Central Banks Coordinate Jawboning, Tapering to Prove Futile

For the world’s financial markets which have become literally dependent on the pronouncements of central banks, this week is lining up to be one of the most important in a while.

Because this week no less than 4 of the world’s most powerful central banks are each meeting to discuss quantitative easing (QE) and interest rate decisions, after which they will ‘inform’ financial markets as to what extent the markets will be kept on life-support stimulus. QE here literally refers to central banks buying government bonds (debt) and other forms of debt and equity securities.

MOPE

First up is the operator of the world’s most influential fiat currency, the US Federal Reserve, whose Federal Open Market Committee (FOMC) meets over two days between Tuesday 14 and Wednesday 15 December, and then tells markets whether it will taper its QE (i.e. decelerate it’s interventions). Simultaneously the Fed will engage in Management of Perception Economics (MOPE) about future interest rate hikes (hint: the Fed cannot significantly raise rates without torpedoing financial market asset bubbles).

The US Fed effective federal funds rate is currently 0.08% with a target rate of between 0.00% and 0.25%.

Following the Fed meeting, the Governing Council of the European Central Bank (ECB) meets on Thursday 16 December, and will also then pronounce about if and when it will scale back it’s trillions of interventional asset purchases, the leading two of which the ECB calls an ‘Asset Purchase Programme (APP)’ and a ‘Pandemic Emergency Purchase Programme (PEEP)‘.

Also expect ECB jawboning about interest rate increases but no rate move. ECB interest rates are currently at historical lows, with the ECBB’s main refinancing operations (MRO) rate at 0%, the marginal lending facility at 0.25% and the deposit facility at -0.5% (minus 0.5%).

On the same day, Thursday 16 December, the Bank of England’s Monetary Policy Committee (MPC) meets to also discuss interest rate increases. But the MPC will most likely use the convenient Omicron propaganda (rampant across mainstream UK media) as an excuse to leave UK interest rates unchanged. The Bank of England ‘bank rate’ or ‘base rate’ is currently 0.1%.

The same day on Thursday 16 December, the perennially interventionalist Bank of Japan (BoJ) begins a 2-day Monetary Policy Meeting (MPM), and in the same vein will chit-chat about decelerating asset purchases and raising interest rates, but in the end, as usual, the BoJ will do nothing. The current BoJ key interest rate is currently -0.1% (minus 0.1%).

As we’ve been saying, you can’t taper a Ponzi. They will talk taper but it’s a mathematical impossibility given record, extreme, duration of underlying bonds. https://t.co/RcP5nElu0B

— ☣️ BITCOIN MAXIMALIST (@maxkeiser) December 1, 2021

Addicted to Stimulus

If you think about it, it’s ludicrous that the world’s so called ‘free market’ financial markets are hanging on the every word of a private banking cartel (the US Federal Reserve) for a signal about whether this same US fed will scale back (taper) it’s massive interventions (asset purchases) into these so-called ‘free markets’. The same is true of the Fed’s colleagues at the ECB, Bank of England and BoJ. This is literally like a bunch of drug addicts (the markets) waiting to see if a drug cartel has enough drugs to sell to them all, or will the cartel dealers need to ‘taper’ the supply.

The question which the mainstream financial media should be asking (but never asks) is why central banks need to intervene at all. The answer of course is clear, that without central bank interventions, the entire debt based financial system would implode.

Each of these central bank decision making bodies also knows that they are now in unchartered territory and that they have painted themselves into corners with unprecedented asset purchases and historically low interest rates (and negative real interest rates), which they cannot reverse without detonating the asset bubbles which they these same central banks have created.

Good Morning from #Germany where #inflation pressure keeps rising. Selling prices in wholesale trade rose by 16.6% in Nov YoY, highest since beginning of calculation of wholesale price statistics in 1962. Mainly driven by increased prices for raw materials & intermediate products pic.twitter.com/yJFytjBBoE

— Holger Zschaepitz (@Schuldensuehner) December 13, 2021

Central Bank Toolbox is Empty

All the while inflation across the board continues to accelerate (except for the curious case of Japan where low growth, low interest rates and low inflation all exist simultaneously).

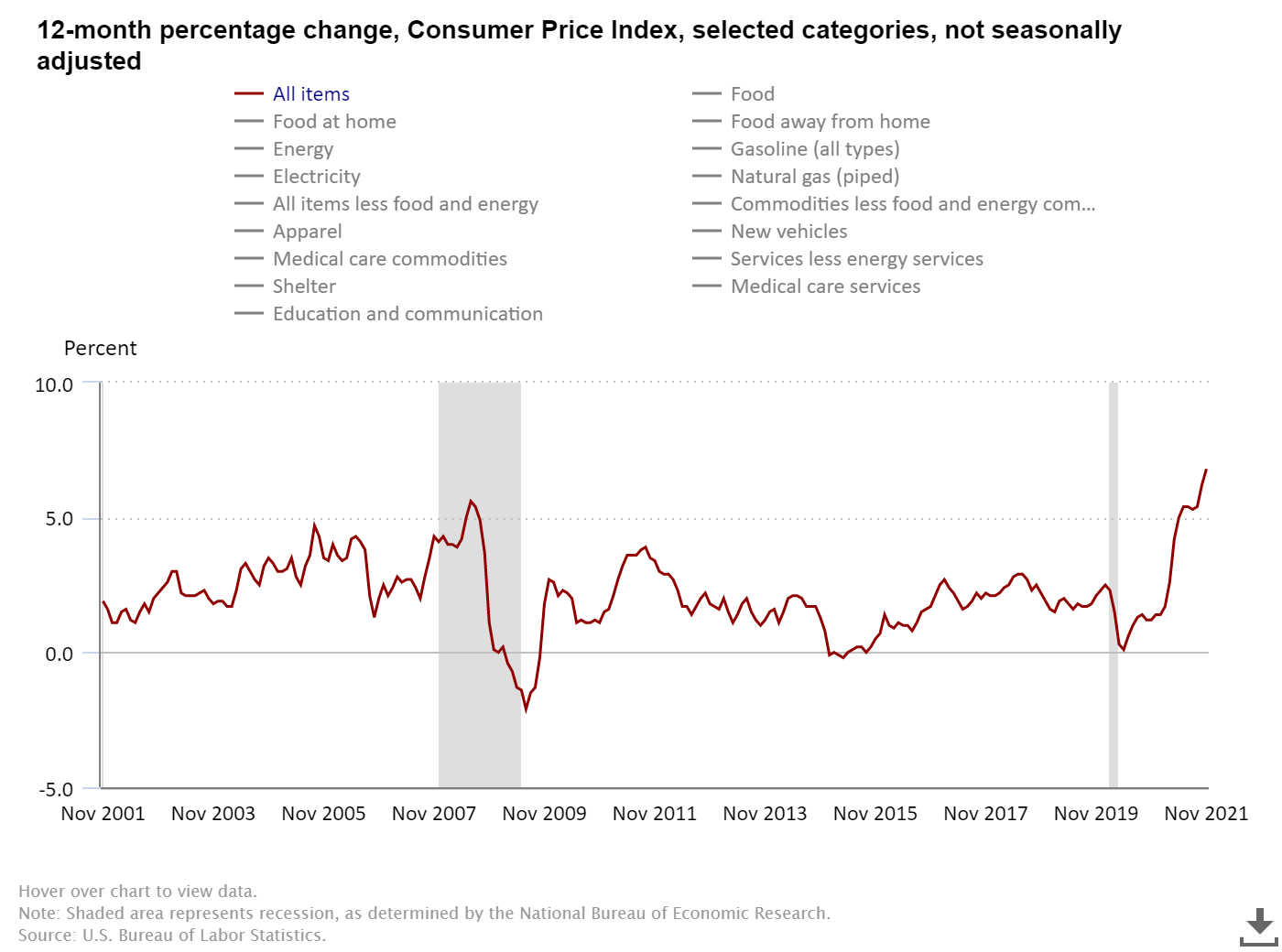

The official Consumer Price Index (CPI) of the US Bureau of Labor Statistics (BLS) is currently 6.8% for the year to end of November 2021. This is the largest annual increase in US official inflation since June 1982. And remember, this is a massaged and manipulated official US Gov inflation figure. True US inflation is much higher.

In the Euro area of the EU, the latest official reading of the EU’s inflation figure called the Harmonised Index of Consumer Prices (HICP) for end of October 2021 was 4.1% annualised, which itself is a huge rise compared to a HICP of 3.4% at the end of September 2021. And even more recently, the estimated HICP for the end of November 2021 (estimated by Eurostat) was an even higher 4.9% annualized. See data here.

Across the English channel, the UK’s inflation rate, as of the end of October 2021, was officially running at 3.8% annualised, compared to 2.9% annualized up to the end of September 2021. Again, these are officially massaged (by a chosen methodology) inflation figures calculated by UK government department, the Office of National Statistics.

So in summary, expect a lot of jawboning from the Fed, ECB, BoE and BoJ, and plenty of MOPE to attempt to fool the markets, but not much else, for in the words of Max Keiser, “You can’t taper a Ponzi”.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments