Tracking ETF & BoE Gold Held in London

Just over a year ago, gold researchers Nick Laird, Bron Suchecki, Koos Jansen and myself took a shot at estimating how much physical gold was accounted for in London within the gold-backed ETFs and under Bank of England custody. The results of that exercise are highlighted in September 2015 articles “How many Good Delivery gold bars are in all the London Vaults?….including the Bank of England vaults”, and “Central Bank Gold at the Bank of England”, and also on Nick Laird’s website in a post titled “The London Float" which contains some very impressive charts that visualize the data. Some of the latest updated versions of these charts from www.goldchartsrus.com are featured below.

Given that it’s now just over a year since that last set of calculations, it made sense at this point to update the data so as to grasp how many Good Delivery golds bars held in London is spoken for in terms of ownership, versus how much may be unaccounted for. Estimating gold held in London vaults is by definition a tricky exercise, since it must rely on whatever data and statements are made available in what is a notoriously secret market, and there will usually be timing mismatches between the various data points. However, using a combination of published sources from the Bank of England, the London Bullion Market Association (LBMA), the Exchange Traded Fund websites, and UK gold import/export data, it is possible to produce some factual numbers.

In the Bank of England vaults

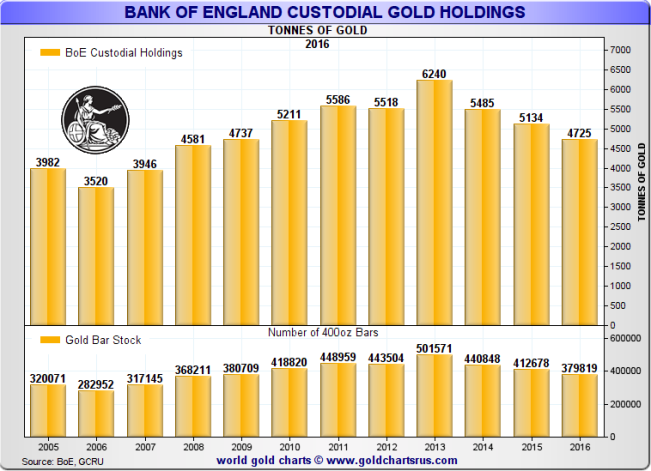

Exactly once per year, the Bank of England publishes a snapshot of how much gold it is holding in custody for its central bank and commercial bank customers. This snapshot is featured in the Bank’s annual report which is usually published around July each year, and reports on its financial year-end, as of end of February. In its 2016 Annual Report, the Bank of England states (on page 31) that:

“At end-February 2016, total assets held by the Bank as custodian were £567 billion (2015: £514 billion), of which £135 billion (2015: £130 billion) were holdings of gold"

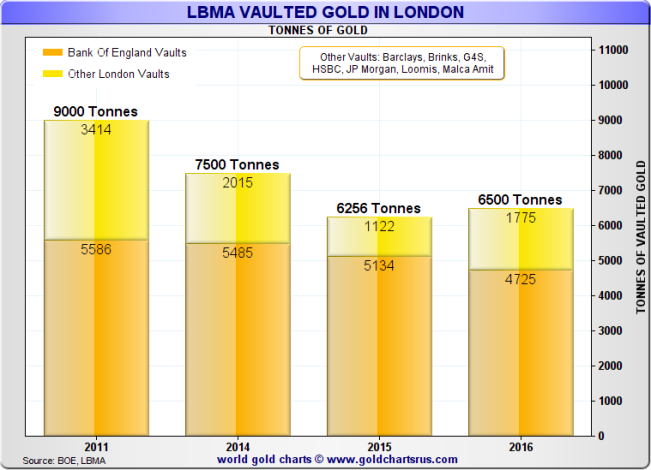

With an afternoon LBMA Gold Price fix of £888.588 on Monday 29 February 2016, this equates to 151,926,427 fine troy ounces of gold, or 4725 tonnes held in custody at the Bank of England. This equates to approximately 380,000 London Good Delivery gold bars, each weighing 400 fine troy ounces.

The corresponding figure for end of February 2015 was £130 billion, which, valued at the afternoon fix on that day of £787.545 per ounce, equalled 5,134 tonnes. Therefore between the end of February 2015 end of February 2016, the amount of gold held in custody by the Bank of England fell by 409 tonnes. Since, according to World Gold Council data, there were no central bank sellers of gold over that period apart from Venezuela whose gold was predominantly held in Venezuela at that time, then most of this 409 tonne decline must be either due to unreported central bank sales, central bank gold repatriation movements, London bullion bank sales, or some combination of all three.

The year-on-year drop of 409 tonnes came after a previous decline of 350 tonnes to end of February 2015, and before that a drop of 755 tonnes between February 2013 and February 2014. So overall between February 2013 and February 2016, the amount of gold held in custody in the Bank of England’s vaults fell by 1,514 tonnes.

LBMA Ballpark: 6,500 tonnes in London

Up until at least October 2015, the vaulting page on the LBMA website stated that:

“In total it is estimated that there are approximately 7,500 tonnes of gold held in London vaults, of which about three-quarters is stored in the Bank of England."

This is based on a Wayback Machine Internet Archive page cache from 9 October 2015.

The current version of that page on the LBMA website now states:

“In total it is estimated that there are approximately 6,500 tonnes of gold held in London vaults, of which about three-quarters is stored in the Bank of England.”

The earliest Internet Archive page cache mentioning 6,500 tonnes is from 8 February 2016. So sometime between October 2015 and February 2016, the LBMA changed its ballpark figure, revising it down by 1000 tonnes. Wayback Machine Archive web crawlers usually update a web page following a change to that page, so its likely that the revision to 6,500 tonnes was done nearer February than October. Using a figure from a LBMA website page is admittedly quite general, but at least it’s an anchor, and someone at the LBMA saw fit to make that actual change from 7,500 tonnes to 6,500 tonnes. In June 2015 (as some readers might recall), the LBMA had said that there were 500,000 Good Delivery gold bars in all the London vaults, which is approximately 6256 tonnes, so perhaps the 6500 tonne estimate was partially based on this statistic from mid-year 2015 that the LBMA was playing catch-up with.

With 6,500 tonnes in London vaults, ~ 75% of which is at the Bank of England, this would mean 4,875 tonnes at the Bank of England, and another 1,625 tonnes at other (commercial) gold vaults in London, mostly at HSBC’s and JP Morgan’s vaults. As per the Bank of England’s annual report as of 29 February 2016, we know now that there were 4,725 tonnes in custody at the Bank, so the LBMA ballpark of 4875 is actually very close to the actual 4725 tonnes reported by the Bank, and the difference is only 150 tonnes. Lets’s move on to the vaulted gold held in London but held outside the Bank of England vaults.

ETF Gold held in London

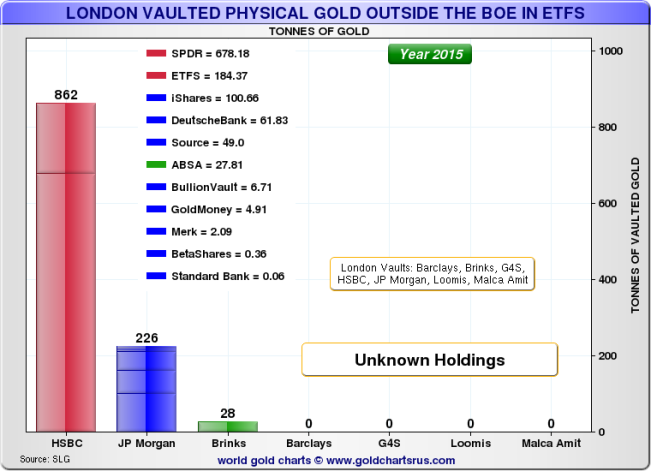

In the September 2015 calculation exercise, we estimated that there were 1,116 tonnes of gold held in the London vaults within a series of gold-backed Exchange Traded Funds.

The known ETFs and other companies that hold their Good Delivery bar gold in London are as follows:

- SPDR Gold Trust: GLD. Custodian HSBC London, all GLD gold held at HSBC vault

- iShares Gold Trust: IAU. Custodian JP Morgan, majority of IAU gold held in London

- iShares Physical Gold ETC: Custodian JP Morgan, code SGLN

- ETF Securities: Six separate ETFs – their short codes are PHAU, GBS, ASX GOLD, HMSL, PHPM, and GLTR. Custodian HSBC London

- SOURCE: Custodian JP Morgan, all gold held in London

- Deutsche Bank: There are 5 Deutsche Bank ETFs that store gold in London. Custodian is JP Morgan London

- ABSA/Newgold: Custodian Brinks, London

- BullionVault: Some of BullionVault customer gold is held in London

- GoldMoney: *It’s not clear how much gold Goldmoney stored in London so the previous figure from September 2015 is used again

- VanEck Merk Gold Trust: Custodian JP Morgan London

- Betashares: Custodian JP Morgan, London

- Standard Bank AfricaGold ETF: Custodian JP Morgan London

The 1,116 tonnes of gold ETF holdings in London, calculated in September 2015, were as follows, with the SPDR Gold Trust accounting for the largest share:

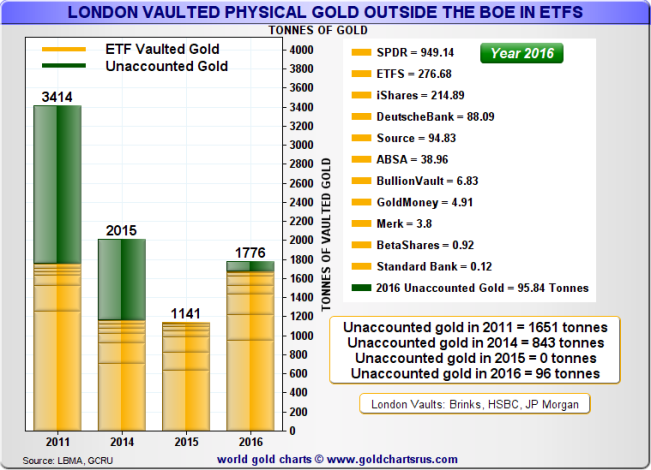

The total figure for all gold held in London that we used in September 2015 was the 6,256 tonne figure implied by the LBMA’s 500,000 gold bars statement from June 2015. With 6,256 tonnes in total, and 5,134 tonnes at the Bank of England (as of end February 2015), this left 1,122 tonnes in London but “not at the Bank of England“, which implied that there was nearly no gold in London outside the Bank of England that was not accounted for by ETF holdings. in other words the ‘London Gold Float’ looks to have been near zero as of September 2015.

Assuming 6,500 tonnes of gold held in London in February 2016, and with 4,725 tonnes at the Bank of England in February 2016, we can repeat this exercise and say that the would leave 1,775 tonnes of gold in London but “not at the Bank of England“, as the following chart shows:

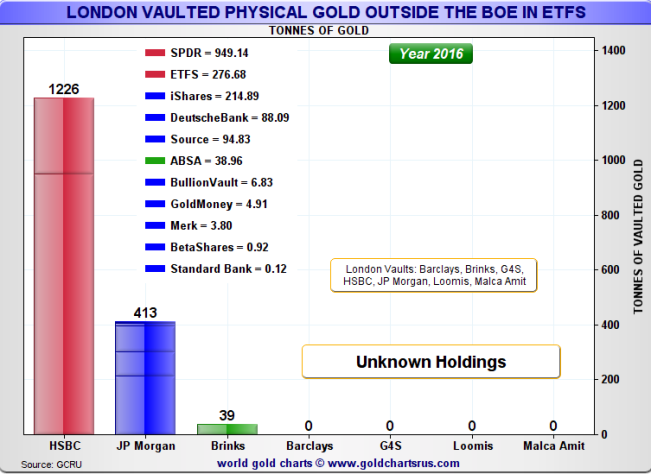

Its well-known by now that the tide of significant gold ETF outflows that occurred in 2015 suddenly turned to very strong inflows into gold ETFs beginning in early 2016. Although our gold ETF holdings data was updated using holdings information as of 30 September 2016, it’s still worth seeing how well the latest London holdings of the gold ETFs help to explain this 1775 tonnes “not in the Bank of England" figure. As it turns out, as of the end of September 2016, the above ETFs collectively held 1,679 tonnes of gold, so right now, if there were 1775 tonnes of gold in London outside of the Bank of England, the ETF holdings would explain all but 96 tonnes of this total.

Taking a quick look at some of the individual ETF holdings, the massive SPDR Gold Trust is currently holding around 950 tonnes of gold in London. The iShares figure reported in the charts of 214.89 tonnes comprises 2 components a) the London held gold within IAU (which can be seen in this daily JP Morgan weight list), and b) the gold bars held in iShares trust SGLN. The bulk of the ETF Securities figure of 276.68 tonnes represents gold held in PHAU (over 150 tonnes), and GBS (over 100 tonnes). The Deutsche Bank total is quite hard to calculate and comprises gold held in 5 Deutsche bank ETFs. Nick Laird receives daily holdings files for these ETFs from Deutsche Bank and performs a number of calculations such as fractional ounces per ETF unit to arrive at a total figure of 88 tonnes. The SOURCE and ABSA ETFs make up the vast majority of the remainder, with the other entities listed, such as BetaShares and Standard Bank ETF, being immaterial to the calculation.

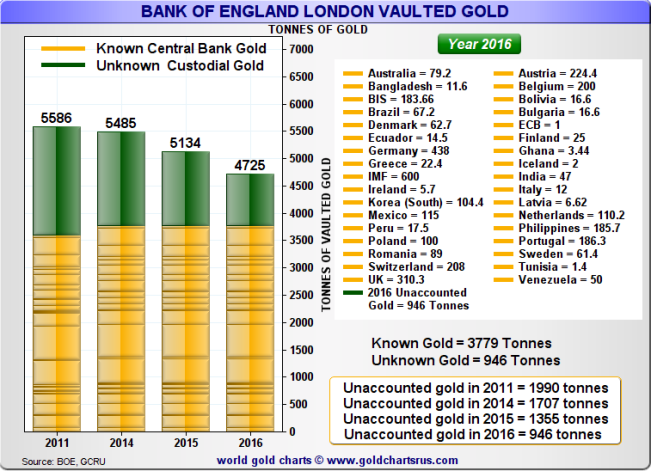

Central Bank gold at the Bank of England

For the purposes of this exercise, data on central bank gold holdings at the Bank of England does not need to be updated since there hasn’t been any reported gold buying or selling activity by any of the relevant central banks since September 2015 (except for Venezuela), so the ‘known figure’ of 3779 tonnes attributed to identified banks in September 2015 remains unchanged. If anything, since the Bank of England revealed last February that its gold under custody fell to 4,725 tonnes, it means that there are now approximately 946 tonnes of gold at the Bank of England that are not explained by known central bank holders.

Given that many central banks around the world will not cooperate in confirming where they store their foreign stored gold, then there are definitely additional central banks storing gold in the Bank of England vaults which would reduce this 946 tonnes of gold with unknown ownership. Therefore some of this total is unknown central bank gold holdings. Some is presumably also gold and borrowed gold held by bullion banks that have gold accounts at the Bank of England. Given that the Bank of England and the LBMA bullion banks maintain a total information blackout about the real extent of the gold lending market out of London, it is difficult to know how much borrowed gold is being held at the Bank of England by bullion bank account holders.

Some of the growth in the SPDR Gold Trust gold holdings this year looks to have been sourced from gold originating from the Bank of England, as was detailed in a July BullionStar article “SPDR Gold Trust gold bars at the Bank of England vaults“, which highlighted that the Bank of England was a subcustodian of the SPDR Golf Trust during Q1 2016. As a SPDR Gold Trust filing stated:

“During the quarter ended March 31, 2016, the greatest amount of gold held by subcustodians was approximately 29 tonnes or approximately 3.8% of the Trust’s gold at such date. The Bank of England held that gold as subcustodian.“

Year to Date ETF changes and UK Gold Imports

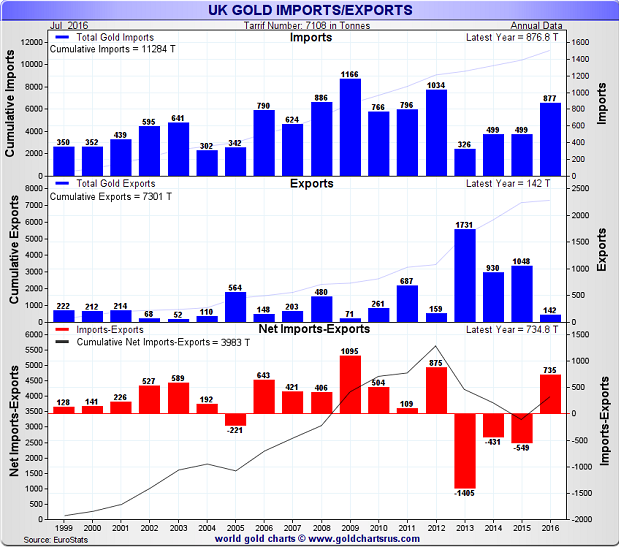

It’s important to highlight that the 6,500 tonnes figure reported by the LBMA and the 4,725 tonne figure reported by the Bank of England relate to the February 2016 period, while the ETF gold holdings totals calculated above are from the end of September 2016. So there is a date mismatch. Nick Laird has calculated that during the February to September 2016 period, the London gold ETFs added 399 tonnes of gold, and during the same period the UK net imported (imports – exports) more than 800 tonnes of non-monetary gold. Given the apparent low float of gold in London late last year, its realistic to assume that gold inflows into the London-based ETFs this year were mostly sourced from non-monetary gold imports into the UK because there was apparently no other gold at hand from which to source the ETF gold inflows. ETF demand would also help explain the drivers of UK gold imports year-to-date. Note that monetary gold imports (central bank gold trade flows) are not reported by the respective trade bodies since the opaque basket of deplorables (i.e. central bankers) get an unfair exemption, therefore the 800 tonnes of net gold imports into the UK refers to non-monetary gold imports.

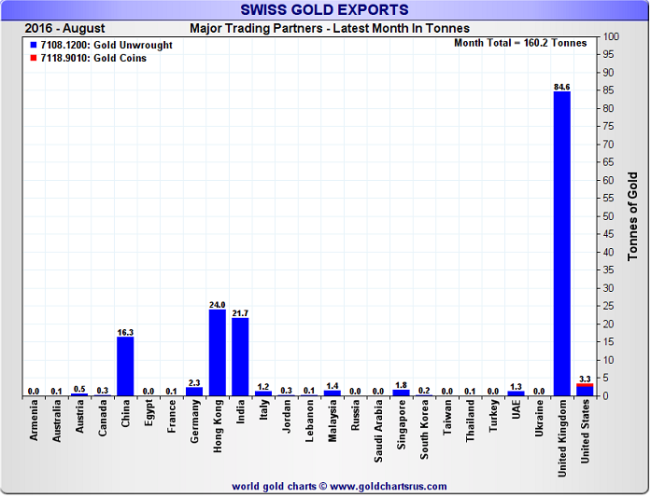

According to the latest comprehensive trade statistics, from January to July 2016 inclusive the UK net imported 735 tonnes of gold from the Rest of the World. To this figure we can add another 84.6 tonnes of gold that the UK net imported from Switzerland in August 2016. This gives total UK gold imports up to August 2016 inclusive of 819.6 tonnes, hence the statement, the UK net imported over 800 tonnes of gold year-to-date.

If 399 tonnes of the 800 tonnes of non-monetary gold imported into the UK during 2016 was channeled into the holdings of gold-backed ETFs, this would still mean that the ‘London Float’ of gold could have been augmented by approximately 400 tonnes year-to-date. However, since most non-monetary gold imports into the UK are for bullion bank customers such as Scotia and Barclays, some of these extra imports could have been for repaying borrowed gold liabilities to central bank customers, and the quantity of gold now held at the Bank of England may be higher than reported by the Bank last February.

In summary, given the large UK gold imports year-to-date, there may now be over 7,000 tonnes of Good Delivery gold bars held in London vaults. But the fact that very large quantities of gold bars had to be imported into the London market during 2016 does suggest that our calculations from September 2015 were valid and that there was a very low float of gold in the London market. This float may now be a few hundred tonnes higher given the imports, but there is still an unquantifiably large number of claims in the form of ‘unallocated gold’ holdings in the London market which are liabilities against the LBMA bullion banks.

Remember that the London Gold Market trades nearly 6000 tonnes of predominantly paper gold each and every day. The latest LBMA ‘gold’ clearing statistics show that on average, 18.8 million ounces (585 tonnes) of ‘gold’ was cleared per trading day in September 2016 which on a 10:1 trading to clearing ratio equates to 5,850 tonnes traded per day, and 128,000 tonnes traded during September. So the LBMA administered market nearly trades as much ‘gold’ connected transaction per day as is held in the entire London vaulting network.

If gold demand from the Rest of the World ticks up, such as from India, then the London market will not have the luxury of being able to import large quantities of gold in the absence of that excess demand putting upward pressure on the gold price. Until then, the London Gold Market looks likely to continue its physical re-stock with one hand, while trading leveraged paper gold with the other hand, all the while rolling over outstanding borrowed central bank gold obligations, such as the short-term gold deposits held by Banco Central de Bolivia, which will be the subject of an upcoming case study into the hidden London gold lending market consortium.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

Surging Silver Demand to Intensify Structural Deficit

Surging Silver Demand to Intensify Structural Deficit

Ronan Manly

Ronan Manly 2 Comments

2 Comments