The Shrinking Window For Anonymous Exchange

There were multiple reports on social media late last month of Germans queuing up to buy gold in Köln, Stuttgart, and Munich.

Germans are queuing at Degussa store to buy #gold in Köln. From Jan. 1, 2020, the limit to buy gold anonymously drops from €10,000 down to €2,000. Only two years ago the limit was €15,000. pic.twitter.com/vhuZTBPA0Y

— EU MCCHDAN Popescu FRITRO (@PopescuCo) December 24, 2019

According to WELT reporter Michael Höfling, it wasn’t just the Christmas rush. Buyers may have been desperate to beat a looming deadline for cash purchases of gold. After January 1, a new law will require all Germans who buy more than €2,000 worth of gold with banknotes to submit to a customer due diligence process. This process involves giving up data like one’s name, date of birth, and address. Prior to the passage of this law, customers could make cash purchases of gold up to €10,000 and avoid sharing their vital details.

Limits on anonymous purchases aren’t a German phenomenon, nor are they recent, nor do they apply solely to gold. For instance, ever since the passage of the U.S. Bank Secrecy Act in 1970, all American sellers of autos or boats, travel agencies, pawnbrokers, and dealers in precious metals & stones have been required to file currency transaction reports on any cash purchase exceeding $10,000. These reports include the information of each buyer including their name, address, and social security number. In Canada, reporting of large cash transactions above $10,000 became mandatory in 2000.

These efforts are all part of a decades-old international trend to cut down on the ability to transact anonymously across multiple industries. Policy makers have good intentions. The point of these rules is to help reduce money laundering and combat the financing of terrorism (CFT). However, in practice it’s not entirely clear whether anti-money laundering and CFT policies actually work.

A steady stream of EU anti-money laundering directives

In Germany’s case, rules concerning cash purchases of gold are derived from a long series of EU anti-money laundering laws. The Third EU Anti-Money Laundering Directive (AML3), which was passed in 2005 and implemented by all EU member states, sets strict rules on the amount of cash that “dealers in high-value goods" could accept without asking for identification.

AML3 stipulated that if a cash payment exceeded €15,000, so-called high-value dealers had to collect key details about the buyer. Businesses included under this definition included not only precious metals dealers but also jewelers, auctioneers, car and boat dealers, and art sellers. When AML4, or the Fourth EU Anti-Money Laundering Directive, came into effect in 2017, it reduced this ceiling from €15,000 to €10,000.

The Fifth EU Anti-Money Laundering Directive (AML5) was passed earlier this year. AML5 didn’t make any changes to the €10,000 ceiling. However, when EU member states bring their own national money laundering laws into conformity with EU directives, they may choose to enact stricter requirements than those proscribed by the EU.

This appears to be what Germany has done as it implements AML5. In a November modification to the Germany Anti-Money Laundering Act, or Geldwäschegesetz (GwG), the German state now sets a specific requirement on precious metals dealers, requiring them to perform due diligence on customers for amounts above €2,000. Buyers in other EU nations like Ireland or Austria continue to be subject to the standard €10,000 ceiling. And thus the big lines in German cities leading up to January 1, 2020.

For more on Germany’s new requirements, Ronan Manly goes into more details here.

The “privacy window" for electronic money and cash is also shrinking

Purchases of high-value goods with cash aren’t the only financial transactions to be restricted. The same goes for electronic money. European citizens are allowed to own small amounts of money in unidentified online wallets. When AML4 was implemented in 2017, the maximum amount that could be stored in these wallets was €250. AML5 reduces this to €150. Not only that, but anonymous online payments will now be capped at €50. Prior to AML5, there was no cap – users could spend their entire €250 online.

Interestingly, Germany’s rules on electronic money – like their rules on gold purchases – have always been stricter than those stipulated by the various EU directives. Germany has implemented a €100 limit on anonymous top ups for several years now.

Not all limitations on anonymous transactions proceed from the EU’s progression of anti-money laundering directives. A number of European nations have also instituted their own general limits on the size of general purchases (not just high-value goods) that can be made with cash. For instance, in France it is illegal to make any purchase with cash (say groceries or clothes) that exceeds €1,000, whereas Spain sets a €2,500 limit. Germany has no limit.

The map below illustrates each nation’s respective regulations on cash transactions:

Cash payment restrictions in the EU:

-prohibitions are enforced in 16 EU members

-11 EU members do not have any cash limitations in place

-in Italy, limits are not applicable for non-residents

-in Denmark, banks & lawyers are exemptSource: https://t.co/ZxYHSuGCvy pic.twitter.com/X7QfcchAT4

— John Paul Koning (@jp_koning) January 8, 2020

The big question: should we limit anonymous transactions?

So as citizens and interested individuals, what should we think about all of these developments?

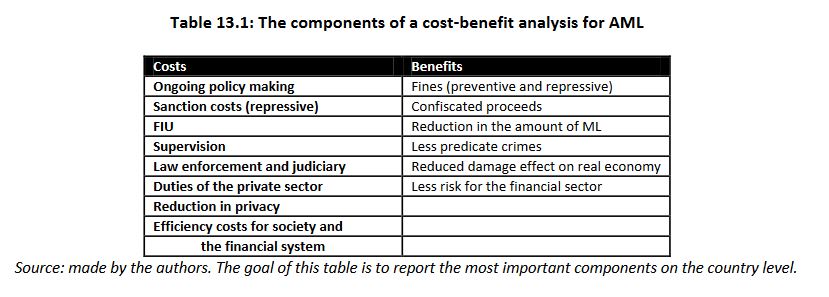

The best way to answer a question like this is to conduct a cost-benefit analysis. In a 2013 report entitled the Economic and Legal Effectiveness of Anti-Money Laundering and Combating Terrorist Financing Policy (or Project ECOLEF for short) a group of EU-funded researchers led by economist Brigitte Unger did just that.

Unger’s team generated the following table of costs and benefits of anti-money laundering policies. They then did their best to quantify each entry. Their end goal was to compute whether the financial value of all the benefits of an EU-wide anti-money laundering policy outweighed the costs.

What did they find? The ECOLEF report was inconclusive. The authors cited a lack of hard data to complete the calculation.

For instance, one of the biggest voids in the cost-side of the analysis comes from measuring the financial value of lost privacy. Privacy is important to members of civil society for many reasons. It allows us to protect our personal information from those who might use it to attack us, like fraudsters. Alternatively it allows us to shield ourselves from harassers like marketers. We may have certain habits that are legal, but not accepted, and we wish to prevent loved ones from finding out. Each reduction in privacy therefore comes at a cost. But how big is it? Does it completely dominate the list of costs, or is it tiny?

(If you are interested in reading more about the value of financial privacy, I’d suggest this excellent article by Federal Reserve economist Charles Kahn.)

Unger and her team concluded that the total costs for all 27 EU member states summed up to €2 billion, an “unmeasurable reduction in privacy", and various inefficiencies & hassles arising from the necessity of collecting so much information. On the benefit side, however, Unger and her team could not quantify a single line-item apart for confiscated proceeds. The biggest supposed benefit, the reduction in money laundering, could not even be measured!

To explain this big gap in the data, the team cited money laundering expert Jacqueline Harvey. In a 2004 paper, Harvey writes that while regulators assume the existence of “an inverse relationship between the degree of regulation and the amount of money laundering", this theory has “not been empirically tested on a wide scale, nor has account been taken of changes in money laundering behavior resulting from changes in regulatory requirements."

In other words, we’ve got a theory for why anti-money laundering regulations work, but we don’t have any real proof.

To sum it all up…

So let’s bring this all back to the German government’s decision to reduce anonymous purchases of gold to €2,000. On the face of it, this may sound like a good policy. After all, it narrows the window for terrorists and money launderers to run their schemes. But as Unger’s ECOLEF report shows, the rhetoric of anti-money laundering laws is not necessarily confirmed by the data.

Maybe Germany’s €2,000 limit is a good thing. Maybe it isn’t. It’s really just a shot in the dark. To sell us on their anonymity-reducing regulations, legislators need to start making a better effort backing up their claims. Not only should they be doing a better job quantifying the benefits of anti-money laundering efforts, but they also need quantify the size of lost anonymity.

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

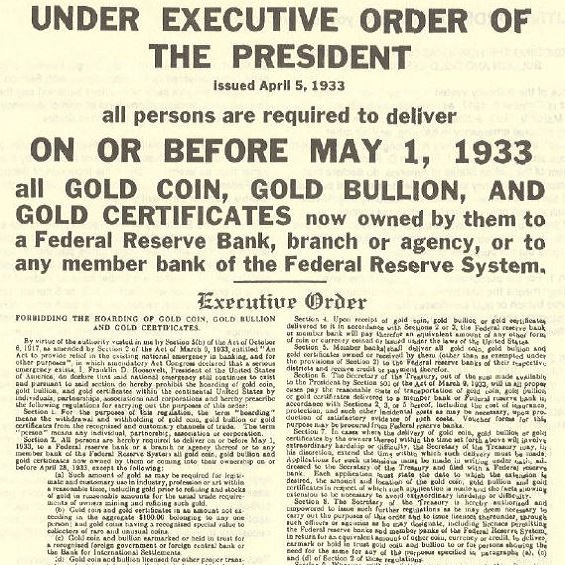

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

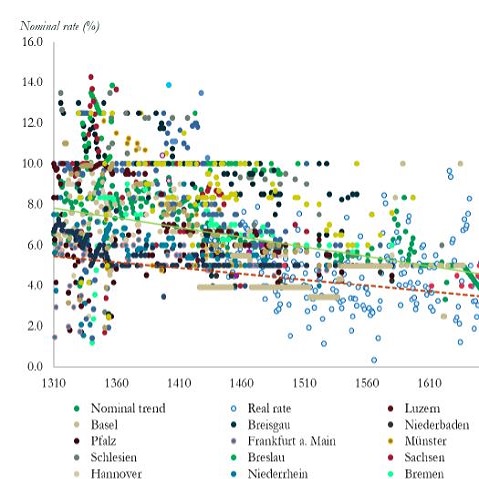

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 4 Comments

4 Comments