Gold, Geopolitics, and the Global Financial Realignment: Insights from Dr. Nomi Prins

In an in-depth interview with BullionStar, economist and former Goldman Sachs and Bear Stearns managing director Dr. Nomi Prins shared her perspective on the accelerating shift in global finance—driven by sovereign debt concerns, geopolitical tensions, and renewed interest in real assets such as gold. Drawing on themes from her books Permanent Distortion and Collusion, Prins outlined the structural disconnect between financial markets and the real economy, and explained why she believes gold is becoming a foundational asset in the emerging monetary order.

From Wall Street to a Global Macroeconomic Lens

Reflecting on her transition from senior roles at Goldman Sachs and Bear Stearns to independent research, Prins explained:

“What was always interesting to me was looking at the real economy, the one that works in the physical and operates for people, the one that has supply chains, versus the sort of financial aspect of that economy which is more sort of engineered products paper markets and fiat currency”

Her work now focuses on uncovering long-term systemic shifts, particularly those obscured by traditional financial narratives.

A System Untethered: Central Bank Policy and ‘Permanent Distortion’

Prins warned of a continued detachment between asset markets and underlying value creation, a dynamic she explored in Permanent Distortion:

“You could have these artificial insurrections, really, from the standpoint of central banks infusing the markets with fictitious money, money that did not come from earning or building or technology or infrastructure development or really anything.”

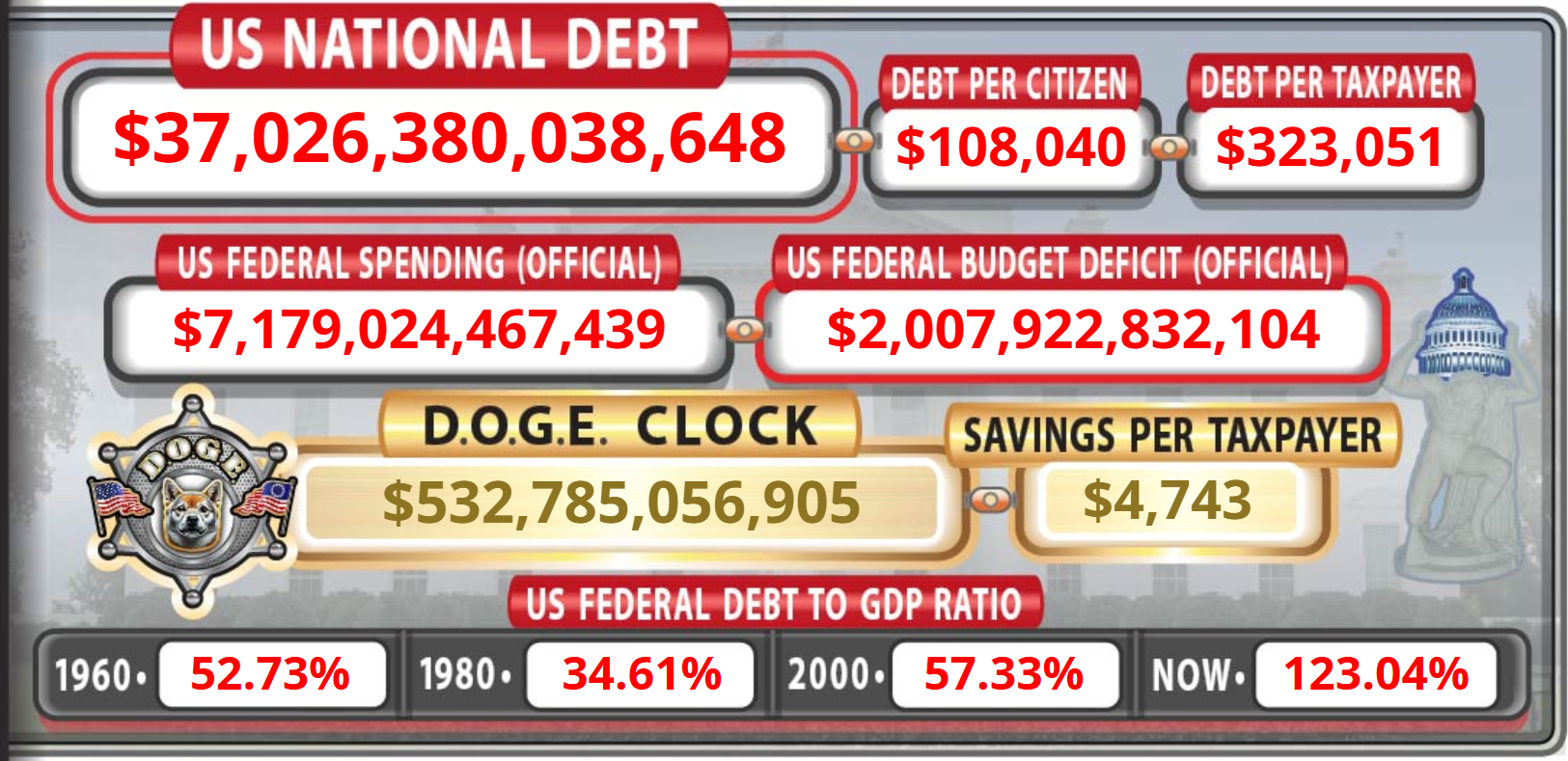

She highlighted that U.S. sovereign debt is approaching $37 trillion, with interest payments nearing $1 trillion annually—a structure she views as increasingly unsustainable.

The Erosion of Dollar Dominance and the Role of Gold

While Prins does not foresee the U.S. dollar losing its reserve currency status imminently, she noted an accelerating trend of countries reducing exposure to dollar-based trade:

“Is it going to stop being the reserve currency in our lifetimes? No. But… there’s a movement and an accelerating movement to go away from using the dollar as the base trade currency amongst countries.”

Among the most notable shifts: China reducing its U.S. Treasury holdings while increasing its gold reserves.

“It’s effectively increased its percentage of gold allocation and reduced its percentage of US Treasuries.”

China’s Systematic Re-monetization of Gold

China’s central bank gold purchases are part of a broader, multi-tiered strategy. According to Prins:

“It’s been very systematic in terms of spreading gold from the central bank, you know, all the way down to the individual in quite a planned way.”

She described this as a structural realignment:

“It’s becoming part of the sort of architecture of the realignment of the financial systems away from the dollar based, the sort of Western based system into the Eastern based system.”

Toward a New Framework for Gold in Global Trade

Prins believes gold may increasingly be used not only as a reserve asset, but also as a structural requirement in international trade and payment systems:

“There could be rules that relate to gold, kind of a new kind of a gold standard where there’s a certain amount that’s required, or a certain amount in reserve that’s required, or a certain amount that the State banks have, or the private banks within a country have.“

She emphasized this is not merely theoretical—participating countries are actively expanding their gold reserves.

Gold’s Renewed Role for Investors and Central Banks Alike

Gold’s appeal, Prins argues, is no longer limited to hedging inflation or volatility. Instead, it is being positioned as a strategic anchor in a fragmented global system:

Gold doesn’t care which governments buy it. The more it owns, the more it has control of the national market.”

She observed that gold has held firm through economic turbulence:

It’s shown remarkable stability through higher inflation, economic uncertainty, more debt… and it is continuing to stay in there because it has a bid from every aspect of China… and every form of investor.

CBDCs and the Case for Privacy-Preserving Assets

![]()

Prins expressed serious reservations about the growing adoption of central bank digital currencies (CBDCs), particularly in terms of data privacy:

“Individuals will have their financial transactions ultimately in a ledger that ultimately a central bank and a government can see.

She contrasted this with the autonomy that physical assets offer:

“You can’t really put a blockchain inside a bullion bar.”

A Bullish Outlook on Gold’s Price Trajectory

Looking ahead, Prins anticipates a continued imbalance between supply and demand, driven by both retail and institutional accumulation:

There’s a scarcity. If there’s a scarcity, it’s going to push the price up. You can’t just like start a gold mine and dig for gold, I mean, yes, there are many operating mines in the world, and they are producing gold. But then there’s also a lot of junior miners that are beginning, or at the beginning or middle stages of developing mines that have yet to produce gold.

Her forecast is clear:

I see prices of gold going up around 4,000 by the end of this year, beginning of next year, per ounce in dollars and 5,000 by the end of the next year.

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Important Update 19/02/2026 – Reduced Minimum Orders & Price Premiums

Important Update 19/02/2026 – Reduced Minimum Orders & Price Premiums

Service Update 31/01/26 – A message from BullionStar’s Chairman/Founder

Service Update 31/01/26 – A message from BullionStar’s Chairman/Founder

BullionStar Announces Record Global Revenue of SGD 761.1M in FY 2025

BullionStar Announces Record Global Revenue of SGD 761.1M in FY 2025

Silver Enters 2026 in a State of Structural Breakdown

Silver Enters 2026 in a State of Structural Breakdown

BullionStar Update: Extreme Demand, Silver Supply, and Market Conditions

BullionStar Update: Extreme Demand, Silver Supply, and Market Conditions

BullionStar

BullionStar 0 Comments

0 Comments