Why QE Didn’t Send Gold Up to $20,000

This blog post is a guest post on BullionStar’s Blog by the renowned blogger JP Koning who will be writing about monetary economics, central banking and gold. BullionStar does not endorse or oppose the opinions presented but encourage a healthy debate.

Why didn’t quantitative easing, which created trillions of dollars of new money, lead to a massive spike in the gold price?

The Quantity Theory of Money

The intuition that an increase in the money supply should lead to a rise in prices, including the price of gold, comes from a very old theory of money—the quantity theory of money—going back to at least the philosopher David Hume. Hume asked his readers to imagine a situation in which everyone in Great Britain suddenly had “five pounds slipt into his pocket in one night." Hume reasoned that this sudden increase in the money supply would “only serve to increase the prices of every thing, without any farther consequence."

Another way to think about the quantity theory is by reference to the famous equation of exchange, or

- MV = PY

- money supply x velocity of money over a period of time = price level x goods & services produced over that period

A traditional quantity theorist usually assumes that velocity, the average frequency that a banknote or deposit changes hands, is quite stable. So when M—the money supply— increases, a hot potato effect emerges. Anxious to rid themselves of their extra money balances M, people race to the stores to buy Y, goods and services, that they otherwise couldn’t have afforded, quickly emptying the shelves. Retailers take these hot potatoes and in turn spend them at their wholesalers in order to restock. But as time passes, business people adjust by ratcheting up their prices so that the final outcome is a permanent increase in P.

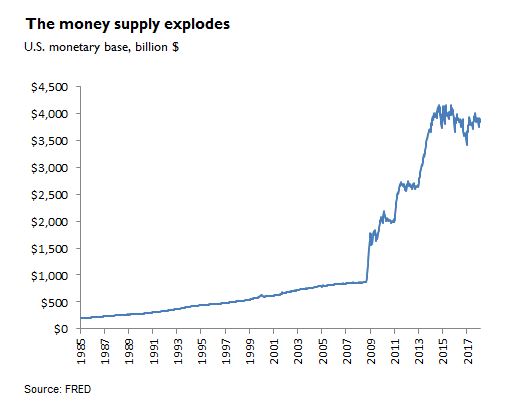

In August 2008, before the worst of the credit crisis had broken out, the U.S Federal Reserve had $847 billion in money outstanding, or what is referred to as “monetary base"—the combination of banknotes in circulation and deposits held at the central bank. Then three successive rounds of quantitative easing were rolled out: QE1, QE2, and QE3. Six years later, monetary base finally peaked at $4.1 trillion (see chart below). QE in Europe, Japan, and the UK led to equal, if not more impressive, increases in the domestic money supply.

So again our question: if M increased so spectacularly, why not P and the price of gold along with it? Those with long memories will recall that while gold rose from $1000 to $2000 during the first two legs of QE, it collapsed back down to $1000 during the last round. That’s not the performance one would expect of an asset that is commonly viewed as a hedge against excess monetary printing.

How Regular Monetary Policy Works

My claim is that even though central banks created huge amounts of monetary base via QE, the majority of this base money didn’t have sufficient monetary punch to qualify it for entry into the left side of the equation of exchange, and therefore it had no effect on the price level. Put differently, QE suffered from monetary impotence.

Let’s consider what makes money special. Most of the jump in base money during QE was due to a rise in deposits held at the central bank, in the U.S.’s case deposits at the Federal Reserve. These deposits are identical to other short-term forms of government debt like treasury bills except for the fact that they provide monetary services, specifically as a medium for clearing & settling payments between banks. Central banks keep the supply of deposits—and thus the quantity of monetary services available to banks—scarce.

Regular monetary policy involves shifting the supply of central bank deposits in order to hit an inflation target. When a central bank wants to loosen policy i.e. increase inflation, it engages in open market purchases. This entails buying treasury bills from banks and crediting these banks for the purchase with newly-created central bank deposits. This shot of new deposits temporarily pushes the banking system out of equilibrium: it now has more monetary services than it had previously budgeted for.

To restore equilibrium, a hot potato effect is set off. A bank that has more monetary services then it desires will try to get rid of excess bank deposits by spending them on things like bonds, stocks, or gold. But these deposits can only be passed on to other banks that themselves already have sufficient monetary services. To convince these other banks to accept deposits, the first bank will have to sell them at a slightly lower price. Put differently, it will have to pay the other banks a higher price for bonds, stocks, or gold. And these buyers will in turn only be able to offload unwanted monetary services by also marking down the value, or purchasing power, of deposits. The hot potato process only comes to a halt when deposits have lost enough purchasing power, or the price level has risen high enough, that the banking system is once again happy with the levels of deposits that the central bank has injected into the system.

What I’ve just described is regular monetary policy. In this scenario, open market operations are still potent. But what happens when they lose their potency?

Monetary Impotence: Death of the Hot Potato Effect

A central bank can stoke inflation by engaging in subsequent rounds of open market purchases, but at some point impotence will set in and additional purchases will have no effect on prices. When a large enough quantity of deposits has been created, the market will no longer place any value on the additional monetary services that these deposits provide. Monetary services will have become a free good, say like air—useful but without monetary value. Deposits, which up to that point were unique thanks to their valuable monetary properties, have become identical to treasury bills. Open market operations now consists of little more than a swap of one identical t-bill for another.

When this happens, subsequent open market purchases are no longer capable of pushing the banking system out of equilibrium. After all, monetary services have become a free good. There is no way that banks can have too much of them. Since an increase in the supply of deposits no longer has any effect on bank behavior, the hot potato effect can’t get going—and thus open market purchases have no effect on the price level, or on gold.

This “monetary impotence" is what seems to have overtaken the various rounds of QE. While the initial increase in deposits no doubt had some effect on prices, monetary services quickly became a free good. After that point, the banking system accepted each round of newly-created deposits with a yawn rather than trying to desperately pass them off, hot potato-like.

And that’s why gold didn’t rise to $20,000 through successive rounds of QE. Gold does well when people find that they have too much money in their wallets or accounts, but QE failed to create the requisite “too much money".

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 17 Comments

17 Comments