LBMA Shows Contempt For Wider Gold & Silver Markets

Exactly six months ago, the London Bullion Market Association (LBMA) began weekly publication of rolled up trade volume data for the London and Zurich gold and silver markets in an exercise that was spun by the LBMA as increasing transparency in the global over-the-counter precious metals markets.

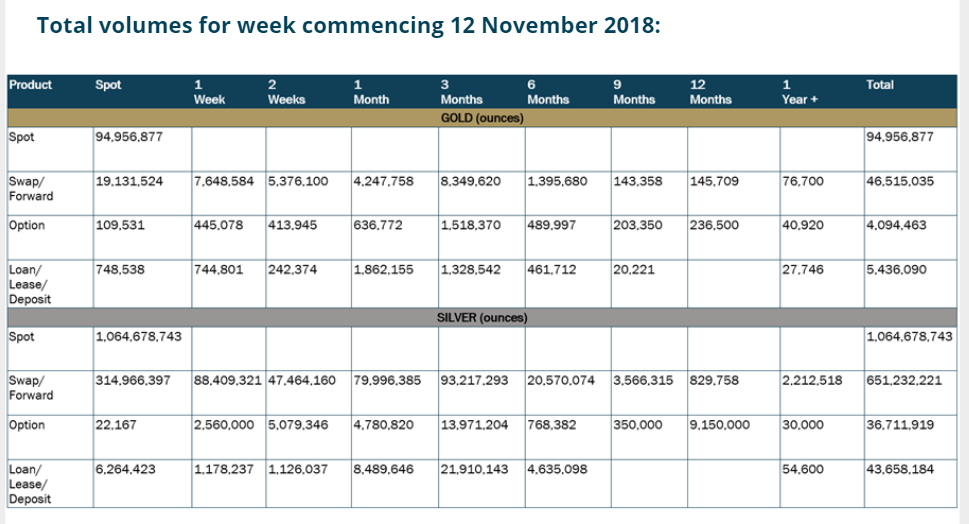

Misleadingly referred to as ‘Trade Reporting’, the data published by the LBMA was nothing of the sort and merely consisted of high level anonymized and aggregated trade activity volume data across a number of trade types and date increments, which was all rolled up and averaged to give a weekly trade volume number for each of gold and silver.

For example, in the first week of publication, the data pointed to there having been on average the equivalent of 939 tonnes of gold (30.2 million ounces) and 11,174 tonnes of silver (359.2 mullion ounces) traded each day over the five trading days between 12th and 16th November 2018.

Putting aside for a minute the sheer impossibility that these figures represent physical metal (since they almost entirely represent synthetic unallocated cash-settled paper gold and silver trading), this data was the first chink of light into what had hitherto been totally opaque trading venues which had never had any trade volume data published save a few sporadic surveys over the years.

Fair and Efficient – LBMA Style

The LBMA’s so-called “Trade Reporting" had also been years in the making, promised four years earlier and subject to excruciating delays and excuses from as early as January 2015, when importantly, the concept for the reporting had evolved out of the UK Financial authorities Fair and Efficient Markets Review (FEMR), a review devised in the wake of countless trading scandals and manipulation by investment banks of practically every Fixed Income, Currency and Commodities (FICC) market in London.

The FEMR initiative aimed to improve the fairness and efficiency of FICC markets and for example, the FEMR report, page 31, section “Market-led improvements in post-trade transparency in commodities markets" said that FEMR’s independent Market Practitioner Panel had recommended that:

“in certain liquid, standardised physical commodities markets (such as gold bullion trading) ‘availability of post-trade reporting would provide an understanding of liquidity, help to dispel some concerns over information abuse, and work towards levelling the playing field‘"

Upon initial publication in November 2018, the LBMA CEO described the new weekly trade volume data as “an exciting moment for transparency in the Global OTC Market“.

The LBMA CEO also described the new data as a development which “will promote transparency for existing and potential investors" and “promote positive investor sentiment".

“Increased transparency should prove a highly beneficial resource for existing and future OTC investors, as they seek to better understand market liquidity and depth". (LBMA – Delivering Transparency and Integrity“).

All Round Enthusiasm

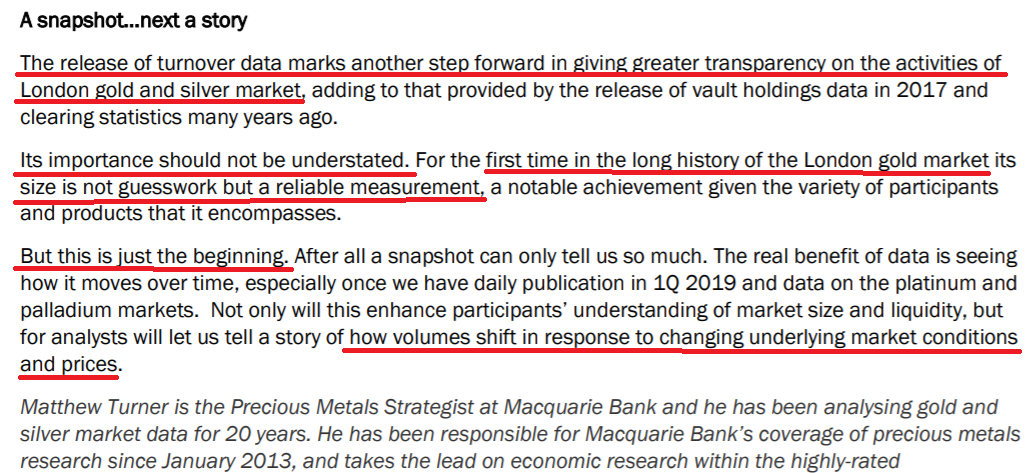

It wasn’t just the LBMA which was excited. Matt Turner of Macquarie, in his commentary in November about the new data said that:

“The release of turnover data marks another step forward in giving greater transparency on the activities of London gold and silver market.

Its importance should not be understated. For the first time in the long history of the London gold market its size is not guesswork but a reliable measurement.

Not only will this enhance participants’ understanding of market size and liquidity, but for analysts will let us tell a story of how volumes shift in response to changing underlying market conditions and prices.

The World Gold Council in its commentary on 21 December 2018 titled “Market Update: Increased transparency on gold trading" said that:

“We believe that this new data, in conjunction with our revised estimates of global trade volumes, will help investors better understand the dynamics of the highly liquid gold market"

“Clarity and transparency in financial markets is beneficial to investors as it increases their level of comfort and their understanding of an asset" (pdf report source: World Gold Council 201812_Gold-trading-volumes)

Nicky Shiels, metals commodity strategist with Scotiabank, in her end of November 2018 analysis, commented that:

“Greater transparency is an overarching theme for almost all markets after 2008. Until now, the size of the London gold market will no longer be a guestimate but a reliable measurement which can be tracked over time for better insight no just on the size of the market, but the shift in forward, option and leasing positioning across the curve"

Pay-to-Play

Given that the LBMA ‘trade reporting’ had been in the works for a number of years and was probably the longest running non-finished project in the history of the City of London, when the data was finally released in November 2018, it was surprising that it was only in snapshot weekly format with a range of data in excel spreadsheets representing averaged data over a five day period.

But at least it was better than nothing, and each week it provided the global gold and silver markets with some level of insight into the absurdity of trading volumes in the predominantly paper gold and paper silver markets of London (with Zurich rolled in), but markets which are extremely influential in setting the gold and silver prices that the rest of the worldwide bullion industry uses. Additionally, last November the LBMA promised that it was moving to daily trade reporting (trade volume) data releases “three months later”, as well as adding platinum and palladium trade volumes to the published data.

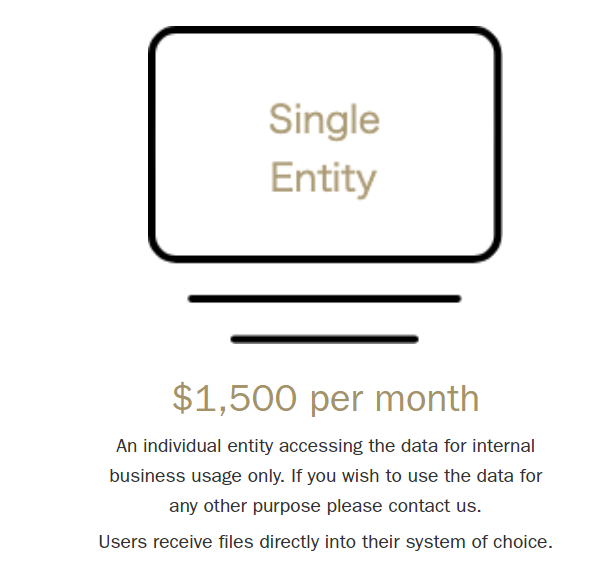

It was therefore shocking to discover that on 10 April, when the daily trading volumes data began to be published, that the LBMA announced that “aggregated and disaggregated daily gold and silver data as well as weekly platinum and palladium data" would only be “available on a subscription basis“, and that this data would cost a whopping US$ 1500 per month, or US$ 18,000 per year.

In the LBMA’s view, as long as you have US$ 18,000 to spare, you can have your high level rolled up anonymized trading data. As long as you pay US$ 1500 per month, you can have your shard of transparency into the opaque London gold and silver markets. How this “levels the playing field" is anybody’s guess, but it would be interesting to hear the view of FEMR’s Market Practitioner Panel who recommended “working towards levelling the playing field" in the London bullion market.

If 20 November 2018 was “an exciting moment for transparency in the Global OTC Market" in the words of LBMA CEO Ruth Crowell, does this make 10 April 2019 “an exciting moment for opacity in the Global OTC Market"? It sure seems like it.

In the nearly four years of the LBMA Trade Reporting project up to November 2018, nothing was ever mentioned about charging for data that is supposed to make the London gold and silver markets more transparent. Until it was updated after 10 April, the LBMA’s web page about its trading reporting data repository, LBMA-i, had said nothing about charging for any data.

How does charging astronomical monthly fees for what should be free data sit with the LBMA’s response to the Fair Effective Markets Review, January 2015, in which it said:

“The LBMA would also welcome further transparency through post trade reporting, providing the industry with data that at the moment does not exist for the bullion market.”

In the words of Crowell, 10 April:

“Moving to more granular daily data and launching new options, price and PGM datasets provides market clients and participants with information never before available on the depth and size of the Global Precious Metals Market. It makes gold in particular, even more attractive for new investors looking for a safe haven asset.“

But only if you have $18,000 to splash out each year to get a glimpse of the data from the LBMA and its data agent Simplitium.

LBMA and Simplitium claim that “the current offering of weekly aggregate trading volumes by metal will remain available on a free-to-view basis“, but this is simply not true and is more weasel words in typical LBMA fashion. The “current offering" prior to the daily datasets was two Excel spreadsheets, one showing data relating to ‘Total Volume’, the other with data related to ‘Open Volume’. Neither of these datasets are available any longer.

When I queried this with LBMA’s data warehouse provider, Simplitium, they confirmed that “Weekly datasets are now available via subscription only“. If you have US$ 18,000 to throw away, you can have your weekly excel spreadsheets. If you don’t, then good luck!

The only thing now free to view on the https://www.lbma-i.com/ website is on the home page in the form of a simplistic bar chart showing the total weekly gold trading volume over a rolling four week period, and the same type of charts for silver, platinum and palladium. There is no data on transaction types (Spot, Swap/Forward, Option and Loan/Lease/Deposit), no details of transaction duration, and no data about open trades.

Despite all of the above, despite now charging US$ 18,000 per year to access what is still only snapshot high level rolled up data that is not trade reporting, the LBMA still has the courage to claim on its website that its “Committed to Transparency". To which it should add “As long as you ‘Pay-to-Play'".

In the previous article I wrote about the LBMA’s so-called trade reporting in November, I concluded with the following:

“The LBMA trade repository or reporting hub, named LBMA-i, into which LBMA member firms report their trade data, has a huge amount of trade data that the LBMA could report to the market if it so chose and wished to do so in the interests of market fairness and efficiency. There could be real trade reporting which as a reminder under MIFID takes the form of reporting “basic details of trades almost immediately, so that the information can be circulated in the market, to improve transparency of pricing”.

“But the LBMA has chosen not to provide any trade reporting at all, and the UK financial authorities have chosen to look the other way."

Which still seems apt. But as the UK financial authorities continue to look the other way, the LBMA has now gone one step further and put all of its data behind a paywall.

But what, you might say, did you expect from the LBMA and the behind the scenes guiding hand from the Bank of England. Transparency? After all, a bullion bank cartel with supposed sovereign immunity does not play by the same set of rules as you or I.

Perhaps the immortal words of Another better sum up the situation, when he perceptively said:

“If you are searching for facts you will find them, but the items you find will not be true!

Did you think that the high powered world of the LBMA would operate in a fishbowl for all to see?"

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

Surging Silver Demand to Intensify Structural Deficit

Surging Silver Demand to Intensify Structural Deficit

Ronan Manly

Ronan Manly 2 Comments

2 Comments