Swiss Gold Refineries and the Sale of Valcambi

The normally low-key Swiss gold refining market has been thrown into the spotlight with the announcement that private company Valcambi, the world’s largest gold refinery, is being acquired by Indian group Rajesh Exports Ltd (REL), the world’s largest gold jewellery manufacturer.

This acquisition is worth analysing for a number of reasons, namely will the Valcambi-Rajesh transaction impact marginal gold supply out of Switzerland and elsewhere, and how will the transaction, if at all, increase the likelihood of other large gold refineries becoming future acquisition targets?

Telegraphed Transaction

The announcement of the Valcambi acquisition should not come as a surprise because it was telegraphed in early July by the Economic Times of India. In its article, the Economic Times revealed that Rajesh Exports was in discussions to acquire a large stake in a Swiss gold refinery, and although the identity of the acquiree was not confirmed at that time, the Times said that Rajesh had “sounded out Valcambi…on a possible transaction”.

Since both Rajesh and majority Valcambi shareholder Newmont Mining declined to comment at the time (with Rajesh citing stock exchange rules), the Times and its industry sources were left to speculate that two of the other three large Swiss refineries, Argor-Heraeus or Metalor, might instead be targets, as opposed to Valcambi. Notably, the 4th large Swiss gold refinery, PAMP, was not mentioned in the Economic Times report.

The Times report would suggest that Rajesh Exports took the initiative in searching for a leading precious metals refinery to purchase. However, now that the acquisition has been announced, Rajesh Exports states that it was the Valcambi shareholders who initiated the search for a buyer. In its press release Rajesh states that:

“the owners of Valcambi conducted a global search for divesting Valcambi, after an extensive search selected Rajesh Exports to acquire Valcambi.”

That the search was prolonged was confirmed by India’s Business Standard, which also highlighted that Rajesh Exports was simultaneously on the look-out for a suitor:

“Valcambi shareholders were looking for a buyer for quite some time. We (Rajesh) were also looking to deploy our cash at a safe place, which could generate a fair amount of business interest and help us grow. So, both of us came together and the transaction was concluded.”

But the transaction looks predominantly to have been a strategically planned sale of Valcambi by its holding company European Gold Refineries (i.e. its owners Newmont Mining and a private Swiss investor group), with what looks like input and advice from investment bank Credit Suisse.

A Quick Recap on Valcambi

Before discussing the Valcambi acquisition, its important to understand the Valcambi shareholding structure and the various parties involved with the refinery over its 54 year history.

Balerna based Valcambi was originally incorporated in the southern Swiss Canton of Ticino as Valori & Cambi SA on 15 May 1961, and changed name to Valcambi SA on 30 June 1967. The founders of the original Valori & Cambi, like its successor, seem to have wanted to maintain low profiles, because other than the fact that it was founded by ‘5 Swiss businessmen/entrepreneurs from Mendrisio”, there is little in the public record to identify who these 5 individuals were, since the online company register records don’t so back that far.

In 1967, Credit Suisse bought 50% of the Valcambi refinery, followed by the purchase of another 30% stake in 1968. The final 20% shareholding was purchased in 1980, giving Credit Suisse 100% control of Valcambi from 1980 up to December 2003. In that era, it was not unusual for a large Swiss bank to own a gold refinery, and the other 2 large Swiss banks of the day, UBS and SBC, also owned their own gold refineries (UBS owned Argor and SBC owned Metalor).

In December 2003, some of the same founders of Valcambi (from 1961) joined up with Newmont Mining and established a company called European Gold Refineries SA (EGR), which was 50% owned by Newmont and 50% owned by a group of Swiss investors (whose identities are not easily discernible). EGR then simultaneously bought 100% of Valcambi SA from Credit Suisse, and at the same time acquired a 66.65% shareholding in a company called Finorafa SA, which was a large gold distribution and financier business into the Italian jewellery market.

In their 2003 funding of EGR, Newmont and the Swiss private investor group each put up CHF 15 million in equal combinations of equity and debt.

In early July 2007, Mitsubishi International Corporation (MIC) of Japan bought a 6.55% shareholdings in EGR, with an option to buy a further 26.78% stake by 15 August 2007 (i.e. over 33% in total). Mitsubishi failed to take up its option in August 2007 to buy a larger shareholding in ERG, so this left Newmont and the Swiss investor group each with a shareholding of 46.725%, since their 50% stakes were each reduced by half of the Mitsubishi International Corporation of 6.55%, i.e. reduced by 3.275% each.

Newmont then bought another 15,960 shares in EGR from some of the private investors in April 2008, which increased its stake from 46.725 to 56.67%. This left the Swiss investor group and Mitsubishi holding a combined 43.33%. By this time ERG owned 100% of Finorafa SA as well as 100% of Valcambi, but Finorafa SA was by that time inactive.

Then in mid-November 2008, Mitsubishi had a change of mind and sold its 6.55% stake back to Newmont and the Swiss private investor group. These resold shares seem to have been split fairly equally between Newmont and the private investor group, bringing Newmont’s stake up to 60% By 2009, Finorafa, although owned by EGR, was in liquidation.

For the Valcambi transaction, Rajesh Exports has actually bought European Gold Refineries SA (EGR), which has full ownership of Valcambi SA. To purchase EGR, Rajesh established a Swiss company called Global Gold Refineries AG, which happens to be registered in the Canton of Lucerne (See company register here).

In turn, Global Gold Refineries AG is 95% owned by REL Singapore Pte Ltd, and 5% owned by Rajesh Exports Ltd India (and REL Singapore is fully owned by Rajesh Exports India). See here for the corporate structure of Valcambi and the holding companies. According to Rajesh, REL Singapore was set up primarily to execute international acquisitions and to source gold from mines.

Who were the Swiss Investor Group?

Note that since the acquisition of Valcambi by Rajesh Exports, there are now only 2 directors listed under the Valcambi Board of Directors, namely Valcambi CEO Michael Mesaric, who is staying on as CEO, and new chairman Federico Domenghini. Domenghini is also listed as the only director of the holding company Global Gold Refineries (see above). Interestingly, Michael Mesaric worked in senior roles at Credit Suisse between 1990 and 2002 before joining Valcambi, and is the first of our Credit Suisse connections.

The penultimate board of directors of Valcambi before the acquisition consisted of 6 individuals, 5 of who have now left the board. This penultimate list of directors can be seen here.

Although the full details of the Swiss investors behind Valcambi appear to be hard to find, some potentially relevant facts can be gleaned from the commercial register of the Canton of Ticino and also from the most recent pre-acquisition list of Valcambi board of directors. In addition, Rajesh mentioned one of the main private investors in its stock exchange press release (see below).

European Gold Refineries SA (EGR) was incorporated in Ticino in December 2003. Since 2003, the members of the board of EGR have been a selection of Newmont appointee directors, a selection of Mitsubishi appointees (for a short period), and a handful of other appointees. It is this third group of directors which may provide clues as to who the ‘Swiss private investors’ are, or at least who represents them.

Looking at EGR’s extract from the commercial register, in reverse date order, the most recent directors of EGR representing Newmont Mining (up until late July 2015) were Thomas Mahoney (chairman), Andrew Strelein, and David Farley. In addition, Carlo Camponovo, Luciano Martelli, and Michael Mesaric were listed as directors. Given that Mesaric is the CEO, this leaves Carlo Camponovo and Luciano Martelli as potential representatives of the Swiss investors, because logically, the Swiss private investors would need representatives on the board.

Going back further, ex-directors of Valcambi include Frank Hanagarne, Darren Morcombe, and Pierre Lassonde, all of Newmont, and Haydar Odok and Toshiro Sakai of Mitsubishi. After that we are left with 3 other directors, namely, Davide Camponovo, Emilio Camponovo, and Marco Cavuoto.

From the recent Valcambi board of directors profiles, Luciano Martelli works at Aurofin SA, and is also a director of Aurofin SA. Martelli has in the past also worked at Credit Suisse. Aurofin is a precious metals trading and financing company that was established in 1969 by Emilio Camponovo. Emilio Camponovo is still chairman of Aurofin.

Carlo Camponovo’s Valcambi profile states that he also worked at Credit Suisse from 1993 to 1997, and then worked at Finorafa SA, which is the second company that EGR owned from 2003 until it was liquidated in 2009. Marco Cavuoto was also a director of Finorafa until 2008.

The main reason for illustrating the above is to show the connections between Valcambi, Aurofin, Finorafa, and tangentially Credit Suisse, and also the Camponovo connections. Furthermore, it illustrates the low-key approach that Valcambi seems to have had in specifically naming its private shareholders.

The Valcambi web site even states that “In Switzerland and beyond: our firm deliberately keeps a low profile but has over the years become a key player in the precious metals refining industry" and to prove the point, the quotation is attributed to an unnamed ‘board member’!

Ironically, in the acquisition press release, Rajesh Exports dropped the low-key approach and provided some additional information about the Valcambi shareholders when it mentioned “Mr. Emilio Camponovo" as “the founder and current major share holder of Valcambi“. This suggests that the Camponovos were in the driving seat for the Valcambi sale alongside Newmont (and possibly Credit Suisse as navigator).

The Deal

Since Valcambi SA and European Gold Refineries SA are both private companies, there is little financial information available about either company. This has even stumped some of Newmont’s sell side analysts on Wall Street, who in their coverage of the sale admit that since Valcambi is a private company, they don’t have much visibility into Newmont’s disposal of Valcambi beyond knowing the net proceeds of the deal.

The Economic Times article on 1 July appears to have had very knowledgeable sources in India since it accurately foresaw that the deal was an all-cash deal for $400 million, 70% of which would be financed from Rajesh’s resources, and the other 30% from “overseas borrowings”.

This was highly prescient, since the announced acquisition turned out to be an all cash deal for $400 million, and Rajesh Exports confirmed at its press conference on 27 July that 30% – 35% of the consideration will be financed by long-term debt (provided by Credit Suisse, no less).

The Rajesh Exports press release states that over the last 3 years, Valcambi booked revenues of US$ 38 billion per annum, and earnings before interest, tax, depreciation and amortization (EBITDA) of US$ 33 million. These revenues look astronomical but they represent the annual average precious metals flows through the refinery being booked at market values (i.e. 945 tonnes of gold and 325 tonnes of silver per annum at market values).

Newmont (the 60% shareholder) will receive net proceeds from the sale of US$119 million. That could mean $200 million net proceeds to the entire shareholder base. Although its unclear as to exactly how much (in net proceeds) the private investor group received. Given that Rajesh is paying $400 million for Valcambi, Rajesh is also taking over or paying down some of the debt of EGR or Valcambi, or else Valcmabi has a quantum of cash on its balance sheet, or both.

Now that the deal has been announced, Newmont has pitched the sale of its stake as a disposal of a non-core asset which it claims will help pay down its debt and focus on its core business. So, being the largest shareholder of Valcambi, and actively wanting to dispose of non-core assets, this reinforces the view that Newmont was the primary driver of the entire ‘global search’ for a buyer of Valcambi.

As mentioned above, Credit Suisse has a long history of involvement with the Valcambi refinery, having fully owned Valcambi from 1980 to 2003. Credit Suisse’s involvement in the new deal also points to ongoing or rekindled relationship with the Swiss private shareholders and Newmont, since it sold the refinery to them in late 2003.

Until 2008, Newmont managed the Valcambi asset through its Merchant Banking group. This group, among other things, took care of “merger and acquisition analysis and negotiations". Although Newmont’s Merchant Banking group was phased out in 2008, skilled corporate finance individuals at Newmont undoubtedly lent a hand to in the Valcambi disposal project.

Theoretically, Rajesh Exports could have just bought Newmont’s stake in Valcambi and become the new majority shareholder alongside the existing private investors. The fact that they didn’t go down this route could either mean that Rajesh wanted full corporate control, or that the investor group wanted to redeem its investment, or both.

Ramifications of the Valcambi Sale

The sale of the Valcambi refinery now raises questions as to whether its customer base and the mix of destinations for its gold exports from Switzerland will change, and what impact, if any, will the acquisition have on the ability of other countries to acquire Valcambi refined gold.

Rajesh Exports was an existing customer of Valcambi before the acquisition, and probably quite a large Valcambi customer.

In a 2011 presentation, Rajesh Exports stated that:

“Top Suppliers include Australian Gold Refinery, ANZ Bank and Valcambi Refinery who constitute 90% of total supply of Raw gold to REL“

So Valcambi was already an important supplied to Rajesh. Although Rajesh Exports only consumed about 170 tonnes of gold over its financial year 2014-2015, Rajesh Mehta, chairman of the group stated in his press release that:

“The acquisition is also of national importance for India, as India is the largest consumer of gold in the world, it would be a step in the right direction by an Indian company to own a world-class asset like Valcambi. On a theoretical basis Valcambi is capable of supplying the entire gold requirement of India.“

Gross gold imports (excluding smuggling) into India totals about 750-800 tonnes per annum at the moment. In its 2013 Sustainability Report Valcambi states that its refinery has an annual capacity for gold refining of 1600 tonnes, and a total annual ‘precious metals’ refining capacity of 2000 tonnes. This is what Rajesh Mehta is referring to ‘in theory’ above.

Will Valcambi start supplying all of its output to India? Most probably no. Could this mean that Valcambi will start supplying more of its output to India? Probably yes. Even if it does though, Valcambi still has a lot of spare refinery capacity.

Rajesh Exports seems to have done the Valcambi acquisition for multiple reasons and not just to secure a source of refined gold supply. Rajesh claims that it wants to become a fully integrated major global gold player. (See above link to presentation where Rajesh even had a ‘Mission 2016’ plan to be a ‘fully integrated jewellery company’ by 2016).

Rajesh also had spare cash which it needed to invest in what it referred to as a safe place (i.e. “We were looking to deploy our cash in a safe place" – See Business Standard quote above). And Switzerland remains a universally known ‘safe place’ to deploy cash.

Rajesh already owns some gold mines, and a refinery, as well as gold manufacturing plants, wholesalers and a retailer network of jewellery showrooms which it plans to expand. The Valcambi acquisition allows Rajesh to move back along the gold supply chain. It also presumably will lead to cost savings on acquiring refinery output.

One of the less tangible benefits will be increased information flow about the gold market, both to Rajesh and to Valcambi. Another benefit to Rajesh will be refinery knowledge and skills transfer. Although headquartered in Bangalore in the state of Karnataka in the southwest of India, Rajesh Exports currently has a gold refinery in Uttarakhand in the north of India. This refinery has a gold output of 200 tonnes per annum. Rajesh plans to upgrade this refinery and turn it a subsidiary of Valcambi and then apply for LBMA gold and silver accreditation for the refinery.

One of the main reasons why Valcambi (and its competitors PAMP and Argor-Hereaus) set up in southern Switzerland near the Italian border was that Italy used to be the world’s largest jewellery manufacturer, consuming vast amounts of refined gold as is occurring in present day India. So in some ways, the acquisition of Valcambi by Rajesh Exports Ltd, as the world’s largest gold jewellery manufacturer, is just taking the supply chain logic a step further and going back to the traditional source of the Italian jewellery manufacturers (i.e. Ticino).

All of the above suggest that the acquisition will not end up diverting huge volumes of Valcambi output to India to such an extent that it would impact other customers’ reliance on Valcambi.

Additionally, Valcambi’s CEO, Michael Mesaric said of the deal that “the coming together of REL and Valcambi would ensure that Valcambi improves on it’s global share of gold business, by opening up new markets in India, Middle East and China." Although Valcambi never broke down its gold exports by destination, about 80% of total Swiss gold exports in 2014 already went to Asia, with India, Hong Kong and China being the top 3 destinations. So what Mesaric is referring to appears to be more of the same, albeit even higher reliance on the existing top export markets.

Furthermore, Valcambi shareholders would not have agreed to the sale to Rajesh if it jeopardised its existing global customer base. Newmont has reiterated its support and will continue to use Valcambi “under the new ownership structure” since it has “long-term contracts with Valcambi for refining the gold produced” from a number of it mines.

In its 2013 sustainability report, Valcambi states that its clients are:

“some of the largest mining companies in the world, premium luxury watch manufacturers,the largest international banks, governments, central banks and scrap dealers"

The report also revealed that on a geographic basis, Valcambi’s ‘business turnover’ was 33% in Europe, 36% in Europe (non EU), 15% in North/South America, 9% in Africa, 4% in Asia, and 3% in Oceania.

Given that the gold exports trade statistics out of Switzerland do not align with the regions of this business turnover data, these figures (which would also include mining company and bullion bank business) must represent where Valcambi books its sales to and/or where the actual clients are based, rather than the ultimately destinations of the refined gold and silver output that are exported from Switzerland,. For example, a London-based bullion bank client of Valcambi that wanted gold refined in Balerna and sent to China would probably be accounted for by Valcambi as a European client, and the China destination of the gold would not get captured in the revenue records.

Valcambi’s refining capacity

Even if Rajesh Exports requires a higher share of the Valcambi refinery output, there is still plenty of spare refinery capacity in the Balerna facility.

Valcambi’s 2013 sustainability report also said that the refinery had an actual ‘product throughput’ of ‘3.8 tons bars and coins per day’ of gold and ‘1.8 tons bars and grain per day’ of silver. Assuming a 5 day week (250 day work year), that would be 950 tonnes of gold throughput and 450 tonnes of silver per annum.

Rajesh Exports just revealed in its press release that over the last 3 years, Valcambi has refined an annual average of 945 tonnes of gold and 325 tonnes of silver (2835 tonnes of gold and 975 tonnes of silver over 3 years). Presumably the last 3 years that Rajesh mentions refers to the last 3 calendar years of 2012-2014.

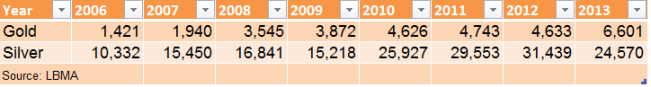

The London Bullion Market Association (LBMA) doesn’t reveal annual production data of its refinery members on an individual level, however, the LBMA recently published high level totals of the refined gold production of its accredited refiners (LBMA Good Delivery List) over the years 2006 to 2013. What was striking about the data was that total refined gold production of its refinery members reached 6,601 tonnes in 2013, which was 42% higher than total refined gold production in 2012, and also more than double global mine production of 3,016 tonnes of gold in 2013. See table below from LBMA publication:

Total annual refined gold and silver production by LBMA refiners 2006-2013 (tonnes)

So with Valcambi being the largest gold refinery in the world, it would be realistic to suggest that its annual average of 945 tonnes of refined gold output over the last 3 years probably hides the higher refined gold production that it too experienced in 2013 versus 2012. Unfortunately, there is no LBMA 2014 data. Doing a quick hypothetical calculation of Valcambi’s annual gold output over 2012-2014 where 2013 production was 42% higher than 2012, and 2012 production equaled 2014 production, then Valcambi would have refined 828 tonnes of gold in both 2012 and 2014, and a massive 1179 tonnes in 2013. This however would still be below the refinery’s gold output capacity of 1400 tonnes per annum.

So, whichever way you look at it, on average, the Valcambi refinery is not yet running at full capacity for gold, it probably hasn’t ever reached full capacity (even in 2013), and it still has plenty of spare capacity. So even if Rajesh Exports ramps up gold flow from Valcambi to India, other export destinations such as China, South East Asia and the Middle East needn’t suffer as long as mining and bullion bank clients of the refinery can provide metal to make use of the reserve refining capacity.

The other Swiss Gold Refineries

Does the sale of Valcambi foreshadow the sale of any of the other large Swiss gold refineries or increase the likelihood of a similar transaction? I’d say no, but to answer these questions, you may find it helpful to look at the shareholder structure of Valcambi’s competitors in Switzerland, and then decide.

Apart from Valcambi, there are 3 other large gold refineries in Switzerland and 2 smaller refineries. Valcambi’s 3 big competitors are PAMP, Metalor and Argor-Heraeus.

The refineries owned by PAMP and Argor-Heraeus are also located in the south of the Canton of Ticino, literally within walking distance from Valcambi, in what’s known as the golden triangle of gold refineries in the southern tip of Switzerland. As mentioned above, these refineries were established in this area in order to be as near as possible to Milan and the Italian gold industry. Looking at the map below you will see the municipalities of Mendrisio (Argor-Heraeus), Balerna (Valcambi), and Castel San Pietro (PAMP). Balerna is only 4kms from Mendrisio, and 2kms from Castel San Pietro. Notice also the Swiss – Italian border at the bottom of the map south of Chiasso.

Along with Metalor, which is in Marin-Epagnier in the Canton of Neuchâtel in north-west Switzerland, these Big 4 refineries refine the bulk of Switzerland’s (and the world’s) gold. Valcambi, PAMP, Argor-Heraeus and Metalor are all Associates of the LBMA, and PAMP, Argor-Heraeus and Metalor are three of the five refiners on the LBMA’s refiner referee list which helps maintain the LBMA’s Good Delivery System for gold and silver.

Two other smaller companies refine gold in Switzerland in addition to the Big 4. These two companies, also in the Canton of Neuchâtel and located quite close to Metalor, are PX Précinox in La Chaux-de-Fonds, and Cendres + Metaux in Biel. Together they arguably form another golden triangle of refineries, close to the Swiss gold watch industry and incidentally close to the headquarters of the Swiss National Bank in Bern (home of the SNB’s gold vaults and where the BIS’s also stores gold).

The good delivery bars of Valcambi, PAMP, Argor-Heraeus, Metalor and PX Précinox are on the LBMA’s current Good Delivery list for gold, while the bars of Cendres + Metaux are on the LBMA’s former Good Delivery list for gold (transferred to the former list in April 2015).

Because PX Précinox and Cendres + Metaux are smaller than the Big 4, the analysis below only focuses on Metalor, PAMP and Argor Hereaus, all three of which are privately held Swiss companies.

Metalor

Metalor here refers to Metalor Technologies International SA. Currently the Metalor group is majority owned by French private equity company Astorg Partners SA (www.astorg-partners.com) headquartered in Paris. The remainder of the shares are owned by Swiss individuals and by Metalor management.

The Metalor group is not just a refinery group. It has two others divisions, Advanced Coatings (for electronics and jewellery) and Electrotechnics (silver conductivity electrical contacts used in electrical applications). The refinery division has 4 refineries worldwide, in Neuchatel Switzerland, in the US (North Attleboro, which is south of Boston and is the headquarters of the refining division), in Hong Kong, and in Singapore. The 2012 Metalor annual report states that the group’s refining capacity of fine gold was 650 tonnes per annum in the Swiss, US and Hong Kong refineries. The Singapore refinery was opened in 2013, and since this has a refinery capacity of 150 tonnes, that boosts the total refinery capacity to about 800 tonnes per annum now.

Metalor is the oldest of the Swiss gold refineries and was under the ownership of Swiss Bank Corporation (SBC) from 1918 until 1998. In 1998 a group of Swiss private investors comprising Ernst Thomke, Martin Bisang, Rolf Soiron and Giorgio Behr acquired the majority of shares from UBS. UBS still retained a minority shareholding following this transaction. Thomke then became Metalor chairman until April 2004, after which Bisang was appointed chairman.

Metalor then raised additional capital from another group of Swiss private investors who operated through a British Virgin Islands company called ‘Partners Only’. Zurich business magazine Bilanz speculated as to the identities of these ‘Partners Only’ investors in an article published in 2005, and another published in 2009. These articles list a number of well-known Swiss investors connected to Roche.

In September 2009, Metalor announced that in July 2009, a majority of the private investor shareholders had sold their shareholdings to Astorg Partners SA in an equity funded transaction. The press releases stated that two of the largest investors would invest their proceeds back in with the Astorg transaction, and that Metalor’s management including Scott Morrison, the Metalor CEO, would also become long-term shareholders. One of these 2 ‘largest shareholders’ who stayed on was Martin Bisang (see above). (Metalor press release and Astorg Partners Press Release).

Swiss newspaper NZZ (Neue Zürcher Zeitung) confirmed in 2010 that Belgium headquartered private equity company Sofina had co-invested alongside Astorg Partners, and together they had acquired almost 60% of the shares, which left the remainder of the shares owned by Metalor management as well as Martin Bisang and Daniel Schlatter. Both Bisang and Schlatter are connected to Bellevue Group, a boutique bank in Zurich, owning 20% and 5% of Bellevue shares, respectively. Bellevue actually acted as co-lead financial advisor to Metalor in its sale to Astorg which lists the transaction as spanning 2008-2009. Astorg lists its Metalor investment as being part of its Astorg IV fund.

The board of Metalor now includes Joël Lacourte, Managing Partner of Astorg Partners, Sophie Pochard, Jean-Hubert Vial, and Benjamin Dierickx, all of Astorg Partners, Martin Bisang and Daniel Schlatter of Bellevue Holding AG, and Metalor CEO Scott Morrison. See Neuchâtel company register extract and Bloomberg.

Of the 2008-2009 sale, Martin Bisang has said previously that “it was extremely difficult to find a buyer” for Metalor. This in some ways was because the Lehman induced financial crisis of 2008/2009 impacted transactional values at that time. However, Astorg was looking for acquisition targets in Switzerland at that time, which obviously helped the sale.

Metalor CEO in 2009 Philippe Royer, said that Astorg was a “long-term majority shareholder". While this is true, private equity companies in most cases eventually want to crystalise their investments, and so its hard to put an exact time-frame on a PE company’s definition of ‘long term’. Maybe 10 years+. The same may be true of the remaining private investors including from Bellevue. A hostile acquirer looking to purchase just the Metalor refineries would have to take on board the other divisions and navigate the complexity of the company. In a similar way a friendly acquirer in the jewellery or investment gold sectors might be put off by the industrial divisions of the group.

Verdict: No change at Metalor in the medium-term.

Argor-Heraeus

The Argor-Hereaeus group, located a few minutes drive from Valcambi and PAMP in southern Ticino, has an “annual refining capacity of 450 tonnes for both gold and silver” according to a 2013 company report.

As well as refining, the group produces a range of bars and coins and high precision products for the watch and jewellery sectors.

The current shareholding structure of Argor-Heraeus is quite diverse and consists of parties from three contiguous central European countries, namely, German engineering conglomerate Heraeus, German bank Commerzbank, The Austrian Mint, as well as Argor-Heraeus management. The fragmented shareholder base evolved as follows:

The company, as Argor SA, was established in 1951. Swiss bank Union Bank of Switzerland (UBS) acquired an 80% stake in 1960, and full ownership in 1973. In 1986, Heraeus of Germany purchased a 25% stake from UBS and entered a joint venture with UBS. In 1999 UBS departed leaving Heraeus and the company management with 100% of the shares. Then in April 1999, Commerzbank took a 35% stake, which resulted in Heraeus having 35%, Commerzbank having 35% and Argor-Heraeus management having 30%.

In 2002, the Austrian Mint (owned by the Austrian central bank) acquired a 24.3% interest, which left then Heraeus with 26.5%, Commerzbank with 26.5% and management were said to have 22.7%.

According to the 2013 annual report of the Austrian Mint, it now claims to own 28.6% of the shares of Argor-Heraeus, with an equity value of CHF 122.4 million (and a profit share for 2013 of CHF 19.5 million). According to the 2014 Commerzbank annual report, Commerzbank now owns 31.2% of Argor Heraeus shares with an equity value of CHF 152.7 million (and a 2014 profit share of CHF 22.7 million). In its latest annual report, Heraeus does not reveal its holding in Argor-Heraeus, but if the Austrian Mint and Commerzbank won a combined 59.8%, then that leaves 40.2% for Heraeus and Argor-Heraeus management.

On the website, Heraeus is listed at the top of the shareholder list, so this may indicate that Heraeus has the largest shareholding, which would be above 31%. This would leave management with the remainder.

A complex and diverse shareholder base means a diverse board of directors, and from the Argor-Heraeus SA company registry filing, the board of directors includes, as expected, a cross-section of directors from Commerzbank, the Austrian Mint, and Heraeus, including Gerhard Starsich, CEO and board member of the Austrian Mint, Hans-Jürgen Deutsch of Heraeus Precious Metals, and David Burns, head of commodities at Commerzbank.

All three parties often refer to the strategic benefits of being a shareholder in the Argor-Heraeus refinery so, it seems that the existing formula, whatever it is, is working well.

For example, Commerzbank states that it has a “long-standing cooperation with the refinery Argor-Heraeus S.A. allows us to combine well-founded experience in physical metals with strong expertise in structuring“. Likewise, the Austrian Mint refers to using Argor-Heraeus as a source of refined metal supply, presumably on preferred terms. All parties also presumably get access to information flow about the Swiss gold refining industry and gold demand and supply trends in and out of Switzerland, which is helpful.

In its 2013 annual report, the Austrian Mint said that Argor-Heraeus achieved “large increases in sales and profits in comparison to the preceding year”, so the refinery appears to be a good investment for the various parties also.

It therefore doesn’t seem likely that any of the 3 external shareholders would need to, or want to, dispose of their shareholdings. An acquirer would have to navigate negotiations with a central bank (Austria), a large German bullion bank, and a large German conglomerate, in addition to the Argor-Heraeus management.

Verdict: No change in Argor-Heraeus ownership over the foreseeable future

PAMP (Produits Artistiques Métaux Précieux)

PAMP SA of Castel San Pietro in Ticino, a neighbour of Valcambi and Argor-Heraeus, operates two precious metals refineries, one in Ticino and the other as a joint venture with MMTC in Delhi in India. PAMP SA is fully owned by MKS (Switzerland) Finance SA of Geneva.

Together the two refineries have an annual capacity for 550+ tonnes of gold, and 1200+ tonnes of silver. According to its website, “PAMP handles over 400-metric-tonnes of gold per year", therefore there is still spare capacity.

MKS, a private company founded in 1979, is actually headquartered in the Netherlands, and has 16 offices around the world. MKS could be described as a physical precious metals refining and distribution company, and also a precious metals trading and financing company. The main office is in Geneva. MKS also owns precious metals bar and coin wholesaler Manfra, Tordella & Brooke (MTB) in New York which will be familiar to some readers as an approved Comex depository for gold. MKS Finance SA is also an Associate of the LBMA.

According to its company registry filing in the Canton of Geneva, the board of MKS (Switzerland) SA includes chairman Marwan Shakarchi, vice-chairman Karma Shakarchi-Liess, Venkata Gopalakrishnan, Hans Isler, Jean-Pierre Roth, and Stanley Walter.

The PAMP SA company filing from Ticino can be seen here.

In India, the PAMP refinery, India’s largest gold and silver refinery, is a joint venture established in 2008 with MMTC, and is known as MMTC-PAMP. MMTC is a ‘Government of India Undertaking’ or Central Public Sector Enterprise (CPSE), and is a huge trading company and the biggest precious metals importer in India. A few of MMTC’s directors are Indian Government appointees and the company’s website even uses a government web site domain (http://mmtclimited.gov.in/).

According to its profile:

“MMTC is the largest importer of gold and silver in the Indian sub-continent, handling about 174 MT of gold and 1165 MT of silver during 2011-12. MMTC supplies gold on loan and outright basis to the exporter, bullion dealers and jewellery manufacturers on all India basis.”

MMTC also has its own nationwide retail jewellery showroom network. From an Indian prespective, it’s not surprising that Rajesh Exports would have steered clear of looking to acquire PAMP because of PAMP’s existing relationships with MMTC. Recall that PAMP was not mentioned by the sources quoted by the Economic Times of India as a potential Swiss refinery target, while Valcambi, Metalor and Argor-Heraeus were mentioned. MMTC-PAMP, is the only precious metals refiner in India currently on the LBMA’s good delivery list.

An acquisition of PAMP SA of Switzerland would probably have to be a full acquisition of the entire MKS Finance group becasue PAMP and MKS are closely integrated across a lot of their respective functions. Since MKS seems to be thriving independently, its doubtful if they’d be interested in being taken over. Perhaps they’d be more open to collaboration. Negotiating with one owner as opposed to multiple owners in an acquisition scenario would undoubtedly be easier though.

It’s still unclear though as to how the exact shareholdings of MKS and PAMP are structured. MKS states that it’s a family-owned business and that would mean either exclusive or majority ownership by the founding Shakarchi family. It probably has some management ownership also. But being a private company, its hard to determine if MKS has, or does not have, a set of external private investors.

Verdict: PAMP and MKS will probably remain independent but watch this space

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments