Rick Rule on Why Gold Could Reach $10,000 as the Dollar Declines

In a wide-ranging interview with BullionStar’s Claudia Merkert, legendary resource investor Rick Rule shared candid views on the state of the gold and silver markets, central bank demand, U.S. fiscal realities, and his upcoming venture, Battle Bank. Rule, founder and CEO of Rule Investment Media, last appeared on BullionStar’s channel in December 2022, when gold traded at around USD 1,800. Since then, both gold and silver have almost doubled, and sentiment has shifted dramatically.

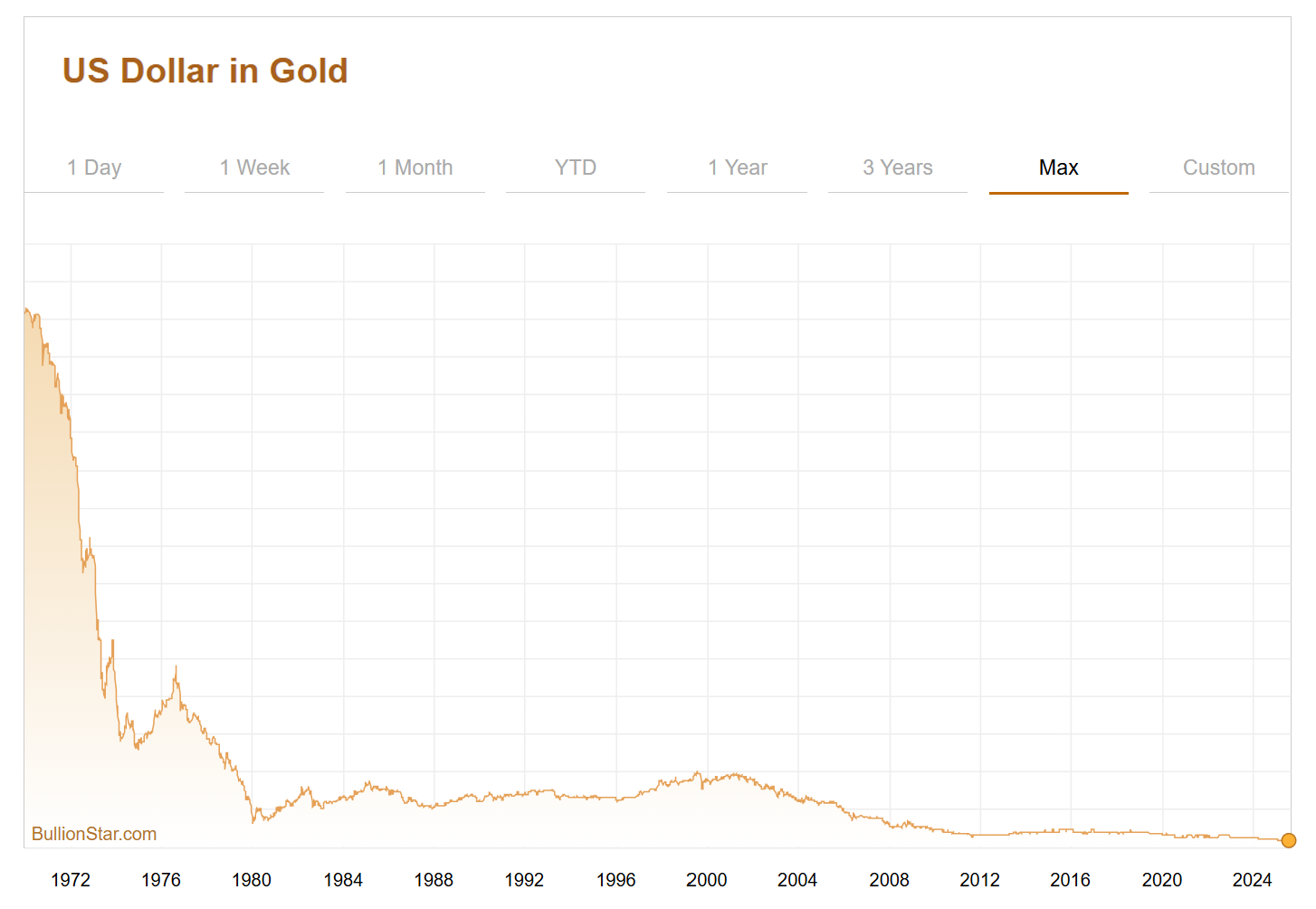

Gold and the Dollar’s Decline

Rule argues that gold’s performance is inseparable from concerns about the U.S. dollar’s purchasing power. “Gold does well when people are concerned about the maintenance of their purchasing power in fiat-denominated savings products,” he explained. Drawing parallels to the 1970s, he expects the dollar could lose up to 75% of its purchasing power over the coming decade — and gold’s nominal price to rise accordingly, potentially reaching USD 10,000–12,000 by 2035.

He stressed that the dynamic is not relative currency weakness: “I don’t fear for the dollar in a relative sense. In other words, I don’t think it’ll do poorly necessarily versus the pound or the euro or the Canadian dollar. But in an absolute sense, I suspect the dollar repeats its 1970s performance.”

Asia Leads, the West Lags

When asked about differences in East–West gold demand, Rule pointed to U.S. sanctions policy as a catalyst for Asian central banks. “By weaponizing the dollar… and stealing $300 billion of Russian holdings in U.S. treasuries, the U.S. has forced central banks to buy gold as defense.”

China, he noted, also reflects deep cultural affinity and strong savings rates: “There was a deep well of support for gold that couldn’t be satisfied when private ownership was banned. Now that it’s encouraged, demand is very strong.”

By contrast, Western investors are only beginning to reawaken. “Retail flows into gold ETFs only began in earnest 20–22 weeks ago,” he observed, likening the current stage to the early 1970s before gold became “front and center in everyone’s mind.”

Portfolio Insurance vs. Speculation

Rule continues to treat physical gold as portfolio insurance, rather than a speculative trade. He holds around 9% of his wealth in bullion, noting that the allocation grew organically as gold outperformed cash after he sold real estate holdings in 2022.

Gold equities, on the other hand, offer leveraged upside. “The golden triumvirate — Wheaton Precious, Franco-Nevada, and Agnico Eagle — have performed spectacularly well,” he said, describing the textbook progression of a gold bull market from bullion to senior miners, then down the quality curve.

Silver: The Speculator’s Metal

If gold is insurance, silver is adrenaline. Rule expects silver to outperform once momentum broadens. “When leadership changes from gold to silver, you won’t need Rick Rule to tell you. We won’t be talking about a move from $36 to $38. We’ll be talking about a much more dramatic move,” he said.

While industrial demand matters, he insists silver’s major price spikes are monetary. “In my experience going back 50 years, the real dramatic increases in silver are always monetary phenomena,” he emphasized.

Market Signals from Billionaires

Asked about the high-profile moves of Warren Buffett, Jeff Bezos, and Ray Dalio, Rule acknowledged their significance but pointed to liquidity as the dominant near-term force. “Family offices are awash in cash and looking for ideas,” he said. However, he warned that U.S. rate cuts in the face of inflation could signal abandonment of the dollar’s integrity — echoing the late 1970s — and trigger “a romp in gold.”

On Resets, Bitcoin, and Government Discipline

Rule dismissed talk of a government-led “gold reset” as hype. “Mercifully, BullionStar customers can do their own reset. Waiting for government seems far-fetched to me,” he quipped. For him, gold’s discipline is the very reason governments avoid it: “The purpose of government is to steal from one constituency and deliver to another. Gold prevents stealing from the unborn.”

As for Bitcoin, he was skeptical of its “reserve” claims but acknowledged its utility for cross-border transfers. He concluded that both gold and Bitcoin remain marginal in global portfolios — less than 1% combined of total savings — leaving room for growth without displacing each other.

Rule’s Advice to New Investors

For beginners, Rule’s guidance was practical: “Read a lot. Don’t take my word for anything. Your biggest investment risk is located between your left and right ear.” He stressed patience and savings discipline: “You cannot be a capitalist if you don’t have capital. Save at least 10% of pre-tax income, no matter what.”

Battle Bank: A New Venture

At 72, Rule is far from retiring. He revealed plans to launch Battle Bank, a branchless institution designed to cut costs, pay interest on deposits, and lend against gold and silver as collateral — with minimum facilities as low as USD 100,000 initially, and hopes to reduce that threshold to USD 20,000.

“We consider gold and silver superb collateral. They trade 24/7. If for some reason you decided not to pay me, I could send your collateral to collateral heaven,” Rule remarked dryly. Regulatory approval is expected imminently, with rollout to the public soon after.

Conclusion

From warnings on U.S. fiscal erosion to the explosive potential of silver, Rick Rule’s insights reflect a lifetime navigating resource markets. His message for investors is clear: discipline, patience, and a willingness to own real assets remain timeless strategies

Watch the full interview here.

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Important Update 19/02/2026 – Reduced Minimum Orders & Price Premiums

Important Update 19/02/2026 – Reduced Minimum Orders & Price Premiums

Service Update 31/01/26 – A message from BullionStar’s Chairman/Founder

Service Update 31/01/26 – A message from BullionStar’s Chairman/Founder

BullionStar Announces Record Global Revenue of SGD 761.1M in FY 2025

BullionStar Announces Record Global Revenue of SGD 761.1M in FY 2025

Silver Enters 2026 in a State of Structural Breakdown

Silver Enters 2026 in a State of Structural Breakdown

BullionStar Update: Extreme Demand, Silver Supply, and Market Conditions

BullionStar Update: Extreme Demand, Silver Supply, and Market Conditions

BullionStar

BullionStar 1 Comments

1 Comments