Does Anyone Use the IMF’s SDR?

Last week I poked some fun at the International Monetary Fund’s special drawing rights. I claimed that no on uses them. I wouldn’t be the first to make this accusation. The International Monetary Fund (IMF) itself once described the role that special drawing rights (SDRs) play as “insignificant".

No one uses the IMF's SDR as a unit-of-account.

One exception. If you lose your life at sea, the ship owner's liability is limited to 3.02 million SDRs. So says International Maritime Organization: https://t.co/a4aRSGymip pic.twitter.com/S3uxRdN308

— John Paul Koning (@jp_koning) September 25, 2019

In response, people tweeted out some interesting uses of SDRs that I wasn’t previously aware of. In this post I’ll do a run-down of the surprising places that SDRs make an appearance.

Let’s start from the beginning

First, what is an SDR? The SDR was introduced in 1969 by the IMF as a transferable reserve asset. At the time economists were worried about a shortage of reserve assets, specifically gold and U.S. dollars. The SDR was intended to be a version of paper gold. Rather than holding gold or dollars in their portfolio, central banks could substitute SDRs. The IMF designed SDRs so that they could also be used to make payments to other IMF members.

Ownership of SDRs has always been limited to the IMF’s member nations (currently 189) and a small group of non-members, or “prescribed holders." These group of prescribed holders includes supra-national central banks such as the European Central Bank, intergovernmental organizations such as the Bank for International Settlements (BIS), and development institutions like the African Development Bank. Notably, individuals and corporations can not hold or transact in SDRs.

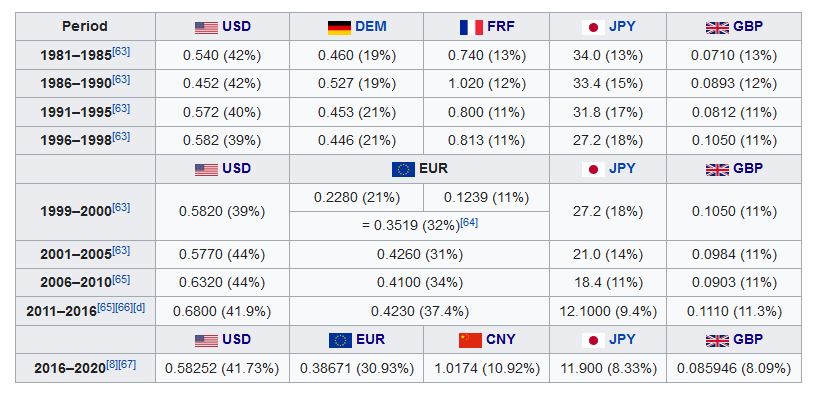

In addition to serving as a specialized payments medium, the SDR acts as a unit of account, or a way of expressing value. Originally defined as 0.888671 grams of gold, in 1976 this definition was changed to a basket of currencies that currently includes the U.S. dollar, euro, Chinese yuan, sterling, and yen.

A (mostly) failed experiment

My original tweet implied that the SDR is a failure. And in most cases, this assessment is correct. The SDR never really took off as a transferable reserve asset. One reason for this is that not many of them were issued. Another is that SDRs are just not as useful as U.S. dollars. Since most of the world is prohibited from owning SDRs, a central bank that keeps some in reserve can only mobilize them after converting them into dollars or euros. The result is that SDRs tended to accumulate back at the IMF rather than being traded between members, a phenomenon I once described here.

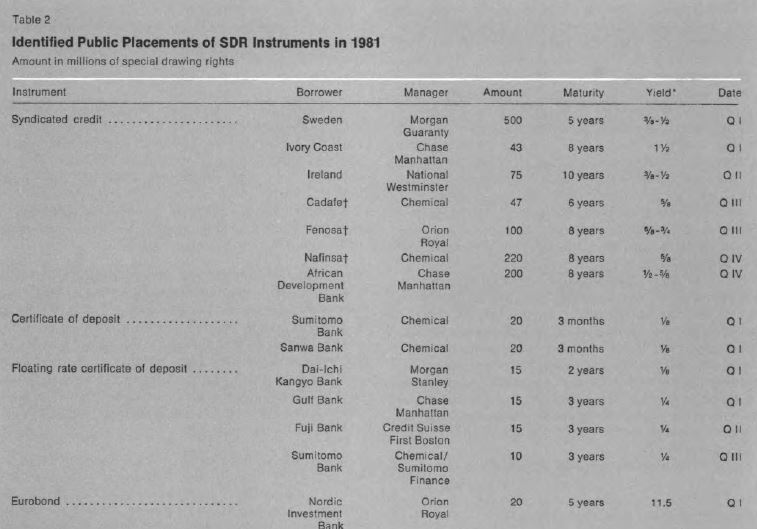

What about usage of the SDR as a unit of account? Early on, the private sector began to experiment with SDRs by using them to denominate financial securities and to offer banking services. For instance, in 1975 Chase Manhattan Bank began to provide SDR-linked bank accounts (see Aschheim & Park, 1976). These weren’t official SDRs. After all, the private sector was not allowed to hold the real thing. Rater, these were a bank-provided version of transferable SDRs .

In a 1981 paper, Sobol documents a number of bonds and other credit instruments that were denominated in SDR:

If you lose your bag, you get 1,130 SDRs

The SDR doesn’t get much usage as a reserve asset nor as a private unit-of-account. But there is one niche in which it seems to have become popular. The SDR has become a widely used unit-of-account in international treaties and law. Government-owned corporations, international agencies, and other intergovernmental organizations have also adopted the SDR for accounting purposes.

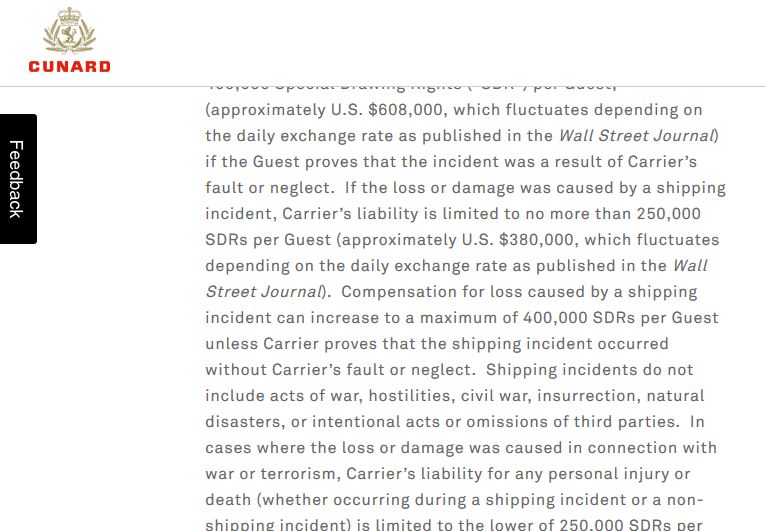

Say that you take a flight or go on a cruise boat and you lose your life or get injured. In either case the standard amount you (or your family) can claim is set in SDR terms. Should you drown, your family is entitled to no more than 250,000 SDRs (US$340,000). In case of an air disaster, the award is 113,100 SDRs (US$150,000).

These amounts are stipulated in two different international conventions, or treaties. The first is the Convention for the Unification of Certain Rules for International Carriage by Air (otherwise known as the Montreal Convention). The other is the Athens Convention relating to the Carriage of Passengers and their Luggage by Sea (link).

Below is the fine print of a Cunard Lines ticket. Cunard offers luxury cruises. The SDR liability limits that it lists come straight out of the Athens Convention.

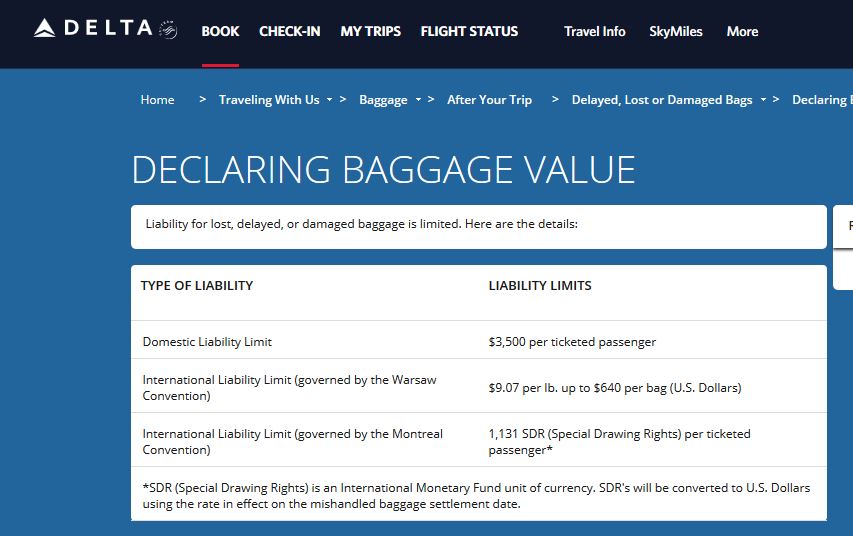

The Montreal Convention also stipulates that airlines are liable for up to 1,131 SDRs (US$1,500) per lost or damaged bag for damaged or lost luggage. This figure can be located in the fine-print of any airline contract. Below I’ve provided a screenshot of a Delta contract:

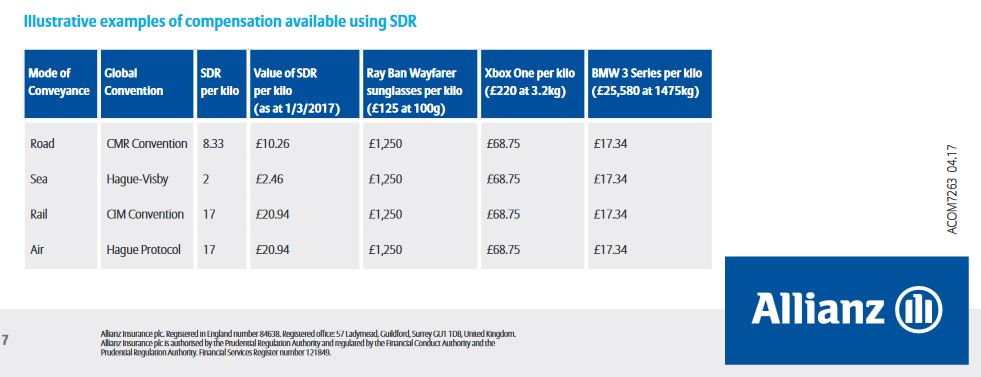

Along with the Montreal Protocol, several other conventions govern liability limits for luggage and cargo. The Convention on the Contract of International Carriage of Passengers and Luggage by Road (CMR) sets a 8.33 SDR per kilo limit on cargo damaged while being transported by road. Rail liability limits are regulated by the The Convention Concerning International Carriage by Rail (CIM) at 17 SDRs per kilogram. A trio of protocols set the amount of damage that can be rewarded for cargo damaged on sea. These include the Hague-Visby rules, Hamburg rules, and Rotterdam rules (2, 2.5, and 3 SDRs per kilogram respectively).

A pamphlet from Allianz SE, a large German insurer, illustrates this jumble of international conventions. For instance, a kilogram worth of Ray Ban Sunglasses is worth £1,250 to an exporter. The various SDR limits stipulated in the conventions to which Allianz is beholden only protect a small chunk of that (£2.45 to £20.94).

For those who send letters or parcels, the SDR has an important role to play in the background. The Universal Postal Union (UPU), a UN agency, sets standards that are in turn adopted by its 196 members. The UPU uses the SDR for many of its standards, including setting terminal dues (the amount that one postal service pays another to complete a delivery), compensation for damaged items, insured values, indemnity limits for international mail.

Look through USPS’s terms & conditions for sending an international letter and the SDR crops up repeatedly. The USPS is enacting the UPU’s standards.

Kind of strange, but the USPS uses SDR as an int’l indemnity basis also. https://t.co/rN6t09vQmQ pic.twitter.com/LCcVuFZkRy

— -Palendromeo- (@jeff_hauschild) September 25, 2019

Here are some other examples of postal services describing to their customers how they use the SDR: India Post, Singapore Post, and Japan Post.

From the Suez Canal to oil spills

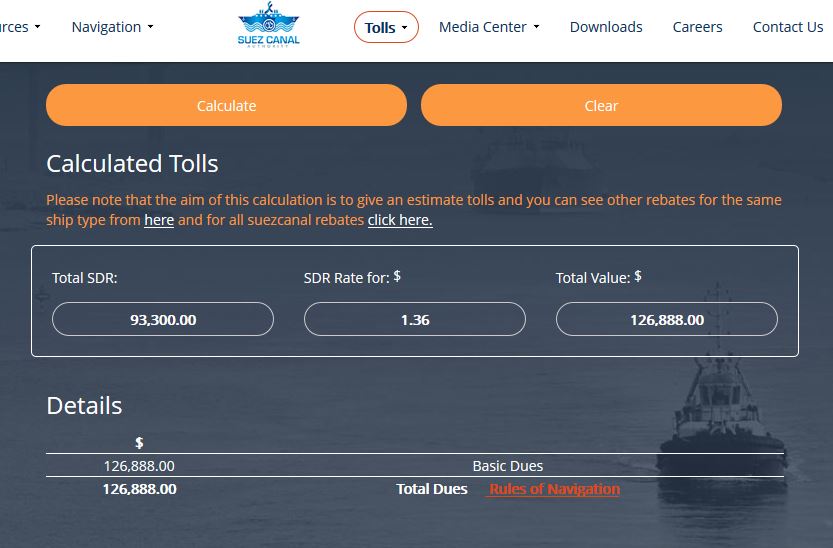

Here’s another maritime usage of SDRs. Millions of tonnes of freight pass through the Suez Canal each day. The Suez Canal Authority, owned by the Egyptian state, sets dues in SDR terms. On its website, it provides a calculator for determining how much is owed according to variables like ship type and size.

Any sea going vessel will use oil as a lubricant or fuel, otherwise known as bunker oil. These ships are also held liable under the International Convention on Civil Liability for Bunker Oil Pollution Damage for damages caused from bunker oil spills. The minimum liability is 1.51 million SDRs for ships below 2,000 gross tonnage.

From the BIS to free trade agreements

The SDR is also used as an accounting unit for the financial statements of several international organizations. This includes the IMF itself, the Bank for International Settlements (BIS), the African Development Bank (ADB), and the Economic Community of West African States (ECOWAS). The World Bank’s International Development Agency also reports its financials in SDR terms, as well as denominating many of its loans in SDRs:

Example here. Of course almost nobody here knows the daily SDR rate and we use the $ equivalents day-to-day. However, I’ve personally experienced situations where a project would be materially affected by xc rate fluctuations between loan signing and disbursement. pic.twitter.com/VEcrqd6FrQ

— Karol Karpinski (@karolkarpinski) September 25, 2019

The Arab Monetary Fund uses an artificial unit called the Arab Accounting Dinar, which it defines as worth three SDRs. The Islamic Development Bank uses a unit called the Islamic Dinar, which it describes as being equal to one SDR.

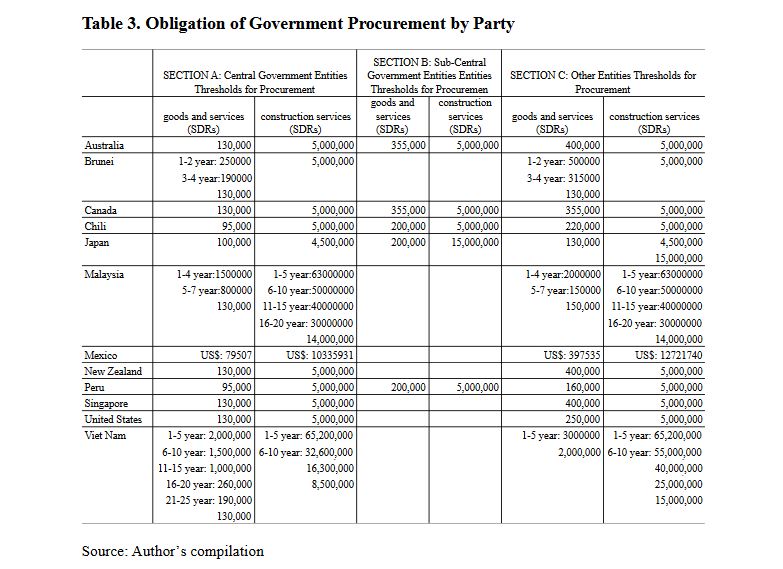

Finally, free trade agreements often make use of the SDR. Take the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), a huge trade agreement recently signed between Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, and Vietnam. One thing the agreement does is open up government bidding to foreign companies. The CPTPP sets minimum thresholds for government contracts. Contracts below that amount are exempt from CPTPP requirements while everything above is now fair game . For instance, Peru sets a 95,000 SDR minimum for central government contracts, while Viet Nam has a 2 million SDR minimum.

The SDR is also used in free trade agreements to help delineate the size of state-owned enterprises to which the agreement applies. For instance, CPTPP requires that governments provide no non-commercial assistance to state-owned enterprises. It sets the threshold at 200 million SDRs in yearly revenues. Only enterprises below this amount are exempt from the CPTPP’s non-commercial assistance rule.

In conclusion…

That completes my quick survey of the SDR and the many appearances it makes in modern life. I still think that the SDR is a fairly minor currency. But I was surprised to see some of the economic nooks and crannies where it is being used.

Using the SDR as a unit-of-account in international law makes a lot of sense. The penalties, thresholds, fines, and dues to which nations abide must be described using some sort of currency unit. The U.S. dollar is probably a decent option. But a more neutral unit like the SDR is surely a better way to achieve political consensus on treaties and trade agreements, which are already fraught with complexities. The CPTPP, for instance, involves 11 countries. Choosing any one currency as a reference rate, say the yen, would be controversial with the other signatories. The SDR solves this.

There are technical reasons for preferring a cocktail. Expressing international values in terms of U.S. dollars subjects treaties to the vagaries of U.S. monetary policy. Use euros and signatories must submit themselves to the whims of European monetary policy. Gold is too volatile. As a cocktail of other currencies, the SDR is cushioned from the monetary decisions of any single constituent of the SDR basket. If the IMF hadn’t created the SDR, some other organization would have had to invent it.

Popular Blog Posts by JP Koning

How Mints Will Be Affected by Surging Bullion Coin Demand

How Mints Will Be Affected by Surging Bullion Coin Demand

Banknotes and Coronavirus

Banknotes and Coronavirus

Gold Confiscation – Can It Happen Again?

Gold Confiscation – Can It Happen Again?

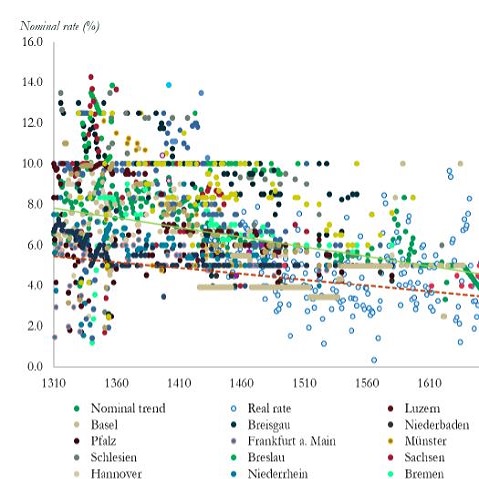

Eight Centuries of Interest Rates

Eight Centuries of Interest Rates

The Shrinking Window For Anonymous Exchange

The Shrinking Window For Anonymous Exchange

A New Era of Digital Gold Payment Systems?

A New Era of Digital Gold Payment Systems?

Life Under a Gold Standard

Life Under a Gold Standard

Why Are Gold & Bonds Rising Together?

Why Are Gold & Bonds Rising Together?

Does Anyone Use the IMF’s SDR?

Does Anyone Use the IMF’s SDR?

HyperBitcoinization

HyperBitcoinization

JP Koning

JP Koning 4 Comments

4 Comments