Can Gold Surge to $65,000 in 5 Years?

Introduction

Financial market prices are generally set by the trading venues which command the highest trading volumes and liquidity. This is also true of the gold market where the venues with the highest gold trading volumes – the London over-the-counter and COMEX gold futures markets – establish the international gold price.

However, these two gold markets merely trade paper gold claims in the form of unallocated gold positions (London Gold Market) and gold futures derivatives (COMEX). This trading creates paper gold supply out of thin air and is also highly leveraged and fractional in nature since the paper gold claims are only fractionally backed by real physical gold.

Although these highly leveraged synthetic gold trades have nothing to do with the transacting of physical gold, perversely they still establish the international gold price because physical gold markets merely inherit the gold prices derived in these ‘high liquidity’ paper gold markets.

BullionStar maintains that these paper gold markets cannot price physical gold accurately because they don’t trade physical gold, instead they trade infinitely scalable fractional claims on a smaller amount of physical gold. The international gold price is thus an artificial gold price totally removed from supply and demand in the physical gold markets.

Drawbacks of paper gold / Benefits of physical gold

Each trading day in the London OTC gold market, the equivalent of a staggering 6500 tonnes of gold is traded.

To put this into perspective, less than 7500 tonnes of physical gold vaulted in the entire London gold vaulting network, most of which is owned by central banks and Exchange Traded Funds.

Nearly all trading in the London OTC gold market is speculate activity based on unallocated gold positions. Unallocated gold positions are just book-keeping entries where the holder of the position is an unsecured creditor to a counterparty bullion bank, and the position just represents indebtedness between the two transacting parties.

Likewise, on the COMEX futures exchange during 2017, only 1 in every 2650 gold futures contracts actually reached delivery via a transfer of underlying gold. The remainder (99.96%) of gold futures are cash-settled. There is very little physical gold backing COMEX gold trading i.e. Registered physical gold inventories in COMEX approved gold vaults represent only a tiny fraction of the total volume of gold futures traded at any given time.

Conversely, real physical gold is a tangible asset that exists in limited quantities, it is inherently valuable, difficult to produce, difficult to counterfeit, and most importantly when held in the form of fully allocated, segregated and unencumbered gold bars and gold coins, it has no counterparty risk and so is no one else’s liability.

Real physical gold is not a claim on gold. It is gold. Real physical gold is real money, and is the ultimate form of saving and store of value due to its ability to retain its purchasing power over time. Unfortunately, the proliferation of paper gold trading dwarfs the volume of physical gold traded, and thus the gold price is set on these huge paper gold trading volumes.

Price Disconnect

But given the dominance of gold pricing by the paper gold markets, can this situation continue, and if so for how long?

BullionStar would contend that this situation can only continue while the bulk of paper gold market participants are happy to continue trading paper gold claims and in the absence of a shock to the physical gold demand-supply balance.

Conversely, a shift in the trading behaviour of paper gold traders away from paper gold towards physical gold, or a scenario in which physical gold demand overwhelms available physical gold supply, could cause a disconnect between gold pricing in the paper gold and physical gold markets, with the paper price falling while the physical price simultaneously rises.

Physical Gold flows West to East

As Western institutional and retail investors continue to speculate and trade staggering volumes of paper gold instruments, Eastern buyers in Asia continue to accumulate real physical gold, physical gold which is in limited supply.

These flows of physical gold from West to East have been ongoing for some time and can even be viewed as a slow and silent bank run on the physical gold market.

Classic commercial bank runs either begin when a subset of a bank’s customers suspect that the bank may not have sufficient liquid cash to repay all depositors, or else suspect that the bank’s loan base has soured. Since commercial banks employ fractional reserve banking where only a fraction of depositors’ money is kept in reserve (the majority being lent out in the form of loans), depositors with early suspicions begin withdrawing their money first.

Word spreads that the bank is having trouble meeting withdrawal requests and more and more depositors follow suit attempting to make withdrawals. Panic soon sets in with the bank forced to limit withdrawals and request emergency assistance from regulators.

The same end-game could be said to be true of fractional-reserve gold banking where holders of claims on physical gold rush to be the first to convert their claims into physical gold. Since the early 2000s, there has been a continual and substantial flow of physical gold from West to East. For example, since 2001, India has net imported over 11,000 tonnes of gold. This imported gold has for the most part stayed within India.

Likewise, since 2001, China has imported over 7,000 tonnes of gold. Because exports of gold are prohibited from the Chinese gold market, this gold cannot leave China mainland. In addition, the Chinese central bank has reported a 1400 tonne increase in its gold holdings since 2001. This is gold that the People’s Bank of China buys exclusively on international gold markets in the form of wholesale gold bars and imports secretively into China, and is above and beyond reported Chinese gold import figures.

In the global gold market, Eastern buyers of physical gold are analogous to the early depositors of a commercial bank withdrawing their cash. In this scenario, a gold market ‘depositor shock’ prompting further withdrawals from the global stock of gold would be analogous to a widespread realization that the outstanding set of traded gold claims is far larger than the dwindling quantity of physical gold backing those claims. This realization would prompt further rotation out of paper gold into physical gold.

If at the margin, paper gold market players (later adopters) begin converting their paper gold claims into physical gold, or more realistically cash settle their paper claims and then try to use the proceeds to buy physical gold, this could set the scene for a disconnect between physical gold prices and paper gold prices.

On the one hand, a shift towards physical gold would overwhelm available physical gold supply, a situation which could only be rectified via an increase in the physical gold price to induce supply from existing above ground stocks. On the other hand, selling pressure in the paper gold markets to release proceeds to convert into physical gold would drive the paper gold price lower, thus also reinforcing this gold price disconnect.

Gold Price $65,000

But what would the real price of physical gold be in the absence of the subduing influence of the fractional and limitless paper gold market, or how do we even approach calculating a range of such physical gold prices?

Throughout history, gold has been the ultimate money and ultimate store of value. Until 1971, physical gold backed the international monetary system. Throughout monetary history and up until the latter half of the 20th century, gold played a critical role in backing paper currencies and in backing monetary debt. It is thus still appropriate to analyse the value of gold in relation to the value of currencies and the value of outstanding debt.

Approximately 190,000 metric tonnes of gold have been mined throughout history. Nearly all of this gold can still be accounted for in one form or another and is known as ‘above-ground gold’. About 90,000 tonnes of this gold is held in the form of jewellery, 33,000 tonnes of gold are (supposedly) held by central banks, 40,000 tonnes are attributed to private gold holders, with the remainder having been used in industrial and other fabrication uses.

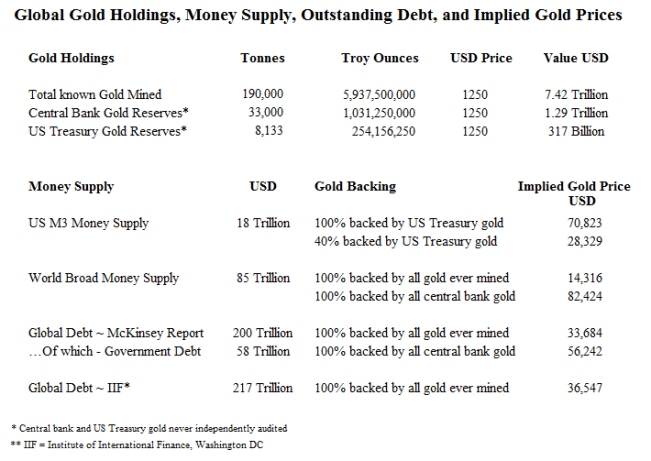

While 190,000 tonnes may sound like a lot, at the current gold price of USD 1250 per ounce, all the gold ever mined in the world is valued at less than $8 trillion, and official central bank gold holdings (monetary gold) are valued at just $1.3 trillion. The US Treasury claims to hold 8133 tonnes (or 261.5 million troy ounces) in its official gold reserves (a figure which, by the way, could be far lower since it has never been independently audited). At the current gold price, these US Treasury gold reserves are worth just under $320 billion.

Compare these gold valuations to total outstanding money supply figures. The total broad US money supply is currently running in excess of $18 trillion (using a “continuation M3" measure). For the US money supply of $18 trillion to be fully backed by the US Treasury’s gold, this would require a gold price of $68,840 per troy ounce.

Even at a 40% gold-backing, a backing which was historically in place for the US money supply in a recent period in US monetary history, this would imply a gold price of $27,500 per ounce.

Beyond the US money supply, total world money supply is currently running at over $85 trillion [source: broad money supply CIA World Factbook]. This global money supply of $85 trillion is approximately 11 times more than the current ‘valuation’ of all the gold ever mined.

For the world’s money supply to be fully backed by total worldwide central bank gold holdings [33,000 tonnes] would require a gold price of $82,600 per troy ounce. Even if world money supply was 100% backed by all the gold ever mined, this would require a gold price of $13,900 per ounce.

According to a recent study by the high-profile consultancy McKinsey, the world’s total outstanding debt is currently $200 trillion (of which government debt is $58 trillion). For the total outstanding stock of global debt to be backed by all the gold ever mined would require a gold price of $32,700 per ounce. For all government debt to be backed by the world’s official central bank gold reserves would require a gold price of $56,000 per troy ounce.

While extrapolating implied prices for physical gold in a world absent of paper gold market distortions will always be estimates, if and when the fractionally-backed paper gold market does cease to function, then ownership of allocated and unencumbered physical gold will become the only way to take advantage of the potential price movements in the physical gold market.

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Gold, Geopolitics, and the Global Financial Realignment: Insights from Dr. Nomi Prins

Gold, Geopolitics, and the Global Financial Realignment: Insights from Dr. Nomi Prins

Silver’s Breakout and What It Signals for Gold: Florian Grummes on the Metals Market Shift

Silver’s Breakout and What It Signals for Gold: Florian Grummes on the Metals Market Shift

The Big Long: Gold’s New Chapter – A Conversation with Ronald-Peter Stöferle

The Big Long: Gold’s New Chapter – A Conversation with Ronald-Peter Stöferle

How to Tell If Gold Is Real – What You Need to Know About Fake Gold, Testing Methods, and Trusted Dealers — A 2025 Guide

How to Tell If Gold Is Real – What You Need to Know About Fake Gold, Testing Methods, and Trusted Dealers — A 2025 Guide

Is It Too Late to Buy Gold in 2025? 7 Signs Pointing to Gold’s Next Major Rally

Is It Too Late to Buy Gold in 2025? 7 Signs Pointing to Gold’s Next Major Rally

BullionStar

BullionStar 31 Comments

31 Comments