Buy Signal on Gold

Crisis? What crisis? One could be forgiven for thinking that the plunge in gold price during the second quarter of 2013 spelt the end of one of the longest bull-runs for the world’s gold markets. But apparently this was not the really the case, at least not for physical gold. According to the May 2013 press release from World Gold Council (WGC), demand for bullion and jewellery, which makes up of 72 % of global gold demand, has seen a surge following the mid-April price fall. This has left many retailers in China and India running out of stock and refineries having to introduce waiting lists for buyers. On the other hand, gold-backed ETF:s have seen outflows of 350 tonnes out of a total of 2700 tonnes held, from January to end of April.

The divergence in behaviour reflects the dichotomous nature of investment in gold, with consumers who prefer bullion and jewellery behaving very differently from investors of paper gold. This phenomenon indicates that even if there is an outflow of investments from the paper gold market, there will be always be a ready market among Indian and Chinese savers and consumers. This is because the global appetite for gold is driven by Asian consumers, who remained confident in the long term prospects for gold. Indeed the profile of a physical gold investor differs from a paper gold investor. The former usually views gold as a safe long term investment for hedging against systemic bank failures and for decreasing portfolio performance volatility. The latter consists of investors who dabble in paper gold and are usually traders or speculators holding short term investment horizons with a view to trade gold for quick returns.

Beginners who are new to the gold investment scene should avoid paper gold products, which include options, futures contracts and ETF shares. This is because investing in these financial instruments requires a certain level of understanding of the gold industry and the possible pitfalls. Paper gold products are supposedly backed by physical gold and derive their value from the underlying asset. Investors need to know that buying these products does not entitle them to the underlying asset and one does not directly own the underlying asset. With paper gold one can leverage substantially and increase investment gains. However, the risk also increases if the price goes against the investor.

Physical gold allows the saver/investor to diversify their portfolio risks and preserve wealth. The precious metal has traditionally been used as a form of currency for thousands of years and therefore its status as the universal currency should not be questioned. Gold bullion should not be considered as investment per se, but rather as a form of saving or insurance that serve to preserve one’s wealth. It should be stored for a rainy day and not for trading purposes. After all, do you treat the home you live in as a form of investment? Do you trade your insurance policies? Likewise, gold should be viewed as a form of wealth to be passed down from generation to generation. Ideally, investors should build up their holding of physical gold over lifetime.

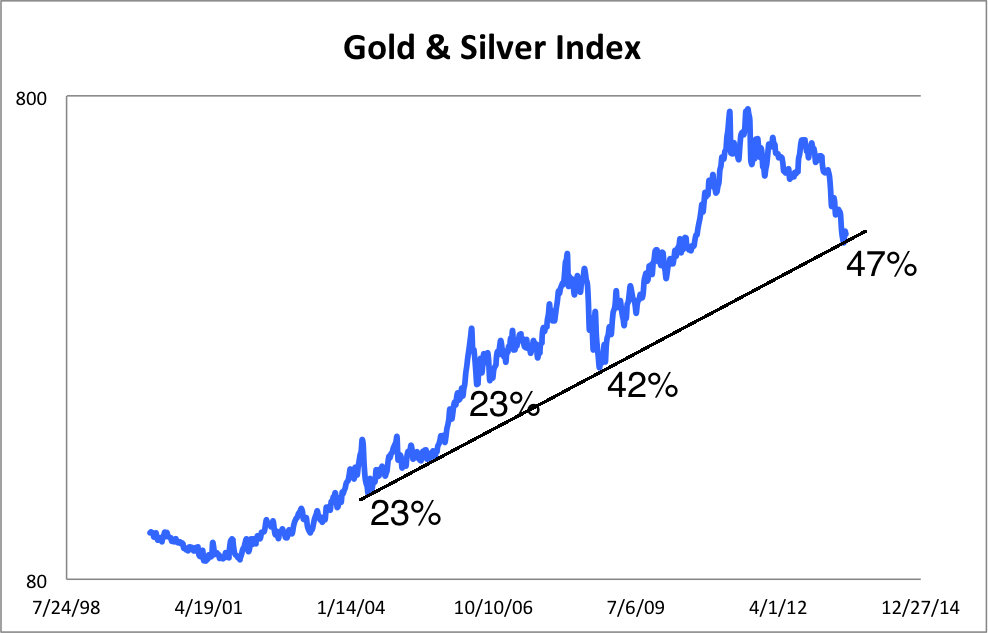

Gold and silver prices recently broke out from their previous downwards trading channel. The price correction for gold and silver may thus be over for good. Even though physical demand for both gold and silver has been increasing steadily globally during the last months, the price has been decreasing. With the paper markets setting the price for physical gold and silver, shortages have appeared. This may thus represent a market turning point and provides the cue for contrarian buying. Always remember, contrarian thinking is easy, but successful contrarian investing is difficult. Most amateur contrarians overlook the fact that the crowd is right most of the time thus the expression "contrarian". It is only at market turning points the crowd is wrong and contrarians are right.

Source: Jordan Roy-Byrne, CMT, Jordan@TheDailyGold.com

To conclude, gold is a placement suitable for everyone but it is important that one hold on to a sober investment philosophy. Not knowing the differences between physical gold and paper gold can be risky and may lead to potential investment losses for small players. As the saying goes, when it comes to gold, “if you don’t hold it, you don’t own it”. There are too many Ponzi scams based on paper gold schemes. Always go for physical gold.