GLD Escalates Sourcing of Gold at the Bank of England

One of the biggest trends in the gold market this year, apart from the rapid rise in the gold price, has been the large investor inflows into gold-backed Exchange Traded Funds (ETFs), and the corresponding swelling of gold holdings in these ETFs.

As highlighted by the World Gold Council, the sponsor of the mammoth SPDR Gold Trust (GLD) through its fully owned subsidiary World Gold Trust Services, gold-backed ETFs had their eighth consecutive monthly inflow during July.

In July, #goldETFs recorded their eighth consecutive month of positive flows, adding 166t, equivalent to US$9.7bn AUM. Once again, this brought global holdings to a new all-time high. Explore more in our recent gold ETFs data and commentary:

— World Gold Council (@GOLDCOUNCIL) August 6, 2020

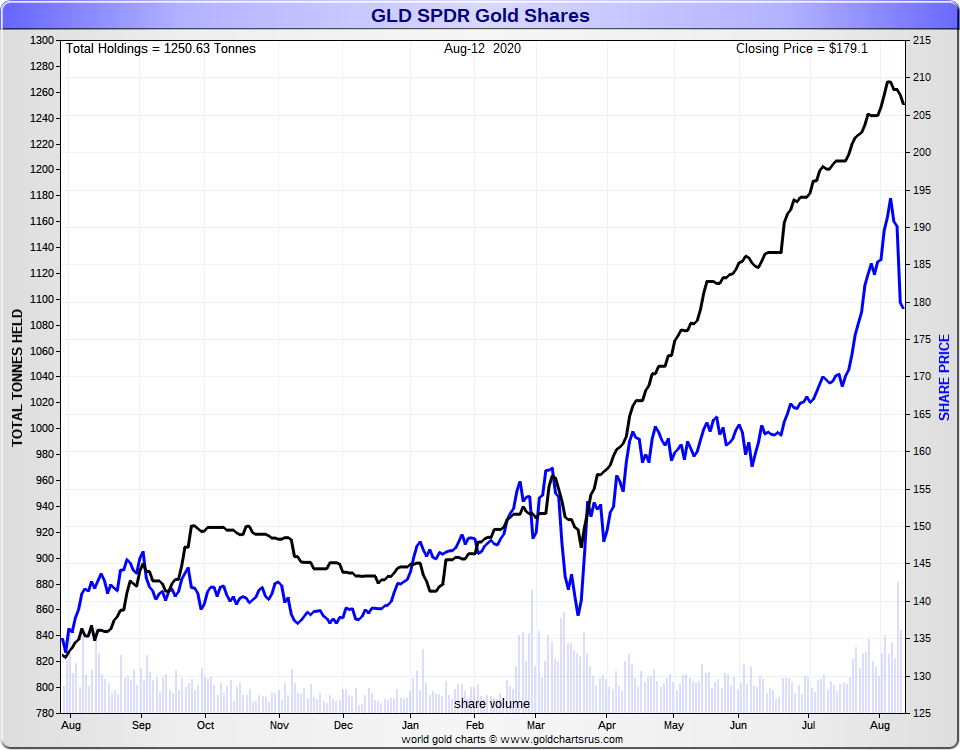

And none more so than the SPDR Gold Trust, the world’s largest gold ETF, which uses HSBC Bank Plc London as custodian for its gold bars. Between January and July inclusive, GLD added a net 348 tonnes of gold, most of which was since late March. In fact, from 20 March to the end of July, GLD’s gold holdings are claimed to have increased by a net 333 tonnes of gold bars – rising from 908 tonnes to 1241 tonnes. See the steep increase in GLD gold holdings over the late March to July period in the below chart.

And where have gold ETFs sourced all of these extra gold bars from in such as short space of time? If you’re HSBC, the SPDR Gold Trust custodian in London, the answer is from anywhere you can, including gold bars at the Bank of England.

Bank of England – Lender of Last Resort

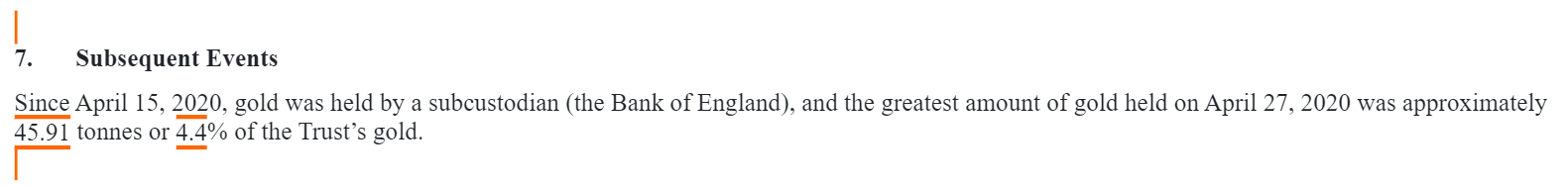

How do we know this? Because in early May, in a first quarter 2020 filing to the SEC, the SPDR Gold Trust (GLD) revealed that starting on 15 April it began holding gold bars stored at GLD subcustodian Bank of England, and that by 27 April, there were 45.91 tonnes of GLD gold bars stored in the Bank of England’s vaults, constituting 4.4% of all the gold the SPDR Gold Trust held at that time. For details of this, see BullionStar article from 13 May,’Amid London gold turmoil, HSBC taps Bank of England for GLD gold bars’.

This Q1 2020 filing was unusual in that according to GLD filings, except for one occasion in Q1 2016, the SPDR Gold Trust never normally needed to resort to source and store gold outside the HSBC London vault, so why did it need to do so beginning in April?

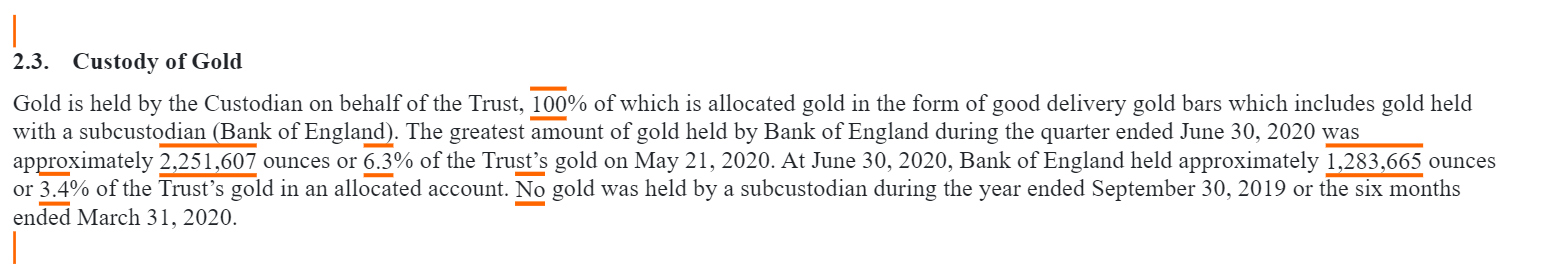

Fast forward to 10 August, when the SPDR Gold Trust published it’s second quarter 2020 filing to the SEC, and this latest 10-Q reveals that not only did the GLD continue to hold gold bars at the Bank of England during Q2, but that GLD overall gold holdings in the Bank of England vaults had risen to 70 tonnes of gold by 21 May.

That’s a net additional 24 tonnes of gold bars the GLD acquired in the Bank of England vaults between 27 April and 21 May, i.e. in less than four weeks.

This 70 tonnes of gold represented 6.3% of GLD’s gold as of 21 May. To quote the Q2 2020 GLD quarterly filing, page 8:

2.3. Custody of Gold

Gold is held by the Custodian on behalf of the Trust, 100% of which is allocated gold in the form of good delivery gold bars which includes gold held with a subcustodian (Bank of England).

The greatest amount of gold held by Bank of England during the quarter ended June 30, 2020 was approximately 2,251,607 ounces [70 tonnes] or 6.3% of the Trust’s gold on May 21, 2020.

At June 30, 2020, Bank of England held approximately 1,283,665 ounces [40 tonnes] or 3.4% of the Trust’s gold in an allocated account. No gold was held by a subcustodian during the year ended September 30, 2019 or the six months ended March 31, 2020.

Not only that, but between the two dates in question, 27 April and 21 May, during when GLD’s total gold holdings rose by 64 tonnes from 1048 tonnes to 1112 tonnes, the increase in GLD’s gold bar holdings at the Bank of England (24 tonnes), represented 37.7% of this total increase in GLD’s gold holdings.

Note that by the end of June, according to the 10Q, the SPDR Gold Trust still held 40 tonnes of gold at the Bank of England.

More than meets the eye – 150 tonnes?

Importantly, the GLD annual report states that all GLD gold should be held in the custodian’s vaults, and that if any gold is held with a subcustodian, HSBC needs to use commercially reasonable efforts to transport that gold from the subcustodian’s vaults to the custodian’s vaults. To quote the 2019 GLD annual report 10-K, page 15:

“The Custodian will hold all of the Trust’s gold in its own vault premises except when the gold has been allocated in the vault of a subcustodian, and in such cases the Custodian has agreed that it will use commercially reasonable efforts promptly to transport the gold from the subcustodian’s vault to the Custodian’s vault, at the Custodian’s cost and risk.”

Gold logistics security carriers Brinks, Malca Amit and Loomis are on record at the end of May confirming in a London Bullion Market Association (LBMA) webinar that they were all active over April and May moving large quantities of physical gold, so why is GLD still holding gold at the Bank of England for over 2 months? Could it be continually tapping gold at the Bank of England while also transferring it out?

Consider the possibility that HSBC has been transferring gold bars out of the Bank of England vaults to the HSBC London vaults during April, May and June. In that case, GLD would be sourcing a lot more gold from Bank of England vaulted stocks than even the figures mentioned in the SEC quarterly filings would suggest. Let me explain.

The Q1 filing in a section called ‘Subsequent Events’ says that the SPDR Gold Trust started holding gold at the Bank of England on 15 April and that the maximum amount of gold GLD held at the Bank of England was on 27 April, when it held 45.91 tonnes.

The Q2 filing says that during the Q2 period, GLD held gold at the Bank of England, that the maximum amount of gold GLD held at the Bank of England was on 21 May, when it held 70 tonnes at the Bank of England, and that on 30 June the GLD held 40 tonnes of gold at the Bank of England.

Note that all of these statements are just referring to total quantities of gold as of various dates and do not say anything about whether the statements refer to the same pile of gold bars at all times.

Based on GLD daily gold holdings changes, we know that between 27 April and 21 May, 64 tonnes of gold was added to GLD. Between 21 May and 30 June, another 66.58 tonnes of gold was added to GLD.

Now consider this. If, of the 45.91 tonnes of GLD gold at the Bank of England on 27 April, HSBC had, after 27 April, transferred 40 tonnes of this gold out of the Bank of England vaults and to the HSBC vault, while adding another 64 tonnes of gold to GLD from gold at the Bank of England between 27 April and 21 May, then it would, by 21 May, still have 70 tonnes at the Bank of England, but also 40 tonnes in its own vaults that had been sourced from the Bank of England.

Then, if after 21 May, HSBC had transferred 70 tonnes of gold out to the Bank of England vaults and to the HSBC vault, while adding another 40 tonnes of gold to GLD at the Bank of England between 21 May and 30 June, then it would, by 30 June, still have 40 tonnes at the Bank of England, but also 110 tonnes in its own vaults that had been sourced from the Bank of England. This would give GLD a grand total of 150 tonnes of gold that it had sourced at the Bank of England.

When I last covered this topic in May, I proposed that the fact that GLD was holding gold at the Bank of England was important because it implied that:

a) there isn’t enough gold in the HSBC vault in London to fulfill SPDR Gold Trust basket creation requests from GLD Authorized Participants (APs).

b) that gold which is ultimately borrowed central bank gold at the Bank of England is being used as a source of GLD gold holdings.

c) that there are physical gold float shortages in the London physical gold market as well as liquidity problems of LBMA market makers in the London paper gold market.

The fact that GLD still needs to source gold at the Bank of England during two quarters in a row, and at an escalating rate, only serves to reinforce this point. No GLD gold was held by a subcustodian in the financial years 2014, 2015, 2017, 2018, 2019 or the 6 months to end of March 2020. In the January – March 2016 period, which corresponded to large inflows of gold into the Trust, GLD did, according to its filings, hold up to 29 tonnes at the Bank of England. But that was only one quarter. Two quarters in a row, Q1 and Q2 2020, is unprecedented.

The murky world of central bank gold lending

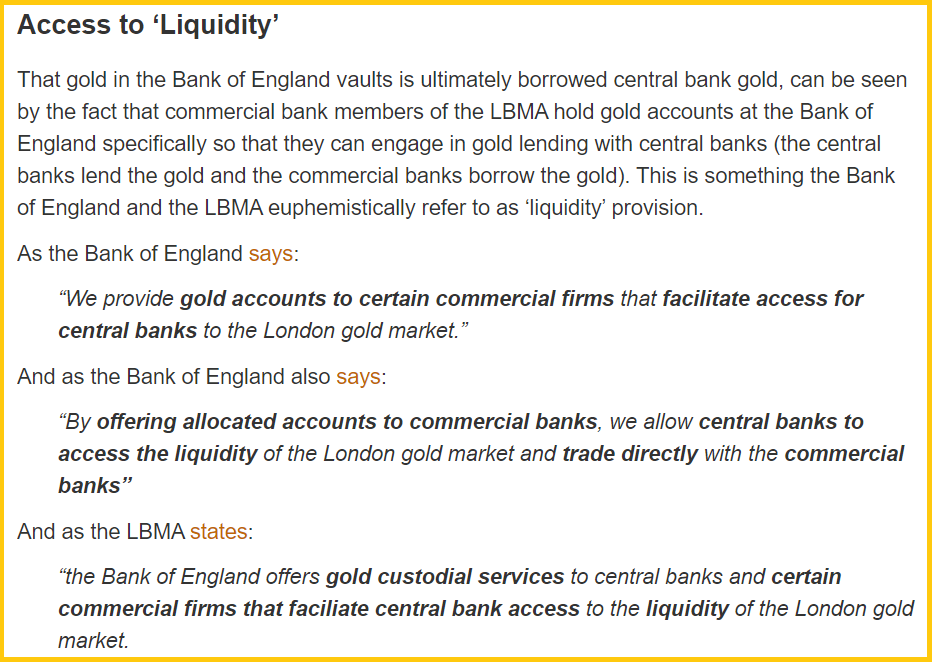

As importantly, given that GLD is holding gold bars in the vaults of the Bank of England, this means, as mentioned in point B above, that GLD is sourcing gold from gold stockpiles that are ultimately from borrowed central bank gold held at the Bank of England.

This is so because, while HSBC is allocating gold to the SPDR Gold Trust from commercial bank gold accounts at the Bank of England, commercial banks (LBMA banks) only hold gold accounts at the Bank of England specifically so that they can engage in gold lending with central banks. The commercial banks hold gold at the Bank of England that is either borrowed from central bank gold holdings, or gold that is going back to replay gold loans from central bank customers at the Bank.

I’ve explained this in more depth in May. See here, and in the screenshot below.

One point to add is that the transfers of gold between central bank gold accounts and commercial (LBMA) bank gold accounts at the Bank of England are carried out using Book Entry Transfers (BETs). As the Bank of England explains:

“The Bank also offers settlement of gold transfers by Book Entry Transfer (BET) on its Gold Bar Management (GBM) system. Central bank reserve managers can transfer gold to and from any other Bank of England gold account holder by BET across the gold custody accounts without the need for the physical movement of gold.

The ability to do BETs is particularly useful for our central bank customers since multiple commercial banks active in the London gold market also have accounts at the Bank of England. BETs can be undertaken on the same day, so reserve managers are therefore able to generate cash from gold holdings quickly, through undertaking gold swaps or sales.“

With HSBC having to resort to allocate a large tonnage of gold bars to GLD at the Bank of England over two consecutive quarters, this raises serious questions about how much gold the SPDR Gold Trust has actually sourced from the vaults of the Bank of England this year. Anywhere between 70 and 150 tonnes is clear. There are also questions about what GLD is doing associating with the murky and opaque world of central bank gold lending at the Bank of England. Questions which the due diligence reviews of all the hedge funds that invest in GLD should be asking.

BoE gold audit? – You must be joking

GLD’s SEC filings also raise questions about auditing the GLD. But surely, you might think that the auditor can access the Bank of England vaults if GLD gold is held there. The answer is no. Neither the Trustee of the SPDR Gold Trust nor its auditor have access to the vaults of GLD subcustodians, and so do not have access to the Bank of England vaults. As page 13 of the GLD annual report makes clear:

“…under the Custody Agreements the Trustee may, only up to twice a year, visit the premises of the Custodian for the purpose of examining the Trust’s gold and certain related records maintained by the Custodian. Inspectorate International Limited conducts two counts each year of the gold bullion stock held on behalf of the Trust at the vaults of the Custodian.”

“The Trustee has no right to visit the premises of any subcustodian for the purposes of examining the Trust’s gold or any records maintained by the subcustodian, and no subcustodian is obligated to cooperate in any review the Trustee may wish to conduct of the facilities, procedures, records or creditworthiness of such subcustodian.”

And who better, you might say, to answer all of these questions about the GLD using gold at the Bank of England than the GLD sponsor itself, the World Gold Council. The World Gold Council can explain, you might think. Alas no. Questions to the World Gold Council via Twitter, cc’ing Bloomberg, on this topic have fallen on deaf ears. Crickets.

Why is the World Gold Council’s SPDR Gold Trust holding gold bars at the Bank of England? 70 tonnes of gold at the Bank of England on 21 May. 40 tonnes of gold at the Bank of England on 30 June. https://t.co/LucTJsgXwG

— BullionStar (@BullionStar) August 13, 2020

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments