Silver’s Breakout and What It Signals for Gold: Florian Grummes on the Metals Market Shift

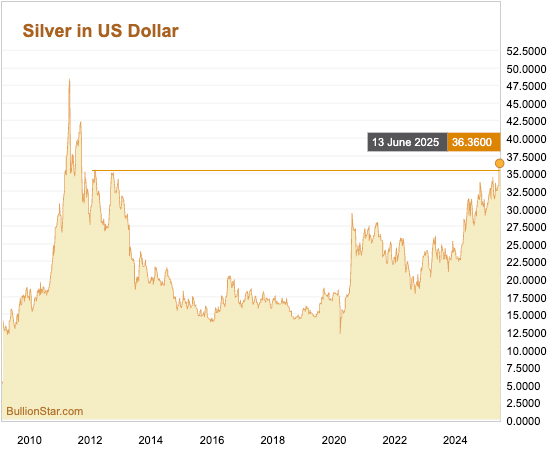

In a recent BullionStar interview, Claudia Merkert spoke with Florian Grummes, founder of Midas Touch Consulting, about the evolving dynamics in precious metals. With silver recently breaking above USD 35 — a level Grummes identified as part of a 13-year resistance zone — and gold entering a consolidation phase, he laid out a roadmap for investors navigating this rapidly shifting landscape.

Silver Surges Above USD 35: A Structural Breakout

Silver has broken through a 13-year resistance zone, climbing rapidly in early June. Grummes noted that this breakout came slightly later than expected, but the strength of the move is significant. On a technical level, he pointed to an “embedded super bullish stochastic setup on the daily chart,” suggesting that further upside is likely in the near term.

Historically, such breakouts in silver tend to unfold over several weeks. According to Grummes, a run toward USD 50 could be on the table — especially if investor demand accelerates. He acknowledged, however, that silver remains volatile and overbought in the short term, and advised investors to stay alert to any reversal signals.

What makes this moment different is the broader macro backdrop. Silver is now in its fifth consecutive year of supply deficit, and new mining capacity remains limited. This combination of tight supply and rising demand is setting the stage for what Grummes believes could become a multi-year structural revaluation of silver.

He also emphasized the psychological component of the market:

“Markets in the end of the day are mass psychological phenomenons.”

As silver garners more attention, institutional and retail investors may begin to reprice it more seriously — not just as a “poor man’s gold,” but as a key asset class in its own right.

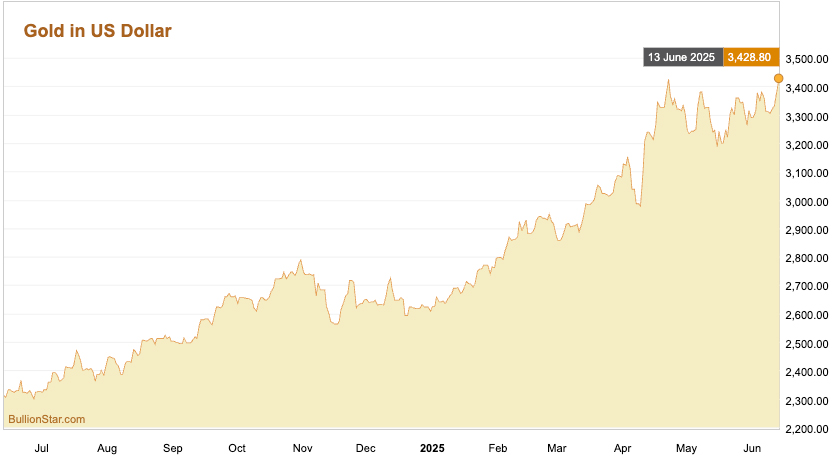

Gold Takes a Breather

While silver is enjoying renewed momentum, gold has entered a multi-week consolidation phase after peaking at USD 3,500 in April. Grummes described gold as “a little bit tired" following a 15-month rally that began with a breakout above USD 2,070 in early 2024.

He noted that this pause is both natural and necessary, especially in light of seasonality. June and July tend to be slower months for gold, and he expects a more decisive move in the second half of the year.

“We know that June is a rather challenging month for the gold price. Usually we get an important turning point somewhere in end of June or during early mid July, and then we get a nice summer rally for the metal prices."

Importantly, Grummes still sees the overall trajectory for gold as upward. He believes the next price target of USD 4,000 is activated, and that a rally could resume in the coming months if gold can establish a solid base around USD 3,100 to USD 3,150.

Asset Allocation: How Much Is Enough?

For investors wondering how to allocate their precious metals holdings, Grummes offered a look at his personal strategy. He currently holds 50% gold, 40% silver, and 10% platinum within the precious metals portion of his portfolio, which itself makes up about one-third of his total net worth.

His general guidance for most investors is simpler:

“Two thirds gold, one-third silver is a good rule of thumb, generally speaking.”

He cautions against extreme overexposure, especially among those who treat precious metals as the only viable store of value:

“Gold bugs tend to have the tendency to believe in the end of the world and distrust any other investment. And then you often see gold bugs having 100% allocation in precious metals, which I think is a little bit questionable."

That said, he believes overweighting silver in the current environment is justifiable, particularly given its potential to catch up.

Don’t Just Stack — Plan Your Exit

While many investors obsess over timing their entry point, Grummes emphasized that exits are far more critical to long-term success.

“People always are focused on the best entry. But the important thing is the exit."

He warns that parabolic moves in silver may be short-lived. A rapid surge to USD 500, for instance, could just as quickly fall back to USD 150. Having a pre-defined exit strategy is essential to avoid watching gains evaporate.

“Into a parabolic move, you need to have a strategy to take exits."

Grummes recommends scaling out gradually and using market psychology to your advantage, especially in emotionally charged phases of a rally.

Complementary Assets: Bitcoin and Gold

Grummes also addressed the growing intersection between crypto and precious metals. He has long followed the Bitcoin-gold ratio and sees value in managing exposure to both assets.

“If you manage during those pullbacks to sit in gold, wonderful, because then the ultimate goal is to have more ounces of gold and more Bitcoin combined."

The key, he says, is not to view them as rivals:

“If you are able to see that gold and Bitcoin complement each other, I think you are still far ahead of most of the crowd which is still fighting that it has to be either gold or has to be Bitcoin, which doesn’t make sense."

Emotional Resilience: The Hidden Skill

Beyond charts and ratios, Grummes stressed the importance of emotional discipline. In a volatile environment, it’s often the investor’s mindset that determines success.

“Usually in the end of the day you play the game with yourself."

To stay grounded, he recommends journaling, time in nature, and meditation. These tools can help reduce noise, increase clarity, and ensure that investment decisions are driven by strategy rather than fear or euphoria.

In a market shaped by momentum, macro shifts, and psychological pressure, Grummes offers a timely reminder: stack wisely, but know when to step off the train. The next few years could reshape how the world sees silver — and those prepared with a plan may be the ones who benefit most.

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Important Update 19/02/2026 – Reduced Minimum Orders & Price Premiums

Important Update 19/02/2026 – Reduced Minimum Orders & Price Premiums

Service Update 31/01/26 – A message from BullionStar’s Chairman/Founder

Service Update 31/01/26 – A message from BullionStar’s Chairman/Founder

BullionStar Announces Record Global Revenue of SGD 761.1M in FY 2025

BullionStar Announces Record Global Revenue of SGD 761.1M in FY 2025

Silver Enters 2026 in a State of Structural Breakdown

Silver Enters 2026 in a State of Structural Breakdown

BullionStar Update: Extreme Demand, Silver Supply, and Market Conditions

BullionStar Update: Extreme Demand, Silver Supply, and Market Conditions

BullionStar

BullionStar 1 Comments

1 Comments