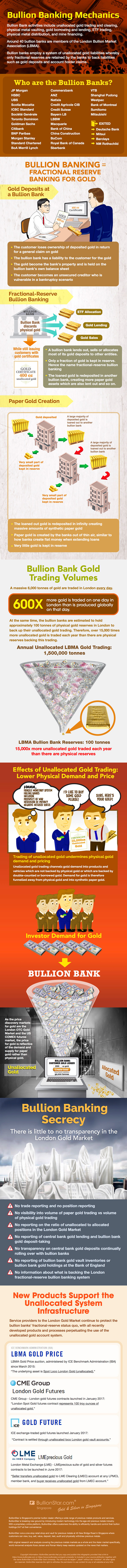

Infographic: Bullion Banking Mechanics

Bullion banks are some of the most influential participants in the global gold market. But who are these players and what do they actually do? And most importantly, how can these bullion banks trade thousands of times more gold each year than is actually in existence?

This infographic lifts the lid on bullion banking, looking at the world of fractional-reserve paper gold trading built on the unallocated gold account system. Topics covered include:

- The identities of these bullion banks

- The fractional reserve nature of bullion banking and the paper gold creation process

- How the staggeringly large paper gold trading volumes are generated

- The gold price discovery process and how the price of gold is set in London by unallocated trading which channels gold demand away from real physical gold and into paper

- The secretive nature of the bullion banking club and how its activities in the City of London are deliberately shrouded in secrecy

- How new competitors into the London Gold Market claim to be providing competition but are actually perpetuating the underlying unallocated gold account system of trading

For more information about the mechanics of bullion banking, please also see BullionStar Gold University article Bullion Banking Mechanics.

To embed this infographic on your site, copy and paste the code below

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Important Update 19/02/2026 – Reduced Minimum Orders & Price Premiums

Important Update 19/02/2026 – Reduced Minimum Orders & Price Premiums

Service Update 31/01/26 – A message from BullionStar’s Chairman/Founder

Service Update 31/01/26 – A message from BullionStar’s Chairman/Founder

BullionStar Announces Record Global Revenue of SGD 761.1M in FY 2025

BullionStar Announces Record Global Revenue of SGD 761.1M in FY 2025

Silver Enters 2026 in a State of Structural Breakdown

Silver Enters 2026 in a State of Structural Breakdown

BullionStar Update: Extreme Demand, Silver Supply, and Market Conditions

BullionStar Update: Extreme Demand, Silver Supply, and Market Conditions

BullionStar

BullionStar 2 Comments

2 Comments