loan (deposit) services of the BIS, or the RBI has bought gold from the BIS and holds this gold in a sub-account of the BIS in either Berne (SNB), London (Bank of England) or New York (FRBNY).

If we go back to mid-2009, to before the RBI supposedly purchased 200 tonnes of gold from the IMF, we find in the “Report on Foreign Exchange Reserves” dated 16 July 2009, that:

“I.7. Management of Gold Reserves

The Reserve Bank holds about 357 tonnes of gold forming about 3.8 per cent of the total foreign exchange reserves in value terms as on March 31, 2009. Of these, 65 tonnes are being held abroad since 1991 in deposits / safe custody with the Bank of England and the BIS.

Eagle-eyed readers will see that, of this 357 tonnes, with 65 tonnes stored aboard as of mid 2009, that left 292 tonnes of RBI gold stored in India at that time, i.e. the unchanged 292 tonnes of gold has been stored in India for many years.

Looking at the RBI’s “Report on Foreign Exchange Reserves” dated 19 January 2010, i.e. after the RBI’s supposed 200 tonnes gold purchase from the IMF, we again see reference to the gold held abroad since 1991:

I.7. Management of Gold Reserves

The Reserve Bank held about 357.75 tonnes of gold forming about 3.7 per cent of the total foreign exchange reserves in value terms as at the end of September 2009. Of these, 65.49 tonnes are being held abroad since 1991 in deposits / safe custody with the Bank of England and the Bank for International Settlements.

In November 2009, the Reserve Bank concluded the purchase of 200 metric tonnes of gold from the International Monetary Fund (IMF), under the IMF’s limited gold sales programme. The purchase was an official sector transaction and was executed over a two week period during October 19-30, 2009 at market-based prices. As a result of this purchase, the Reserve Bank’s gold holdings have increased from 357.75 tonnes to 557.75 tonnes.

So before supposedly buying 200 tonnes of IMF gold in 2009, the RBI had held 65.49 tonnes of gold at the Bank of England and / or with the BIS.

Which IMF Gold was Sold to India?

Assuming that the IMF did sell 200 tonnes of gold to the Indian central bank in October 2009, then where was this gold located when ownership was transferred from the IMF to the RBI?

IMF gold is stored in 4 “gold depositories” across the world. These 4 gold depositories are the Federal Reserve Bank of New York, the Bank of England in London, the Banque de France in Paris, and the Reserve Bank of India in Nagpur India. For details, see “The IMF’s Gold Depositories – Part 1, The Legal Background” and “The IMF’s Gold Depositories – Part 2, Nagpur and Shanghai, the Indian and Chinese connections“.

The most logical answer is that the IMF gold transferred to the RBI in 2009 had been held in the Bank of England vaults in London. Why? Firstly, the IMF gold sale to the RBI in October 2009 definitely did not use IMF stored in Nagpur, India. This is because the 200 tonnes purchase in 2009 was immediately classified by the RBI as “held abroad” as soon as it was transacted. Besides, the IMF never had as much as 200 tonnes of gold stored at the Nagpur depository. The most IMF gold that was ever stored in Nagpur was 144.4 tonnes. Additionally, some of the IMF gold held in India is of variable quality and includes confiscated smuggled gold and other non-good delivery gold from domestic mine production.

Secondly, the IMF gold held in the New York and Paris depositories (i.e. FRB New York and Banque de France) is not / was not in good delivery form. To quote the IMF during the 1970s when it previously conducted gold sales:

“…most of the gold of the Fund is not in the form of individually stamped and weighed bars but consists, with the exception of the gold held in depositories in the United Kingdom and India, of melts, comprising 18-22 individual bars, which will first need to be identified, weighed, and selected before they can be delivered.”

“A melt is an original cast of a number of bars, usually between 18 and 22. The bars of an unbroken melt are stamped with the melt number and fineness but weight-listed as one unit; when a melt is broken, individual bars must be weighed and stamped for identification. It is the practice in New York and Paris to keep melts intact.”

“As indicated in the staff paper on Gold Sales (EBS/76/46, 2/2/76), most of the Fund’s gold held with the Federal Reserve Bank of New York and the Banque de France is in the form of melts. Before the gold can he offered in gold auctions a part of these holdings has to be transformed into individually weighed and identified bars.

For details see “The IMF’s Gold Depositories – Part 3, Gold Swaps and the Quality of the IMF Gold”.

And additionally, as the Banque de France commented to National Geographic in February 2011:

“Buyers don’t want the beat-up American gold. In a nearby room pallets of it are being packed up and shipped to an undisclosed location, where the bars will be melted down and recast in prettier forms."

So with the IMF gold in Nagpur being a hodgepodge of mostly low quality old gold, and with IMF gold in New York and Paris being in the form of bundled up old US Assay Office melts and even some low quality coin bars, then it would be logical for the IMF in October 2009 to sell the RBI some of its good delivery gold which was stored in London (which, until at least the late 1970s, was predominantly held in the form of Rand Refinery 400 oz gold bars).

Thirdly, prior to October 2009, the only gold which the RBI stored abroad was with the Bank of England and the BIS, and after October 2009 this was still the case, so the 200 tonnes of gold which the IMF acquired in October 2009 had to have come from IMF gold bars that the IMF had stored at the Bank of England, because this is the only remaining IMF gold depository when the other 3 IMF gold depositories are excluded.

Note that prior to 2009, the RBI had not purchased any gold in the preceding years between 2002 – 2008 (which is the earliest data that is available on the World Gold Council website).

Conclusion

So putting this all together, we know that of the 724.24 tonnes that the Indian central bank claims to hold, 292.3 tonnes in held by the RBI in its vaults in Nagpur, India, and the rest, 432 tonnes, is held with the Bank of England and the BIS. Of this 432 tonnes, 65.5 tonnes has been held with the Bank of England / BIS since 1991, 200 tonnes was bought from the IMF in 2009 and is stored at the Bank of England, and the rest, 166 tonnes (purchased over 2018 – 2021) is held with the Bank of England / BIS.

But similar to all central banks the world over, the Indian central bank never publishes any physical audits of the RBI gold, never publishes weight lists (bar lists) of the gold bars held, never published a breakdown of much RBI gold is held by the Bank of England and how much is held by the BIS, and never publishes any information about gold loans or gold swaps nor how much gold is out on loan with bullion banks.

The 292.3 tonnes of gold held by the RBI in Nagpur has been held for many years. Some since pre-Independence times, and some accumulated during the 1950s – 1960s. This gold is not high quality / purity. In fact, in July 2014, the RBI was in discussions with bullion banks about conducting gold location and quality swaps whereby the RBI would provide this old / inferior quality gold to the banks, and swap it for access to Good Delivery gold bars in London. See Economic Times article here – “RBI plans to swap old gold in Nagpur vault with purer variety”.

Appendix – The Gold Vault in RBI Nagpur

For those who are interested in central bank gold vaults, and especially vaults which claim to gold IMF gold, I will leave you with an intriguing old report from the RBI website which was published in February 1984 and which is titled “Report of the Committee on Security Arrangements, Vol 1” (pdf RBI CR671). This report gives some insight into the RBI’s gold vault in Nagpur at that time. From pages 107 – 109:

“Gold vaults

5.8 The Bank has in its custody a considerable quantity of gold not only on its own account as Reserve Gold for note issue but also balances held in safe custody on behalf of Government of India and the International Monetary Fund. The bulk of this gold is held in Nagpur. The major portion of the remaining gold is held in Bombay.

In regard to the custody and operation of the gold vaults, the Committee would recommend the following :-

(a) Nagpur

(i) The main door of the gold vault is enclosed in a grilled enclosure in the patrol corridor

(ii) The actual joint custodians of the gold balances are the Assistant Currency Officer and the Treasurer. In view of the nature of the treasure, viz gold and the fact that not only is it the Reserve Bank of India’s own gold but also gold of the Government of India and the International Monetary Fund which means that it is not merely the tangible value of the gold that is involved but also the intangible, viz. the image of the Reserve Bank as the custodian of the gold of the World body and the Central Government that is involved, it will be more appropriate to elevate the status of the joint custodians.

On the analogy of the holding of one key by the Treasurer, the head of the cash department, the other key may be held by the other comparable head of the issue department, viz. the Currency Officer (Administration). This will also be in keeping with the controlling key being held by the Manager.

(b) (ii) In Nagpur, the original keys of the joint custodians are held in safes, under the third lock of the Manager, and the safes themselves are kept in different vaults.

A lot may have changed in the Nagpur vaults since 1984, although a lot may have remained the same. And with the RBI vault in Nagpur being an IMF gold depository, the IMF would undoubtedly prefer that the world forgets that the Nagpur gold vault even exists.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments