LBMA Misleads Silver Market With False Claims

In a shocking retraction, the bullion bank dominated London Bullion Market Association (LBMA) has just announced that it has been overstating LBMA silver vault holdings by a massive 3,300 tonnes of silver.

This overstatement relates to the total quantity of physical silver bars that the LBMA claimed were being held in LBMA vaults in London as of end of March 2021.

These LBMA vaults in London are operated by three banks, namely the infamous JP Morgan, the equally infamous HSBC, and the maybe not so infamous ICBC Standard Bank, and three security vaulters, Brinks, Malca Amit and Loomis.

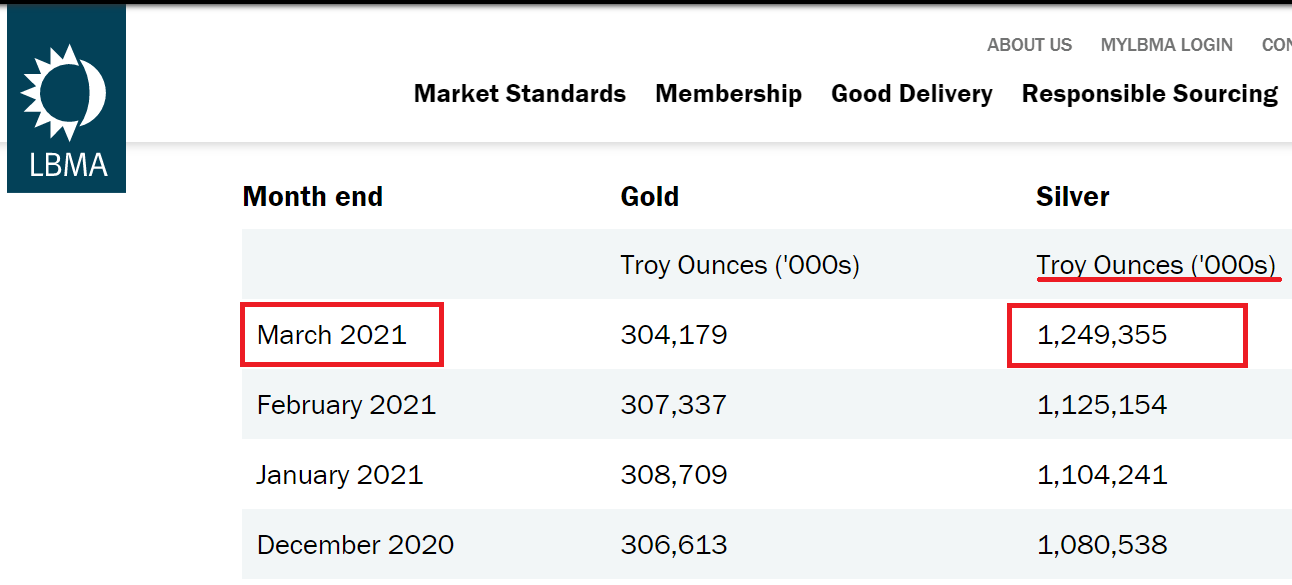

On 9 April, to much fanfare, the LBMA published updated monthly vault data for London vaulted silver bars, claiming that as of end of March 2021, total silver held in LBMA London vaults had risen by a whopping 11.04% during March from 1.125 billion ozs (34,996 tonnes) to 1.249 billion ozs (38,859 tonnes), i.e. an increase of 124 million ozs or 3863 tonnes.

LBMA even claimed that this surge in silver holdings created a new record for stocks of physical silver in London, and it even titled it’s press release, ‘Record Stocks of Silver in London Vaults – End March 2021’:

“As at end March 2021, there was a record stock of silver held in London vaults. In total there was 38,859 tonnes of silver, representing an 11% increase on the previous month, valued at $30 billion which equates to approximately 1,259,310 silver bars.”

This claim by the LBMA, as it turns out, was false.

Now you see it, Now you don’t

However, for an entire month the LBMA let this fiction persist, before deciding to change its claim on 10 May when it released a statement saying that:

“A data submission error led to the publication of an incorrect aggregate figure for the total silver held in London vaults in March. The corrected figure is 1,143,194 Troy ounces (‘000s).“

This new figure of 1,143,194,000 ozs (1.13 billion ozs) is equal to 35,557 tonnes.

In short, instead of silver holdings in LBMA vaults having risen by 3,863 tonnes (or 11%) in March, the new LBMA claim is that the silver inventories rose by 561 tonnes (or 1.6%). Which is 6.88 times less.

Instead of a 124.2 million oz increase, the increase was 18 million, a difference of a massive 106.1 million ozs. Instead of record silver holdings in London, there was no record. Therefore, the folks at the Guinness Book of Records are not needed. The record still belongs to March 2020, when 1.175 million ozs of silver was claimed by the LBMA to be stored in London.

You can still see the original LBMA press release in a 28 April archive of the page here, where it still lists the 1,249,355,000 figure in ozs, and which states:

“As at end March 2021, there was a record stock of silver held in London vaults. In total there was 38,859 tonnes of silver, representing an 11% increase on the previous month, valued at $30 billion which equates to approximately 1,259,310 silver bars.”

At the time on 9 April, BullionStar pointed out how unlikely it was that a massive 11% surge in LBMA London silver stocks could have occurred during one month, and called for an Audit of the LBMA vaults.

The LBMA claim was so unreal that it was like pulling a rabbit from a magician’s hat.

Mints, Refineries, Wholesalers and Retailers around the world cannot find sufficient silver bar supply, yet the LBMA in London finds an extra 124,201 large 1000 oz Silver bars – like a rabbit from a magician’s hat

— BullionStar (@BullionStar) April 9, 2021

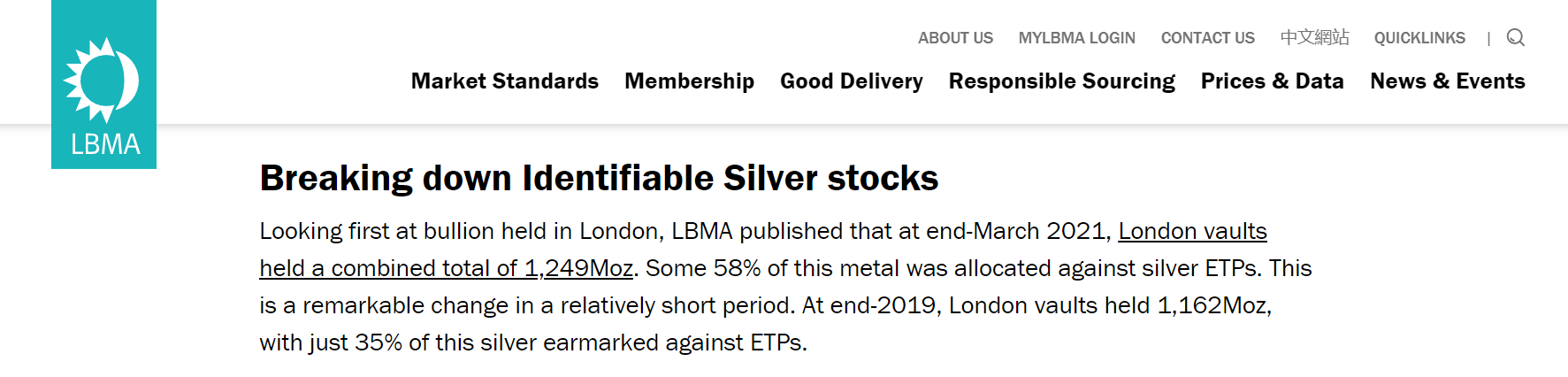

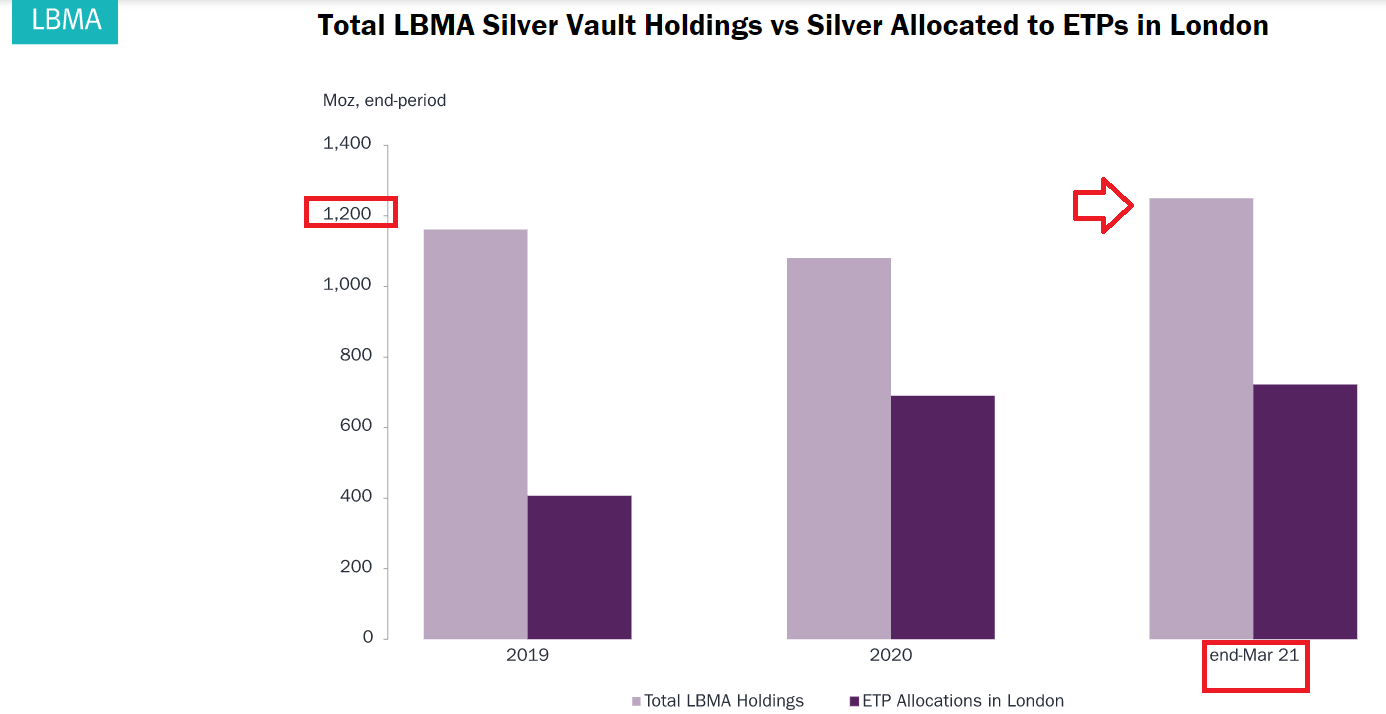

That didn’t stop the LBMA claiming, throughout the entire month of April and into May, that the LBMA vaults in London held 1,249 million ozs (38,859 tonnes) of silver at the end of March, and it even did so in its much trumpeted ‘LBMA Spotlight on Silver Investment Report, which the LBMA wrote in conjunction with the consultancy Metals Focus, and which was published on 18 April. An overview analysis of this LBMA report can be seen in the BullionStar article here.

The introduction to that report can be seen here on the LBMA website, where the 1,249 Moz figure is still quoted, and in a 18 April Archive here, and in a 23 April Google cache here. The LBMA will soon delete the original reference.

“LBMA has launched its Spotlight on Silver Investment

…. The report analyses bullion held in London, expanding on recent LBMA vault data which revealed that London vaults held a combined total of 1,249moz at end-March 2021”

The same 1.249 billion ozs end of March 2021 figure can be seen in a bar chart table in the original report:

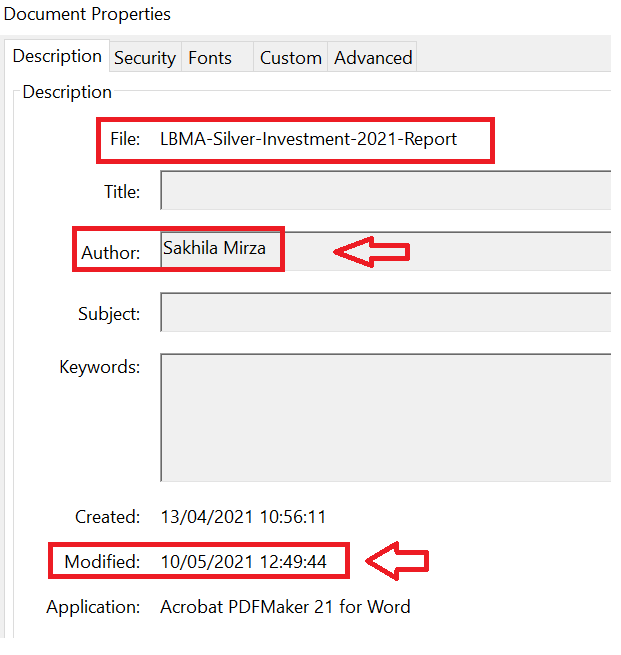

The pdf version of the LBMA Spotlight on Silver Investment Report has already been changed to delete the overstated figure. It was changed on 10 May with an author name of none other than Sakhila Mirza, the LBMA General Counsel and LBMA Board member.

The new version of the pdf report, called LBMA-Silver-Investment-2021-Report.pdf, can be seen here. The original version of the pdf report, called LBMA-Silver-Investment-2021-Report-Final.pdf, can be seen in a Google cache here.

The Bigger the Lie

Let’s look for a minute at the very brief retraction statement which the LBMA released on 10 May admitting to the 3300 tonne ‘error’. To recap:

“A data submission error led to the publication of an incorrect aggregate figure for the total silver held in London vaults in March. The corrected figure is 1,143,194 Troy ounces (‘000s)."

So it was ‘a data submission error’. The question then is, a data error submitted by who? There are only 6 vault operators in the LBMA London vault network. These are JP Morgan, HSBC, Brinks, Malca Amit, ICBC Standard, and Loomis. Why does the LBMA not clarify which vault submitter submitted the claimed erroneous data? The LBMA runs a ‘Vault Managers Working Group‘ so should be intimately acquainted with the 6 heads of vault management at the respective vaults.

‘an incorrect aggregate figure’ – The LBMA claims that the aggregate figure was incorrect, again implying that one of the submitted figures was incorrect. So the LBMA is implying that the problem lies with one vault operator. Which vault operator?

‘led to the publication’ – Since the LBMA silver vault holdings data series began in July 2016, there has never been a month-on-month increase in London silver holdings of more than 2.33% which was in April 2017. Likewise, there has never been a month-on-month fall in LBMA silver holdings of more than 2.57%, which was in June 2020. Therefore, the variability of month-on-month silver holdings changes has always been within the range of +2.33% to -2.57%.

So the LBMA want us to believe than in March 2021, the month-on-month silver holdings increase was a whopping 11.04%, and that no one in the LBMA staff or LBMA marketing team or in the LBMA vault committee noticed this outlier, and that it just was let go and ‘led to the publication’ of the fake data, the fake record stocks claims and subsequent quotation of this data in an LBMA – Metals Focus report on Investment Silver? Where is the oversight within the LBMA on checking data that is about to be published?

At the time in April after the LBMA claimed (with a straight face) that London silver vaulted stocks had jumped by 3,863 tonnes of 11% during March, I wrote the following short piece on the BullionStar Telegram channel here, which is worth reciting in full here. It said:

“The latest vault reporting data from the London Bullion Market Association (LBMA) in London, which is now released on the 5th business day of the month, claims that as of the end of March, there were 1.25 billion ozs (38,859 tonnes) of silver in the LBMA London vaults, which would be an 11% increase on the total claimed to be held in those vaults at the end of February.

To put this into perspective, that’s an extra 3,863 tonnes that the LBMA claims has arrived into its vaults in London during March, or an extra 124.2 million ozs. That’s nearly as much silver claimed to be added by the LBMA during March, as the Sprott Physical Silver Trust PSLV holds. (PSLV holds 130.97 million ozs of silver).

Said another way, 3863 tonnes added to the London LBMA vaults during March would be 124,200 wholesale silver bars (each bar weighing about 1000 ozs). These 124,200 bars are stored 30 bars per pallet. This would be 4,140 extra pallets of silver bars. Usually these vaults store pallets of silver 6 pallets high. That would be 690 extra towers of pallets, each 6 pallets high.

It would mean that 193 containers (each allowed to carry a maximum of 20 tonnes) arrived at the London vaults during March, or over 8.4 containers on average per day, every business day, and that the vault staff had to move and store 180 pallets each day.

All of this in an environment where everyone from refiners to Mints to wholesalers to bullion retailers are reporting availability issues in sourcing physical silver bars right now.

Seems plausible, right? And this LBMA vault data does not even break down how much each of the LBMA London vaults of JP Morgan, HSBC, Brinks, Malca-Amit, Loomis, and ICBC Standard, claim to hold.

Which is why, if the LBMA vault data on silver (and gold) is to be even remotely trusted (which is a far stretch), then it is now time to independently and physically #AUDIT THE LBMA VAULTS.

Not that this will ever happen given that the LBMA is run by the bullion banks which run the paper silver and gold markets. But it needs to happen. https://www.lbma.org.uk/prices-and-data/london-vault-holdings-data"

Crime Scene London

For those who may not know, it was in early March 2021 when the LBMA suddenly and mysteriously decided to change the reporting lag on its London vault silver holdings.

Up until Monday 1 March, the LBMA was still reporting silver vault holdings on a 1 month lagged basis, and so on 1 March, the LBMA reported silver holdings data for the end of January 2021. See 1 March press release here.

At that time, it reported 1.104 billion ozs or 34,346 tonnes of silver “valued at $30.3 billion“. At that time, there were still seven vault operators in the LBMA vault network, the above mentioned six, and also G4S Cash Solutions (UK).

Then at the end of the same week, on Friday 5 March, the LBMA suddenly changed the reporting lag on silver holdings from 1 month to 5 business days, ludicrously claiming in its press release it was doing so to increase transparency:

“In a move towards greater transparency and timeliness the London vaults will on the 5th business day of each month publish the amount of silver they were holding at the end of the previous month."

“As at end February 2021, there were 34,996 tonnes of silver, valued at $30 billion. This equates to approximately 1,166,540 silver bars. This represents a 1.89% increase in volume of holdings from the previous month."

Nothing the LBMA does is for transparency. In fact, the opposite is usually the case. This 5 March press release also stated that by then there was only 6 vault operators, namely, JP Morgan, Brinks, HSBC, Malca-Amit, Loomis and ICBC Standard Bank. So G4S had departed that same week.

And so why did the LBMA suddenly change its reporting lag on London silver holdings to 5 business days from 1 month previously? Why of course it was to try to make it look like there was ample silver in London, when actually there was a silver availability problem, the problem (for the LBMA) being that there was massive demand for physical investment silver that outweighed available supply.

Recall that over 3 days from late January and early February, there were massive inflows into the SLV ETF, with SLV claiming to have added 110 million ozs of physical silver bars over 3 days:

“Between Friday 29 January and Wednesday 3 February inclusive, SLV shares outstanding increased by a net 109.85 million. Over the 3-day period from Friday 29 January to Tuesday 2 February, SLV claimed to have added an incredible 109.83 million ozs of silver (3,416.11 tonnes),

Recall that the iShares Silver Trust (SLV) then made a prospectus change that same week, noting that:

“The demand for silver may temporarily exceed available supply that is acceptable for delivery to the Trust, which may adversely affect an investment in the Shares.

“It is possible that Authorized Participants may be unable to acquire sufficient silver that is acceptable for delivery to the Trust"

Recall that, a group of ETFs, and not just SLV together accounted for 85% of all the silver held in the LBMA London vaults:

“A few more days of inflows like the ones seen over 29 January to 2 February would be a major emergency for these ETF providers, particularly the iShares SLV. Because there is just not that much physical silver left in the vaults of JP Morgan, Brinks, Malca-Amit, Loomis and HSBC, which is not already reported as being in these ETFs.”

Even the above quoted Metals Focus report published in April 2021 conceded this shortage saying that:

“Early 2021 saw an unprecedented 110Moz added in just three days. Although some liquidations emerged, there were concerns that London would run out of silver if ETP demand remained at a high level.”

“As the social media frenzy gathered pace in late January, demand for coins, bars and ETPs all jumped…..This was concentrated in the iShares fund (SLV), where holdings rose by 110 mn ozs. Given that most of this metal was allocated in London, fears emerged as to whether there was enough silver should demand continue at this pace.”

With the LBMA in panic mode and as a reaction to the silver supply problem, it is now clear that the LBMA reduced the reporting lag on vaulted silver stocks down to 5 days in early March so as to fast track through the February silver holdings data and try to manipulate the perceptions of the market into thinking there was no panic. That in itself is market manipulation.

Recall also that in mid March the acting chairman of US regulator CFTC, Rostin Behnam, is on record trumpeting the fact that the COMEX had the “market structure" to “tamp down what could have been a much worse situation in the silver market." Tamp down means to drive down by succession of blows, to put a check on, reduce. Are all of these things related? They sure look to be.

A blatant case of knowing about and condoning recent silver price manipulation during February 2021, but also showing the panic that the LBMA and Wall Street bullion banks were under in fearing a silver price breakout and an availability problem for wholesale silver bars.

But what of the massive claim by the LBMA on 9 April that during March, the LBMA London vault stocks had risen by a massive 11%, a claim that inflated the total by 3,301.95 tonnes of silver, or 106.16 million ozs? That in itself is blatant deception and market manipulation, and should be investigated immediately by regulators and even by the Serious Fraud Squad in London.

This quantity of 3,300 tonnes is suspiciously similar to the 3,416.11 tonnes of silver or 109.83 million ozs that the iShares SLV (whose custodian is JP Morgan) claimed to have added to SLV over 3 days from 29 January to 2 February. Was that silver ever part of the SLV? Was 3,300 tonnes hidden within the LBMA aggregate numbers and later backed out of reported calculations and these numbers got caught up in the data submissions?

Conclusion

It’s highly possible that all of this is a concreted propaganda campaign by the LBMA bullion banks under the watchful eye of the regulators to confuse and deceive the market and deflect attention away from physical silver supply problems in London and elsewhere. The fast tracking through of reduced lags on silver vault reporting. A plausibly deniable ‘data submission error’ by an LBMA vault. Someone with a fat finger at the LBMA. All to break the positive investment sentiment in the silver market and stifle the momentum of physical silver buying.

All the while the precious metals consultancy cheerleaders play along, and the corrupt regulators sit back and talk of tamping down what could have been a much worse situation in the silver market. This latest gambit by the LBMA with false reported vault stocks shows, however, that the #SilverSqueeze movement has them on the run.

What’s needed now is a full explanation by the LBMA of what this silver vault data submission error refers to, how it could have happened, and how it was allowed to remain uncorrected for one entire month from 9 April until 10 May 2021.

What is also need going forward, is a full breakdown in the LBMA vault reporting data by each vault operator and each vault. Not just a useless rolled up aggregate.

In addition, also needed is an investigation by an independent third party of the LBMA vault reporting data and its vault reporting processes. Also an independent full physical audit of the vaults of the 6 LBMA vault operators in London, i,e. all of the silver vaults of JP Morgan, HSBC, ICBC Standard, Brinks, Malca Amit and Loomis in the City of London, in North West London, and beside Heathrow Airport.

At this point, none of this LBMA vault data can be trusted. The data has been proven to be false and is a potential crime scene. All the while the LBMA acts as if nothing happened, tweeting platitudes that the silver and gold stocks held in London vaults “provide an important insight into London’s ability to underpin the physical OTC market“. Underpinning the market with fake non-existent silver. These people should really be on the stand up comedy circuit.

Read the latest #gold and #silver stocks held in London vaults (end April 2021). These figures provide an important insight into London’s ability to underpin the physical OTC market. https://t.co/jrO5CUloeW pic.twitter.com/oWRZKyPKsR

— LBMA (@lbmaexecutive) May 10, 2021

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments