London Bled 184t of Gold In December

When there is no more gold left in London to export the gold price is likely to go higher on strong global demand induced by economic headwind. At the time of writing the spot gold price is $1,251.80 per ounce, up 18 % year to date, while the S&P 500 is down 9 % year to date.

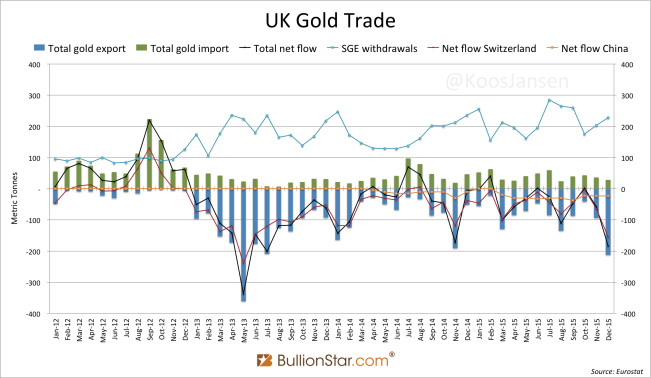

In a year that saw strong gold demand from China, in total withdrawals from the vaults of Shanghai Gold Exchange accounted for 2,596 tonnes in 2015, we turn our eyes to the most obvious place for sourcing such quantities of physical gold: London, the heart of gold wholesale market. Since the gold price came down sharply in April 2013 there has been a spectacular drain from the vaults in the London Bullion Market. In 2013 the UK net exported no less than 1,424 tonnes. Whilst net gold export from the UK in 2014 decreased to 452 tonnes, in 2015 the gold exodus from London has accelerated to 573 tonnes.

In December 2015 the UK has net exported 184 tonnes of gold, which is the third highest amount on record, according to data released by Eurostat. Net gold export in December was up 218 % from November and up 3,730 % from December last year. In December 2015 the UK gross exported 213 tonnes of gold – the second highest number on record, which is up 127 % from November and up 315 % from December 2014. The UK’s gross import accounted for 29 tonnes in December 2015, down 20 % from November and down 38 % from December 2014.

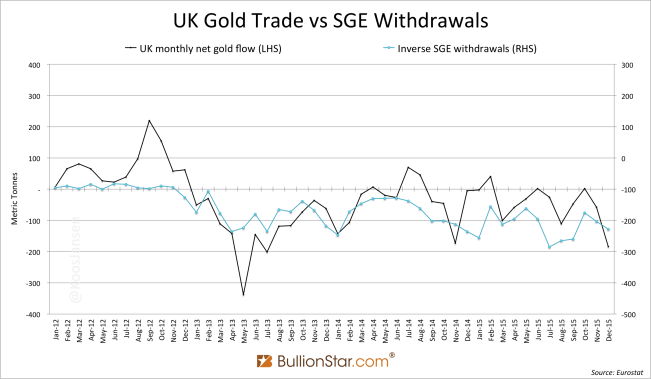

In the chart above we can see a clear correlation between the UK’s net gold export (“Total net flow", the black line) and China’s wholesale gold demand (measured by “SGE withdrawals", the turquoise line), implying gold import by China is supplied, directly or indirectly, by London. In the chart below we can see the same data as in the chart above, but now I’ve inverted “SGE withdrawals" and moved its scale on the right hand side so the correlation is even more clear.

Of total export from the UK in December 29 tonnes were net exported directly to China and a “surprising” 155 tonnes were net exported to Switzerland – from where 59 tonnes were net exported to China. From what we know China net imported at least 217 tonnes in December 2015, which is the highest amount ever (computed from data by countries that export gold to China, 29 tonnes from the UK, 59 tonnes from Switzerland and 129 tonnes from Hong Kong).

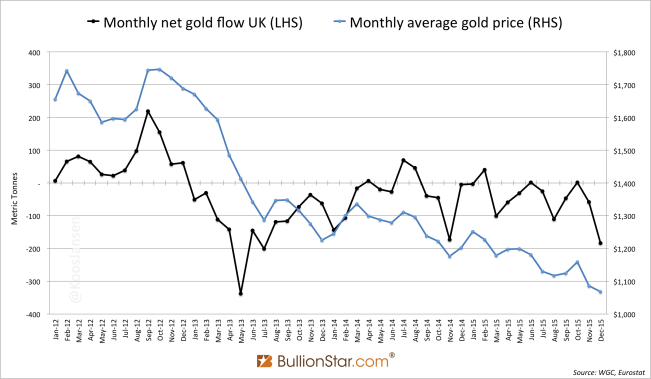

So how come the gold price has been going down from April 2013 until December 2015 while Chinese demand has been so strong? First of all, because the West has been a strong supplier of physical gold. In my view physical supply by the West and the gold price are linked. For instance, if we compare the average monthly gold price to net gold trade by the UK this interconnection becomes apparent.

We can see that whenever the UK is exporting gold the price is declining – and vice versa. Effectively, China has been able to purchase huge amounts of gold by the grace of London selling the metal. But what if London is running out and global demand picks up on the back of failing QE and negative interest rate policy (NIRP)? In that scenario likely the gold price would climb higher, which, coincidentally, is what we’re seeing at the time of writing. Year to date the gold price measured in US dollars has increased 18 % from $1,061 at 1 January to $1,251.80 at 11 February.

How much gold is left in London? We can make a rough estimate, although we don’t know how much of this residual is in weak or strong hands. Research by Ronan Manly from BullionStar and Nick Laird from Sharelynx pointed out there were roughly 6,256 tonnes of gold in London in June 2015. However, of this total at least 3,779 tonnes is monetary gold owned by central banks around the world stored at the Bank Of England (BOE), which is not for sale. The remaining 2,477 tonnes in non-monetary gold was potentially for sale (note, this number included 1,116 tonnes that was allocated as ETF gold in London at the time). In any case, we know now that from June until December the UK net exported 390 tonnes of non-monetary gold, which leaves approximately 2,087 tonnes in non-monetary gold in the UK as of 31 December 2015. Assuming the People’s Bank Of China hasn’t purchased some of this gold and covertly exported it to Beijing in the past months.

As long as London is selling gold and China is buying the price can go down. However, if London stops selling (or becomes a buyer) the price can make a reversal.

Popular Blog Posts by Koos Jansen

China’s Secret Gold Supplier is Singapore

China’s Secret Gold Supplier is Singapore

Audits of U.S. Monetary Gold Severely Lack Credibility

Audits of U.S. Monetary Gold Severely Lack Credibility

China Gold Import Jan-Sep 797t. Who’s Supplying?

China Gold Import Jan-Sep 797t. Who’s Supplying?

The Gold-Backed-Oil-Yuan Futures Contract Myth

The Gold-Backed-Oil-Yuan Futures Contract Myth

Estimated Chinese Gold Reserves Surpass 20,000t

Estimated Chinese Gold Reserves Surpass 20,000t

Did the Dutch Central Bank Lie About Its Gold Bar List?

Did the Dutch Central Bank Lie About Its Gold Bar List?

PBOC Gold Purchases: Separating Facts from Speculation

PBOC Gold Purchases: Separating Facts from Speculation

U.S. Mint Releases New Fort Knox Audit Documentation

U.S. Mint Releases New Fort Knox Audit Documentation

China Net Imported 1,300t of Gold in 2016

China Net Imported 1,300t of Gold in 2016

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Why SGE Withdrawals Equal Chinese Gold Demand and Why Not

Koos Jansen

Koos Jansen