Gold & Silver Roar Higher: The Canaries in the Coal Mine

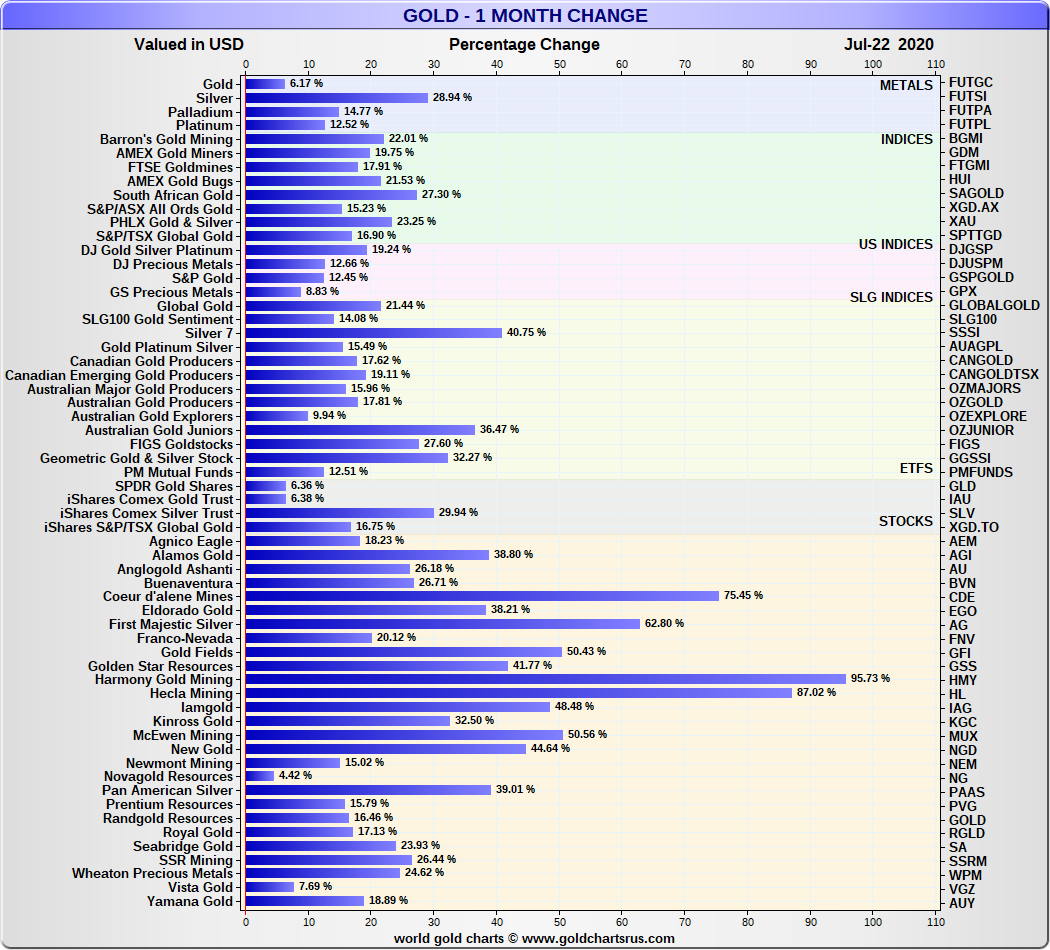

This week has the makings of an historic one for gold and silver, a week which will be remembered for the stellar performances and breakout of the US dollar denominated gold price and silver price across spot, futures and physical markets. This has ignited everything from gold and silver mining shares, to gold and silver mining ETFs and Indexes, and sparked increased interest across the financial media, as well as across the institutional and retail investor bases.

Having closed the previous week at $19.34 and at a 4 year high, the spot silver price took off Monday 20 July, and is now, at time of writing, trading at $22.85, an intra-week gain of a mammoth 18%. While silver rose to just shy of $20 on Monday, it was Tuesday that provided the main fireworks, with the spot price zooming roughly 12.5% higher (or $2.50) to the $22.5 range, and a new six year high. After some brief consolidation, Wednesday’s trading included a successful attempt on the $23 mark, a level which is again being revisited as we speak, which is near the seven year high which silver recorded in September 2013.

Notably, at current levels, the silver price has now nearly doubled from its year-to-date low of $11.9 per oz recorded on 19 March, which was in the midst of wider financial market gyrations and down drafts.

Over in gold where new multi-year highs for the US dollar gold price have become the norm in the last few months, this week has been key because the holy grail of a new all-time high nominal gold price is currently unfolding as gold seeks out $1900. It is therefore now a question of when, rather than if, the US dollar gold price surpasses the $1920 mark, the previous all-time high level that was set in early September 2011. That would leave gold clear to run up towards the psychologically important and probably media frenzied $2000 mark.

As of the time of writing, spot gold in US dollars is trading at $1887.45, a 24.4% year-to-date gain, after having risen as high as $1898 in Thursday’s trading (23 July). With the current surging gold price, it’s easy to forget that a brief 4 months ago, gold fell abruptly during the second and third weeks of March to a low of $1473. The rebound from that year-to-date low, which was also recorded on 19 March, is now a 28.5% recovery.

For gold priced in all other fiat currencies, new all-time highs have of course become common occurrences and have been happening practically every week recently. But given that the gold price is primarily quoted and traded in US dollars, and given that the US dollar is the world’s de facto reserve currency, a new all time high for the gold price in US dollars will be the motherload and now on everyone’s radar, including in the boardrooms of central bankers where the prices of precious metals are feared and revered in equal measure.

Why is the gold price rising?

For those who have been reading BullionStar blogs, the reasons for the gold price trending higher and towards an all-time US dollar high should be familiar. These reasons have been covered in, for example, such articles as “QE Insanity | Helicopter Money and the Risk of Hyperinflation” in May, “BullionStar Interview with SG Wealth Builder: Gold at 8 Year High” in June, and “Rising gold prices attract global and local attention” in July.

But to summarize, some of the main triggers pushing the paper gold price higher include the ongoing financial crisis, negative US Treasury yields, explosive quantitative easing (QE) by central banks, fiat currency debasement, zero to negative official interest rates, government Covid-related spending out of thin air, ballooning global debt, the risk of a US dollar crisis, and the growing risks of hyperinflation. It’s also important to stress that there is still an ongoing financial crisis, because nothing in the financial system has been resolved, merely postponed, and in fact has even been made worse by QE and the creation of more debt.

On the investment demand side, demand for physical gold is strong and rising (as we have seen in the BullionStar shop and showroom in Singapore and online this week) for the same reasons savers and investors always buy physical gold, i.e. as a safe haven, as a store of value / financial insurance, but also due to more momentum buying due to the rising price.

Why is the silver price rising?

The current surge in silver is being attributed to any number of drivers, including stronger industrial demand as economies reopen, silver mine supply disruptions, strong physical bar and coin demand, ETF silver demand, and ETF potential demand. While these may be all influences, its important to remember that like gold, the spot silver price is determined by unallocated trading in the LBMA ‘silver market’ in London and by bullion bank silver futures trading on the COMEX.

However, in these venues there appears to have been a sentiment shift, reflecting a recollection by investors that silver, like gold, is a monetary metal and a store of value and so the silver price is reflecting the triggers that have been pushing gold higher, i.e. unlimited QE, global money supply expansion, government, fiscal stimulus, and inflationary expectations.

In short, gold and silver are proverbial canaries in the coal mine, their prices inversely correlate to the perceived health of the rest of the financial system, and they are traditional barometers of inflation. Which is why central banks and the Bank for International Settlements (BIS) are so interested in precious metals prices. Even though they will pretend not to be.

On a technical basis, the US dollar silver price is primarily moving up because it has momentum and has taken out both a 4 year high and 6 year high. This attracts investor and media interest which in turn attracts further investor interest. Similarly, the surge in the silver price also feeds into interest in the gold price, and vice versa.

The Gold / Silver Ratio

We also should not forget that the Gold / Silver Ratio, a relative value measure of the number of units of silver it takes to buy one unit of gold, had peaked at an all time high of 123.8 in March as the silver price plummeted. For those who believe in mean reversion, the recent surge in silver, returning the Silver / Gold Ratio towards its 4 year average (in the region of 82), was to be expected which meant the silver price rising faster than the gold price. Remember also that the price of silver is always more volatile than gold, i.e. silver can have larger and faster moves and larger price swings, something that was well illustrated in the fast and violent silver price moves of, for example, 2011.

Coverage of fast moving gold and silver prices will always mean that recent prices mentioned above and year-to-date returns will differ from current prices when you read this article. Therefore:

For live gold prices and a full guide about everything to do with the gold price, see BullionStar’s Gold Price page here.

For live silver prices and a full guide about everything to do with the silver price, see BullionStar’s Silver Price page here.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments