How California Stuck With Gold When the U.S. Adopted Fiat

This blog post is a guest post on BullionStar’s Blog by the renowned blogger JP Koning who will be writing about monetary economics, central banking and gold. BullionStar does not endorse or oppose the opinions presented but encourages a healthy debate.

We are ten years into the age of bitcoin. But people are still using national currencies like yen, dollars, and pounds to buy things. What does history have to say about switches from one type of monetary system to another? In this post I’ll dig for lessons from California’s successful resistance to a fiat standard that was imposed on it in the 1860s by the rest of the U.S.

Not long after the war American Civil War broke out in 1861, a run on New York banks forced most of the country’s banks to stop redeeming their banknotes with gold. A few months later Abraham Lincoln’s Union government began to issue inconvertible paper money in order to finance the war. These notes were popularly known as Greenbacks.

Thus the 19 states in the Union shifted from a commodity monetary standard onto a fiat monetary standard. But Californians, who had been using gold as a payments medium for the previous decade-and-a-half, chose not to cooperate and continued to keep accounts in terms of gold. As a result, California stayed on a gold standard while the rest of the Union grappled with fiat money.

This had very different repercussions for prices in each region. As the Union issued ever more greenbacks to finance the war, the perceived quality of these IOUs deteriorated. Through much of 1863 and 1864, their price fell relative to gold. Because prices in the Union were set in terms of greenbacks, consumer and wholesale prices rose rapidly.

In California, on the other hand, prices continued to be set in gold. Thus Californians did not experience significant inflation during the Civil War.

The waging of California’s monetary civil war

Why did the east so easily switch onto a fiat dollar standard whereas California continued to define the dollar in terms of gold? By the 1860s, most Americans who lived east of the Rockies dealt primarily in banknotes. These notes, which were issued by private banks and convertible into gold on demand, circulated widely. Gold coins, which were heavy and prone to wear, were largely confined to bank vaults.

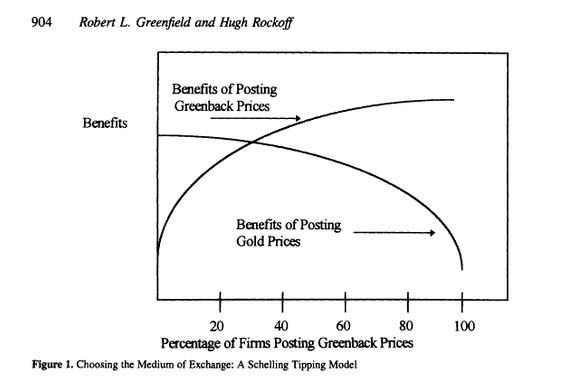

Economists Greenfield & Rockoff (2006) write that if “most people use a particular money, then everyone else has good reason to use it." But if most people refuse to use a money, then any given individual has no reason to adopt it. In the chart below, the more firms that choose to post prices in greenbacks, the greater the benefits to any individual firm of posting prices in greenbacks. And vice versa with gold. According to Greenfield & Rockoff, a nation will naturally “tip toward" either general refusal or general acceptance of a given monetary instrument .

When private banknotes became inconvertible in 1861 and the prices of gold and banknotes began to diverge, shopkeepers all across the U.S. had to decide which of these two instruments would serve as their accounting unit. For instance, if a horse merchant chose to sell horses at $4, did that mean that a customer owed $4 worth of greenbacks, or $4 worth of gold coins? The decision was an important one, since by 1864 one greenback would be worth just 40 cents in gold. Given that banknotes were already the dominant form of doing business in the east, shopkeepers in most Union states converged on banknote-based pricing.

But Californians had never been fond of banknotes. The 1849 First State Constitutional Convention had prohibited the chartering of banks and issuing of bank notes:

but no such association shall make, issue, or put in circulation

any bill, check, ticket, certificate, promissory note, or other

paper, or the paper of any bank, to circulate as money

[California, 1853 #64, Article IV, Section 34]

Suspicion of banknotes ran so strong in California that when businessman Samuel Brannan tried to establish a note-issuing bank in 1857, the following was printed in the Evening Bulletin:

Mr. Brannan, attempts to violate the Constitution of the State, and to fasten upon the community that most pernicious of all evils, a shin-plaster currency….The evils of shin-plaster currency are so great, and the wishes of nine-tenths of our people are so bitterly opposed to its introduction, that we call upon every individual who has any regard for the interest of our State financially or otherwise, to repudiate Mr. Brannan and his shin plasters. (Cross, 1944)

According to Cross (1944), people referred to banknotes as shin-plasters because they were about the size of the plasters put on the injured shins of farmers and other outdoor workers.

Needless to say, Brannan’s notes never took hold. In place of banknotes, Californians had always preferred to pay each other with physical gold. With the discovery of the yellow metal in 1848 in California, the state had plenty of the stuff. Gold dust, despite its inconvenience (see below) was a popular early medium of exchange. Later on, private and government-issued gold coins also became important. Non-chartered private banks existed, but they issued only deposits, not notes.

“How much can you raise in pinch?"

Some interesting anecdotes about the difficulties of using gold dust as money in 1840s California. Source: https://t.co/meZnxOYRax pic.twitter.com/AyD3skPsg2

— JP Koning (@jp_koning) January 13, 2019

And thus California, unlike the rest of the Union, refused to adopt the greenback as a medium of account. Since banknotes were rare and merchants expected other merchants to continue dealing in gold coins, the “$" continued to be represented by the yellow metal.

It wasn’t impossible to pay with greenbacks in California, however. But if a customer needed to pay with paper money, the market value of the notes would be used and not their face value. So if a horse’s sticker price was $4, and greenbacks were trading for just $0.50 to the gold dollar, then it would cost $8 to buy the horse with greenbacks. Also, since the Federal government continued to accept greenbacks for tax payments, there was constant demand for greenbacks in order to discharge tax liabilities.

San Francisco’s merchants and the Greenback embargo

Perhaps Lincoln could have counteracted Californian’s natural predilection to continue using gold by threat of force. But the Union’s attention was otherwise occupied with the Confederacy. Furthermore, Californians simultaneously deployed their own set of defences to ensure that gold remained the dominant medium.

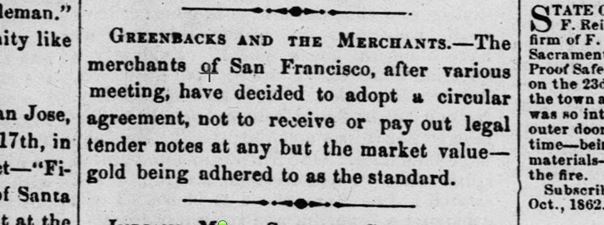

In 1862, San Francisco’s merchants set up a greenback embargo. The merchants agreed that they were “not to receive or pay out legal-tender notes at any but the market value, gold being adhered to as the standard." Any merchant who was caught asking for payment in greenbacks was to be reported to the merchants association, their names recorded in a black book. Once their name was black listed, rule-breakers could not buy merchandise on credit from other merchants. Instead, they would have to pay up-front in gold (Shearer, 2000).

Shearer points out that the boycott did not work perfectly. For instance, the following ad appeared in the San Francisco Bulletin in late 1864:

Greenbacks. Caution is herewith given to all persons doing business with a man named Charles Strassman of the East India Tea Store on Washington Street opposite Maguires Opera House, that he has been purchasing goods to a considerable amount very lately from the subscribers and paying for them in the above currency, having bought [i.e. contracted for the goods] for gold coin. Castle Brothers,Jones & Co.

Even though merchants could be blacklisted if they dealt in greenbacks, they could still legally compel their creditors to accept them in settlement of any dollar debt. In 1863, the state legislature closed this avenue by passing the Special Contract Act. By including a gold clause in a debt contract, a merchant now had the legal right to force a debtor to pay with gold, not greenbacks. Usage of these clauses became standard practice in California, and this would have further marginalized the greenback (Mitchell, 1903).

In Summary…

Californians rejected the greenback because they had long adhered to gold as a form of payments. Any given merchant expected the rest of the mercantile community to continue paying with gold coin, which made it costly to adopt greenbacks. The reverse happened in the east, the monetary system tipping towards the more familiar banknote. Even as the greenback inflated, easterners still preferred to set prices in terms of paper. It was too costly for an individual merchant to shift onto gold given that every one else already accepted paper.

This same stickiness explains why new technologies like bitcoin haven’t got much usage as a way to pay. It also accounts for why Venezuelans have been slow to shift away from a bolivar monetary system to a dollar-based one despite the collapse of the bolivar. When groups of people collectively adopt a habit, this habit is very difficult to change.

References:

1. Cross, I. Californians and Hard Money. California Folklore Quarterly, 1945

2. Greenfield, R and H Rockoff. Yellowbacks out West and Greenbacks Back East: Social-Choice Dimensions of Monetary Reform, 1996.

3. Mitchell, W C . A history of the greenbacks, with special reference to the economic consequences of their issue: 1862-65. 1903. Link: https://archive.org/details/historyofgreenba00mitcrich

4. Moses, M. Legal Tender Notes in California. The Quarterly Journal of Economics, 1892.

5. Shearer, R. California and the Gold Standard During the American Civil War. 2000. Link: https://open.library.ubc.ca/cIRcle/collections/facultyresearchandpublications/52383/items/1.0340777

6. Watner, C. Hard Money in the Voluntaryist Tradition. 1987. Link: http://voluntaryist.com/articles/issue-23/hard-money-in-the-voluntaryist-tradition/#.XD4Xh2navIW

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 4 Comments

4 Comments