Venezuela’s Gold in Limbo at the Bank of England

In early November news was placed into the British media (Reuters and The Times) revealing that the Bank of England in London, one of the world’s largest custodians of gold bars on behalf of other central banks, was refusing to allow the withdrawal and repatriation of 14 tonnes of gold belonging to Venezuela’s central bank, the Banco Central de Venezuela (BCV).

According to these media reports, the delays / refusals by the Bank of England to allow the Venezuelan gold repatriation ranged from excuses about the prohibitive cost of transport insurance to concerns about future money laundering. In all cases, these excuses were bogus, as I explained in the article “Bank of England refuses to return 14 tonnes of gold to Venezuela” on the BullionStar website, dated 15 November, and that the real reasons for the Bank of England’s refusal were political. As I stated at the time in my conclusion:

“The reasons put forward by official sources in the Reuters and Times articles for why Venezuela can’t withdraw its gold from the Bank of England are clearly bogus. The more logical and likely explanation is that the US, through the White House, US Treasury and State Department have been liaising with the British Foreign office, HM Treasury to put pressure on the Bank of England to delay and push back on Venezuela’s gold withdrawal request.”

According to the Reuters report dated 5 November, the Venezuelan central bank gold withdrawal plan had “been held up for nearly two months”, which would put the original withdrawal request by the BCV to the Bank of England at a date in at least September and probably earlier. So the BCV had been looking for its gold back for sometime, and the Bank of England was stalling. One reason the Bank might have been stalling was to wait for the introduction of US Executive Order 13850 which was signed on 1 November, imposing US economic sanctions on anyone doing business with the Venezuelan gold sector.

As far as the BCV’s gold withdrawal request and the Bank of England’s refusal, nothing much happened in the public domain until early December when there came a flurry of news and activity showing that the Venezuelan custodied gold matter at the Bank of England was far from resolved, and indeed that the heat had been turned up a few notches by both sides.

Borges and Vecchio appeal to Mark Carney

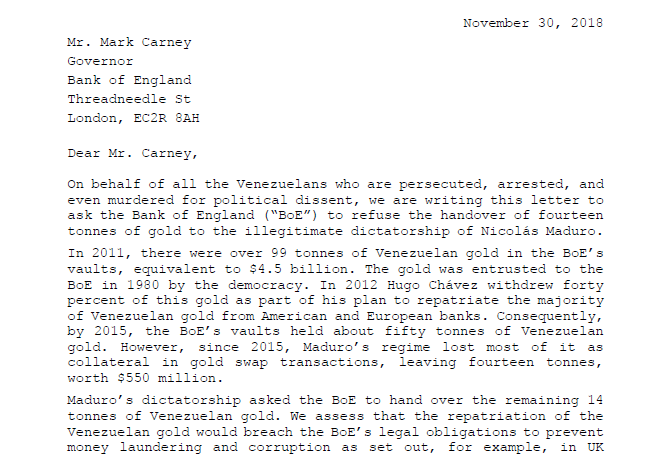

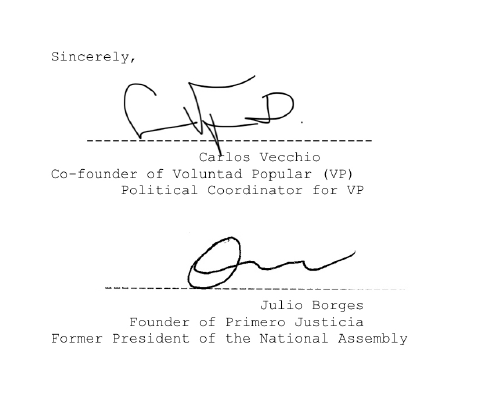

First up was a letter to the Bank of England Governor Mark Carney, dated 30 November, from two dissident figures of the Venezuelan political opposition, Julio Borges and Carlos Vecchio. Borges is a former Venezuelan national assembly (legislature) president and also founder of Venezuelan political party Primero Justicia (Justice First). Vecchio is co-founder of and coordinator for another Venezuelan political party Voluntad Popular (Popular Will).

A summary of this letter and its background can be read in a 3 December Univision News article by David Adams in a link here. The actual letter in pdf format can be read here at this link -> Borges-Vecchio-Letter-to-the-BoE.

Before looking briefly at the letter’s arguments for not allowing the gold to be withdrawn, its interesting to see how Borges / Vecchio explain how the now infamous 14 tonnes of gold came to be still sitting in the Bank of England’s vaults in London. They write:

“In 2011, there were over 99 tonnes of Venezuelan gold in the BoE’s vaults, equivalent to $4.5 billion. The gold was entrusted to the BoE in 1980 by the democracy. In 2012 Hugo Chávez withdrew forty percent of this gold as part of his plan to repatriate the majority of Venezuelan gold from American and European banks. Consequently, by 2015, the BoE’s vaults held about fifty tonnes of Venezuelan gold. However, since 2015, Maduro’s regime lost most of it as collateral in gold swap transactions, leaving fourteen tonnes, worth $550 million.“

Having previously done a detailed analysis of Venezuela’s gold and its repatriation, including the article “Venezuela’s Gold Reserves – Part 1: El Oro, El BCV, y Los Bancos de Lingotes“, I can say that most of what Borges and Vecchio state looks accurate.

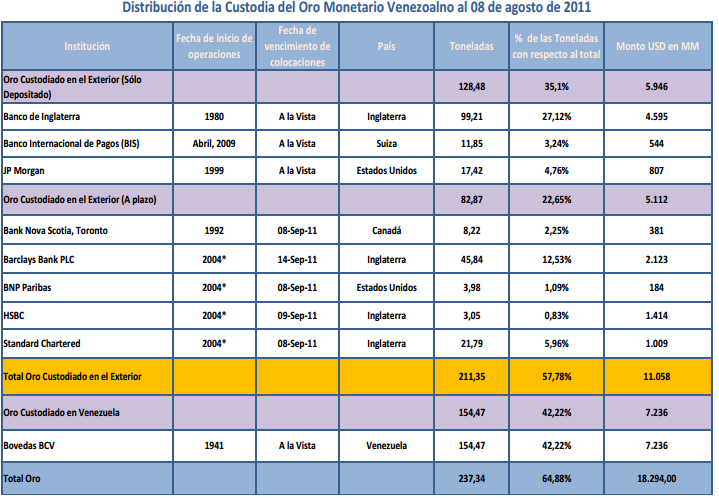

“From 1980 and up until 2011, Venezuela had 99 tonnes of gold at the BoE." True. The BCV had 99.2 tonnes of gold stored at the Bank of England since 1980. See table below of the distribution and location of Venezuela’s gold reserves as of August 2011.

“In 2012, Chavez withdrew 40% of this gold, leaving 50 tonnes there by 2015“. Not fully accurate. The Venezuelan gold repatriation operation started on 25 November 2011 and ended on 30 January 2012. In August 2011, the BCV had 16,908 Good Delivery gold bars held abroad (including gold deposits that were claims on bullion banks). The BCV then repatriated 12,819 Good Delivery bars to Caracas in Venezuela, leaving 4,089 Good Delivery gold bars in the Bank of England’s vaults (about 50.8 tonnes). I would therefore say that the BCV repatriated 50% of its gold held at the Bank of England, not 40%, and that the operation was completed by January 2012. Why Borges/Vecchio say 40% is not clear. Maybe the Bank of England used some gold swaps with another central bank such as the Banque de France as part of the gold transfers repatriated to Venezuela over late 2011 / early 2012 (note: there is some evidence that some of Venezuela’s repatriated gold came from Paris).

“Since 2015, Venezuela lost most of this 50 tonnes of gold as collateral in gold swap transactions, leaving 14 tonnes at the Bank of England." Highly likely, and probably true, but the exact numbers for gold swaps are not known since the details of central bank gold swap transactions with bullion banks are highly secretive and protected by the Bank of England / IMF / LBMA.

The BCV did enter various gold swaps in recent years, such as with Deutsche Bank, Citibank and the Bank for International Settlements (BIS). Gold swap transactions most commonly occur for gold held at the Bank of England. In 2017, the BCV let a gold swap with Deutsche Bank lapse which was using $1.7 billion of the BCV’s gold as collateral. Deutsche Bank then kept the gold that was put up as collateral. This would have been between 30 – 40 tonnes of gold.

Then in April 2018, the BCV paid Citibank $172 million to recover some of the gold that had been collateral in another gold swap with Citi. Rolling up a haircut on the amount the BCV paid Citi, this would be about 5 tonnes of gold returned by Citi to the BCV. So the figure of 14 tonnes remaining after the bullion banks had got their hands on most of the 50 tonnes of Venezuela’s gold at the Bank of England (which appears to have been about 36 tonnes) seems plausible. After the Citi swap was wound up in April, maybe this was when the BCV began asking for its gold back. If this was the case, then the BCV withdrawal request to the Bank of England has been pending for some time now, and all through the summer.

Doing a rough calculation of how many Good Delivery gold bars the remaining 14 tonnes of Venezuela’s gold at the Bank of England now represents, an estimate would be in the region of about 1125 gold bars (or 27% of the original 4,089 gold bars). This is the gold now being frozen by the Bank of England, about 1125 gold bars. If this gold is in custody, it will be set-aside or allocated and the BCV will know the individual serial numbers of every bar. As I wrote previously, the BCV should at the very least publish for everybody to see, the weight list / serial number list of all of these gold bars so that they cannot be confiscated / used by the Bank of England or bullion banks for other purposes, such as being sold to other central bank customers or sold to gold-backed ETFs.

As for the actual letter by Borges and Vecchio, not surprisingly since they oppose Venezuela’s Maduro-led government, the letter uses a series of arguments about Venezuela’s Maduro ‘regime’ to try to convince the Bank of England not to release the gold. These arguments include references to the threat of ‘future crime’ money laundering even before it may exist, human rights violation allegations, allegations about the lack of independence of the BCV, as well as Trump’s Executive Order from 1 November, etc.

Readers can read the full letter for themselves at the above link (3 pages and signature page) to get a sense of the Borges / Vecchio arguments.

A Visit to Threadneedle Street: Calixto Ortega and Simón Zerpa

Less than a week after the Borges / Vecchio letter to the Bank of England became public knowledge, the Venezuelan central bank and government raised the stakes in the tug of war, with news that “two high-ranking Venezuelan officials" were flying over to London to have a meeting at the Bank of England in an attempt to retrieve Venezuela’s 14 tonnes of gold. This meeting was scheduled for Friday 7 December. The two high-ranking officials in question were Venezuelan central bank (BCV) president Calixto Ortega Sánchez, and Venezuelan finance minister Simón Zerpa Delgado.

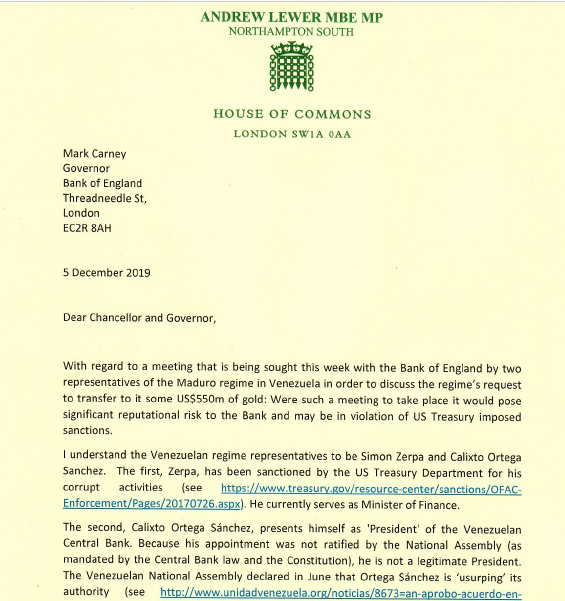

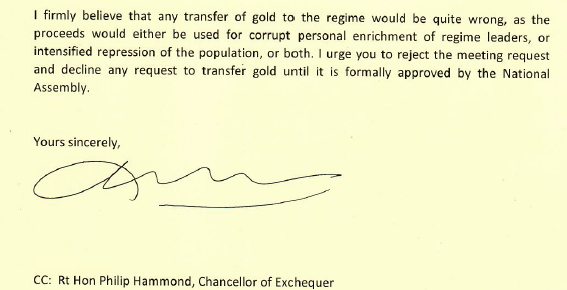

While Reuters was the only media source initially revealing the news that Ortega and Zerpa were coming to visit the Bank, the planned visit was also confirmed by a letter from British MP, Andrew Lewer, who on 6 December also wrote to Bank of England governor Mark Carney (cc’ing the UK Chancellor of the Exchequer Philip Anthony at HM Treasury), asking that any meeting request by Ortega and Zerpa be rejected and any request to transfer the 14 tonnes of gold to Venezuela be declined. Lewer’s full letter in pdf can be read here -> Andrew Lewer letter to Mark Carney.

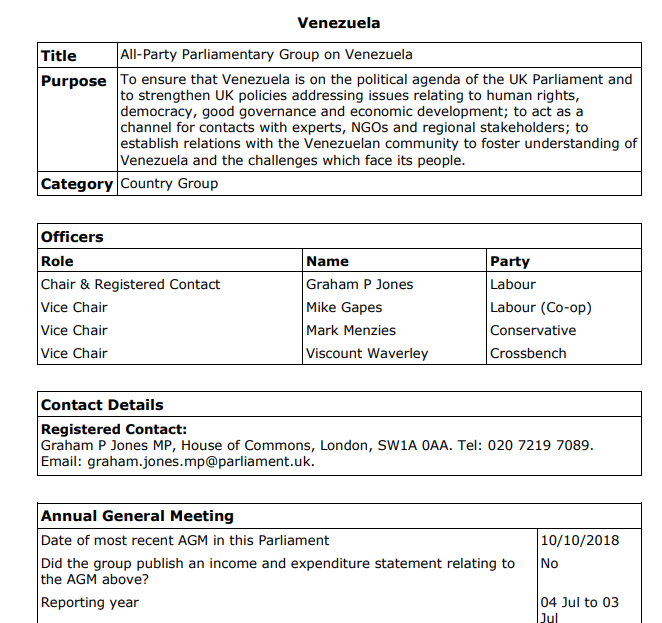

Quite why Andrew Lewer, a backbench Tory MP who was only elected to the UK Parliament for the first time last year, should take it upon himself to write to the Bank of England to try to scupper the Venezuelan meeting with the Bank seems odd. Has he been put up to it? Lewer claims to be vice-chairman of a grouping in Westminster’s parliament called the Venezuela All-Party Parliamentary Group (APPG) but strangely his name does not appear on the latest list of officers of this Venezuela APPG dated 21 November 2018, who are Graham Jones, Mike gapes, Mark Menzies and Viscount Waverley..

In his letter to the Bank of England’s Carney, which reads like a schoolboy letter to the BBC’s Newsround, backbencher Lewer makes reference to the fact that Simón Zerpa was put on a US Treasury list of sanctioned Venezuelan government officials in June 2017 for a previous role he held at state-owned oil company PDVSA. Zerpa was only on this list as it was part of a recommendation made by a US congressional commission on Venezuela which deemed PDVSA to be a corrupt government entity. Interestingly, last April US headquartered Citibank didn’t have a problem returning gold to the BCV at the Bank of England when it unwound the Citi – BCV gold swap, and didn’t have an issue about sanctions since Zerpa was also Venezuelan minister of finance at that time, so obviously this argument from Lewer is as it appears, bogus.

In the case of Ortega who was appointed as BCV president in June 2018, Lewer says that Ortega’s appointment was not ratified properly by the Venezuelan National Assembly. Lewer includes a link to a statement on a website of Venezuelan opposition political coalition website “Mesa de la Unidad Democrática" (Unidad) (Democratic Unity Roundtable in English), to back up his claim. While its true that the National Assembly is now heavily Maduro dominated, this is primarily because the Unidad coalition boycotted the National Assembly election in 2017 and vacated its ability to contribute to the Assembly..

Lewer signs off saying that he thinks ‘any transfer to the regime would be quite wrong’ and ‘urges’ a rejection of the meeting between the Bank of England and the BCV’s Ortega and the Venezuelan minister for finance Zerpa. As a supposedly independent central bank, the question must also be asked, what business does a British Member of Parliament have interfering in the operations of the Bank of England and in its gold storage agreements with its international central bank customers?

Meeting or No Meeting?

So did the meeting between the Bank of England’s Carney (or his lieutenants) and Venezuela’s Ortega and Zerpa actually take place, either on Friday 7 December or any date after that? The simple answer is no one knows. Since the reporting of the intended meeting on 6 December, there has been zero new media coverage of this topic. A report by London financial district newspaper City AM on 6 December said that Bank of England “deputy governor Sir David Ramsden will attend the meeting. It is unclear whether Carney will be present."

So did Sir Ramsden attend the meeting? Did HM Treasury officials such as the Chancellor of the Exchequer Philip Hammond, attend the meeting? Was there even a meeting and did Ortega and Zerpa fly into London or not? The answer a the time of writing is no one seems to know?

As well as the public interest and general media interest, many central banks from around the world (more than 70) store their gold in the vaults of the Bank of England under gold storage agreements, so presumably these central banks will be very interested in knowing the outcome of this bizarre saga of 14 tonnes of gold in limbo in London. If the Bank of England was to take the take Borges / Vecchio / Lewer / US Treasury concerns on board and continue to freeze the Venezuelan gold, then surely it should apply a consistent yardstick, and examine some of the other less salubrious central bank and government customers from aroudn the world that it stores gold bars on behalf of. Should it not?

David Adams in his 3 December article raises the interesting point that on 10 January Maduro begins a new term in office, and that by delaying the gold transfer until after that, it would be easier for the Bank of England to keep the 14 tonnes of gold on the basis of ‘government illegitimacy’.

Whatever happens next, this Venezuelan gold bar drama at the Bank of England is far from over, and the gold could still become a symbol in the battlefront that appears to be forming among the world’s influential powers, with the US and UK on one side, and the gold hoarding nations of China, Russia and Turkey on the other. City AM reports that “Carney discussed the [Venezuelan] gold transfer during a meeting at the G20 summit in Argentina“.

After the same G20 summit, Turkey’s president Erdogan visited Venezuala’s capital Caracas, and ‘slammed Venezuela sanctions’ according to Reuters, saying that “Political problems cannot be resolved by punishing an entire nation…we do not approve of these measures that ignore the rules of global trade.”

Recently, China agreed to lend Venezuela $5 billion during a visit by Venezuela’s Maduro to Beijing in September. And following a Maduro visit to Moscow earlier this month where Russia agreed $6 billion in investment deals with Caracas , Russia has now sent military bomber aircraft to Venezuela in another show of support for Maduro.

With the Bank of England staff now in party mode and many about to leave on their Christmas and New Year breaks, it looks like Venezuela’s 14 tonnes of gold will sit quietly in London until at least January, if not indefinitely. But if the Bank of England governor Mark Carney has sleepless nights, that its a fair bet to suggest that Venezuela’s gold is one of the topics that is keeping him awake at night.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments