The Gold Market – Where Transparency Means Secrecy

The following speech, by BullionStar precious metals analyst Ronan Manly, was given to an audience during a Precious Metals Seminar held at BullionStar’s shop and showroom premises in Singapore on 19 October 2016.

Introduction

Good evening ladies and gentlemen, you are all very welcome to this event at BullionStar.

This evening, I will be discussing the topic of transparency versus secrecy in the gold market, and specifically looking at this transparency and secrecy by highlighting a number of areas of the gold market which claim to be transparent but which are in fact very secretive.

Transparency is an important concept in financial markets mainly because it encourages informational and market efficiency. Applied to the gold market for example, this would prevent larger gold traders having an information and trading advantage over the retail gold buying public such as ourselves. So transparency is not just an abstract concept, it has real world implications.

To illustrate this contradiction of transparency versus secrecy, I’ll look at two main sets of gold market participants:

– firstly the central bank or official sector, which includes central banks and organisations such as the International Monetary Fund (IMF) and the Bank for International Settlements (BIS),

– and secondly the wholesale London gold market as represented by the London Bullion Market Association (LBMA) and its bullion bank members.

I have chosen the official sector and the investment sector since together they represent two of the largest areas of gold ownership and gold activity globally, with central banks claiming to hold about 33,000 tonnes of gold, and bullion banks being the largest traders of gold globally.

The London gold market, which is a wholesale gold market dominated by bullion banks, is also arguably the most influential market for gold price discovery. And as Torgny explained just now, these bullion banks are generally defined as the large commercial or investment banks involved in the wholesale gold market.

Central banks and bullion banks also overlap in the gold lending market which is also centred in London, and which is an ultra-secretive market, probably the most secret market on the planet.

The title of my talk actually stems from a recent article that I wrote about the 2010 International Monetary Fund (IMF) gold sales and how those sales were marketed by the IMF as being transparent but which in actual fact were the exact opposite – they were highly secretive, and information about those sales even remains highly classified to this day, six years later.

Transparency

But first, let’s quickly define what we mean by transparency. We are talking here about financial market transparency. A Transparent financial market is one in which, simply put, much is known by many.

In a transparent market, the market institutions are also transparent, and importantly, the institutions can be held to account – i.e. accountability.

In a transparent market there is also open exchange of information between all market participants, and accurate information is freely available about price, supply, demand and market transactions.

And one last point, which is very important, is that in a transparent market, the market data of that market is available and open to independent verification by investors and analysts. Which is totally not the case in the gold market as we’ll see shortly.

In short, a transparent market is one in which all relevant information is freely and fully available to the public (and to all participants).

Secrecy

The opposite of transparency is obviously secrecy, which comes from the Latin ‘Secretus’ meaning hidden, concealed, and private. Secrecy at the extreme allows collusion to occur between market participants.

So the extent of transparency in a market can be visualised as a spectrum with transparency at one end of the scale and secrecy, or opacity, at the other.

Lack of transparency in market structure also contributes to lack of transparency in the derivation of market prices, in other words lack of transparency stifles price discovery, and also causes associated higher trading costs for market participants than would otherwise be the case.

Market Efficiency

Transparency is also a prerequisite for market efficiency. Simply put, market efficiency is the degree to which financial asset prices reflect or embody all available information.

An efficient market is also informationally efficient. This information efficiency requires competition, low barriers to entry, and very importantly, it requires low costs of information gathering. i.e. ‘transparency’.

Some of you might be familiar with the work that Nobel prize-winning financial academic Eugene Fama did on market efficiency. I used to work at Dimensional Fund Advisors (DFA) which is an investment firm that subscribes to market efficiency and which actually has Eugene Fama on its board of directors. So this market efficient view was drilled into me.

But you don’t have to agree with market efficiency theory to see how it’s linked to transparency. The more transparent a market is, the more information is available in that market, and therefore the more likely it is to be an efficient market.

The opposite of this is inefficient markets which can allow a situation to develop known as asymmetric information. That’s where some market participants possess far more information than others, who then have an advantage over others in trading and transacting.

Motivations

There are some markets such as the stock market where there is a relatively high degree of transparency since individual companies have to maintain high standards of investor relations, high standards of corporate governance, and proper corporate communication because of the intense scrutiny under which the market puts those companies and also the in-built checks and balances that exist in common equity such as company voting rights.

Similarly in bond markets, be it sovereign bonds or corporate bonds, there is a high level of available market data about those markets, and in-depth information on the mechanics and market mechanisms of those markets.

There is a debate as to whether it’s the army of equity and bond analysts and hedge fund analysts actually scrutinising stock and bond markets that keeps them efficient, or whether those markets are inherently structurally efficient, but whatever the answer, stock and bond markets are generally considered to be quite efficient.

So, when I turned my attention to looking at the gold market a few years ago, it was actually quite a shock, at least when looking at the central bank and London Gold Market segments of the market, that there is little information of real substance available about the workings of these areas of the gold market, and also, and this is a critical point, there is a culture of secrecy in the gold market that I had never witnessed before in other financial markets.

Perhaps as surprisingly, is the fact that the gold and commodity market analysts working in the major investment banks in places like London and New York don’t seem to ask the simple questions, at least in public, as to how the central bank and wholesale London gold markets actually work. This lack of scrutiny also extends, in my view, to the London financial media, who as far as I can see, almost never question how the gold market really works or question why the gold market is so secretive. Whatever most of these financial reporters actually do all day, they don’t investigate the gold market. That is for sure.

Back in 2011 and 2012, I visited the Bank of England archives in London and the Banque de France archives in Paris a number of times and read and photographed a lot of files about central bank gold operations and transactions that took place between the 1960s and early 1980s, which I then subsequently researched using file copies that I had made.

Those documents made me realise that central banks and the large bullion banks used to regularly discuss the gold market, and also operated within it, and often the discussions and memos were classified and even Top Secret. There are literally hundreds of these files and memos on gold markets in the archives, if not thousands. So, my view is that although 30-40 years has passed since the 1960s – 1980s, and although technology and products have changed, that behind the scenes, the physical gold market is still pretty much the same, and still generates a lot of discussion by central banks and their bullion bank counterparts.

So when I see an opaque contemporary gold market and knowing that central banks and bullion banks used to discuss this gold market in-depth, it motivated me to research this area and try to find out how the contemporary gold market works, how its infrastructure and its transactions work, because I still think that central banks and bullion banks regularly and frequently discuss the market, although never in public.

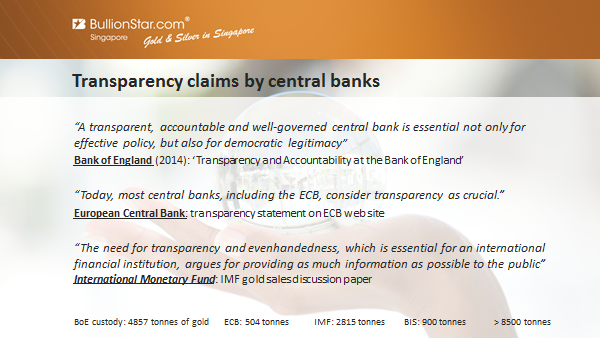

Transparency claims by Central Banks

There are many examples where central banks claim transparency in their operations and policies, but where these claims don’t stand up to scrutiny when applied to their operations in the gold market. Given this contradiction, the only rationale conclusion is that the central banking sector merely pays lip-service to operating with transparency.

Let’s look at a few examples:.

We’ll start with The Bank of England, one of the largest gold storage custodians in the world, also custodian for the UK’s gold reserves, and also heavily involved in the London Gold Market in conjunction with the clearing group London Precious Metals Clearing Limited (LPMCL), and also central to facilitating lending in the London gold lending market. The Bank of England actually established the LBMA in 1987. So what does the Bank of England say about transparency? The Bank of England says:

“A transparent, accountable and well-governed central bank is essential not only for effective policy, but also for democratic legitimacy”

This quote comes from a Bank of England report in 2014 titled ‘Transparency and Accountability at the Bank of England’.

Next we have the transparency claims made by the European Central Bank.

“Today, most central banks, including the ECB, consider transparency as crucial.”

This quote actually come from the ECB’s web site from a page entirely devoted to describing the ECB’s supposed transparency.

Then we have the International Monetary Fund, with a transparency claim that it pronounced in relation to its 2010 IMF gold sales:

“The need for transparency and evenhandedness, which is essential for an international financial institution, argues for providing as much information as possible to the public”

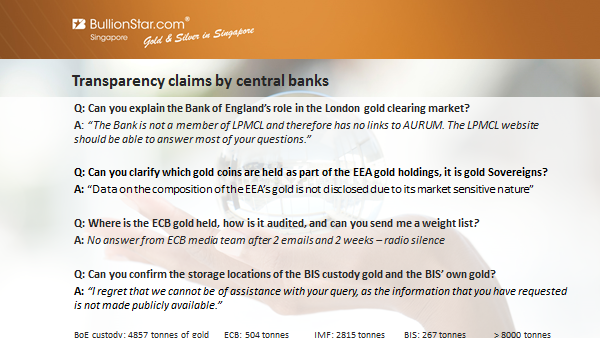

So how do these organisations respond when asked questions related to the gold market? I’ve asked the Bank of England a number of gold related questions over the years, and their answers are mostly classic deflection, i.e. not answering the question. As an example, the Bank of England is involved in gold clearing in the London gold market, where each of the 5 clearing members of LPMCL maintain gold accounts at the Bank, and where the Bank of England clears the net positions of the 5 clearers (from the AURUM system) each day using book entry transfers (BETs) at the Bank of England. In effect, the Bank of England is the London Gold Market’s central clearer.

So I asked the Bank of England to explain its role in this gold clearing? The Bank of England’s answer…

“The Bank is not a member of LPMCL and therefore has no links to AURM. The LPMCL website should be able to answer most of your questions."

However, the LPMCL website has zero information about this process. So, as you can see, the Bank of England is engaging in disinformation and deflection. And this is an institution which claims to be gold custodian for 4857 tonnes of gold held in its London vaults.

The UK Government also claims that all of its departments are transparent and it even launched a ‘Public Sector Transparency Board" in 2010 at which time it stated:

“We want transparency to become an absolutely core part of every bit of government business.”

However, the UK Treasury doesn’t seem to have gotten this message about transparency, since Her Majesty’s Treasury (HM Treasury), a UK government department, is even more uncooperative than the Bank of England in relation to gold market related questions. The UK’s gold reserves are actually owned by HM Treasury and managed by the Bank of England in an account called the Exchange Equalisation Account (EEA).

I was recently writing an article about central banks that hold both gold bars and gold coins in their gold reserves. The UK holds some gold coins, including gold Sovereigns, in its gold holdings. These holdings of gold Sovereigns are actually mentioned in the UK National Archives files as well as in the Bank of England archives.

So I asked HM Treasury what any reasonable person would consider an innocuous question about HMT’s gold coin holdings, and I even included the links to the Archive websites that discuss the HM Treasury gold sovereign holdings:

Can you clarify which gold coins are held as part of the EEA gold holdings, it is gold Sovereigns?"

Not surprisingly, HM Treasury replied:

“Data on the composition of the EEA’s gold is not disclosed due to its market sensitive nature”

HM Treasury actually wrote an entire page to me as an answer while deflecting the question and padding it out with irrelevant material which had nothing to do with my question.

What about the ECB, an institution which holds over 500 tonnes of gold reserves. More transparency than the aloof British institutions? Actually, far from it. As preparation for this presentation, I sent a question to the media department of the ECB asking:

“Where is the ECB gold held, how is it audited, and can you send me a weight list?"

Answer? After two weeks, and 2 emails (including a follow-up), there is no answer from the ECB media team, i.e. complete radio silence.

[Note, since this presentation, the ECB responded after I sent additional emails to them. Their response said that the ECB gold is held in 5 locations in London, Paris, New York, Rome and Lisbon. The ECB hold is not physically audited at all since the ECB considers the central banks that hold it to be ‘totally reliable, and no surprise, the ECB will not publish a weight list of the gold bars which it claims to hold since it says that “the weight of each gold bar is a technicality" and " does not warrant a publication“. See BullionStar blog “European Central Bank gold reserves held across 5 locations. ECB will not disclose Gold Bar List" for full details.]

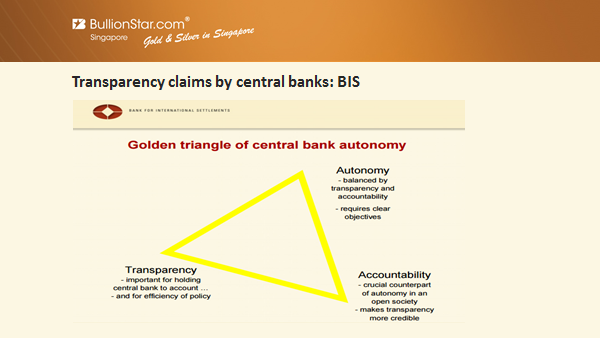

Next we come to the Bank for International Settlements (BIS), the central bankers’ central bank, based in Basel, Switzerland.

In a 2007 presentation, the BIS actually had a slide titled the ‘Golden Triangle of central bank autonomy’ where it links the concepts of Transparency, Accountability, and Autonomy and says that transparency is “important for holding central bank to account“, while accountability is the “crucial counterpart of autonomy in open society" as it “makes transparency more credible“.

The BIS holds its own gold holdings on its balance sheet, as well as holding gold as a custodian on behalf of other central banks, and it also offers these banks a gold deposit taking service. Altogether these BIS holdings represent over 900 tonnes of gold.

So you may think maybe the BIS takes these transparency claims seriously, for example in the gold market, especially given its fondness for gold with the Golden Triangle analogy. However, unfortunately no.

Quite recently, I asked the BIS about its gold as follows:

:Can you confirm the storage locations of the BIS custody gold and the BIS’ own gold?"

The BIS answered:

‘I regret that we cannot be of assistance with your query, as the information that you have requested is not made publicly available.”

So it seems that the only gold that the Bank for International Settlements will talk about is the ‘gold’ in its ‘Golden Triangle’ gimmick of Transparency, Accountability, and Autonomy. In the real world, transparency does not apply to the BIS real gold. Another example of the fiction and deception practiced by central bankers.

IMF Gold Sales

As mentioned earlier, the title of my talk is based on some research I did on the gold sales of the International Monetary Fund which I wrote about recently. Between November 2009 and December 2010, the IMF sold 403.3 tonnes of gold in a series of off-market and on-market sales. The off-market sales were direct sales to a number of central banks: 200 tonnes to India in November 2009, 10 tonnes to Sri Lanka, 2 tonnes to Mauritius, and later on in late 2010, 10 tonnes to Bangladesh.

Then 181.3 tonnes of gold were sold via ‘on-market’ transactions over 10 months between February to December 2010. You might think that “on-market" means that the gold was sold on a well recognised market somewhere, but this was not the case, or at least we don’t know what market was used since the entire operation was and is still secret.

When these ‘on-market’ sales began in February 2010, the IMF came out with a statement saying “A high degree of transparency will continue during the sales of gold on the market”.

Actually, the well-known gold investor and entrepreneur, Eric Sprott, was starting a gold fund at that time and went to the IMF saying that he was interested in buying the entire 181.3 tonnes of IMF gold, but the IMF quickly told him his money wasn’t good with them. The well-known website Business Insider then asked the IMF a series of questions on why Sprott couldn’t buy the IMF gold. These questions were also either arrogantly not answered or dismissed by the IMF’s external communications officer.

Last year, when looking at the IMF online archives for a different reason, I stumbled upon 3 IMF reports titled ‘Monthly gold sales’ which actually covered the first 3 months of these sales in 2010, i.e. Monthly reports on gold sales for February / March 2010, March / April 2010, and April / May 2010. These reports contained some, but not a lot, of information about the sales process and seemed to indicate that the BIS had been used as the sales agent. I wrote about these reports in my blog and you can find all the details on the BullionStar website.

But a footnote in the 3 monthly reports caught my eye since it referenced 2 further IMF papers as follows:

“Modalities for Limited Sales of Gold by the Fund (SM/09/243, 9/4/09) and DEC/14425-(09/97), 9/18/09“.

SM stands for “Staff Memorandums" which are classed under the IMF’s Executive Board Documents series. DEC stands for ‘Text of Board Decisions’, which are also Executive Board Documents. These 2 document titles looked interesting and relevant, however, when I checked, neither of these 2 documents appeared to be retrievable in the IMF archives. The IMF have a 3 year rule on releasing Executive Board Documents into their archives, so both of these documents should have been available by at least 2013, and definitely by 2015.

So I went to the IMF archives people with 2 sets of questions. Firstly, could they confirm where these 2 missing documents were, the staff memorandum about the IMF gold sales, and the text of the board decision about the same sales.

Secondly, in a separate question, I asked the IMF archives staff where the other 7 monthly gold sales reports that were missing were, since logically, as these gold sales were conducted over 10 months, one would expect 10 monthly reports in the IMF archives, not just 3 reports covering February to the middle of May 2010.

After a large number of email exchanges with the IMF Archives people about the staff memorandum and the text of the Executive Board decision, they ultimately responded and said:

“these two documents are still closed because of the information security classification”

“The decision communicated back to us is not to declassify these documents because of the sensitivity of the subject matter.”

On the 7 missing monthly gold sales reports, the IMF responded that:

“The reports after May 2010 haven’t been declassified for public access because of the sensitivity of the subject matter.“

So as you can see from the slide, there is absolutely nothing transparent about these gold sales when the documents relating to them have not even been declassified due to the supposed “sensitivity of the subject matter".

So the IMF’s claims that “The need for transparency and evenhandedness, which is essential for an international financial institution, argues for providing as much information as possible to the public” is actually a complete lie. And this is an institution which still claims to hold 2815 tonnes of gold.

Based on the IMF archive rules, these Executive Board Documents can only be declassified on the authorisation of the IMF Managing Director, who is currently MS Christine Lagarde. I’m not making this up. I did think of maybe sending her an email asking ‘Please can you declassify these documents’ but then I thought what’s the point, it wouldn’t be any use.

My personal theory is that some or all of these sales involved the IMF using the BIS to transfer gold to either the Chinese State (People’s Bank of China), or else helping to bail out bullion banks by selling IMF gold to a set of bullion banks, or both of these scenarios.

It looks like we’ll have to wait a long time to find out the exact answers, but this incident hopefully illustrates to you that in the official sector gold market, Transparency really does mean Secrecy. So, gold is not just a ‘Pet Rock’, as the Wall Street Journal would have you believe. In the IMF world, gold is a topic whose discussions remain highly classified due to the sensitivity of the subject matter.

The Secrecy of Gold Storage Locations

Last year in 2015 I did some research on which central banks stored gold at the Bank of England’s vaults in London, and how much each bank stored there. This required asking a number of central banks, by email, about their gold storage locations. While a few such as the Bank of Korea told me that they store their gold at the Bank of England vaults, many central banks didn’t divulge this information. Lets look at a few examples:

The Banca d’Italia, one of the biggest central bank gold holders in the world, which holds 2450 tonnes of gold, half of it in Rome, said “The Banca d’Italia will not be giving information in addition to the website note.

The Bank of Japan, which claims to hold 765 tonnes of gold: “We have nothing to comment on the matter”.

The South Africa Reserve Bank (or SARB), a holder of 125 tonnes of gold: “The SARB cannot divulge that information”

The Spanish central bank claims to hold 280 tonnes of gold. They replied to me that: “The only information provided [to the public] on Banco de Espana’s gold reserves is total volume [held]”

Between them, these 4 banks claim to hold more than 3,600 tonnes of gold, and they won’t even provide a breakdown of where their gold is stored.

Since we happen to be in Singapore at the moment, what about the central banks in the local South east Asian region? Do you think these central banks would be more transparent than some of the examples we’ve just looked at, or less transparent, or about the same when it comes to gold storage locations?

As it turns out, they’re pretty much the same, i.e. not transparent. The Bank of Thailand replied “I could not share that information as requested”.

The Malaysian central bank said “If the information you require is not on our website [which it’s not], it may imply that the said information is not meant for public viewing / reference”. Since they knew that this storage information is not on their website (hence the question), this is a particularly lame response from Bank Negara Malaysia.

The Monetary Authority of Singapore, here in Singapore replied that “We are unable to share with you where we store the gold as the information is confidential.”

The Bank of Thailand claims to hold 152 tonnes of gold reserves, Singapore 127 tonnes, and Malaysia 36 tonnes, that’s 315 tonnes of gold where central banks in the region won’t say where its held.

These central banks we’ve just looked at were actually some of the central banks which did bother to respond to me. Many central banks such as the central banks in Lebanon, Kuwait, Jordan, Morocco, Kazakhstan and Cambodia didn’t even respond.

Where are the Central Bank gold bar Weight Lists?

Another huge area for central bank secrecy on gold is the topic of weight lists, or gold bar lists. A gold bar weight list is, as the name suggests, just an itemised list of all the gold bars held within a holding that uniquely identifies each bar. In the wholesale gold market, such as the London Gold Market, there are rules on the data that this list has to contain.

These rules are specified in the LBMA’s “Good Delivery Rules", actually in Annex H which is titled “Sample Weight Lists". For each gold bar on a weight list, and these are the large variable weight bars which each roughly weighs 400 ozs, it must include the bar serial number, the refiner name, the gross weight of the bar in troy ounces, the gold purity of the bar and the fine weight of the bar (i.e. the gold content weight). The LBMA also state that “year of manufacture is one of the required ‘marks’ on the bar"

The Good Delivery Rules annex even states that “This Annex shows the form of weight lists that should accompany shipments of GD bars to London vaults”, which confirms that all gold bars entering and exiting the London vaults will be on such a list.

The large gold-backed Exchange Traded Funds (ETFs) such as the SPDR Gold Trust (GLD), which holds nearly 1,000 tonnes of gold, and the iShares Gold Trust (IAU), actually produce and publish weight lists of their gold bar holdings in pdf format each and every trading day. It’s not a big deal and it doesn’t take long to produce these lists because the process is automated from the vault to the custodian back office all the way to the ETF websites.

For example, here’s a line item for an iShares gold bar weight list, where you can see the refiner name PAMP, the bar serial number, the purity, and the bar weight (gross and fine weight). It even says where the bar is stored, in JP Morgan’s vault in London.

Brand Bar No. Assay Gross Ozs Fine Ozs Vault

PAMP. SA. TC7490 9998 413.425 413.342 JPM London V

A full weight list is also needed when completing a physical gold bar audit, which is something that the large gold-backed ETFs perform twice per year.

So you would think that since commercial gold-backed ETFs produce gold bar weight lists, then central banks should be able to also? And given that large central banks have large teams of technology staff, and good IT infrastructure, that it will not be a big issue for them to produce such a weight list, in either pdf or Excel format.

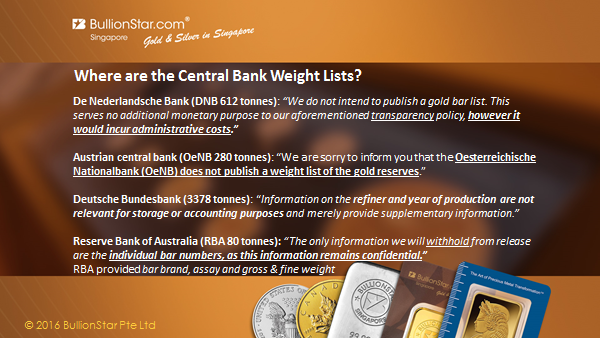

However, the reality is that not a single central bank, when asked, will produce and publish such a gold bar weight list.

Koos Jansen, precious metals analyst at BullionStar, recently asked the Dutch central bank, De Nederlandsche Bank (DNB), to provide a weight list.

The De Nederlandsche Bank, which holds gold in Amsterdam, London (Bank of England), and New York, replied:

“We do not intend to publish a gold bar list. This serves no additional monetary purpose to our aforementioned transparency policy, however it would incur administrative costs.”

Frankly, this reply from the Dutch is an absurd and infantile excuse and is implausible since gold-backed ETFs produce pdf versions of their gold bar weight lists on their websites each and every trading day which run into hundreds of pages in length.

In preparation for this presentation, I recently asked the Austrian central bank (the OeNB) the same question, could they provide a weight list. The Austrian central bank holds 280 tonnes of gold, 80% of which is currently stored in London at the Bank of England. The OeNB’s response was:

“We are sorry to inform you that the Oesterreichische Nationalbank (OeNB) does not publish a weight list of the gold reserves.”

Last year in October 2015, the German Bundesbank issued a useless list of its gold bar holdings, useless since the industry standard required refiner brand and bar serial number details were omitted from the weight list. As the Bundesbank, which claims to hold 3,378 tonnes of gold, stated at the time:

“Information on the refiner and year of production are not relevant for storage or accounting purposes and merely provide supplementary information.”

This continual accumulation of evidence that central banks refuse to issue industry standard gold bar weight lists suggests that there seems to be a coordinated campaign between central banks never to release this information into the public domain.

FOIA: Central Bank of Ireland

The Central Bank of Ireland holds 6 tonnes of gold, the majority of which, according to its annual report, is in the form of “gold bars held at the Bank of England”. In June 2015, I submitted a Freedom of Information Request to the Central Bank of Ireland asking for a weight list / bar list that identifies these bars of gold held on behalf of the Central Bank of Ireland by the Bank of England.

My request was refused by the central bank. The FOIA reply mentioned that the Central Bank of Ireland didn’t have a weight list, and couldn’t find one. Their exact reply was:

“the record concerned does not exist or cannot be found after all reasonable steps to ascertain its whereabouts have been taken.”

The only documentation the Central Bank of Ireland claimed to have was a statement from the Bank of England dated 2009 which listed a ‘total’ of the number of bars stored on behalf of the Central Bank of Ireland and an equivalent total in ‘fine ounces’, but they said that could not provide this statement to me on the basis that it could have “serious, adverse effect on the financial interests of the State”.

I followed up with a phone call to the FOIA officer who had handled my request (as is the procedure) and was told that the Central Bank of Ireland had conducted 2 conference calls with the Bank of England about my request, with the second conference call even including a ‘chief security officer’ from the Bank of England FOI office, and that the Bank of England told the Central Bank of Ireland that ‘you absolutely cannot’ send this statement out to this guy with bars total and fine ounces since its ‘highly classified‘.

While you will note the conflict that arises when a request made under the Freedom of Information Act of one country (Ireland) can allow interference from the central bank of another country (the Bank of England) in determining its outcome, the pertinent point here is that the Bank of England views the topic of gold bars as ‘highly classified’.

Given that the Central Bank of Ireland reports to the Minister of Finance who, as part of the Irish Government, works on behalf of the citizens of Ireland, this refusal shows that the Central Bank of Ireland is not in the least bit transparent or accountable to its citizens, especially about a topic as important as its gold bar holdings.

Fully Opaque – Central Bank Exemptions on Trade and Reporting

There are many other areas of central bank secrecy in the gold market that make a mockery of their transparency claims. The gold that central banks hold on their balance sheets as official reserves alongside major currencies and Special Drawing Rights (SDRs) is conveniently defined as by the IMF as a ‘financial asset’ and so is exempt from international merchandise trade statistics. Therefore, central banks can transport gold between countries and foreign locations and no on will ever know, since customs authorities are prohibited from reporting on these gold movements.

Central Bank accounting of gold holdings is another area of complete secrecy where the reporting does not follow international norms, and where for most central banks, ‘Gold and Gold Receivables’ are reported as one line item. This ‘get out clause’ accounting rule for central banks arose from lobbying of the IMF at the BIS in Basel in 1999 by a group of European central banks including the Bank of England, Bundesbank and Banque de France when they forced the IMF to drop plans to split out gold receivables such as gold loans and gold swaps, since, in the words of the bullying central banks, the data was ‘highly market sensitive’.

As you can see, the words ‘highly classified’, ‘sensitivity of the subject matter’, ‘highly market sensitive’, ‘confidential’, and ‘not publicly available’ are all different forms of the same thing, i.e. they reflect a culture of secrecy, where aloof and arrogant central bankers think that they have a mandate to cover up market sensitive information and not allow free markets to operate efficiently nor allow free market price discovery to work.

This arrogant and misguided behavior by central banks is not surprising given their constant meddling and intervention in all things market related. Again, the mainstream financial media will never discuss this, preferring to be invited as ‘embedded reporters’ for freebies at events such as the LBMA conference that we’ve just attended here in Singapore.

London Gold Market and the LBMA

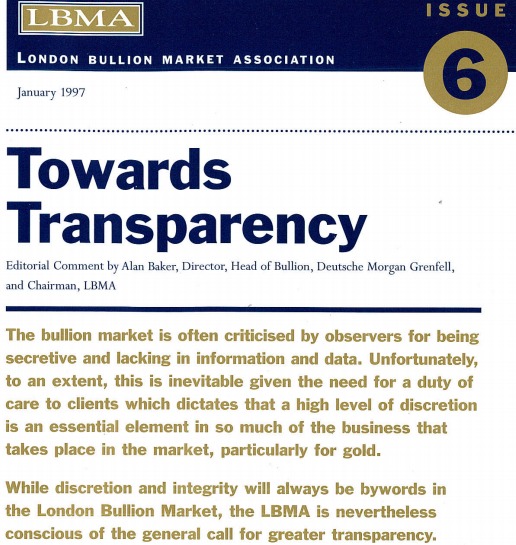

We now look at the London Gold Market, its industry representative body, the London Bullion Market Association (LBMA) and its bullion banking members. The LBMA has recently begun to make soundings that it wishes to improve transparency in the London bullion market, a desire which is partially in the context of a UK regulatory Fair and Efficient Markets Review (FEMR).

However, this newly found sense of duty by the LBMA for transparency is hard to believe when you realise that the gold market today is even less transparent than it was 20 years ago.

In January 1997, the LBMA published Issue 6 of its magazine ‘The Alchemist’ and devoted the entire issue to the theme of Transparency, even going so far as to title the cover page “Towards Transparency”. The very title of the publication, ‘Towards Transparency’, conceded that the London Gold Market was not transparent at that time and admitted that the bullion market was secretive and lacking in information and data.

There was an introduction to that issue written by the then chairman of the LBMA, Alan Baker, who worked at Deutsche Bank at the time. I want to share with you just the first few lines of that introduction since its quite eye-opening:

Alan Baker wrote:

“The bullion market is often criticised by observers for being secretive and lacking in information and data. Unfortunately, to an extent, this is inevitable given the need for a duty of care to clients which dictates that a high level of discretion is an essential element in so much of the business that takes place in the market, particularly for gold.

While discretion and integrity will always be bywords in the London Bullion Market, the LBMA is nevertheless conscious of the general call for greater transparency. With this in mind we have considered ways in which to enhance transparency in the market while in no way compromising integrity, something perhaps of a delicate balancing act.”

Therefore, we have a situation where the ‘Towards Transparency’ era of January 1997 has not only not improved, but it’s actually gone backwards. So if January 1997 was ‘Towards Transparency’ what exactly should 2017 be called, perhaps ‘Still Towards Transparency but quite a way to Go’?

There was also an article in Issue 6 of the Alchemist about GOFO, the Gold Offered Forward Rate (GOFO), which also had a notable quote about what the London gold forward market was like before GOFO was introduced in 1989. The author of that article, Martin Stokes of JP Morgan, quoted Winston Churchill, saying that before 1989, the gold forward market was “a riddle shrouded in mystery wrapped up in an emigma”, and that ‘transparency was non-existent’.

The January 1997 issue of the Alchemist covered 3 developments of the time which the LBMA considered as moves towards transparency:

- The launch of clearing statistics for the London gold and silver markets

- The publication of trading data from a 1998 survey by the Bank of England

- The launch of a London Gold Lease Rate page by the LBMA on the Reuters terminal to compliment the GOFO rates that the LBMA had begun publishing in 1989.

Now, fast forward nearly 20 years from January 1997 to practically January 2017, and what do we have? What we have is:

- The same high level practically useless rolled-up London gold and silver market clearing data each month which doesn’t really explain anything since it’s not granular enough, and which baffles people more than anything due to the phenomenally large clearing volumes stated in the data

- There was a trading survey in Q1 2011 but nothing since then, nothing in nearly 6 years

- GOFO has been discontinued since January 2015

So the question needs to be asked, what happened to this “general call for greater transparency” back in 1997?

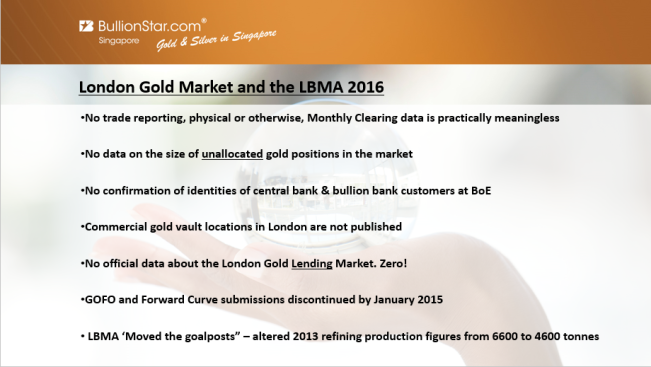

Looking at the ‘London Gold Market’ in 2016, there is:

- No trade reporting, physical or otherwise, Monthly Clearing data is practically meaningless

- No data on the size of unallocated gold positions in the market

- No confirmation of the identities of central bank & bullion bank customers at the Bank of England

- Commercial gold vault locations in London are not published by the LBMA

- No official data about the London Gold Lending Market. Zero!

- GOFO and Forward Curve submissions were discontinued by January 2015

- The LBMA ‘Moved the goalposts” – as they altered 2013 refining production figures from 6600 to 4600 tonnes after I had reported on the original numbers, thereby obscuring the fact that a few thousand tonnes of large bar wholesale gold left the London market for Switzerland, where it was melted down into kilobars and shipped to markets in Asia.

This list is just a sample. There are plenty of other areas where there is no transparency in the LBMA controlled London Gold Market.

As mentioned, the LBMA has recently been making soundings that it will improve transparency in the London bullion market, specifically in the context of trade reporting. There was even a slide titled “LBMA’s commitment to enhance transparency” in one of its Singapore conference presentations that addressed trade reporting and the appointment of BOAT Services and Cinnober as the planned provider of a London gold and silver market trade reporting service in the first quarter of 2017.

But this new awareness of transparency seems, in the first instance, to be being undertaken for regulatory reasons and to optimise something called the Net Stable Funding Ratio (NSFR) which is a Basle Committee concept for banking sector stability. So transparency for transparency’s sake and for the benefit of the smaller participants in the global bullion market is not the raison d’être.

Furthermore, the LBMA has made it clear that central banks will be exempt from any ‘transparency’ that may arise out of the planned London bullion market trade reporting project in 2017. In a letter dated January 2015 to the Bank of England Fair and Efficient Markets Review, the LBMA wrote that:

“it is worth noting, that the role of the central banks in the bullion market may preclude ‘total’ transparency, at least at public level, but that transparency could be increased via post-trade anonymised statistical analysis of nominal volumes, provided by the clearing banks."

As to what exactly the role of central banks is in the bullion market, the LBMA did not say, nor did the Bank of England query. But I think we can conclude that this nudge-nudge wink-wink codespeak about central banks’ operations in the bullion market is exactly as it appears to be, i.e. nefarious.

So here again we see that central banks are going to be given an exemption from transparency, i.e. central bank trading in the London Gold Market will remain opaque, with the blessing of the LBMA and the banking regulators. The post-trade anonymised statistical analysis unfortunately looks like it will be another stitch up and cop-out, and as useless a set of data as any data that gets deliberately rolled-up and masked.

Conclusion

In conclusion, why do central banks refuse to release details of the serial numbers of their gold bars Because after all, If the gold is allocated, then there shouldn’t be an issue. This secrecy around weight lists appears to be deliberate.

In my view, the reason for non-publication of central bank weight lists is because of gold lending. If a gold bar serial number turned up in the weight list of an ETF, then it would become clear that the ETF was holding borrowed gold that the central bank still claimed to hold. And the more lent gold that appears in transparent gold holdings such as ETF weight lists, the more the wider gold market knows the extent of the gold lending market. The same would be true of gold for US dollar swaps.

Similarly, if a gold bar turns up in one central bank’s list when it was previously in another central bank’s holding, this could suggest undisclosed central bank gold sales or alternatively it could suggest a location swap, where gold was swapped between holdings at two different gold depositories / vaults.

Publishing a central gold bar list would forever more also allow those bars to be independently traced with a high accuracy due to the serial number – refiner brand – year of manufacture attributes.

So there appears to be a concerted and coordinated effort by central banks, most likely formulated and imposed by the large gold custodians, to absolutely prevent any central bank gold bar weight list from ever being published anywhere.

However, in my view, there are other reasons for the secrecy. Like major currencies, monetary gold is a reserve asset on the balance sheets of central banks, and like major currencies, gold can be used for international payments, gold swaps, and for interventions into fx and gold markets. Monetary gold is also a strategic asset, what the Bank of England called a ‘war chest’, or the ultimate store of value. The Bank of England also described the rationale for holding gold as an insurance policy against gold making a re-appearance at the centre of the international monetary system

There is also a general culture of secrecy in central banking and an aloofness where central banks don’t feel obliged to justify their policies and decisions due to an entitlement issue with ‘independence’.

Turning to bullion banks, and to put it simply, these large banks are commercial enterprises, and they wish to protect their status quo and also to protect their profit margins. This motivation goes back to asymmetric information, where one party possesses more information than the other.

However, for investment banks, some of the superior knowledge relative to the wider gold market is obtained, not because of superior skill, but because of being able to operate in an environment where secrecy is not just tolerated, but where secrecy is actively protected by the industry body (LBMA) and the regulators (the Financial Conduct Authority and the Bank of England).

Although central banks and large bullion banks often have different motives in the gold market, their motives align in protecting the market’s secrecy. Taken central bank secrecy and bullion bank secrecy together, the phrase ‘A riddle shrouded in mystery wrapped up in an emigma’ is unfortunately still an excellent description for the entire London Gold Market.

Thank You!

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Gold, Geopolitics, and the Global Financial Realignment: Insights from Dr. Nomi Prins

Gold, Geopolitics, and the Global Financial Realignment: Insights from Dr. Nomi Prins

Silver’s Breakout and What It Signals for Gold: Florian Grummes on the Metals Market Shift

Silver’s Breakout and What It Signals for Gold: Florian Grummes on the Metals Market Shift

The Big Long: Gold’s New Chapter – A Conversation with Ronald-Peter Stöferle

The Big Long: Gold’s New Chapter – A Conversation with Ronald-Peter Stöferle

How to Tell If Gold Is Real – What You Need to Know About Fake Gold, Testing Methods, and Trusted Dealers — A 2025 Guide

How to Tell If Gold Is Real – What You Need to Know About Fake Gold, Testing Methods, and Trusted Dealers — A 2025 Guide

Is It Too Late to Buy Gold in 2025? 7 Signs Pointing to Gold’s Next Major Rally

Is It Too Late to Buy Gold in 2025? 7 Signs Pointing to Gold’s Next Major Rally

BullionStar

BullionStar 1 Comments

1 Comments