First Ever Filming of Singapore's Super-Secret Gold Reserves

Singapore’s Channel News Asia (CNA) recently published a fascinating new documentary film about Singapore’s national reserve assets, including Singapore’s famed monetary gold reserves.

The CNA documentary includes a segment featuring BullionStar’s CEO Luke Chua in BullionStar’s vault visually explaining what 1 tonne of gold looks like, to illustrate the magnitude of Singapore’s gold reserves.

The CNA documentary team also obtained access to the secret gold vault of the Monetary Authority of Singapore (MAS), Singapore’s central bank, where more than half of Singapore’s official gold reserves appear to be stored. This is the first time ever that Singapore’s gold reserves have been filmed inside the MAS central bank gold vault.

Singapore’s central bank holds 225.4 tonnes of gold, making it the 24th largest sovereign gold holder in the world. Up until March 2021, MAS held 127.4 tonnes of gold, and had not bought gold for many years.

But then Singapore’s central bank went on a gold buying spree, buying 26.4 tonnes of gold bars between April and May 2021 (see here), and then adding another 73.6 tonnes of gold bars between January and July 2023. See here.

Singapore’s central bank (MAS) added another 2 tonnes of gold to its monetary reserves during July, taking its total gold holdings to 227.34 tonnes.

With this new purchase, MAS has now bought exactly 100 tonnes of gold since it started its gold buying spree in April 2021.… pic.twitter.com/mA0ylARNvD

— BullionStar (@BullionStar) September 4, 2023

In total, that was 100 tonnes of gold added to Singapore’s gold reserves over just 2 years, which in percentage terms was a massive 77% increase compared to early 2021.

In fact, the rate of gold accumulation by Singapore’s central bank during early 2023 was so intense that MAS earned the distinction of being the world’s largest central gold buyer in Q1 2023, during which it bought 68.7 tonnes of gold.

While Singapore’s gold reserves have a market value of approximately SGD 18.8 billion, this represents less than 5% of MAS’s total reserve assets, which in total are worth about SGD 400 billion. The rest of the reserve assets of Singapore’s central bank, which consist of holdings of securities (bonds and stocks) and foreign currencies, are also, along with the 225.4 tonnes of gold, managed by the Monetary Authority of Singapore.

In addition, Singapore has two additional state sovereign investment funds. One is the Government of Singapore Investment Corporation (GIC), a Singapore government-owned company which manages Singapore’s sovereign wealth fund. The other is Temasek, a Singapore government-owned global investment company. GIC invests globally in equities, bonds and real. estate. Temasek invests in equities, but also owns entire companies across the world, and has an investment portfolio worth SGD 400 billion. Both of these national investment funds are also profiled in the CNA program.

The CNA documentary, which is titled “Singapore Reserves: The Untold Story | Singapore Reserves Revealed”, can be viewed on the CNA Insider channel on YouTube here.

The segment featuring BullionStar’s CEO in BullionStar precious metals vault, and which also features footage from the MAS gold vault, runs from approximately minutes 11:46 until 15:35. That segment can be seen here.

The MAS Secret Gold Vault in Singapore

Near the beginning of the CNA documentary, the narrator states that Singapore’s central bank (MAS) granted the CNA team exclusive access to the MAS secret gold vault, on condition that CNA signed an undertaking to keep the location of the vault secret. This narration is accompanied by a shot of a one page document titled ‘Undertaking to Safeguard Official Information’ which invokes Singapore’s Official Secrets Act, and which the CNA documentary producer and crew had to sign as an undertaking with MAS not to reveal the location of the vault to anyone.

CNA also says that its crew (which consisted of a cameraman and a producer) chose to be blindfolded and were driven in a ‘super secretive trip’ to a secret location in Singapore where the vault is located. This is very reminiscent of another filmed visit to a gold vault in 2011, when CNBC’s Bob Pisani and his crew were supposedly blindfolded (maybe for dramatic effect) and driven to an undisclosed location in London to visit the HSBC gold vault which stores the gold bars of the SPDR Gold Trust (GLD).

Fast forward to 2023, and the recent video footage from the MAS gold vault which is included in the CNA documentary spans just 41 seconds between minutes 14:12 and 14:46 of the video, and for a few seconds again between 15:21 and 15:26. However, the CNA video segment (which can be seen directly below) is very interesting and reveals plenty of information about Singapore’s gold holdings, which we will analyse here.

The opening shot shows the CNA producer standing in a large open plan vault space among towering racks of steel trays that contain large Good Delivery (400 oz) gold bars. When the producer takes her blindfold off, she appears genuinely surprised and in awe to be viewing huge quantities of 400 oz gold bars.

The large open space where Singapore’s gold is stored has a ceiling about 4 metres high, with air-conditioning, a sprinkler system and light fittings, and is probably underground, presumably in a basement level of a building.

According to the narrator, and confirmed visually in the video, “each tray contains up to 20 gold bars”. From the video footage, each tray contains two rows of 8 bars each, and 4 more bars in the middle, i.e. 20 bars per tray.

“Each bar is worth close to USD 800,000” says the narrator, which is true because they are London Good Delivery gold bars (approx. 400 ozs per bar @ USD 2000 per oz).

Historic 128 tonnes of Gold stored in Singapore

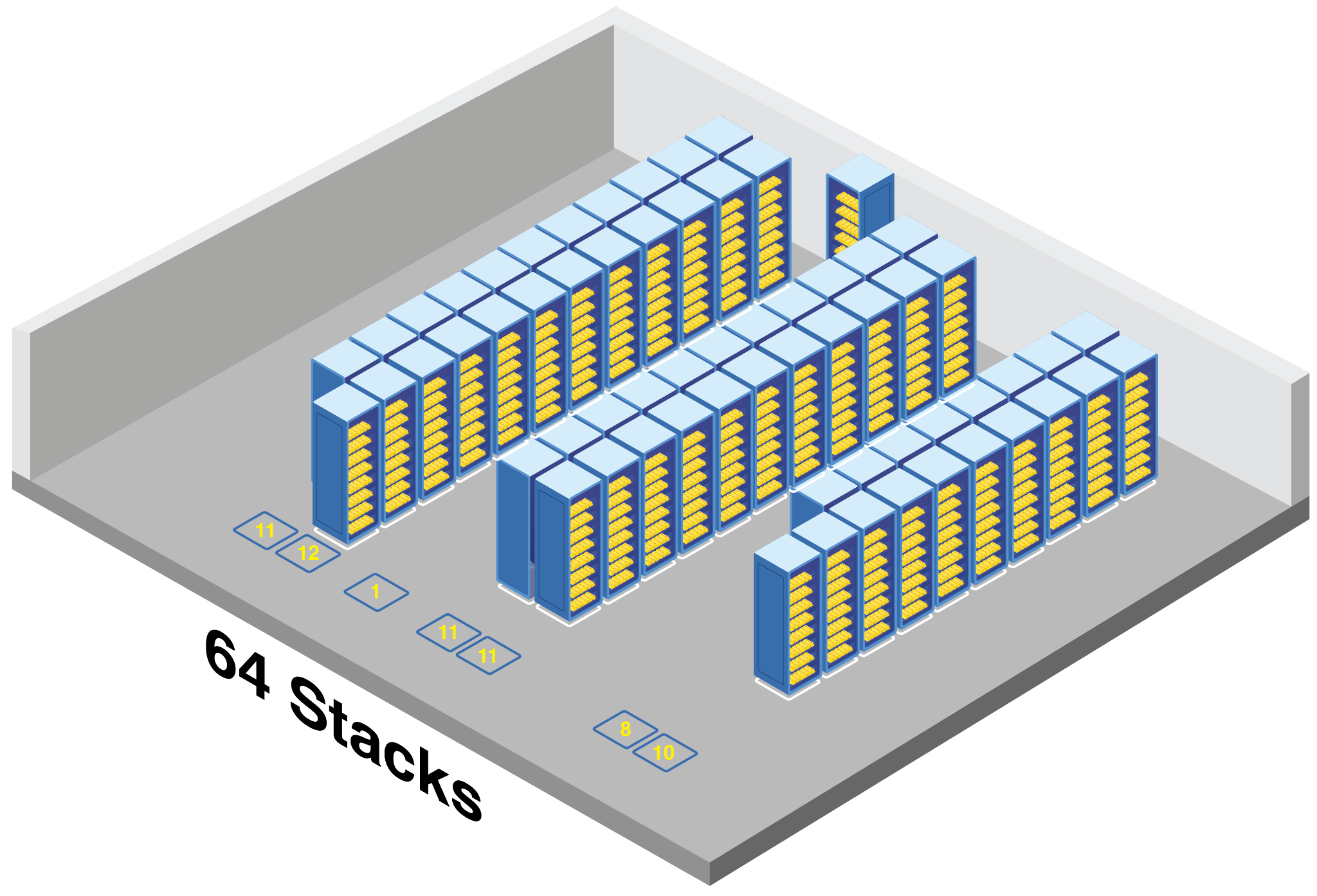

The trays (each with 20 gold bars) are stacked 8 trays high to form what we’ll call a ‘Stack’. Each stack therefore contains 2 tonnes of gold.

The video shows that in the MAS gold vault, there are various rows of these ‘Stacks’ (comprising eight trays full of gold bars), and these stacks have been positioned in long lines to form walking spaces or corridors in between the lines of stacks. These rows of stacks are between 10 – 12 stacks in length, and some rows are positioned back-to-back to form double rows. There are also additional stacks of trays that have been placed in some of the spaces of the ‘corridors’.

Even though the CNA narrator says that they are in “a vault, the size of which we can’t disclose”, it is possible to estimate the size, from observing the CNA video footage, and then creating an approximate ‘floorplan’ of the MAS gold vault, complete with the arrangements of the stacks of metal trays containing the gold bars.

This floorplan can be seen in the diagram below, where each ‘X’ represents a ‘Stack’ of 8 trays of gold. Each stack therefore contains 160 Good Delivery gold bars, i.e. 2 tonnes.

On the left hand side, there are two rows of stacks, back-to-back, with 11 stacks in one row and 12 in the other row. Then there is a corridor, but there is one stack positioned at the end of this corridor. To the rights of this are two further rows of stacks, each 11 stacks long. Then there is a corridor and one final row of stacks (10 stacks long) to the right. But within this corridor there have been placed another 7 stacks. In total that is 64 stacks of trays.

At 2 tonnes of gold per stacks, this would mean that 64 stacks of trays (each stacks holding 160 gold bars) would equal 128 tonnes of gold. Recall that up to early 2021, Singapore held 127.42 tonnes of gold bars, a gold holding which had not changed in many years. Bingo!

Given that the CNA video shows a vault which appears to hold 128 tonnes of gold bars, it therefore appears that the gold vault which MAS recently showed to Channel News Asia is holding all of the historical 127.4 tonnes of gold which Singapore purchased many years ago.

South African Rand Refinery Gold Bars

This hypothesis is backed up by the fact that all the gold bars in the video where the bar refinery ‘brand’ is visible are gold bars from South Africa’s Rand Refinery. This is very relevant since the first gold purchase which Singapore’s government made was in 1968 when Singapore’s finance minister at that time, Dr Goh Keng Swee, along with his senior adviser Ngiam Tong Dow, transacted a deal with the South African government to buy 100 tonnes of gold which was then delivered to Switzerland. See the last section of the BullionStar article here for details.

This 100 tonnes of gold seems to have then subsequently been transported from Switzerland to Singapore at some unspecified time in the past.

There is also evidence that the Rand Refinery gold bars appearing in the CNA video have not been fabricated recently, since there is no year of manufacture stamped on any of them.

According to the authoritative 2014 Gold Bars Worldwide report on Rand Refinery Gold Bars (written by Nigel Deesbrock for Grendon International Research), all 400 oz Rand Refinery gold bars have had year of manufacture stamped on them since 2008.

Also, the Rand Refinery Good Delivery gold bars in the video, where the purity stamp is visible, show gold purities (fineness) of 9965 (bar OC 1064) and 9958 (bar LQ 1807), meaning they contain 99.65% and 99.58% gold purity respectively.

However, and this is very relevant, all Rand Refinery Good Delivery gold bars have been fabricated with a fineness of 9999 for many years now, and since that time, their serial numbers have consisted of a sequence of numbers without letters.

If 128 tonnes of Gold is in Singapore – Where are the other 98 tonnes?

Therefore, all of these Rand Refinery gold bars featured in the video footage from the secret MAS gold vault in Singapore are quite old and have gold purities a little less than 99.99%. All of this therefore points to the fact that the gold which CNA recently filmed in the MAS vault in Singapore is the 127.4 tonnes of gold which Singapore accumulated many years ago.

This then raises the question as to where are the more recent 98 tonnes of gold bars which Singapore’s central bank purchased between 2021 – 2023. If these gold bars were purchased in the London Gold Market at the Bank of England’s gold vaults (which is likely), then these bars are probably still being stored in London. If this is the case, then the question should be asked of MAS as to whether this gold is in fully allocated and segregated from, or has this gold been lent out to the bullion banks of the London Bullion Market Association (LBMA), in which case it should be classified as a ‘gold receivable’.

If this recently purchased gold has in fact already been brought back (repatriated) to Singapore by MAS, then is there another part of Singapore’s secret gold vault which the CNA documentary did not film?

As to where the secret gold vault of Singapore’s central bank is located, that remains a mystery. It could be in the basement of a government-owned or government-occupied building in Singapore’s financial district, or there again it could be in a more secure location, such as in one of Singapore’s military bases or air bases, a number of which are dotted across the island of Singapore.

Given that the MAS gold vault is rumoured to be guarded by members of the elite Singapore Police Force Gurkhas contingent, a contingent which is described on the Police website as a “world-class security unit”, that is employed “across the spectrum of para-military operations to help safeguard Singapore” – then perhaps the MAS gold vault could be located near the grounds of one of Singapore’s Police headquarters or divisional headquarters.

Following the video footage of the gold bars in the secret MAS gold vault, the CNA documentary switches back to BullionStar CEO Luke Chua who explains that:

“Gold’s true value really shines during times of uncertainty, in times of crisis. During times of crisis, the value of the other reserve assets will tend to fall.

Gold has been tested across centuries, across thousands of years, and has still proven to be a good store of value.”

Luke concludes by elegantly explaining that Singapore’s government did indeed make a shrewd investment when it purchased its first 100 tonnes of gold in 1968 at a price of US $40 per troy ounce, since the gold price today is nearing US $2000 per troy ounce. That’s 50 times more than the purchase price.

BullionStar’s Vault Storage – Singapore, Texas and New Zealand

While the gold vault of the Monetary Authority of Singapore (MAS) is indeed impressive, it’s important to remember that secure gold vaults are not just the exclusive domain of MAS and other central banks.

BullionStar offers one of the most comprehensive precious metals secure vaulting services in the industry, which is available to retail investors, high net worth individuals, and corporates who want to maximise the protection of their high value bullion and avoid the risk of home storage. Our precious metals storage rates are some of the most competitive in the industry.

In Singapore, one of the world’s safest jurisdictions, BullionStar operates not just one but two secure precious metals vaults. One of our high security vaults is integrated into BullionStar’s shop and showroom at 45 New Bridge Road, close to Singapore’s central business district. BullionStar also operates a vault facility at the famous Le Freeport in Singapore, a maximum-security vault close to Singapore’s international airport.

Not only that, but we also offer our customers the ability to diversify their precious metals storage across some of the other safest and securest jurisdictions in the world, with secure high-security vaulting offerings in both New Zealand, and in Texas in the United States.

New Zealand is also one of the safest jurisdictions in the world and embodies a system of very strong property rights and a strong rule of law. In New Zealand, BullionStar’s high security vault is located in the basement of a building in Wellington built by the Bank of New Zealand, and the vault is offered in conjunction with our partner New Zealand Vault in Wellington.

Texas has some of the most favorable tax policies in the US related to the sale and storage of bullion as well as strong protection of individual rights and an established bullion sector. The Lone Star State is also famous for its independent nature and stands for freedom and individual responsibility.

In Texas, BullionStar’s high security vault is located in the city of Dallas, and BullionStar’s vault is offered in conjunction with our partner IDS of Texas.

BullionStar’s Vault Storage Solution

BullionStar’s precious metals vaulting platform is one of the most technically sophisticated and easy to use bullion storage platforms in the world.

Opening a BullionStar customer account is quick and easy and once online in our simple user-interface, you can control your bullion online 24/7, buy bullion for vault storage, audit your bullion, withdraw your bullion from vault storage and also sell your bullion at any time.

Our vaults are some of the most secure in the industry, employing multiple means of surveillance and security including high resolution cameras, motion sensors, seismographic sensors, and biometric scanners.

All physical precious metals stored in our vaults is fully allocated and segregated and you can see pictures of your stored bullion to verify its existence. Customers retain full unencumbered legal title to all their stored bullion. All customer orders for dispatch and vault storage are handled under camera surveillance, with this handling meticulously documented.

All bullion stored in our vaults is fully insured against all risks at full replacement value, with insurance coverage underwritten by syndicates at Lloyd’s of London, the world’s leading provider of specie insurance to the bullion industry.

BullionStar employs no less than five types of audit for customer stored bullion, to verify the existence of your bullion, and to give you the customer, piece of mind.

- LBMA-approved auditor, Bureau Veritas, is engaged by BullionStar to conduct bi-annual physical audits of all customer bullion stored in BullionStar vaults.

- BullionStar customers can verify their stored holdings using a Live Audit Report that is extracted live from BullionStar’s vault inventory system.

- Customers can conduct a personal physical on-site audit of their stored bullion, after making an appointment.

- As part of internal audits for our insurance underwriters, BullionStar conducts frequent internal stock enumerations.

- As part of BullionStar’s annual auditing process, a licensed Singaporean auditor conducts a physical stock inventory, and the results are published in the auditors reported attached to BullionStar’s annual report.

Via your online customer account, you can view your unique Vault Certificate, which lists all bullion products that you currently hold in vault storage. This vault certificate is proof of your direct legal ownership of your fully allocated, insured, and audited bullion products stored with BullionStar.

If you choose to withdraw bullion from vault storage, withdrawals can be fulfilled either via shipping, or you can make an appointment to personally collect your bullion from our vault facilities.

Opening a BullionStar account is quick and easy and once online in our simple user-interface, you can control your bullion online 24/7, buy bullion for vault storage, audit your bullion, withdraw your bullion from vault storage and also sell your bullion at any time.

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Gold, Geopolitics, and the Global Financial Realignment: Insights from Dr. Nomi Prins

Gold, Geopolitics, and the Global Financial Realignment: Insights from Dr. Nomi Prins

Silver’s Breakout and What It Signals for Gold: Florian Grummes on the Metals Market Shift

Silver’s Breakout and What It Signals for Gold: Florian Grummes on the Metals Market Shift

The Big Long: Gold’s New Chapter – A Conversation with Ronald-Peter Stöferle

The Big Long: Gold’s New Chapter – A Conversation with Ronald-Peter Stöferle

How to Tell If Gold Is Real – What You Need to Know About Fake Gold, Testing Methods, and Trusted Dealers — A 2025 Guide

How to Tell If Gold Is Real – What You Need to Know About Fake Gold, Testing Methods, and Trusted Dealers — A 2025 Guide

Is It Too Late to Buy Gold in 2025? 7 Signs Pointing to Gold’s Next Major Rally

Is It Too Late to Buy Gold in 2025? 7 Signs Pointing to Gold’s Next Major Rally

BullionStar

BullionStar 1 Comments

1 Comments