BullionStar featured on The Business Times

13 Feb 2026

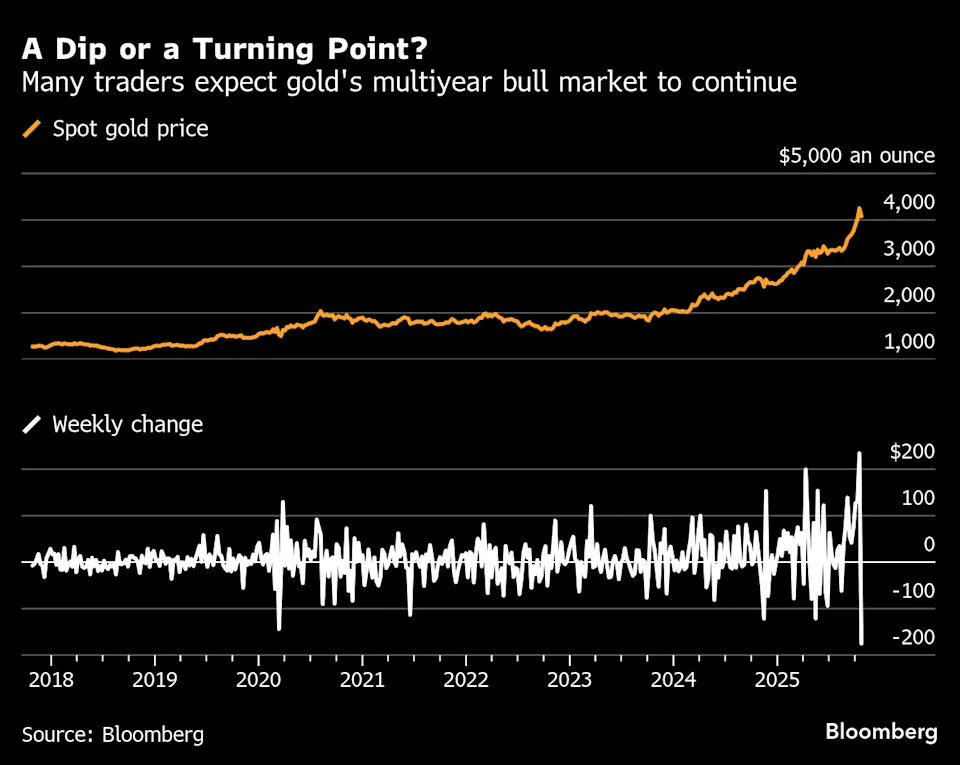

BullionStar was featured in a recent Business Times Singapore rticle titled Singaporeans flock to gold despite record-high prices ahead of Chinese New Year. The article highlights the extreme demand for physical metals in late months of 2025 into early 2026.

A spokesperson from BullionStar said the company’s orders between December 2025 and January 2026 increased by around 190 per cent compared to the same period last year. The local precious metals dealer’s revenue has also jumped by over five times year on year over the same period. January 2026 was the busiest month in BullionStar’s history with over 11,000 purchase orders, said the spokesperson. " Across all denominations, the prevailing trend is clear: investors continue to accumulate, with buy orders significantly outpacing sell orders.”

Read the full article here.