Gold’s Official Price is $42, and Maybe That’s a Good Thing

This blog post is a guest post on BullionStar’s Blog by the renowned blogger JP Koning who will be writing about monetary economics, central banking and gold. BullionStar does not endorse or oppose the opinions presented but encourages a healthy debate.

People often whisper conspiratorially about the age-old U.S. practice of fixing the gold price at $42.22. “They’re just trying to keep gold down," is a complaint I’ve heard more than a few times. But in this post I’ll show that the monetary authorities have sound reasons for keeping the price of gold at $42.22.

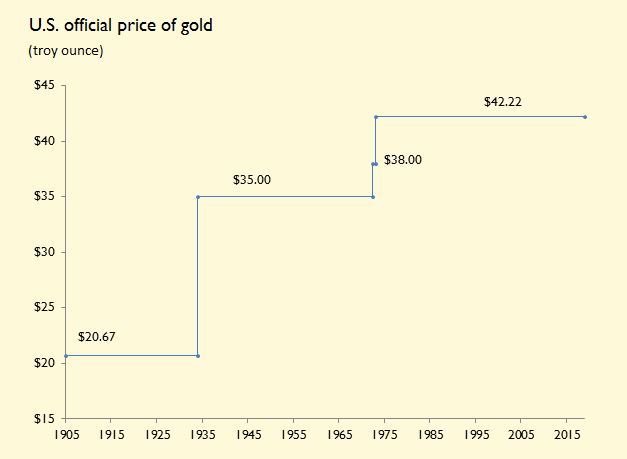

Below, I’ve charted out the history of the U.S.’s official gold price. As you can see, the $42.22 price has been maintained since 1973, an odd-seeming state of affairs given that gold is currently hovering at around $1225. The practice of setting an archaic price for the yellow metal looks even stranger when we consider that central banks all over the world have adopted the habit of using the market price of gold to value their gold reserves.

US Monetary Gold

To understand what is at stake, let’s start with a few stylized facts about U.S. monetary gold:

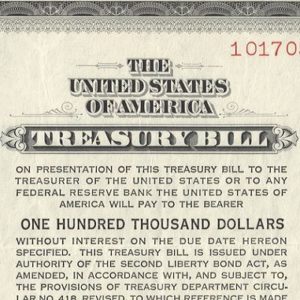

- Central banks that keep gold on their balance sheet tend to hold physical gold. But the U.S. Federal Reserve doesn’t actually hold physical metal. Instead, it owns gold certificates.

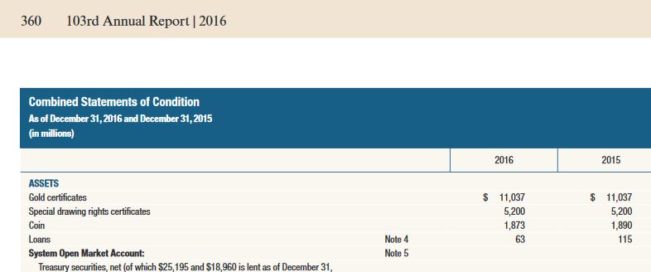

- The Fed registers the value of these gold certificates on its books at $11 billion (see screenshot below). It has used this same number for decades.

- These certificates have been issued to the Fed by the U.S. Treasury, a different branch of the Federal government. (To learn about why and when the Treasury issued them, read my old posts on the topic)

- To “back" these certificates, the Treasury in turn holds physical gold. According to the September 30, 2018 Status Report of U.S. Government Gold Reserve, the U.S. Treasury currently records 261,498,926 fine troy ounces of gold in reserves.

- The Fed’s Treasury gold certificates are quite odd. They do not provide the Fed with a claim on a fixed weight of gold held at the Treasury. Rather, they provide the Fed with a claim on $11 billion dollars worth of gold. It would be as if your coat check tag constituted a claim on $40 worth of coat, rather than the coat itself.

How many ounces of gold does the $11 billion claim entitle the Fed to? That depends on the price of gold that is used in the calculation.

At the official price of $42.22, the Fed’s $11 billion in gold certificates lay claim to 261 million ounces of gold held at the U.S. Treasury ($11,000,000,000/$42.22). So pretty much every bit of the 261,498,927 ounces held at the Treasury is the property of the Fed.

We can now start to see some of the complications involved in marking the official gold price to market. Setting the official price at today’s level of $1225 per ounce, the Fed’s $11 billion worth of gold certificates would constitute a claim on just 9 million ounces of the yellow metal ($11,000,000,000/$1225). That is, of the 261,498,927 ounces held at the Treasury, just 3.4% would now be earmarked to satisfy the Fed’s gold certificates. This would deprive the Fed of 96.6% of the ounces that had previously been stored on its behalf. The remaining 252 million or so ounces of gold would henceforth constitute the property of the U.S. Treasury.

The Fed and The Treasury

But who cares, you ask? Sure, changes to the official price of gold may alter the effective owner of the U.S.’s gold stash. But given that the Fed and the Treasury are arms of the same U.S. government, it seems irrelevant which of them owns the 261,498,927 ounces.

There is some truth to this. However, economists generally believe that if a central bank is to set an independent monetary policy, it needs to be capable of operating at an arm’s length from the government. An independent (i.e. technocratic) monetary policy is generally believed to be preferable to one that is set by politicians, who may be willing to take risks with inflation in order to enjoy short-term political gain.

If the Fed is to set monetary policy independently of political interference, it must have a large base of assets under its control. This base of assets will allow it to repurchase currency in a manner that reinforces its monetary policy targets, specifically its chosen path for the purchasing power of the dollar. Without its own base of assets, the Fed may have no choice but to depend on the goodwill of those in power to provide ongoing resources.

And that is probably why the U.S.’s statutory price of gold stays fixed at a decades-old level of $42.22. The consensus that independent central banking is a good thing (because it keeps a lid on inflation) dictates that the Fed have plenty of ammo. If the official gold price stays at $42.22, the Fed can lay claim to the full 261,498,927 ounces held by the Treasury. If the price is increased, the Fed gets only a sliver of that, the Treasury laying claim to the rest. And with fewer resources, the Fed’s has less control over the purchasing power of currency.

When I hear people complain about the baffling $42.22 gold price, it makes be think of G.K. Chesterton’s old adage about fences. Before tearing down a fence that seems to serve no purpose, first go away and think. Once you have seen the use of the fence, you may not want to destroy it anymore. It may very well be that the old price of $42.22 is the best official price for gold.

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

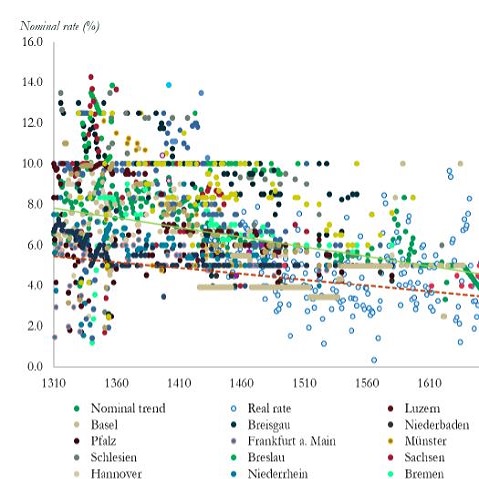

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 25 Comments

25 Comments