LBMA Removes JP Morgan’s Michael Nowak From Board

Just when you think it couldn’t get any more embarrassing for JP Morgan’s precious metals business and its embattled head, Michael Nowak, today it just did, as the powerful London Bullion Market Association (LBMA) moved to oust Nowak, who has become too toxic, from the LBMA’s board of directors.

According to the Financial Times, 20 September 2019:

“The London Bullion Market Association has removed Michael Nowak, JPMorgan’s head of precious metals trading, from its board after he was indicted by the US Department of Justice for a “massive, multiyear scheme" to manipulate the precious metals markets.

“In light of the ongoing investigation by the Department of Justice, the LBMA, under the terms of its Articles of Association, has removed Mr Nowak from its board,” the LBMA said.

The DoJ indictment is an embarrassment for the LBMA, which represents London’s precious metals market, and launched a code of conduct for its members in 2017.

Toxic Board Member – Widespread Spoofing

As background, Nowak become too toxic for the LBMA from at least last Monday 16 September, when the DoJ charged and unsealed an indictment against Nowak, JP Morgan precious metals trader Gregg Smith, and former JP Morgan precious metals trader Christopher Jordan for:

“alleged participation in a racketeering conspiracy and other federal crimes in connection with the manipulation of the markets for precious metals futures contracts, which spanned over eight years and involved thousands of unlawful trading sequences.”

In the words of the DoJ indictment, the three traders and and their co-conspirators allegedly engaged in:

“massive, multiyear scheme to manipulate the market for precious metals futures contracts and defraud market participants”

“widespread spoofing, market manipulation and fraud while working on the precious metals desk”at JP Morgan “through the placement of orders they intended to cancel before execution (Deceptive Orders) in an effort to create liquidity and drive prices toward orders they wanted to execute on the opposite side of the market.

In thousands of sequences, the defendants and their co-conspirators allegedly placed Deceptive Orders for gold, silver, platinum and palladium futures contracts traded on the New York Mercantile Exchange Inc. (NYMEX) and Commodity Exchange Inc. (COMEX), which are commodities exchanges operated by CME Group Inc.”

In its charges, the DoJ used the severe Racketeer Influenced and Corrupt Organizations Act (RICO Act), charging each of Nowak, Jordan and Smith with one count of conspiracy under the RICO Act.

The background and details to the DoJ charges were explained in a BullionStar article on Tuesday 17 September titled “LBMA Board Member & JP Morgan Managing Director Charged with Rigging Precious Metals“, which also broke the news that Nowak was a board member of the powerful London Bullion Market Association (LBMA), an Association which is dominated by bullion banks such as JP Morgan, and an Association which is in the words of the LBMA “the world’s authority on precious metals".

Promoting a Fair, Effective and Transparent Market

Nowak’s continued role as a board member of the LBMA seemed strange in light of these DoJ charges, and stranger still that the LBMA claims in its Global Precious Metals Code that the Code:

“promotes a fair effective and transparent market. It provides market participants with Principles and Guidance to uphold high standards of business conduct. All of this creates confidence in the market for all participants"

More specifically, the LBMA’s Global Precious Metals Code states that:

“Market Participants should not engage in trading strategies or quote prices with the intent of hindering market functioning or compromising market integrity."

“Such strategies also include collusive and/or manipulative practices, including but not limited to those in which a trader enters a bid or offer with the intent to cancel before execution ( sometimes referred to as “spoofing”, “flashing” or “layering”) and other practices that create a false sense of market price, depth or liquidity."

In our article earlier this week, we therefore wondered:

“how does the LBMA explain that one of its Board of Directors has been charged in US Federal Courts of these very practices, using the RICO Act, an act that was created to take down mafia mobsters?"

while also asking:

“Will the LBMA remove Nowak from its Board of Directors? Will the LBMA reprimand or expel JP Morgan from its membership list?

LBMA in discussions with JP Morgan

As the week progressed and the world’s financial media continued to cover the story, there was still no word out of the LBMA as to how it would react, if at all to the Michael Nowak story. This then promoted the Financial Times on Friday to ask the LBMA what it intended to do about the indictment of one of its board members, i.e. Nowak, to which the LBMA responded that it was merely in ‘discussions’ with JP Morgan.

According to the FT’s first story on Friday 20 September, which was titled “LBMA in ‘discussions’ with JP Morgan after board member indictment:

“The London Bullion Market Association is in “discussions” with JP Morgan after its board member was indicted by the US Department of Justice for a “massive, multiyear scheme” to manipulate the precious metals markets.

The LBMA said that it had not made any decision to remove Michael Nowak, JP Morgan’s head of precious metals, from its board.

“We are still in discussions with JP Morgan," Aelred Connelly, a spokesmas for the LBMA, said.

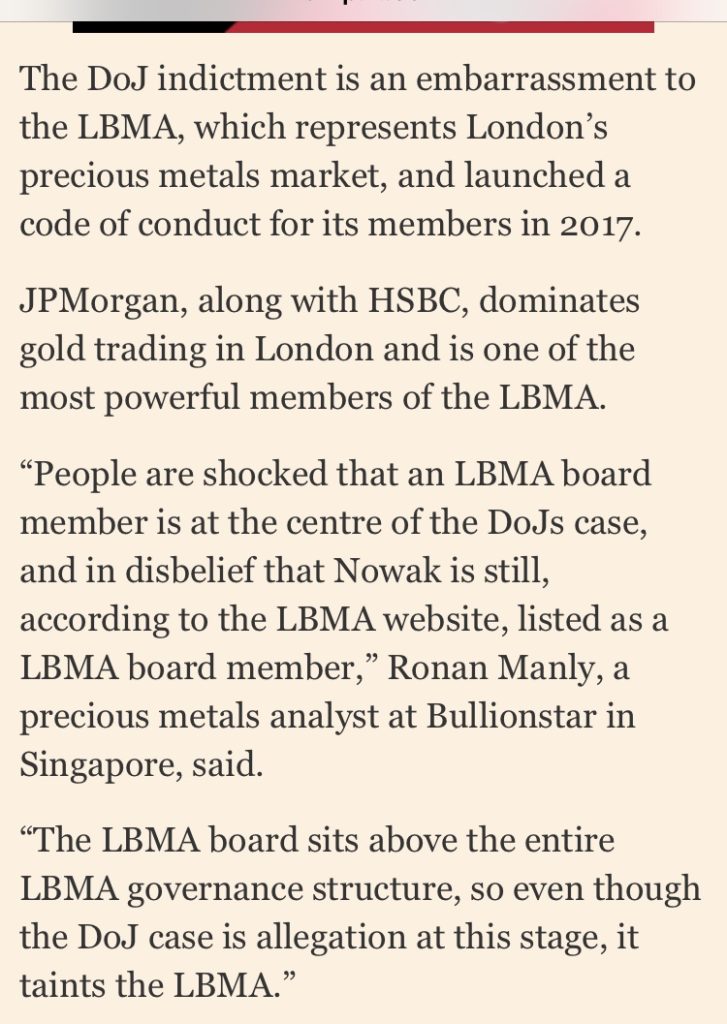

The DoJ indictment is an embarrassment for the LBMA, which represents London’s precious metals market, and launched a code of conduct for its members in 2017.

JP Morgan, along with HSBC, dominates gold trading in London, and is one of the most powerful members of the LBMA.

This article also quoted me after I had discussed the topic with the FT’s correspondent:

“People are shocked that an LBMA board member is at the centre of the DoJs case, and in disbelief that Nowak is still, according to the LBMA website, listed as a LBMA board member," Ronan Manly, a precious metals analyst at BullionStar in Singapore, said.

“The LBMA board sits above the entire LBMA governance structure, so even though the DoJ case is allegation at this stage, it taints the LBMA.”

Nowak’s Bio removed from LBMA website

What exactly went down in the ‘discussions’ between LBMA and JP Morgan is not clear, but within a few hours of the Financial Times’ initial story, the LBMA released a statement to the FT saying that:

“In light of the ongoing investigation by the Department of Justice, the LBMA, under the terms of its Articles of Association, has removed Mr Nowak from its board.”

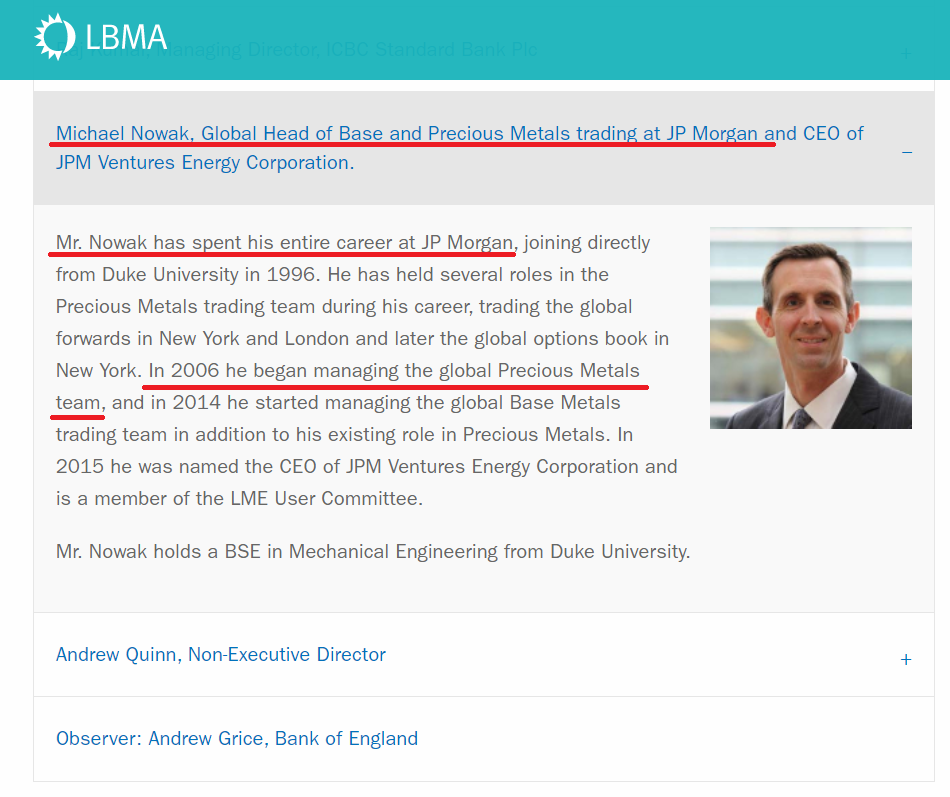

At the same time the LBMA quietly removed Michael Nowak’s bio from its board of directors page. The previous version of the LBMA Board members page, including Nowak, can be seen here. The new updated version where all references to Nowak have been removed, can be seen here.

Is this the first time that the LBMA has been forced to remove someone from its Board of Directors? Probably yes. Now that the LBMA has made its move, can the London Metal Exchange (LME) be far behind? For the same Michael Nowak, who is head of both base metals and precious metals trading at JP Morgan, is also on the LME ‘User Committee’ as can be seen on the LME website here, and in case the page changes, a Wayback Machine archive from September 20th can be seen here.

Conclusion

All that remains for now is for Michael Nowak’s defense lawyer, David Meister of law firm Skadden, Arps, Slate, Meagher & Flom, the same Meister who was former Director of Enforcement for the CFTC from November 2010 to October 2013 under then chairman Gary Gensler, to show how he is going to get Nowak off the hook on this one.

While he’s at it, Meister needs to also explain how there is not a conflict of interest in representing Nowak, when the CFTC closed down an investigation into the manipulation of the silver markets in October 2013, an investigation that had been running since September 2008, saying that there was:

“not a viable basis to bring an enforcement action with respect to any firm or its employees related to our investigation of silver markets."

And finally, does David Meister sleep soundly at night representing an alleged criminal enterprise of market manipulation at JP Morgan, knowing that in July 2013, Meister stated in another CFTC enforcement case that:

“While forms of algorithmic trading are of course lawful, using a computer program that is written to spoof the market is illegal and will not be tolerated. We will use the Dodd Frank anti-disruptive practices provision against schemes like this one to protect market participants and promote market integrity, particularly in the growing world of electronic trading platforms.”

The LBMA claims it is the world’s authority on the bullion market, yet has aligned itself at board level with an appointee who is now under criminal investigation by the US Department of Justice. As well as displaying unfortunately bad corporate governance judgement, the bigger question is how the LBMA can claim to be the “reference" for the physical gold market while simultaneously working against the very same physical gold market by being a lackey for the bullion banks. And while Nowak has now been removed from the LBMA board, the LBMA has said nothing about JP Morgan’s continued membership of the LBMA.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments