COMEX Adds 730 Tonnes of Gold Since Late-March

Back in the last full trading week of March beginning Monday 23 March when bullion banks in London failed to deliver gold in Exchange for Physical (EFP) transactions, this kicked off a huge and unprecedented divergence between COMEX 100 gold futures contract prices and the interbank spot gold price quoted in London, with for example, the COMEX price trading by over $80 higher than spot on Tuesday 24 March.

This price differential, known as the COMEX-spot spread or the basis (between the gold futures price and the bullion bank gold spot price), is also used to calculate pricing on gold Exchange for Physical (EFP) transactions, hence a lot of media talk at the time and indeed since then has referred to the March’s price rupture phenomenon as an EFP spread divergence, COMEX spread blow out etc.

The COMEX-spot spread blow out which followed the gold delivery failure and which also triggered an associated illiquid London market (causing gold market maker bid-ask quotes to blow out to over $100 on 24 March), was sufficiently terrifying for the bullion banks operators of the gold market in London to rush out a damage control statement on the morning of 24 March through their front group, the London Bullion Market Association (LBMA), claiming to have “offered its support to CME Group [COMEX] to facilitate physical delivery in New York” and to be “working closely with COMEX and other key stakeholders”.

The most interesting thing about that statement, apart from the public collusion between the LBMA bullion banks and the Commodity Exchange (COMEX), was that bullion banks had never before had to worry about physical delivery of gold to a futures exchange in New York, so why all of a sudden did they need to do so on 24 March and to such a coordinated extent?

Coupled with the LBMA’s jaded cover story of flight logistics delays and refinery shutdowns, the LBMA 24 March statement did nothing to placate the global gold market nor EFP clients nor COMEX clients, because for the rest of the month the COMEX-to-Spot spread remained wide and elevated.

This then forced the panicked bullion banks to come back a week later on 1 April, this time with the LBMA roping in the COMEX owner, the CME Group, with an unprecedented second damage control statement, making two in one week, titled “LBMA and CME Group comment on healthy gold stocks In New York And London” and sub-headed “LBMA reports record gold stocks” and ”CME Group depositories open and gold stocks near record high”. This second statement was disingenuous in a number of ways as:

– it referred to a rolled up and out of date London gold vault holdings total of 8326 tonnes without explaining that about 85% of the quoted figure comprised central banks gold holdings and ETF gold holdings.

– it referred to a total of 9.2 million ozs (286 tonnes) of gold held in the COMEX vaults with 5.6 million ozs (174 tonnes) eligible, without explaining that eligible gold may have nothing to do with COMEX trading, that the balance, 3.6 million ozs (112 tonnes), was registered was already under warrant, and so may not be available for contract settlement either, and that there was also pledged gold (as collateral) which was not available for contract settlement.

– it did not refer to the CME’s intended letter to the US Commodity Futures Trading Commission (CFTC), which CME sent to the CFTC one week later on 9 April, which in one fowl swoop by the CME’s own logic took half the eligible gold off the table. In the CME’s own words “the Exchange (COMEX),in an effort to represent a conservative deliverable supply that may be readily available for delivery, made a determination at this time to discount from its estimate of deliverable supply 50% of its reported eligible gold” because “gold is used as an investment vehicle and as such some gold stock may be held as a long-term investment”.

Unanswered Questions

Interestingly, this second LBMA/CME joint statement from 1 April also commented on the COMEX’s New York precious metals depositories claiming that “deliveries are occurring as planned”. So between the 24 March and 1 April LBMA-CME statements, we know that the LBMA and its bullion banks were offering support to COMEX to facilitate physical delivery of gold in New York and that gold deliveries were occurring in New York as planned. The question is why?

• Why were gold deliveries needed to COMEX in New York if there were “healthy gold stocks in New York”, which were “near record high”? Why the need to stockpile?

• Why on 24 March did LBMA rush to “facilitate physical delivery [of gold] in New York” and “work closely with COMEX” if there was no gold shortage in New York?

• What, on 24 March, made the LBMA suddenly think that it needed to facilitate physical delivery of gold in New York when there had never been before any gold delivered from London / Europe to settle loco New York on COMEX?

• How could LBMA, on 24 March, already know what COMEX physical gold delivery intentions would be like in April or subsequent months when delivery intentions for the April gold futures contract only began to be published starting 30 March?

• Why on 1 April did LBMA/CME claims that “deliveries are occurring as planned”. Occurring according to which plan?

Unless of course the LBMA and COMEX knew on Tuesday 24 March that because of the physical delivery failure in the gold EFP, there would instead need to be equivalent delivery against the COMEX 100 gold futures contracts in New York, an alternative solution for EFP clients who had asked for delivery.

As of close of business Monday 23 March, there were 1,795,846 ozs (55.86 tonnes) of gold bars in the registered category in the COMEX approved warehouses of which 556,226 ozs (17.30 tonnes) was pledged as collateral, and 6,938,585 ozs (215.81 tonnes) of gold bars in the eligible gold category, for a total of 8,734,431 oz (271.67 tonnes).

See Bullionstar’s November 2019 article “New COMEX Pledged Gold – Shrinking the Pool of Registered Inventory” for an explanation of pledged gold. Excluding pledged gold, there was just 38.56 tonnes of gold in the registered category (against which warrants of title for COMEX trading had been issued by the COMEX approved vaults). As for the 215.81 tonnes in the eligible gold category, the CME itself assumes that half of the gold in this category (or 107.9 tonnes) is not readily available for delivery.

Even assuming that half the eligible gold in the COMEX vaults on the night of 23 March was available for delivery, that just gave a deliverable supply of 146.46 tonnes of gold that could be conceivably delivered against COMEX 100 gold futures contracts.

But why stop at 50%? The reality is that no one except the owners of eligible gold in the COMEX approved vaults know what they plan to do with it. Eligible gold just happens to be gold that is residing in the COMEX approved vaults that meets the eligibility requirements of trading on COMEX and that vault managers have an obligation to report to COMEX. It does not necessarily mean that the gold is in the approved vaults for COMEX trading purposes. It could be there for any reason and owned by anybody.

You can see that if none of this gold wanted to enter COMEX trading, then there was less than 40 tonnes of gold of deliverable supply – i.e. the gold in the registered category (that had previously been warranted for COMEX trading), and which would indeed create a potential nightmare for the COMEX shorts in terms of longs wanting gold delivery.

Before Deliveries comes Inflows

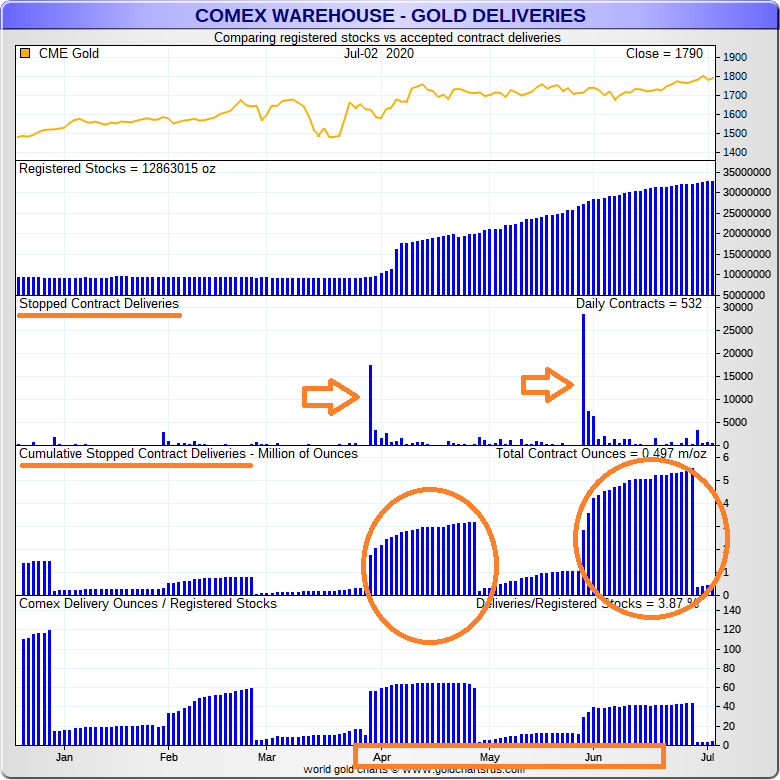

We have already looked at how the EFP spread blow up has played out in terms of COMEX deliveries from 24 March to the end of June. Delivery here means vault warrants of the COMEX 100 (GC) contract changing hands between contract shorts and contract longs. This is documented in a recent BullionStar article titled “The Curious Case of COMEX Gold Deliveries in April and June”. The initial move was a huge explosion in COMEX gold deliveries beginning first intent date 30 March when a huge 17,302 contracts representing (53.81 tonnes) of gold appeared on the Delivery Notice report, which was 67% of registered stocks on that day (excluding pledged gold)

Over the remainder of April, this number expanded to a massive 31,666 contracts (98.5 tonnes of gold) moving to delivery, an all time monthly record at the time. Compared to the 3 preceding months between January and March when a combined total of only 13,864 contracts had gone to delivery (for a monthly average of 4,621 over Q1), April’s report was showing deliveries of nearly 7 times that amount.

Noticeably, gold delivery activity continued into the non-active month of May contract when another 10,277 warrants moved ownership changed hands, representing another 32 tonnes of gold.

If this wasn’t all shocking enough for the former COMEX gold futures backwater where physical delivery was rarer than hen’s teeth, it was just a warm-up for what was to come. Because on 29 May, the first notice day for June deliveries, an incredible 28,375 contracts moved for delivery, which was nearly as many contracts on that first intent day as went through in the whole of April, itself a previous record month.

From the end of May, the contracts moving to deliver just piled up, reaching 52,010 contracts for the month of June, which is 5,201,000 ozs of gold, or 161.7 tonnes. Over the 3-month period from April to June, that’s 97,045 contracts (representing 301.85 tonnes of gold) that have moved for delivery.

The trend has continued into July (another non-active futures month), with another 4,973 contracts moving for delivery up to 2 July, making a grand total of 102,108 contracts triggering COMEX gold warrant transfers since the end of March, representing 317.6 tonnes of gold in total.

While the 300+ tonnes of gold moving to delivery within COMEX New York vaults since the end of March has been historically high, that’s only part of the equation, because, apart from churning, you could not have had record amounts of gold moving to delivery within the COMEX vault network without sufficient new gold coming into the COMEX vault network.

The Vaults of New York

We therefore need to take a look at the physical gold that is ‘reportable’ that has flowed into COMEX New York vaults since 24 March, the day the LBMA made its announcement that it would “facilitate physical delivery in New York”. Reportable gold for the COMEX 100 oz (GC) contract refers to 100 oz gold bars and 1 kilo gold bars which are of eligible refiner brands (i.e. brands that COMEX has approved as being eligible for GC contract settlement).

Known as licensed depositories by COMEX, and also called approved facilities and delivery facilities, the vaults in New York City (NYC) storing the gold that is reported on the COMEX daily gold holdings reports are operated by:

- Brink’s Inc

- JP Morgan Chase Bank

- HSBC Bank USA

- The Bank of Nova Scotia

- Manfra, Tordella & Brookes (MTB)

- Malca-Amit USA

- Loomis International (US) Inc.

JP Morgan Chase, HSBC and Scotia are [obviously] banks, some of the biggest bullion bank players in the gold market. Brinks, Malca-Amit and Loomis are security companies providing logistics, armoured transport and vault storage. MTB is a well-known gold company in Manhattan that is part of the MKS PAMP group.

There are also two other vault operators on the COMEX gold inventory report, namely Delaware Depository of Wilmington, Delaware, and International Depository Services (IDS) of New Castle Delaware. The facilities in Delaware, although outside NYC, can qualify as COMEX depositories due to the COMEX rule that “the depository for gold deliverable against the Gold futures (GC) contract … must be located within a 150-mile radius of the City of New York”

To calculate how much gold has actually arrived into the COMEX approved vaults over the period, we compare two snap shots of the COMEX daily “Gold Stocks” report dated end of day 23 March and end of day 30 June, respectively, to derive a net change in reportable gold holdings for the COMEX 100 (GC) contract over the period. This daily “Gold Stocks” report, which is in Excel format, can be downloaded from the CME website here.

There is also an additional issue that needs to be taken into account when talking about gold that has flowed into COMEX vaults since the end of March, and that is gold that is reportable under the newly launched “Gold (Enhanced Delivery) futures (4GC)" contract, a hilariously named contract which was rushed out by the CME and LBMA in the wake of the late March EFP fiasco which claims that it can be settled in 400 oz, 100 oz, and Kilo gold bars. See BullionStar article “COMEX can’t find a 400 oz bar for its new 400 oz gold futures contract" from 31 March for an explanation of this new 4GC contract.

The appearance of this 4GC contract (which still doesn’t have any trading volume on COMEX) has led to an entirely new category of reported gold on the daily COMEX gold stocks report called “Enhanced Delivery (400 Oz And Eligible Brands)“, but without a breakdown of inventory into 400 oz bars, 100 oz bars or 1 kilo bars.

Note that eligible brands for this 4GC contract refers to gold refineries which are listed on the GC eligible brand list AND all brands that are on the current and the former LBMA Good Delivery Lists, which means that the list of refinery brands eligible for the 4GC contract is far wider than that of the GC contract. While the GC contract has an eligible refiner list of 68 brands, the 4GC has 68 brands from the existing GC contract + 71 brands from the LBMA current Good Delivery List + another 113 LBMA former Good Delivery List. This slight of hand by the CME and LBMA would also make eligible any gold bars from COMEX suspended refiners such as Republic Metals Corp and Elemetal which still happen to be sitting in the COMEX vaults in New York. To avoid double counting, the entries on the COMEX gold stocks under Enhanced Delivery (400 Oz And Eligible Brands) do not include gold bars that are already eligible for the GC (100) contract.

The Gold Inflows – 24 March to 30 June

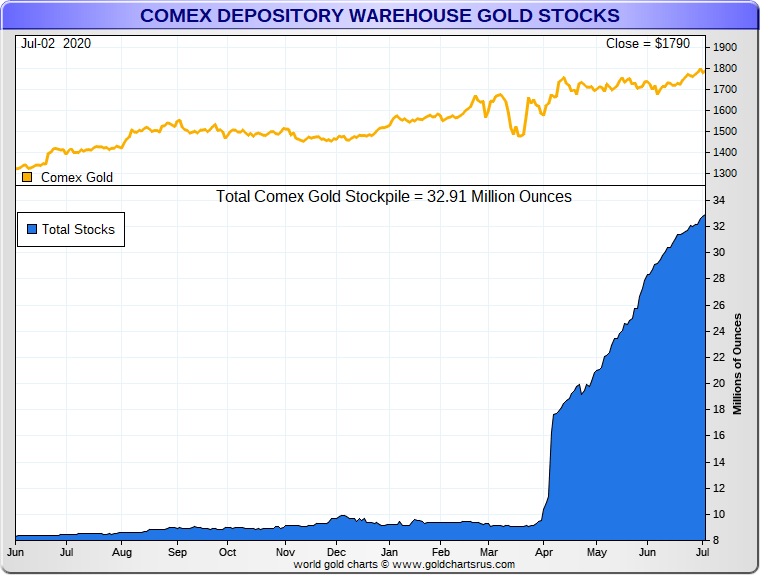

If you were surprised at the size of the GC contract gold deliveries over the April to June period discussed above, you’ll be even more surprised by the magnitude of the reportable GC vault inflows which between 24 March and 30 June inclusive, which reached a whopping 601.2 tonnes.

There was also, as of 30 June, another 131.31 tonnes of gold reported under this “400 oz and eligible brands" category. Which means that added to the 601.2 of gold inflows that are reportable under for the GC contract, there has been a whopping 732.51 tonnes (601.2 + 131.31) net inflow of gold into the COMEX vaults between 24 March and 30 June inclusive. That means 82% of the gold inflows reportable under the GC 100 contract and the remaining 18% under the 4GC contract. to out this 732.51 tonnes into perspective, this amount of gold if held by a sovereign entity would be the world’s ninth largest gold holder, just behind Japan and ahead of both the gold holdings of India and the Netherlands.

Said another way, from 271.67 tonnes of reportable gold claimed to be in the COMEX vaults as of end of day 23 March, the total gold reported on the COMEX daily gold stocks report as of 30 June was 1004.18 tonnes, a net addition of 732.51 tonnes.

Of the 601.2 tonnes of gold inflows to vaults reportable under the COMEX 100 contract, 331.79 tonnes are already in the registered category, and 269.4 tonnes are in the eligible category. Interestingly, after excluding pledged gold, the jump in registered gold from 24 March to 30 June totals 327.83 tonnes which is fairly near the 301.85 tonnes of gold that have moved for delivery over the 3 month period April to June. So as gold has flowed into the COMEX vaults it has been ‘stopped’ for delivery (warrant transfers), which explains nearly all of the huge jump in registered gold.

Of the 131.31 tonnes that are being reported under the 400 Oz And Eligible Brands (4GC contract), only 9.72 tonnes are being reported in the registered category with 121.56 tonnes still in the eligible category.

Overall, of the total reportable gold inflows of 732.51 tonnes from 24 March to 30 June inclusive, 341.53 tonnes were categorised as registered as of the 30 June (of which 13.7 tonnes was pledged), and 390.98 tonnes categorised as eligible.

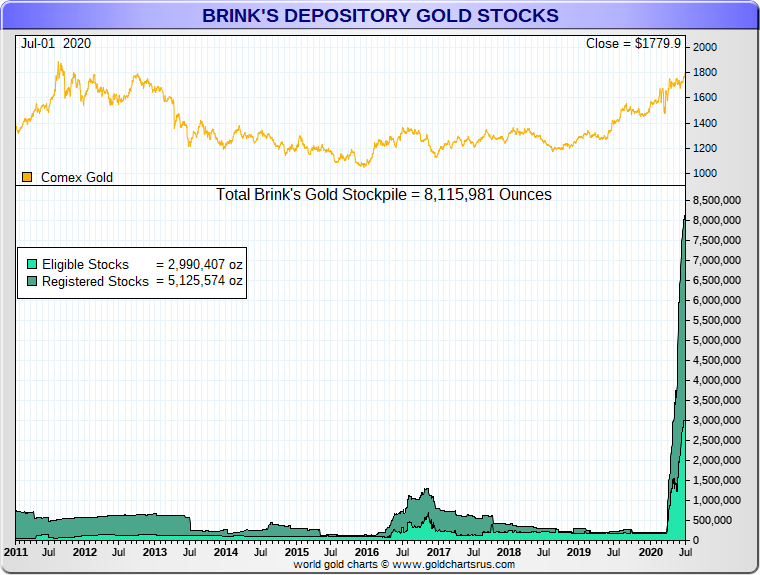

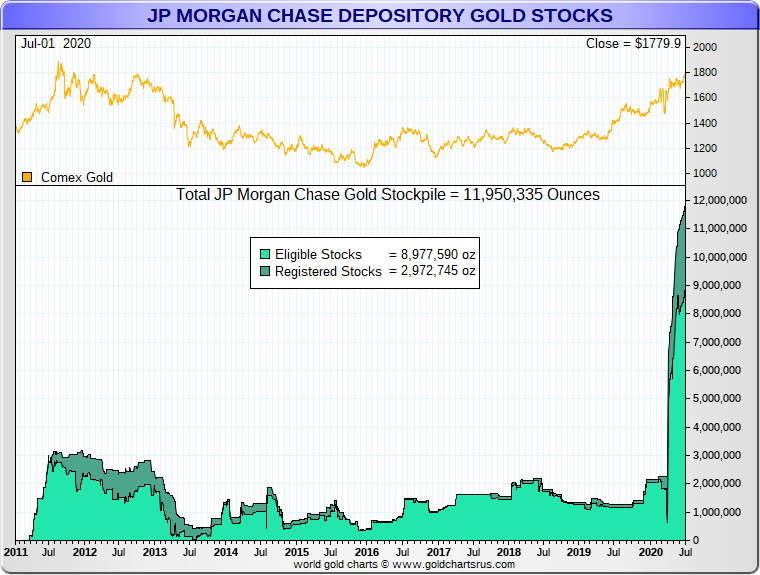

But while the volume of these flows is notable, the New York vault destinations of these gold inflows is even more interesting. Of the 601.2 tonnes flowing in from 24 March to 30 June, nearly 40% (or 239.2 tonnes) has gone into Brinks New York vaults, 193.5 tonnes (32.2 %) into JP Morgan New York, 58.12 tonnes (9.7%) into HSBC New York, 34.4 tonnes into Malca-Amit’s 34.5 tonnes in MTB, 22.6 tonnes into Loomis, and just 14.1 tonnes into Scotia’s vault. The reminder of the total, 4.78 tonnes, is attributed to the two vaults in Delaware.

Of the 131.31 tonnes inflows listed under the “400 oz and eligible brands" category, a massive 102.83 tonnes (78.30%) is sitting in the JP Morgan vault, 20.92 tonnes (15.93%) in the HSBC vault, 6.8 tonnes (5.18%) in Brinks vaults, with the remainder 0.76 tonnes (0.59%) in the Loomis vault.

Conclusion

From 24 March to 30 June a staggering 732.51 tonnes of gold have entered the COMEX gold vaulting system in New York, with nearly three-quarters of this gold entering the vaults of Brink’s and JP Morgan. During the same time period, the ownership of more than 300 tonnes of gold has changed hands in COMEX vault warrant transfers (gold deliveries). With 390.98 tonnes of the April – June gold inflows still being categorised as eligible gold, how much of this will now move to delivery in July, August and beyond?

If there were such “healthy gold stocks in New York” in late March, then why did LBMA bullion banks on 24 March panic and rush to facilitate physical delivery in New York” by sending hundreds and hundreds of tonnes of gold to COMEX, a known backwater for physical gold trading?

The next installment in these intriguing gold inflows will profile the actual COMEX approved vaults where these gold inflows are claimed to have gone into, and how the gold was brought in. For now, these vaults in New York are:

Brinks – 580 5th Avenue, Midtown Manhattan (World Diamond Tower) and 652 Kent Avenue, South Williamsburg, Brooklyn (Brooklyn Naval Yard)

JP Morgan Chase – The (infamous) vault facility located under 1 Chase Manhattan Plaza in south Manhattan, across the road from the New York Federal Reserve building at the same depth underground as the Fed gold vaults, and which most likely has a tunnel linking the JPM and Fed vaults.

HSBC Bank USA – The former Republic National Bank of New York vault at 1 West 39th Street, SC 2 Level in Midtown Manhattan, now operated by HSBC. This vault is under 450 Fifth Avenue, near Byrant Park.

Manfra, Tordella & Brookes (MTB) – MTB’s vault is in 50 West 47th Street, in midtown Manhattan which is the International Gem Tower building.

The Bank of Nova Scotia – Scotia Mocatta, of WTC4 vault fame, now operates its vault from beside JFK Airport at 230-59 International Airport Center Blvd, Building C, Jamaica, (Queens)

Malca-Amit – 580 Fifth Avenue ( World Diamond Tower), 50 West 47th Street (International Gem Tower) and 153-66 Rockaway Blvd. Jamaica (near JFK Airport)

Loomis – 130 Sheridan Blvd. Inwood (near JFK Airport)

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments