The Money Printer of the Universe

One of the issues with today's monetary system is that it is heavily politicized. The money originates from the state and the state governs the money system thru the central bank. In the USA, for instance, the central bank is known as the Federal Reserve. They create money thru a process known as Fractional Reserve Banking.

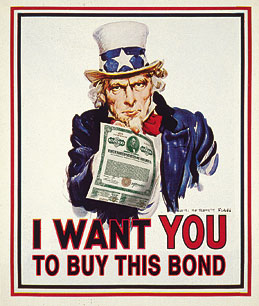

Bond auctions

The actual process thru which money is created in the Federal Reserve System starts with congress requesting additional funds for some government program. And yes, the US government needs a lot of money to run! The federal debt level has reached record levels the latest years and shows no sign of slowing down. As of now, the US national debt is closing in on 17 trillion dollars. That's the number 17 with 12 zeros after. That's 53,000 dollars per US citizen! A lot of money.

The request that congress makes for more money is passed over to the US Treasury who then prints up a stack of bonds with a certain face value. The face value is the amount that the bond will be sold for. The bond also caries a stated rate of interest that it will pay to its holder. Treasury bonds are sold in auctions

New money is created when the Federal Reserve buys a treasury bond from a bank. But where did the money that the Federal Reserve used to buy the bond with really come from? The simple answer is: "Out of thin air".

That's right, the Federal Reserve doesn't need to have any funds covering the check as there is no account from where the check is drawn.

When central banks write checks they create new money.

Making money on seigniorage

Except for treasury auctions there is something called seigniorage. It's hard to spell, hard to pronounce and it is also hard to explain. But putting it simply, it basically means that when the government prints a new dollar bill it makes a hefty profit. The profit comes from the fact that a hundred dollar bill doesn't cost a hundred dollars to produce. Let's say that it costs 10 cents to produce. This means that the government makes a profit of a $99 and 90 cents.

The government's cost to produce money is simply very small in comparison to what the money is worth on the market. The money that the Treasury and the Federal Reserve creates, thru the various means described above, is then used as the basis of issuing "loans".

But why are the money worth anything if the cost of producing them are close to zero? Here's where the term "fiat" comes in to play.

Make it so!

A state can proclaim something to have value thru a so called "government fiat" or "government decree". When a government issues a fiat, or a decree, it

So the only reason this fiat money has any value is because of the government's decree, and the law that says we have to pay taxes using this money. This creates the demand for it.

The banks credit money

Except for the money that is created directly by the state, there is also the banks credit money. This is the money that banks create by simply making entries in their ledger. When someone asks for a loan, the bank will check whether or not the person has good credit worthiness and If the bank finds the person trustworthy enough, the loan will be granted. Not uncommonly something is also placed as collateral for the loan, like for example a house. If you can't make the monthly mortgage and interest payments, the bank may seize whatever you have pledged as collateral.

Many people think that banks lend out the money that the state has created and that they can only lend money that they actually have, i.e. the money that someone else has deposited. But modern models of banking show that banks actually do not need to wait for deposits to start making loans. If the banks have faith in their borrowers, and in the economy at large, they can issue loans and then wait for the deposits to arrive at a later date. The only thing they need to have is a little bit of the government created money to meet their reserve ratio.

Exponential money out of thin air

So we are living in an exponential money system where some entities have the legal charter to print money at will, while others have to work to obtain money. Not only is this obviously flawed, It also extremely unfair because it leaves entities like governments and banks with an enormous power to tax and confiscate the value of other peoples labor.

You have to ask yourself the following question: When money is printed out of thin air, where does the newly printed money get it's value from? The answer is that the newly printed money gets its value from the money that is already in existence. The economy has adapted its price levels to the amount of money circulating. When new money is created out of thin air, the existing money supply is diluted. The new money starts to bid up the prices of goods and services, and the prices rise until they account for all the newly printed money. This also means that early receivers of the new money, such as governments and banks, get a discount. Since they are the first to spend the money, the prices hasn't been bid up yet. But when the money reaches the low or fixed income wage workers, retirees, and so one, the prices has been bid up to higher levels than they where before, constantly reducing their purchasing power. This is a way of

The system of today constantly creates new money thru governments request for additional funding, and thru the issuing of fiat bank credit, also known as "loans". This means that we will have continuous inflation with a constant bid up of prices.

When gold and silver were used as money there were no printing presses that the government could use to print money. People did try to "print" gold. It's called alchemy. Alchemy was an ancient philosophical tradition in which its practitioners sought to have a number of powers, amongst them the ability to turn base metals in to precious metals such as gold and silver. They failed. Gold and silver is namely very hard to produce, since it requires huge amounts of energy.

More rare than a supernova explosion

So how did nature "print" its own currency, gold and silver? Well, it is said, to quote the late astronomer Carl Sagan, that we are all made out of star stuff.

Scientist have long theorized that all the elements of the periodic table, including gold, were originally formed in exploding supernovas. But an astronomical observation in June this year has shown evidence indicating that elements such as gold might be formed during an event that is even more rare than exploding supernovas, namely the collision of neutron stars. Neutron stars are collapsed cores of stars stemming from a supernova explosion. Most neutron stars wander thru the vastness of space alone, but some pair up and orbit each other. They may do so for a billion years, but sooner or later they will attract each other until they collide and merge. The collision brings together so much mass that it collapses on itself, creating a black hole. When the collision takes place, some matter is thrown outwards. It is in this we find the heavy elements like gold, mercury, lead, platinum and even uranium.

Rare galactic event

Even at a galactic level, the collision of neutron stars is no routine matter. The Milky Way alone contains hundreds of billions of stars. But in spite of its vastness, the cataclysmic event of a neutron star collision only happens every 100,000 years.

The elements formed in colliding neutron stars and exploding supernovas are the building blocks that created our earth millions of years ago.

A few thousand years ago, human beings started to use the gold created in these stellar explosions as money. This use came about when people bartered different goods on the market. Soon, some goods became overwhelmingly more sought after than others. These goods were not consumed, like grain or rice. Instead, they circulated as a medium of exchange. In the beginning many things were used, such as stones, nautilus shells, feathers and so on. But after a while gold and silver came to be the most widely used money in history. Gold and silver could be divided in to small pieces, they did not corrode or rust and they could not be printed out of thin air. As mentioned earlier, people did try to "print" gold thru the process of alchemy and failed.

Keep your wealth where it belongs - in your hands!

In which kind of money would you like to store your wealth? In the fiat money created by debt ridden governments, or in the kind of money that humans have used to trade and save in for thousands of years?

Gold can not be created thru the arbitrary whim of a politician or thru an edict of the state. It can only form thru extremely energy dense processes in our universe. This is why politicians hate it. With gold as money, they can't devalue our savings and confiscate our wealth thru the printing of money.

The reason that politicians hate gold and silver is the same reason why you should love it. Gold and silver preserves wealth in the hands of the ones who create the wealth and not the ones confiscating it thru taxation.