The LBMA Silver Price: Broken Promises

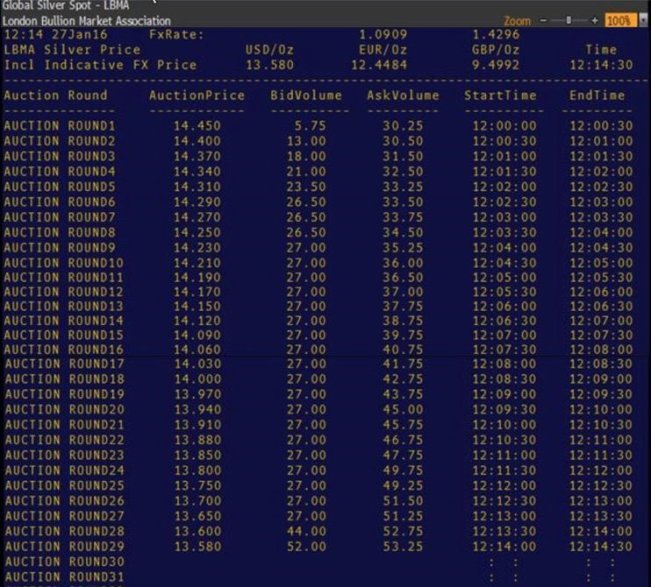

On 28 January 2016, the midday LBMA Silver Price auction took 29 rounds to establish a final price of US$13.58 which was manipulated down by a whopping 6% below where silver spot and futures prices were trading at that time. This auction fiasco and price manipulation has caused deep concern among silver benchmark price users as well as consternation among the Gang of Three companies which own/administer/operate the LBMA Silver Price, namely the London Bullion Market Association, Thomson Reuters Benchmark Services, and CME Group.

Notice in the following financial data distribution screenshot (taken from a US terminal) of the entire set of rounds in the LBMA’s distribution of the Silver Price auction results that day, that a trading entity was progressively increasing the Ask (Sell) volume between each round, thereby causing the auction algorithm to continual try lower opening prices each round, because the Bid volume was not increasing by enough to meet the tolerance threshold between bid and ask volume (i.e. the imbalance was too great). Notwithstanding the possibility that collectively no participants or other traders felt the desire to arbitrage this price anomaly during the auction, it appears that someone was turning up the sell volume as the price went lower every 30 seconds for at least 14 minutes between midday and 12:15pm that day.

Joint statement by Thomson Reuters, CME Group and the independent Silver Price Oversight Committee

On 4 February 2016, after scrambling and squirming for an entire week, Thomson Reuters, the CME Group, and the ‘Independent’ Oversight Committee for the LBMA Silver Price released a statement solely by email. This statement was not published on the websites of either the CME Group, Thomson Reuters, nor the website of the LBMA, hence, many people would not have seen it. Therefore, the full statement that they released is as follows:

“Developments to LBMA Silver Price Benchmark

Joint statement by Thomson Reuters, CME Group and the independent Silver Price Oversight Committee

LONDON, February 4, 2016 – Thomson Reuters and CME Group with the agreement of the LBMA and the independent LBMA Silver Price Oversight Committee today announce a package of measures to further develop the silver benchmark.

In addition to its regular meetings, the Committee has held two extraordinary meetings since the auction on Thursday January 28, 2016 and has been working with the benchmark administrator (Thomson Reuters) and calculator (CME Group) to address concerns. The regulatory authority, the Financial Conduct Authority, has been kept fully informed.

At the meeting, the Committee endorsed an intervention protocol agreed by the administrator and calculator to suspend an auction if they believe the integrity of the auction or participants is threatened.

This protocol has been in place since Friday January 29, 2016. All participants and the FCA have been informed of its implementation.

The Committee, Thomson Reuters and CME Group will present details of the measures to participants, their clients and the Financial Conduct Authority for discussion and implementation at the earliest opportunity.

These include: a blind auction, where only prices and not volumes are disclosed to participants until after the auction has closed; increasing the settlement tolerance where necessary to maintain the integrity of the auction; change the structure for sharing the differential to encourage full participation; and a package of measures to increase participation in the benchmark process and to encourage non-banks’ participation.

In addition we look at the viability of introducing centralized clearing of all auction trades, to make the process easier and less capital-intensive for participants.

“We are committed to maintaining the integrity of the LBMA Silver Price,” said Neil Stocks, chairman of the Oversight Committee. “We are introducing enhancements and are consulting on further developments with the many users who rely on this important benchmark.”

Note to editors

The LBMA Silver Price is calculated daily on a transparent electronic auction platform operated by the CME Group; Thomson Reuters is responsible for administration.

Contact

Brian Mairs, Thomson Reuters

Donal McCarthy, CME Group"

The above statement from Thomson Reuters, CME Group and the Oversight Committee is, in my view, misleading from a number of perspectives. As you will see below, the above statement fails to mention that increased participation in the benchmark auction, as well as non-bank participation in the auction, were promised by Thomson Reuters, the CME Group and the LBMA in July and August 2014, which was before the LBMA Silver Price auction was even launched.

The above statement also fails to mention that the introduction of centralized clearing was also promised by Thomson Reuters, CME Group and the LBMA in July and August 2014, again before the LBMA Silver Price auction had even been launched.

It is now February 2016, more than 18 months after the LBMA Silver Price was introduced, and here we have Thomson Reuters and the CME Group with the gall to state that they have suddenly formulated plans for wider participation and central clearing, when all along, these plans were actively discussed by the LBMA and CME Group during July and August 2014 as practical mechanisms that were promised to be implemented to address the pricing concerns of the wider silver market community and the spirit of the IOSCO benchmark Principles.

Given that the details of wider auction participation and central clearing of silver auction trades were quietly dropped and evidence of said discussion was even actively removed from the websites of CME Group and Thomson Reuters, it is not unreasonable to conclude that various powerful entities representing the London Bullion Market have been doing everything they can to prevent wider participation in the Silver auction, and doing everything they can to prevent central clearing being implemented for Silver auction trades.

London Silver Price Seminar – CME Webinar 29 July 2014

On Tuesday 29 July 2014, just over two weeks after the CME Group and Thomson Reuters had been awarded the contract to run the LBMA Silver Price auction process, and just over two weeks before the 15 August 2014 auction go-live date, “CME Group Metals Products and OTC Solutions" held a webinar titled the ‘London Silver Price Seminar’.

Recall that at that time, the new auction was still being referred to as the ‘London Silver Price’, and not the ‘LBMA Silver Price’. Critically, at various points in the 29 July webinar presentation (38 minutes long), reference was made to the new silver auction eventually using CME Clearing Europe as a central clearing counterparty (CPP) for all trades in the LBMA silver price auction.

The webinar consisted of presentations by four CME Group staff, namely, Jack Allen of the CME business team, Michel Evaraert, Head of OTC solutions for CME, Harriet Hunnable, CME’s Global Head of Precious Metals, and Anindya Boral, also of the CME business team. There was also a selection of Q&A from attendees at various points in the webinar.

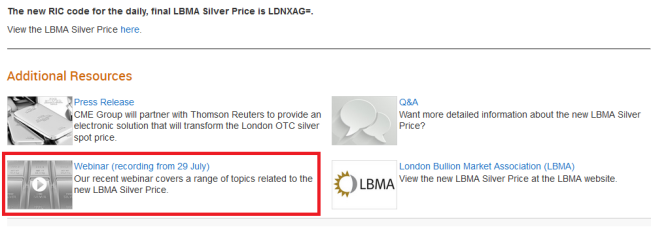

From July 2014 to October 2014, a link to this CME webinar presentation was prominently listed on the CME Group’s LBMA Silver Price web page under the section ‘Additional Resources’, with the description “Our recent webinar covers a range of topics to the new LBMA Silver Price“. The following screenshot from the 9th October 2014 Wayback Machine archive link to the page in question can be seen below, with the Webinar link highlighted.

Sometime between October 2014 and early January 2015, but at least before 12th January 2015, the CME’s webinar link had been removed from the ‘Additional Resources’ section of the same webpage.

Now, why would such a useful ‘Additional Resources’ link in the form of a webinar covering “a range of topics to the new LBMA Silver Price" suddenly be removed from the website of the LBMA Silver Price calculation agent (CME) just a few shorts months after the new silver fixing auction was launched?

For those who want to see this webinar, don’t panic, because the full CME webinar from 29 July 2014 on the LBMA Silver Price can be seen here:

The CME webinar can also be played at this direct CME website. Let’s see how long this link stays live: http://cmegroup.adobeconnect.com/p3o9n3qj6gr/

At the outset of the 29 July 2014 webinar, the CME Group displayed a power point slide showing a timeline divided into three phases:

- Phase 1 was listed as ‘Today (July 29th) till August 15th’, described as ‘Day 1 participation’ and ‘business as usual’.

- Phase 2 was titled ‘Broader base Participation”, including “Tier 2 participation”.

- Phase 3 was ‘Extended Participation’, ‘Central Clearing via CME Clearing Europe’, and an ‘on-boarding process’, and also ‘EUR & GBP ability’.

Harriet Hunnable introduced the webinar, by saying:

“We wanted to make sure that we were addressing some of the questions that were coming to us from end-users, from silver producers and refiners and the like with regard to this transition that is happening in the London silver market. We wanted to make sure we were doing this pretty quickly given the number of inquiries we were getting and also the depth of business change that end-users were trying to prepare themselves for."

Harriett Hunnable also stated that the CME wanted to"

“enable more wide participation over time, directly towards this key market benchmark and reference price.”

Harriett Hunnable introduced Jack Allen of the CME business team, saying that Jack Allen:

“will be talking about what the banks are doing now and other participants can do over time to be part of this new London Silver Price”.

Both Jack Allen and Michel Everaert highlighted that the CME Group seemed to be under time pressure to deliver the new electronic based silver auction between July 11 and August 15:

Jack Allen said

“Time is short, 5 weeks, from when we were mandated, which is tough, it’s tough."

Michel Evaraert said that:

“this really is what we call phase 1 of this effort. We were under very tight timelines to move the auction process into this new model…..we fully expect more functional changes over time…..we have simply electronified this (existing) process and we’ve introduced an audit trail and significantly more transparency to that process…”

Jack Allen’s explanation of the CME’s three phases highlights how the CME planned that the LBMA Silver Price would progressively evolve over the period after it was launched:

“For Day 1 participation, what have we got? We’re looking at the LBMA Market Makers with consistent and constant bilateral credit facilities. These are very much encouraged due to restrictive timelines, and we know that this as a core participation that will work.”

“For the corporate and commercial user it will be business as usual. As a commercial user from day 1 please reach out to your correspondent banks and trading counterparties. There will be very little difference to what you previously had and what you’re going to be getting on 15th August”.

On Phase 2, Allen said:

“Phase 2 we are looking for broader participation. On Day 1 our market makers may not be up and ready really yet. We will be very much again encouraging them to join, as well as suitable bilateral, what I would call, upper echelon banks with a good credit basis”.

On Phase 3, Allen said:

“Extended Participation, we envisage central clearing via CME Clearing Europe under the auspices of the UK and European regulated authorities which should effectively open the door for most participants.”

There were a number of Q&A breaks during the CME’s 29 July 2014 webinar. Many of the questions and answers from the webinar are very important and revealing, and are therefore documented below. Jack Allen read out the questions that came in from webinar participants:

Question: We have a question around getting the banks signed up and negotiating the legal documentation.”

Jack Allen: “I can answer that. Basically it’s going pretty well at the moment, in terms of numbers without being specific. I think we can pretty much say in category one, two and three, with one being the top-tier, we’ve probably got between 6 and 7 verbal interests, good interests… I would say there’s probably a couple of mid-term ones on the lower scale, 5 of those are still considering what they are going to do. But it’s actually looking very good at the moment.”

Question: “Is the platform open by invitation or is there a process for new participants to go through?”

There seemed to be hesitation by Jack Allen to answer this question (listen to the webinar to see what I mean), and Harriet Hunnable then stepped in and answered the question:

Harriet Hunnable: “The LBMA is going to be running the accreditation for phase 2 participants, they are setting up some criteria, and it will be open for people to apply.”

Question: “What is the targeted timeframe for moving to centralised clearing?”

Jack Allen: “We’re basically starting the process as soon as possible. Let’s get this up and running by 15th August and then it’s all hands to the pumps on the clearing side so hopefully it will happen soon.”

Harriet Hunnable added:

“It’s possible to clear some trades already today on CME Europe and also in the US, to clear silver forwards and spot trades already, these are for loco London delivery. The work we’ve got to do is to set this up so that’s it’s part of the platform so it’s a level playing field for participants…

Anindya Boral will be starting to do a big drive to enable cleared transactions through our clearing house and wider participation in August, so if you’re interested in that please get in contact with your broker or clearer or current bank. Boral is going to be doing a lot of work across CME Europe to facilitate that.”

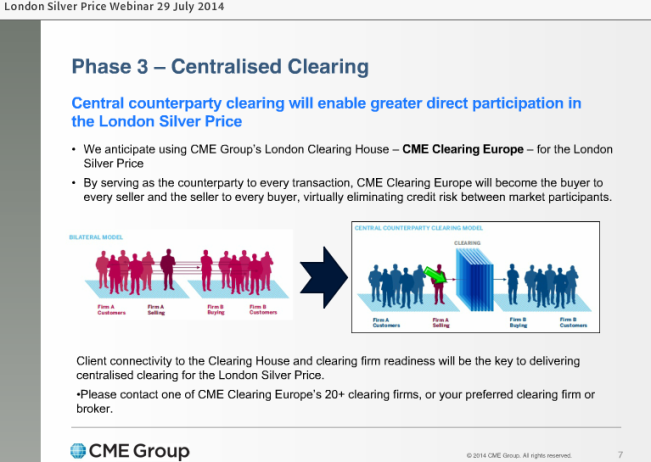

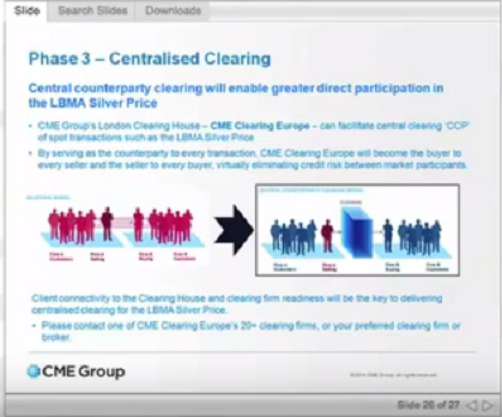

There then followed a short discussion by Anindya Boral addressing central counterparty clearing through CME Clearing Europe, and a discussion of the slide which follows below. This is a very important slide because a variant of this slide appeared in the Thomson Reuters / CME Group / LBMA webinar presentation on 19 August 2014 (see below), but by then, the reference to CME Clearing Europe in the 19 August version of the same slide had been watered down significantly.

SLIDE 7 from CME Webinar:

Slide text

Phase 3, Centralised Clearing

“Central counterparty clearing will enable greater direct participation in the London Silver Price”.

- We anticipate using CME Group’s London Clearing House – CME Clearing Europe – for the London Silver Price

By serving as the counterparty to every transaction, CME Clearing Europe will become the buyer to every seller and the seller to every buyer, virtually eliminating credit risk between market participants

- Client connectivity to the Clearing House and clearing firm readiness will be the key to delivering centralised clearing for the London Silver Price

- Please contact one of CME Clearing Europe’s 20+ clearing firms, or your preferred clearing firm or broker

That slide concluded the CME Group webinar on 29 July.

Reuters Global Gold Forum – 17 July 2014

On 17 July 2014, less than a week after the CME Group and Thomson Reuters had won the LBMA silver contract, Jonathan Spall of G Cubed Metals (and formerly of Barclays Capital) appeared in a Thomson Reuters Global Gold Forum webinar session where he was interviewed by Jan Harvey of Thomson Reuters about the new silver auction and associated topics.

A LBMA press release from 11 July 2014, titled “LBMA SILVER PRICE SOLUTION: CME GROUP & THOMSON REUTERS“, stated that the market consensus (to choose CME and Thomson Reuters)…

“…was also supported by the independent review conducted by Jonathan Spall of G Cubed Metals Ltd. As part of his review, Jon carried out in-depth interviews with the seven companies who delivered presentations at the seminar on the 20th June."

So the review written by Jonathan Spall, the ‘independent consultant’ hired by the LBMA, also supported the choice of CME Group and Thomson Reuters to operate the new LBMA Silver Price auction. The regular Thomson Reuters global gold forum over the Reuters platform is hosted by Reuters journalists, and takes the form of a question and answer session with precious metals industry representatives, often facilitated by Jan Harvey.

Jan Harvey (Thomson Reuters):

“What made the successful proposal successful, as far as you were concerned?”

Jonathan Spall (G Cubed Metals Ltd) (part of answer to the above question)

“The hope of course is that we get many more participants in the new benchmark process….while it is likely that we will start by having banks involved it is ultimately hoped that the wider market will participate, be they refiners, miners etc. The idea of starting with banks is that they are likely to have credit lines with each other, and without centralised clearing that is obviously vital.”

So, centralised clearing precludes the need for using bilateral credit lines in the auction, and therefore removes one of the barriers to entry that favours the bulllion banks as the exclusive direct participants in the auction. The Thomson Reuters Forum continued:

Jan Harvey: (with a question from the floor):

“How is this going to work, as not everyone has credit with everyone. What if the algo (algorithm) matches you against someone with whom you don’t have credit?"

Jonathan Spall (G Cubed Metals Ltd):

“That’s why it’s starting with the banks. Ultimately, there may be some form of agreement such that if a refinery, for example, wants to become part of the benchmark (and I very much hope that they do) – then a bank could agree that if the algo matches the refiner/miner etc to a name where they do not have credit lines, the bank would be allowed to intermediate.”

Jan Harvey:

“Another question from the floor: ‘Will there be a published parallel run of the silver fix? And will only banks get access to the platform and also the run of the auction?’

Jonathan Spall (G Cubed Metals Ltd):

“There all be parallel testing – so basically during August we can see if the system and software works. But it will not take place at noon. The idea of the auction is that volumes and the number of buyers and sellers will be published unlike now. So you can see that there were 3 buyers and 1 seller perhaps with 3 million ounces of silver taking place the names of the buyers and sellers will not be released though.

Ultimately – and as I said before – the intention is that there is much wider participation. So yes, refiners, miners etc.”

Jan Harvey (also from the floor):

“Will the volumes and number of sellers be published in real-time?"

Jonathan Spall (G Cubed Metals Ltd):

“My understanding is that it will be.”

Jan Harvey

“From the same questioner – ’Will that be the case as of 15th August or not initially?’"

Jonathan Spall (G Cubed Metals Ltd):

“There is an enormous amount to sort out in less than a month – certainly the intention is there but not necessarily from day 1. There will also be the ability to see orders of the bank themselves and clients – again this will follow later. So orders will be gross – ultimately – and not net. The intention is to make it as transparent as possible but it will not be all singing and dancing on day 1.”

Thomson Reuters Webinar 19 August 2014 – including Ruth Crowell (LBMA) and Harriet Hunnable (CME)

On Tuesday 19 August 2014, Thomson Reuters hosted two sessions (London morning and afternoon) of a broadcast webinar titled “The New LBMA Silver Price, Greater Transparency, Facilitated by Thomson Reuters, CME Group, and LBMA”. The morning session took place from 9.30am – 10:30am London time. Note that by August 19 2014, the CME’s Phase 1 had by that time passed (i.e. it was after the 15 August 2014 launch date of the LBMA Silver Price).

Douglas Pollack, Thomson Reuters Head of Market Development for Commodities in Europe, hosted the webinar. Other speakers included Bernd Sischka, Global Metals Proposition Manager for Thomson Reuters, Ruth Cowell, LBMA CEO, and again, Harriet Hunnable, of CME metals products.

This webinar was available on the following link but has been taken down: http://edge.media-server.com/m/p/j82fcpca/st/TR/. Accessing this link now returns an error message:

Lucky however, the morning session of the LBMA – Thomson Reuters – CME Group 19 August 2014 webinar can still be viewed in full here:

Attendees at the 19 August 2014 could post questions to the panel during the webinar to be answered in the Q&A parts of the session.

Bernd Sischka began the 19 August 2014 webinar, and said that he would cover methodology and auction process, and then cover the details of participation:

“The third point I will highlight, who can participate in the LBMA Silver Price auction, and highlight the requirements for any new market participants who are looking and aiming to participate in the auction”.

This is what Bernd Sischka then said about auction ‘Participation’:

“So who can participate in the LBMS Silver Price auction? There are a number of market participants which have signed up for Day 1 participation and successfully participated in the auction process, but obviously given that this benchmark is meant to provide access for a wider range of market participants, and also increase the transparency and establish the LBMA Silver Price as a widely used benchmark, there obviously are certain ways that other participants who have heard about the new LBMA Silver Price, who can actually fulfill certain criteria for participation.

However, Bernd Sischka did not explain or even list what the LBMA accreditation criteria consisted of:

“So I will just briefly highlight what those requirements are. First of all there are certain benchmark criteria which are set out by the LBMA, given that the LBMA is accrediting all the market participants. That is probably one of the key requirements that have to be fulfilled..

.. followed on by from the Thomson Reuters side, we’ve got a participant code of conduct which is a legal document which we require as the administrator, for every market participant to sign up to, and then thirdly from the CME side, obviously given that the CME operates the electronic auction platform, there are technological requirements and documents, and legal documents, that need to be signed off by the individual market participants, in order to be able to participate in the auction platform.”

About the methodology document, Bernd Sischka said:

“the second key document is a very extensive methodology document which goes into much more detail which was drafted by the CME, LBMA and Thomson Reuters as a joint document”.

During Ruth Crowell’s part of the session, she discussed the survey that the LBMA had launched in May 2014 to solicit views on improvements to the then existing Silver Fixing. This survey received 444 responses from interested parties in the Silver Market. While discussing slide 19 of the presentation, Crowell stated that there was a:

“clear demand that came out that there was market satisfaction with the current mechanism, but demand for some improvement, particularly further transparency, as well as increased direct participation, and we had 25% of those 444 coming back saying they would be interested, and we’re still interested in having all of those participants on board, and I can talk a little bit about that later, and I know Harriett will as well.”

However, the later discussion in the webinar from Ruth Crowell and Harriet Hunnable did not talk about extended participation until an attendee of the webinar specifically asked a question about it.

After the formal presentation completed, there was a Q&A session for the attendees, with the questions submitted via the webinar and read out by Douglas Pollack.

Question:

“According to the presentation, phase 3 introduction of centralised clearing and CCP….Does this mean that the London price, trading loco London, becomes more exchange based, rather than OTC market?"

Harriett Hunnable:

“Lets go ..to slide 27,..ehm..central clearing is not something we’ve spoken about here because we wanted to focus on what’s up and running on Day 1 and how it’s set up”

Note: By 19 August 2014, the CME’s slide on ‘Phase 3 – Centralised Clearing’ had been distorted and the first bullet point which had previously stated…

“Central counterparty clearing will enable greater direct participation in the London Silver Price"

had now become…

“CME Group’s London Clearing House – CME Clearing Europe – can facilitate central clearing CCP of spot transactions such as the LBMA Silver Price"

Harriett Hunnable continued:

“We have discussed with the LBMA and with a number of interested participants…., it is possible today to centrally clear through our clearing houses, at CME Group silver spot and silver forward transactions and it is possible that at a later stage we introduce under the auspices of the LBMA, central clearing, into this model…

..and we’ve called that phase 3, just to illustrate that there are several steps that need to be gone through to get there. ….to answer that question, will it become an exchange traded market, no, this remains an over the counter product, it is not listed on a recognised investment exchange, so whether it remains like it is today, whether it is bilaterally cleared, from one participant to another participant, or centrally cleared with a clearing house in the middle, it will remain an over-the-counter marketplace, and it will not be an exchange marketplace.”

Ruth Cowell:

“The advantage with centralised clearing, particularly for the pricing mechanism, is that we can really exponentially grow the amount of direct participants, and that was something that was really highlighted during the working group and the testing is that credit is an issue, and obviously in the old model, the participants in it had quite high credit with one another, but managing the credit in the new system is something that we’ve …..addressed, but there is a limit when it comes to.. there’s a difference between a small participant and one of the larger institutions credit wise, you still want to allow liquidity, but centralised clearing is a way to get to meet all of those things …..”

Question:

“What happens to London Precious Metals Clearing Limited?”

Ruth Cowell: “…. nothing happens to London Precious Metals Clearing Limited. It remains the institution which is separate from the LBMA…..and.. it continues business as usual..”

Harriett Hunnable: “..business as usual in London.”

Douglas Pollack: “Nice easy answer on that one!”

It appears to me that there was a reluctance of the presenters to talk about London Precious Metals Clearing Limited (listen to the webinar to see what I mean).

Question:

“Will actual direct participating members who are direct participants become brokers for their underlying clients?”

Harriett Hunnable:

“They may do and some of them may decide not to…so it is very possible that we have a major producer who wants to become a direct participant and does so. It is possible that we have a trading company and a bank who are…both of whom act as brokers for other participants, and accept their orders and place them on the fixing …so the model allows for clear direct participation and what you might call aggregated direct participation…so yes, we expect some of the participants to take direct orders from others but it’s not a requirement.”

Ruth Cowell:

“And that’s the way it has traditionally worked…I think for a lot of participants, particularly those who haven’t been involved in the process, if you’re looking at institutions, like producers, if they have significant business to do during the auction then they could probably make a business case to become a direct participant, ..put the controls and the governance in place, however, if it’s something that they are just doing a few times per year, they probably, I would expect, would do business the way they traditionally have, through their metals partner”

That said…many of the accredited participants have made it clear that if you’re someone who is another bank or trading house, they may not be willing to take your orders on the long-term basis, and that is something that has got to change….and because there is direct participation that is comparable…if you’re the type of player that should be directly involved from their perspective, they reserve the right to say no.”

Harriett Hunnable:

“So this is really the new world, this is not the old fixing…..this is wider participation…and the London bullion market is really encouraging that…this is the new world, or the LBMA Silver Price!”.

Question:

“Why have some participants refused to take others from a lot of semi-pros for the new LBMA Silver Price?

Ruth Cowell:

“What we want to see is more direct participation. If you’re an institution who should be directly involved or able to have the controls, because you’re participating in another benchmark, the market would like to see those people there as well, which is why a lot of the traditional players have said we will not take your orders. We don’t want to have just the liability on ourselves, we want everyone to put direct participation in, so it stops being only a few institutions.

In the new mechanism it’s definitely a big change….in that there’s not the ownership and liability that we had with the old,…..ultimately everyone is a participant, they are not obliged to participate every day, if they don’t participate then they don’t share the differential so it is something that you can be accredited for and when you have business, you put that business in, it’s not a blind ….in the same way as the past.”

Question:

“What phase is the current implementation, is there a roadmap to phase 3?”

Ruth Cowell:

“There is a roadmap for phase 3, there is also a roadmap for phase 2..and that’s something we’ve been working with the participants and potential participants on, in conjunction with the CME Group and Thomson Reuters. So if there is interest I invite you to engage with the LBMA and we can put you in touch with the right people to start sharing and building that roadmap together.”

I think the above spin speaks for itself. No comment necessary. But I advise readers and especially journalists to listen to the 2 webinars above, and to begin asking proper questions to the LBMA, to Thomson Reuters, and to the CME Group.

The above webinar was the morning Thomson Reuters webinar session. Coverage of the 19 August 2014 afternoon webinar session (London afternoon) by a Resource Clips article ‘Claims of greater transparency fail to satisfy critics of the LBMA silver price‘ referred to it thus:

“Phase II will bring more participants, possibly including trading houses, large refiners and producers, according to the CME, which expects to see “a big jump in terms of who can take part.” Those who seldom trade or can’t meet the LBMA criteria may do business through a broker or banker.

Wider participation will further enhance transparency says Harriet Hunnable, CME head of precious metals”.

There was also a Q&A session at the second August 19 webinar and the Resource Clips web site covered some of the Q&A topics. The questions chosen to be answered in the second webinar were far less challenging than those in the morning webinar session, and, according to Resource Clips, covered topics such as regulation of the auction, purpose of the algorithm, reason for having a minimum 100,000 ounce lot size and ‘physical’ delivery.

Even so, Resource Clips concluded in its article that:

“Some of those (Q&A) replies might have benefited from greater conviction, not to mention clarity.”

LBMA distances itself from the scandal

Some journalists, such as in Platts, have admittedly now begun to ask the pertinent questions. But the ‘Gang of 3’ entities that should be answering the questions are refusing to do so.

Apart from the mis-leading and disingenuous 4 February “Joint statement by Thomson Reuters, CME Group and the independent Silver Price Oversight Committee" (see above), the auction owner (LBMA), administrator (Thomson Reuters) and calculation agent (CME Group) have not co-operated with those asking the questions, such as Platts. From a Platts article on the afternoon of 4 February 2016:

“The LBMA, which does not participate in daily operations, declined to comment on the matter.

Both CME and Thomson Reuters declined to comment, pending an investigation into last week’s settlement issues."

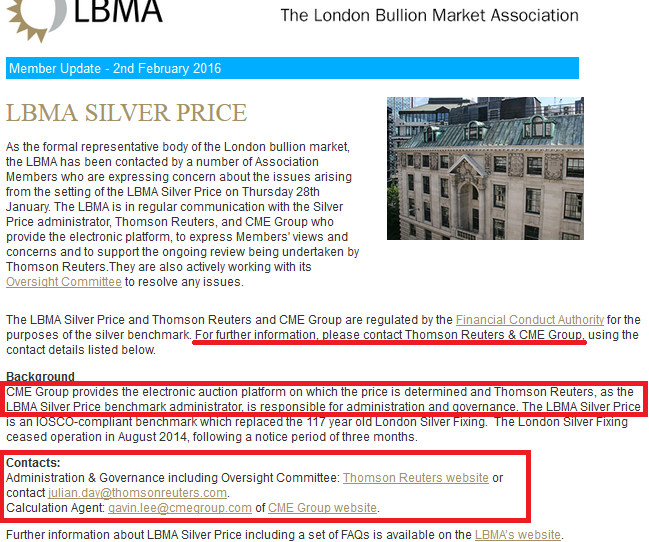

The LBMA looks to be running scared and has distanced itself from the latest silver price manipulation controversy. The one noncommittal acknowledgement that the LBMA did communicate on 2 February (after pressure and contact from silver market participants) was only transmitted via a link to a page that had been uploaded to an obscure email management software app called createsend.com – See link http://createsend.com/t/j-85A8744E09A02D2B and below is the screenshot. Notice how the LBMA seeks to highlight in a few places in its release, the roles and responsibilities of Thomson Reuters and the CME Group. Rats on a sinking ship perhaps:

The above bereft LBMA update does not even acknowledge that the LBMA owns the intellectual property rights to LBMA Silver Price (as well as similar ownership rights to the LBMA Gold Price). The LBMA registered the Trademarks for both the LBMA Silver Price and the LBMA Gold Price on the same day, August 15 2014. See LBMA Silver Price Trademark and LBMA Gold Price Trademark.

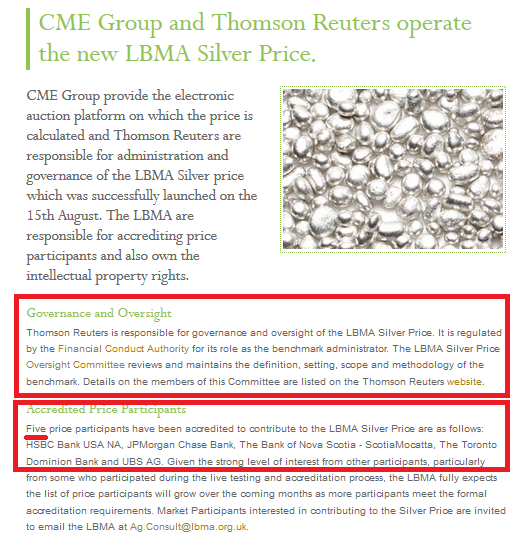

The LBMA also updated its website after 28 January 2016 by adding an entire ‘Governance and Oversight’ section near the top of its LBMA Silver Price description page pinning the responsibility on Thomson Reuters and the CME Group.

The first screenshot is from a Google cache imprint on 28 January 2016. This cache has now updated but a Wayback Machine imprint with the same information from 22 September 2015 shows the same imprint.

The second current version of this LBMA Silver Price web page shows the hastily added ‘Governance and Oversight’ paragraph, with similar text to that which appeared in the LBMA’s arms-length email stunt using createsend.com.

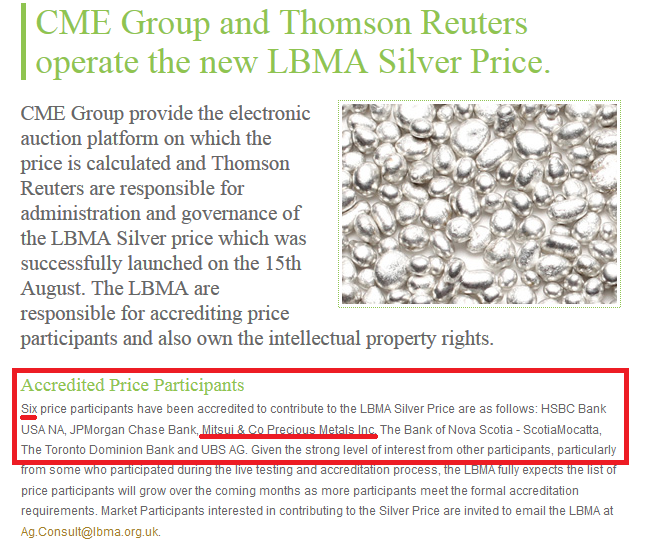

In the above 2 screenshots, you will notice that the ‘Accredited Price Participants’ paragraph has also been highlighted. It was only after the 28 January 2016 silver price fiasco auction that the LBMA suddenly changed its text and pulled Mitsui and Co Precious Metals Inc from the list of 6 participants of the LBMA Silver Price. Why were there 6 participants accredited on 28 January, but only 5 participants accredited on 29 January? And why was Mitsui still listed as a silver auction participant when it was reported in October 2015 to be “shutting down precious in London and New York in December" according to Reuters “Mitsui to shut precious metals business in London, New York-sources“.

Even an early version of an article from BullionDesk on 28 January reported that

“The [silver] price is set every day by six participants – HSBC, JPMorgan Chase Bank, Mitsui & Co Precious Metals, The Bank of Nova Scotia, Toronto Dominion Bank and UBS – using a system run by CME and Thomson Reuters“.

Thomson Reuters (as administrator of the LBMA Silver Price) only very recently added a number of compliance type documents to its website. In one of them, the ‘silver price participant code of conduct‘, there is a paragraph about a participant needing to give 1 month’s notice of withdrawing from the auction:

Participants Notice of Withdrawal

1.5 Participants considering withdrawing from the LBMA Silver Price Benchmark auction process must endeavor to provide Thomson Reuters with at least one calendar month’s notice in order to protect the continuation of the Benchmark.

On launch day in August 2014, the LBMA trumpeted the addition of Mitsui to the LBMA Silver Price but has now reverted to very quietly amending its website when Mitsui has departed.

The Gang of Six

The new LBMA Silver Price was launched on 15 August 2014, administered by Thomson Reuters, with CME Group as auction calculation agent. On launch day there were only 3 direct participants, Bank of Nova Scotia (Scotia Mocatta), HSBC Bank USA NA, and the now infamous Mitsui & Co Precious Metals Inc. HSBC and Scotia had been existing members of the London Silver Market Fixing Limited company, in conjunction with Deutsche Bank.

On 15 August 2014, the LBMA claimed that it “fully expects the list of price participants will grow over the coming weeks” and that “these participants include banks, trading houses, refiners and producers”. This growth of participants, as readers will be aware, never happened. Scandalously, only 3 further participants ever joined the LBMA Silver Price auction, and these 3 participants were all banks which had representatives on the 10 person LBMA Management Committee. UBS joined the Silver auction on 26 September 2014, JP Morgan Chase Bank joined the Silver auction on 14 October 2014, and The Toronto Dominion Bank signed up to the auction on 6 November 2014.

During that time, the 10 person LBMA Management Committee of the LBMA included Steven Lowe of Bank of Nova Scotia-ScotiaMocatta (Vice-Chairman), Peter Drabwell of HSBC Bank USA NA, Kevin Roberts of JP Morgan Chase Bank, Philip Aubertin of UBS AG, Robert Davis of Toronto Dominion Bank, and Anne Dennison of Mitsui. The chances of the only 6 participants ever to join the LBMA Silver Price auction being 6 of the 8 banks which were represented on the LBMA Management Committee when they signed up, is infinitely small.

Gates and Obstacles to Wider Participation crafted from Day 1 in August 2014

On August 15, a document titled “Commodities Benchmark Methodologies: LBMA Silver Price” was published under the name of Thomson Reuters, the administrator of the new LBMA Silver Price benchmark. Some of this was covered in a section of the BullionStar blog post “Chinese Banks as direct participants in the new LBMA Gold and Silver Price auctions? Not so fast!“, but is critical here to understand which entities can and can’t participate in the Silver auction.

This Silver Price methodology guide was jointly written by the LBMA, Thomson Reuters, and the CME Group and discusses the methodology that the three groups have established for the silver price benchmark, including the criteria that qualifies an applicant to be authorised as a silver auction participant.

This LBMA Silver Price Methodology document states that:

“Participation in the auction is open to all silver market participants who meet the following conditions:

- meet the Benchmark Participant criteria set out by the LBMA

- meet the Participation criteria set out by Thomson Reuters as the Administrator

- meet the requirements set by CME Benchmark Europe Ltd to use the technology platform and

participate in the auction market place.

The market participants are accredited by the LBMA; access to the auction platform is approved by CME Benchmark Europe Ltd.

It’s important to look at each of these three sets of criteria/requirements as these criteria/requirements are the basis under which the LBMA plays the role of gatekeeper in deciding which applicants to allow to join the new silver auction process. It’s also important to note the distinction between participant criteria and participation criteria:

The LBMA’s Benchmark Participant criteria

In a section titled “Benchmark Participant criteria”, the document states:

- A participant has to be a Full Member (Ordinary or Market Making) of the LBMA.

- The participant also needs to have a Loco London Clearing account.

- Applicants to be a Full LBMA Member must demonstrate that they:

- actively trade spot, options or forwards in the London Bullion Market

- Pass KYC (know your customer) procedures

- Declare conformance with the Non-Investment Products Code

- Applications are subject to review and ultimate approval by LBMA

- The participant has to accept and implement the Thomson Reuters LBMA Silver Price Participant Code of Conduct

- Participation is additionally subject to the requirements set by CME Benchmark Europe Ltd for use of the technology platform and for participation in the auction (e.g., in respect of credit arrangements)

In a further section titled “Accreditation of Participants” the document states:

- Participants will be accredited by the LBMA based on the Benchmark Participant Criteria

- Accredited Price Participants will be listed separately on the LBMA website

There is no reference in the Thomson Reuters document to the phrase to the concept of ranking participants based on ‘credit ratings’ or ‘credit scores’ as Jack Allen of CME stated in the CME webinar when he said “LBMA Market Makers with consistent and constant bilateral credit facilities“.

Note that all of the market-making members of the LBMA already meet the LBMA’s benchmark participant criteria and just need to receive formal LBMA authorisation and sign up to the CME’s platform and participation requirements.

Thomson Reuters’ Participation Criteria

Thomson Reuters’ participation criteria refer to the fact that “all participants are required to adopt the LBMA Silver Price Participant Code of Conduct”. This is addressed in a section titled “Benchmark Participant Codes of Conduct”.

CME Benchmark Europe Ltd Requirements

The CME Benchmark Europe Ltd also has requirements which participants must adhere to. These requirements relate to the use of the technology platform and to participating in the auction.

One participation requirement cited in the document is “in respect of credit arrangements”. These credit arrangement refer to the bi-lateral credit lines between the participating bank in the auction.

According to the methodology guide, the auction platform also has a credit screener built-in which ensures “that an order entered by a participant will not result in that participant exceeding their pre-set credit limit”.

Auction participants also need to sign the CME Benchmark Europe Ltd Participation Agreement.

Limitations of the Silver Price Auction in terms of IOSCO

The most obvious limitation of the LBMA participant criteria is that auction participants are required to be Full Members of the LBMA, and so the auction is not representative of the global Silver Market.

The IOSCO benchmark principles state that a benchmark should be a reliable representation of interest, i.e. that it should be representative of the market it is trying to measure. Interest is measured on metrics such as market concentration. In the Thomson Reuters methodology document, on page 11 under benchmark design principles, the authors estimate that there are 500-1000 active trading entities in the global silver market.

4.2 Financial Benchmarks Design Principles

Reliable representation of the interest:

“Market concentration Estimated ~500-1000 active trading entities; an estimated 5 market markets at launch date rising to approximately 15 spot market makers in the auction."

Yet there are only 75 full members of the LBMA, 61 of which are Ordinary members, and some of these ordinary members are just logistical and infrastructure type entities. Even the 66 Associates and 9 affiliates of the LBMA cannot even apply to participate directly in the Silver auction. Therefore, due to the strict auction participant criteria, a handful of LBMA market-makers are being assigned to globally represent the 500-1000 active trading entities. The Methodology document also foresaw 15 spot market makers in the auction. Where too are these 15 spot market makers?

The IOSCO benchmark design principles, page 11, also recommend measuring a metric called “relative size of the underlying market in relation to the volume of trading (the volume of trading that is being used to form the benchmark)”.

iii. Relative size of the underlying market in relation to the volume of trading

Volumes in the LBMA Silver Price auction are a fraction of the daily volume traded in the silver futures and OTC markets

The Thomson Reuters methodology document admits that “volumes in the LBMA Silver Price are a fraction of the daily volume traded in the silver futures and OTC markets”.

The first day of the LBMA Silver Price auction only saw a net 525,000 ounces of silver offered and a net 325,000 ounces bid. Since the CME group and Thomson Reuters don’t provide any other volume data beyond this net data, on face value this looks like a miniscule amount of silver compared to global daily silver trading, and it not representative of anything in particular. Net auction volume data is not useful without the pyramid of gross trade data that may or may not lie underneath it.

All for One and One for All

Finally, since this article started with the Statement jointly issued by Thomson Reuters, CME Europe and the ‘Independent’ Silver Price Oversight Committee, let’s look at what exactly these 3 entities are.

The new LBMA Silver Price is therefore being ‘run’ by a combination of three entities, namely, the LBMA, CME Group and Thomson Reuters, but more specifically, the LBMA, CME Benchmark Europe Ltd. (“CMEBEL”), and Thomson Reuters Benchmark Services Ltd. (“TRBSL”).

There is now an extensive disclaimer on the LBMA website addressing the LBMA Silver Price (which obviously wasn’t there during the time of the London Silver Market Fixing Limited company). Given the involvement of the three parties, LBMA, CME and Thomson Reuters, together they now comprise the ‘Disclaiming Parties’. The introduction of this (long) disclaimer is as follows:

LBMA Silver Price (“Benchmark”) is owned by The London Bullion Market Association (“LBMA”), calculated by CME Benchmark Europe Ltd. (“CMEBEL”) and administered by Thomson Reuters Benchmark Services Ltd. (“TRBSL”).

None of LBMA, CMEBEL, TRBSL, their group companies, nor any of their or their group companies’ respective directors, officers, employees or agents (collectively the “Disclaiming Parties”) shall be liable in respect of the accuracy or the completeness of the Benchmark or the market data related thereto (“Market Data”) and none of the disclaiming parties shall have any liability for any errors, omissions, delays or interruptions in providing the Benchmark or market data."

So who are CEMBEL and TRBSL?

Thomson Reuters Benchmark Services Limited

The administrator of the LBMA Silver Price process is a freshly established subsidiary of Thomson Reuters called “Thomson Reuters Benchmark Services Limited” (TRBSL).

Thomson Reuters Benchmark Services Limited is a private limited company, company number 08541574 which was incorporated on May 25, 2013, but only really ‘launched’ in March 2014. TRBSL has a registered address of “The Thomson Reuters Building, 30 South Colonnade, Canary Wharf, London E14 5EP”.

Initially the directors appointed to TRBSL were legal and compliance staff from Thomson Reuters including David Mitchley, Global Compliance Controller. From October 2013 onwards these directors were replaced by other directors from Thomson Reuters, namely Peter Moss, Head of Trading, Mark Beaumont, Global head of Treasury, John Cooley, Global Head of Indexes and Reference Rates, and Philip Wellard, Head of Transaction Services. TRBSL was then publicly launched in March 2014 via various press releases. Philip Wellard resigned from TRBSL in May 2014.

Mark Beaumont was a director of TRBSL all the way through the LBMA consultation and selection process but then dropped off the director list on July 17 2014, a few days after the LBMA had selected Thomson Reuters to administer the auction. On July 17 2014, another Thomson Reuters executive, Stephen Turner, Global head of Planning and Deployment, Real Time Technology, was appointed as a director of TRBSL. Julian Day, Global Head of Fixing Operations at Thomson Reuters was appointed to TRBSL in October 2014, Peter Moss dropped off in March 2015, Tobius Sproehnle, Global head of Benchmark Services at Thomson Reuters was appointed to TRBSL in June 2015, and interestingly, the company’s Auditor resigned on 1 October 2015. Why would the auditor have resigned?

Thomson Reuters established TRBSL so as to have a separately governed and registered entity to provide benchmark services. This was partially done for compliance reasons in light of regulatory guidance and client expectations in the wake of the LIBOR scandal, when regulators took action against some of the banks that contributed to BBA LIBOR. TRBSL is now regulated by the FCA.

LIBOR had been administered by BBA LIBOR Ltd and calculated and published by Thomson Reuters. John Ewan (see below), a director of BBA LIBOR Ltd, left BBA LIBOR Ltd in 2012 and joined Thomson Reuters as Head of Fixings Business Development, and worked with Mark Beaumont on promoting the benchmark calculation and publication services of Thomson Reuters (see below). Ultimately, the senior people listed above are responsible for the LBMA Silver Price given that they are directors of TRBSL.

Note that LIBOR is now a regulated benchmark and regulated by the FCA since April 2015. ICE Benchmark Administration is the administrator of ICE LIBOR and also oversees the methodology and calculation process of this benchmark.

CME Benchmark Europe Limited

CME Benchmark Europe Ltd is a newly incorporated legal entity, purely set up for the LBMA Silver Price. CME Benchmark Europe Ltd (CMEBEL) is a private limited company, company number 09165067, which was only incorporated on 6 August 2014, a week before the new LBMA Silver Price auction went live.

On 6 August 2014, CEMBEL had a registered address of “3 More London Riverside, London SE1 2AQ”, which is the same address as law firm Norton Rose LLP, located near London Bridge Station. The secretary of the company is “Norose Company Secretarial Services Limited”, also of 3 More London Riverside, London SE1 2AQ. Norton Rose acts as outside legal counsel for CME Europe.

On 6 August 2014, the sole director of the company was Clive Weston, 3 More London Riverside, London SE1 2AQ. Clive Weston is listed with an occupation of company secretary. On 7 August 2014, the registered office of CME Benchmark Europe Ltd was re-registered to 4th Floor, One New Change, London EC4M 9AF, which is CME’s London headquarters office.

On 1 October 2014, two Appointment of Director forms were filed with Companies House on behalf of CMEBEL, appointing two CME employees as directors of CMEBEL. These forms were backdated to 6 August 2014. So, technically, the CME auction was being run for over six weeks by a company that had only one director and this director was a company secretary employed by law firm Norton Rose, who was not a direct employee of the CME Group. The forms filed on 1 October 2014 appointed William Knottenbelt and Adrienne Seaman as directors of CMEBEL. William Knottenbelt is CEO of CME Europe. Adrienne Seaman is CME Group associate general counsel for EMEA.

In February 2015, Richard Bodnum, md Tax, Jill Harley, md Corp Fin Services and Harriet Hunnable (Global Head of Precious Metals) were appointed to CMEBEL, with Bodnum and Harley both stepping down as directors in June 2015, after which Thomas Krabbe, director of Corporate Finance and Development and Julie Winkler, md Research, Product Development, were appointed as directors the same month, and Gavin Lee was appointed as a director in September 2015. On 11 December 2015, Harriet Hunnable’s directorship of CMEBEl was terminated, since she left the CME Group at that time.

CME Europe Benchmark Limited performs the roles of ‘auction platform operator’ and ‘calculation agent’ for the LBAM Silver Price. Immediately prior to each daily auction the ‘operator’ performs a calculation on diverse CME market data silver price sources in order to establish an opening or seed price that starts the whole auction process. CME Direct is used as the auction platform. This is an electronic trading platform for trading OTC and exchange traded markets.

According to Thomson Reuters, “the calculation agent is a legal entity with delegated responsibility for determining a benchmark through the application of a formula….with the methodology set out by the administrator”.

CME Europe Benchmark Limited also has an ‘Auctions Market Team’. This team is part of the CME Global Command Center (GCC) some of whom are located in the CME’s London office at One New Change in the City of London.

Additionally, according to the LBMA Silver Price methodology paper “CME Benchmark Europe Ltd will conduct limited monitoring of live auction activity for suspicious bids, offers, or trades.” As to why this monitoring of live auction activity is limited and not constant is not addressed by the administrator, Thomson Reuters.

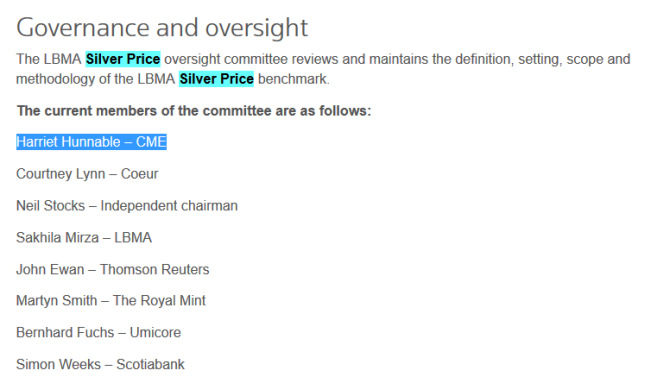

‘Independent’ Silver Price Oversight Committee

You may recall that the statement on the LBMA Silver Price issued on 4 February was issued by Thomson Reuters, the CME Group and “the independent Silver Price Oversight Committee". Who and what is this independent committee?

In March 2015, I asked Thomson Reuters by email as to who was on this committee. The question was precipitated by the fact that the LBMA Gold Price, administered by ICE Benchmark Administration (IBA) had just launched the LBMA Gold Price (on 20 March 2015) and had appointed its Oversight Committee. The Silver Price methodology guide had referred to a LBMA Silver Price Oversight Committee, but it did not explain who was on such as committee or whether it actually existed in practice.

Thomson Reuters replied to me in March 2015 that:

“Yes we are pleased to confirm there is an LBMA Silver Price Oversight Committee, as mentioned in our methodology guide. We will release the committee members names in due course (we have not yet made them public) and committee procedures will be in full compliance with all FCA requirements when silver becomes an FCA-regulated benchmark on April 1." [2015]

This list had still not been published on the Thomson Reuters website by September 2015, as this Archive (Wayback) link makes clear. So 6 months after Thomson Reuters said they would release the list ‘in due course’ it still wasn’t on the website. The list was eventually published sometime between September and December 2015.

Fast forward to the end of January 2016 when the embarrassing LBMA Silver Price auction took place, and this was probably the first time in quite a while that Thomson Reuters and CME Group and LBMA had actually given any thought to the ‘Independent Oversight Committee’. For in a google cache link from 29 January, it still listed a version of the Committee list with Harriet Hunnable listed as the CME Group representative, and Harriet Hunnable left the CME Group in December 2015, as explained above, and as Reuters reported:

“CME Group Inc’s executive director for metals products, Harriet Hunnable, will leave the company later this month, a CME spokesman said on Wednesday.“

Where does Hunnable’s departure from CME leave all of the improvements of wider participation and central clearing for the LBMA Silver Price that she promised the attendees during those 2 webinars in July and August 2014?

You can see a Bing cache of this page from 24 January 2016 here. Bing sometimes has its uses. It was only after the suspect price auction on 28 January that the named CME representative was amended on the list from Harriet Hunnable to Gavin Lee, suggesting that no one even noticed the out of date information until Thomson Reuters realised that there were lots of eyes looking for this list. Importantly, there are NO published minutes of ANY meetings held by this LBMA Silver Price Oversight Committee, ever. Contrast that to the LBMA Gold Price Oversight Committee which has published minutes of 6 of its meetings since 27 February 2015.

As the 4 February ‘joint statement’ at the top of this article said:

“In addition to its regular meetings, the [Silver] Committee has held two extraordinary meetings since the auction on Thursday January 28, 2016"

So, where are the minutes for these meeting and for any of the ‘regular’ meetings, which obviously hadn’t taken place at least since Harriet Hunnable left CME Group in early December 2015.

Lets look at these 8 individuals on the Silver oversight committee?

Gavin Lee is head of benchmark services at CME. Courtney Lynn is treasurer at Coeur Mining. She also says in her Linkedin profile that she is on the “LBMA Silver Price Oversight Committee" and joined this committee in April 2015, and that the “LBMA Silver Price oversight committee reviews and maintains the definition, setting, scope and methodology of the LBMA Silver Price benchmark." This is the same Courtney Lynn of Coeur Mining who told Bloomberg in August 2014 in relation to new LBMA Silver auction, that:

“We hope to have the opportunity to become a direct participant down the road and look forward to working with the LBMA, CME and other silver producers to drive the evolution of this market.”

Hope springs eternal….because with price manipulation in the Silver auction, and Mitsui now departed from the Silver auction, it looks like the evolution of the market is being driven backwards rather than forwards. Even being on the Oversight Committee doesn’t seem to be enough for the LBMA to allow Coeur to become a direct participant in the LBMA Silver Price auction.

The “Neil Stocks", who is “Independent chairman" of this committee, appears to be the Neil Stocks who is global head of compliance at UBS. There can’t be many “Neil Stocks" in London that fit the role of being able to be appointed as chair of a Silver Price oversight committee, but Thomson Reuters doesn’t see fit to ascribe Neil Stocks to any organisation, presumably because that would make him less independent. If it is the Neil Stocks from the infamous precious metals manipulator UBS (that made clear attempts to manipulate the prices of precious metals), than that is not independent since UBS is one of the 5 remaining direct participants in the Silver auction. Sakhila Mirza is the general counsel for the LBMA and a member of the LBMA Gold Price Oversight Committee.

Now we come to the infamous John Ewan from Thomson Reuters, and remember that Thomson Reuters is the officially retained administrator of the LBMA Silver Price benchmark. This is the same John Ewan who worked at the British Bankers Association and was managing director of BBA Libor Ltd (surely with oversight?) and was subsequently referred as Mr Libor. This is also the same John Ewan, who according to the Wall Street Journal article from 2012:

“assured participants that the BBA had rigorous quality-control measures to prevent any problems, the minutes indicate" and “advocated further expansion, touting the potential revenue from broadening Libor’s reach"

This is also the same John Ewan whose senior at Thomson Reuters, wrote a letter in Q4 2012 introducing Ewan to benchmark contributor associations:

“I am writing to introduce myself and some key contacts at Thomson Reuters, to provide an update on our recent activities with regard to benchmark fixings and to make some proposals to improve fixings to the advantage of both you as a sponsor and partner as well as the broader market and end users of the data."

“There has been regulatory action taken against contributors to BBA LIBOR, by authorities acting in co-ordination. Regulators and other authorities have announced inquiries, consultations and other actions"

“Thomson Reuters has unrivalled experience in calculating and publishing fixings and benchmarks. “

“We invest in teams of experts, close to key markets, who specialize in the collation, calculation, publication and onward distribution of fixings content. These teams can also provide the specialist analysis and reporting required to guide your decisions on potential changes, challenges to contributors and process improvements."

“In short we are passionate about fixings and proud to provide a service which assures data of the highest quality.“

“The global regulatory community is currently focussing on BBA LIBOR.“

Please address any correspondence to either John Ewan, whose contact details are below, or directly to myself.

John Ewan, Head of Fixings Business Development, Thomson Reuters, The Thomson Reuters building, South Colonnade, London E14 5EP, Email: john.ewan@thomsonreuters.com

“We believe that accurate well-governed benchmarks, fixings and indices are vital tools that allow market participants to have confidence that markets are clean and efficient and we welcome any level of debate on the topic.“

Mark Beaumont, Global Head of OTC Market Content, Thomson Reuters, mark.beaumont@thomsonreuters.com“

The final 3 committee members are Martyn Smith, bullion development manager at The Royal Mint, Bernhard Fuchs, senior vp at Umicore, Simon Weeks, md at Scotiabank, who is also former chairman of the LBMA, former chairman and director of the London Gold Fixing, former chairman of the London Silver Fixing etc.

Conclusion – Can’t get Fooled Again?

Such a strong Libor scandal to LBMA Silver Price connection in the form of Mr. Libor becoming ‘Head of Fixings’ business development at Thomson Reuters is in my view problematic, even from an image point of view. You could not make this up. The guy in charge of BBA Libor is now the Oversight Committee representative of the Administrator of the LBMA Silver Price benchmark, a benchmark which trust in is rapidly disappearing, just like the trust in Libor evaporated. It also brings to mind the famous George Bush junior quote, when he said:

“There’s an old saying in Tennessee — I know it’s in Texas, probably in Tennessee — that says, fool me once,… shame on.. — ..shame on… you. Fool me,.eh,. — you can’t get fooled again!"

Furthermore, what happened to “increased direct participation" as Ruth Crowell said was needed, and what happened to her interest in having 25% of 444 participants (or 111 participants) come on board?

Why was there an initial rush in 5 weeks in July-August 2015 that pressured the CME Group to come up with a rudimentary system that could not handle central clearing, and yet 18 months later there has been no evolution of the system?

Why was there mis-leading evidence from the LBMA, CME Group and Thomson Reuters in July-August 2014 that wider participation and central clearing would happen in the Silver auction and then these developments never happened? Who leaned on CME to back off on central clearing?

Why is the joint statement from Thomson Reuters, the CME Group and the ‘Independent’ LBMS Silver Price Oversight Committee referring to wider participation and central clearing as if it was a fresh plan, when in fact it was the original plan in July – August 2014 that got pushed to one side. And why did it get pushed to one side. Cui bono?

Why is the LBMA giving an advantage to the bullion bank participants in the LBMA Silver Price auction by perpetuating a system where direct participants are required to maintain bilateral credit limits?

Where is the Financial Conduct Authority in all these developments and why has it not made any statement? Remember, the LBMA Silver Price is now a Regulated benchmark.

Where are the Chinese banks that said that they wanted to become direct participants in the LBMA Silver Price auction?

Which trading entity was putting massive and increasing sell orders into the midday Silver fixing on 28 January?

These are just some of the questions that remain outstanding in what has surely been the most suspicious financial benchmark launch of all time.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments