From Gold Trains to Gold Loans: Italy's Huge Gold Reserves

Italy’s gold has had an eventful history. Robbed by the Nazis and taken to Berlin. Loaded on to gold trains and sent to Switzerland. Flown from London to Milan and Rome. Used as super-sized collateral for gold backed loans from West Germany while sitting quietly in a vault in New York. Leveraged as a springboard to prepare for Euro membership entry. Inspired Italian senators to visit the Palazzo Koch in Rome. Half of it is now in permanent residency in downtown Manhattan, or is it? Even Mario Draghi, European Central Bank (ECB) president, has a view on Italy’s gold. The below commentary tries to make sense of it all by bringing together pieces of the Italian gold jigsaw that I have collected.

2,451.8 tonnes

According to officially reported gold holdings, and excluding the gold holdings of the International Monetary Fund (IMF), Italy’s central bank, the Banca d’Italia, which holds Italy’s gold reserves, is ranked as the world’s third largest official holder of gold after the US and Germany, with total gold holdings of 2,451.8 tonnes, worth more than US$ 105 billion at current market prices. Notable, Italy’s gold is owned by the Banca d’Italia, and not owned by the Italian State. This contrasts to most European nations where the gold reserves are owned by the state and are merely held and managed by that country’s respective central bank under an official mandate.

Italy’s gold reserves have remained constant at 2451.8 tonnes since 1999. Although the Banca d’Italia has been a signatory to all 4 Central Bank Gold Agreements and could have conducted gold sales within the limits of the agreements between 1999 and the present, it did not engage in any gold sales under either CBGA1 (1999-2004), CBGA2 (2004-2009), or CBGA3 (2009-2014), and as of now, has not conducted any sales under CBGA4 (2014-2019). With 2,451.8 tonnes of gold, the Banca d’Italia holds marginally more than the Banque de France, which claims official gold holdings of 2,435.8 tonnes.

Gold as a percentage of total reserves for both banks is very similar, with Italy’s gold comprising 69.7% of total reserve assets against 67.2% for France. Similarly, German’s gold reserves, at 3,378.2 tonnes, are 70.1% of its total reserves. See the World Gold Council’s Latest World Official Gold Reserves data for details.

So it appears that the big three European gold holders consider their gold to be a critical part of their foreign reserves and are keeping the ratio of their gold to total reserves within around the 70% mark.

Towards Transparency?

In April 2014, Banca d’Italia published a 3 page report about Italy’s gold reserves titled “Le Riserve Auree della Banca D’Italia" (published only in Italian). The report highlights that Italy’s gold is held in four storage locations, one of which is in Italy.

Specifically, in the report, Banca d’Italia confirmed that 1,199.4 tonnes of its gold, approximately half the total, is held in the Bank’s vaults which are located in the basement levels of its Palazzo Koch headquarters in Rome. The majority of remainder is stored in the Federal Reserve Bank’s gold vault in New York. The report also states that small amounts of Banca d’Italia gold are stored at the vaults of the Swiss National Bank in Berne, Switzerland, and at the vaults of the Bank of England in London.

As to why Italian gold is stored abroad in New York, London and Berne and not in other countries, is explained by historical data, and explained below.

Palazzo Koch

In its Palazza Koch vaults in Rome, the Banca d’Italia claims to store 1199.4 tonnes of gold. Of this total, 1195.3 tonnes are in the form of gold bars (represented by 95,493 bars), and 4.1 tonnes are in the form of gold coins (represented by 871,713 coins). While most of the bars in Rome are prism-shaped (trapezoidal), there are also brick-shaped bars with rounded corners (made by the US Mint’s New York Assay Office) and also ‘panetto’ (loaf-shaped) ‘English’ bars. The average weight of the bars in Palazzo Koch is 12.5 kg (400 oz), with bar weights ranging from relatively small 4.2 kgs up to some very large 19.7 kgs bars. The average fineness / gold purity of the Rome stored bars is 996.2 fine, with some of the holdings being 999.99 fine bars.

The Banca d’Italia also states that 141 tonnes of gold that it transferred to the ECB in 1999 as a requirement for membership of the Euro is also stored in Palazzo Koch. This would put the total gold holdings in the Palazzo Koch vaults at 1340 tonnes. Gold transferred to the ECB by its Euro member central banks is managed by the ECB on a decentralised basis, and is held by the ECB in whatever location it was stored in when the initial transfers occurred, subject to various location swaps which may have taken place since 1999.

The Vault is revealed

While the Banca d’Italia’s 3 page report appears to be the first official written and self-published confirmation from the Bank which lists the exact storage sites of its gold reserves, these four storage locations were also confirmed to Italian TV station RAI in 2010 when an RAI presenter and crew were allowed to film a report from inside the Bank’s gold vaults in Rome.

This RAI broadcast was for an episode of ‘Passaggio a Nord Ovest’, presented by Alberto Angela.

Translation of Video

For those who don’t speak Italian, such as myself, I asked an Italian friend to translate Alberto Angela’s video report and the other voice-overs in the report. The translation of the above video is as follows:

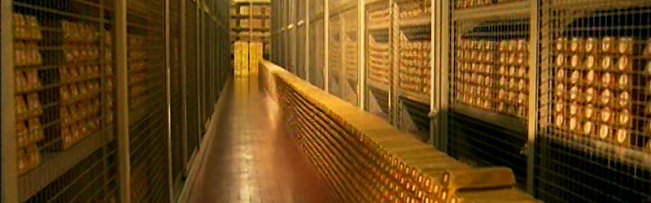

“Banca D’Italia features a secret and extremely important place which represents Italy’s wealth: it’s our gold reserve.

We’ve had a special permission to visit this place, called “the sacristy of gold." Here there’s a big protected door, and three high personnel from Banca d’Italia who are opening the door for me. Three keys are needed to open the door of the vault, one after the other and operated by three different people. Obviously we can’t show the security systems nor the faces of these men, but the door is huge, at least half a metre, and leads to another gate where again three keys must be used. Past this, that’s where our country’s gold is kept.

Here we are. It’s exciting to get in here, the environment is simple, sober. [general commentary, then camera shows a large amount of gold]

This is not all the gold we own, as part of it is also stored in The Federal Reserve in the US, in the Bank of England in the UK and in Banca dei Regolamenti Nazionali in Switzerland. I’m speechless when exploring the sacristy, … you don’t see this every day.

The value of all this gold is established by the European Central Bank, that also establishes its price. The overall value appears in the end of year balance. In 2005 the gold was valued at 20 miliardi of Euros (billions)

There are three types of lingotti (square-shaped gold). {he says how much the bars weigh}

They feature some signs on them, to say that they have been checked. Some are almost 100% gold, pure gold. There’s also a serial number on the gold, and a swastika on some of them as the Nazi took away all our gold, transferring it first to the north of Italy and then to Germany and Switzerland. At the end of the war part of it came back featuring the Nazi sign.

This gold represents the symbol of our wealth, without this we wouldn’t be able to deal with the rest of the world, it’s a symbol for Italy, a guarantee, like a family’s jewelry. They can be used to get loans as happened when Italy asked for a loan from Germany and they demanded, as a guarantee, the value in gold. So the name Germany was put on this gold at the time.

{the reporter then talks about going from gold to notes and ‘convertibility’ – trust in the States is now the guarantee for exchanges, and not gold, says the voice. It’s a relation of trust … Banca d’Italia keeps an eye on this. After Maastricht, a lot of our gold has left Italy to join the other countries’ gold to create the communitarian reserve of the Euro}"

Note that the reporter, Angela, states that in addition to Rome, the Italian gold is stored at the Federal Reserve Bank in New York, the Bank of England in London, and at the Bank of International Settlements (BIS) in Switzerland. The reporter uses the exact words “Banca dei Regolamenti Nazionali”.

The BIS and SNB

This BIS as Italy’s gold custodian was also confirmed in 2009 by Italian newspaper “La Repubblica”, which published an article about Italy’s gold, stating that it was held in Rome, at the Federal Reserve in New York, in the ‘vaults’ of the BIS in Basel, and in the vaults of the Bank of England.

This apparent inconsistency between a) the Banca d’Italia’s report, which claims that its gold in Switzerland is at the Swiss National Bank (SNB) in Berne, and b) the RAI broadcast, which states that some Italian gold is stored with the BIS in Switzerland, is technically not a contradiction since the BIS does not maintain its own gold storage facilities in Switzerland. The BIS just makes use of the SNB’s gold vaults in Berne.

If you look on its website, under foreign exchange and gold services, the BIS specifically states that it uses ‘Berne’ as one of its safekeeping facilities for gold, i.e. it offers its clients “safekeeping and settlements facilities available loco London, Berne or New York”. Loco refers to settlement location of a precious metals transaction. By confirming that its Swiss storage is with the BIS, and that it also stores gold at the Swiss National Bank in Berne, the Banca d’Italia has, maybe inadvertently, confirmed that the BIS makes use of the Swiss National Bank’s gold vaults, and that the SNB vaults are in fact in Berne. while its knwn that the SNB gold vaults are in Berne, the SNB rarely, if ever, talks about this.

However, in 2008, Berne-based Swiss newspaper “Der Bund” published an article revealing that the SNB’s gold vaults are in Berne underneath the Bundesplatz Square. Bundesplatz Square is adjacent to the SNB’s headquarters at No. 1 Bundsplatz. BIS literature, such as the official BIS history publication “Central bank Cooperation at the Bank for International Settlements, 1930 – 1973” also confirms that the SNB gold vaults are in Berne and that the BIS and the Banca d’Italia have held gold accounts with the SNB in Berne since at least the 1930s. Note that the SNB actually has two headquarters, one in Berne, the other in Zurich at Börsenstrasse.Its quite possible that some of the SNB custodied gold is also stored in the vaults of its Zurich headquarters under Paradeplatz or Bürkliplatz.

Simple Questions met with Ultra-Secrecy

In April 2014, in two emails, I asked the Banca d’Italia’s press office specifically about this SNB / BIS situation, and also about the Banca d’Italia gold stored in New York, (and also about gold leasing – see separate section below). My questions were as follows:

“The Banca d‘Italia states in its April (2014) gold document that the Italian gold held in Switzerland is stored at the Swiss National Bank in Berne. Previous profiles of the Banca d‘Italia gold storage arrangements in an RAI TV broadcast in 2010 and in a La Republica newspaper article in 2009 state that the Italian gold in Switzerland is deposited with the Bank of International Settlements (BIS).

Given that the BIS use the SNB vaults in Berne to store gold deposited with them (since they don’t have their own gold storage facilities in Switzerland), then the reference to the SNB is not surprising.

However, my question is, does the Banca d‘Italia store its gold in Berne as gold sight deposits with the BIS or as earmarked custody gold with the SNB, or a combination of the two?"

“Is the gold of the Banca d’Italia that is held by the Federal Reserve Bank of New York held under earmark (custody), or held in a sight account?"

By ‘website note’, the press and external relations division was referring to the 3 page report on gold reserves (see above) that the Bank published in April 2014.

Nazi Bars in Rome

The RAI television broadcast from 2010 was also notable in that it revealed that the Banca d’Italia holds bars of varied origins in its Rome vaults, including bars stamped with the official Bank of England stamp, and bars from the US Assay Office in New York including a featured bar from 1947. There are also Russian bars shown in the RAI video, one of which is shown in the video with the CCCP lettering, the hammer and sickle stamp, and the letters HKUM.

More surprisingly perhaps, is the fact that the Banca d’Italia also holds Nazi gold bars from the Prussian Mint in Berlin. The RAI broadcast video shows a 1940 Nazi bar from Berlin, stamped with the eagle and swastika insignia and with Prussian mint markings. The Nazi bar holdings can be explained by the fact that the Italian gold was confiscated by the Nazis during World War 2 and ended up being moved out of Rome up to the north of Italy and then most of it was transported onwards to Berlin in Germany or else to Switzerland. Following the war, some of the gold given back to the Italians as part of the Tripartite Commission payouts happened to be Prussian Mint bars stamped with the Nazi symbol (see below for historical account of Italian gold movements during World War 2).

The Foreign held Italian gold

The Banca d’Italia gold document does not specify how much of the Italian gold is held in New York, London and Berne, apart from stating that most of the gold that is not stored in Rome is stored in New York. Note that this is even less transparent than the brief information that the Deutsche Bundesbank publishes about its gold reserves storage locations. However, the Banca d’Italia document does state that “the bulk” of foreign stored gold is in New York (“la parte più consistente è custodita a New York“), and that “contingents of smaller size” are located in London and Berne (“Altri contingenti di dimensioni più contenute si trovano a Berna, presso la Banca Nazionale Svizzera, e a Londra presso la Banca d’Inghilterra“).

While one could argue about the meaning of ‘the bulk’ in terms of quantity, essentially the Banca d’Italia gold document implies that the London and Berne holdings are not very large. More specifically, it is possible using historical data and records of Italian gold movements to infer that there is little Italian gold in London and Berne.

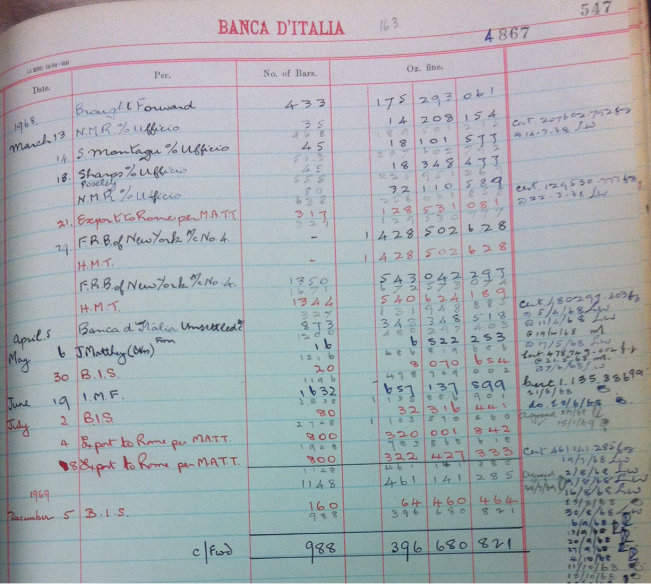

Not a lot in London

It does not look like Banca d’Italia holds anything other than a very small amount of gold in London. During the late 1960s, mainly between 1966 and 1968, the Banca d’Italia transported most of the gold that it had stored at the Bank of England vaults back to Italy. Regular shipments were exported and delivered by MAT (the secure transport company) to the Banca d’Italia’s vaults in both Rome and Milan, sometimes about 4 tonnes at a time, sometimes 10 tonnes at a time. Historic Bank of England gold account “set-aside” ledger entries (C142/5 Bullion Office Set Aside Ledger, A-K, 1943-1971) show that by the end of 1969, the Banca d’Italia only held 988 gold bars in London, weighing 396,000 ozs, or approximately 12.34 tonnes. In support of the veracity of this statement, see the specific ledger entry below.

During the Banca d’Italia’s gold transport period out of the Bank of England, various other transfers were also made from the Banca d’Italia gold account to the BIS gold account at the Bank of England. Since Italian gold reserves have not in total changed very much since December 1969, it is realistic to assume that the Banca d’Italia’s London gold holdings have not changed dramatically since December 1969, unless there have been location swaps executed since that time between London and New York or between London and Berne. This would generally only have been done for a specific reason such as to allow Italian gold lending through the London market. Significant gold lending only began in London in the mid-1980s, and the Banca d’Italia has never been on public record as having engaged in gold lending on the London Gold Lending Market.

Another possibility is that the Italians now use the BIS gold account(s) to hold gold in London in the same way that they do in Berne. This would allow the statement that some of the Italian gold is held in London to be true, even though the gold would, in this case, be held via the BIS gold account at the Bank of England, and not directly by a Banca d’Italia gold custody account in London.

Little in Berne

There does not appear to have been any Italian gold left in Berne after WWII (see historical details below), so whatever Italian balance is currently in Berne has been built up since 1946. Of relevance to the gold vaults in Berne, both the central banks of Finland (Bank of Finland) and Sweden (Riksbank) recently published the international locations of their gold reserves, and revealed that only very small percentages of their gold is kept in the Swiss National Bank vaults in Switzerland. Of the Riksbank’s 125.7 tonnes of gold reserves, only 2.8 tonnes (2.2%) is stored in the SNB vaults. For the Bank of Finland, only 7%, or 3.4 tonnes of its 49.1 tonnes of gold reserves are stored with the SNB in Switzerland.

Mostly in Manhattan

If this Swedish-Finnish 2-7% range of allocations held at the SNB was applied to the Italian gold that held outside Italy, it would result in between 25 tonnes and 87.6 tonnes of Italian gold being held at the SNB vaults in Berne. Factoring in 12 tonnes held at the Bank of England and a small amount held in Berne, this would imply nearly 1,200 tonnes of Italian gold at the Federal Reserve in New York.

There were at least 543 tonnes of Italian gold at the Federal Reserve in New York in the mid-1970s, since this was the quantity of Italian gold collateral that the Bundesbank held at the New York Fed during its first gold loan to Italy between 1974 and 1976 (see discussion below of the 1970s West Germany – Italy gold loan). If the quantities in London and Berne are as low as they appear to be, this 543 tonnes used as collateral might not have even been half the gold that Italy has custodied with the Federal Reserve Bank of New York.

A gold vault in Milan

It’s notable that the Banca d’Italia has used a vault in the city of Milan to store gold as recently as the late 1960s, although there is no mention of a Milan vault in the Banca d’Italia’s 2014 gold document. This would either imply that the gold stored in Milan in the 1960s was transported to Rome at a later date, or else that the Rome statistics may represent combined holdings stored in Rome and Milan, and are just rolled up to Rome for reporting purposes, since Rome is the head office of the Banca d’Italia. The Banca d’Italia’s Milan vault did feature as a key part of Italian gold movements during World War 2 (see below).

Historical Italian Gold

Like other central banks, the Banca d’Italia states that it uses 4 storage locations partly due to historical reasons and partly based on a deliberate strategy gold storage diversification strategy.

Although the Banca d’Italia held 498 tonnes of gold in 1925, Italian gold reserves fell to 420 tonnes in 1930, and continued to decline throughout the 1930s, falling to 240 tonnes in 1935, before another sharp fall to 122 tonnes in 1940 at the beginning of World War 2. With both Rome and Northern Italy under German occupation in 1943, the German occupiers pressurised the Banca d’Italia’s governor Azzolini to move the Italian gold north. Ultimately this led to 119 tonnes of Italian gold being transported by train from Rome to the Banca d’Italia’s vaults in Milan. But the transfer to Milan turned out to be just an interim stopover since the Germans continued to pile on pressure to move the Italian gold to Berlin.

The fascist government that controlled Northern Italy at that time initially resisted the German plan, but negotiated a compromise and agreed to move 92.3 tonnes of gold to a castle in Fortezza, in the far north of Italy near the Austrian border, close to the Brenner Pass and likewise very close (via Austria) to the German border.

Eventually the fascist government capitulated fully to the German demands and 49.6 tonnes of Italian was moved from Fortezza to the Reichsbank vaults in Berlin, followed by an additional transfer of 21.7 tonnes, so in total 71.3 tonnes of Italian gold ended up in the Reichsbank in Berlin. See here for graphic showing these wartime movements of Italian gold, and a comprehensive discussion (in Italian).

In the 1930s, the Bank for International Settlements Bank had invested substantially in Italian short-term treasury bills, which had a built-in gold conversion guarantee. Likewise, the Swiss National Bank held or was the representative for claims on some of the Italian gold. With the German pressure on the Italian gold in 1943, the BIS and SNB both became anxious about their investments and requested that their Italian gold-related be fully converted into gold with a view to moving the converted gold to the SNB vaults in Berne, Switzerland.

The Gold Trains to Berne

After intense negotiations, which the Banca d’Italia also supported (since it would allow some of the Italian gold to go to Switzerland and so avoid Berlin), the SNB and BIS succeeded in releasing the gold transfers, and over 72 years ago on 20th April 1944, 23.4 tonnes of Italian gold was sent by train from Como in Italy to Chiasso in Switzerland and then onwards by another train to Berne.

This required four railcars, two with 89 crates of gold weighing 12,605 kgs for the BIS (1,068 bars in total), and two other railcars of gold bars for the SNB which probably contained 9-10 tonnes – since this was the balance of Italian gold which did not go to Berlin or to the BIS but which had been moved to Fortezza from Milan.

A few days later on 25th April 1944, the Banca’Italia also executed an additional intra-account transfer in the Berne vault to the benefit of the BIS. This was part of a location swap with the BIS. To quote the official BIS historical narrative:

“On 25th April 1944, the Bank of Italy transferred an additional 3,190 kgs of fine gold from its own gold account with the Swiss National Bank in Berne to the BIS gold account there.” (Central Bank Cooperation at the Bank for International Settlements, 1930-1973, Gianni Toniolo, BIS).

The actual transfer comprised 244 gold bars containing 2,966 kgs. An additional 233 kgs was debited from the Banca d’Italia sight account with the BIS, which suggests that the Italians only had 2,966 kgs in physical gold stored in Berne with the balance having to come from their sight deposit with the BIS (i.e. unallocated storage). (See “Note on gold shipments and gold exchanges organised by the Bank for International Settlements, 1st June 1938 – 31st May 1945.”

The above suggests that the Banca d’Italia had no gold in Berne at the end of WWII. In fact, after WWII ended in 1945, the Italians essentially had very little gold anywhere except for small amounts that were left in Fortezza and found by the Allies, which was then returned to the Italians. Italy started buying gold again in 1946 with a 1.8 tonne purchase from the Banque de France. The Italians also began receiving gold back as reparations from the Tripartite Commission for the Restoration of Monetary Gold (TGC), getting 31.7 tonnes a few years after WWII ended, and another 12.7 tonnes in 1958. Since 71.4 tonnes had been taken by the Germans to Berlin, the Italians ended up with a net loss of about 27 tonnes due to theft and/or other war losses.

Some of these post-WWII gold reparations contained the Nazi Prussian Mint bars which are now stored in the Banca d’Italia’s Rome vaults. The initial gold bar reparations for Italy in the late 1940s came from the TGC account set up at the Bank of England. Records from the Clinton Library show that Italy received 575 Prussian bars set-aside from the TCG account in its early allocations. Prussian bars also made it to the Federal Reserve in New York. The same records show that were over 2,500 Prussian Mint bars held under earmark at the FRBNY for various customers as of January 1956 including the BIS, IMF, SNB, Bank of England, Netherlands and Canada among others. Some of these bars were later remelted into US Assay Office bars. (The Gold Report, Presidential Advisory Commission on Holocaust Assets in the United States, July 2000, Clinton Library).

In a similar way to other major European central banks, the Banca d’Italia’s gold reserves were mainly built up during the late 1950s and early 1960s. Although the Banca d’Italia was a relatively important official gold holder during the first half of the 20th century, it ‘only’ held 402 tonnes of gold as of 1957. But starting in 1958 and running through to the late 1960s, Italy’s gold reserves rose by nearly 600% to exceed 2,560 tonnes in 1970. See page 19 of “Central Bank Gold Reserves, An Historical perspective since 1845, by Timothy Green, Research Study No. 23, published by World Gold Council, for data on Italian gold reserve totals during the 1950s and 1960s.

Since 1970, Italy’s gold holdings have remained fairly constant, although at times some of the Italian gold has been used in various financial transactions such as:

- gold collateral against a loan from Germany during the 1970s

- contributions to the European Monetary Cooperation Fund (EMCF)

- contributions to the European Central Bank (ECB)

The gold collateral transactions with Germany and the EMCF and ECB contributions explain why, in the absence of purchases or sales, Italy’s historic gold holdings statistics appear to fluctuate widely at various times since the mid-1970s.

l’Ufficio Italiano dei Cambi (UIC)

Until the 1960s, most, if not all of Italy’s official gold reserves were held not by the Banca d’Italia, but by an associated entity called l’Ufficio Italiano dei Cambi (UIC). In English, UIC translates as the “Italian Foreign Exchange Office”. The UIC was created in 1945. One of its tasks was the management of Italy’s foreign exchange reserves (also including gold).

Therefore the Italian gold purchases in the 1950s and 1960s were conducted for the account of the UIC, not the Banca d’Italia. However, during the 1960s there were two huge transfers of gold from the UIC to the Banca d’Italia, one transfer in 1960 and the second in 1965. In total, these two transactions represented a transfer of 1,889 tonnes from the UIC to the Banca d’Italia. The UIC’s main function then became the management of the national currency and not the nation’s gold. The UIC ceased to exist in January 2008 when all of its tasks and powers were transferred to the Banca d’Italia.

Gold Collateral for the Bundesbank – 1970s

In 1974, Italy required international financial aid to overcome an economic and currency crisis and ended up negotiating financial help from the Deutsche Bundesbank. This took the form of a dollar-gold collateral transaction, with the Bundesbank providing a US$ 2 billion loan secured on Italian gold collateral of equivalent value. On 5th September 1974, Karl Klasen, President of the Bundesbank, sent the specifics of the collateral agreement to Guido Carli, Governor of the Banca ‘dItalia. The details of the transaction were as follows:

US$ 2 billion was transferred from the Bundesbank to the Banca d’Italia for value date 5th September. Simultaneously, for value date 5th September, the Banca d’Italia earmarked 16,778,523.49 ounces of gold (about 522 tonnes) from its gold holdings stored at the Federal Reserve Bank in New York into the name of the Bundesbank, and received a gold claim against the Bundesbank for the same amount. (2A96 Deutsche Bundesbank Files, 1974, Bank of England Archives).

The gold collateral was valued at $149 per ounce based on a formula of 80% of the average London gold fixing price during July and August 1974. The loan was for a six month maturity but could be rolled over up to three times, i.e. up to two years in total. It turns out that the loan was rolled over up to the maximum two years allowed. Not only that, but the entire gold-backed dollar loan was renewed in September 1976 with larger gold collateral of 17.5 million ounces or about 543 tonnes. This gold loan renewal in 1976 was underwritten by the UIC, and the 543 tonnes of gold was transferred from the Banca’Italia to the UIC prior to the loan renewal. Note that Paolo Baffi had become Governor of the Banca d’Italia in 1975, taking over from Guido Carli.

In September 1978, at the 2 year maturity date of the renewal, the 543 tonnes of gold was returned to the ownership of the Italians but instead of being transferred to the Banca d’Italia, the 543 tonnes was transferred to the balance sheet of the UIC, since the UIC had been involved in underwriting the entire loan agreement. This 543 tonnes of gold stayed on the UIC books and was revalued over the years, thereby creating a large capital gain for the UIC.

Gold capital gain Controversy – 1997/98

When the gold held by the UIC was sold to the Banca d’Italia in 1997, the UIC realised a capital gain of 7.6 billion Lira which then became taxable. The UIC then owed the Italian Exchequer 4 billion Lira, 3.4 billion Lira of which was transferred to the Italian State in November 1997. At the time in 1997, Italy was preparing for entry to the Euro, and needed to keep its deficit under the 3% ceiling required by the Maastricht Treaty criteria. Eurostat ruled that this windfall transfer to the Italian Exchequer was not allowed to be offset against the government deficit. See here for January 1998 statement from Eurostat.

However, a European Parliament parliamentary set of question in March 1998 to the European Council seems to suggests that the UIC tax payment to the Italian Exchequer was offset against Italy’s public sector deficit, and that it helped to keep the Italian deficit under the critical 3% Masstrict ceiling, thereby helping Italy to qualify for Euro membership. The parliamentary questions were from Italian politician Umberto Bossi:

“Does the Council intend to finally ascertain the nature of this transaction?

Does the Council intend to establish whether it is permissible to encourage tax revenues of this kind to be offset against the public sector deficit?

If not, does the Council not consider that this incident shows yet again that Italy has not changed its ways and is prepared to stoop to dubious accounting practices in order to enter Europe?"

The answer to this parliamentary question in June 1998 seems vague, but did not deny that the tax windfall generated by the capital gain on the 543 tonnes of gold may have helped improve the Italian fiscal condition in the run-up to Euro qualification and entry.

EMCF and EURO

As referenced above, Italian gold has been contributed to various European monetary experiments since the 1970s. This explains why the yearly official total figures of Italian gold fluctuate widely over the 1970s-1990s period, and indeed have also fluctuated since 1999.

In 1979, Italy’s gold reserves dropped by 20% and stayed that way until 1998 when they increased again to the previous 1979 level. This was due to Italy contributing to the European Monetary Cooperation Fund (EMCF) which was a fund within the European Exchange Rate Mechanism (ERM) of the European Monetary System (EMS). In exchange for providing 20% of their gold and dollar reserves to the EMCF, member countries received claims denominated in European Currency Units (ECUs). [The ECU was an abstract precursor to the Euro]. The gold that was transferred to the EMCF was accounted for as gold swaps, but there was no physical movement of gold, it was just a book entry to represent a change in ownership to the EMCF.

In 1999, with the advent of the Euro (initially as a virtual currency), central bank members of the Eurozone had to again transfer gold, this time to the European Central Bank (ECB). The ECB stipulated that each member had to transfer foreign reserves assets, and 15% of these transfers had to be in the form of gold. In Italy’s case it transferred 141 tonnes of gold to the ECB, so Italy’s gold reserves fell by this amount.

The gold owned by the ECB is not centrally stored and managed by the ECB. It stays wherever it was when transferred by each member country, and the ECB delegates the management of its gold reserves to each member central bank, so essentially, it’s just another accounting transaction. It’s unclear whether the ECB gold managed by the Banca d’Italia on behalf of the ECB is “managed” any differently to the non-ECB gold (i.e. its unclear whether the same investment policy always applies to both gold holdings). One person who would certainly know the answer to that questions is Mario Draghi, current president of the ECB, former governor of the Banca d’Italia, and also born in Rome, home of the Palazzo Koch gold vault.

Is any Italian Gold pledged or leased out?

Banca d’Italia annual reports follow International Monetary Fund reporting conventions and classify the gold in its balance sheet as ‘gold and gold receivables‘. In September 2011, when I asked the Banca d’Italia to clarify what percentage of the asset category ‘gold and gold receivables’ in its 2010 balance sheet referred to gold held, and what percentage represented gold receivables, the Bank’s press office replied succinctly that “it’s only gold, no receivables.”

Following the publication of the Bank’s three page gold document in April 2014, I asked the Banca d’Italia press office a number of questions (see above), one of which was about gold leasing:

“Are any of the Bank’s gold reserves subject to lease agreements, and if so, what percentage of the gold is leased out? Is any of the Bank’s gold swapped or pledged in any other way?“

As mentioned above, the Banca d’Italia’s response was:

Gold Audits

The Banca d’Italia states in its 3 page gold document that external auditors verify the gold held in Rome each year in conjunction with the Bank’s own internal auditors. For the gold held abroad, the external auditors are said to audit this using annual certificates issued by the central banks that act as the depositories (the depositories being the Federal Reserve Bank of New York, the Bank of England, and either the BIS or perhaps the SNB depending on the type of certificate that is issued for BIS deposits).

This approach is analogous to the methodology used to audit the German gold reserves stored abroad, i.e. there is no independent physical audit of the gold stored abroad by the Bundesbank. The paper-pushing auditors merely audit pieces of paper.

As regards the Banca d’Italia’s gold holdings at the Bank for International Settlements (BIS), these holdings could either be in the form of a “Gold Sight Account" or a “Gold Ear-Marked Account", as explained here by the Bank of Japan in 2000 when it switched its gold holdings at the BIS from a gold sight account to a gold earmarked account:

“The Bank of Japan has recently transferred its claims against the Bank for International Settlements (BIS) embodied in a “Gold Sight Account" to a “Gold Ear-marked Account" with the BIS." (July 2000)

If the Banca d’Italia’s gold holdings at the BIS are just in a sight account, then this is just a claim on a balance of gold, not a holding of specific gold bars.

It’s also surprising to me that the mainstream media have taken a significant, albeit superficial, interest in the Bundesbank’s ongoing exercise to repatriate 300 tonnes of its gold reserves from New York to Frankfurt, but zero interest in the fact that the Banca d’Italia supposedly has a huge amount of gold stored in New York that has never physically audited it and does not even see a need to repatriate it.

Banca d’Italia office in Manhattan

Like the Bundesbank, the Banca d’Italia also maintains a representative office in New York, at 800 Third Avenue – 26th Floor, New York – NY 10022 (see representative office contact details here). The head of this representative office is Giovanni D’Intignano (see LinkedIn). Therefore, it should be very easy for the Banca d’Italia to ask the Federal Reserve Bank of New York to conduct an on-site physical gold audit of the Italian gold at the vaults of the New York Fed, all 1000 plus tonnes of it.

In fact, the Banca d’Italia also maintains another of its only 3 representative offices abroad in London at 2 Royal Exchange, London EC3V 3DG, which is right across the road from the Bank of England’s headquarters and gold vaults. It should therefore also be a simple matter for the Banca d’Italia to also organise a physical on-site audit of its gold reserves stored at the Bank of England in London, something the Bank of England has been allowing its gold storage customers to do since 2013.

Political Awakening

There has been a developing political trend recently in Italy for more transparency on the Italian gold and also calls for its ownership and title to be protected against control by outside entities.

In January 2012, Italian politican Rampelli Fabio (co-signed by Marco Marsilio) submitted some written questions to the Italian Ministry of Economy and Finance, a department headed at the time by Mario Monti (Monti was also simultaneously Italian Prime Minister at that time), asking the following questions about the Italian gold (questions 4-14567 : Italian version and English version):

“When and under what agreement or statutory provision were the storage location decisions (regarding New York, London and BIS Switzerland) taken and whether that strategic decision is still considered to serve the interests of Italy?

Who owns the gold reserves held at Palazzo Koch (in Rome) and the gold reserves held at the foreign locations?

Does Italy have full availability to the gold reserves held at the Bank of Italy and at the foreign locations?"

Even though these questions were submitted nearly 5 years ago, the official status of the questions on the parliamentary website still says “In Progress", suggesting that they have not been answered by the Ministry of Finance. I can find no other evidence elsewhere either that these questions were ever answered.

Senators visit Palazzo Koch vault

Three Italian senators of the political party Movimento Cinque Stelle visited the Banca d’Italia gold vaults in Rome on 31 March 2014 and are calling for the ownership of the gold to be transferred from the Banca d’Italia to the Italian public so that its control cannot be compromised. See video below of their before and after visit which was broadcast from outside the Palazzo Koch vault in Rome.

These 3 representative (in the above video) are Senator Giuseppe Vacciano, Senator Andrea Cioffi and Senator Francesco Molinari. I do not have a direct English translation of this video, however, anyone interested can translate this page from Italian, which was published on 3 April 2014, and features Senator Vacciano explaining the senators’ vault visit.

In his report, Vacciano confirm some interesting facts, such as that the Italian gold belongs to the Banca d’Italia and not the Italian State. The ownership issue is also confirmed by the Banca d’Italia’s 3 page gold report (see above) which states:

“La proprietà delle riserve ufficiali è assegnata per legge alla Banca d’Italia” – (Ownership of official reserves is assigned by law to the Bank of Italy)

Unusually for a central bank, Banca d’Italia’s share capital is held by a diverse range of Italian banks and other financial institutions as well as by the Italian state

Vaccciano also confirmed that in the vault they saw some South African gold bars, many American gold bars, and “several bearing the Nazi eagle". And in a similar way to the RAI reporter Alberto Angela, who said in 2010 that he was speechless when viewing the gold in the sacristy, Vacciano says:

“from a purely human perspective, we could see with our own eyes a quantity of precious metal that goes beyond an ordinary perception … I must say that arouses feelings that are difficult to explain“.

Italian Citizens

The Italian business community and public appear to be quite aware of the importance of the country’s gold reserves. In May 2013, the World Gold Council conducted a survey of Italian business leaders and citizens which included various questions about the Italian gold reserves. The findings showed that 92% of business leaders and 85% of citizens thought that the Italian gold reserves should play an important role in Italy’s economic recovery. There was very little appetite to sell any of the gold reserves, with only 4% of both citizens and business leaders being in favour of any gold sales. Finally, 61% of the business leaders and 52% of the citizens questioned were in favour of utilising the gold reserves in some way without selling any of them. The World Gold Council interpreted this sentiment as allowing the possibility for a future Italian gold-backed bond to be issued with Italian gold as collateral. The Italian gold could thus play a role similar to that used to collateralise the international loans from West Germany to Italy in the 1970s.

Mario Draghi – Last Word

For now, the last word on the Italian goes to Draghi. Even Mario Draghi, former governor of the Banca d’Italia, and current president of the European Central Bank, has a similar view to the Italian public about not selling the Italian gold. In the video below of a 2013 answer to a question from Sprott’s Tekoa Da Silva, Draghi says that he never thought it wise to sell Italy’s gold since it acts as a ‘reserve of safety’. However, as would be expected from a smoke-and-mirrors central banker, Draghi doesn’t reveal very much beyond generalities, and certainly no details of storage locations or whether the Italian gold comprises gold receivables as well as unencumbered gold.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

China’s Golden Gateway: How the SGE’s Hong Kong Vault will shake up global gold markets

Ronan Manly

Ronan Manly 0 Comments

0 Comments