COMEX & ICE Vault Reports Overstate Gold Inventories

Introduction

In the world of gold market reportage, much is written about gold futures prices, with the vast majority of reporting concentrating on the CME’s COMEX contracts. Indeed, when it comes to COMEX gold, a veritable cottage industry of websites and commentators makes its bread and butter commentating on COMEX gold price gyrations and the scraps of news connected to the COMEX. The reason for the commentators’ COMEX fixation is admittedly because that’s where the trading volume is. But such fixation tends to obscure the fact that there is another set of gold futures contracts on ‘The Street’, namely the Intercontinental Exchange (ICE) gold futures contracts that trade on the ICE Futures US platform.

These ICE gold futures see little trading volume. Nonetheless, they have a setup and infrastructure rivaling that of COMEX gold futures, for example, in the reporting of the gold inventories from the vault providers that have been approved and licensed by ICE for delivery of gold against its gold futures contracts.

At the end of each trading day, both CME and ICE publish reports showing warehouse inventories of gold in Exchange licensed facilities/depositories which meet the requirements for delivery against the Exchanges’ gold futures contracts. These inventories are reported in two categories, Eligible gold and Registered gold. Many people will be familiar with the COMEX version of the report. A lot less people appear to know about the ICE version of the report. For all intents and purposes they are similar reports with identical formats.

Most importantly, however, both reports are technically incorrect for the approved vaults that they have in common because neither Exchange report takes into account the Registered gold reported by the other Exchange. Therefore, the non-registered gold in each of the vaults in common is being overstated, in a small way for COMEX, and in a big way for ICE. And since COMEX and ICE have many approved vaults in common, technically this is a problem.

The Background

Before looking at the issues surrounding the accuracy of the reports, here is some background about CME and ICE which explains how both Exchanges ended up offering gold futures contracts using vaults in New York. The Commodity Exchange (COMEX) launched gold futures on 31 December 1974, the date on which the prohibition on private ownership of gold in the US was lifted. In 1994, COMEX became a subsidiary of the New York Mercantile Exchange (NYMEX).

In 2001, Euronext acquired the London International Financial Futures and Options Exchange (LIFFE) to form the Euronext.LIFFE futures exchange. In April 2007, NYSE and Euronext merged to form NYSE Euronext. Following the merger with NYSE, this merged futures exchange was renamed NYSE Liffe US.

In July 2007, Chicago Mercantile Exchange (CME) merged with the Chicago Board of Trade (CBOT) and CME and CBOT both became subsidiaries of ‘CME Group Inc’. CBOT had traded a 100 oz gold futures contract from 2004 and a ‘CBOT mini-sized’ gold futures contract (33.2 ozs) from 2001. During 2007, NYSE Euronext had also been attempting to acquire CBOT at the same time as CME.

In August 2008, the CME Group acquired NYMEX (as well as COMEX), and NYMEX (including COMEX) became a fully-owned subsidiary of holding company CME Group Inc. Just prior to acquiring NYMEX/COMEX and its precious metals products, the CME sold the CBOT products to NYSE Euronext in March 2008. This included the CBOT 100 oz and mini gold futures contracts, and the CBOT options on gold futures. NYSE Euronext then added these gold contract products to its NYSE Liffe US platform.

In 2013, ICE acquired NYSE Liffe. In mid 2014, ICE transferred the NYSE Liffe US precious metals contracts to its ICE Futures US platform. ICE then spun off Euronext in 2014. ICE Futures US had been formerly known as the New York Board of Trade (NYBOT). ICE had acquired NYBOT in January 2007 and renamed it as ICE Futures US in September 2007.

Both COMEX and ICE Futures US are “Designated Contract Markets" (DCMs), and both are regulated by the Commodity Futures Trading Commission (CFTC). Any precious metals vault that wants to act as an approved vault for either COMEX or ICE, or both, has had to go through the COMEX / ICE approval process, and the CFTC has to be kept in the loop on these approvals also.

The Vault Providers

For its gold futures contracts, COMEX has approved the facilities of 8 vault providers in and around New York City and the surrounding area including Delaware. These vaults are run by Brink’s, Delaware Depository, HSBC, International Depository Service (IDS) Delaware, JP Morgan Chase, Malca-Amit, ‘Manfra, Tordella & Brookes’ (MTB), and The Bank of Nova Scotia (Scotia). Their vault addresses are:

- Brinks Inc: 652 Kent Ave. Brooklyn, NY and 580 Fifth Avenue, New York, NY 10036

- Delaware Depository: 3601 North Market St and 4200 Governor Printz Blvd, Wilmington, DE

- HSBC Bank USA: 1 West 39th Street, SC 2 Level, New York, NY

- International Depository Services (IDS) of Delaware: 406 West Basin Road, New Castle, DE

- JP Morgan Chase NA: 1 Chase Manhattan Plaza, New York, NY

- Malca-Amit USA LLC, New York, NY (same building as MTB)

- Manfra, Tordella & Brookes (MTB): 50 West 47th Street, New York, NY

- Scotia Mocatta: 23059 International Airport Center Blvd., Building C, Suite 120, Jamaica, NY

Malca-Amit and IDS of Delaware were the most recent vault providers to be approved as COMEX vault facilities in December 2015/January 2016.

ICE has approved the facilities of 9 vault providers in and around New York City and the surrounding area including Delaware and also Bridgewater in Massachusetts. A lot of the ICE vaults in New York and the surrounding region were approved when its gold futures were part of NYSE Liffe. The ICE approved vaults are run by Brink’s, Coins N’ Things (CNT), Delaware Depository, HSBC, IDS Delaware, JP Morgan Chase, MTB, Loomis, and Scotia. From these lists you can see that Malca-Amit is unique to COMEX, and that CNT and Loomis are unique to ICE. The addresses of CNT and Loomis are as follows:

- CNT Depository in Massachusetts: 722 Bedford St, Bridgewater, MA 02324

- Loomis International (US) Inc: 130 Sheridan Blvd, Inwood, NY 11096

There are therefore 10 vault providers overall: Brink’s, CNT, Delaware Depository, HSBC, IDS Delaware, JP Morgan, Loomis, Malca-Amit, MTB, and Scotia. Three of the vaults are run by security transport and storage operators (Brink’s, Malca, and Loomis), three are owned by banks (HSBC, JP Morgan and Scotia), three are parts of US precious metals wholesaler groups (MTB, CNT and Dillon Gage’s IDS of Delaware), and one Delaware Depository is a privately held precious metals custody company.

Importantly, there are 7 vault provider facilities common to both COMEX and ICE. These 7 common vault providers are Brink’s, Delaware Depository, HSBC, IDS Delaware, JP Morgan, MTB, and Scotia.

The Inventory Reports

Each afternoon New York time, CME publishes a COMEX ‘Metal Depository Statistics’ report for the previous trading day’s gold inventory activity, which details gold inventory positions (in troy ounces) as well as changes in those positions within its approved vault facilities at Brink’s, Delaware Depository, HSBC, IDS Delaware, JP Morgan, Malca-Amit, MTB and Scotia. The COMEX report is published as an Excel file called Gold_Stocks and its uploaded as the same filename to the same CME Group public directory each day. Therefore it gets overwritten each day: https://www.cmegroup.com/delivery_reports/Gold_Stocks.xls.

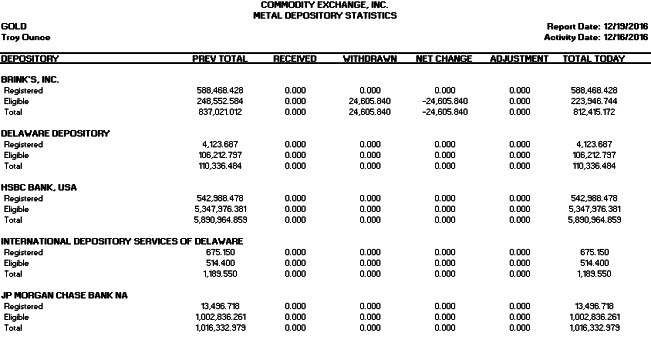

Below are screenshots of this COMEX report for activity date Friday 16 December 2016 (end of week), which were reported on Monday 19 December 2016. For each depository, the report lists prior total of gold reported by that depository, the activity for that day (gold received or withdrawn) and the resulting updated total for that day. The report also breaks down the total of each depository into ‘Registered’, and ‘Eligible’ gold categories.

Eligible gold is all the gold residing in a reporting facility / vault which is acceptable by the Exchange for delivery against its gold futures contracts and for which a warrant (see below) has not been issued, i.e. the bars are of acceptable size, gold purity and bar brand. In practice, this just applies to 100 oz and 1 kilo gold bars. This ‘eligible gold’ could be gold owned by anyone, and it does not necessarily have any connection to the gold futures traders on that Exchange.

For example, 400 oz gold bars in a COMEX or ICE approved vault would not be eligible gold. Neither would 100 oz bars or kilo bars arriving in a vault if the bars had been outside the chain of custody and had not yet been assayed.

Registered gold is eligible gold (acceptable gold) for which a vault has issued a warehouse receipt (warrant). These warrants are documents of title issued by the vault in satisfaction of delivery of a gold futures contract, i.e. the vault receipts are delivered in settlement of the futures contract. This is analogous to set-aside or earmarked gold.

For the COMEX 100 oz gold futures contract (GC), physical delivery can be either through 1 unit of a 100 troy ounce gold bar, or 3 units of 1 kilo bars, therefore eligible gold on the CME report would include 100 troy ounces bars of gold, minimum 995 fineness, CME approved brand, and 1 kilo gold bars, CME approved brand. The CME E-Mini gold futures contract (QO) is exclusively cash settled and has no bearing on the licensed vault report. CME E-micro gold futures (MGC) can indirectly settle against the CME 100 oz GC contract through ‘Accumulated Certificates of Exchange’ (ACEs) which represent a 10% claim on a GC (100 oz) warrant. Therefore, the only gold bars reported included on the CME Metal Depository Statistics reports are 100 oz and 1 kilo gold bars.

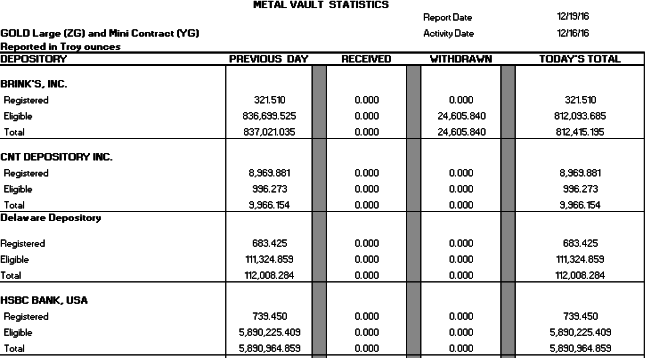

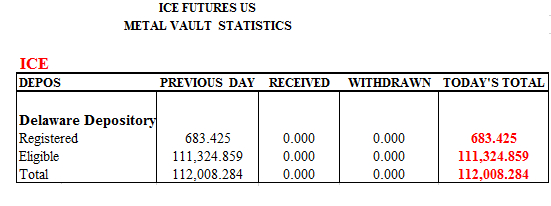

Each afternoon New York time, ICE publishes a “Metal Vault Statistics" report as an Excel file which is uploaded to an ICE public web directory. The report lists the previous trading day’s gold inventory activity, and like the CME report, shows gold inventory positions and changes in those positions (receipts and withdrawals) in troy ounces within its approved vault facilities. The ICE report also breaks down the total of each depository into ‘Registered’ and ‘Eligible’ gold.

The ICE licensed vault reports are saved as individually dated reports. The ICE report dated 19 December 2016 for activity on 16 December 2016, can be seen at https://www.theice.com/publicdocs/futures_us_reports/precious_metals/Precious_Metals_Vault_Stocks_Dec_19_2016.xls.

Two gold futures contracts trade on ICE Futures US, a 100 oz gold futures contract (ZG), and a Mini gold futures contract (YG). YG which has a contract size of 32.15 troy ounces (1 kilo). Both of these ICE gold contracts can be physically settled. The gold reported on the ICE Metal Vault Statistics report therefore comprises 100 oz and 1 kilo gold bars that are ICE approved brands. In practice, CME and ICE approved brands are the same brands.

The Rules

The data required to be conveyed to CME each day by the approved depositories is covered in NYMEX Rulebook Chapter 7, section 703.A.7 which states that:

“on a daily basis, the facility shall provide, in an Exchange-approved format, the following information regarding its stocks:

- a. The total quantity of registered metal stored at the facility.

- b. The total quantity of eligible metal stored at the facility.

- c. The quantity of eligible metal and registered metal received and shipped from the facility."

The ICE Futures US documentation on gold futures does not appear to specifically cover the data that its approved vaults are required to send to ICE each day. Neither does it appear to be covered in the old NYSE Liffe Rulebook from 2014. In practice, since ICE generate a report for each trading day which is very similar to the CME version of the report, then it’s realistic to assume that the vaults send the same type of data to ICE. But as you will see below, the vaults seem to just send each Exchange a ‘number’ specifying the registered amount of gold connected to warrants related to the Exchange, and then another ‘number’ for acceptable gold that is not registered to warrants connected to that Exchange.

The Comparisons

What is immediately obvious when looking at the CME and ICE reports side by side is:

- a) they are both reporting the same total amounts of gold at each of the approved facilities (vaults) that they have in common, and also reporting the same receipts and withdraws to and from each vault. This would be as expected.

- b) CME and ICE are reporting different amounts of ‘Registered’ gold at each facility because they only report on the gold Registered connected to their respective Exchange contracts…

- c)… which means that CME and ICE are also reporting different amounts of ‘eligible’ gold at each approved facility that they have in common.

In other words, because neither Exchange takes into account the ‘Registered’ gold at the other Exchange, each of CME and ICE is overstating the amount of Eligible gold at each of the vaults that they both report on.

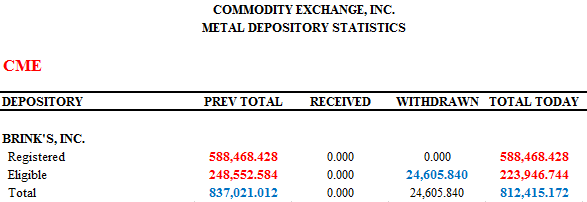

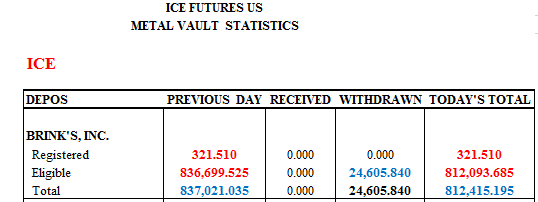

Brink’s Example

Look at the below Brinks vault line items as an example. For activity date Friday 16 December 2016, CME states that at the end of the day there were 588,468.428 troy ounces of gold Registered, leaving 223,946.744 ounces in Eligible, and 812,415.172 ounces in Total. ICE also states the same Total amount of 812,415.195 ounces (probably differs by 0.023 ozs due to rounded balances carried forward), but from ICE’s perspective, its report lists that there were 321.51 ounces (10 kilo bars) registered in this Brink’s vault, so therefore ICE states that there are 812,093.685 ounces of eligible gold in the Brinks vaults. However, CME has 588,468.428 troy ounces of gold ‘earmarked’ or Registered against the total amount of reported 100 oz and 1 kilo gold bars in the Brink’s facility. In practice, if the situation ever arose, the Brink’s vault could issue warrants against ICE gold futures of more than 223,635.234 ozs, because this is the maximum amount of eligible gold in the vault which is neither registered with the COMEX exchange or registered with the ICE exchange.

CME Brinks gold – Report date: 19 December 2016, Activity date: 16 December 2016

Therefore in this example, both the CME and ICE reports are not fully correct, but the ICE report is far ‘more’ incorrect than the CME report because the ICE report substantially understates the true amount of Eligible (non-registered) gold in the Brink’s vault. This trend is evident across most ‘Eligible’ numbers for the vaults in the ICE report. Since the trading volume in ICE gold futures is very low overall, the number of ICE gold futures contracts that have ultimately generated warrants is also very low.

Although the relatively tiny amounts of ‘Registered’ ounces listed on the ICE report won’t really affect the overall accuracy of the COMEX reporting, a more correct approach to reflect reality would be for the vault providers to combine the Registered numbers from the two Exchanges, and subtract this combined amount from the reported Total at each facility so as to derive an accurate and real Eligible amount for each vault facility.

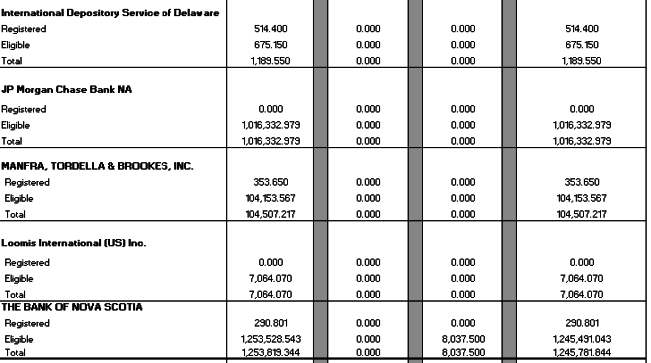

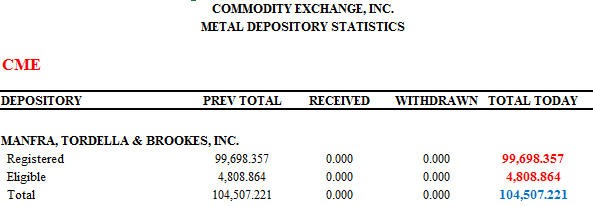

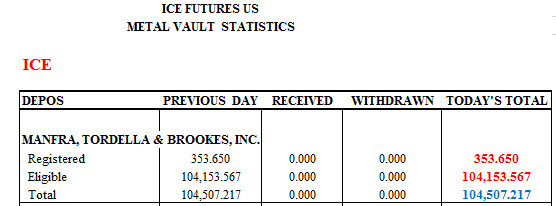

MTB Example

But what about a scenario in which very little non-registered gold is actually left in a vault right now due to a high Registered amount having been generated from COMEX activity? In such a situation, the ICE report will overestimate the amount of Eligible gold in a big way and a reader of that report would be oblivious of this fact. This is the case for the Manfra, Tordella & Brookes (MTB) vault data on the ICE report.

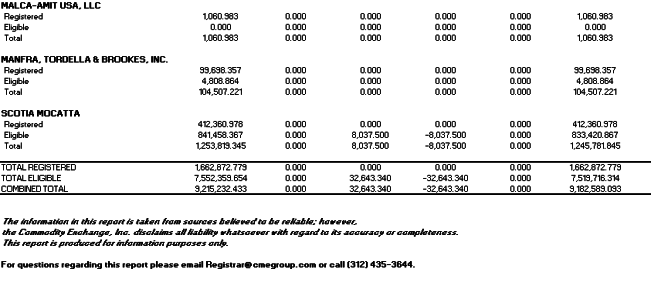

According to the CME report, as of Friday 16 December, there were 104,507.221 ozs of gold in the MTB vault in the form of acceptable 100 oz or 1 kilo bars, with 99,698.357 ozs of this gold registered against warrants for COMEX, and only 4,808.864 ozs not Registered (i.e. Eligible to be Registered).

The ICE report for the same date and same vault states that there are the same amount of Total ounces in the vault i.e. 104,507.217 ounces (0.004 oz delta). However, the ICE report states that 104,153.567 ozs are Eligible to be registered, since from ICE’s perspective, only 353.65 ozs (11 kilo bars) are actually Registered. But this ICE Eligible figure is misleading since there are a combined 100,052.007 ozs (99,698.357 ozs + 353.65 ozs) Registered between the 2 Exchanges, and only another 4,455.214 ozs of Eligible gold in total in the vault.

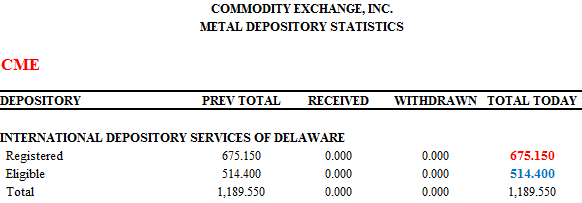

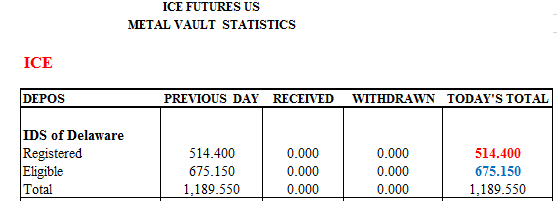

IDS Delaware Example

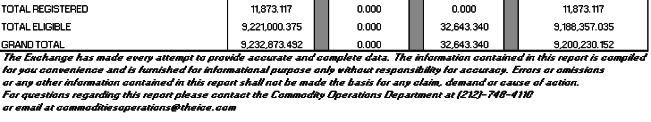

The reporting for International Depository Services (IDS) of Delaware is probably the most eye-opening example within the entire set of vault providers, because when looking at the 2 reports side by side, it becomes clear that there is no ‘Eligible’ (non-Registered) gold in the entire vault. CME states that 675.15 ozs (21 kilo bars) are Registered and that 514.4 ozs (16 kilo bars) are Eligible, giving a total of 1,189.55 ozs (37 kilo bars), but ICE states that 514.4 ozs (16 kilo bars) are Registered and thinks that 675.15 ozs (21 kilo bars) are Eligible. But in reality, between the two Exchanges, the entire 1,189.55 ozs (37 kilo bars) is Registered and there are zero ozs Eligible to be Registered. CME thinks whatever is not Registered is Eligible, and ICE thinks likewise. But all 37 kilo bars are Registered by the combined CME and ICE. IDS therefore sums up very well the dilemma created by the Exchanges not taking into account the warrants held against each other’s futures contracts.

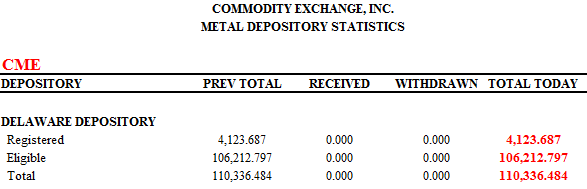

Delaware Depository Example

Based on a report comparison, Delaware Depository (DD) is unusual in that there are different ‘Total’ amounts reported by each of CME and ICE. CME states that there are 110,336.484 ozs of acceptable gold in the DD vault, whereas ICE states that there are 112,008.284 ozs. This difference is 1,671.80 ozs which is equivalent to 52 kilo bars. So, for some unexplained reason, the vault has provided different total figures to CME and ICE.

The above comparison exercise can be performed for the other 3 vaults that both CME and ICE have in common, namely the 3 bank vaults of HSBC, JP Morgan and Scotia. These 3 vaults hold the largest quantities of metal in the entire series of New York area licensed vaults. The ICE contracts have very tiny registered amounts in these vaults, but the Eligible amounts listed on the ICE report for these vaults should technically take account of the Registered amounts listed on the CME report for these same 3 vaults.

The licensed vault that is unique to CME, i.e. the vault of Malca-Amit, surprisingly only reports holding 1060.983 ozs of gold (33 kilo bars), with all 33 bars reported as Registered. This is surprising since given that Malca operates a vault in the recently built International Gem Tower on West 47th Street, one would expect that Malca would be holding far more than just 33 gold kilo bars which would only take up a tiny amount of shelf space.

The two vaults that are unique to ICE, namely CMT and Loomis, also report holding only small amounts of acceptable gold. CNT has 9966.154 ozs (310 kilo bars), 90% of which is Registered, while Loomis reports holding just 7064.07 ozs, all of which is non-registered.

Conclusion

In gold futures physical settlement process, it’s the responsibility of the exchanges (COMEX and ICE) to assign the delivery (of a warrant) to a specific vault (the vault which is ‘stopped’ and whose warehouse receipt represents the gold delivered). Presumably, the settlement staff at both CME and ICE both know about each other’s registered amounts at the approved vaults, and obviously the vaults do since they track the warrants. But then, if this is so, why not indicate this on the respective reports?

The CME and ICE reports both have disclaimers attached as footnotes:

CME states:

“The information in this report is taken from sources believed to be reliable; however, the Commodity Exchange, Inc. disclaims all liability whatsoever with regard to its accuracy or completeness. This report is produced for information purposes only."

ICE states:

“The Exchange has made every attempt to provide accurate and complete data. The information contained in this report is compiled for you convenience and is furnished for informational purpose only without responsibility for accuracy."

The exact definition of ‘Eligible’, taken from the COMEX Rulebook, is as follows:

“Eligible metal shall mean all such metal that is acceptable for delivery against the applicable metal futures contract for which a warrant has not been issued“

However, in the case of ICE, its report is vastly overstating figures for Eligible gold at the vaults in which COMEX is reporting large registered amounts. In these cases, a warrant has been issued against the metal, it’s just not for ICE contracts, but for the contracts of its competitor, the COMEX. Surely, at a minimum, these footnote disclaimers of the ICE and CME vault inventory reports should begin to mention this oversight?

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments