Should We Restore the Gold Standard?

This blog post is a guest post on BullionStar’s Blog by the renowned blogger JP Koning who will be writing about monetary economics, central banking and gold. BullionStar does not endorse or oppose the opinions presented but encourage a healthy debate.

Would it make sense to rebuild an international gold standard like the one we had in the late 1800s? Larry White says the idea has merit, David Glasner believes it isn’t worth the risk. Over the years I’ve followed the back-and-forth between these two blogging economists, each of whom has done an admirable job defending their respective side for and against the gold standard. Let’s look at one or two of the most important themes running through the White v Glasner debate.

Like a ruler measures distances, a nation’s monetary standard serves as a measuring stick for the value of goods and services. People need to be able to set sticker prices with the unit, calculate profit and loss, negotiate labour contracts, and establish the terms of long-term debts using it. If the measuring stick is faulty, then all these important tasks becomes unnecessarily difficult.

Gold as Unit of Account

Since 1971 our measuring stick has been irredeemable paper currency, or a fiat money standard. Central banks try to ensure that, within the confines of their nation, the general level of domestic consumer prices stays constant, or at least rises at a constant rate of around 2-3%. And while the first decade of the fiat standard was a disaster characterized by high and rising inflation, central bankers in developed nations have generally managed to keep inflation on track for the last thirty or so years.

To re-establish gold as the measuring stick, each nation’s unit of account—say the $ or ¥ or £—would have to be redefined as a certain fixed number of ounces of gold. Banknotes and central bank deposits, which are currently inconvertible, would be made convertible into an appropriate amount of gold. It is important that all nations return to the gold standard rather than just one, because one of the big advantages of an international gold standard is that with all currencies pegged to gold, it is much simpler for citizens of one nation to make calculations using another nation’s unit. And this makes cross-border trade and investment easier to engage in.

In Favour of the Gold Standard: Larry White

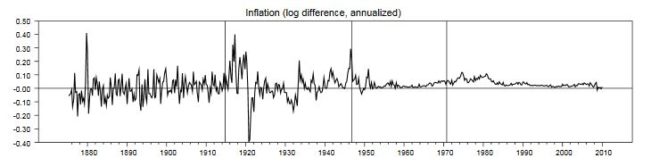

How well have the two standards served as measuring sticks? As the chart below illustrates, year-to-year changes in U.S. consumer prices were quite variable during the classical gold standard era, rising some years and falling the next. The source for this chart is from this paper that White has coauthored with George Selgin and William Lastrapes. The classical gold standard from which the authors draws their data lasted from 1880—when the majority of the world’s major nations defined their currency in terms of the gold—to 1914 when the gold standard was dismantled on the eve of World War I. Data shows that the fiat standard that has been in place since 1971 demonstrates more predictable year-to-year price changes. Citizens of developed nations are pretty safe assuming that next year, domestic prices will rise by 2-3%.

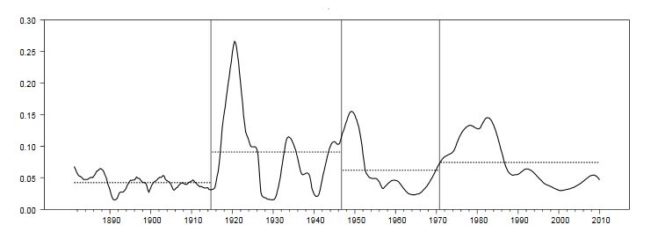

However, it is over longer periods of time that gold outperforms as a measuring stick. In the chart below, the authors show that the quarterly price level during the gold standard tended to deviate much less from its six-year average rate than during the fiat era. Because the general level of prices was more predictable under a gold standard, this provided those who needed to construct long-term debt contracts with a degree of certainty about where prices might be in ten or twenty years that is lacking under a fiat standard. White points out that this may be why 100-year bonds were common in the 1800s, but not so much now.

According to White, the main reason for the long-term stability of gold is the tendency for higher prices to encourage gold miners to increase the supply of metal, thus tamping down on the price, and conversely lower prices to encourage them to reduce production, thus buoying prices. In other words, prices under a gold standard were mean reverting. This mean reversion was generated “impersonally", or automatically, by the market, a superior sort of stability compared to that generated by a fiat standard, which depends on the skills and wherewithal of technocrats employed by the central bank.

Against the Gold Standard: David Glasner

David Glasner is skeptical about the gold standard because he doesn’t agree that it mean-reverts fast enough. All of the gold ounces that have ever been mined continue to exist in vaults or under mattresses or around necks. Compared to this extant gold stock, the flow of new gold production is tiny. So if there is an increase in people’s demand for gold, it is unlikely that new flows will be able to satisfy it, at least not for some period of time. Likewise, reduced gold production on the part of gold miners won’t be able to vacuum up enough of the slack should people suddenly want less of the stuff. In either case, the price of gold will have accommodate shifts in demand by rising or falling quite a bit.

One thing that most monetary economists agree on is that fluctuations in the value of the item used as the standard—gold or fiat money—should not interfere with the “real" economy, say by causing unemployment or gluts of unsold goods. While many prices in an economy are incredibly flexible, like the price of stocks or gold or bitcoin, there are also many prices that are sticky, in particular labour. Under a gold standard, if there is a sudden increase in the demand to hoard gold, then there will be pressure on price of gold to rise. The rise in the gold price means that the general level of prices must fall. Goods and services, after all, are priced in terms of gold-backed notes. But with wages and many other prices locked in place, the response on the part of employers will be to adjust by announcing mass layoffs. Rather than cutting the sticker prices of goods, retailers will suffer though gluts of unsold inventory. This is a recession.

Glasner’s favorite example of this occurred during the late 1920s. After WWI had ended, most nations attempted to restore the pre-war gold standard with banknotes once again being redeemable with fixed amounts of gold. But then the Bank of France, France’s central bank, began to buy up huge quantities of gold in 1926, driving the gold price up. The U.S. Federal Reserve was unwilling to counterbalance what was viewed as insane purchases by the Bank of France, the result being the worst recession on record, the Great Depression.

What Type of Gold Standard?

Given that various commodity standards have been in place for centuries, why did it take till 1929 for a massive monetary mistake to finally occur? White blames this on large government actors, specifically central banks. In the initial international gold standard that ran from 1880-1914, nations such as Canada, Australia, and the U.S. didn’t have central banks. Commercial banks in these nations chose to link their privately-issued banknotes to gold, the goal of these competing banks being to to earn profit rather than enact social policies. So earlier versions of the gold standard functioned far more naturally, without the meddling of large actors who refused to abide by the typical rules of a gold standard. It is for this reasons that White prefers that any return to the gold standard be packaged with an end to central banks, thus precluding episodes like the Great Depression from occurring.

David Glasner remains skeptical. According to Glasner, even the classical gold standard that ran from 1880 to 1914 required management, the Bank of England leaning in such a way as to counterbalance large demands for gold from other central banks and thus preventing anything like the Great Depression from occurring. And even if central banks were to be dismantled under a 21st century version of the gold standard so as to preclude an “insane" Bank of France scenario, there remains the problem of “panic buying" of gold by the public—and the resulting gold-driven recession this would cause.

So Where does that Leave us?

As I hope you can see by a quick exploration of the debate between Larry White and David Glasner, restoration of the gold standard is a complicated issue. I’d encourage readers who are interested to dive a bit deeper into the subject by reading David’s posts here and Larry’s here.

As for myself, White’s work on the 1880-1914 gold standard has been helpful in removing many of the preconceptions I had of the gold standard, no doubt passed off to me by commentators who were never very familiar with the actual data. Nevertheless, I tend to agree with Glasner that under a global gold standard (with no central banks) a sudden spike in the public’s demand for gold would impose large costs on the global economy. With citizens of the globe being so connected through the internet and free capital markets, these sorts of episodes might be more common nowadays than they were in the 1800s. I’m not sure the benefits of a gold standard, including exchange rate stability, make up for this risk. Given that Western central banks have done a fairly decent job of keeping inflation under control for the last thirty or so years, I’ll give them the benefit of the doubt… for now.

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 18 Comments

18 Comments