The Curious Case of COMEX Gold Deliveries in April & June

Did you think that the high-powered world of the LBMA would operate in a fishbowl for all to see? – ANOTHER

A lot has been written about the London gold spot price – COMEX gold futures price spread (EFP) blow up on 23/24 March, whose detonation has sent blast waves across the gold market on each side of the Atlantic, and whose trigger has been the subject of much speculation and debate.

Importantly, the fallout from this seismic event continues to roll on, and has caused unusual goings-on among the bullion banks in London and New York, such as:

– Deteriorating liquidity (bullion banks rapidly departing COMEX and London gold trading)

– Large trading losses at bullion banks, for example HSBC

– Gold borrowing rates rising over the time of the March event

– Bullion banks scrambling to secure physical gold to send to New York

– The SPDR Gold Trust ETF using gold stored at the Bank of England

– Sharp drops in COMEX gold futures open interest (OI)

– The launch of a COMEX 400 oz contract and 400 oz bars in COMEX vaults

– Huge volumes of gold bar exports from Switzerland to New York

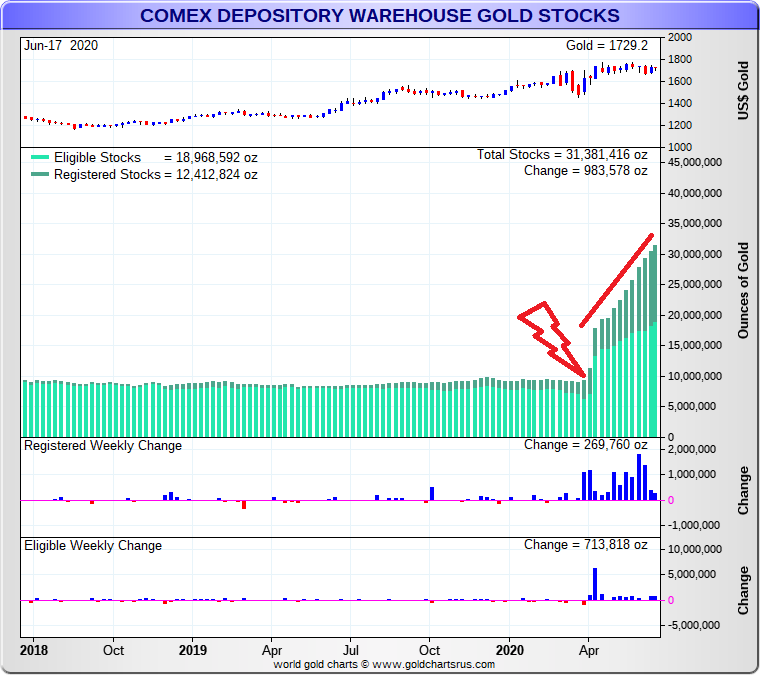

– Record gold inventory build-ups in COMEX approved vaults

– Record numbers of COMEX gold contracts moving to delivery (June and April)

Is all of this connected you may ask? The answer in my view, is yes, but not in the way that you may think.

However, given the opacity of the wholesale gold market and the unconvincing explanations from its fronting organizations the London Bullion Market Association (LBMA) and COMEX operator CME Group (e.g. closed refineries, grounded flights), those looking for a ‘Theory of Everything’ framework to connect all of the above have had to do so on their own.

While Bloomberg and Reuters are content with repeating spoon-fed handouts about all of the above – eating the breadcrumbs instead of following the trail – and between them have published at least 30 articles on the subject, thankfully there are many on the sidelines who are more inquiring and less gullible, hence the skepticism, speculation and debate.

In an open and transparent market where full gold trade data including Exchange for Physical (EFP) and gold allocation trades were published in real time, all market participants would instantly assimilate and understand the late March event and its aftermath, and with those full facts the market would instantly and accurately be able to predict and monitor the succeeding chain of events – which by the way – are still in motion, a case in point being at the COMEX, where right now unprecedented numbers of COMEX gold futures contracts are moving into delivery.

Familiar to many, the Commodity Exchange (COMEX) owned by CME Group is the world’s largest gold futures trading venue, and although gold futures trading now takes place on CME’s Globex and Clearport electronic platforms, the COMEX has its roots as a New York exchange, and is hence synonymous with “New York" gold trading.

Most importantly, the COMEX 100 oz gold futures contract, along with the London OTC gold market, between them have a near monopoly on gold price discovery, and are the playground of the LBMA bullion banks such as JP Morgan, HSBC, Scotia, and Goldman Sachs which dominate and control both venues.

Electronic Warrants – The Delivery Process

The COMEX 100 oz gold futures contract is structured as a deliverable gold futures contract with delivery being in the form of an electronic warehouse (vault) warrant representing one 100 troy oz gold bar or three 1 kilo gold bars. . The gold backing these contracts is claimed to be in the network of COMEX approved vaults in New York City (and Delaware).

However, while COMEX 100 oz contract offers the ability to make and take delivery of gold in these vaults through a process of vault warrant transfers, normally in practice, the vast majority of COMEX 100 ounce gold futures are never delivered, they are offset (closed out) and cash-settled, or else rolled over to the next active month. Normally, only a tiny fraction of these gold futures contracts are ever ‘delivered’.

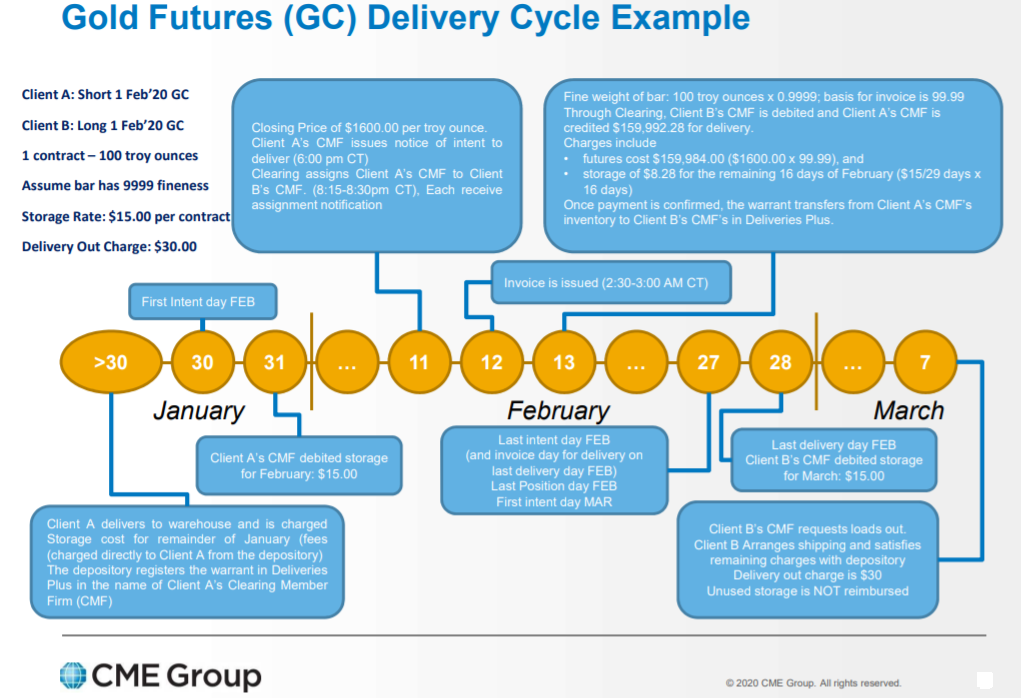

COMEX gold vault warrants contain information such as brand and weight of the gold bar that the warrant represents and which approved COMEX vault it is supposedly stored in. While a long contract holder can make its clearing firm and the Exchange aware that it wants delivery, it’s the short futures holder that actually submits the warrant for delivery (in a CME online app called Deliveries Plus), with the CME matching the warrant to the long and facilitating the transfer of title to the long.

For delivery intent notices (see below), it is therefore the short who submits notice of intention to deliver a warrant, after which the CME clearinghouse matches the sides, issues allocation notices to the long and issues invoices to both parties. Delivery can then take place on any business day during the delivery month, at which point the short receives dollar funds and the long (buyer) receives the warrant (electronically) in the Deliveries Plus application. A presentation from CME which can be read here, explains the main steps of the delivery process.

Importantly, the buyer of the future (long) has no control over which of the COMEX vaults the warrant it receives refers to. It is the Exchange (COMEX) which assigns delivery to a specific vault. Note also that physical withdrawal of the gold bars underlying warrants is a totally separate step between the warrant holder and the vault where the gold is supposedly held and will involve transport costs and no doubt persistence to convince the COMEX approved vault to allow you to withdraw your gold bars.

Warehouse warrants are also central to any discussion of the gold inventories claimed to be in the COMEX approved vaults in New York and Delaware, since metal under warrant is in COMEX parlance ‘Registered gold’, while Eligible gold is not. Eligible gold is just any gold that happens to be in a COMEX approved vault that is of an approved weight and refiner brand that could be used in the COMEX delivery process. Also, pledged gold is registered gold (under warrant) that “is on deposit with CME Clearing for performance bond" (collateral), and importantly, warrants for pledged gold cannot be use “to satisfy delivery obligations".

Issues and Stops – The Delivery Report

Central to the delivery process of COMEX gold warrants between shorts (the gold sellers) to longs (gold buyers) is a CME report called the COMEX Metals Delivery Notices report, also known as the Metals Issues And Stops report. This report is published in daily, monthly and year-to-date versions and can be accessed here. Now more than ever, this report is worth looking into since COMEX “delivery" numbers have literally ‘gone off the charts".

Not the easiest report in the world to read, essential points to remember in the Issues And Stops report are that:

– A delivery notice is the seller’s notice to the CME clearing house of his intention to make delivery against an open short futures position.

– The Issues and Stops report lists clearing firms of CME that have been matched for making or taking delivery, and the aggregate number of contracts making or taking delivery for each clearing firm.

– Clearing firms are banks that work directly through the CME’s clearing house to execute trades on behalf of futures market participants.

– “Issued" refers to contract short positions that issue notices intending to deliver warrants representing gold

– “Stopped" refers to contract long positions that are receiving delivery notices for warrants representing gold

– In essence, ‘issues’ makes delivery and ‘stops’ takes delivery

– On each report, the sum of the Issues adds up to the sum of the Stops. They have to as they are two sides of the same transfers

– H refers to on behalf of a house account (for house). A house account is a clearing firm’s proprietary non-segregated trading account

– C refers to on behalf of a customer account (for customer). A client account is a client of the clearing firm

– Figures under House Issued refer to the number of warrants that a House account needs to deliver. House Stopped refers to the number of contracts where a House account will receive. Similarly, a Client Issued refers to a client account having to deliver a warrant, and a client stopped is will receive.

– Apart from the clearing firm names, the Issues and Stops report does not list the identities of any account holders, nor does it say anything about which warrants are being delivered and which vaults the warrants are associated with.

The above is important as it helps interpret what’s been happening on the COMEX gold notice report since the end of March.

Stand and Deliver

On 31 March, a week after the 23/24 March spot – futures blowups and the first notice day for the then active April gold futures, COMEX watchers were stunned when a huge 17,302 contracts representing (1,730,200 ozs or 53.81 tonnes) of gold appeared on the Delivery Notice report, which was 56% of registered stocks on that day or 67% when of registered stocks excluding pledged gold.

Over subsequent days in April, this number expanded to a massive 31,666 contracts (98.5 tonnes), a record at the time. To put this into perspective, for the 3 preceding months January to March, a combined total of only 13,864 contracts had gone to delivery, an average of 4,621 per month. Now April’s report was showing nearly 7 times that amount.

With gold futures contracts representing 1.73 million ozs of gold wanting delivery, and only 3.07 million ounces of Registered gold in the COMEX vaults, that means deliveries are already 56% of registers stocks. pic.twitter.com/nVK8QJniwe

— BullionStar (@BullionStar) March 31, 2020

On Comex, gold contracts are listed for the nearest 3 consecutive months, and also for any February, April, August, or October in the next 2 years, and any June and December in the next 5 years.

The front month contract (or spot month) is the month closest to delivery and will also usually be the most active and liquid until traders roll positions to the next active month before first notice day and expiration of the near month and before liquidity dries up. Back in late March and early April the shift was out of the April contract and into the June contract. Then in late May and shift was out of the June contract and into the August contract.

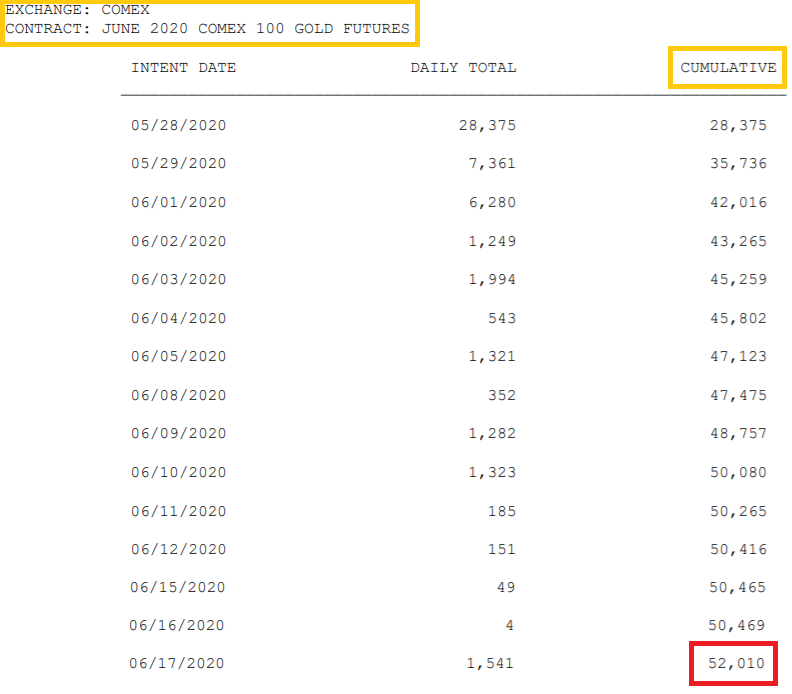

While the April deliveries of 31,666 contracts were unprecedented, that was just a warm up, something which became apparent when the intent for deliveries notices for the June contract started showing up from late May onwards. On 29 May, first notice day for June deliveries, COMEX released a report showing that short holders had indicated that they were moving an incredible 28,375 contracts for delivery on the first day, which was nearly as many contracts as went through in the whole of April, itself a previous record month. From there the contracts intending to deliver just piled, over 7,000 the next day, 6,000 the day after that, to a situation where there are now 52,010 June contracts lined up for delivery. That’s 5,201,000 ozs of gold or 161.7 tonnes. With June Open Interest now at tiny levels, it looks like 5.2 million ozs is now more or less the amounts of gold warrants which will be delivered for June. See table below from the Issues and Stops report for the latest June delivery intent total.

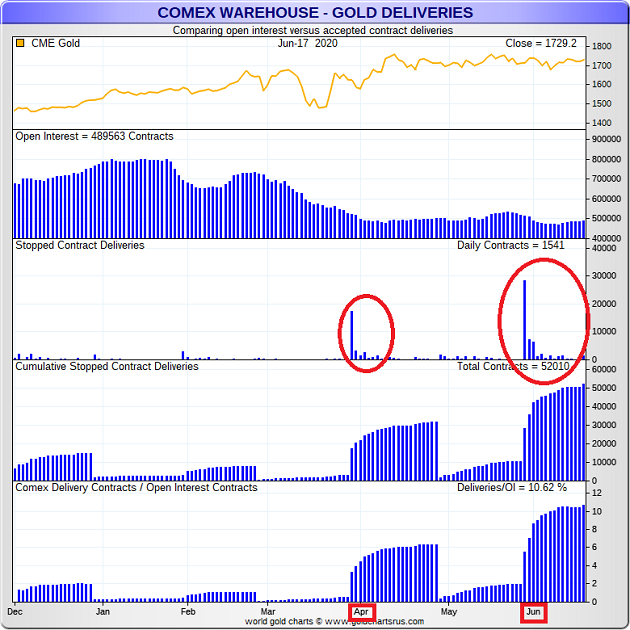

The chart below shows the 2 huge spikes in delivery notices in April and June and the subsequent accumulation of delivery notices in each of those delivery periods. In contrast, notice the small quantities of delivery notices from January to March and again in May.

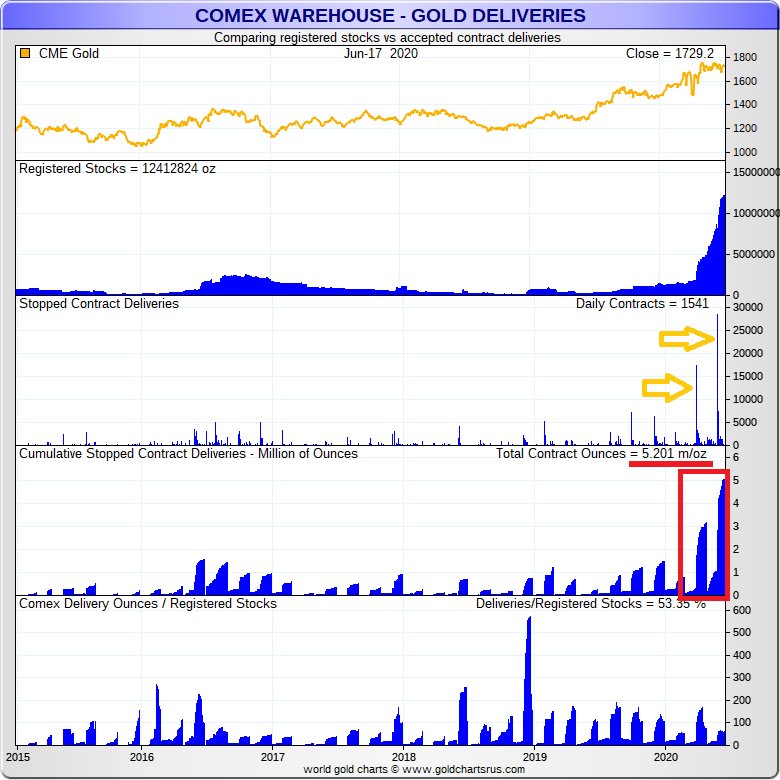

A zoomed out version of the above chart covering a 5 year horizon from 2015 to 2020 can be seen in the below chart. Again, the stopped contract deliveries in June and April 2020, both the first notice day spikes and the cumulative monthly totals, are unprecedented.

Looking at which clearing firms are the big players in issuing and stopping, it will not come as a surprise that dominant gold trader JP Morgan leads the pack across both client and house accounts. JP Morgan accounts for nearly 25,000 contracts for client accounts stopped (taking delivery) in June, and over 20,000 contracts for client accounts issued (making delivery) in June. Morgan was also the dominant issuer and stopper in April and May. In fact, JP Morgan accounts for issuing and stopping over 50,000 contracts over the April to June period. Other bullion banks with large activity for the June contracts include Goldman Sachs, issuing for clients but receiving more for house, Morgan Stanley receiving for house, and Scotia, BNP and RBC issuing for house. Notable for having less activity in all of this is HSBC, a diminished presence?

The Swiss Angle

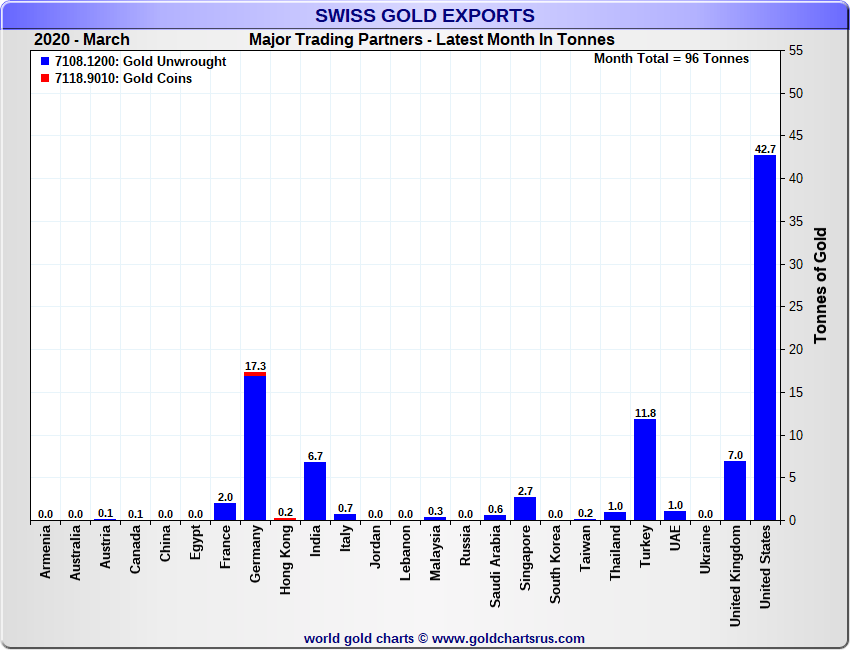

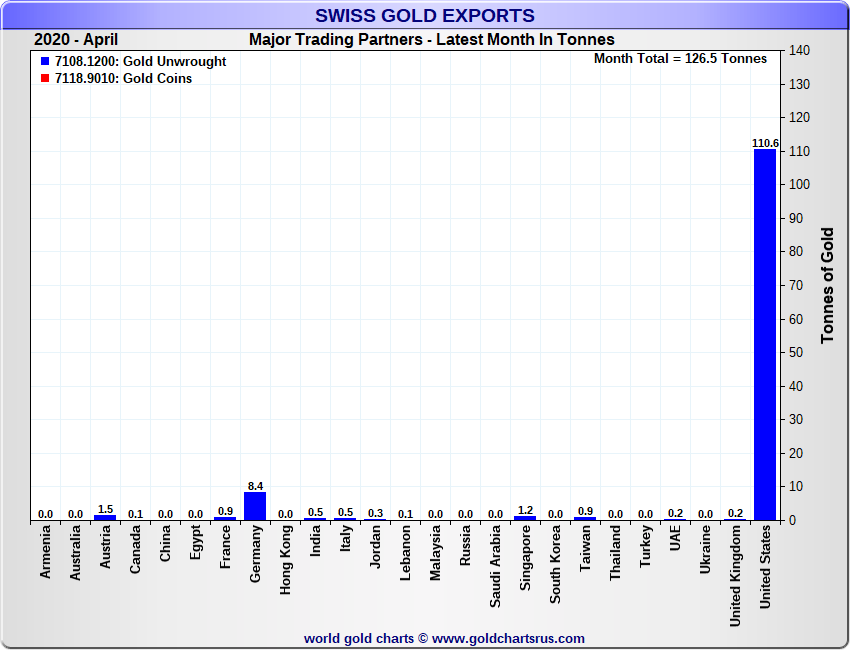

With 5,201,000 ozs of gold (161.7 tonnes) involved in these delivery notices, this is interestingly just a few tonnes more than all the gold that was exported from Switzerland to the New York during March and April, i.e. 42.7 tonnes in March and 110.6 tonnes in April, for a combined 153.3 tonnes.

Switzerland never normally exports gold to the US. In fact, the US usually exports gold to Switzerland gold to Switzerland – to be refined. Why was 153.3 tonnes rushed into New York during late March and April. Were these COMEX deliveries known about in advance?

Another coincidence is that the amount of gold that has flowed into COMEX since early April that is reported as eligible for the new COMEX 400 oz gold futures contract totals 155.67 tonnes of gold. Very similar to the total amount of gold ready to be delivered for the June 100 oz contract.

The next article will look at the flows into the COMEX gold vaults since 23 March, which have totaled a huge 694 tonnes, comprising 363 tonnes in eligible and 331 tonnes in registered. This has brought registered stocks up to 387 tonnes and eligible stocks to 578 tonnes, for a combined total of 965 tonnes.

Could it be that the entity or entities that were looking for gold in London on 23-24 March and didn’t get it, switched their attention back to the COMEX and demanded delivery through futures, the delivery of which is now panning out? A trans-Atlantic shock that left bullion banks scrambling.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments