Amid London Gold Turmoil, HSBC Taps BoE for GLD Gold Bars

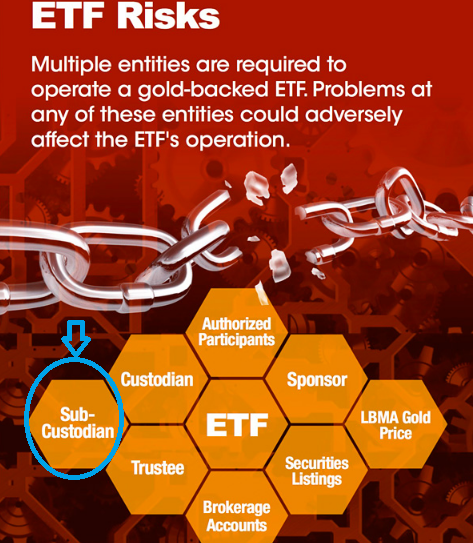

During March and April, amid global financial turmoil, unprecedented demand for physical gold, refinery closures and a London lockdown, one question on the minds of many in the gold market was how HSBC London, the vault custodian of the SPDR Gold Trust (GLD), was consistently able to source huge amounts of gold bars to back the enormous inflows into the world’s largest gold-backed Exchange Traded Fund (ETF).

173 tonnes during London Lockdown

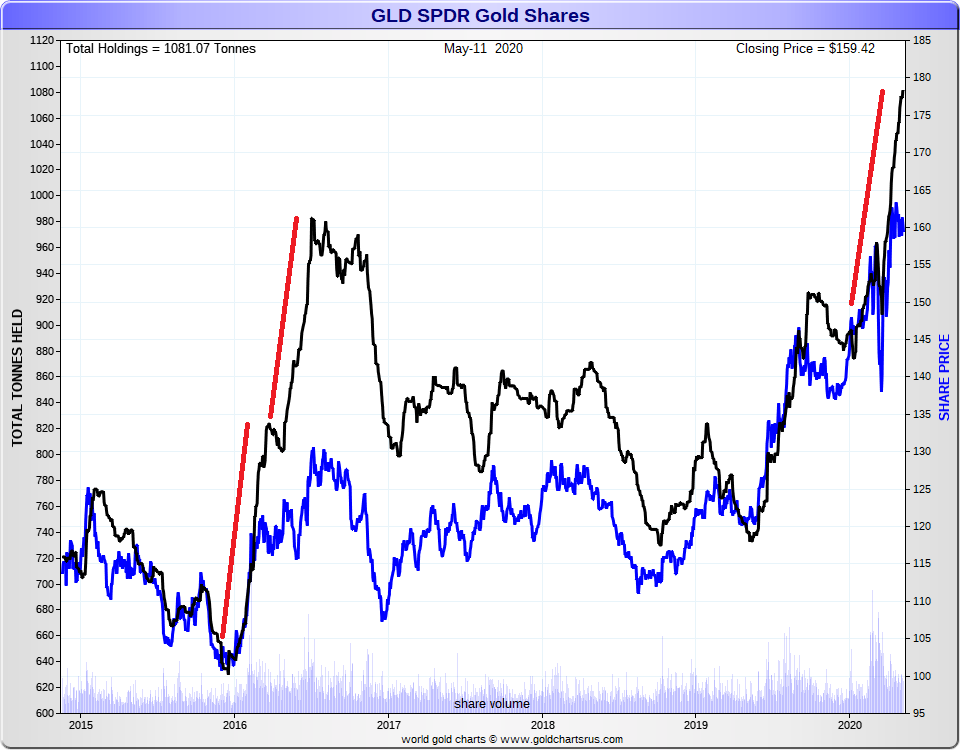

From Monday 23 March (the day Boris Johnson triggered the UK and London lockdown) to close of business 12 May, the SPDR Gold Trust claims to have taken in a massive inflow of 175 tonnes of gold bars, swelling its gold holdings from 908 tonnes to 1083 tonnes.

That’s an addition of approximately 14,065 large Good Delivery gold bars since 23 March, each weighing 400 troy ozs, which would take up 29 stacks of pallets, each 6 pallets high, and is more than three times the amount of gold pallets labelled in the below photo.

The time period of these GLD gold bar inflows was also not ‘business as usual’ in the London gold market despite what the London Bullion Market Association (LBMA) may have you think, coinciding as it did with London gold spot liquidity problems (LBMA market maker bid-ask spreads and COMEX futures – spot gold spreads both reaching nearly $100 on 24 March) and a period in which no one else around the world was able to get their hands on physical gold in large quantities.

It also came at a time in which HSBC now reveals that it had a $200 million one-day loss due to what HSBC describes as:

“unprecedented widening of the gold exchange-for-physical basis, reflecting Covid-19-related challenges in gold refining and transportation, which affected HSBC’s gold leasing and financing business and other gold hedging activity leading to mark-to-market losses. “

So how did HSBC manage to source so much gold for the GLD during these times? Having gold in the right place at the right time? Using a proverbial forklift truck to shunt 173 pallets of gold from one side of a secretive vault in London to the other during the London lockdown? Or begging and borrowing the gold from anywhere it could find it?

Lender of Last Resort – Bank of England

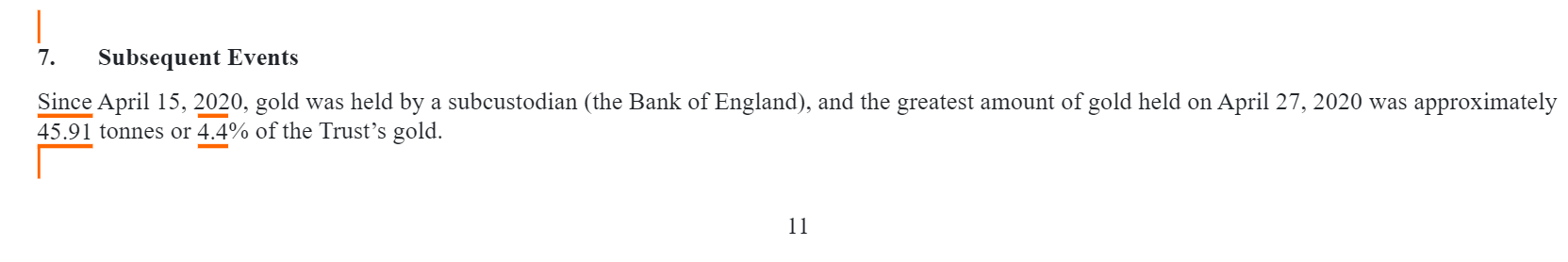

On some recent days it appears to have been the latter, for buried deep within the latest SPDR Gold Trust (GLD) quarterly SEC filing (10Q), filed on 8 May, we see the following admission from the Trust’s Sponsor, World Gold Trust Services (the US subsidiary of the World Gold Council):

“Since April 15, 2020, gold was held by a subcustodian (the Bank of England), and the greatest amount of gold held on April 27, 2020 was approximately 45.91 tonnes or 4.4% of the Trust’s gold.”

This means that during April, HSBC used nearly 46 tonnes of gold stored in the Bank of England gold vaults to add to the SPDR Gold Trust, instead of using gold at HSBC’s own commercial London vault.

And why is this important? It’s important because it implies that:

a) there isn’t enough gold in the HSBC vault in London to fulfill SPDR Gold Trust basket creation requests from GLD Authorized Participants (APs).

b) that gold which is ultimately borrowed central bank gold at the Bank of England is being used as a source of GLD gold holdings.

c) that there are physical gold float shortages in the London physical gold market as well as liquidity problems of LBMA market makers in the London paper gold market.

SPDR Gold Trust (GLD) gold bar inflows into HSBC London vault during the total London lockdown are:

— Ronan Manly (@ronanmanly) April 24, 2020

HSBC’s secretive Vault – An Open and Shut case?

Looking first at a), the GLD creation process is as follows. When Authorized Participants (APs) of the SPDR Gold Trust want new baskets of GLD shares to sell to investors, they transfer unallocated gold (gold credit) to the Trust, after which HSBC London then allocates the equivalent physical gold from its vault inventory to the SPDR Gold Trust account.

The fact that since mid April, HSBC has directed its custodian, the Bank of England, to allocate gold bars stored in the Bank of England vaults to the SPDR Gold Trust when processing Authorized Participant GLD creation requests implies that the HSBC London vault has not had sufficient gold inventory to provide at a minimum 45.91 tonnes gold bars to the SPDR Gold Trust (as of 27 April), and because of this had had to revert to using the gold of the GLD sub-custodian (the Bank of England).

From the GLD Prospectus:

“The subcustodians that the Custodian currently uses are the Bank of England, The Bank of Nova Scotia-ScotiaMocatta, ICBC Standard Bank London, JPMorgan Chase Bank and UBS AG.”

The fact that HSBC had to source gold at the Bank of England subcustodian and not from one of the commercial vaults also puts in doubt the ability of the other SPDR Gold Trust sub-custodians (JP Morgan Chase, ICBC Standard Bank, ScotiaMocatta and UBS) as sources for providing sufficient physical gold to GLD during this time. Note that JP Morgan and ICBC Standard have their own vaults in London but Scotia and UBS do not.

Access to ‘Liquidity’

That gold in the Bank of England vaults is ultimately borrowed central bank gold, can be seen by the fact that commercial bank members of the LBMA hold gold accounts at the Bank of England specifically so that they can engage in gold lending with central banks (the central banks lend the gold and the commercial banks borrow the gold). This is something the Bank of England and the LBMA euphemistically refer to as ‘liquidity’ provision.

As the Bank of England says:

“We provide gold accounts to certain commercial firms that facilitate access for central banks to the London gold market.”

And as the Bank of England also says:

“By offering allocated accounts to commercial banks, we allow central banks to access the liquidity of the London gold market and trade directly with the commercial banks”

And as the LBMA states:

“the Bank of England offers gold custodial services to central banks and certain commercial firms that faciliate central bank access to the liquidity of the London gold market.

Those clearing members without their own vault operations – Scotiabank and UBS – utilise their accounts with one of the LBMA custodians or the Bank of England (BoE)”.

The 5 commercial bank members of the bullion clearing group London Precious Metals Clearing Limited (LPMCL), i.e. HSBC, JP Morgan, ICBC Standard, Scotia and UBS, also use these gold accounts at the Bank of England as part of their ability to call on each other for allocation of gold to help in the clearing process.

Beyond the LPMCL members, the Bank of England also provides gold custody accounts to any LBMA bullion bank member engaging in gold lending with central bank gold storage customers of the Bank of England. For example, these bullion banks would include Goldman Sachs, Morgan Stanley, BNP

Paribas, Citibank, and Standard Chartered etc.

Why is all of this important to the SPDR Gold Trust? Because, Bank of England vault gold held by commercial banks ultimately comes from central banks through gold lending or is for delivery back to central banks. Which means that when GLD holds 400 oz gold bars at the Bank of England with Bank of England as subcustodian, it is holding gold bars that either came from gold lending transactions or are ultimately going back to the lending central banks.

If the SPDR Gold Trust is now holding leased central bank gold as part of its gold holdings, this raises the issue of double counting, a situation in which the same gold bars are claimed by two distinct parties, the central bank which lent the gold and still accounts for it on its balance sheet, and an exchange traded gold-backed ETF (GLD) which thinks that it has title to those same gold bars since they were ‘allocated’ to GLD at the Bank of England.

She can’nae take any more, Captain!

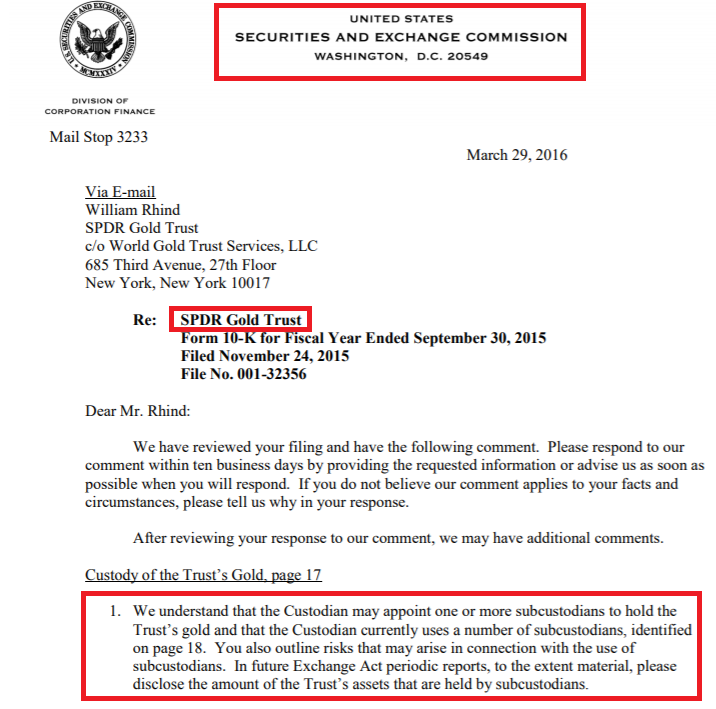

An admission in an official SEC filing that the SPDR Gold Trust uses gold at the Bank of England is not unprecedented but is rare enough that it has not happened since 2016 after the SEC directed the GLD Sponsor, World Gold Trust Services to specifically divulge the use of subcustodians since the SEC deemed subcustodian holdings a risk to the Trust. See BullionStar article “SPDR Gold Trust gold bars being held at the Bank of England" for details.

Similar to the current scenario, the use of gold at the Bank of England in 2016 to back the SPDR Gold Trust took place during a time of very large and fast inflows into the GLD during Q1 2016, particularly in February 2016 when 108 tonnes of gold were added to GLD, and March 2016 when 42 tonnes of gold were added. See below chart and the steep increases in GLD gold holdings in early 2016 and again now since 23 March 2020.

The GLD 10Q to the SEC at that time (filed on 29 April 2016), stated it as follows:

“During the quarter ended March 31, 2016, the greatest amount of gold held by subcustodians was approximately 29 tonnes or approximately 3.8% of the Trust’s gold at such date. The Bank of England held that gold as subcustodian.“

It[s notable therefore that the allocation to GLD of gold bars stored at the Bank of England corresponds to times in which there are fast and large inflows into GLD, with the Bank of England acting as an emergency backup to the HSBC vault. This time around with London on lockdown, is the HSBC London vault even open, or has it been shuttered along with everything else. Given that HSBC, the LBMA, and every party associated with the SPDR Gold Trust is ultra secretive about this vault even to the extent of not divulging its location, then no one in the market really knows.

Conclusion

It is interesting to note that the current large flows into the SPDR Gold Trust began on Monday 23 March. This was the same day as:

– the UK and London went into lockdown

– prices between COMEX gold futures and London gold spot (EfP) began to diverge widely

– Bid – Ask spot gold spreads quoted by LBMA market makers diverged wildly

UK Prime Minister speech on COVID-19, 10 Downing Street, 23 March, 8:30 pm

The consistent and large inflows into the SPDR Gold Trust starting on 23 March all the way through April and into May also correspond to the period of persistent and wide spreads between COMEX futures gold prices and London spot gold prices when the LBMA in unprecedented fashion made various attempts to reassure that all was OK in the London gold market.

The biggest spread between COMEX and London spot was on 24 March, when the contango was at one point $96. The spread remained wide (between 60 and 50) into 25 March, then contracted slightly to the 30 range over the rest of March. It was during this time that HSBC made its huge loss, which it describes in another filing here as:

“delivery disruptions in the gold market, which became highly illiquid on news of refinery closings".

At the start of April the spot to COMEX contango was in the $20-25 range, but it expanded to the $40 range from 6 April, and exploded again for the whole week before Easter, to between $60 and $80. The contango remained high on Monday 13 April at over $65 when GLD started sourcing its gold from gold holdings in the Bank of England vaults.

The latest GLD 10-Q filing says that the SPDR Gold Trust began holding gold bars in the Bank of England beginning 15 April. While this is a delivery date of physical gold into the Trust, it could be based on trades a few days earlier, which would put the initial transactions in the days before Easter (12 April).

With this new revelation that the SPDR Gold Trust began allocating gold bars at the Bank of England during the very same time as market maker liquidity broke in the London gold market, it seems that the liquidity problems of the LBMA bullion banks are both in physical gold and in paper gold. Which would make sense seeing that the giant London paper gold trading pyramid sits atop the tiny foundations of the London physical gold market.

And was the 27 April, the date on which the SPDR Gold Trust says it held 45.91 tonnes of gold at the Bank of England, merely the latest date the GLD accountants ran a query for their filing before signing it off? What about since 27 April? How low really is the London gold float?

Since 27 April, another 35 tonnes of gold have been added to the mammoth GLD ETF. Where did this extra 35 tonnes of gold come from? If this were a bet, the odds on this gold being from the Bank of England would surely be less than evens, i.e. a sure fire wager.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments