Bullion Banking 101 – Speech by BullionStar's Torgny Persson

The following speech, by BullionStar CEO Torgny Persson, was given to an audience during a Precious Metals Seminar held at BullionStar’s shop and showroom premises in Singapore on 19 October 2016.

Introduction

What have I got here?

It’s 87 grams of gold.

As many of you know, we have our own bullion vault integrated in BullionStar’s bullion centre here in Singapore. What if I told you that every day we sell 6 kgs (6000 grams of gold), meaning that we sell about 1500 kgs gold per year to customers storing with us, but that we actually only keep 87 grams of gold in storage as reserves.

You would call it fraud and have me arrested, right? I’m obviously running a Ponzi scheme with very small fractionalised reserves backing up huge trading of unallocated paper gold.

Now, for clarity, that’s not how we conduct business. When you buy and store bullion with BullionStar, your bullion is fully allocated and you can withdraw your metals at any time by just walking into BullionStar’s bullion centre. You don’t even have to notify us beforehand.

What I just explained to you is something else – it’s bullion banking per definition – more precisely it’s unallocated gold trading by bullion banks.

As most of you know, the London Bullion Market Association (LBMA) has held its annual Precious Metals Conference in Singapore over the last two days. The LBMA is at the core of the world’s bullion trading system, a system which generates extremely large trading volumes every trading day. To understand the gold market, one has to understand the LBMA system as it is of great significance to both the price of gold and also to the physical movements of gold around the world. I will therefore provide you with an introduction to bullion banking and this LBMA system, and talk about how bullion banking operates.

Bullion Banking – Unallocated Gold

Almost all gold traded in the LBMA system today is in the form of unallocated gold which is accounted for in unallocated accounts. The definition of an unallocated gold account, as we can read on the LMBA’s website, is that the holder of such an account with a LBMA bullion bank does not have any ownership interest in any specific gold bars.

Instead, the account holder is merely an unsecured creditor of the bullion bank and holds a claim on the bullion bank for an amount of gold. At the same time, the bullion bank has a liability to this customer for this same amount of gold. Therefore unallocated gold is essentially paper gold. It is gold that doesn’t exist in the physical realm.

The creation of unallocated gold is in fact very similar to how fiat currency is created in the fractional reserve banking system. The fractional reserve banking system provides a good gateway into understanding bullion banking.

How is Fiat Money Created Today?

Let’s quickly recap on how fiat money is created in the fractional reserve banking system.

Money is created out of thin air. When a bank extends a loan, the money is created out of thin air.

Let’s take an example:

1) Robert plan to buy a house for $1 million.

2) Robert goes to a bank and the bank takes a look at Robert and deems him credible. With today’s low lending standards, it is rather easy for Robert to secure a loan. The bank deposits $1 million into Robert’s account.

3) Where does this $1 million come from? The answer is ‘nowhere’. It doesn’t come from anywhere. The money is created out of thin air when loaned out to Robert.

This is easy to understand but hard to believe for some people. But it is true that this money is created out of thin air and lent into existence. About 92% of our money today is lent into existence in this fashion.

Banks keep a very small amounts of money in reserve to cover withdrawals, but they face liabilities which are far larger in size that their reserves.

The term “loan" as used in banking has been corrupted and twisted by banks. When a bank extends a loan, there is nothing loaned. To loan something you need to be in possession of it first, but when banks make loans, there is no countervailing transaction – The money is just created when the loan is extended.

How is Paper Gold Created?

Now, what about gold? How is gold created? You might say gold can’t be created, it has to be mined, right? Yes, you would be correct, physical gold cannot be created, but gold as an investment product definitely can be created and is created on a massive scale.

When a bullion bank customer goes to the bank and requests to buy gold, the standard procedure is for the bullion bank to create unallocated paper gold and credit this paper gold to the customer’s account. This ’gold’ is simply created out of thin air as a book-keeping entry in the bank’s accounting system.

Similarly, if actual physical gold is deposited into an unallocated account operated by a bullion bank, this deposit of gold is also in fact very similar to a deposit of fiat money. Just as a bank keeps deposited fiat money on its own balance sheet, a bullion bank keeps deposited physical bullion on its own balance sheet.

Bullion banks don’t generally safeguard or segregate gold deposited with them or held by them unless they are specifically instructed to do so if a customer opens an allocated gold account.

This means that depositors of gold into bullion banks’ unallocated accounts are no longer the legal owners of the gold that they have deposited. Instead, they are just one of the general creditors to the bank, and they merely hold a claim for gold against the bank.

By depositing gold into an unallocated account at a bullion bank, you therefore lose ownership of your gold in return for a mere claim on gold.

Trading in unallocated gold by the bullion banks is thus based on book-keeping entries denominated in gold. The gold is fractionally reserved. Gold is created out of thin air as book-keeping entries in the banks’ ledger systems, and even gold that is deposited into an unallocated account becomes the property of the bank.

LBMA Unallocated Gold Trading Volumes

From the LBMA’s published clearing statistics, which is one of the only transactional statistics that the LBMA does publish, we know that 600 tonnes of gold are “cleared" in the London Gold Market each and every trading day. Cleared means that it’s 600 tonnes of gold that’s transferred between participants after netting out all trades between all trading participants.

According to a LBMA gold trading survey conducted in 2011 (the last such survey), the ratio between trading turnover and clearing on the London Gold Market was about 10 to 1. This means that the total amount of gold traded in the LBMA system each day is about the equivalent of 6,000 tonnes!

In other words, almost twice as much gold is traded in the LBMA system in a single trading day than is physically mined globally during an entire year.

But what is backing this 6,000 tonnes of unallocated gold traded each day, or 1.5 million tonnes of gold traded each year?

Let’s take a look at the reserve side of bullion banking in the LBMA system.

Bullion Bank Gold Reserves

The LBMA bullion banks’ outstanding gold liabilities, and the unallocated trading system in the London Gold Market are ultimately backed by a quantity of 400 oz Good Delivery gold bars.

However, bullion banks don’t really want to hold physical gold. They will buy it if someone forces it on them but bullion banks have no real need for physical gold and are therefore incentivised to keep as little gold as possible in reserve, and lend out the gold they hold in reserve so as not to incur storage fees and handling costs. Banking reserves are looked upon as a dead asset so the banks minimise these reserves and try to make them into live assets by loaning them out.

When a bullion bank receives a gold bar by buying or borrowing it, it either sells, leases or allocates that bar elsewhere.

This sets a bullion bank apart from any other bullion entity because a bullion bank can hold deposits of gold on its balance sheet as assets even if it no longer has, or never had, the actual physical gold in its possession.

How much backing is there for all the unallocated gold traded in the LBMA-system?

We don’t exactly know as there are no reserve figures published but we can make an educated guess.

Vaulted Gold in London

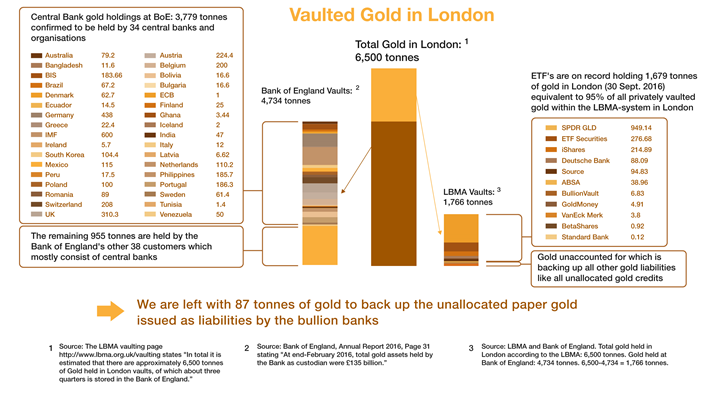

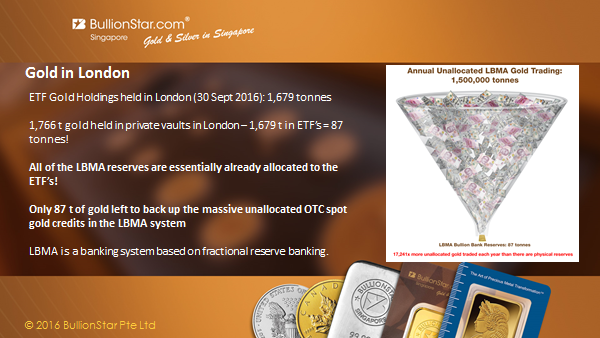

How much gold is actually vaulted in London? The LBMA recently said on its website that there was approximately 6,500 tonnes of gold stored in London, about three-quarters of which was at the Bank of England. The Bank of England recently revealed that it was custodian for 4,734 tonnes of gold in its vaults.

This would leave 1,766 tonnes of gold privately stored in the LBMA vaulting system outside the Bank of England.

BullionStar research recently calculated (30 September 2016) that ETF gold holdings held in London accounted for 1,679 tonnes. This would mean that there are only 1,766 – 1,679 = 87 tonnes of gold in the LBMA system which is not allocated to ETFs!

Therefore, nearly all of the LBMA reserves are allocated to the ETFs with only 87 tonnes of gold left to back up the vast amorphous of unallocated gold trading amounting to 6,000 tonnes per day or 1.5 million tonnes per year!

Chart layout inspired by GoldChartsrus /Nick Laird. Data gathered by Goldchartsrus/BullionStar’s Ronan Manly

Physical gold in the LBMA bullion banking system is therefore like physical cash in the monetary system. It is rarely seen!

Double-counted Reserves

LBMA is a banking system that by definition is based on fractional reserve banking.

HSBC, JP Morgan and ICBC Standard Bank are the only LBMA bank custodians with their own precious metals vaults in London. Most of the circa 42 LBMA bullion banks don’t even have their own gold vaults but still keep books denominated in gold ounces. A bullion bank without a gold vaults instead holds its gold reserves with a bullion bank that does have a gold vault.

For example, if Citibank keeps its reserves with a bank with a vault such as JP Morgan, then Citibank merely holds a gold claim for which JP Morgan has a gold liability. These unallocated gold reserves are therefore just pooled with the bullion banks that do have vaults.

The bullion banks without a vault never see or touch the metal they keep in reserves. If a bullion bank stores its gold reserves at another bullion bank’s vault, this means that the reserves are unallocated credits/claims which are standing behind the bank’s own liabilities. So even the reserves are fractionalised. So not only are bullion banks’ liabilities to their customers unallocated, even the reserves are unallocated inter-bank liabilities which are fractionalised.

Paper gold thus stands behind the liabilities of paper gold.

The LBMA system serves as a pool of reserves and uses coordinated reserve management where the different participating bullion banks can loan and lend to each other the few physical reserves that there are in the system so as to meet any demand for physical bullion.

Gold Bank Run

The bullion banks face massive liabilities in the form of unallocated gold credits. Bullion banks are thus, just like normal banks, susceptible to bank runs.

The difference between bullion banks and normal commercial banks is that whereas central banks are the ultimate lenders of last resort to commercial banks, most central banks no longer back-stop bullion banks as the lender of last resort because most central banks no longer sell or lease bullion that can be used to prop up bullion banks’ reserves.

In case of the LBMA, the central bank is replaced by a private company called London Precious Metal Clearing Limited (LPMCL) which is run by 5 clearing bullion banks and whose clearing system AURUM nets out all gold claims and liabilities in the LBMA system. The clearing system functions as a pooled system in that only net balances are cleared and the bullion banks’ gold reserves are essentially pooled and can be leased and double counted whenever necessary.

When they no longer have any physical gold to deliver, the ultimate rescue plan for bullion banks is to use cash settlement instead.

In the same way that banks increasingly promote cashless solutions as a means to reduce cash handling costs, earn credit card fees, reduce the risk of bank runs and lock in customers, LBMA system bullion banks promote gold-less gold transacting.

Just as the banking system inherently incentivises reckless debt behavior, the bullion banking system inherently incentivises the reckless creation of paper gold assets.

LBMA – The Paper Gold Protector

In creating artificial paper gold, bullion banking protects the fiat money system.

If even a small minority of the paper gold traded today was backed up by physical gold, the price of gold would have skyrocketed. A gold price significantly higher than today would point towards the inferiority of the fiat money system, and possibly the collapse or implosion of the current monetary system.

Bullion banks and gold industry organisations, such as the LBMA and the World Gold Council, which itself has developed and owns securitized gold products, can profit from gold trading volumes that are far higher than they would be if they were limited to the constraints imposed by the availability of physical gold to trade.

The bullion banks and the LBMA work hard to overcome the tangible limitations of physical gold mining. By promoting gold-less gold transacting, the LBMA unallocated system artificially increases the supply of gold, earning the banks higher fees from artificially large trading volumes.

To reiterate, the LBMA unallocated gold trading is a banking system based on fractional reserve banking which is all about exposure to the price of gold but not to gold itself.

The LBMA system is used to coordinate unallocated paper gold trading where ‘gold’ is created out of thin air, and the tiny physical reserves held are pooled and shared out among participants so as to minimise costly reserves and avoid gold bank runs.

When bullion banks need to allocate gold to the ETFs, such as to the SPDR Gold Trust (GLD) in London, they use credits from the same unallocated gold credit system as was previously used to offset other gold liabilities. Even though the ETF may own the gold outright, the gold is still being double counted within the system because its being allocated out of a bullion bank pooled systems of credits.

To summarize what the LBMA is all about, it is a paper gold protector for the bullion banks which allows the bullion banks to earn fees from an artificially high trade turnover while at the same time protecting the fiat currency system.

The Guarded Secret of no Gold

The fractionally-reserved bullion banking system is a fragile system. Many investors and savers holding paper gold believe that the gold they are holding is backed up by real physical gold. But if the bullion banking system implodes, which it will do if the high demand for real physical gold in Asia is sustained at anywhere near today’s levels, these holders of paper gold will at best end up holding paper claims which will be cash-settled, or at worst these paper gold holders will be empty-handed.

Demand for ETF’s and unallocated gold will likely not stress the system systemically since the pooled LBMA gold reserves are used for leasing and double counting. It is the demand for real physical gold, draining bank gold reserves, that stresses the system.

Many gold investors/savers buy various paper gold products as a means of protecting themselves against the fiat currency Ponzi scheme. It may therefore come as a surprise to some holders that these investments are no safer or even less safe than the fiat currency against from which they are seeking to protect themselves. Bullion banks give the impression that these investors into unallocated gold are actually holding gold, whereas in reality they are just unsecured creditors holding paper gold, gold that is created out of thin air, in a fractionally-reserved Ponzi scheme.

As long as everyone is happy to buy and sell ledger entries/book-keeping entries, this fragile system can continue to balance on a thin thread. The systemic problem arises when larger entities start to demand physical delivery, a trend which has been happening in the last few years, most notably in Asia and Russia. There is therefore an imminent risk of the bullion banking system collapsing in the next few years.

This is an accident waiting to happen, because when enough holders of paper gold ask for delivery, the default that will follow will trigger the biggest bank run for gold in history, which due to gold’s significance as a monetary proxy, will shake the entire monetary system.

When there is no longer any physical metal to deliver, the ensuing shortage will result in a disconnect between prices, in which paper gold will become worthless while the price of real physical gold will be revalued at a much higher level based on the market equilibrium for physical supply and demand of gold.

Thank you!

Popular Blog Posts by BullionStar

How Much Gold is in the FIFA World Cup Trophy?

How Much Gold is in the FIFA World Cup Trophy?

Essentials of China's Gold Market

Essentials of China's Gold Market

Singapore Rated the World’s Safest & Most Secure Nation

Singapore Rated the World’s Safest & Most Secure Nation

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

Infographic: Gold Exchange-Traded Fund (ETF) Mechanics

BullionStar Financials FY 2020 – Year in Review

BullionStar Financials FY 2020 – Year in Review

Gold, Geopolitics, and the Global Financial Realignment: Insights from Dr. Nomi Prins

Gold, Geopolitics, and the Global Financial Realignment: Insights from Dr. Nomi Prins

Silver’s Breakout and What It Signals for Gold: Florian Grummes on the Metals Market Shift

Silver’s Breakout and What It Signals for Gold: Florian Grummes on the Metals Market Shift

The Big Long: Gold’s New Chapter – A Conversation with Ronald-Peter Stöferle

The Big Long: Gold’s New Chapter – A Conversation with Ronald-Peter Stöferle

How to Tell If Gold Is Real – What You Need to Know About Fake Gold, Testing Methods, and Trusted Dealers — A 2025 Guide

How to Tell If Gold Is Real – What You Need to Know About Fake Gold, Testing Methods, and Trusted Dealers — A 2025 Guide

Is It Too Late to Buy Gold in 2025? 7 Signs Pointing to Gold’s Next Major Rally

Is It Too Late to Buy Gold in 2025? 7 Signs Pointing to Gold’s Next Major Rally

BullionStar

BullionStar 14 Comments

14 Comments