The Workings Of The Shanghai International Gold Exchange, Part One

“This event is a major milestone in China’s opening of its financial market to foreign investors. The Shanghai International Gold Exchange will bolster China’s gold market toward greater trading volume and further highlight the price discovery function of the gold market”, Zhou Xiaochuan, governor of the People’s Bank Of China, at the opening ceremony of the Shanghai International Gold Exchange September 18, 2014.

The one with the biggest smile, just left of the center, is PBOC governor Zhou.

An Introduction To The Shanghai International Gold Exchange

As most of you have probably noticed last week the Shanghai Gold Exchange (SGE) launched it’s subsidiary the Shanghai International Gold Exchange (SGEI) located in the Shanghai Free Trade Zone. Much has been written in recent days about the SGEI, but how does the new gold exchange actually operate? How can you and I participate in the Chinese gold market and how does this affect the global gold market? Well, you and I can trade physical gold in renminbi through an exchange in China from now on, how this will affect price discovery (of gold) we'll see in the coming months and years.

I’ve written many posts on the structure of the Chinese domestic gold market, with the SGE at its core, and how gold trade between China mainland and foreign countries is regulated. Has all this suddenly changed now the Chinese gold market is fully opened to the rest of the world? No, the structure of the Chinese domestic gold market and Chinese gold trade policy has not been altered. The SGE and SGEI are technically separate exchanges. This is because a Free Trade Zone (FTZ) in terms of trade is a separate country from China mainland. FTZ's enjoy different trade rules; one can not freely import goods from a FTZ into the mainland. Hence, gold imported into a FTZ is not imported into China's domestic gold market. However, there is a fashion conceived that links the Chinese with the international gold market.

The launch of the SGEI is a very important step in China’s process of liberalization, opening up, going out and internationalizing the renminbi to bolster economic strength and become a dominant player on the world stage of geo-politics. Developments in the Chinese economy are rapidly accelerating and in their gold market it’s no different.

Prior to the launch of the SGEI, which is also referred to as the International Board (IB), no less than 16 English rulebooks were released on the website of the SGE on September 16, 2014. Because the structure of the Main Board (MB) had already been documented in Chinese, I think these existing documents have been translated in English and supplemented by new rulebooks on the principles of the IB - and will additionally be supplemented if the IB or MB develop. This would explain the large amount of rulebooks. A welcome incidental of the SGE English rulebooks is that it provides nomenclature on everything related to the SGE and the SGEI, or the Exchange. In the past there has been much confusion on terms like physical delivery on the SGE in the gold space, these misconceptions will hopefully be a thing of the past. From now on I will use the exact same nomenclature used in the rulebooks of the Exchange with regard to the Chinese gold market.

In this post I will expand on the most important changes that took place on September 18 as clearly as I can, perhaps at first it may seem a bit confusing, in the end it will all make sense. Note, all my analyzes of the Exchange are by definition simplified.

New Physical Gold Products Offered To International Investors By The IB

The International Board has launched three new physical products international customers can buy and sell:

- iAu100g physical product 100 gram gold bar fineness 999.9

- iAu99.99 physical product 1 kg gold ingot fineness 999.9

- iAu99.5 physical product 12.5 kg gold ingot fineness 995.0

According to the rulebooks of the Exchange gold bars weigh 0.05 kg, 0.1 kg and gold ingots 1 kg, 3 kg, 12.5 kg.

Before we can go into detail on physical products and how international investors can trade these, we must first learn a bit more about the trading structure on the Exchange.

When you become a customer of the Exchange you will receive a trading code that is connected to your identity (or company) until infinity, no matter if you switch broker twice a week this code will stick with you until death does you part (article 17). Subsequently, you will be attributed two accounts:

- The first is your Bullion Account; each customer’s physical deliveries, load-in and load-out amounts shall be recorded in its Bullion Account. Note, physical deliveries are not withdrawals from the vaults. As we can read from Article 85 of the Spot Trading Rules of the Shanghai Gold Exchange:

Article 85

The term “Physical Delivery” refers to the act of transferring the ownership of the precious metals traded by the Exchange for the performance of the terms of a trade.

In physical delivery the Exchange transfers precious metals from one Bullion Account to another.

- The second account is your Margin Account. Article 28 of Detailed Clearing Rules of the Shanghai Gold Exchange states:

Article 28

Funds in a Margin Account are composed of Trading Margin and Clearing Deposit. The Trading Margin recorded in the Exchange’s system is the margin that is tied to current day’s trades and the Clearing Deposit is the sum of all other funds on the margin account that is not part of the Trading Margin.

The most basic way of trading bullion on the Exchange is through physical products (which do not enjoy leverage or fractional backing): After submitting a buying order of the respective product you wish to purchase on the Exchange, your order has to be matched with a seller's order before a deal can be closed. When a deal is closed physical products are settled the same day. The amount of RMB in full is transferred from your Margin Account to the seller’s Margin Account and the corresponding amount of bullion is transferred from the seller’s Bullion Account to your Bullion Account. You would now be the owner of physical gold (located in an SGE(I) Certified Vault) and are free to process your bullion to your discretion. From the Spot Trading Rules of the Shanghai Gold Exchange:

Article 46

To trade in a physical product, a buyer must possess funds of an amount equaling the total transaction value of the product when placing the order; and a seller must have the corresponding full amount of physical bullions in its trading account when placing an order. After an order is placed, the funds or physical bullions covered by the order will be frozen immediately.

After an order on physical gold product is filled, the buyer may re-sell the purchased gold on or after the current trading day, or may request to withdraw the gold.

From the Detailed Rules for Physical Delivery of the Shanghai Gold Exchange:

Article 18

A member or customer trading in a physical gold or platinum product may request to withdraw the gold or platinum bullions as soon as the trade is executed.

Settlement on the same day a deal is closed is referred to as (T+0) settlement.

Be aware of the fact that when bullion is withdrawn from a MB or IB Certified Vaults it's not allowed to re-enter these vaults before it is melted and re-assayed again. From the Detailed Rules for Physical Delivery of the Shanghai Gold Exchange:

Article 23

Any gold bullion withdrawn by a member or customer shall not be loaded into any Certified Vault in the future.

Gold Products Offered To International Investors By The MB

Next to the three new physical products offered by the International Board, the Main Board offers 8 of its existing products to international customers, divided in two types; 4 physical products and 4 deferred products.

- Au100g physical product 100 gram gold bar fineness 999.9

- Au99.99 physical product 1 kg gold ingot fineness 999.9

- Au99.95 physical product 3 kg gold ingot fineness 999.5

- Au99.5 physical product 12.5 kg gold ingot fineness 995.0

- Au(T+D) deferred product 1 kg gold ingot fineness 999.5

- Au(T+N1) deferred product 1 kg gold ingot fineness 999.5

- Au(T+N2) deferred product 1 kg gold ingot fineness 999.5

- mAu(T+D) deferred product 100 gram bar fineness 999.9

The details of all MB and IB products are documented in Annex 2 of the Spot Trading Rules of the Shanghai Gold Exchange. In a future post we’ll discus the workings of deferred products.

As mentioned before the IB and its vault are located in the Shanghai FTZ. From the SGE website we know the IB Certified Vault is owned by the Bank Of Communications. According to China's state TV network CCTV this vault has a capacity of 1,000 tonnes.

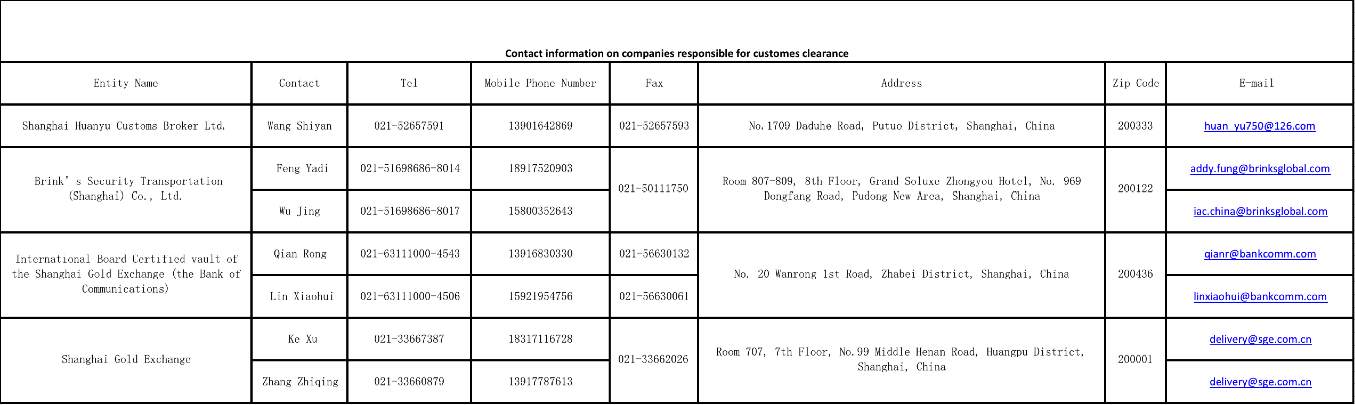

These are the details of the vault as disclosed by the SGE:

Malca-Amit, a global gold vaulting and transportation company, opened a 2,000 tonnes gold vault, their biggest vault on the planet, in the Shanghai FTZ in November 2013.

It could very well be this vault will also become an IB Certified Vault. If not, it would still be able to store 2,000 tones of gold in the Shanghai FTZ in addition to the 1,000 tonnes Vault of the Bank Of Communications. These huge amounts of vaulting capacity signal the threat of the Chinese gold market to the London Bullion Market that traditionally has been the global center of precious metals trading, but saw a large share of its bullion transported to China in recent years. Subsequently, the gold markets are moving East, the SGEI being a clear feat.

The Workings Of The Shanghai International Gold Exchange

Now we have a little bit more background information it’s time to put the pieces of the puzzle together. This is how the Exchange operates since September 18:

(Domestic) SGE customers can trade 12 gold products: 9 domestic gold products offered by the MB: Au50g, Au100g, Au99.99, Au99.95, Au99.5, Au(T+D), mAu(T+D), Au(T+N1), Au(T+N2) - and 3 international gold products offered by the IB: iAu100g, iAu99.99, iAu99.5. Some of these domestic customers, the ones blessed with a PBOC import license, can buy international (or domestic) physical products and have the bullion withdrawn form an IB Certified Vault to import the gold into the mainland. Or the gold is directly transferred (imported) from an IB Certified Vault to an MB Certified Vault. For domestic customers without an import license it's prohibited to withdrawal gold purchased through IB physical products.

(International) SGEI customers are allowed to trade 11 contracts: 8 domestic gold products offered by the MB: Au100g, Au99.99, Au99.95, Au99.5, Au(T+D), mAu(T+D), Au(T+N1), Au(T+N2) - and 3 international gold products offered by the IB: iAu100g, iAu99.99, iAu99.5. However, international customers can only deposit and withdrawal gold into and from IB Certified Vaults. This way international banks or investors trading IB physical products can not drain physical gold from China mainland. When international customers withdrawal gold from the IB Certified Vault they are only allowed to store the gold elsewhere in the Shanghai FTZ or export the gold from the Bonded Zone (FTZ), they are not allowed to export the gold into the mainland. The core business of the SGEI is to facilitate offshore gold trading in RMB. When a international customer collaborates with a domestic customer that holds an import license, he can deposit bullion into a IB Certified Vault for the domestic customer to buy through the MB.

The next quote is from an announcement published on the Chinese SGE website on September 16, one of my dear friends in the mainland was so kind to translate it:

...

No 3. The products that international members and international customers can trade include 3 International Board products and 8 Main Board products (Au99.99, Au99.95, Au100g, Au99.5, Au(T+D), mAu(T+D), Au(T+N1), Au(T+N2). However, they can only deposit and withdraw on the international products.

No 4. Domestic members and domestic customers can participate in trading all the International Board products, but can't deposit and withdraw on the International Board products (the members with import and export qualifications excluded).

...

I would like to clarify and strengthen the previous statements by quotes from the rulebooks. From the Detailed Rules for Physical Delivery of the Shanghai Gold Exchange:

Article 31

A Domestic Member or Domestic Customer may deposit physical bullions deliverable on the Main Board into a Main Board Certified Vault (“MB Certified Vault” for short); the member or customer is not permitted to deposit physical bullions deliverable on the International Board into any MB Certified Vault, nor may the member or customer deposit any physical bullions into any International Board Certified Vault (“IB Certified Vault” for short).

Article 32

An International Member or International Customer who has obtained an approval from the Exchange may deposit physical bullions deliverable on the International Board into an IB Certified Vault. Furthermore, an International Member or International Customer who has obtained an approval may deposit, within its permitted quota, physical bullions deliverable on the Main Board into an IB Certified Vault. An International Member or International Customer is not permitted to deposit bullions into an MB Certified Vault.

Article 36

Each Domestic Member and Domestic Customer may withdraw physical bullions deliverable on the Main Board from an MB Certified Vault, but is not permitted to withdraw physical bullions deliverable on the International Board from an MB Certified Vault. Except for those members and customers qualified to import and export gold, no Domestic Member or Domestic Customer is permitted to withdraw bullions from an IB Certified Vault. Any Domestic Member or Domestic Customer that has gold import and export qualifications may withdraw physical bullions deliverable on the International Board from an IB Certified Vault.

From the Operating Guidelines for International Board Deliveries Of the Shanghai Gold Exchange:

Article 9

To deposit bullions into Transaction Vaults, an International Member or International Customer must apply to the Exchange for Good Delivery accreditation. An accredited International Member or International Customer may then deposit physical bullions deliverable on the International Board into an IB Certified Vault. Furthermore, an International Member or International Customer whose application is approved may, within the permitted quota, deposit physical bullions deliverable on the Main Board into an IB Certified Vault.

Article 22

Any approved International Member or International Customer that sells physical bullions deliverable on the Main Board must engage a member which has the gold import/export qualification to carry out the import procedures on its behalf, and pay import agent fees for the fulfillment of such import procedures. The Exchange will issue a separate notice providing for the rate schedule and terms of payment of such fees.

From the Spot Trading Rules of the Shanghai Gold Exchange:

Article 99

Domestic members can trade on the IB. Where physical bullions are delivered and transported into the customs and deposited into a Main Board Certified Vault, the Exchange will further issue a SGE Execution Statement to the Domestic Member or the customer qualified to import gold for customs declaration purposes.

In my opinion it's likely more Chinese gold imports henceforth will enter through the newly launched SGEI, as more sellers of gold would like RMB in exchange - if the sellers prefer to receive USD the gold can still flow though the FTZ. The role of Hong Kong as the main conduit to China has been significantly diminished by the latest developments. Although I still expect net outflows from Hong Kong as they net imported almost 600 tonnes in 2013, which I assume was parked there in anticipation to the rise of the Asian gold market.

More in Part Two!

Koos Jansen

Copyright information: BullionStar permits you to copy and publicize blog posts or quotes and charts from blog posts provided that a link to the blog post's URL or to https://www.bullionstar.com is included in your introduction of the blog post together with the name BullionStar. The link must be taret="_blank" without rel="nofollow". All other rights are reserved. BullionStar reserves the right to withdraw the permission to copy content for any or all websites at any time.