LBMA Claims Record Amount of Gold in London’s Vaults

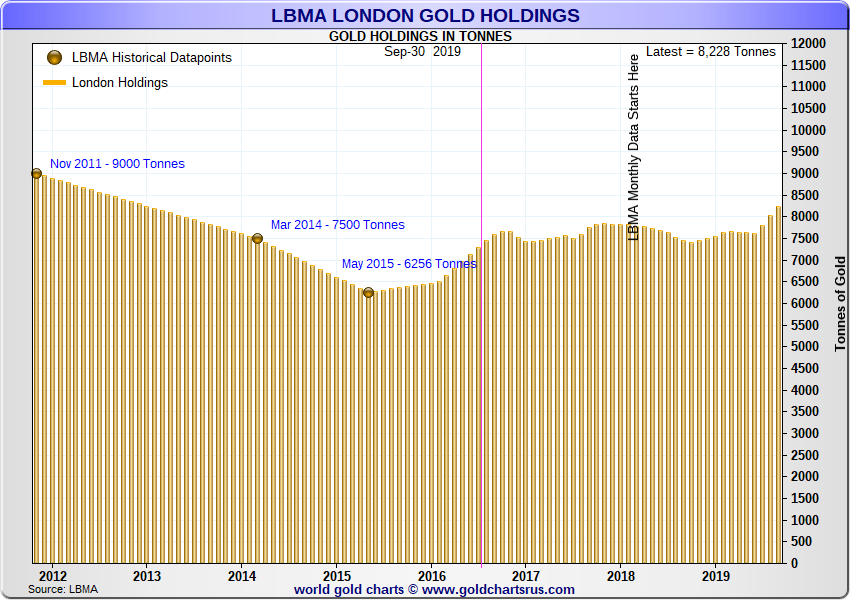

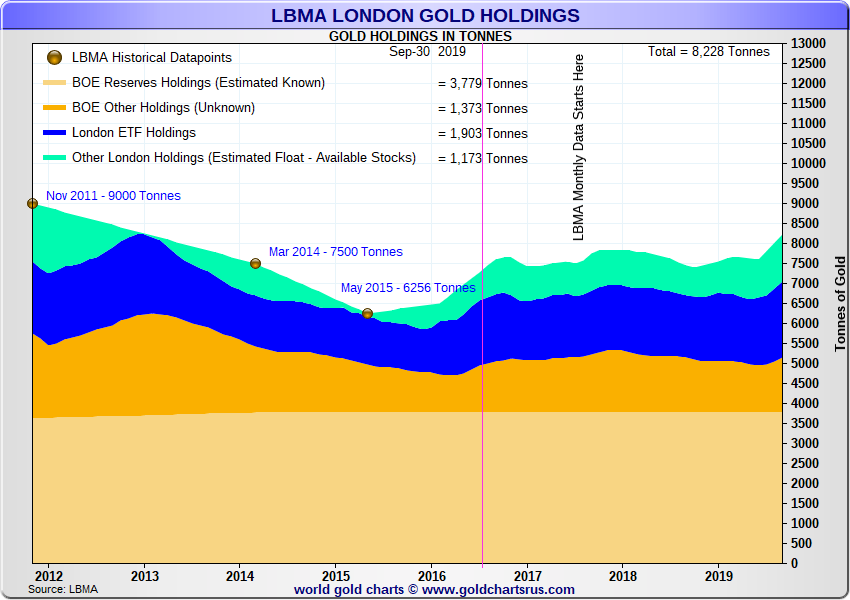

According to a press release this week from bullion bank controlled industry group the London Bullion Market Association (LBMA), the total amount of gold held by combined LBMA commercial vaults and Bank of England vaults in London hit a record 8,228 tonnes as of the end of September 2019. This, says the LBMA, equates to 658,274 wholesale market gold bars (London Good Delivery gold bars) valued at approximately US $392.9 billion.

Given that LBMA monthly London vaulted gold holdings data is published on a 3-month lagged basis and was first published in July 2017 (with initial data going back to July 2016), the “record high” of London vaulted gold that the LBMA is referring to here is in terms of the 3.5 years since the LBMA made monthly vaulting data public from July 2016 onwards, i.e. the pink line in the chart below.

But because neither the LBMA’s nor the Bank of England’s reported London gold holdings figures have ever been independently audited, none of this data can be independently verified. The LBMA does not even publish where the gold vaults it refers to are actually located, so immediately you can see a large problem with transparency and verification.

What lies beneath?

According to the LBMA, its gold vaulting data reflects gold held by seven LBMA member commercial vault providers at their subterranean vaults in London, as well as gold held for central banks and bullion banks at the Bank of England’s London vaults. Of the seven commercial vault providers, three of these are bullion banks (JP Morgan, HSBC and ICBC Standard), with the other four being security carriers (Brinks, Malca-Amit, G4S and Loomis). From analysis, princupally at BullionStar, we know that the LBMA gold vaults are located in the City of London, such as the vaults of JP Morgan and possibly HSBC, or in west London near Heathrow Airport, such as the vaults of Malca-Amit, Brinks (Radius Park), and G4S and Loomis.

Note that both central banks and LBMA bullion banks maintain gold accounts at the Bank of England’s vaults in London. While central banks store gold with the Bank of England in London, they also lend their gold out to LBMA bullion banks in London. Therefore, LBMA bullion banks are involved in transacting borrowed central bank gold and need to have gold accounts at the Bank of England. Furthermore, the Bank of England also plays a role in helping to ‘clear’ the physical gold market in London in cahoots with the London gold clearing banks of HSBC, JP Morgan, Scotia, UBS and ICBC Standard, which are the same five banks that comprise London Precious Metals Clearing Limited (LPMCL). This also means that these banks need gold accounts and at times have gold holdings in the Bank of England vaults.

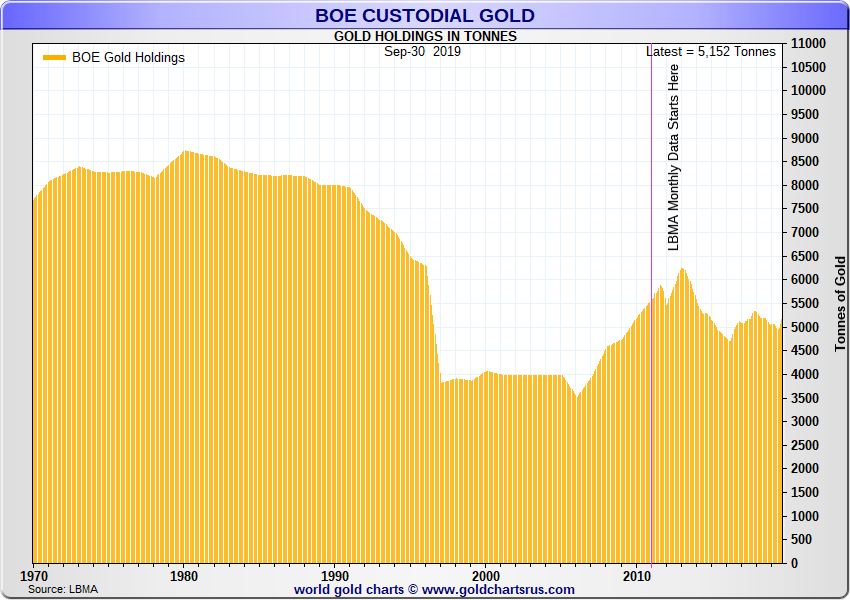

While the LBMA’s monthly gold vaulting data does not explicitly split out the amount of gold held by the commercial vault providers versus the amount of gold held at the Bank of England, the Bank of England helps in this endeavor as it publishes its own monthly gold holdings (also on a 3 month lagged basis). This then means that the total held by the LBMA bank and commercial vaults can be inferred by subtracting the Bank of England vault holdings.

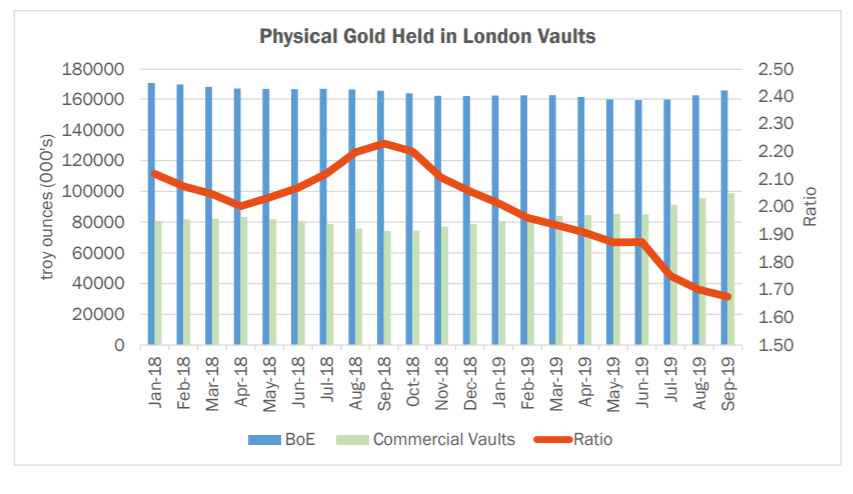

Looking at the latest Bank of England total vaulted gold as of month-end September 2019, the Bank claims to have been holding a combined 5152 tonnes of gold in its vaults. Which in turn means that excluding the Bank of England vaults, the LBMA commercial and bullion bank vaults claim to have been holding 3076 tonnes of gold as of 30 September 2019. The LBMA points out in its latest press release that the ratio of gold (said to be) held at the Bank of England vaults compared to gold (said to be) held at the LBMA commercial vaults has fallen to 1.67 as of month-end September 2019, a new low since the dataset began, and notably lower than the ratio was a year earlier in September 2018 when it sat above 2.25.

Q3 gold flows in to London vaults

The reason this ratio has fallen is that, according to the London gold holdings data, while the LBMA bullion bank and commercial vaults added about 775 tonnes since end of September 2018, an incredible 621 tonnes of which was added between July 2019 and September 2019 alone, the Bank of England gold vault holdings were relatively flat over the same period, having lost about 215 tonnes in the 9 months from September 2018 to June 2019, before adding back about 190 tonnes between July and September 2019.

Therefore with the bullion bank / commercial vaults adding gold while the Bank of England (BoE) holdings remained relatively flat (or rose at a lower pace), the ratio of commercial vault gold to BoE vault gold naturally fell. This trend is particularly acute for the three months from July to September 2019, when as mentioned above, over 600 tonnes of gold flowed into commercial vaults against about 190 tonnes of gold inflows for the BoE vaults.

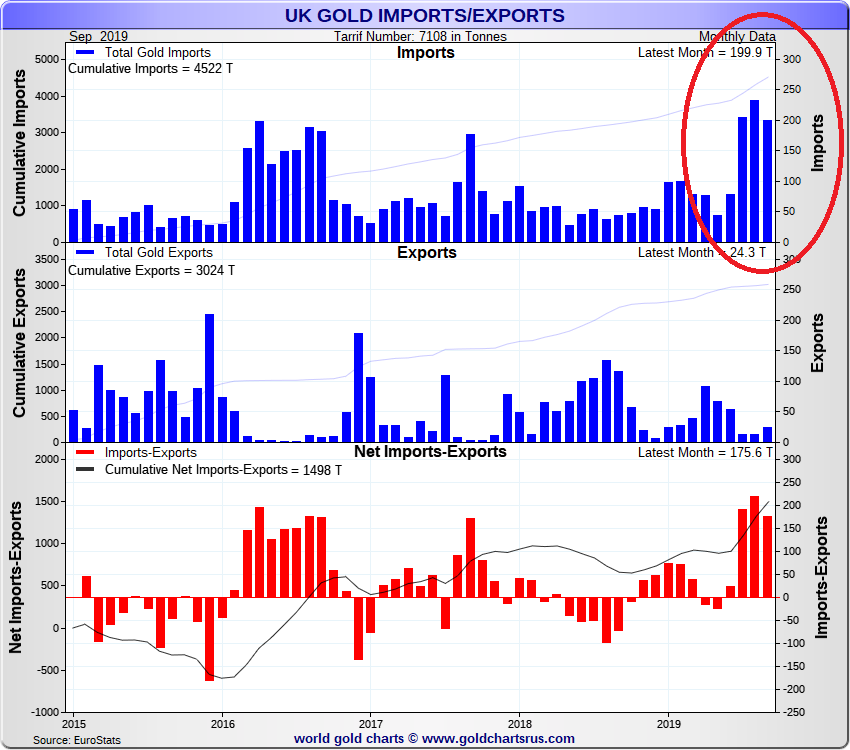

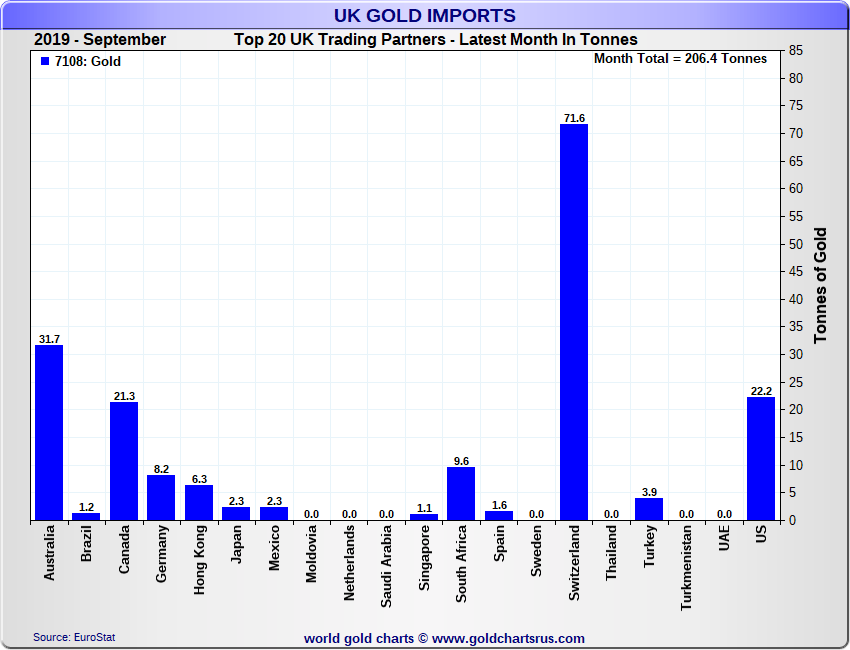

But where did this extra gold appearing in London’s vaults come from? In the case of the commercial vaults, the answer is that a lot of this gold was imported into the UK which in practice means imported into London. This is clear from UK gold import and export data for 2019 which captures cross-border non-monetary gold flows, and where over July, August and September 2019, more than 200 tonnes of gold arrived into London in each of those months, much of this gold from Switzerland but also from the US, Canada, Australia and South Africa.

For example in September 2019, London imported about 40% of that month’s 200 tonnes of imports from Switzerland, another 40% from Australia, Canada and the US, and the bulk of the remainder from South Africa, Hong Kong and Germany. While US, Canada, Australia and South Africa are major gold producing countries and traditional exporters of gold to London (see above chart), Switzerland, Hong Kong and Germany are not, except when cross-border gold flows change direction if the London gold market needs supplying, as happened in the third quarter 2019.

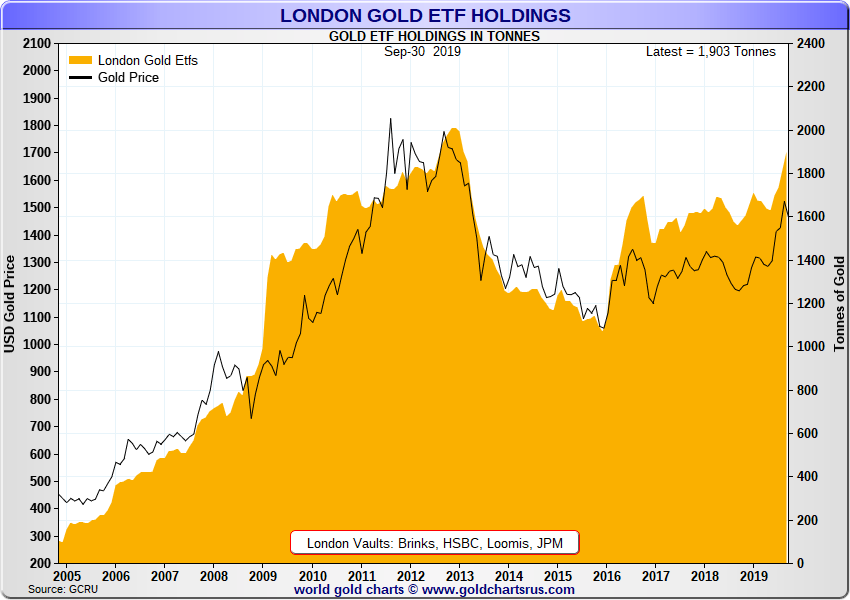

Nearly 2000 tonnes in gold-backed ETFs

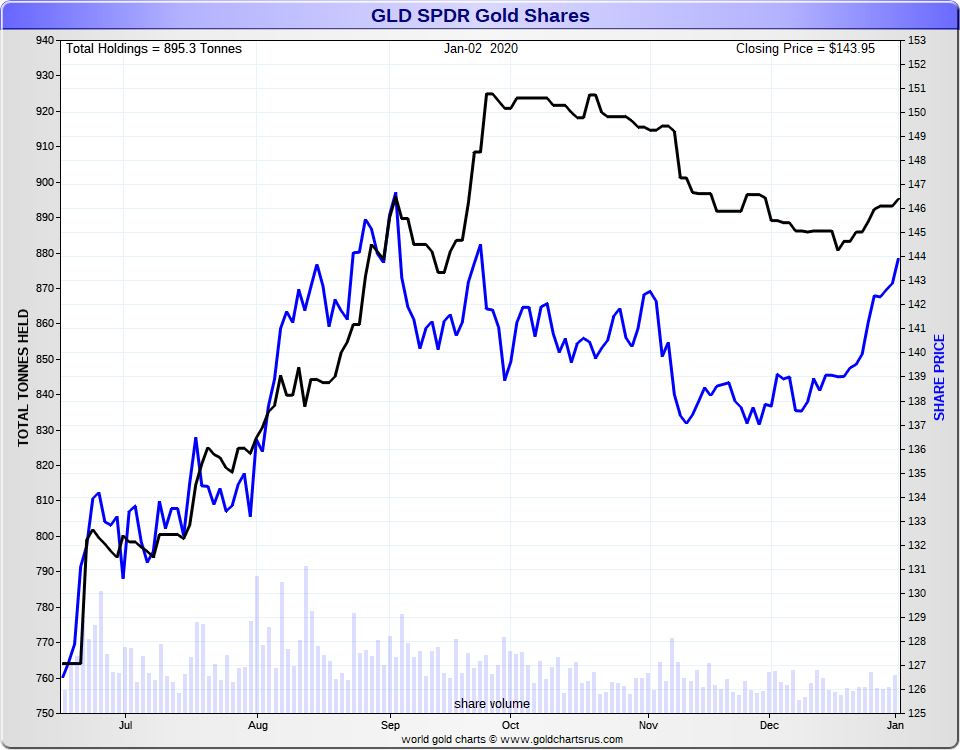

Some of the additional gold flowing into the London commercial vaults during Q3 2019 can be accounted for as additions to gold-backed Exchange Traded Funds (ETFs), many of which store their gold in these LBMA London gold vaults. For example, the SPDR Gold Trust (GLD) and Blackrock Gold Trust (IAU), which have their gold custodied in the London vaults of HSBC and JP Morgan respectively, saw substantial inflows of gold during Q3, with GLD adding more than 120 tonnes of gold (see chart below) and IAU adding about 50 tonnes.

The same was true across the board with the London gold holdings of other large gold-backed ETFs operated by ETFS, Source and Deutsche Bank all showing a noticeable increase over Q3, bringing the total amount of ETF gold stored in London LBMA vaults at the end of September 2019 to a whopping 1903 tonnes. See chart below.

Running on Fumes

Armed with the figures for total gold held in London vaults (8228 tonnes) and total gold held at the Bank of England vaults (5152 tonnes), we therefore know that 3076 tonnes of gold was held in the LBMA commercial vaults as of the end of 30 September 2019. But with 1903 tonnes of this total consisting of ETF stored gold, this means that only 1173 tonnes of gold in these LBMA vaults was unconnected to ETFs. In other words, the LBMA bullion bank gold float to support the entire London Gold Market was only 1173 tonnes, which is only about 0.5% of total above ground global gold stocks.

Visually, we can therefore write the entire London Gold Market as a simple equation as follows:

Total London gold – BoE vault gold – ETF held gold = London gold Float

For month-end September 2019, the figures are as follows:

8228 – 5152 – 1903 = 1173 tonnes float

We can also create a separate ratio relevant to these LBMA commercial vaults of ETF gold to non-ETF gold, which as of the end of September 2019 was (1903/1173) or 1.62.

Conclusion

In the words of the LBMA:

“The physical holdings of precious metals held in the London vaults underpin the gross daily trading and net clearing in London“

But with only 1173 tonnes of real physical gold held in the LBMA commercial vaults that is unconnected to ETFs out of a total of 3076 tonnes, this means that only 38% of the gold in the LBMA commercial vaults is available to support the London gold market. However, in reality, out of the ‘record’ 8228 tonnes of gold which the LBMA claims is held in London, only 14% of this total (1173 tonnes) is available to ‘underpin’ the giant gold trading and clearing casino that is the London gold market on any normal trading day.

Additionally, apart from the gold of the ETFS, there is no information whatsoever in the public domain about who owns the gold in the London commercial vaults, how much gold the LBMA bullion banks have to back their giant paper based unallocated gold account system, or how much gold liability claims they have compared to physical gold assets. In short, the market has no information on what gold stocks are available if everyone suddenly stood for physical delivery.

Furthermore, there are also no independent audit reports on any of the gold in the LBMA vaults, there are no gold bar weight lists published, and there is no public evidence of how much of this LBMA gold ‘float’ is unencumbered, free of lien, claim or otherwise. The same by the way is true of all the gold at the Bank of England where there have never been any independent public audits of any central bank gold, and where the Bank prevents the publication of any serial numbered gold bar weight lists. What would a run on the physical gold at the Bank of England look like, or even a continuation of central bank gold repatriation requests?

The @bankofengland every time they receive a gold repatriation request… pic.twitter.com/Cf0dfTFsbd

— Silver Watchdog (@Silver_Watchdog) November 30, 2019

Finally, latest clearing figures from the LBMA show that in November 2019, 19.7 million ounces of ‘gold’ (613 tonnes) were cleared each day in London. The figure for LBMA gold trading in mid-December was even higher with a daily trading volume of 32 million ounces of ‘gold’ (995 tonnes) traded per day, which is 5,000 tonnes per week. While the vast majority of this trading is not in real gold but more correctly paper or synthetic gold, that is the whole point. There is very little physical gold in London backing a gigantic inverted pyramid of smoke and mirrors.

So instead of cheerleading the fact that there was a record 8,228 tonnes of gold held in London at the end of September, should not we be sounding alarm bells that in terms of the giant casino that is the London Gold Market, there is practically no gold to back up the giant leveraged unallocated and synthetic gold charade?

Special thanks to Nick Laird of GoldChartsRUs for creating the updated gold charts featured in this article.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments