Recent innovations in buying gold

What does ‘innovation’ entail?

When recent ‘innovations’ in investing in gold are mentioned, most people would think of exchange-traded funds (ETFs), or mutual funds where gold futures are traded, and the like. Indeed, these weren’t options for smaller investors just a decade ago, and the growth of these funds over the years has been significant. However, the fact that these funds use the same flawed system, of counting more gold than the gold actually held, makes it risky, just as wildly profitable Ponzi schemes are all the more unsustainable.

The point of investing in precious metals is to move away from such a model of debt-based trading. ETFs and futures rely on heavy margin trading. Margin trading involves an investor buying more shares than he has in his brokerage fund, as though this amount was lent by the broker. Although large gains are hoped for, there is also the potential for much larger losses when prices shift downwards of when redemptions go beyond the available supply of physical assets.

Making physical gold more accessible

By ‘innovations,’ we are looking rather to processes that make the still very physical precious metals more accessible to the regular investor.

One such innovation is the use of the internet in facilitating trade. Online trading has mushroomed since the mid-1990s, as companies were quick to use cyberspace upon its advent. And with the international financial situation in its current mess since 2008, the popularity of sites have increased severalfold.

Online, one could now trade gold in whole items, that is, specific bars or coins, or by counted units with gold stored in a vault. The ownership of certain grams in a single bar is divided among investors who place their orders online. This provides the lowest premiums and maximal ease in buying and selling.

ATMs

Automated teller machines that contain gold came on the scene in 2010, in Dubai, the United Arab Emirates. It remains a commercially viable means of procuring gold. Although premiums are high, this is expected, as one also pays for the convenience in acquiring one’s gold.

Now, gold ATMs are available elsewhere, such as in the US and Germany.

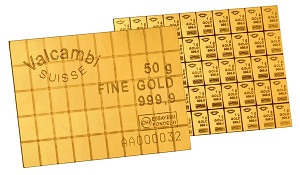

Combibars

Looking to the future

In all this, the value of gold doesn’t change, only the forms in which buying is facilitated. We can expect more innovations like these in the future.

This is not a matter of improvements in technology. After all, such technologies for online gold trading, ATMs or Combibars have been around for some time. Rather, it is a matter of entrepreneurial discoveries as to what technologies best work in providing people with an asset whose popularity is growing.