New COMEX Pledged Gold: Shrinking the Inventory Pool

For those who have at times struggled to understand the difference between COMEX inventory categories ‘registered gold’ and ‘eligible gold’, now your head can spin even more, since the CME’s COMEX has just introduced a new category – ‘pledged gold’.

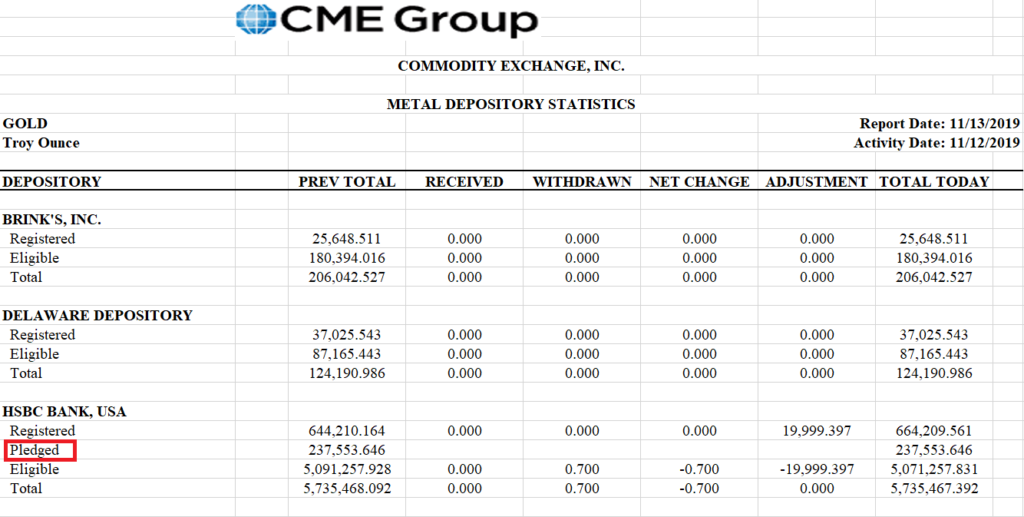

This pledged category was first noticed on the infamous COMEX warehouse gold stocks report late last week by Nick Laird of GoldChartsRUs fame, with the pledged gold column intriguingly populated with an entry next to the New York vault of bullion bank, HSBC. What did this pledged column entry mean, we wondered, and where did it come from?

After some digging on the CME website, the answer was revealed. Pledged is a new gold inventory category representing COMEX gold warrants which have been deposited with CME Clearing as performance bond collateral, in other words margin collateral. CME defines performance bonds as follows:

“Performance Bonds, also known as margins, are deposits held at CME Clearing to ensure that clearing members can meet their obligations to their customers and to CME Clearing.”

Before looking at how this relates to COMEX gold, a quick recap and some definitions are in order. Although COMEX gold futures rarely settle physically in gold, they are physically deliverable contracts which are capable of being settled in real gold. believe it or not. However in 2018, for example, COMEX gold deliveries totalled just 1.6 million ounces (51 tonnes), meaning that 99.98% of COMEX gold futures did not result in physical delivery, a Ponzi scheme if ever there was one.

But since 0.02% of COMEX gold futures do physically settle, at least by some shuffling of warrants between bullion banks, the CME has therefore approved the vaulting facilities operated by nine vault providers in and around New York City and Delaware, which it refers to as depositories or approved warehouses, which can store gold that can be used for contract settlement. In New York, these vaults are run by HSBC, JP Morgan, Scotia Mocatta, MTB, Brinks, Malca-Amit and Loomis, and in Delaware the vaults are operated by Delaware Depository and IDS of Delaware.

Eligible – But So What?

In COMEX parlance, “eligible gold” is all gold residing in an approved COMEX vault which is acceptable for delivery against COMEX gold futures contracts. This includes 100 gold oz bars and gold kilo bars, but not 400 oz gold bars. Importantly however, eligible gold just happens to be gold that is residing in the approved facilities that meets the eligibility requirements of the COMEX. It does not necessarily mean that the gold is in the approved vaults for trading purposes. Some of it may have been deposited in the vaults by owners who are trading COMEX gold futures, but other eligible gold could be deposited in the approved vaults for a host of other reasons unrelated to gold futures trading.

“Registered gold” on the other hand, is eligible gold for which a warrant has been issued by an approved warehouse. These warrants, not to be confused with equity warrants, are ‘documents of title’ issued by the warehouse in satisfaction of delivery of a gold futures contract. They confirm title to a certain quantity of gold of acceptable quality that is stored in that warehouse. A warrant will therefore specify a certain number of gold bars, the serial numbers of those bars and the refiner brands of those bars.

Now this is where it gets interesting as regards the new “Pledged gold” category. Starting on Monday 4 November, the CME began allowing its clearing members to deposit and use COMEX gold warrants as collateral in meeting performance bond requirements for its Base Guaranty Fund Products and Interest rate Swaps (IRS).

To reflect this change, the CME therefore needed to amend Chapter 7 of its NYMEX/COMEX Rulebook which covers “Delivery Facilities and Procedures” to reflect the acceptance of COMEX gold warrants as collateral. It did so by adding a reference to “pledged” precious metal, while defining “pledged” metal as “registered metal for which the warrant that has been issued is on deposit with CME Clearing for performance bond.”

Out of Bounds

Furthermore, the amendment also added “the requirement for approved facilities to report pledged metal to the Exchange”, hence the appearance of the new pledged gold category on the COMEX daily warehouse report.

Critically, the amendment also clarified that “clearing members that have deposited gold warrants as performance bond with CME Clearing may not use these warrants to satisfy their delivery obligations.” Simply put, this will therefore mean that any registered gold whose warrants are used as collateral cannot be used to settle gold futures.

Finally, the amendment also adds that “gold warrants that are deposited with CME Clearing as performance bond cannot be cancelled without the consent of CME Clearing.” All of these changes can be seen in the recent one page CME summary titled “Addition of COMEX Gold Warrants as Acceptable CME Clearing Performance Bond Collateral”.

Prior to the acceptance of COMEX gold warrants as collateral, the CME had already been accepting “London gold bullion” as collateral for these performance bond requirements, so in effect COMEX gold warrants have now been added to the mix. What exactly this “London gold bullion” takes the form of is not clear, for example, is it real physical gold or unallocated bullion bank created book entries? If there are no fees for storing, insuring and handling any “London gold bullion” deposits, you can bet your bottom dollar that it is not physical gold.

Whatever it is, the CME is also now increasing the collateral limit from a previous $250 million per clearing member for “London gold bullion” to a new combined limit of $750 million per clearing member for both “London gold bullion” and COMEX gold warrants.

Conclusion

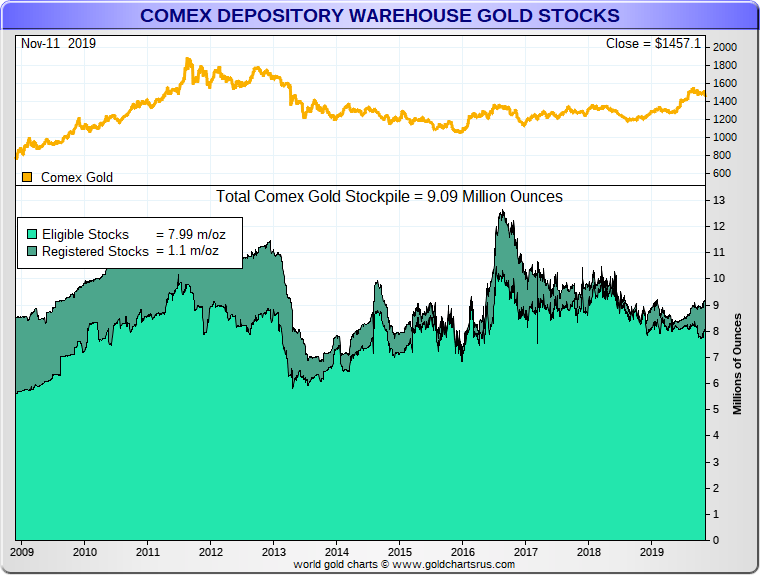

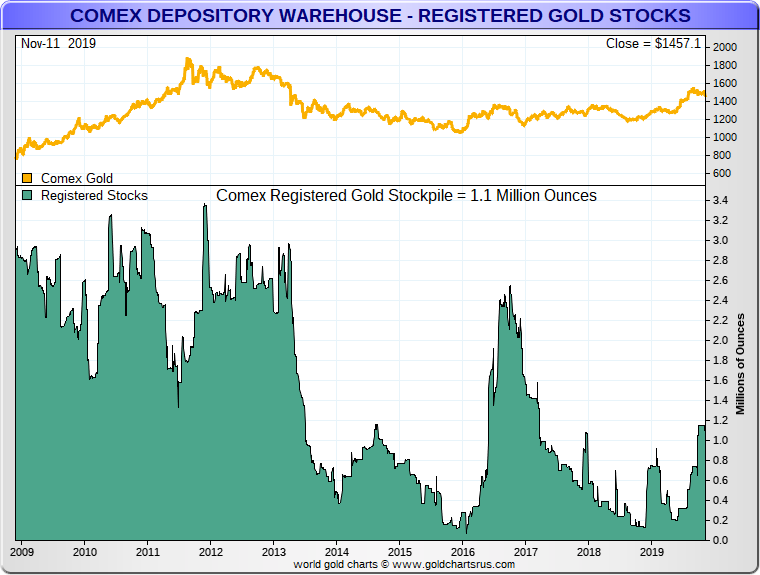

COMEX registered gold stocks (those which are available for delivery) are currently only about 34 tonnes, a tiny foundation underpinning for a giant inverted paper pyramid. At the same time, COMEX gold futures contracts trade the equivalent of 27 million ounces per day (equivalent to 260,000 tonnes of gold per year) – more gold than has been mined in history, and over 86 times annual gold mining supply.

While the amount of pledged gold listed on the latest COMEX gold warehouse report is still relatively tiny, covering 100 oz of gold held at HSBC’s vault under the HSBC Tower at 1 West 39th Street, SC 2 Level, in Manhattan, that could well change. It will therefore be well worth watching these COMEX reports in future to see if this Pledged gold category snowballs.

The amount of pledged gold listed on the latest COMEX gold warehouse report is now growing, up at 237,500 oz of gold held at HSBC’s vault, a vault that lies under the HSBC Tower at 1 West 39th Street, SC 2 Level, in Manhattan. If and when this pledged gold category continues to grow, it will be well worth watching these COMEX reports in future.

If this pledged gold category snowballs, it will be even more important to remember that any COMEX gold warrants which are deposited as performance bond collateral with CME Clearing will move out of the Registered gold category, since the holder “may not use these warrants to satisfy their delivery obligations.”

Which will mean an even smaller pool of registered gold to keep COMEX gold futures trading going, a paper gold trading casino which is actually a giant Ponzi scheme, but for the time being is unfortunately and perversely still nearly single-handedly responsible for international gold price discovery in the global gold market.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments