Swiss Gold & Silver Refineries, GFMS Data, and the LBMA

In early September 2015, I wrote an article titled “Moving the goalposts….The LBMA’s shifting stance on gold refinery production statistics”, in which I explained how the London Bullion Market Association (LBMA) had, on Wednesday 5 August, substantially lowered its 2013 gold and silver refinery production statistics literally a few days after I had commented on the sizeable figure of 6601 tonnes of 2013 refined gold production that the LBMA had previously published in May 2015.

Specifically:

- On 5 August, the LBMA substantially altered and republished Good Delivery List gold and silver refinery production statistics in two of its published files: LBMA Brochure Final 20120501.pdf and LBMA Overview Brochure.pdf

- For gold, the alterations were most pronounced in the 2013 refined production figure which was reduced from 6601 tonnes to 4600 tonnes, i.e. a 2001 tonne reduction

- Other years’ figures for refined gold refinery output (2010-2012) were also reduced, with the 2008-2009 figures being increased

- As part of the update, the LBMA linked its amended figures solely to GFMS estimates of gold mining and scrap output, adding the words ‘estimated to be‘ in front of the 4,600 tonnes figure, and the words ‘owing to recycling of scrap material‘, thereby framing the revised figure solely in terms of scrap gold in excess of 2013 gold mining supply. This use of GFMS data is bizarre because all refiners on the LBMA’s Good Delivery List provide exact refinery production statistics to the LBMA Executive as part of the LBMA Pro-Active Monitoring programme, so there are no need to reference estimates from external data providers

- In the updated versions of the brochures, the LBMA made no reference to why the gold figures had been reduced, nor what the original figures referred to, particularly for the huge difference of 2,000 tonnes of gold refinery output in 2013 between its two sets of figures

- By 12 August, the LBMA had again updated its 2013 gold refinery output figure to 4579 tonnes

In my Part 1 article, I had concluded that:

“There are 2,300 tonnes of 2013 gold refining output in excess of combined mine production and scrap recycling being signalled within the 6,601 tonnes figure which was removed from the LBMA’s reports on 5 August 2015.

Could it be that this 6,601 tonne figure included refinery throughput for the huge number of London Good Delivery gold bars extracted from gold ETFs and LBMA and Bank of England vaults and converted into smaller gold bars in 2013, mainly using LBMA Good Delivery Swiss gold refineries? And that maybe this 6,601 tonne figure stood out as a statistical outlier for 2013 which no one wanted to talk about?"

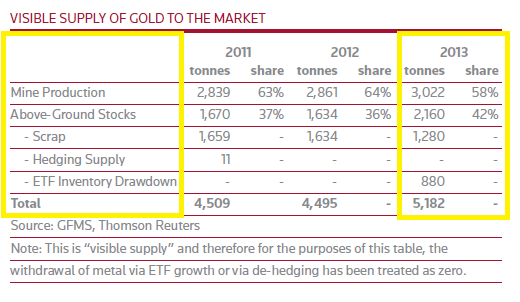

Note that for 2013, Gold Field Mineral Services (GFMS) estimated gold mining production to be 3,022 tonnes, and gold scrap supply to be 1,280 tonnes for 2013, so in total GFMS estimated gold mining + scrap supply at 4,302 tonnes in 2013. Therefore, the LBMA’s original figure for 2013 gold refinery production of 6,601 tonnes exceeded the combined GFMS mine and scrap supply by 2,300 tonnes.

Whose interests are served by replacing actual refinery output figures with far lower estimates comprising GFMS gold mine production and scrap recycling data? What happened to the third major source of gold supply to refineries during 2013, i.e. London Good Delivery gold bars, and why won’t the LBMA reference this? Why would the LBMA go to great lengths to de-emphasise the huge volume of Good Delivery gold bars being sent to gold refineries (especially in 2013) for conversion into 9999 fine kilobars, when its obvious for all to see that this huge migration of bars happened?

This article, which is Part 2 of the analysis into the LBMA’s 2013 gold refinery statistics, looks into this 6,601 tonne number and the 2,300 tonne delta compared to GFMS estimates, specifically examining the mountain of evidence that highlights the huge volume of Good Delivery bars that were processed through the Swiss gold refineries in 2013, and the huge associated shipments of gold from the UK to Switzerland, and onward from Switzerland to Asia.

Part 2 also looks at the extent to which GFMS and the World Gold Council, through their report text and data, addressed, and did not address, the non-stop processing of Good Delivery gold bars into smaller finer kilobars during 2013.

When Part 1 was written, I had also planned that Part 2 would examine the 2013 gold withdrawals from the London-based gold ETFs, and the 2013 withdrawal of gold from the Bank of England, however, these topics were subsequently addressed in a separate piece titled “How many Good Delivery gold bars are in all the London Vaults?….including the Bank of England vaults“.

That article itself had found a lot of interesting information including:

- that the entire London LBMA vault network (including the Bank of England) lost 1,500 tonnes (120,000 bars) between 2011 and early 2014, shrinking from 9,000 tonnes to 7,500 tonnes

- Between the end of February 2013 and the end of February 2014, the amount of gold in custody at the Bank of England fell by 755 tonnes

- In 2013, the large physically-backed gold ETFs which store their gold in London saw a 720 tonne outflow of gold (GLD 561, IAU 60, ETF Securities’ PHAU 52, ETS Securities GBS 42, ‘Source’ Gold 31)

- The full set of gold ETFs storing their gold in London can, nearly down to the exact tonne, account for all of the LBMA vaulted gold held outside the Bank of England vaults (See start of my article titled “Central bank gold at the Bank of England" for an explanation of this)

Note: Deutsche Bank gold ETFs and an ABSA gold ETF also store their gold in London, and during 2013, these 2 sets of ETFs lost approximately a combined 12 tonnes of gold (~9 tonnes from Deutsche and ~3 tonnes from ABSA, so this would increase the 720 tonne ETF loss above, to about 732 tonnes.

Yet another Change to the LBMA Brochure in September 2015

On 29 September 2015, the LBMA made a further alteration to the 4-page LBMA Overview Brochure, the brochure that had featured the shifting gold and silver refinery output statistics.

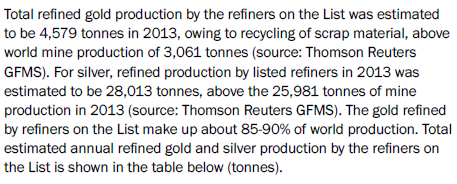

On this occasion, although the data in the table remained unchanged, some unusual footnotes were added underneath the table of refining statistics. The text, table and the new footnotes are as follows:

The footnotes are highlighted as per yellow box:

Let’s look at these 3 footnotes one by one.

Note 1): The data for 2008-2013 contains estimates which will be updated when actual data becomes available.

This note is illogical, since the LBMA already has all of the exact data of gold and silver output per refinery. This was stated in the previous versions, and it’s all detailed in my previous article.

Also, specifying ‘Figures correct as at September 2015’ is illogical since the LBMA states that the data is ‘estimates’ and not ‘actual data’. Correct relative to what? How can ‘estimates’ be deemed to be correct if the ‘actual data’ is not published?

That would also explain the bizarre note number 2.

Note “2) Refined production should include only the refinery’s output that has gone through a refining process".

Footnotes to tables are normally used to explain data, not to justify the data. This Note 2 sounds more like a pronouncement or a direction from a LBMA communication to the refineries rather than an explanatory footnote.

In English grammar, ‘Should‘ means to give advice, a recommendation or a suggestion, and to express obligation or expectation. This footnote looks like it has been lifted out of a directive from the LBMA to the member refineries.

Converting a 995 fine Good Delivery ~400oz bar into a series of 999 kilo bars does involve a a chemical refining process in addition to melting and pouring. The transformation by the refineries of large bars into smaller bars is still throughput, and is a refinery process (as you will see below).

Also problematic to the LBMA’s footnote is that converting 9999 fine scrap (in the form of old bars) to new 9999 bars, which sometimes happens, would not necessarily be captured in the above LBMA footnote, so this approach to seemingly attempt to tie in the LBMA data to GFMS mining and scrap refining data opens up a can of worms.

Note 3): the production of newly accredited refiners excludes production in the years prior to accreditation.

Note 3 should be obvious, and besides, it wouldn’t change much in terms of the huge gaps in the numbers between 6601 tonnes in 2013, and the GFMS figure of 4302 tonnes.

Macquarie 2013 – Where has the ETF gold gone

In August 2013, Macquarie Commodities Research, in its report “Where has the ETF gold gone" commented that:

“over 1H 2013 it [the UK] has exported 797 tonnes [of gold], equivalent to 30% of annual gold mine production"

“…gold bars from ETFs have gone to Switzerland, where most of the world‟s gold refining capacity is, to be remelted into different size bars and coins and then sold on end consumers, predominantly in Asia, specifically China and India.“

“Trade data also backs up this movement of gold – Hong Kong customs reported imports of gold from Switzerland of 370t in 1H 2013, up 284t on 1H 2103 (fig 3), while Indian imports from Switzerland appear to have risen by more than 100t YoY.

It is not really very surprising that the gold has found its way from vaults in London (and most likely the US and Switzerland) to Asia via Swiss refineries. We have repeatedly noted that gold ETFs are part of the physical gold market and if investors don’t want the gold it has to go somewhere else."

Since the four large Swiss gold refineries account for the lions share of worldwide annual gold refinery output (See my article “Swiss Gold Refineries and the sale of Valcambi“), its important to examine what the Swiss gold refineries had to say about the smelting of London Good Delivery gold bars into smaller bars in 2013, as well as their comments about the dramatic reduction in gold scrap coming into the refineries during that time.

Note that London Good Delivery gold bars are variable weight bars that weigh about 400oz each (12.5kgs). These are the standard type of gold bars stored in central bank vaults and held in physically backed gold Exchange Traded Funds (ETFs) such as the SPDR Gold Trust (GLD).

Swiss Gold Imports from the UK: 2013

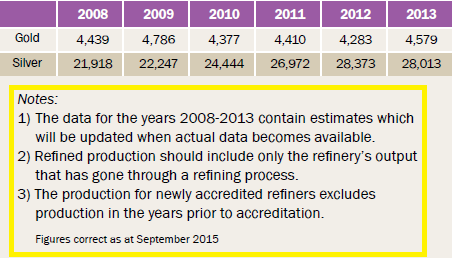

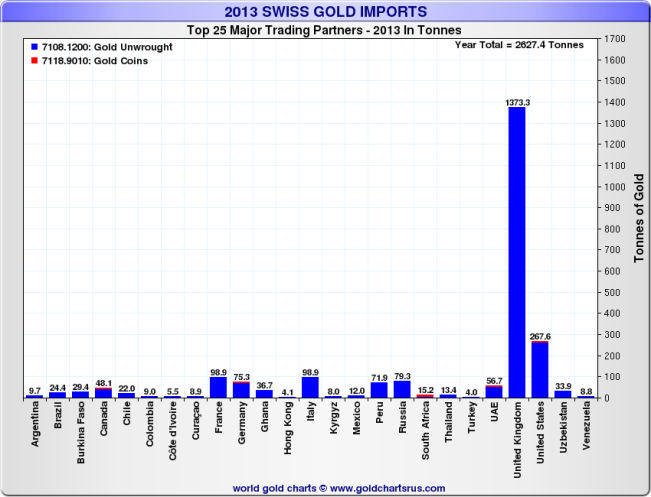

In 2013, Switzerland imported more than 2,600 tonnes of gold and exported approximately 2,800 tonnes of gold. That year’s gold import and export totals were the highest ever annual totals recorded for Switzerland. See chart below from Nick Laird’s Sharelynx.

Although Switzerland doesn’t possess any major gold mines, it does host one of the largest physical gold markets in the world, which regarding investment gold, primarily comprises the large Swiss gold refineries along with some bullion banks (including UBS and Credit Suisse), the Swiss National Bank and the Bank for International Settlements (BIS), and the Swiss wealth management and private banking sector. But the throughput and precious metal processing of the four large gold refineries accounts for nearly all the country’s gold imports and exports.

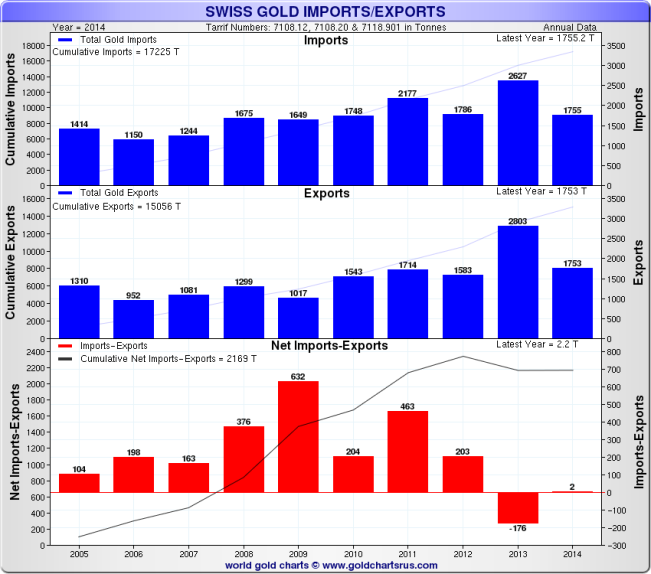

The UK is consistently the largest import source of gold into Switzerland. In 2013, Switzerland imported nearly 1,400 tonnes of gold from the UK during the year, with hardly any gold moving back in the opposite direction. Notwithstanding the fact that the UK does not have any producing gold mines, 1,400 tonnes is 46% of GFMS 2013 global gold mining production estimate of 3022 tonnes. And despite the fact that GFMS itself stated that the UK only contributed 41 tonnes of gold scrap to the 1280 tonne global gold scrap total in 2013, 1400 tonnes of UK gold exports to Switzerland is 109% of GFMS’s 2013 global gold scrap estimates.

So why is the LBMA not including all of this 1400 tonnes of UK to Switzerland gold exports in its 2013 gold refinery production statistics?

Even Swiss gold imports from the United States in 2013, at 267 tonnes, paled into comparison compared to Switzerland’s imports of 1,373 tonnes of gold from the UK, and left all other import sources such as Italy and France in a distant third.

Thanks to Nick Laird of Sharelynx for permission to use the above 3 charts.

Swiss Refineries – From the Horses’ Mouths

Let’s look at what the Swiss gold refineries had to say about the conversion of Good Delivery gold bars into smaller bars during 2013. You will see that the large Swiss refining companies treat Good Delivery bars as one of three sources of supply coming in to their refineries.

It’s important to note that the transformation of London Good Delivery bars of 995 fineness into, for example, kilobars of 9999 fineness, still involves the use of chemicals in reactions, albeit smaller amounts than when refining mining ore, and is not just a simple melting and re-casting exercise.

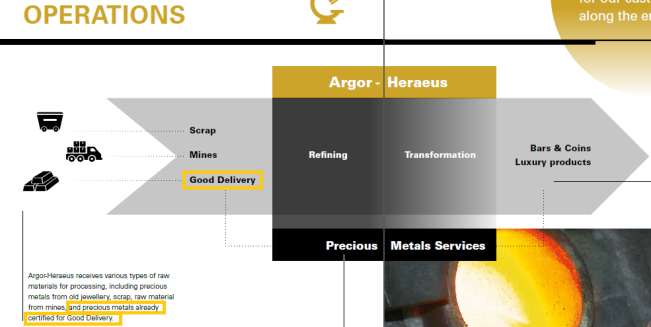

Argor-Heraeus’s perspective on Good Delivery bars in 2013

In its 2013 Corporate Sustainability Report, Argor-Heraeus had the following comments to say about the 400oz bar to smaller bar transformations:

“In 2013, we consumed 3,120,603 kg of chemicals, 4% less than in 2012, despite a slight increase in precious metals processing. This decrease derives from the fact that a large percentage of gold processing involved the re-smelting of metal already in circulation (Good Delivery) to obtain high-fineness ingots, which are in great demand. The processing of a metal that is already pure requires smaller amounts of chemicals in reactions, as opposed to the refining of raw materials from mines.”

Argor-Heraeus even divides the gold inputs that go into its refining process into three distinct categories, namely, a) Scrap, b) Mines and c) Good Delivery, such is the importance of the Good Delivery refining activity to the refinery. See the following graphic from the Argor-Heraeus 2013 Sustainability report, complete with descriptive icons of the three input sources inputs of metal:

The text box from the left-hand corner of the above graphic has been zoomed in and magnified below to aid readability:

Elsewhere in the same report, Argor-Heraeus reiterates the same 3 sources of gold supply that come in to its refineries for ‘Transformation and Processing‘.

Argor-Heraeus picks up the Good Delivery bar theme again in its 2014 Corporate Sustainability Report, where it produces a similar but slightly more detailed graphic, complete with the icons, and which explains that the Good Delivery bars can be either ‘grandfathered or non-grandfathered‘ and that the materials are ‘already certified Good Delivery, or already high-quality‘. High quality but not good delivery could be signifying gold bar brands on the former London Good Delivery list, or else lower grade coin bars, that had originally been made from melting down and casting into bars the gold coins that were previously in circulation. Coin bars were at one time on the London Good Delivery list up until 1954.

Grandfathered is a term used by the LBMA in its discussions of ‘Responsible Gold Guidance‘ and is defined as:

“Grandfathered Stocks: Gold investment products (ingots, bars, coins and grain in sealed containers) held in bullion bank vaults, central bank vaults, exchanges and refineries, with a verifiable date prior to 1 January 2012, which will not require a determination of origin. This includes stocks held by a third-party on behalf of the listed entities.“

The Argor-Heraeus 2014 graphic referencing Good Delivery bars is as follows:

Metalor’s information on Good Delivery bars in 2013

In its 2013 Annual Report (large file 3.4 MBs), within the review of 2013 performance section, large Swiss based gold refinery Metalor Technologies highlights a steady demand for ‘recasting of gold bars for banks’:

“Full-year net sales in the Refining business unit declined by 16 percent as precious metal prices remained low, reflecting a weak global economy. The drop in prices negatively impacted the price/volume mix, as reduced quantities were retained at lower prices. This was partly offset by steady demand in less profitable activities, such as the recasting of gold bars for banks.”

Metalor also provided a host of pertinent insights into other drivers of the 2013 gold market:

“The spot-price of gold and silver declined by more than 30 percent over a six-month period, and this prompted sharp sell-offs of the gold stored in ETF (Exchange-Traded Funds) vaults. The consensus is that this surplus was absorbed by strong China based bullion purchases, while price-dependent scrap flow fell rapidly.”

“High grade precious metal bearing scrap flows worldwide dropped sharply due to sustained price erosion. This market development created an overhang in refining capacity, and a much more competitive pricing environment, although some of the volume reduction in scrap flows was offset by new mining doré contracts. The drop in price led to strong bullion purchases, mainly driven by China.”

The Refining business unit saw a challenging 2013, due to reduced gold prices. This resulted in a continuous slowdown in the scrap market. …….a decreasing volume of mining doré coming from abroad, due to changes in country regulations.”

“In Asia, the Hong Kong refinery was able to sustain a high level of activity due to strong demand and a high premium on bullion products.”

Valcambi on refining of Banks’ gold

Valcambi has an annual refining capacity “in excess of 1,200 tons for gold and 400 tons for silver“, so is known for having potentially unused refining capacity.

Following the July 2015 Valcambi acquisition by Indian company Rajesh Exports, the acquirer clarified to Indian newspaper ‘Business Standard’ that it was a regular activity for Valcambi to use its excess capacity to meet “emergency" refining requirements for gold held by bullion banks.

In fact, on the recently updated Valcambi website, an entire web page is now devoted to describing how transportation works for banker clients, in addition to clients that are miners, scrap dealers, other refineries, and watch makers. See ‘Transportation for Bankers‘ web page which details the import and exports procedures which the Valcambi refinery offers its banker clients.

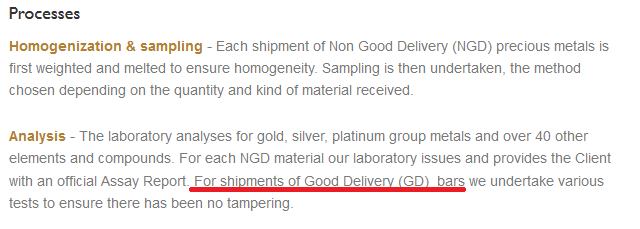

Under its Assaying web page, Valcambi even sees fit to specifically explain the process for the incoming ‘shipments of Good Delivery (GD) bars‘ which are merely checked to confirm that they haven’t been tampered with, as opposed to the shipments of ‘Non Good Delivery (NGD) precious metals‘, which are subjected to homogeneity checking, sampling and analysis. This shows that the volume of Good Delivery bar shipments into Valcambi is significant enough to warrant specific coverage on its website.

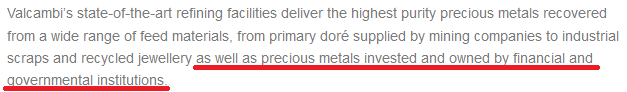

Under its Refining web page, Valcambi again details its ‘3’ sources of incoming gold, namely “primary doré supplied by mines", “industrial scrap and recycling“, and “metals invested and owned by financial and governmental institutions“, i.e. London Good Delivery Bars.

On the phenomenon of a low gold price leading to a decline of gold scrap coming into Valcambi, the CEO, Michael Mesaric, recently had the following to say while talking with Indian publication Bullion Bulletin at the India International Gold Convention (IIGC) 2015 in Goa:

“Bullion Bulletin: The gold price is coming down continuously, is there any impact on the refinery segment?

“Michael Mesaric: There is a small impact as well because if the gold price is very low there is very little scarp coming in."

Argor-Heraeus interviews –“They’re bringing in good delivery bars"

On 4 December 2013, Alex Stanczyk from Anglo Far-East group, in an interview with Koos Jansen published on his BullionStar blog, said that he (Stanczyk) and colleague Philip Judge, accompanied by Jim Rickards, had just returned from a visit to Switzerland where they had met with the managing director of one of the large Swiss refineries. Although the identity of the refinery was not revealed, Alex Stanczyk said that the refinery MD informed them that there was huge demand for fabrication at his refinery and that:

“They put on three shifts, they’re working 24 hours a day, and originally he (the MD) thought that would wind down at some point. Well, they’ve been doing it all year. Every time he thinks its going to slow down, he gets more orders, more orders, more orders. They have expanded the plant to where it almost doubles their capacity. 70 % of their kilobar fabrication is going to China, at a pace of 10 tons a week."

“They’re bringing in good delivery bars, scrap and doré from the mines, basically all they can get their hands on."

“…sometimes when they get gold in, it’s coming from the back corners of the vaults. He knew this because these were good delivery bars marked in the (nineteen) sixties."

The same Swiss gold refinery executive was interviewed by Jon Ward of the Physical Gold Fund in September 2015, with the interview published as a podcast and as a transcript.

“Jon Ward: In 2013, I recall you commented on the tightening of physical supply in the gold market and even the difficulties you were having in sourcing material. In fact, as I remember, you remarked that in 30 years, you’d never seen anything like it."

The exact identify of the Swiss refinery executive was also not revealed in the September 2015 interview, however the executive is most certainly from the Argor-Heraeus refinery. Why? Because, the introduction to the 2015 interview states that:

“The gentleman we are interviewing is part of senior management of one of the largest Swiss refineries. His refinery is one of only 5 global LBMA referees…”

The LBMA appoints 5 refinery assay laboratories to help it to maintain the Good Delivery system. These appointees are known as ‘Good Delivery Referees’ and they meet on a quarterly basis at the LBMA. The 5 Good Delivery Referees are Argor-Heraeus, Metalor Technologies and PAMP (all from Switzerland), Rand Refinery (South Africa), and Tanaka Kikinzoku Kogyo (Japan).

Therefore, the interviewee has to be from one of three Swiss refineries, namely, Argor-Heraeus, Metalor or PAMP.

Furthermore, and this is the critical point, during the interview, the refinery executive states that his company has just opened in Santiago, Chile.

“Head of Refinery: ..looking at mining partnerships, we are expanding in Latin America. We have just opened in Santiago, Chile, and are trying to provide even more competitive services for the Latin American mining industry."

Out of the short-list of Argor-Heraeus, Metalor, and PAMP, the only one of the three to open an operation in Santiago, Chile in 2015 (and the only one of the three to even have an operation in Chile) is Argor-Heraeus. See Argor-Heraeus new item below from the news page of its website dated 16 September 2015:

The press release for the above Chilean plant announcement is only in Italian, but can be read here.

Lets look at what the Argor-Heraeus refinery executive says about conversion of Good Delivery bars to kilobars, both in 2015 and during the few years prior to that. From his September 2015 interview:

Jon Ward: Over the last couple of years, has this meant that you actually had to melt down and re-refine a whole lot of 400-ounce bars for China? If you have, I’d like to know where the bars come from.

Head of Refinery: The bars are coming from what you could call “the market.” Looking back, there were all these ETF liquidations, and the ETFs were holding bars in the form of 400-ounce bars. At that time a lot of the physical liquidity maintained in the London gold market was actually in 400-ounce large bars. The final customers were not interested in 400-ounce bars, so it was one of our jobs to take these bars, melt them down, refine them up to the 999.9 standard, and cast them into kilo bars.

Jon Ward: Were a whole lot of these bars coming from London?

Head of Refinery: Regarding the ETF liquidations, this gold had to go somewhere, and that was all converted. This is a thing you see every year. You also see some liquidations of physical gold held with COMEX and NYMEX. More or less, these are the sources of gold other than newly mined.

PAMP – Three Shifts and Full Capacity – Barkhordar

In January 2014, in an article titled “Gold Flows East as Bars Recast for Chinese Defying Slump“, Bloomberg highlighted that the PAMP refinery, owned by MKS (Switzerland) SA, was at full capacity during parts of 2013, and the article quoted PAMP Managing Director Mehdi Barkhordar as saying that they had to add production shifts to cope with processing demand:

“Gold’s biggest slump in three decades has been a boon for MKS (Switzerland) SA’s PAMP refinery near the Italian border in Castel San Pietro, whose bullion sales to China surged to a record as demand rose for coins, bars and jewelry."

“To keep up with orders, MKS added shifts at the PAMP refinery, located about 4 miles (6.4 kilometers) from the Italian border, Barkhordar said in November…"

“Furnaces that can process more than 450 tons a year were at full capacity from April to June, melting mined metal, scrap jewelry and ingots at 1,000 degrees Celsius (1,832 degrees Fahrenheit) into the higher purities and smaller sizes favored by Asian buyers."

“The surge in orders meant some parts of the refinery worked three shifts instead of the usual two, Barkhordar said."

Again, you can see that there were three sources of supply for the PAMP refinery in 2013, i.e. mining, scrap and ingots (bars). According to GFMS, global scrap gold supply fell by 354 tonnes (21%) from 1634 tonnes in 2012 to 1280 tonnes in 2013, so this did not account for the ‘surge in orders’ and the need to add extra refinery shifts. Likewise, global gold mining output only increased by 160 tonnes (5%) from 2860 tonnes in 2012 to 3022 tonnes in 2013, and much of this increase was in China, Russia, Australia, Kyrgyzstan, and Indonesia which refine their own gold domestically, so this would also not explain the surge in orders, which therefore can only be attributable to recasting existing large gold bars into “smaller sizes favored by Asian buyers“.

Therefore, all 4 of the 4 large Swiss gold refineries are on the record that London Good Delivery gold bars were a very significant source of gold supply into their refineries during 2013 and even since then. So why did the LBMA amend its 2013 gold refining production statistics and seek to purely link its revised ‘estimate’ numbers to GFMS estimates of gold mine supply and gold scrap supply? There is an entire third source of gold supply to the refiners being overlooked because the LBMA dramatically reduced its 2013 gold refining production figure of 6,601 tonnes. Classifying Good Delivery bars as a supply source for refining is as legitimate as classifying gold scrap as a supply source for refining, and both come from above ground gold stocks.

GFMS and the World Gold Council

The well-known gold research consultancy GFMS, as well as gold mining lobby group the World Gold Council, between them produce a number of gold supply and demand reports each year. [Note: GFMS, formerly known as Gold Fields Mineral Services, is now part of Thomson Reuters].

Each year GFMS publishes a gold survey and related update reports later in the year. In 2013, this GFMS gold survey included two update reports. The 2013 survey and its updates were sponsored by Swiss refiner Valcambi and Japanese refiner Tanaka, with ‘generous support‘ from a selection of entities including Swiss refiner PAMP (part of the MKS Group), South African refiner Rand Refinery, US gold mining companies Barrick and Goldcorp, bullion bank Standard Bank, US futures exchange CME Group, and the gold mining sector backed World Gold Council.

Its notable that the GFMS reports are ‘sponsored’ by some of the large Swiss gold refiners, yet there is nothing in the GFMS reports that puts cold hard factual numbers on the amount of Good Delivery bars processed through the refineries. As you will see below, GFMS mentions the good delivery bar processing in passing in its text, but not in its 2013 gold supply-demand ‘model’.

What, if anything, did GFMS have to say about conversion of London Good Delivery gold bars into smaller gold bars, such as kilobars, during 2013?

In its GFMS Gold Survey for 2013 – Update 1 (large file 11MBs) report, published in September 2013, the report states that:

“Strong trade flows were recorded between the UK and Switzerland, where Good Delivery metal was refined to smaller bars and shipped to India and China."

The GFMS Gold Survey for 2013 – Update 2 (large file 9.8 MBs), published in January 2014, reiterated this point about large bar to small bar refining. On page 5 of the Update 2 report it states:

“The duality of disinvestment in the developed world and an increase in physical demand from Asia was witnessed by the largest movement of gold, by value, in history as bars were shipped to Asia, often being melted down into smaller bars en route.”

Notice that not all Good Delivery bars were converted to smaller bars before shipment to Asia. Some shipments went straight to Asia without being melted and converted.

And on page 9 of the same Update 2 report, the source of some of these smaller bars is given, i.e. the source was UK ETF gold holdings:

“As a consequence, UK-led ETF outflows found their way to Switzerland, where refiners melted the metal into smaller bars, and shipped them East, in order to satisfy the surge in demand.”

The World Gold Council (WGC), regularly issues its own gold supply demand reports called ‘Gold Demand Trends‘, and publishes these reports in the form of an annual version, followed by shorter quarterly updates. In ‘Gold Demand Trends Q3 2013’, published in November 2013, the WGC said:

“Gold continued to work its way through the supply chain, to be converted from London Good Delivery bar form, via the refiners, into smaller Asian consumer-friendly kilo bars and below. This process is borne out by recent trade statistics. Data from Eurostat show exports of gold from the UK to Switzerland for the January – August period grew more than 10 fold to 1016.3 tonnes. This compares to a total of just 85 tonnes for the same period in 2012."

In its Full Year 2013 edition of ‘Gold Demand Trends’, published in February 2014, the World Gold Council had this to say about the London Good Delivery bar shipments going to refineries, being transformed into smaller bars, and then recommencing their onward journey to the East:

“No review of 2013 would be complete without a mention of the unprecedented flow of gold from western vaults to eastern markets, via refiners in North America, Switzerland, and Dubai.”

“These shifts resulted in the shipment and transformation – on an epic scale – of 400oz London Good Delivery (LGD) bars into smaller denominations more suitable for consumers’ pockets.”

Notice the reference to refiners in North America and Dubai also, in addition to Switzerland.

In its ‘Gold Demand Trends Q1 2014‘ published in May 2014, the WGC stated that:

“As illustrated last year when gold flowed out of western ETFs, through refineries in Switzerland and to consumers in the East, official trade data can provide insights into global gold flows."

The full GFMS Gold Survey for 2013 (large file 6.2 MBs), i.e the report before the 2 updates, was originally published in April 2013, and was written too early in 2013 (probably written in March 2013) to really capture the flows of Good Delivery gold bars from the UK to Switzerland that were smelted into smaller bars. This was before the massive gold price smash of April 2013 that got the ETF gold sales going. That report mentions ETF gold outflows of 148 tonnes up to 11th March 2013, including 111 tonnes from the SPDR Gold Trust (GLD), but the 2 GFMS update reports from September 2013 and January 2014 were written at a later date, with a better vantage point, when the 400oz bar to smaller bar trend had gathered momentum.

Where was the Swiss refinery output going to in 2013?

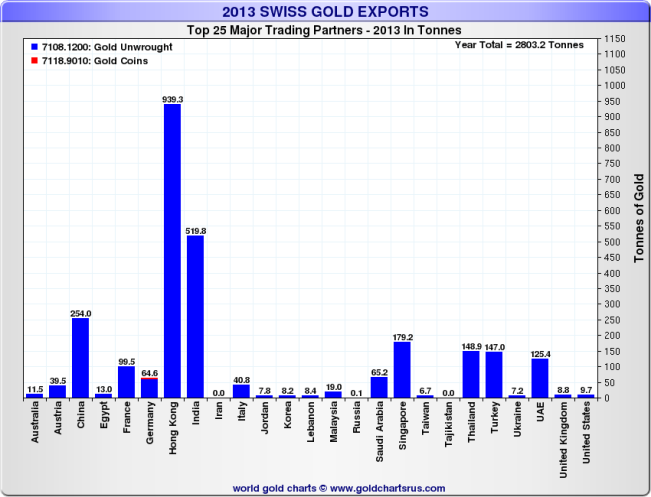

On the outbound export route, Swiss gold exports of 2,800 tonnes in 2013 went primarily to Hong Kong (939 tonnes), India (520 tonnes), China (254 tonnes), Singapore (179 tonnes), Thailand (149 tonnes), Turkey (147 tonnes) and the United Arab Emirates (125 tonnes), with the residual 500 tonnes going to other destinations as detailed in the below chart from Nick Laird’s Sharelynx.

GFMS – Masking the Swiss refining of Good Delivery Bars?

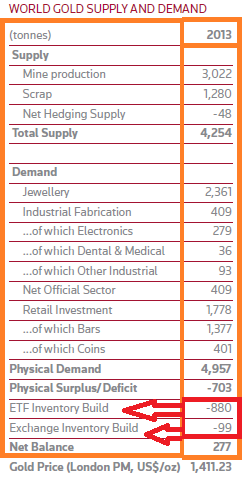

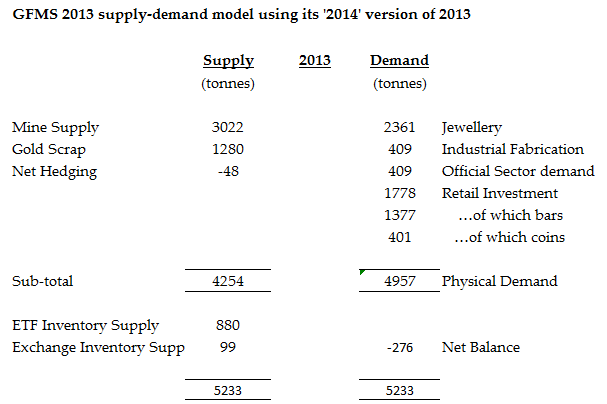

Given that the LBMA decided to compare its amended gold (and silver) refinery production statistics against GFMS ‘estimates’ of gold supply (especially out of sync for 2013), then its important to look at what GFMS claimed gold supply and demand to be in 2013. This may help in determining a possible rationale the LBMA had for reducing its refinery output figures.

So, does the 2013 GFMS gold supply and demand data model show this “largest movement of gold, by value, in history" “on an epic scale" phenomenon from the UK to Swiss refiners to Asia? The answer is explicitly NO, neither in 2013, nor in any prior year, but to a limited extent yes, but only after drilling down into the sub-components of an obscure GFMS balancing items within the GFMS supply-demand equation.

But GFMS precious metals supply data and the way it’s presented does not seem to want to highlight the ‘largest movement of gold, by value, in history‘. So even though GFMS mentions (in passing – see above) the historically important 2013 movement of 400oz bars to refineries through places like Switzerland and their transformation into smaller bars by the large gold refineries, the GFMS gold supply statistics keep some of the relevant numbers locked away and jumbled up within a rather odd rolled up figure that it calls “implied net (dis)investment“. Other relevant data, such as OTC demand data, is not even detailed by GFMS, it’s just assumed.

GFMS gold supply – Disaggregating the implied figure

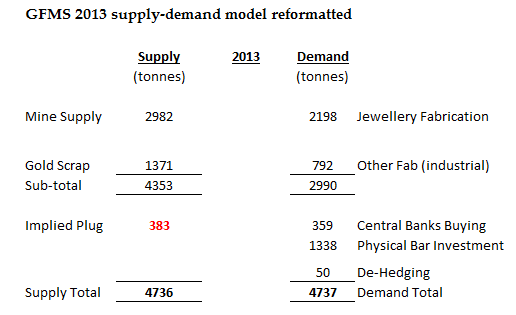

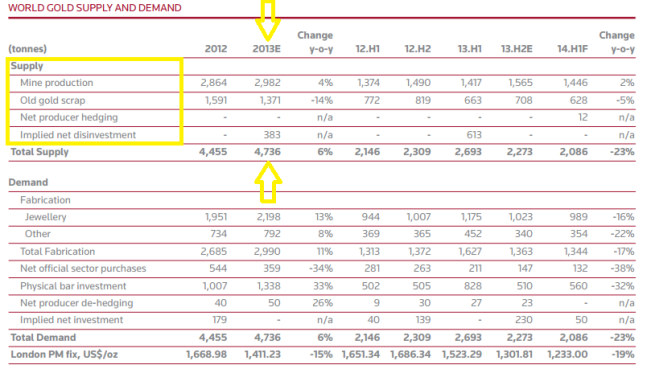

Here is how GFMS gold supply statistics looked for 2013, taken from the GFMS Update 2 2013 report published in January 2014. In 2013 GFMS used 4 supply categories, namely, ‘Mine production‘, ‘Old gold scrap‘, ‘Net producer hedging‘ and ‘Implied net disinvestment‘.

The first thing to notice is that there is no GFMS supply category called ‘Good Delivery bars’, unlike the large Swiss gold refiners themselves which actually list Good Delivery bars as a distinct gold supply category, such is the importance of that supply source.

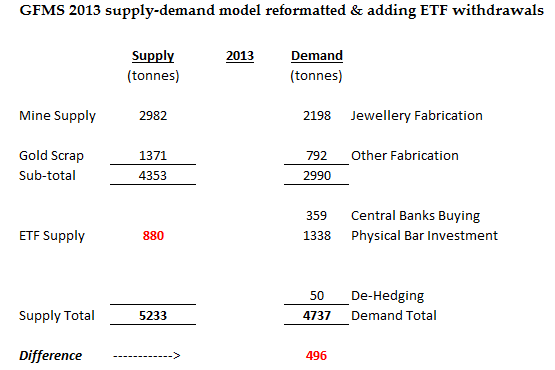

Neither is there any category for Gold ETF outflows. So even though 6,600 tonnes of gold came out of LBMA gold refineries in 2013, if you looked at a GFMS supply demand model from 2013, you would never know this. Apart from gold mine production of 2,982 tonnes and old scrap supply of 1,371 tonnes (which together totalled 4,353 tonnes), the only other non-zero supply figure in the GFMS model was ‘implied net investment’ of 383 tonnes.

On the demand side in 2013, GFMS listed jewellery fabrication (2,198 tonnes), other fabrication (792 tonnes), central bank purchases (359 tonnes), physical bar investment (1338 tonnes), and producer de-hedging of 50 tonnes. Again, looking at this demand side, you would not know that gold refinery output in 2013 reached 6,600 tonnes, and that this figure was 2,300 tonnes more than combined mine production and scrap recycling.

There was also a footnote to the above GFMS supply and demand summary table which defines the GFMS definitions of ‘Net producer dehedging‘ and ‘Implied net disinvestment/investment‘.

GFMS defines ‘Implied net disinvesment‘ or “Implied net investment‘ as a residual figure in its supply-demand table (i.e. a plug figure), and states that this “captures the net physical impact of all transactions not covered by the other supply/demand variables“, So basically, it’s a catch-all plug figure. GFMS says that “the implied net (dis)investment figure is not independently calculated, but derived as the item which brings gold supply and demand into balance." See full GFMS explanation below:

This ‘Implied net’ (investment/disinvestment)’ figure is where the 2013 GFMS supply and demand figures become, in my view, completely convoluted and opaque. GFMS says, in both its 2013 Update 1 and Update 2 reports that:

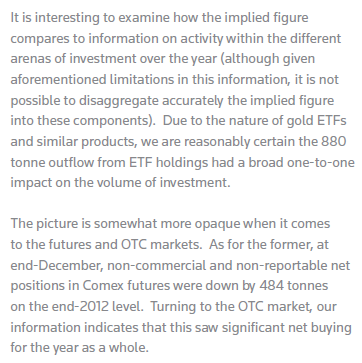

“It is interesting to examine how the implied figure compares to information on activity within the different arenas of investment over the year, (although given aforementioned limitations in this information, it is not possible to dis-aggregate accurately the implied figure into these components)”.

How GFMS exactly makes sense of its ‘Implied net’ (investment/disinvestment)" figures is hard to fathom because there is no proper explanation of the ‘aforementioned limitations‘ that GFMS alludes to except the fact that it doesn’t seem to be able to offer estimates for physical bar movements in Comex nor physical bar movements in OTC activity, part of which it considers the bar shipments to Switzerland to be.

GFMS could also maybe ask the gold refineries in Switzerland and elsewhere for the throughput figures on what they refined in 2013, be it gold mine doré, scrap metal, or Good Delivery bars, and then use that data also. And GFMS could also ask the SPDR Gold Trust Authorised Participants how much gold each of them took out of the GLD in 2013 and how this gold made its way to Switzerland and elsewhere, did the banks send the gold to Switzerland themselves using secure transporters such as Brinks, or did they sell it to other parties who then sent it to the refineries etc etc. The same question could be asked of the Bank of England and the amount of gold withdrawn from its gold vaults and the bullion bank identities of who withdrew it.

In the GFMS world, demand has to equal supply, so whichever side of the equation is greater, the other side has to have a plug figure. In 2013, GFMS put the above items into the demand side, and arrived at an estimate of 4,737 tonnes for demand. It then did an estimate for supply using only 2 components (mining and scrap), and arrived at 4,353 tonnes for supply. Since demand did not equal supply, GFMS then said that implied dis-investment was 383 tonnes. (The figures are 1 tonne out due to what must be a rounding error).

Here is my quick and easier to read version of the GFMS 2013 gold supply – demand table:

GFMS then takes the plug figure of 383 tonnes and thinks about an explanation for it.

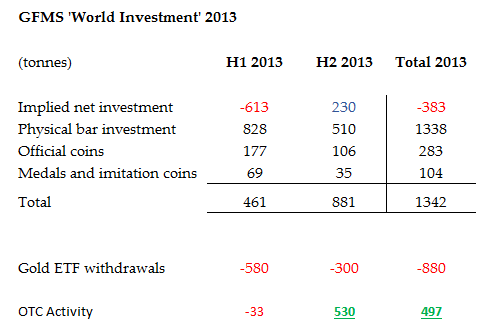

In its 2013 gold surveys, GFMS also produced another figure which it called ‘World Investment‘, which it defined as “the sum of implied net investment, physical bar investment, and all coins“. It provided this ‘world investment’ figure for both H1 and H2 2013.

This ‘world investment’ figure includes investment demand for physical gold bars and coins, gold medallions, and imitation coins (made of gold), but it also includes investment in products such as gold-backed ETFs. So if there is a huge outflow of gold from the gold ETFs, as there was in 2013, GFMS did not consider this to be gold supply, but rather, GFMS considered it to be negative demand, that it then buries in the implied net investment category.

Since the Authorised Participants of the large gold ETFs redeemed huge amounts of gold from these ETFs in 2013, especially in the first half of 2013, GFMS refers to this as gold ETF ‘investors’ redeeming gold from the ETFs. This is not entirely true because only large investors can redeem from an ETF such as GLD. Small investors just sell their shares in GLD. GFMS calls these 2013 ETF redemptions ‘implied disinvestment’, and it is this phenomenon that caused the GFMS ‘implied disinvestment’ category to be negative in the first half of 2013, but not in the second half of 2013, when GFMS insists that there was positive ‘implied net investment’.

GFMS calculated that there were 550 tonnes of gold outflows from ETFs in the first half of 2013, and 330 tonnes of gold outflows from the same ETFs in the second half of 2013, making a total outflow of 880 tonnes for 2013. Somehow, although the 550 tonnes of gold that left ETFs in H1 2013 caused the H1 implied net investment to be a negative 613 tonnes (as would be expected), the 330 tonnes of outflow from gold ETFs in H2 2013 did not, in GFMS’s eyes, have the same effect, and GFMS’s implied net investment in H2 2013 was a positive 230 tonnes, meaning that although ETFs had an 880 tonne outflow for the full year 2013, the GFMS implied net investment was only -383 tonnes. This then creates another residual number which would have to have been a positive 497 tonnes from some other type of investment demand.

What else is buried in this GFMS implied net investment apart from ETF flows? It seems to have been Comex exchange activity and OTC activity that is within this implied figure, but GFMS avoids putting numbers on it, hence the confusion.

The reason given by GFMS for a positive net investment of 230 tonnes in the second half of 2013, which cancelled out approximately 500 tonnes of the ETF gold outflows, was what it calls “significant net buying" in the OTC market.

GFMS refers to its implied net investment figure as “a proxy for institutional investor activity" and said that it “shifted to negative territory" in H1 2013. I’ve included the GFMS 2013 discussion below, just to should how convoluted and unsatisfactory this GFMS logic was. Firstly, the GFMS Update 1 report discussion on ‘implied net investment’:

“The implied net (dis)investment figure is not independently calculated, but derived as the item which brings gold supply and demand into balance. The figure should therefore not be seen as an exact tonnage equivalent but instead an indication of investment activity separate from retail bar and coin demand. Additionally, although a substantial majority of this tonnage will reflect such activity, implied net (dis)investment could also include other flows that, technically, are outside the definition of investment. One example is the impact of any central bank activity that is not being picked up in our official sector figures and that would, as a result, be absorbed within our implied net (dis)investment category."

“Despite this caveat, implied net (dis)investment typically does provide a clear indication of the overall impact of investor activity on the market for the period discussed. Furthermore, using information collected through field research and publicly available data, Thomson Reuters GFMS performs a ‘reality check’ on these values."

“It is interesting to examine how the implied figure compares with information on activity within the different arenas of gold investment (although given aforementioned limitations in this information, it is not possible to disaggregate accurately the implied figure into these components).

Due to the nature of gold ETFs and other similar products, we are certain that the near 580-tonne decline in ETF holdings had a one-to-one impact on the volume of investment. The picture is somewhat more opaque when it comes to the futures and OTC markets. As for the former, at end-June, noncommercial and non-reportable net positions in Comex futures were 477 tonnes lower than the end-2012 figure. Turning to the OTC market, however, the first half-year saw robust volumes of investment.“

“As a shortage of bullion rapidly developed in many regional markets and local premia jumped, transactions that were related to physical gold transfer jumped in the London market. Feedback from our contacts, gold trade data and clearing statistics published by the LBMA indicate that a substantial amount of large gold bars (from redemptions of ETFs and sales from unallocated accounts) were shipped to Switzerland from mid-April to be converted to small bars for markets in Asia and the Middle East”.

In its 2013 Update 2 report, GFMS then stated the following. Notice how a lot of the text is copied over from the previous Update 1 report. Update 2:

Therefore, GFMS throws a number of items into its OTC category but steers clear from committing itself to really explaining what it means by OTC activity. It states that “the OTC

market is dominated by institutional investors“. It states that “a substantial amount of large gold bars (from redemptions of ETFs and sales from unallocated accounts) were shipped to Switzerland from mid-April to be converted to small bars for markets in Asia and the Middle East“.

It alludes to “direct shipments, albeit more restrained, from the United Kingdom to the Far East also jumped, as refineries reached full capacity."

GFMS hazily refers to ‘metal accounts’, which I would consider to be unallocated accounts, and not directly related to absorbing physical ETF gold outflows. GFMS says in its 2013 Update 1 report that “Metal accounts held by western high-net-worth investors also posted a net rise, largely reflecting gold’s traditional role as a means of wealth preservation. This was also partly related to the ongoing shift out of gold ETFs, as metal accounts offered lower fees, while transactions in the OTC market were less transparent than in ETFs."

By the time it wrote its Update 2 report for 2013, GFMS had concluded that:

So an 880 tonne outflow of gold from the large ETFs (which are predominantly based in London), as well as hundreds of tonnes of gold outflows from the Bank of England, that led to 1373 tonnes of gold being exported from the UK to Switzerland in 2013, the lions share of which were transformed into kilobars and then shipped to the Asian markets, somehow, according to GFMS, turned into only a negative 383 tonne implied net investment due to “significant net buying for the year as a whole" in the OTC market. There is no attempt to explain the 1373 tonnes of gold exported from the UK to Switzerland in 2013.

If you classify gold ETF outflows as a distinct supply category of gold, which seems logical to me and which the large Swiss gold refineries also consider it to be, then a GFMS supply-demand model would look like this:

The trouble (for GFMS) then is, that the model doesn’t balance, and they are left with a 496 (or 497 tonne) item on the demand side that they can’t explicitly explain what it refers to.

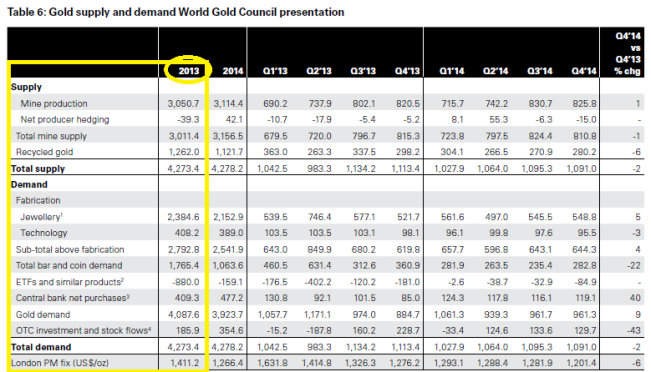

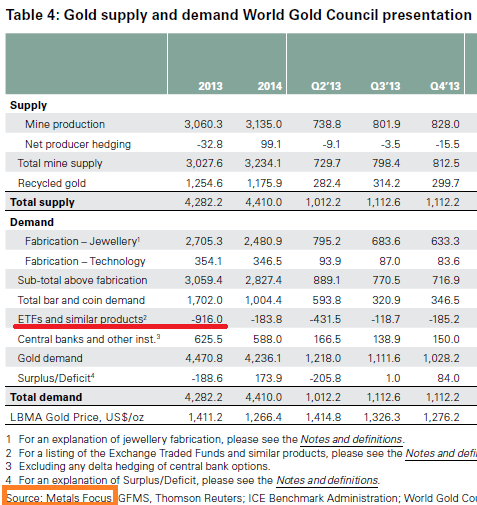

World Gold Council version of GFMS 2013 data

The World Gold Council (WGC) also publishes gold supply and demand data in its annual and quarterly ‘Gold Demand Trends‘ publication. Until 2015, the WGC used GFMS data as a data source, after which it switched to using gold supply and demand data from the Metals Focus consultancy (see below for discussion of the WGC – Metals Focus switch). The WGC uses a different (and easier to understand) layout format for presenting the gold supply and demand data, but for the 2013 format, it still subscribed to the approach of putting ETF withdrawals in the demand category as a negative number.

In its ‘Gold Demand Trends – Full Year 2014’ report, which has the most complete data for 2013, the WGC states in a footnote that the source is

“Source: GFMS, Thomson Reuters; The London Gold Market Fixing Ltd; World Gold Council. Data in the table are consistent with those published by GFMS, Thomson Reuters in their Gold Survey but adapted to the World Gold Council’s presentation"

The above WGC model puts gold ETF outflows (Good Delivery bars) into its own line item, but instead of including it as Supply, the WGC puts this in a negative demand. There is also another line item under demand that the WGC calls ‘OTC investment and stock flows‘, which it defines as “Partly a statistical residual, this data is largely reflective of demand in the opaque over-the-counter (OTC) market, with an additional contribution occasionally from changes to fabrication inventories."

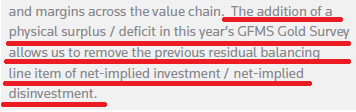

GFMS changes its Supply-Demand Methodology in 2014

When the GFMS 2014 Gold Survey was published in April 2014, GFMS had surprisingly altered the methodology and formatting of its supply-demand data model to include gold ETF outflows as an explicit line item. GFMS also ditched the implied investment concept, but came up with a physical surplus /deficit plug figure instead. I say surprisingly because GFMS had used its previous supply-demand model for a long number of years. GFMS did not dwell on why this had not been done earlier, choosing instead to highlight the benefits of such a change:

Could it be that GFMS subscribers questioned as to why the huge ETF withdrawals were not explicitly listed in the 2013 GFMS supply-demand model, that forced the change? Perhaps.

The inclusion of ETF gold flows (and gold flows from gold futures exchanges) were explained as follows. The OTC category continued to seem to cause problems to GFMS. See below:

The actual re-gigged GFMS supply-demand model, redone for 2013 was as follows. The figures for 2013 are slightly different from the ones that GFMS published during 2013, since the table below was published in April 2014 when GFMS probably had updated data about 2013 compared to the reports it published during 2013:

The above GFMS revised model can also be reformatted as below, moving ETF and Exchange ‘build’ to the supply side, since they are supply and not demand:

How the 99 tonnes of Exchange Inventory supply is calculated is not clear. Net Balance of 277 became 276 due to rounding differences. Even including ETFs and Exchange Inventory, there is no explanation by GFMS of what the Net Balance referred to beyond a vague reference to OTC activity.

This GFMS 2014 Survey report was sponsored by Swiss refiner Valcambi, and Japanese refiner Tanaka, with support from Swiss refiner PAMP, the CME Group, the World Gold Council, German refiner Heraeus, Italian refiner Italpreziosi (Italy), Rand Refinery of South Africa, and Istanbul Gold Refinery. Again my question would be why not ask all of these refiners (especially the Swiss refiners) what their throughput of Good Delivery bars was during 2013.

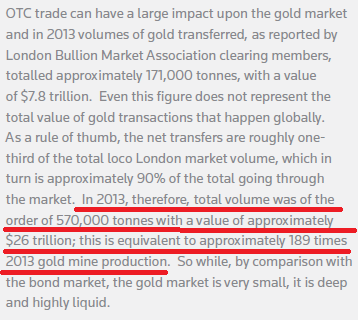

Instead, GFMS still seemed to struggle with explaining what it calls ‘OTC trade’. It even discussed (with a straight face) the huge London gold market clearing volumes of paper gold in 2013, seemingly trying to use this as some sort of vague connection to physical bar movements:

As to GFMS’ assessment (on page 26) of OTC activity, there is nothing concrete offered by GFMS as to what the OTC investment consists of. It mentions bars being shipped to Switzerland and on to Asia, but why is this activity not captured in physical demand?

However, GFMS does have a section in its 2014 (discussing 2013) titled “Supply from Above-Ground’ Stocks".

“If we include the sales of ETF holdings, then the visible supply of gold to the market from above-ground stocks was 2,160 tonnes, equivalent to 42% of total demand in 2013. The figure comprises 1,280 tonnes of scrapped fabricated products and 880 tonnes of sales from ETF stockpiles."

And it also included a table of ‘Visible Supply’ in which it did add ETF withdrawals of 880 tonnes to the ‘SUPPLY’ side for 2013, which created a total of 5,182 tonnes of gold supply for 2013. So this is further proof that the amended LBMA gold refinery figures for 2013 are completely out of sync with reality, since even GFMS now includes this ETF supply.

But still, 5182 tonnes of supply does not explain 6600 tonnes of gold refining output for 2013. What about all the gold that was withdrawn from the Bank of England in 2013 and shipped to Switzerland? Does GFMS capture this central bank related flow?I can’t see anywhere in the GFMS model where these type of gold flows are captured.

GFMS claims that for official sector transactions, it uses sources such as the IMF and central bank websites, and also “our own proprietary data on undeclared central bank activity, compiled using information collected through field research“. Then why does it not capture all the gold at the Bank of England that has been lent by central banks to bullion banks which has then been withdrawn from the vaults of the Bank of England and flown to Zurich during 2013?

And even for some central bank purchases that it has learned about, GFMS won’t reveal who the purchasers were due to ‘respect of confidentiality’. What does this say for accuracy of a supply-demand model if the nontransparency of central bank transactions prohibits gold transactions being publicised? See example from GFMS Update 1 report 2013:

“South Korea raised its bullion holdings by 20 tonnes in March. The balance of gross buying in the public domain consisted of small gains in gold reserves in a handful of countries. The overwhelming majority of these purchases were made by Asian countries, including Nepal, Mongolia, Brunei and Indonesia. Apart from the aforementioned buyers, over 40% of gross purchases or some 80 tonnes were accounted for by undeclared transactions, details of which cannot be released in respect of confidentiality. In some cases, gold was added quietly in the local market."

By the time it wrote its Update 2 report for 2013, GFMS listed some additional central bank buyers during 2013, and then stated that:

“Apart from the aforementioned buyers, over 60% of gross purchases or some 225 tonnes were accounted for by undeclared transactions, details of which cannot be released in respect of confidentiality. In some cases, gold was added quietly in the local market."

That’s more than 135 tonnes of central bank purchases during 2013 that were not captured in the GFMS model.

Borrowing Gold in London

In my 7 September article “How many Good Delivery gold bars are in all the London Vaults?….including the Bank of England vaults“, I included a quotation from the Financial Times on 2nd September 2015 which stated:

“The cost of borrowing physical gold in London has risen sharply in recent weeks. That has been driven by dealers needing gold to deliver to refineries in Switzerland before it is melted down and sent to places such as India, according to market participants.”

And I concluded that:

“it begs the question, why do the dealers need to borrow, and who are they borrowing from. And if the gold is being borrowed and sent to Swiss refineries, and then shipped onward to India (and China), then when will the gold lenders get their gold back?"

Scotia Mocatta, a bullion bank which is very active in the Indian and Hong Kong/Chinese gold markets, vindicated this point in its ‘Metals Monthly September 2015‘ (page 3):

“The recent low Gold price has spurred physical buying interest to the extent that lease rates have climbed as metal is borrowed and delivered to refineries to be melted into the required bar sizes (such as kilobars) before being shipped to its final destination.”

So, where in the GFMS and World Gold Council data models is this “metal that is borrowed and delivered to refineries to be melted into the required bar sizes (such as kilobars)" being reflected? It appears that these gold bar movements are not being reflected at all.

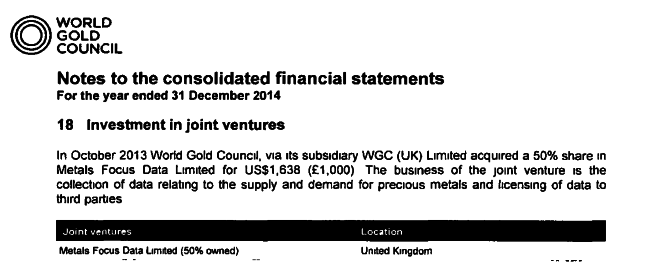

World Gold Council switch from GFMS to ‘Metals Focus’

Earlier this year, the World Gold Council (WGC) switched from using GFMS as a data provider of gold supply and demand data. In an announcement, the WGC said:

“Starting in May 2015, we will be publishing gold supply and demand data provided by Metals Focus, a leading precious metals consultancy. These data will feature in Gold Demand Trends First Quarter 2015 onwards. Previously, we sourced gold supply and demand data from GFMS Thomson Reuters. The decision to change data providers was based on rigorous market research and a competitive pitch process. For more information, please see the focus box in Gold Demand Trends First Quarter 2015”

The focus box in Gold Demand Trends First Quarter 2015 states:

“When new data sets become available and new methodologies are developed, we review how these might complement and advance our own methods. To that end, in 2014 we conducted a rigorous assessment of the gold market data landscape – a process which involved an in-depth review of a number of leading data providers. Following this review we appointed Metals Focus as the provider of our core demand and supply statistics.”

“The World Gold Council is committed to publishing the most accurate gold demand data available. We are confident that the move to Metals Focus supports this aim.”

What the WGC didn’t mention in its press release nor in its Gold demand Trends Q1 2015 report is that in October 2013, the WGC purchased a 50% shareholding in Metals Focus Data Limited via its subsidiary WGC (UK) Ltd. The other 50% is owned by Metals Focus Limited. Surely this 50% shareholding is material information that should have been divulged by the WGC in its ‘focus box’ statement above? With its recent emphasis on costs savings, the WGC may have opted for switching from GFMS to Metals Focus partially because it may save money by using a data provider that it has an ownership interest in.

From the WGC 2014 financial statements:

WGC (UK) Ltd (Company No. 07867682) is a fully owned subsidiary of the World Gold Council, operating out of the same address as the parent company, 10 Old Bailey, London.

Metals Focus Data Limited is a joint venture for “the collection of data relating to the supply and demand for precious metals and licensing of data to third parties".

What is Metals Focus Limited?

Metals Focus Ltd (Company No 08316950) was incorporated in December 2012, and was founded by Nikos Kavalis, Charles de Meester and Philip Newman, all of whom have previously worked at GFMS. Kavalis (through Premier Metals Consulting Ltd), de Meester and Newman each own a 28.87% shareholding in Metals Focus according to CompanyCheck. Metals Focus 2013 accounts can be seen here.

Metals Focus Data Limited, the 50-50 joint venture between the World Gold Council and Metals Focus Ltd, whose latest accounts can be seen here, has the following directors: Nikos Kavalis, Philip Newman and Lisa Mitchell of Metals Focus, and Terry Heymann, an MD at the World Gold Council.

Some of the sponsors of Metals Focus and its reports include Swiss refiners Valcambi and PAMP/MKS PAMP, other refiners Asahi Refining, TCA (Italian precious metals refining), the World Gold Council (obviously), Brady Commodity Software Solutions, the CME Group, and G4S. So Metals Focus could also obtain very direct data from at least these Swiss refineries as to their throughput of Good Delivery gold bars.

Although the World Gold Council has now switched data suppliers to Metals Focus since earlier this year, in its 2015 Q1 Gold Demand Trends, it still uses the same supply-demand presentation format as previously, with ETFs in 2013 being classified as negative demand and not supply. Interestingly, in the Metals Focus data, the ETF line item for 2013 has now risen to 916 tonnes.

Conclusion

With 6,600 tonnes of Good delivery refinery gold refining production confirmed by the LBMA to have taken place during 2013 (before the LBMA altered its data), you can see in the above analysis that this is problematic for the models of GFMS, the World Gold Council and possibly the model of Metals Focus too. Since the LBMA is sent refining data by its members, then, if it chose to, the LBMA could generate very accurate data for gold and silver refinery output for all of 2014 and nearly all of 2015.

Almost all other industries are able to publish accurate industry production figures with a minimal lag of maybe 2-3 months that provide an up-to-date snapshot of that industry’s activity. This is also true of economic data such as labour statistics and housing starts. Why then is it so hard for the LBMA to publish full and comprehensive gold refinery output data on a quarterly basis?

If this reporting procedure was put in place, the global gold industry would have far more clarify and insight into the huge flows of kilobar gold that are, on a daily and weekly basis, now being flown from Switzerland into Delhi, Ahmedabad, Chennai, Bangalore, Hyderabad and Kolcata in India, and that are also flowing at a torrential rate through Brinks vaults in Hong Kong and on into China.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments