An Early Attempt at Standardizing Money With Gold Coins

This blog post is a guest post on BullionStar’s Blog by the renowned blogger JP Koning who will be writing about monetary economics, central banking and gold. BullionStar does not endorse or oppose the opinions presented but encourages a healthy debate.

In November, representatives of 54 nations met at a gathering of the International Bureau of Weights and Measures (BIPM) and unanimously voted to redefine the kilogram. For over a century, an actual weight housed in the BIPM’s basements has been used to define the kilogram. Now it will be defined by reference to Planck’s constant

Given how easily we are able to modify our global standard for measuring weight, isn’t it remarkable that we have never been able to set an equivalent standard for monetary value? Some 180 currencies are currently being used around the globe, most of them floating haphazardly against each other.

Efforts to establish the metric system for weights and other measures go back to the late 1700s. At the same time that scientists and policy makers were working to get the world’s nations to use metres, kilograms, and the like, they were also trying to do the same with money. This post will be about an ambitious effort to create an international system of monetary measures in the 1860s and 70s, and its failure.

Convention monétaire and the 1867 International Monetary Conference

One of the first efforts of monetary standardization was the Latin Monetary Union, or LMU. In December 1865, Belgium, France, Italy, and Switzerland all agreed to abide by the convention monétaire, or what was derisively termed the LMU by the English press. Prior to the deal being struck, Italy, Belgium, and Switzerland had already begun to issue their own local versions of the French franc. For instance, Italy’s lira – introduced in 1862 – was of the same purity and weight as the French franc. The LMU formalized this relationship by, among other measures, committing each government to accept the others’ coins at par in payment of taxes and other dues.

Citizens of France were welcome, but not obliged, to accept Swiss, Belgian, or Italian coins, and vice versa. The poster below helped locals to know which gold and silver coins were issued by LMU members, and which were foreign and thus not acceptable at the state tax office.

To help deal with a confusing number of coins, this 1880 poster helped people living in the Latin Monetary Union know which to accept or refuse. The LMU (1865-1926) was comprised of France, Italy, Greece, Belgium & Switzerland.

Source: https://t.co/KkdXjeH0aF pic.twitter.com/DM24fV1KAk— JP Koning (@jp_koning) December 7, 2018

With the LMU establishing a common coinage standard across a large part of Europe, why not expand the standard? Paris would be hosting the World Fair in the summer of 1867. With so many people in attendance, it was decided to host a monetary conference with the view of “promoting the uniformity" of coins. The conference was attended by representatives of twenty different nations, including United States, France, Great Britain, Russia, and Turkey.

In the document emerging from the conference, delegates agreed that without a common system of coins, business between nations would be forever burdened with the costs of converting from one type of coin to another. This could be solved by introducing into each nation a “point of common contact," specifically a gold coin that was to be of uniform weight and purity. These common coins could be used in each nation, thus ending the need to constantly convert from currency to currency as one crossed borders. Taking a page from the LMU, conference delegates supported the five franc gold coin as the universal coin on which to model all other coins. In addition to creating a common coin, it was agreed that national governments would accept each others coins as legal tender.

Governments needn’t actually issue french francs, of course. They could add their own emblem and denomination as they pleased, but would be encouraged to add the relation between its value and that of the five franc piece.

The difficulty of standardizing coins

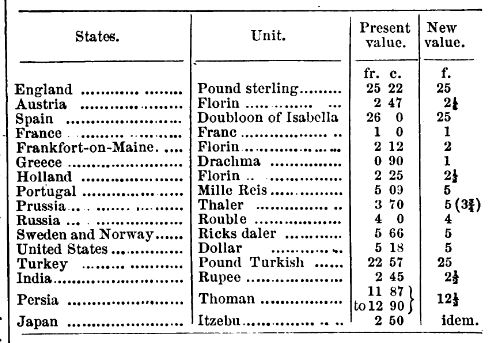

There were several significant hurdles in the way of establishing an international coin standard. Getting the Brits and Americans on side was important, given how sizable these nations were. The problem is that one British pound, represented by the gold sovereign, was worth 25.22 francs, as illustrated in the table below. This was hardly a convenient ratio for establishing a “point of common contact." Either the franc would have to have a bit of gold added to it to bring the ratio to an even 25 francs to the pound, or the pound would have to have a bit of gold removed.

With the conference having established the franc as the universal standard – the reasoning being that the franc circulated more widely than the pound – it was the Brits who were called on to make the adjustment. By reducing the gold content of the pound by 0.88%, one British pound would now conveniently be worth 25 francs.

The same problem characterized the ratio between the U.S. dollar and the French franc. A franc was worth $5.18 (see table above). To bring the dollar into alignment with the franc, 18 cents worth of gold would have to be removed from the dollar, or 3.5%.

A set of U.S. dollar proofs, or sample coins, were created to capture the essence of this small alteration. The coin below successfully lives up to the spirit of the 1867 conference by establishing a clean US$1/5 franc exchange rate and illustrating both the local dollar as well as the universal franc on the obverse side.

The French had their own coin created to capture the spirit of the conference, with the face of Napoleon III instead of Liberty.

Meanwhile, on the British side, Thomas Graham, Master of the London Mint and a British delegate to the 1867 conference had the following proof minted.

Graham’s coin also conformed to the strictures of the 1867 conference. It listed both the local currency value, the British double florin (1/5th of a pound), as well as the franc.

For both the U.S. and U.K., redefining their currency was a big step to take. Each nation’s existing coins would have to be called in and remade to the new and lighter standard. Secondly, all existing American and English debts – which had been based on dollars and pounds of a certain gold content – would have to be renegotiated to account for a lightening of the standard. For instance, a legacy $50 obligation would have to be recognized as a debt of $51.75 using new coins. That way a creditor was assured of getting the same amount of physical gold as before.

In the U.S.’s case, the change would have been easier to pull off. It had already switched over to a fiat standard not long before. In 1861, greenbacks had been declared irredeemable. Since then, $1 worth of greenbacks was worth a fraction of $1 in gold coin. Imposing a new coin on Americans, and requiring that all debts be re-denominated by 3.5% would be less of a nuisance in what was an already chaotic system. Indeed, John Sherman, the powerful chairman of the Senate finance committee, nonchalantly wrote that since “contracts are now based upon the fluctuating value of paper money, even the reduced dollar in coin will be of more purchasable value than our currency."

William Stanley Jevons and a tidy English solution

Matters in the UK were more complicated. First, some background. Coins are more useful than raw bullion. They can be passed quickly from hand to hand whereas an equivalent amount of bullion needs to be weighed or assayed by whoever accepts it. Because these services are valuable, people generally put a premium on gold coins relative to an equivalent amount of gold.

For centuries, however, the UK supplied these services for free. Anyone could bring some gold or silver into the mint and have it converted into an equivalent amount of coins without having to pay a fee. Since English mints imposed no fees, an English coin that contained 10 grams would always have the same market value as 10 grams of raw gold. Were the coin to be worth more than that, a trader could quickly arbitrage the difference by purchasing raw gold, bringing it to the mint and having it turned into coin for free, pushing the premium back to zero.

If the mint charged a fee, however, coins would be worth more on the market than an equivalent amount of raw gold. After all, melting down a coin meant that one had to pay a fee to turn the bullion into useful coin again.

With all this in mind, William Stanley Jevons, one of the most well-known British economists of the day, proposed a tidy solution. Reduce the gold content of the sovereign by 0.88% to bring it inline with the franc but counterbalance this by introducing a mint charge of the same size. The reduction in gold content would hurt its market value, but mintage fee would exert pressure in the opposite direction and drive it higher. Since this combination ensured that a new sovereign would be worth as much as an old one, British debts would not have to go through the arduous process of being re-denominated. Yet at the same time, British pounds would now be on the same basis as the franc. Each would contain the same amount of gold.

Failure and Dana Bickford’s international coin

So what happened with all these efforts at standardizing monetary units? The LMU never ended up expanding very far, with only Greece taking up membership in 1867. According to Luca Einaudi, the strongest members of the LMU weren’t keen to expand given problems involved in policing weaker members like Italy and Greece, in particular each nation’s limit on small silver coins, which was fixed by the convention at six francs/lira per inhabitant.

As for the U.S., Sherman brought the U.S. onto the gold standard in 1873, which was one of the requirements set out in the 1867 monetary conference. But he never went as far as reducing the U.S. dollar to the level of the franc.

In the U.K., Jevons and his allies managed to get the discussion about international coinage rolling in 1868, as chronicled in this interesting paper by John Maloney. But Jevons’ solution may have been a bit too fancy, and discussants got bogged down in the details. On top of that, Britain was solidly in favour of the gold standard, and France and the LMU were on a bimetallic standard. This was enough to dash prospects for monetary standardization.

And thus ended official efforts to create an international system of monetary measurement. The last attempt emanated from the private sector a few years later. In 1874, an American named Dana Bickford minted a $10 international coin displayed below. On it Bickford inscribed the coin’s official value in terms of the domestic currency of several nations, including Sweden, France, and the UK.

Failed monetary technology. Dana Bickford’s 1874 $10 gold coin was designed for international usage, having its value inscribed in yen, sterling, German marks, Danish kroner, gulden, and francs: https://t.co/RiGGrlBOFx pic.twitter.com/TL7CddScUz

— JP Koning (@jp_koning) June 25, 2018

But this was a much less ambitious attempt than the original coins inspired by the 1867 Paris monetary conference. One of the advantages of coins is that their denomination structure is composed of nice round number. This allows for easy divisibility, the making of change, and adding up sums. For French shoppers or merchants, Bickford’s 51.81 franc coin would have been a terribly awkward coin to handle. Two of the elegant 1867 $5/25 franc Liberty pieces would have been much a more convenient solution.

Is there any role for monetary standardization to play in the present? The Eurozone is certainly the most important modern attempt to impose a standard unit across many nations. And while it has scored some initial successes, it has experienced many difficulties since the euro crisis that began in 2010. Since the crisis period hit, Estonia, Latvia, and Lithuania have all joined the monetary union. At the same time, several nations that had previously intended to join, including Croatia, Czech, and Poland, have delayed potential start dates. This may indicate that the perceived benefits of monetary standardization may not be worth the nuisances. While the kilogram unites us all, the odds of a single common monetary measure seem fleeting, as always.

References:

1. Einaudi, L. A Historical Perspective on the Euro: the Latin Monetary Union (1865–1926). Available here: https://www.cesifo-group.de/DocDL/dice-report-2018-3-einaudi-oct.pdf

2. Einaudi, L. From the Franc to the ‘Europe’: Great Britain, Germany and the attempted transformation of the Latin Monetary Union

into a European Monetary Union (1865-73). Available here: http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.201.2319&rep=rep1&type=pdf

3. Jevons, W. Money and the Mechanism of Exchange. Chapter 15, available here: https://www.econlib.org/library/YPDBooks/Jevons/jvnMME.html?chapter_num=15#book-reader

5. Jevons, W. On the Condition of the Metallic Currency of the United Kingdom, with Reference to the Question of International Coinage. Available here: https://www.jstor.org/stable/2338797?seq=1#metadata_info_tab_contents

6. Maloney, J. Joining the ‘Europe’ and Shrinking the Pound; Britain’s Single Currency Debate of the Late 1860s. Available at https://core.ac.uk/download/pdf/6402295.pdf

7. Report of the International Conference on Weights, Measures, and Coins, Held in Paris, June 1867. Available here: https://hdl.handle.net/2027/mdp.35112103466761

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 4 Comments

4 Comments