The IMF’s Gold Depositories – Part 2, Nagpur and Shanghai

Part 1 of the IMF’s Gold Depositories series explained the legal background as to why the IMF originally made the decision to hold gold at the Federal Reserve Bank of New York, the Bank of England, the Banque de France and the Reserve Bank of India.

See Part 1 for details, but as a quick recap, although the current IMF Rule F-1 on the location of its gold depositories states that “Gold depositories of the Fund shall be established in the United States, the United Kingdom, France, and India", the original 1946 version of the rule, then called Rule E-1, said that “Gold depositories of the Fund shall be established in New York, London, Shanghai, Paris, and Bombay."

It is generally known that the central banks in some of these cities are indeed locations are IMF gold depositories, and the IMF will actually, on occasion, bring itself to confirm these facts.

What is less well understood however are the references to the cities in two of the word’s great gold markets, specifically, the reference to the Reserve Bank’s Bombay office, the transfer of IMF gold to another Indian city, Nagpur, and the fact that Shanghai was only removed “temporarily” and could, in theory, be reinstated as an IMF gold depository.

The Road to Nagpur

The original version of Rule E-1 was adopted on 25th September 1946, and then amended in 1956. This amendment in 1956 was triggered by the Reserve Bank of India (RBI), but it created some far-reaching implications for where the IMF’s gold can be stored.

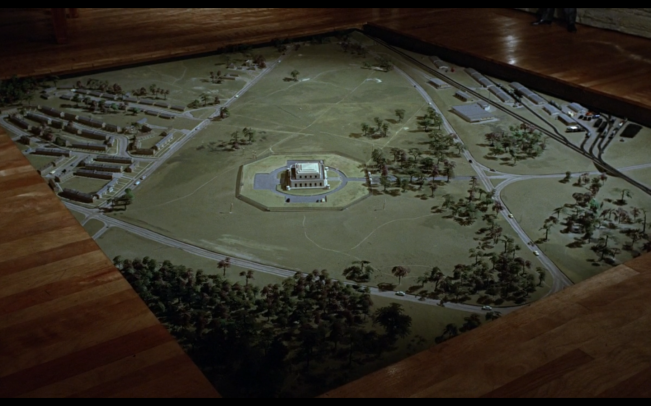

The trigger for the amendment of Rule E-1 in 1956 was an initiative by the RBI to move their own gold from their Bombay office to a new office in Nagpur which they had just opened. Nagpur is a city in the very heart of India in the state of Maharashtra.

In moving their own gold, the RBI asked the IMF if it objected to the re-location of the IMF gold at the same time. There was actually not much IMF gold held in Bombay, the only gold held there being India’s initial gold subscription to the IMF that had been transferred at the Fund’s inception, worth $27.5 million at $35 an ounce, or just over 24 tonnes. No other founding nation of the IMF had supplied gold to Bombay at that time.

In a 1956 staff document to the IMF Executive Directors, “Gold Depositories of the Fund”, the IMF staff explained the RBI’s move and recommended that the wording of Rule E-1 should be made more flexible so as to take account of future situations where other gold depositories of the Fund might want, or need, to hold gold at alternative locations in their respective countries, other than those locations already specified.

The IMF staff also proposed to the IMF Executive Directors that they should agree to the RBI’s request:

“At the moment, the Fund holds the equivalent of US$27.5 million in gold with the Reserve Bank of India in Bombay. The Fund has received a letter from the Reserve Bank stating that it has recently opened an office at Nagpur, which is situated about 520 miles from Bombay in the interior of the country.

The office is in the Bank’s own building, and it contains a special vault for storing the Bank’s stock of gold. The special vault was constructed partly to enable gold to be stored at a comparatively safer place and partly to relieve the pressure on vault accommodation at the Bombay office. The Reserve Bank is transferring its own gold to Nagpur and inquires whether the Fund would object to the movement of the Fund’s gold."

The staff document went on to explain the logistics of the move:

“The arrangements for transport would be made under the supervision of the military, and safe custody arrangements at Nagpur would be subject to the same security conditions as are observed at present in Bombay. The Fund’s gold would continue to be held under earmark, and the normal procedures which gold depositories follow in relation to the Fund would continue to be observed.”

A critical point in this IMF document, beyond the Indian gold transfer, is that the IMF staff viewed it as an opportunity to propose more general wording for Rule E-1 so as to allow IMF gold to be stored in any location within the designated countries. The Staff proposed to the Executive Directors.:

“Although Rule E-1 is not free from ambiguity, the more obvious reading of it requires that gold held in India shall be held in Bombay.

The question of the physical transfer of gold may be raised by other gold depositories of the Fund. For example, in the United States, there have been occasions when official stocks of gold have been held simultaneously in New York, Denver, San Francisco and Fort Knox.

The staff believes that it would be advisable to amend Rule E-1 so as to give the Fund more flexibility in dealing with a proposal of the kind made by the Reserve Bank of India. Accordingly, it recommends that Rule E-l should be amended…”

(Source: EBS/56/39, “Gold Depositories of the Fund”)

An IMF Executive Board meeting in November 1956 about the move of the Fund’s gold to Nagpur, approved on January 9th, 1957 (Meeting 57/1), deemed that “it is agreed that the Fund’s gold held with the Reserve Bank of India shall be held at Nagpur."

The Executive Directors also used the opportunity of the 1956 amendment to Rule E-1 to delete the reference to Shanghai as an IMF gold depository (‘without prejudice’). This is explained below.

And so, in 1956 the Rule E-1 sentence

“Gold depositories of the Fund shall be established in New York, London, Shanghai, Paris, and Bombay”

became

“Gold depositories of the Fund shall be established in the United States, United Kingdom, France, and India”

and the phrase “at places agreed with the Fund” was added as follows:

“The gold of the Fund shall be held with the depositories designated by the members in whose territories they are located at places agreed with the Fund”.

IMF gold, anywhere

Since the 1956 Rule E-1 persists into the current Rule F-1 (see Part 1), it opens up the possibility that IMF gold could be stored in any central bank gold vault (or other outsourced vaults) in any of the four jurisdictions of the US, UK, France and India, and even in China in the future if China looked to use its “without prejudice” option to be re-listed in the current day F-1 Rule list.

For example, the wording of Rule F-1 suggests that IMF gold held at the FRB New York vaults could be transferred to another Federal Reserve Bank vault as long as the other Bank had secure storage facilities.

Whether, in terms of Rule F-1, this transferability extends to US Treasury storage locations such as Fort Knox is unclear; the IMF staff document from 1956 seemed to think that US Treasury locations were feasible storage locations since it mentions them as indirect justification for changing the Rule E-1 wording.

There appears to be legal authority for the US Treasury and Federal Reserve Bank to use the Treasury’s Mint institutions for storing foreign central bank gold. Such arrangements were even being discussed as early as the 1940s as the following ‘Treasury Department, Inter Office Communication’ letter from a Mr. Luxford to a Mr. Dietrich makes clear:

“The quantity of gold available in New York for sale to foreign governments for earmarking by the Federal Reserve Bank of New York has declined to such an extent that it will soon be necessary to ship gold from Fort Knox to New York, or make other arrangements for earmarking.

It has been suggested that, to avoid the tying up of transportation facilities and the high cost of shipping, arrangements be made whereby the Federal Reserve Bank can, with the consent of the governments concerned, earmark gold while it is still in the Mint institutions."

The letter goes on to describe a proposal whereby the FRB could earmark foreign central bank gold in the vault of the Denver branch of the FRB of Kansas City, or even lease private bank vaults in Denver, but if this didn’t solve the space issue, then compartments in Fort Knox and the Denver Mint were available:

“Mr. Howard has contacted the superintendents at the Fort Knox and Denver institutions and I am informed that the following spaces are available:

1. Fort Knox – two compartments which, when filled completely, could hold approximately $1,000,000,000 in gold.

2. Denver – three compartments which, when filled completely, could hold approximately $450,000,000 in gold."

Luxford concluded that:

“I believe that there is legal authority for the use of the mint institutions for the purpose outlined above."

(Source: ‘Treasury Department, Inter Office Communication’, Sept 1943, Clinton Library, gold files)

So, there appears to be a legal precedent for foreign central banks, governments and international institutions to hold earmarked gold at US Treasury storage locations. These arrangements would be very useful if the US Treasury needed gold at the FRBNY and, for example, the Treasury conducted a gold location swap with the Bundesbank or IMF, swapping Treasury Fort Knox gold for Bundesbank or IMF gold.

The IMF is legally allowed to engage in location swaps for its gold and has done so numerous times in the past with entities such as the FRB and the BIS. Some of these IMF gold location swaps are covered in Part 3.

According to the current Rule F-1, IMF gold could also be stored, for example, in Bank of England provincial branch office vaults (assuming there are any of these vaults still operational). The Bank of England has in the past stored HM Treasury and other customer gold in its branch offices, for example in Liverpool, Birmingham and Southampton. Some of these branch offices have now closed but the Bank of England still maintains various agency offices across the UK.

In theory it’s possible that IMF gold could be transferred from the Bank of England’s London vaults to secure storage at one of the Bank’s provincial locations or even to emergency storage locations in England or Wales that have, at various times in the past, been considered by HM Treasury and the Ministry of Defence.

The IMF’s Article XIII, Section 2(b) also seems to open up the possibility that the IMF’s gold could be stored in other locations entirely, even in other countries. Remember that Article XIII, Section 2(b) states:

“(b) The Fund may hold other assets, including gold, in the depositories designated by the five members having the largest quotas and in such other designated depositories as the Fund may select”.

The IMF’s Articles will always have precedence over its Rules and Regulations, due to Rule A-1 which states

“A-1: These Rules and Regulations supplement the Articles of Agreement and the By-Laws adopted by the Board of Governors. They are not intended to replace any provision of either the Articles or the By-Laws.”

There is another clause in Article XIII, section 2(b) referring to an emergency, which is pretty self-explanatory:

“In an emergency the Executive Board may transfer all or any part of the Fund’s gold holdings to any place where they can be adequately protected.”

There is therefore plenty of legal scope for the IMF’s gold to be stored in locations that at first glance might not appear obvious.

Shanghai Surprise

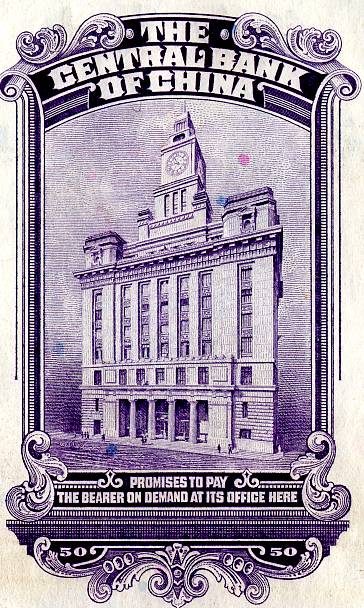

The IMF Executive Board confirmed the five gold depositories of the Fund in November 1946, including the Central Bank of China, Shanghai. However, no IMF gold was ever held in Shanghai because no IMF member country (including China) ever deposited gold to the IMF at Shanghai.

The removal of the reference to Shanghai as an IMF gold depository during the 1956 amendment had its origins in 1949. In 1949 the IMF Executive Board discussed a proposal that Shanghai should be temporarily removed from the gold depositories list due to political instability in the country at that time.

The following Executive Board minutes illustrate the discussion of the proposal that was recommended by the Board Chairman Camille Gutt. The discussion involved Frank Southard (F A Southard), the US Executive Director to the Fund, who had helped plan the Bretton Woods conference in 1944, and Y C Koo, who was subsequently Treasurer of the IMF, and who was part of the nationalist Chinese delegation that attended Bretton Woods:

“Gold Depository

The Executive Board considered a recommendation by the Chairman that, in view of recent developments in China, the Fund should remove Shanghai from the list of gold depositories for the time being.”

“Mr. Southard said he assumed the action would be of a temporary character. Mr. Koo said his Government had no objection on the understanding that the action was temporary. However, the Government would wish to reserve the right to raise the matter again with the Fund at an opportune time.

The decision was: In view of recent developments in China and under the emergency provisions of Article XIII, Section 2(b), Shanghai is for the time being removed from the list of depositories in which the Fund may hold assets, including gold. Members shall be so informed. It is understood that China may, at an opportune time, raise the matter again.”

(Source: Executive Board Meeting 465, 21st July 1949)

While the decision to temporarily remove Shanghai as a gold depository had been taken in 1949, it re-emerged as an issue in 1956 when the amendment to Rule E-1 was being discussed at a meeting. This was because the Executive Board wanted to ensure that the changed wording to Rule E-1 did not prejudice the previous decision to temporarily remove Shanghai as a gold depository.

The Acting Chairman in the 1956 meeting was H. Merle Cochran, deputy Managing Director of the Fund. The Executive Director for China (representing the Taiwan based government) was Mr Tann:

“The Acting Chairman stated that, in order to make it clear that the proposed action would not prejudice a previous decision temporarily removing Shanghai from the list of depositories, the staff wished to recommend the addition of the following paragraph to the decision proposed:

(c) The amendment of Rule E-1 as set forth in paragraph (a) above is without prejudice to the decision of the Executive Board at Meeting 465 (July 21, 1949)"

“Mr. Tann said he had no objection to the staff’s proposals and particularly welcomed the additional paragraph put forward by the management since it would leave no doubt that the 1949 decision was not being nullified.”

(Source:Executive Board Meeting 56, 29th November 1956)

The 1956 amendment to Rule E-1 was adopted by the IMF Executive Board on 9th January 1957, and then reviewed and accepted by the Fund’s Board of Governors at the 12th IMF annual meeting 1957 where Per Jacobsson, Managing Director and Chairman of the Executive Board highlighted to the Governors that

“On November 29, 1956, Rule E-1 was amended to provide for greater flexibility in the location of the Fund’s gold held with designated depositories.”

(Source: Draft letter by Per Jacobsson to the Chairman of the Board of Governors, twelfth Annual Meeting of the IMF)

On paper, the reinstatement of China as a gold depository of the IMF looks possible, but in reality would be complicated by a number of issues, not least the unravelling of claims and representations that could arise from Taipei and Beijing over the 1949 agreement with the IMF.

With Shanghai now re-emerging as a dominant player in the global gold market, its fitting that the story of the IMF’s Shanghai depository should not be forgotten even though it never really existed.

The Nagpur gold vault, which does exist, is itself a relatively forgotten IMF outpost. But it still contains, or is said to contain, both IMF and Reserve Bank of India gold. For this reason, the Nagpur gold vault, and some of its details, will be the subject of a future post.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments