The World Gold Council's Funding Model

In a little noticed development at the end of March 2015, World Gold Council (WGC) member company Newcrest Mining of Australia ceased to be a member of the WGC, thereby reducing the Council’s membership from 19 to 18 gold mining companies. Newcrest Mining is one of the world’s largest gold mining companies and Australia’s largest gold miner.

This exit by Newcrest Mining from the World Gold Council followed similar exits in 2014 by three other gold mining companies, namely, the very large South African gold miners Anglogold Ashanti and Goldfields, and the mid-sized Canadian gold miner IAMGOLD. These gold miner departures directly impact the World Gold Council’s annual funding because members’ dues constitute an important component of the Council’s total revenue.

The World Gold Council’s annual revenue consists primarily of ‘Member Dues‘ and ‘Sponsor Fees‘. A third income line item, ‘Other Income’, provides a very marginal contribution to the Council’s revenue.

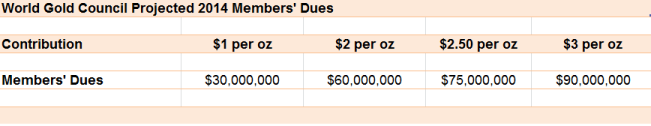

Each gold mining member contributes a US dollar amount each year to the World Gold Council based on the number of ounces of gold produced for that year by that member. Fewer members means less revenue, or alternatively higher members’ dues for remaining members. With the combined Anglogold Ashanti, Goldfields, Newcrest and IAMGOLD producing more than 9 million ounces of gold per year in 2014 (actual production) and in 2015 (forecast guidance), the foregone member dues contributions from these former members will be a big loss to the WGC’s annual revenue, since the lost dues represent about $9 million at $1 per gold ounce members’ dues contribution, or $18 million at $2 per gold ounce contribution.

The departure of Newcrest, Anglogold Ashanti, Goldfields, and IAMGOLD will undoubtedly have been concerning to the Council ‘s remaining directors of the WGC’s board and the Council’s executive management. The departures also leave Barrick, Newmont, Goldcorp and Kinross as the four largest gold miner members in a World Gold Council increasingly dominated by North American, and especially Canadian, gold mining companies.

The WGC’s 18 member list now reads as follows: Barrick, Newmont, Goldcorp, Kinross, Agnico Eagle, Buenaventura, Yamana, Eldorado, Alamos, China Gold, Golden Star Resources, Primero, Franco Nevada, Acacia, Royal Gold, Silver Wheaton, Newgold, Centerra.

Sponsor Fees and GLD Trust Indentures changes

The ‘Sponsor Fees‘ revenue line item in the World Gold Council’s consolidated financial statements refers to fees earned by the WGC’s US subsidiary, World Gold Trust Services from the SPDR Gold Trust (also known as GLD due to its exchange ticker symbol). The relative size of such GLD sponsor fees is dependent on the size of the SPDR Gold Trust in any given year. With huge gold outflows from GLD over the last few years and a lower gold price (the combined effect of which shrinks assets under management in the Gold Trust), this ‘Sponsor Fees’ revenue stream, which is 0.15% of the GLD adjusted net asset value (ANAV), has plummeted. The same is true for the Marketing Agent fees earned by the GLD marketing agent, State Street Global Advisors. In total, these two fees are a combined 0.30% of GLD’s ANAV.

More than 640 tonnes of gold have been withdrawn from the GLD since gold holdings of the Trust peaked at 1353 tonnes in December 2012. It’s notable that, as of early June 2015, the SPDR Gold Trust has just dropped out of the worldwide top 10 ETFs list by size, a list that at one time the GLD occupied top place in.

In another little noticed, but critical, development at the end of February 2015, the World Gold Council’s 100% owned U.S. subsidiary World Gold Trust Services successfully attained (after persistent consent solicitations and consent solicitation adjournments) a majority (51%) of SPDR Gold Trust consent votes so as to amend GLD’s trust indenture to a) increase the sponsor fee from 0.15% per annum to 0.40% per annum, and b) to be permitted to compensate the World Gold Council and its affiliates for the provision of marketing and other services to the SPDR Gold Trust.

When these GLD trust indenture changes are implemented by the SPDR Gold Trust in the near future, it will centralise the payment and disbursement of all GLD marketing agent fees, all GLD trustee fees and all GLD custodian fees to World Gold Trust Services (in addition to the existing ‘Sponsor’ fee), thereby allowing the World Gold Trust Services to revisit the current marketing agent fee arrangement with State Street Global Advisors, while also allowing an increase in the employment of the World Gold Council in the provision of GLD marketing services. These trust indenture changes look primarily to be a revenue generating tactic by the World Gold Council to re-route a larger portion of a shrinking GLD fee pie to itself.

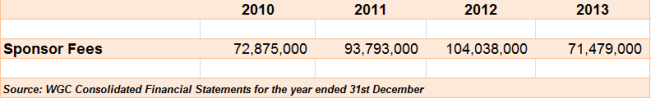

Sponsor Fees dominate Members’ Dues

Since the emergence of the SPDR Gold Trust as one of the world’s largest ETFs, sponsor Fees from the GLD account for a far larger share of World Gold Council revenue than Member Dues, despite the World Gold Council still being widely known as a ‘miner funded’ association. Sponsor fees to World Gold Trust Services (i.e. to the World Gold Council) were $93.8 million in 2011 and a whopping $104 million in 2012, allowing 2012 WGC revenues to reach $169 million. Sponsor fees then dropped by 31% in 2013 to $71.5 million, and plummeted further to less than $48 million in 2014. See table 1 below for 2010-2013 data and see separate section below for 2014 calculations.

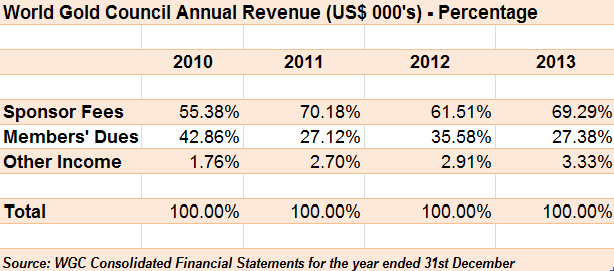

Table 1: WGC Revenues 2010-2013

From 2010 to 2013, the revenue contribution from GLD Sponsor Fees dominated the revenue contribution from WGC member dues, with Sponsor fees running at 55% of total revenue in 2011, 70% in 2011, 61.5% in 2012 and 69% in 2013.

This mix of sponsor fees versus member dues clearly illustrates why the WGC now refers to itself as a commercially driven organisation, as you will see below. It also demonstrates that, in contrast to having diversified revenue streams, the annual revenue of the World Gold Council looks like a one trick GLD pony, or perhaps a two trick GLD and miner pony.

Table 2: WGC Revenues 2010-2013 (percentages)

The World Gold Council has not yet published its consolidated financial statements for 2014, however, the Council’s 2014 revenues from the SPDR Gold Trust can be calculated from the GLD regulatory filings which are available on the SEC EDGAR database website. Likewise, the World Gold Council’s projected revenue from gold miner member dues can be calculated under various scenarios and assumptions. See below.

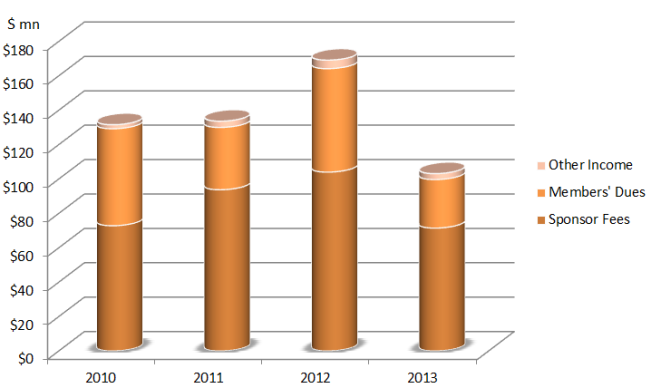

Chart 1: World Gold Council Revenues, 2010-2013, $ millions

Source: WGC Consolidated Financial Statements for the year ended 31st December

In 2013, World Gold Council assets totalled $231.7 million (2012 total assets $296.8 million). In 2013, WGC revenues totalled $103 million (2012 revenues $169 million). By any standards, these assets and revenue totals continue to be substantial, despite the drop in both assets and revenues between 2012 and 2013. However, with member departures in 2014-15 and reduced commercial earnings from the GLD, the question becomes, in light of the low US dollar gold price environment, are the WGC’s revenue streams, and in turn, the WGC’s sizable annual expenditure sustainable without dipping into reserve cash funds and investments?

A discussion of this question requires an in-depth understanding of how the WGC’s revenue is generated and how the Council is funded, which in turn requires an understanding of how the World Gold Council is structured.

Swiss Verein

The World Gold Council (WGC) is registered as a Swiss ‘Association’ (or Verein) under the commercial register of the Canton of Geneva (officially, the Republic and Canton of Geneva). See Swiss Registre Du Commerce (Federal Commercial Registry Office) extract for the WGC here -> WGC Extrait. The WGC’s company numbers are CH-660-0534987-6 and (IDE/UID) CHE-106.151.454. Numerous organisations established in Switzerland are structured as associations, such as the notorious FIFA, which is registered in Zürich (company number CHE-107.301.064). Coincidentally, both the WGC and FIFA employ KPMG Switzerland as their auditors.

A Swiss association comprises members, and in the case of the WGC, the members are its member gold mining companies from around the world. Member firms of a Swiss association control the assets and earnings of the association, so this was probably why the World Gold Council choose such a structure.

In the original Articles of Association of the Council from 1987, Article 1 Preamble, “Name and Purpose" stated that:

“The Association shall be known as the World Gold Council, an Association. It shall be a non-profit association with legal personality under Article 60 et seq. of the Swiss Civil Code and shall have its principal offices in Geneva, Switzerland. It is organized for the purposes of:

a) promoting the use of gold for jewellery, investment, and industrial applications and as a store of value;

b) research and development leading to new uses of gold and gold products; and

c) collecting and disseminating information about gold."

Since 1987, the only amendment to the original Article 1 has been a change in wording to state that the Association “shall have it’s principal offices at such locations as the board of directors may determine from time to time" i.e. not in Geneva.

While the Articles of Association describes the Council as a ‘non-profit association‘, this does not mean that the WGC doesn’t strive to make a profit. Many associations, industry associations or otherwise, do make a profit; they just can’t distribute the profit in the normal way a corporation can. However, the WGC does have a draw-down facility for its members that can be used where profits have been created by a liquidity event such as a sale of assets or investments.

Indeed, over the years the WGC seems to have taken a more generous interpretation of its own ‘Purpose’ as stated in its Articles of Association, and now describes itself as a commercially driven marketing organization, and for example, in 2008, it was using the below self-description:

The World Gold Council (WGC), a commercially-driven marketing organization, is funded by the world’s leading gold mining companies. A global advocate for gold, the WGC aims to promote the demand for gold in all its forms through marketing activities in major international markets."

A 2009 submission to a Basel Committee consultation also reiterated the same theme:

“The World Gold Council’s mission is to stimulate and sustain the demand for gold and to create enduring value for its stakeholders."

“The WGC is a commercially-driven organisation and is focused on creating a new prominence for gold. It has its headquarters in London and operations in the key gold demand centres of India, China, the Middle East and United States."

As recently as 2005, the WGC was still being referred to by one of its members as a non-commercial organisation. This reference was made by Anglogold Ashanti. See section below.

Currently, on its website, the WGC describes itself as “the market development organisation for the gold industry“, with aims to “stimulate demand, develop innovative uses of gold and take new products to market." On a sectoral basis, the WGC focuses on gold mining supply, and demand across the jewellery, technology, investment, and central bank reserve asset management sectors.

Although the registered office of the WGC is in Geneva, the WGC’s head office is now in London, and has been for a long time. As the WGC financial statements say, “the WGC’s principal place of business is London“.

Under the Registrar of Companies (England and Wales), the World Gold Council is registered as an overseas company, specifically, a non-profit association under Swiss Civil Code Article 60, foreign company number FC014324, with a registered office in Geneva. The Council is also registered as a UK establishment company with a company number of BR012707.

The WGC maintains offices in 8 other cities around the world apart from London, namely, New York, Hong Kong, Shanghai, Beijing, Singapore, Tokyo, Mumbai, and Chennai. Note that the offices are all either in large global financial centers or else in large cities within the largest gold consuming nations. World Gold Council offices previously maintained in Dubai, Istanbul, Cairo and Jeddah were closed in 2011.

Note that the usage of the name ‘World Gold Council’ as applied by the WGC itself can refer to ‘The World Gold Council, An Association and it’s subsidiaries or affiliates ( together or alone “World Gold Council”)‘.

The WGC has approximately 20 fully owned subsidiaries, the most important of which (from a revenue generating perspective) is the US-based fully-owned subsidiary World Gold Trust Services LLC (WGTS) which earns the sponsor fees on the SPDR Gold Trust (GLD). World Gold Trust Services LLC, is a Delaware registered company, incorporated on 17 July 2002, with Delaware company number 3548735. See here for the original Certificate of Formation of WGTS, here for amended and restated LLC agreement of WGTS (the sole member of which was the World Gold Council), and here for the original funding agreement between the WGC and WGTS dated October 2004.

Newcrest Mining’s departure

In early April 2015, I spotted that the WGC’s membership page had been amended to state a membership total of 18. The exact wording on the membership page on the WGC’s web site now reads as follows:

“The World Gold Council’s 18 Members are some of the world’s most forward-thinking gold mining companies. They are headquartered across the world and have mining operations in over 40 countries.“

Using the Internet Archive (aka Wayback Machine) to view what this web page stated prior to the above update, the most recent imprint of this web page was 23 March 2015, and it stated:

“The World Gold Council’s 19 Members are some of the world’s most forward-thinking gold mining companies. They are headquartered across the world and have mining operations in 47 countries."

Looking at the amended list of members versus the previous member list, the missing company was Newcrest Mining. The reference to Newcrest on the WGC web site (before it was deleted) was as follows:

“Headquartered in Australia, Newcrest Mining is a gold producer with mining operations in Australia, Papua New Guinea, and Indonesia and in Cote d’Ivoire in West Africa. The company has a global workforce of over 19,000 people.

Website: http://www.newcrest.com.au“

I then emailed Newcrest Mining investor relations / communications asking for confirmation as to whether Newcrest had left the World Gold Council, and if so, the rationale for leaving. Newcrest did not reply to my email.

I then emailed the World Gold Council. My query about Newcrest to the World Gold Council was part of an email with a number of other questions, some of which the WGC media team did reply to, and some of which, including the Newcrest question, they chose not to answer.

Another source confirming the Newcrest Mining departure from the WGC is the Newcrest web site itself, and its Internet Archive imprints. On the Newcrest website under the board of directors’ biographies, as late as 12th April 2015, Newcrest CEO Sandeep Biswas was still listed as a director of the World Gold Council, while Newcrest CFO Gerard Bond was still listed as an alternate director of the Council. These bios listings were then amended during April to delete the references to NewCrest’s directorships on the board of the World Gold Council. See the current Newcrest board of directors web page here.

Anglogold Ashanti and Goldfields

Anglogold Ashanti and Goldfields, the two South African gold mining companies, both departed from the World Gold Council circa June 2014. Anglogold Ashanti and Goldfields were both listed as members on 17th May 2014 (when the total membership was 21), then Anglogold Ashanti and GoldFields had both departed from the World Gold Council by late June 2014, but Silver Wheaton had joined, so the total membership suffered a net reduction of one member and became 20. Despite the name, Silver Wheaton sources both gold and silver, via precious metal revenue streaming, not directly by mining.

Mining publication ‘Mining Global‘ covered the Anglogold Ashanti and Goldfields departures from the WGC in an article on 4 July 2014, when it reported that both companies explained their departures in terms of cost savings:

“We have left the WGC, which is part of our broader focus on costs,” AngloGold Ashanti senior VP for investor relations and group communications Stewart Bailey confirmed.

“The reason for Gold Fields’ departure from the WGC was purely a cost decision,” Gold Fields spokesperson Willie Jacobsz said in an email.

“Members pay per ounce of metal produced and with all the cost-cutting we’ve seen, especially here at Gold Fields, we’ve had a look very carefully at our membership of all sorts of organizations around the world.”

By November 2014, Canadian gold miner IAMGOLD had also departed the Council, bringing the total membership down to 19.

According to a Reuters article in November 2014, IAMGOLD was “withdrawing from the World Gold Council as it reduces its corporate memberships to save money."

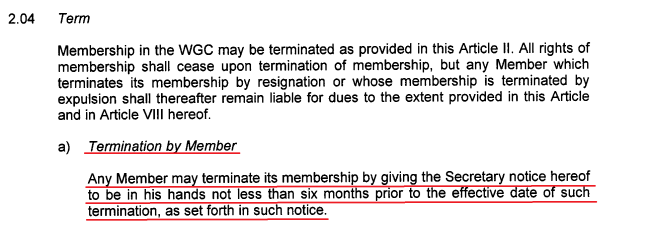

Six Months’ Notice

Therefore, within 10 months of each other, 4 gold miners, 3 of which are major players worldwide and one of which is a mid-sized player, departed from an organisation whose aim is to promote the potential of gold globally and to increase demand for gold worldwide. Ironically, in respect of the World Gold Council’s effectiveness or lack thereof in boosting the gold price (which it claims is not its raison d’être), at least 3 of these gold miners (and probably Newcrest also) departed from the Council because they needed to save money in an environment of a sustained downtrend in the US dollar gold price.

Any World Gold Council member gold mining company that wishes to terminate its membership of the WGC needs to give the WGC 6 months’ notice of such departure, as per the WGC’s Articles of Association. Therefore, South African miners Anglogold Ashanti and Goldfields would have given notice termination to the WGC in about December 2013. Canadian miner IAMGOLD would have given termination notice in about May 2014. And finally, Newcrest Mining of Australia, which lapsed it’s WGC membership at the end of March 2015, would have needed to give termination notice to the WGC in late September 2014. See below for the relevant clause of Article II of the WGC’s Articles of Association on termination of membership.

As recently as October 2013, the World Gold Council had 23 members, specifically 18 full members and 5 ‘Associate’ members. These 5 associate members were Franco-Nevada, Hutti Gold Mines, Royal Gold, China Gold, and Mitsubishi Materials Corp. Full members were known as Category A members in the Articles of Association, while Associates were known as Category B members. WGC then abolished the associate member category in 2013.

By mid November 2013, four of these five associate members had transferred to full membership and the Council then had 22 full members and no associate members. At the same time (October – November 2013), Indian gold mining company Hutti Gold Mines ceased to be listed as a member.

Mitsubishi Materials Corp then departed the member list in the first week of January 2014, bringing the total membership down to 21 members. And as explained above, then Anglogold Ashanti, Goldfields, IAMGOLD, and Newcrest Mining all departed and Silver Wheaton joined.

Going back even further to April 2012, membership of the WGC totalled 24 companies with Coeur d’Alene Mines also a member.

The current role call of the membership list of the World Gold Council (18 members) now reads as follows: Barrick, Newmont, Goldcorp, Kinross, Agnico Eagle, Alamos Gold, China Gold, Golden Star Resources, Primero, Eldorado Gold, Franco Nevada, Acacia, Yamana Gold, Royal Gold, Silver Wheaton, Newgold, Centerra Gold, Buenaventura. Note that Acacia was formerly known as African Barrick Gold.

Of the current 18 members, Barrick, Newmont, Goldcorp and Kinross (in that order) have the largest annual production and are 1st, 2nd, 4th and 5th in the current worldwide top 10 gold producers list . Anglogold Ashanti, GoldFields, and Newcrest, were numbers 3, 6 and 7 on the same list, so their departure from the WGC is a significant blow to the World Gold Council’s members’ dues revenues, which, as explained below, are calculated based on ounces of gold production, billed every three months, and these four gold miners produce more than 9 million ounces of gold per annum.

WGC Source Documents

Neither the WGC’s annual consolidated financial statements nor the WGC Article of Association are published on the World Gold Council web site. However, these documents are key to understanding the finances of the World Gold Council. These documents can be viewed here:

2011: WGC Accounts to 31 Dec 2011

2012: WGC Accounts to 31 Dec 2012

2013: WGC Accounts to 31 Dec 2013

(All WGC consolidated financial statements are audited by KPMG SA, Geneva)

WGC Articles of Association amended September 2011

WGC Articles of Association amended July 2012

WGC Articles of Association amended April 2013

Additionally, the SPDR Gold Trust filings on the SEC Edgar website are essential sources for understanding the sponsor fees generated by GLD, which generate revenue for World Gold Trust Services, and the revenue of which in turn is passed through to the World Gold Council and appears in its consolidated financial statements. These GLD filings also shine a light on the World Gold Trust Services’s persistent attempts (ultimately successful) to amend the SPDR Gold Trust “trust indenture" so as to centralise the payment of the marketing agent fee, the trustee fee, the custodian fee and the sponsor fee to World Gold Trust Services.

I asked the World Gold Council on numerous occasions and through numerous channels as to when it’s 2014 consolidated financial statements would be published, but they declined to answer. The 2014 WGC accounts have to be approved by the WGC board of directors prior to the WGC AGM, so if the AGM has not yet taken place, this could suggest that the 2014 consolidated financial accounts have not been approved. If the AGM has taken place (which I could not ascertain), then the delay in publishing the 2014 financial statements must be for some other reason.

Recent Departure of WGC CFO and WGTS CFO and CEO

Coincidentally, the Chief Financial Officers of both the World Gold Council and it’s US subsidiary World Gold Trust Services have departed recently. The Council’s executive team web page still listed Robin Lee as World Gold Council CFO as recently as 15th March 2015 (but not the week after), although Lee’s LinkedIn profile lists his tenure at the WGC as ending in 2014. Emails to Lee’s WGC address currently respond with the message “Please email Sidney Chan, the new CFO, on all CFO matters“. An email I sent to Sidney Chan about the 2014 financial accounts went unanswered.

According to the most filing on the Swiss registry, the authorised signatories for the WGC are still the President, Randall Oliphant, the CEO, Aram Shishmanian, the CFO, Robin Lee, and KPMG SA of Geneva.

Regarding the GLD Sponsor, World Gold Trust Services, it’s CFO, Adrian Pound, resigned on 10th March 2015. This was 2 weeks after the GLD Sponsor ultimately attained a 51% majority of GLD votes so as to amend the GLD trust indenture. An SEC filing for the SPDR Gold Trust stated:

“On March 10, 2015, Adrian Pound resigned as Chief Financial Officer and Treasurer of World Gold Trust Services, LLC, or WGTS, the Sponsor of the SPDR® Gold Trust. His resignation did not arise from any disagreement on any matter relating to the operations, policies or practices of the SPDR® Gold Trust."

Adrian Pound’s LinkedIn profile currently (as of early June 2015) states “Actively seeking new opportunities“.

It’s quite unusual for the 2 CFOs who were most responsible for the WGC 2014 financial statements to both now be gone from the employment of the World Gold Council old Trust Services, and the 2014 accounts have still not been published.

Additionally, on 31 July 2014, World Gold Trust Services CEO Kevin Feldman also resigned. This was just over one month after WGTS began its consent solicitation campaign with GLD Shareholders to change the Trust Indenture to the benefit of WGTS and the World Gold Council.

“On July 31, 2014, Kevin Feldman resigned as Chief Executive Officer of World Gold Trust Services, LLC (‘WGTS’), the sponsor of the SPDR® Gold Trust (the “Trust”), effective as of August 15, 2014. Mr. Feldman’s resignation was a personal decision and was not as a result of any CEO or WGTS performance-related issue or any other matters related to the operations, policies or practices of the Trust."

It’s not clear from Kevin Feldmand’s LinkedIn profile as to what he is doing now. After Kevin Feldman resigned, Aram Shishmanian, CEO of the World Gold Council, was appointed as acting CEO of WGTS on 31 July 2014 and remained as acting CEO until 8 September 2014, at which point William Rhind was appointed as CEO of WGTS.

Member Dues – The Details

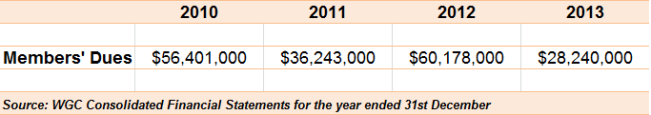

The annual membership ‘dues’, or fees, that the member gold mining companies pay to the World Gold Council can fluctuate widely each year. These member dues totalled $56.4 million in 2010, but only $36 million in 2011. Likewise, members’ dues totalled $60.2 million in 2012, but in 2013 were just under half of the 2012 figure, reaching only $28.2 million.

Table 3: World Gold Council miner Member Dues 2010-2013, US$ millions

Although the number of members in any given year will have an impact on total members’ dues revenue, the wide fluctuations in annual member dues shows that the per member annual fee itself (which can fluctuate each year) is the most important determinant in the equation.

Chart 2: World Gold Council annual Member Dues 2010-2013, US$ millions

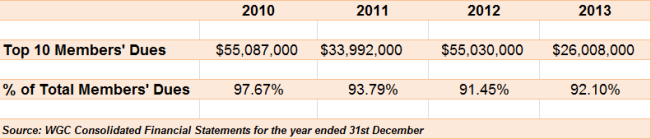

Another important consideration is that, in an organisation which had more than 20 members in each of the years’ 2010-2013, the “Top 10" members’ dues in all of those years accounted for over 90% of all members dues, which illustrates the critical importance of the large gold miners to the funding of the World Gold Council.

In 2010, the Top 10 miners contributed practically all (97.67%) of members dues, and this percentage remained over 90% for 2011-2013. See Table 4:

Table 4: World Gold Council “Top 10" Members’ Dues 2010-2013, US$ millions

In April (2015), I emailed the WGC and asked how it’s member dues were calculated and whether it was based on a metric such as ounces of gold produced by each company each year, size of gold reserves of each company, market cap of each company or some other way. In other words, was it based on a formula?

I also asked about the interaction between the level of Members’ Dues and Sponsor Fees as follows:

“Member dues seem to be able to fluctuate quite substantially between years. For example, in 2012, members dues were $60 million whereas in 2013, member dues were only $28 million. This appears to be because the other main source of WGC revenue, Sponsor Fees, was a lot higher in 2012 than in 2013, thereby allowing the Council to reduce the member dues for 2013. Would it be correct to say that the level of member dues charged in a given year is to some extent influenced by the Sponsor Fees generated in that particular year?"

The WGC media team merely replied to my questions as follows:

“Member fees are defined each year and will be set to reflect a wide range of market conditions and objectives. The World Gold Council has additional revenue streams, including a fee share from SPDR GoldShare (GLD). How fees are allocated is a private business decision."

In its statement “How fees are allocated is a private business decision", the WGC must be referring purely to member dues (which it here called member fees), because the Sponsor ‘fees’ charged by World Gold Trust Services to the SPDR Gold Trust are not a private business decision, they are publicly specified in the Trust Indenture and Prospectus of the SPDR Gold Trust, and also in the numerous SEC filings that GLD makes multiple times per year. The SPDR Gold Trust sponsor fee is currently 0.15% per annum.

The members’ dues allocation is not really a private business decision, it’s more of a goal-seek using a simple formula and a budget projection of revenues and expenditures, taking into account GLD sponsor fees.

Since the WGC media team response did not provide much useful information nor refer me to any useful data sources, we need to turn to the WGC consolidated financial statements, and the Articles of Association, and the GLD filings, which all do provide a lot of useful answers. It turns out that the members’ dues are based on the annual gold production of each member, based on quarterly production summaries submitted to the WGC by each member. It would have been very easy for the World Gold Council to explain this to me, but they chose not to for whatever reason.

Quarterly Gold Production

In the Notes to the WGC 2013 consolidated financial statements, section 3 “Significant accounting polices, Revenue" states that “Members’ dues are assessed and recognised quarterly on an accruals basis. These revenues are recorded at their estimable net collectible amounts."

In the Notes to the 2013 consolidated financial statements, section 19 “Related party transactions" it states that in 2013, the year in which total members dues were $28.24 million, the Top 10 members’ dues totalled $26 million, representing 92.10% of total members’ dues. (the 2012 figures were total members’ dues of $60.18 million, with the top 10 members contributing $55 million, representing 91.45% of total member’s dues).

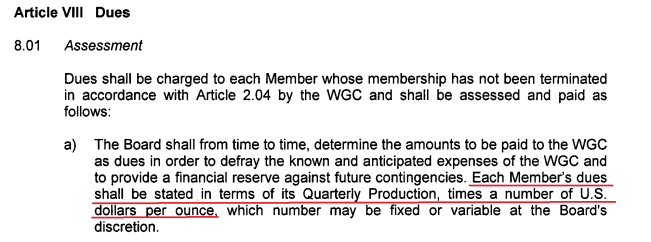

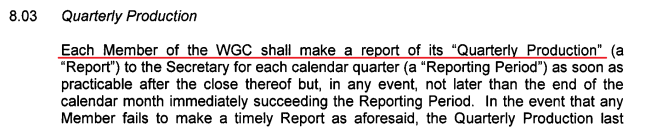

The WGC Articles of Association, specifically , Article VIII ‘Dues’, provides in-depth information on how the member dues are calculated. Article VIII explains how each member’s dues are calculated using a formula based on quarterly gold production multiplied by X US dollars per ounce (where X seems to be at least >= 1).

As Article 8.01 states:

After every quarter, each member is expected to report its quarterly gold production to the WGC as soon as practicable. Quarterly production consists of either “ounces of refined gold" or “gold content of ore and concentrate" primarily under the operational control of that member, and then various other proportions for other operations in which that member may have an interest etc etc.

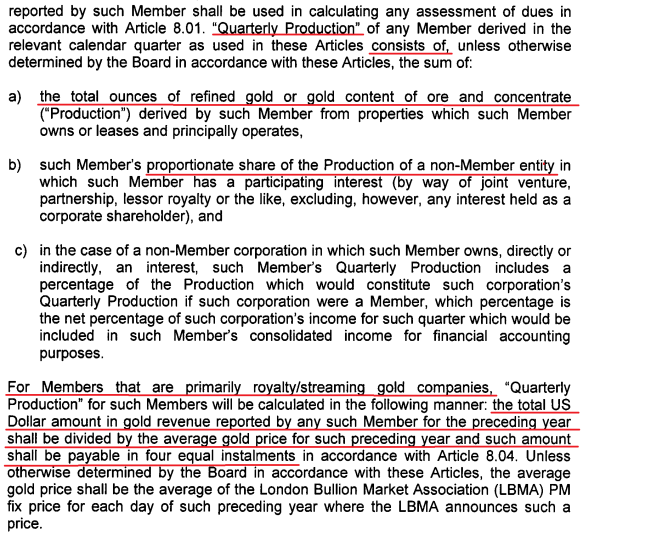

Because gold royalty/streaming companies are now also members of the WGC, i.e. Royal Gold, Silver Wheaton and Franco Nevada, the Articles of Association (2013 version) also addresses how the member dues of such companies are calculated. The formula for the member dues of a royalty/streaming company is simply that company’s annual US dollar revenue divided by the average gold price for the previous year, payable in 4 installments. So that’s $1 per ounce of gold. For example, if a royalty company had $300 million in revenue, and the average gold price was $1200 during the year, the member’s dues to the WGC would be $300m / $1200 = $250,000.

Before the ‘Associate’ member category was discontinued in 2013, the WGC charged ‘Reduced Dues’ or ‘Associate Dues’ to associates (category B members), as opposed to ‘Regular Dues’ for Full members (Category A members). These “associate dues" were specified as “a fixed annual fee in US dollars", and not a per ounce dollar amount.

Per ounce dollar amount – some examples

In 2001, a Telegraph article reported that “The Gold Council will announce this week that it has increased its membership fees from $1 per ounce mined to $2."

Back in 2003, a ‘Minesite’ article about the WGC said that the “subscription to the World Gold Council … amounts to US$2 for each ounce of gold produced."

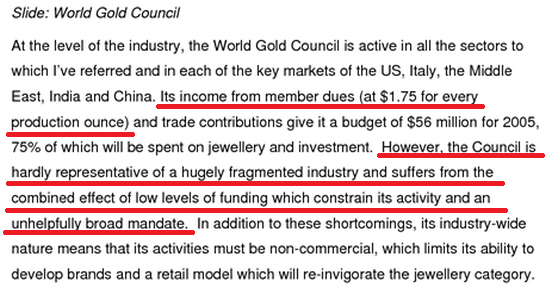

An Anglogold Ashanti presentation from 2005 (when Anglogold Ashanti was a WGC member) said that the World Gold Council’s “income from member dues" was “$1.75 for every production ounce." The same 2005 presentation also pointed to some of the limitations of the WGC such as it being non-representative, suffering from funding constraints, and also as being “non-commercial“. As to when the World Gold Council went from being non-commerical to ‘commercially driven’ is not clear, but it seems to have been somewhere between 2005 and 2008, as the GLD became more important to total revenues.

The Per Ounce Formula – Retrofitting

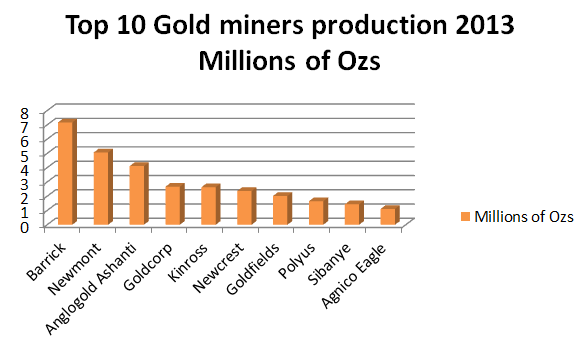

We now know that the World Gold Council uses a simple ‘US dollar per ounce of gold production‘ formula when setting annual members’ dues, and that it can be a round figure dollar amount such as $1 or $2 per ounce, and also can be a dollar and cent amount such as $1.75 per ounce. Let’s take a quick look at annual gold production figures for 2013 using the top 10 gold miners as a proxy to see how closely they fit in with this formula.

Members’ dues were $28.24 million in 2013, with the top 10 members contributing $26 million, or 92% of the total. A February 2015 article by Mining.com provides estimated annual gold production statistics for the" world’s top 10 gold producers" in 2013 and 2014.

With Moz = millions of troy ounces, in 2013 Barrick produced 7.17 Mozs of gold, Newmont 5.07 Moz, AngloGold Ashanti 4.11 Moz. Goldcorp 2.67 Moz, Kinross 2.63 Moz, Newcrest Mining 2.36 Moz, Gold Fields 2.02 Moz, Polyus Gold International (Russian miner) 1.65 Moz, Sibanye Gold Limited (South African) which split from Gold Fields in February 2013 mined 1.43 Moz, and in 10th position was Agnico Eagle Mines Ltd with 1.1 Moz.

These 10 miners produced 30.22 Moz of gold in 2013. Excluding WGC non-members Polyus and Sibanye, the production figure was 27.14 Moz. Excluding Agnico Eagle (which mined 1.1 Moz), the top 7 produced 26.03 Moz. So, it looks like the World Gold Council charged its members a subscription dues of about $1 per ounce of gold production in 2013. Let’s call it a round $1 per ounce. You could add back Agnico Eagle and a few other miners such as Yamana and Buenaventura to arrive at 28 Moz. This would account for the 2013 members’ dues of $28.24 million, so the real fee might be a few cents less than a dollar. However, a dollar is roughly in the ballpark of what the members’ dues charge looked to be, and its easy to conceptualise.

This would also suggest that in 2012, when members’ dues totalled $60.17 million, that the World Gold Council charged its members $2 per ounce of gold produced or thereabouts.

Chart 3: Top 10 Gold Miners 2013, millions ounces, data from Mining.com

Data: Mining.com

GFMS published slightly different top 10 gold miner production figures to Mining.com for 2013 production. The GFMS 2013 data in tonnes, via Mineweb was: Barrick 222. 9, Newmont 157.5, Anglogold 127.7, Goldcorp 82.9, Kinross, 77.7, Navoi (Uzbek) 70.5, Newcrest, 73.5, Goldfields 58.1, Polyus 51.3, Sibanye 44.5 tonnes. These tonnes figures, when converted to ounces, gives a total of 31,076,190 ozs, or 31.1 Moz.

Excluding Polyus, Sibanye, and Navoi, then the Top 7 producers, who were all members of the WGC in 2013, produced 25.8 Moz in 2013. So, these GFMS figures also support the assumption that the WGC charged its members a member dues of about $1 per ounce in 2013.

Similarly, in 2011, it looks like members contributed about $1 per ounce of production or a little more (using figures from Mining.com), and possibly an amount between $1.66 and $1.75 per ounce in 2010. Therefore, although 2014 World Gold Council financial statements not yet published, it’s still possible to project the contribution of members’ dues to total WGC revenue, using 2014 gold production statistics and assumptions of various dollar contributions per ounce as member dues.

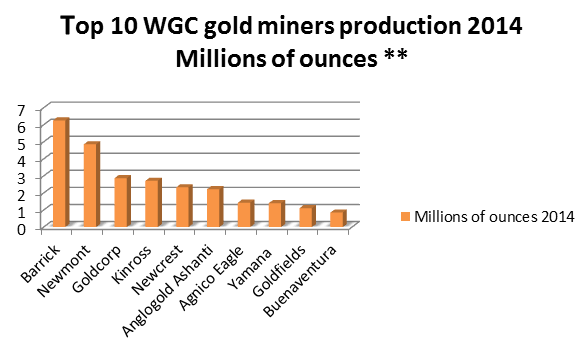

Applying the Per Ounce Formula to 2014

Again using Mining.com provided data, in 2014, Barrick reported 6.25 Moz in gold production, Newmont 4.85 Moz, AngloGold Ashanti 4.44 Moz, Goldcorp 2.87 Moz, Kinross 2.71 Moz, Newcrest Mining 2.33 Moz, Gold Fields produced 2.22 Moz, Polyus Gold 1.7 Moz, Sibanye Gold 1.59 Moz, and in 10th position Agnico Eagle with 1.43 Moz.

Let’s assume that the date on which Anglo Gold Ashanti and Gold Fields departed from the World Gold Council was 30 June 2014, so only half their 2014 production can be included (They departed sometime in May or June according to the WGC web site). Excluding non-members of the WGC, Polyus and Sibanye, and also excluding half of the 2014 production of Anglogold Ashanti and Goldfields, gives a total gold production from the above eight miners of 23.77 Moz. Add in two other World Gold Council companies to bring the list back to ten miners. In this case, I add in Yamana, which reported 2014 production of 1.4 Moz, and Buenaventura with 0.85 Moz in 2014, so in total, this top 10 list would represent about 26 million ounces.

Chart 4: Top 10 Gold Miners 2014, millions ounces, assuming 50% contribution from Anglogold Ashanti and Goldfields, and also assuming Yamana and Buenaventura in Top 10

Data: Mining.com

Beyond the Top 10 gold producers

The list of gold producers outside the worldwide Top 10 includes many gold mining companies who are not members of the World Gold Council, and some who are not purely or primarily gold miners. Therefore, the drawback with a published top 20 list of miners that produce gold, such as one by Mineweb here, is that many miners on the top 20 list from positions 8 up to 20, such as Navio, Polyus, Sibanye, Randgold, Harmony, Shandong, and China National Gold are not members of the World Gold Council, and some listees such as Freeport and Glencore are not primarily gold miners. The only two that make the 8-20 positions ranking, and that are also WGC members, are Agnico Eagle and Yamana.

According to Mineweb’s Top 20 list for 2014, World Gold Council member listees (including Anglogold Ashanti, GoldFields, and Newcrest) produced 874 tonnes (28.1 Mozs) of the Top 20’s total 1311 tonnes production, or 66% of the Top 20 total.

Excluding Anglogold Ashanti, GoldFields, and Newcrest, the remaining Top 20 miners that are also World Gold Council members produced 595 tonnes (19.13 Mozs), or 45%, of the 2014 top 20 total. So, the WGC now only represents less than half of the Top 20 gold producers (by ounces produced).

Since this worldwide top 20 list is problematic to an analysis of the WGC, a top 20 list (or all 21) that comprised WGC members in 2014, has to be reconstructed.

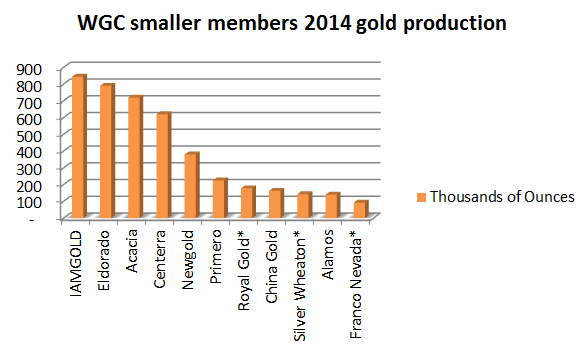

Beyond Agnico Eagle and Yamama (and Buenaventura), some other WCG members such as 2014 member IAMGOLD with 844,000 ozs, and current member Eldorado Gold with 790,000 ozs, also produced reasonable amounts of gold in 2014.

Chart 5: Smaller WGC Gold Miners 2014, millions ounces produced

Data: Company websites, results presentations and results reports

Overall, the following eleven WGC member gold miners and gold royalty/streamers produced about 4.3 million ozs of gold or gold equivalent ounces in 2014:

IAMGOLD (844,000 ozs), Eldorado (790,000 ozs), Acacia (719,000 ozs), Centerra (621,000 ozs), Newgold (380,000 ozs), Primero (225,000 ozs), Royal Gold* (178,000 ozs), China Gold (163,443 ozs), Silver Wheaton* (142,800 ozs), Alamos (140,500 pzs), Franco Nevada* (92,774 ozs).

These production figures were sourced on company websites, company results presentations and end-of-year financial reports, but are listed here purely as indicative figures. Note also that * = Royalty company or Streamer company, and the ounces figures listed for these companies are for gold equivalent ounces (GEOs) or similar, and haven’t been cross-referenced with other sources.

So in total, the members of the WGC members still produced just over 30 million ounces of gold in 2014. Newcrest still contributed a full year in 2014, and the assumption is that Anglogold Ashanti and Goldfields still contributed about half a year. The impact on member dues will become more apparent for 2015 revenue. Even though Anglogold Ashanti and Goldfields left in 2014, some of the smaller members have now increased production, and the top 10 members now look as if they are contributing about 86%-87% of total member dues.

At $1 per ounce, member dues for 2014 would be about $30 million.

It would be logical for variable members’ dues for a forthcoming year to be set towards the end of the preceding year. With 2013 sponsor fees from the SPDR Gold Trust well down on 2012 due to gold outflows from the GLD and a lower gold price, the World Gold Council board would probably have decided that member dues should increase for 2014. Therefore a more realistic members’ dues for 2014 would be $2 per ounce or even higher. Given that both Alglogold Ashanti and Goldfields both exited from the World Gold Council around June 2014, this would suggest they informed the WGC of their intention to leave in about November/December 2013.

November/December 2013 may have been the time at which the WGC informed members of revised members dues for the year 2014. And since Anglogold and Goldfields decided to leave, because of a need to save costs, it would be logical to assume that the 2014 member dues were higher than in 2013, and possibly high enough that an increase in members’ dues forced the South Africans to balk and walk away. This would suggest a 2014 contribution per ounce of gold produced of $2 or $2.50 and maybe, but less likely, as high as $3 per ounce.

Table 5: 2014 Projected WGC Members’ Dues, US$ millions

Interestingly, for Q1 2015, Newcrest Mining increased gold production to 610,186 ozs, from 577,110 oz in Q4 2014, so on an annualised basis, Newcrest may produce about 2,440,000 ozs in 2015. With Newcrest Mining having exited from the WGC at the end of Q1 2015, this substantial member’s dues will also be missing from the 2015 revenue numbers, as will the 2.2 million projected 2015 ounces from Goldfields, the 4.0 million – 4.3 million ounce 2015 guidance for Anglogold Ashanti, and the 820,000 – 860,000 ounce 2015 guidance from IAMGOLD.

In total, somewhere between 9.46 million – 9.80 million ounces of gold production that otherwise would be factored into WGC 2015 revenues will now be missing. At $2 per ounce, this is nearly $20 million, and starts to look like quite a big hit for the WGC’s annual budget to take.

SPDR Gold Trust (GLD) – Sponsor Fees

Between 2010 and 2013, the majority of the World Gold Council’s revenue was earned via ‘Sponsor fees’ accruing to the Council’s fully owned US subsidiary World Gold Trust Services LLC (WGTS) in return for acting as ‘Sponsor’ to the SPDR Gold Trust. These sponsor fees were 55% of World Gold Council total revenue in 2011, 70% in 2011, 61.5% in 2012 and 69% in 2013.

A board of directors was established for WGTS in January 2013. According to Reuters, the members of the board of directors of WGTS are William Rhind, the WGTS CEO, William Shea, chairman of the board, Aram Shishmanian, CEO of the World Gold Council, and also two other directors Neal Wolkoff and Roco Magiotto. Andrian Pound, the ex CFO, was also listed as a member of the board when the director list was drawn up by Reuters.

Within the SPDR Gold Trust (GLD) structure, the sponsor fee is payable monthly in arrears to World Gold Trust Services and is currently accrued daily at an annual rate equal to 0.15% of the adjusted net asset value (ANAV) of the Trust. The sponsor fee that World Gold Trust Services will earn will soon change to 0.40% per annum – see discussion below on the recent GLD consent solicitation. Because the sponsor fee in the GLD is specified as a percentage of the Trust’s asset value, as the asset value of the Trust increases, the sponsor fee naturally increases. Conversely, as the asset value shrinks, the sponsor fee does likewise.

Looking at historical GLD holdings data (see spreadsheet xls link on webpage here), the amount of gold held in the SPDR Gold Trust rose sharply between 2006 and 2010. From a daily average gold holding of 372 tonnes during 2006, the daily average gold holding increased to 499 tonnes during 2007, 669 tonnes in 2008, 1068 tonnes in 2009, and 1233 tonnes in 2010. This 1200+ tonne average daily gold holding in the Trust was maintained in 2011 and 2012, at 1238 tonnes and 1244 tonnes, respectively.

Therefore, on the back of very strong growth in the asset value of GLD in the years up to and including 2012, the sponsor fees earned by the World Gold Council (via its subsidiary WGTS), also grew strongly. This direct “GLD Asset Value ~ Sponsor Fee" relationship allowed the World Gold Council to generate sponsor fee revenue of $72.8 million in 2010, $93.8 million in 2011, and $104 million in 2012.

Table 6: Sponsor Fees to WGTS (& WGC) from SPDR Gold Trust (GLD), 2010-2013, US$

Gold holdings only began exiting the GLD in a significant way in 2013, a downtrend which continued in 2014. In 2013, the average gold holding in the Trust fell to 998 tonnes, and then fell further to an average of 779 tonnes for 2014.

As cash and gold flowed out of the GLD in 2013, the sponsor fee took a large hit and fell to $71.5 million for the 12 months to December 2013 from $104 million in 2012. You will also see below that the total sponsor fee for 2014 fell a further 33% to $47.8 million for the year ending 31 December 2014.

Outflows of cash and gold from GLD continued in 2015, and for the five months from January 2015 to May 2015 inclusive, the daily average amount of gold held in the GLD was 742 tonnes. As of early June 2015, the GLD only holds 708 tonnes of gold, about the same as it held in September 2008. This is why, as mentioned in the introduction, the GLD has now fallen out of the Top 10 ETFs worldwide, by size.

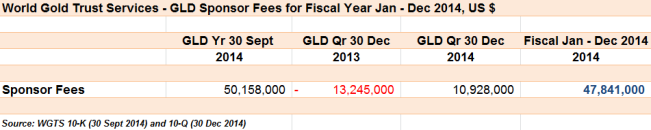

Although the World Gold Council has not yet published its 2014 consolidated financial statements, it’s very easy to calculate exactly what the GLD sponsor fees were in 2014 (and also in Q1 2015) because they are published in detail in up-to-date GLD regulatory filings (which are unaudited financial statements). GLD uses a fiscal year from October to the following September, so it has a year-end on 30 September. So, to calculate the GLD sponsor fees between January 2014 to December 2014, all you have to do is subtract Q4 2013 from the full GLD fiscal year figures in its 10-K filings and add Q4 2014 from its 10-Q filing, or else add up four quarters in four of the 10-Q filings.

To check that this type of calculation makes sense, we can work out what Jan -Dec 2013 fiscal year sponsor fees would be just using GLD filings data.

The GLD sponsor fee for the 3 months to end of December 2012 was $28.006 million. The sponsor fee for the 3 months to end of December 2013 was $13.245 million. (GLD 10-Q for quarter-end Dec 2013) The sponsor fee for the year ended 30 September 2013 was $86.152 million (GLD 10-K for year-end Sept 2013).

(86.152m – 28.006m) + 13.245m = 71.391m

This $71.391 million is very close to the World Gold Council’s reported sponsor fee figure of $71.479 million for fiscal year January – December 2013. Therefore, the same approach can be used to calculate the 2014 full year figure.

2014 GLD Sponsor Fees: $47.8 million

For the year ended 30 September 2014, GLD sponsor fees only totalled $50.148 million (10-K). For the quarter ended 31 December 2013, sponsor fees were $13.245 million (10-Q). For the quarter ended 30 December 2014, sponsor fees were $10.928 million. This produces GLD sponsor fees for the January to December 2014 fiscal year of $47.841 million.

Table 7: Sponsor Fees to WGTS (& WGC) from SPDR Gold Trust (GLD), 2014, US$

Given that the calendar year 2013 GLD sponsor fees of more than $71 million looked very low relative to the comparable full year figure of $104 million in 2012, the 2014 total of $47.8 million looks shockingly low on a relative basis. This is 33% below the 2013 GLD sponsor fee, and a massive 54% less than the 2012 GLD sponsor fee. Which is why the recent consent solicitation by World Gold Trust Services to alter the terms of the trust indenture looks increasingly interesting.

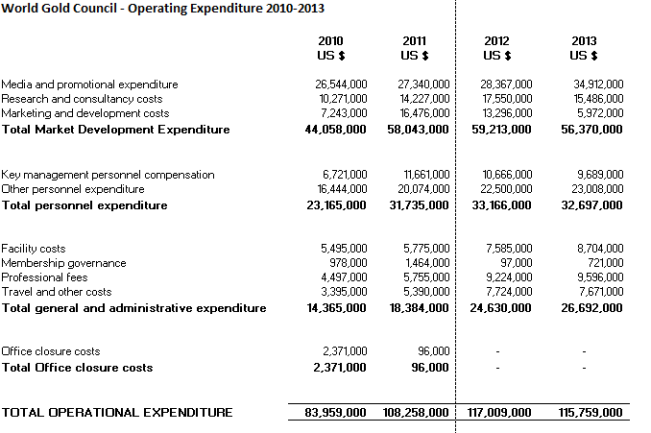

World Gold Council Expenditures

World Gold Council total expenditures were running at $84 million for 2010, $108 million in 2011, $117 million in 2012, and nearly $116m in 2013 (so for the 2011-2013 period, expenditures were averaging over $113 million per year). In each of the four years featured in the table, market development expenditures account for roughly half of annual expenditure, with personnel, and general & administrative expenditures comprising the other half. Nearly all sub categories of expenditures within these three main categories have risen sharply in the 2010-2013 period. The strong revenues generated from GLD sponsor fees have most definitely facilitated this huge expenditure increase over 2010-2013. Without GLD, the World Gold Council’s member dues would not have covered even half this expenditure.

Table 8: WGC Operating Expenditures, 2010-2013, US$

As an illustration of what the World Gold Council spends on itself, consider the real estate that the World Gold Council occupies.

WGC Offices in London and Manhattan – No expense spared

Since the WGC first opened an office in London at 6 Carlton Gardens in 1987, it was moved address quite frequently within central London, always within the plushest of London locations, first to 10 Haymarket in 1991, then to 45 Pall Mall in 2000, then to 55 Old Broad Street in the Square Mile in 2003, and most recently in 2010 to 10 Old Bailey (still in the City of London). To the World Gold Council, image and location seem to be critical.

The rationale for the 2003 London move from Pall Mall to Old Broad Street was explained by then CEO James Burton in 2008 as follows:

“We wanted to be in the City…We firmly believe that a central component of the gold story is investment."

In a June 2011 statement, it was announced in New York that the World Gold Council had:

“signed a 10-year, 11,500-square-foot lease to relocate to 510 Madison Avenue, more than doubling the size of its New York City headquarters. The World Gold Council will be moving from 4,948 square feet at 424 Madison to occupy the entire ninth floor of the recently developed building at 510 Madison Avenue in Midtown Manhattan."

“The World Gold Council will build out the space to mirror its London headquarters, designed by British architect Peldon Rose."

“Their [the WGC’s] new home at 510 Madison will help shape their corporate image not only as an advocate for the gold industry but as a leader in the global investment community as well."

Turning back to London, the new WGC London headquarters (occupied in 2010) is a fully redesigned building in Old Bailey can be seen here in this Peldon Rose project profile, which notes that:

“The new Old Bailey location allowed us to work with truly striking architecture. So once we had a sound understanding of the building, we set out to create a modern space that looks like it was built from scratch especially for the World Gold Council."

“the office interiors – with their Wenge veneers sitting next to white glass partitions and floating walls – are full of drama. Of course, we couldn’t entirely leave out the gold, but we kept it subtle, with pendant lighting and inlaid carpeting to soften the design".

An April 2012 feature on Peldon Rose shed more light on the Council’s London HQ, revealing that:

“In the World Gold Council offices an innovation room was created. Peldon Rose was conscious about the importance of creating a room that was completely different from the rest of the formal office space. This area has been furnished with off -the-wall iconic pieces of furniture and has an electronic wall that will digitally copy anything that has been written down, capturing spur of the moment brain storm ideas."

What the above glossy corporate architect-speak does not mention, but which is buried in the WGC financial statements, is that:

“In the prior year [2010] due to rental conditions, it was not expected that the contract for the former London office in Old Broad Street would be re-let, and as such an onerous provision of US$ 1.5 million (£971,000) was recognised.“

A tenant was eventually found for the Council’s Old Broad Street office in 2011 and the lease was then re-assigned to that tenant. However, more persistent lease problems flared up due to the New York office move:

“Other provisions include an onerous lease contract in New York for a non-cancellable lease for office space. Due to changes in its activities and a requirement for larger office space, the World Gold Council had ceased using this space in September 2011. The facilities have been sub-leased for the remaining lease term, but changes in market conditions have meant that the rental income is lower than the rental expense. The obligation for the discounted future payment, net of expected rental income has been provided."

In other cities around the world, the World Gold Council also maintains offices in some of the most prestigious office towers, such as the 57th floor (near the top) of the Republic Plaza, on Raffles Place in Singapore, one of Singapore’s tallest skyscrapers; the 19th floor of 2 International Financial Centre, Hong Kong island’s pre-eminent landmark; and the 48th floor of the skyscraper at 1717 Nanjing Road in Shanghai.

Will 2014 revenues have covered the expenditure trend?

If 2014 members’ dues were based on $1 per ounce of gold produced (and so totalled about $30 million), when added to the relatively small 2014 GLD sponsor dues of $47.8 million, and about $4 million in other income, this would only bring total 2014 revenues to about $82 million, the same as the 2010 spend.

Members’ dues for 2014 of $2 per ounce would bring in another $30 million, bringing 2014 total revenues up to about $112 million, just short of the average WGC annual expenditure for the three years prior to 2014. Therefore, the WGC may even have raised member dues above $2 per ounce in 2014, for example to $2.50 per ounce of member gold produced.

Obviously the World Gold Council CFO and team would have been projecting all of the above 2014 budget estimates during 2013. Indeed, it is required as per the WGC Articles of Association. Article IX of the WGC Articles of Association, “Financial Provisions", section 9.01 Annual Budget states that “An annual budget, setting forth an estimate of revenues, expenses and financial reserves, if any, for the succeeding fiscal year [January to December] shall be prepared under the direction of the CEO, and approved by the Board."

In 2013, WGC Operational Expenses of $115,759,000 exceeded Total Revenue of $103,135,000, causing a deficit in results from Operational Activities of $12,624,000. These deficits ultimately have an adverse effect on the Council’s equity reserves. It will be interesting to see how the revenue to expenses equation pans out for fiscal year 2014 when the WGC’s consolidated financial statements for 2014 are eventually published.

The falling gold price in US dollar terms has hit the World Gold Council from all sides. A lower USD gold price has put gold miners into cost cutting mode, and made them more likely to reject higher World Gold Council members’ dues by departing. The lower USD gold price has also undermined the institutional investor base that was a large part of the success of the GLD, and so has undermined WGTS GLD sponsor fee revenue.

The WGC’s revenue model appeared at first glance to be one where the Council had essentially full control over members dues and a lot less control over GLD fees. However, in June 2014, World Gold Trust Services moved to exert full control over all of the fees of the SPDR Gold Trust via initiaing some critical changes to the sponsor fee calculation and the GLD trust indenture via a consent solicitation to GLD shareholders. This is likely to see the World Gold Council gain far more revenue from the GLD in the near future.

The GLD Consent Solicitation – Flogging a Golden Goose

Between June 2014 and February 2015, the GLD Sponsor, World Gold Trust Services, ran a protracted and non-stop blitz-like global consent solicitation campaign to try to persuade 51% of the beneficial owners of GLD Shares to consent to (vote for) 2 proposals that WGTS was desperate to push through. These two Sponsor proposals were to:

a) increase the Sponsor fee from 0.15% per annum to 0.40% per annum

b) to be permitted to compensate the World Gold Council and its affiliates for the provision of marketing and other services to the SPDR Gold Trust

Teeing up these 2 proposals for implementation required amendments to the GLD Trust Indenture. Changes of this nature to the Trust Indenture required 51% of GLD Shareholders to consent, hence the consent solicitation campaign. This 51% threshold was eventually reached on 25 February 2015, after which the consent solicitation campaign was halted.

To fully understand the significance of the consent solicitation process that took place between June 2014 and February 2015, and the upcoming changes to the GLD fee structure in the near future, requires an understanding of the GLD Trust Indenture and the GLD Marketing Agent Agreement, as well as an understanding of how the GLD Sponsor and current GLD Marketing Agent are currently compensated versus how they will be compensated in the future. This will also allow a better understanding of the Sponsor’s real (as oppossed to stated) motivations behind the consent solicitation campaign.

Part 2 of this World Gold Council funding series analyses the GLD Consent Solicitation campaign and further considers the GLD golden goose future fee structure.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments