Poland’s Central Bank Ramps Up Gold Purchases

Poland’s central bank, Narodowy Bank Polski (NBP), has been back buying gold again during the month of July, and in a big way.

Latest “official reserve assets” data from the NBP website, and the IMF’s International Financial Statistics (IFS) database, show that at the end of July 2023, the NBP added more than 22 tonnes of monetary gold to its gold holdings compared to the end of June 2023.

This means that the NBP has been buying gold for 4 consecutive months now, and over that time has added 71 tonnes of gold to its monetary gold reserves: 14.93 tonnes during April, 19.91 tonnes during May, 13.69 tonnes during June, and now another 22.39 tonnes during July.

This also means that July’s gold buying by the Polish central bank has been the largest monthly addition by the bank so far this year. Following July’s gold purchases, the NBP now holds 299.47 tonnes of gold, within a whisker of 300 tonnes.

With 300 tonnes of sovereign gold reserves, this also puts Poland into the Top 20 sovereign and supranational holders of gold worldwide, in 20th position, and in 18th position when excluding the IMF and ECB.

The gold on the Polish central bank’s balance sheet is now worth € 17 billion (at the end of July), up from € 15.65 billion (at the end of June). In US dollar terms, Poland’s gold is now worth US$ 18.83 billion (at the end of July), up from US$ 16.96 billion (at the end of June).

The July purchase of 22.4 tonnes of gold also boosts the NBP’s “Gold as a % of Total Reserve Assets" ratio from 9.4% to 10.3%, and although now in the double digits, this is still far less than the “Gold as a % of Total Reserve Assets" of most of the large gold holding central banks of European Union countries, such as Germany, France, Italy, Netherlands, Belgium, Austria, Portugal and Spain.

Predictions coming True

The July gold buying by the NBP shouldn’t come as any surprise for those that read the recent BullionStar article “Poland’s 50/50 gold buying: 50 tonnes bought over 3 months, but another 50 tonnes to go”.

That article, dated 2 August 2023, explained that the NBP has a plan to buy at least 100 tonnes of gold this year (probably in London), and then promptly fly this 100 tonnes of gold back from London to Poland. To quote:

“NBP’s 100 tonnes of gold buying is now materializing in 2023, with 48.5 tonnes already complete. Similar to 2019, the NBP is most likely buying its gold in London in the interbank market with the help of the Bank of England.

At the current rate of accumulation over April – June 2023, this means that the Polish central bank could buy another 50 tonnes between July 2023 and September 2023.”

That part of my prediction above is coming along right on schedule.

And the second part of my prediction is that the Poles will fly this newly acquired 100 tonnes of gold back to Poland (mostly to the NBP Treasury building in Poznań) using the same air cargo and security transport logistics that they did during 2019. As explained in the same article:

“Similar to 2019, and in line with what Glapiński [NBP President Adam Glapiński] said that ‘we want to buy at least another 100 tonnes of gold and keep it in Poland as well’, this additional 100 tonnes of gold will then be repatriated by air from London back to Poland, probably during the last quarter of 2023, possibly starting in October.”

The Data on July’s NBP Gold Buying

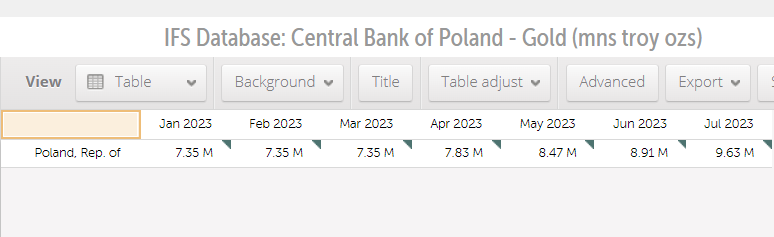

Each month, the Polish central bank, like many central banks across the world, contributes its monetary gold holdings information (in millions of troy ounces to 2 decimal places) to the International Financial Statistics (IFS) database of the international Monetary Fund (IMF). In turn, the World Gold Council (WGC) bases its central bank gold holdings data on the IFS data (for countries that contribute to the IFS).

However, this IFS data is lagged somewhat, and for example, for Poland’s July gold holdings, was only updated to the IFS database on Friday 10 August.

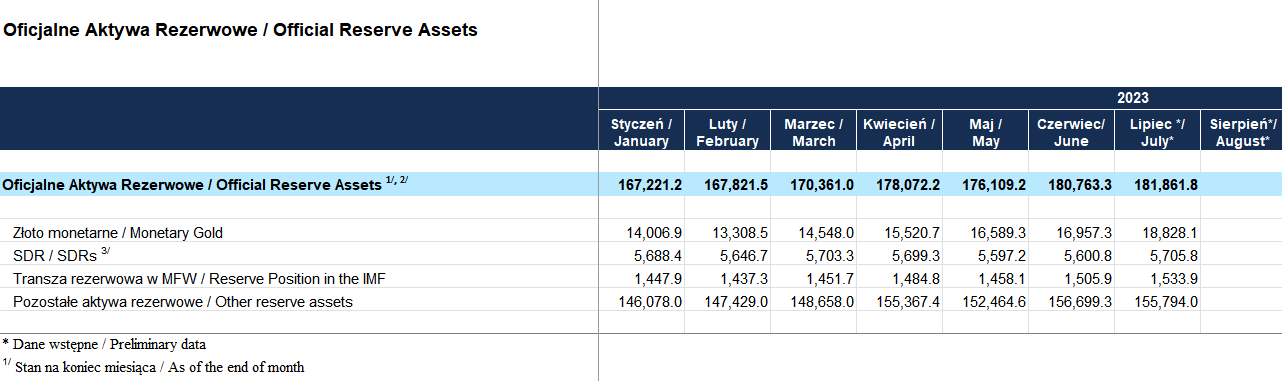

However, the Polish central bank directly publishes updated monetary gold holdings with a shorter lag, just one business week after month end. The NBP does this via its publication of monthly official reserve assets, which this month was published on Monday 7 August.

Looking at the July 2023 release of the NBP’s official reserve asset report (which is an Excel report – see here), we see in tab 3 (US dollar version) that the value of Poland’s monetary gold holdings was US$ 18,828.1 million at the end of July. This is a month end valuation based on the LBMA Gold Price on 31 July 2023.

For some reason, the NBP uses the ‘AM’ (morning) LBMA Gold Price for its month end valuation and not the ‘PM’ (afternoon) version, and on 31 July, the AM LBMA Gold Price (settled by a bullion bank auction of unallocated gold credit) was US$1955.55 per troy ounce.

This means that on 31 July, Poland’s central bank held 9,628,033 ozs of gold, or 299.47 tonnes. You can see this this is identical to the number now reported in the IFS database, 9.63 million ozs.

Therefore, we have a way of finding out about Poland’s gold buying, just one business week after month-end, via the NBP Official Reserve Assets reports. Just for validation of this approach, we can back test this calculation based on the June and May monetary gold values on the same NBP report and then compare it to the IMF IFS data.

In June 2023, the NBP official reserve asset report shows that the Polish central bank held monetary gold (Złoto monetarne) worth US$ 16,957.3 million. The AM LBMA Gold Price on 30 June was US$ 1903.55. This equates to 8,908,250 ozs or 277.08 tonnes.

The IMF IFS database shows that at the end of June 2023, Poland held 8.91 million ounces of gold. So the NBP numbers and IFS numbers are therefore the same.

Similarly for May, the NBP official reserve asset report shows that the Polish central bank held monetary gold worth US$ 16,589.3 million. The AM LBMA Gold Price on 30 June was US$ 1959.0. This equates to 8,468,249 ozs or 263.39 tonnes.

The IMF IFS database shows that at the end of May 2023, Poland held 8.47 million ounces of gold. Again we see that the NBP numbers and IFS numbers are therefore the same, and that based on the official reserve assets report, So there is no need to wait for the IMF IFS database to be updated. Anyone can look at the NBP Official Reserve Assets report next month at the end of the first business week of September.

We also see from these calculations that the NBP, for some reason, always uses the morning auction (AM) LBMA Gold Price as a month end valuation, and not the afternoon (PM) auction price.

Why is Poland Buying so much Gold?

To understand why Poland continues to ramp up it’s gold purchases, you need to understand the mind of Polish central bank president Adam Glapiński, and also that the NBP’s gold buying is part of an agreed plan of the NBP’s Management Board.

To illustrate, Glapiński wrote an article in July 2021 for CFI.co (“Capital Finance International"), an international business / finance / economics magazine, aptly titled “Investing in the long term: gold as a pillar of the NBP’s reserve management strategy”, and which can be seen in English here.

Glapiński writes:

“As a public investor, NBP places primary weight not on maximizing returns but on preserving liquidity and security of its endowment. The underlying idea is simple: if the FX reserves are not deployed to combat some financial stability or balance-of-payments emergency, they are to be preserved, preferably increased and passed on to another generation.

With such a strict investment mandate, it is perhaps no wonder that NBP considers gold as a special component of its official reserve assets. After all, the characteristics of gold are very well aligned with the precautionary role of maintaining foreign reserves and preserving capital in the long term, weathering periods of stress and varied market conditions.

Gold offers some unique investment features – it is devoid of credit risk, it is not easily “debased” by monetary or fiscal mismanagement of any country, and while its overall supply is scarce its physical features ensure durability and almost indestructibility. For all these reasons gold is considered as an ultimate strategic hedge.

The practical side of it all is that gold acts like a safe haven asset, in that its value usually grows in circumstances of increased risk of financial or political crises or turbulences. In other words, the price of gold tends to be high precisely at times when the central bank might need its ammunition most.”

Could you imagine the US Fed’s Jerome Powell writing anything of this nature? Absolutely not, well at least not in public.

The Polish central bank president goes on to say that:

“Despite the purchase of significant gold reserves in the recent period, the NBP has not yet said the last word on this matter. The foreign exchange reserve management strategy adopted by the Management Board of Narodowy Bank Polski in 2020 assumes a further increase in gold resources, and the scale and pace of this process will depend on the dynamics of official reserve assets and market conditions.”

So there you have it, straight from the horse’s mouth (of Glapiński)!

This “further increase in gold resources" is what we are now witnessing with Poland’s 71 tonnes of gold buying between April and July, with more expected to come in August and September.

Conclusion

Given that Poland now has 300 tonnes of sovereign gold holdings and is targeting a buying total of 100 tonnes this year (of which 71 tonnes has already been made), the additional purchases over the next few months will leave the NBP with 329 tonnes of gold.

This is no mean feat, as Polish monetary gold reserves will then surpass those of the sizable sovereign gold holders of the United Kingdom (310 tonnes), Kazakhstan (313 tonnes), and Saudi Arabia (323 tonnes). This is sure to raise some eyebrows in London, Astana and Riyadh, and commentary from their respective medias.

Poland’s 71 tonnes of gold buying so far this year also puts it comfortably in third place in the league table of known sovereign gold buying for 2023, with only Singapore (71.7 tonnes of gold added in 2023), and China (126 of gold added in 2023) having bought more.

If the Monetary Authority of Singapore (MAS) fails to report additions to its gold reserves over July and August (as expected), and the Polish central bank continues to add gold during August (as expected), then Poland will soon officially become the world’s second largest known sovereign gold buyer in 2023, second only to the gold powerhouse China. This will also surely raise some eyebrows in the capitals of European Union countries and at the European Central Bank (ECB) in Frankfurt.

When Poland completes its 100 tonnes of gold buying (probably by the end of September, expect this 100 tonnes of gold (8000 gold bars each weighing 400 ozs) to be flown out of London and into Poznań and Warsaw (probably during October – December).

Most of that gold will then up in the NBP’s Treasury building on Kaliska Street in Poznań, the fortress like building which you can see right here, on Google Earth.

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

Surging Silver Demand to Intensify Structural Deficit

Surging Silver Demand to Intensify Structural Deficit

Ronan Manly

Ronan Manly 2 Comments

2 Comments