Swiss Pressure Against UAE Gold Imports Causes Rebuttal

There have been some intriguing new developments in the ongoing competitive confrontation between the United Arab Emirates (UAE) / Dubai gold market and the incumbent ‘western gold market’ (centred on the LBMA London gold market and the LBMA Swiss gold refineries).

Readers may recall some previous BullionStar articles on this theme, such as “In Delusional Push, LBMA Threatens to Blacklist Entire Gold Trading Centres”, 24 November 2020, and “In Ongoing Saga, Dubai Stands its Ground with the LBMA”, 18 June 2021.

While the latest intrigue involves the economic arm of the Swiss Government taking a swipe at the UAE / Dubai gold sector via a warning to the big Swiss gold refineries, these latest developments are best viewed in the wider context of the recent attacks against Dubai / UAE by the LBMA, and UAE / Dubai’s counter initiatives.

And it’s hard not to see that in all of this, ‘all roads lead to London’, with the LBMA bullion bank gold cartel attempting to protect it’s market against the competitive threat of a surgent UAE / Dubai.

Letter seen by Bloomberg in London

On 15 October 2021, an article appeared on Bloomberg, titled “Switzerland Tells Refiners to Get Strict on UAE Gold”. Written by Bloomberg reporter, Eddie Spence, the article states that the Swiss State Secretariat for Economic Affairs (known as SECO) wrote to Switzerland’s gold refineries, telling the refineries to increase scrutiny of gold imports from the UAE:

“Switzerland has told its gold refineries to tighten up audits on imports arriving from the United Arab Emirates to make sure illicit African bullion isn’t involved.

In a letter dated Oct. 11 seen by Bloomberg, the State Secretariat for Economic Affairs said refineries should ensure sufficient steps are taken to identify the true country of origin for all gold coming from the UAE.

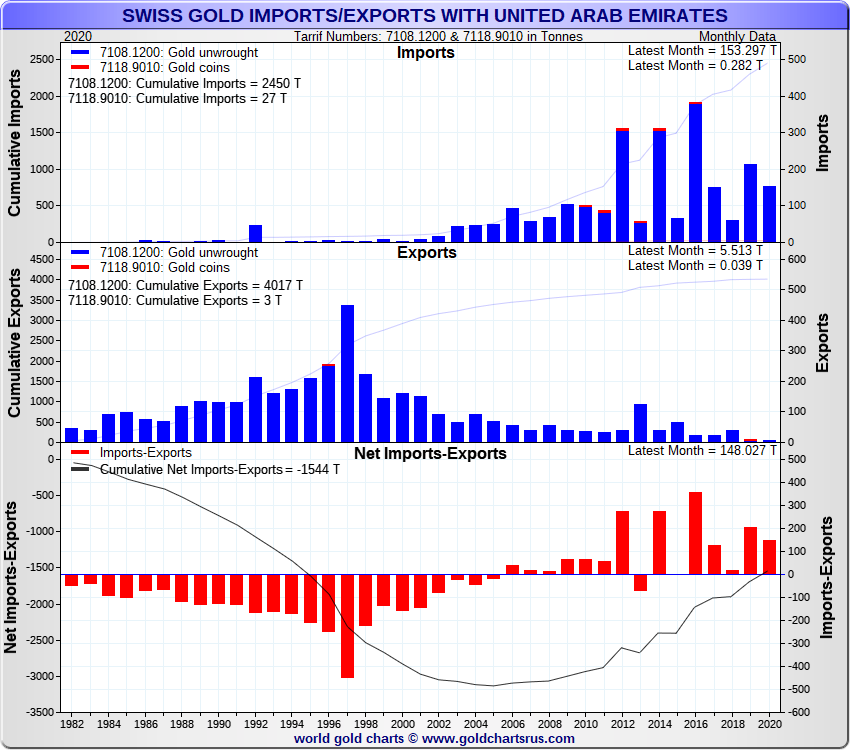

He pointed to the high volume of imports coming from the state, which is set to account for 10% of Switzerland’s total in 2021.

Erwin Bollinger, head of the bilateral economic relations division, also told the refineries that Swiss President Guy Parmelin plans to visit the UAE later this month.”

The Bloomberg article also included a short response from UAE Minister of State for Foreign Trade Affairs, Thani Ahmed Al Zeyoudi, who said that “we have long been cooperative with all international regulations and best practices including anti-money laundering efforts and unethical sourcing of gold,”

Note that Switzerland is home to the world’s four largest gold refiners, namely, PAMP, Valcambi, Argor-Heraeus and Metalor, all four of which are members of the London Bullion Market Association (LBMA), and all four of whose wholesale gold bars are approved on the current LBMA Good Delivery List for gold. However, there are no UAE gold refiners on either the current Good Delivery List or the Former good delivery list of the LBMA.

Interestingly, while on the surface this may look like a Swiss matter, the Bloomberg article ended with a reference to the LBMA, saying that:

“The London Bullion Market Association last year threatened to blacklist countries that didn’t meet its standards on responsible sourcing, a move targeted at Dubai”

Below we will look at how a Bloomberg reporter in London may have ‘seen’ a private letter from SECO to the Swiss gold refineries, but from the article it’s clear that Bloomberg did not talk to SECO as it states that “the state secretariat in Bern didn’t respond to requests for comment.”

Swift Response from Dubai

Not surprisingly, following publication of the Bloomberg article on 15 October, it didn’t take long for a comprehensive response from Dubai / UAE lambasting the Swiss letter, and not surprisingly it was from Ahmed Bin Sulayem, executive chairman and CEO of Dubai Multi Commodities Centre (DMCC), who on previous occasions has defended the UAE gold industry against attacks from the LBMA (see here and here), and who is also central to initiatives in growing and internationalising the UAE / Dubai gold market.

The indelicate balance of ethics against profit

— ahmed binsulayem (@ahmedbinsulayem) October 20, 2021

20 Oct 2021https://t.co/T7uO7H3Oc7 @business @Edspencive @Global_Witness @lbmaexecutive @Rapaport @JCKMagazine @Reuters @ParmelinG @PeterSchiff @saylor @FT @CMEGroup @ICEDataServices @JeffatRPMC @Nasdaq @NasdaqTech @Metalor

As per previous responses to attacks against the Dubai gold market, Bin Sulayem published his response on LinkedIn (published on 20 October), with a post introduction as follows:

“Further to a recent article published on @Bloomberg, I’ve felt compelled to respond to one of the biggest political missteps taken by Switzerland in recent years, namely Erwin Bollinger of the State Secretariat for Economic Development informing its “refiners to get strict on UAE gold".

While I can’t be sure of the motivation behind the individual responsible, this type of unethical targeting needs to cease.”

The post also cc’ed the Swiss President @ParmelinG, Swiss SECO, as well as the OECD, LBMA, CME Group (COMEX), IMF, Responsible Jewellery Council, World Diamond Council, Human Rights Watch, and Global Witness.

Bin Sulayem begins his rebuttal (posted here) by highlighting his personal connections to Switzerland and the many business connections between DMCC and Switzerland, and there is even a Swiss Tower in the DMCC which is home to the Swiss Business Council and multiple Swiss companies. He therefore says he is “slightly pained to write this blog”, however he has “felt compelled to call out the Swiss State Secretariat for Economic Affairs, who issued a letter to its “refiners to get strict on UAE gold."

The DMCC CEO considers the letter ‘an insult’, and interestingly suggests that it is the Swiss gold refiners who may have influenced SECO into sending the letter, a letter which had the objective in isolating the UAE.

“Putting the obvious insult to one side, it appears that Switzerland’s leadership needs to ask itself several key ethical questions.

Firstly, is playing the type of identity politics that enables refiners to lobby politicians to push their agendas the sort of practice they want to be known for?

And is taking a blanket approach to isolating key trading partners such as the UAE, rather than working with them to address specific, evidence-based issues, a credible way to protect its gold industry?

Bin Sulayem points out that Dubai / DMCC procedures already adhere to the OECD’s Due Diligence Guidance (in the form of the Dubai Good Delivery system for gold and the Market Deliverable Brand for accredited refiners), similar to how the LBMA’s Responsible Gold Guidance policy makes LBMA accredited refiners adhere to OECD guidance.

In targeting and ‘isolating’ the ‘sovereign country’ of the UAE, says Bin Sulayem, this Swiss attack is ‘insinuating’ that ‘the OECD guidelines to which it adheres aren’t worth the paper they’re printed on.’ And he continues:

“Either you accept that the OECD is a standard worth following, in which case you should accept all gold from accredited refiners or none at all.”

As a global refining centre, it is plain to see how Switzerland would benefit from sullying the reputation of the UAE through such statements.”

In his come back against the Swiss letter, the DCMM CEO also refers to the UK and London gold sector, and specifically mentions the LBMA, likely a hint at where he thinks the latest pressure against the UAE really emerged from, saying that the UAE has “earned our place as a gold trading centre by having to go the extra mile to compete with historically prominent centres such as London."

The LBMA, says Bin Sulayem:

”was only recently addressed by civil society organisations earlier this year regarding concerns of how its “responsible sourcing programme fails to curtail human rights abuse and illicit gold in the supply chain“.

Despite such concerns, no further due diligence protocols were requested from the United Kingdom, one of Switzerland’s key trading partners.

I wonder how Britain would have reacted should the letter issued by the State Secretariat for Economic Affairs told refiners to get strict on “UK Gold"?

Bin Sulayem had already caused concern for the LBMA banks earlier this year when he revealed that the DMCC had begun gathering a grouping of the “international community and industry stakeholders” to discuss the global gold market, a move which at the time I said “could be viewed as the genesis of a strategy to create a counterweight to the LBMA in London.”

Ahmed Bin Sulayem’s rebuttal also raises the issue of perceived Swiss hypocrisy, given Switzerland’s “own, very public history of unethical conduct” from “using gold to aid the Nazi war effort despite its supposed neutrality, through to its reputation as the de-facto refuge for the illicit funds of dictators and political crooks.”

“Most offensively”, says Bin Sulayem,

“the [Swiss] Secretariat highlighted that its primary concern was to protect the gold industry from accepting illicit African gold from entering the market, a statement that is almost laughable when you learn about the role of Swiss commercial banks in sustaining South Africa’s devastating apartheid regime.”

In his posting, Bin Sulayem even mentions the recent criminal case in Switzerland involving former attorney General Michael Lauber and his handling of an investigation into corruption at football organisation FIFA (which is headquartered in Switzerland).

The DMCC head wraps up his post highlighting the imminent visit to the UAE by the Swiss President, but not before taking a swipe at the actual issuance of the SECO letter:

“I hope that the individual responsible for issuing the State Secretariat for Economic Affairs statement is aware that attempting to sway global trade on unethical grounds, particularly if that involves the exchange of favour, goods, or money, will eventually end with them in the same court [as Lauber]”

“It is perhaps fortunate timing that Guy Parmelin, President of the Swiss Confederation, is intending to visit the UAE in the coming weeks; allowing him the opportunity to see first-hand how gold is managed throughout our supply chains, from refiners to retail, not to mention the chance to meet with our vibrant, DMCC-based community of 342 Swiss companies.”

According to a Swiss Government press release, Guy Parmelin’s visit to the UAE is actually scheduled for Friday 29 October, when he will:

“be in Dubai in the United Arab Emirates (UAE) to attend the official Swiss Day at Expo 2020. Talks with the UAE government are also scheduled, which “will focus on economic and financial relations between Switzerland and the UAE.”

Bilateral Economic Relations

And who is Erwin Bollinger? According to his SECO profile, Erwin Bollinger is Head of Bilateral Economic Relations at the State Secretariat for Economic Affairs (SECO), in Basel, Switzerland. According to his LinkedIn profile, Bollinger’s specialties are “international trade negotiations, diplomacy, sanctions and export control policy”.

Ironically, this letter from SECO to the Swiss gold refiners appears to have torpedoed bilateral economic relations between the UAE and Switzerland, and will certainly need someone else’s “negotiations and diplomacy” to repair the relationship.

Following the above post from Bin Sulayem, Bloomberg’s Eddie Spence covered Bin Sulayem’s rebuttal in an article, also published 20 October, titled “Dubai Bourse CEO Rebukes Switzerland Over Letter on UAE Gold”, at which point the Swiss SECO had still not commented, as Spence writes:

“Switzerland’s State Secretariat for Economic Affairs, which sent the letter to refineries this month, didn’t immediately respond to a request for comment on the DMCC’s response.”

So, even after Bin Sulayem’s posting, the Swiss State Secretariat for Economic Affairs did not make any comments about the SECO letter of 11 October.

Subsequent to his 20 October article in LinkedIn, Bin Sulayem also spoke to the Khaleej Times, a Dubai daily newspaper, saying that the Swiss State Secretariat for Economic Affairs’s letter “reeked of mischief and a deliberate attempt to tarnish the UAE’s reputation”, saying:

“I’m not going to let them get away with this. What moral compass does the Swiss secretariat have given its country’s morally dubious and irrefutably sordid trading history, which includes using gold to aid the Nazi war effort."

Stirring up a Hornet’s Nest

So why did the Swiss SECO issue a letter to the Swiss gold refiners, that made it’s way into the public domain and that SECO knew would irk UAE and Dubai so much?

The Swiss State Secretariat for Economic Affairs (SECO) cannot play dumb as it has full knowledge of the UAE gold that is being imported into Switzerland. From 1 January 2021, SECO even implemented a change to the international customs duty classification for gold imports into Switzerland so as to differentiate between mined gold and banking gold in the Swiss customs tariff so as to improve transparency and traceability in gold sourcing.

As recently as 30 September 2021, SECO even published a country profile report of the UAE, stating that “Swiss imports from the UAE are mainly composed of gold (79.1%) and pieces of jewelry (17.5%).” (Page 7)

The same country profile report also stressed how important the trade relationship between Switzerland and UAE is (page 1):

“The United Arab Emirates is Switzerland’s 11th largest trading partner and 1st in the region MENA (Middle East and North Africa), with merchandise trade reaching CHF 12.3 billion in 2020.

Hundreds of Swiss companies are present in the United Arab Emirates, in particular Dubai, which has become a hub of regional and international trade, a financial center and major tourist destination.

The United Arab Emirates is also a significant foreign investor, via the sovereign fund Abu Dhabi Investment Authority.

Switzerland and the United Arab Emirates have a free trade agreement (via the European Free Trade Association EFTA and the Council of Gulf Cooperation GCC), an investment protection agreement and a convention against double taxation.”

Talk about shooting yourself in the foot. So why would SECO’s head of Bilateral Economic Relations issue a letter which gets into the public domain via Bloomberg and taints one of Switzerland’s largest international trading partners? Who is pulling the strings here?

Better Gold – As long as it’s not from UAE

As it turns out, the Swiss State Secretariat for Economic Affairs (SECO) is closely connected with the Big 4 Swiss gold refineries through a group called the Swiss Better Gold Association (SBGA) and a collaboration known as the Swiss Better Gold Initiative.

As well as a number of Swiss luxury brand companies, the heavyweight members of the Swiss Better Gold Association (SBGA) are the Swiss gold refineries PAMP, Argor-Heraeus, Valcambi, Metalor (all of which are members of the LBMA), UBS and Julius Bär banks (both of which are LBMA members), PX Group (also involved in gold refining), and Raiffeisen bank. See SBGA member list here.

The president of the Swiss Better Gold Association is Olivier Demierre of the MKS PAMP Group (which is the parent company of the PAMP refinery). See SBGA board of directors here.

Intriguingly, the only full partner of the Swiss Better Gold Association (SBGA) is the State Secretariat for Economic Affairs (SECO), and they have been partners since 2013.

The SBGA website describes the relationship thus:

“Arising from a wish to improve the situation of artisanal and small-scale gold miners, the State Secretariat for Economic Affairs (SECO) and the Swiss Better Gold Association have developed a public-private partnership named the Swiss Better Gold Initiative for Artisanal and Small-Scale Mining.

Set up in 2013, the Swiss Better Gold Initiative became a pioneer solution with the purpose of generating transparency, responsibility and profitability in the ASM gold sector.”

In fact, only last month on 6 September 2021, the State Secretariat for Economic Affairs (SECO) and the Swiss Better Gold Association (SBGA) together launched what they describe as the third phase of the Swiss Better Gold Initiative, in a launch conducted by SECO Director, Marie-Gabrielle Ineichen-Fleisch (who is also Swiss State Secretary and Director of the Foreign Economic Affairs Directorate), and Olivier Demierre of MKS PAMP.

Therefore, the State Secretariat for Economic Affairs (SECO) is literally in partnership with an organization, the Swiss Better Gold Association (SBGA), whose core member include the Big 4 Swiss gold refineries and UBS, and all of which are members of the London Bullion Market Association (LBMA).

And on 11 October 2021, SECO has now told these same gold refiners to tighten up audits on gold imports from the UAE, and to get strict on UAE gold.

With such close connections between SECO and the Swiss refineries, could it even be the case, as DMCC’s Ahmed Bin Sulayem alluded to, that the Swiss refineries influenced SECO to actually formally direct these same refineries to get tough on UAE gold imports? i.e. a mutual interest solution.

Recall that Nin Sulayem described it as “identity politics that enables refiners to lobby politicians to push their agendas".

OECD

Interestingly, just a few days before SECO sent the letter to the Swiss gold refineries on 11 October telling them to get strict on UAE gold, the director of SECO, Marie-Gabrielle Ineichen-Fleisch, attended the OECD’s 2021 Ministerial Council Meeting in Paris between 5-6 October.

Some readers night recall that in the initial LBMA move against the Dubai and UAE gold sector starting in November 2020, there are many connections between the LBMA, the OECD and the OECD’s Financial Action Task Force (FATF). For details see the article “In Delusional Push, LBMA Threatens to Blacklist Entire Gold Trading Centres”.

Could there be behind the scenes maneuvering where the LBMA, via the OECD, is directing the Swiss State Secretariat for Economic Affairs (SECO) to get strict on Swiss gold imports from the UAE?

Ahmed bin Sulayem was vocal in making sure the OECD saw his rebuttal of the SECO letter, as his following tweet from 20 October highlights, which referenced a number of OECD twitter accounts.

@OECD @OECD_Centre @OECDEduSkills @OECD_ENV @OECDeconomy

— ahmed binsulayem (@ahmedbinsulayem) October 20, 2021

Publicly, the LBMA is also on record as being supportive of the partnership between the State Secretariat for Economic Affairs (SECO) and the Swiss Better Gold Association (SBGA):

#SECO and #SBGA are supporting Artisanal and Small-Scale Mining through their shared Better Gold Initiative despite all the challenges and difficulties experienced this year. Read more about it here: https://t.co/C43xqSswEf#Gold #ASM pic.twitter.com/lYWrY0rpF6

— LBMA (@lbmaexecutive) December 17, 2020

Who sent Bloomberg the Letter?

In addition, the question must be asked, how did the Bloomberg reporter Eddie Spence, who is based in London, get to see a private letter written by the Swiss State Secretariat for Economic Affairs (SECO) and sent only to the Swiss gold refineries.

Spence himself said in his 15 October article that “the state secretariat in Bern didn’t respond to requests for comment,” and again on 20 October in a follow-up article, after DMCC’s Bin Sulayem had responded to the Swiss, that SECO “which sent the letter to refineries this month, didn’t immediately respond to a request for comment on the DMCC’s response.”

So, the letter obviously was not sent by SECO to Bloomberg, because Bloomberg did not even talk to the Swiss State Secretariat. Therefore, Bloomberg and Eddie Spence must have seen the letter after one of the gold refinery recipients (which are all LBMA members) either sent it to Bloomberg, or perhaps forwarded it to the LBMA or to an LBMA bullion bank, which then showed the letter to Bloomberg London. As Eddie Spence is based in London, but the Swiss refineries are not, while the LBMA and LBMA bullion banks are, then that in itself points to the probability of communication within London.

Which is perhaps why Ahmed bin Sulayem in his rebuke of Swiss SECO on 20 October look another swipe at the LBMA and the London gold cartel, saying that even though a group of prominent NGOs such as Global Witness, RAID and SwissAid had raised concerns with the LBMA about how gold of it’s LBMA approved Swiss refineries was being sourced, the Swiss SECO did not tell the Swiss refiners to get strict on gold imports from the UK.

An Emirates Good Delivery Gold Standard

However, out of all of this, the most intriguing piece of insight is the timing of the letter from Switzerland’s SECO to the Swiss gold refineries, which remember is dated Monday 11 October.

Why would the Swiss State Secretariat for Economic Affairs suddenly decide to write a letter on 11 October 2021 warning about gold imports from the UAE, when everybody from SECO to the Swiss gold refineries knows that gold imports from the UAE are continually coming into Switzerland month after month, year after year, and when Swiss SECO already has gold import and sourcing transparency measures in place?

Could it have something to do with the fact that only 2 days earlier, on Saturday 9 October, the UAE Bullion Market Committee, consisting of UAE government and UAE gold sector members, met in Abu Dhabi, UAE to finalise the launch of an Emirates Standard for Good Delivery of Gold?

This new Emirates Good Delivery standard, is a UAE federal wide technical standard for wholesale gold bar settlement, much like the LBMA’s London Good Delivery Standard and was first discussed at a UAE governmental meeting on 6 December 2020.

And this new Emirates Good Delivery standard, which will compete with the LBMA Good Delivery Standard, will be officially launched on 18 November as part of the Expo 2020 Dubai, and will be launched internationally next year in 2022.

See here and here for coverage of this Saturday 9 October meeting, which was chaired by UAE Minister of State for Foreign Trade Affairs, Thani Ahmed Al Zeyoudi.

Conclusion

The timing of the Swiss letter to the LBMA refineries, on Monday 11 October, only 2 days after the UAE meeting to launch an Emirates Good Delivery Standard for Gold is incredible to say the least.

A huge coincidence, or a shot across the bow from those in the gold market who view the UAE as a threat, i.e. the London establishment?

That is the question that everyone should be asking, not least the Swiss President Guy Parmelin, who has the unenviable task of turning up in Dubai this Friday 29 October and engaging in some damage control with the UAE government following the SECO “get strict on UAE gold" letter.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments