ETF Firm Warns Buying Silver Will Harm Hedge Funds & Banks

Just over a week ago, we showed you how, following the #SilverSqueeze triggered surge in demand for physical silver, the 14 ETFs which claim to hold silver in LBMA vaults in London between them accounted for over 28,000 tonnes or 85% of all the silver said to be in those London vaults. And that the biggest of these ETFs, the infamous Blackrock managed iShares Silver Trust (SLV), which has JP Morgan London as custodian, accounted for over 70% of this total.

And just a few days ago we showed you how, following the #SilverSqueeze induced surge in SLV trading from 29 January to 02 February on NYSE Arca, the very same SLV had quietly and without fanfare amended its Prospectus on 03 February conceding that there may not be enough silver bars available in London or elsewhere to add to the Trust, when it stated in its filing to the SEC that:

“The demand for silver may temporarily exceed available supply that is acceptable for delivery to the Trust, which may adversely affect an investment in the Shares.

To the extent that demand for silver exceeds the available supply at that time, Authorized Participants may not be able to readily acquire sufficient amounts of silver necessary for the creation of a Basket.

It is possible that Authorized Participants may be unable to acquire sufficient silver that is acceptable for delivery to the Trust for the issuance of new Baskets due to a limited then-available supply coupled with a surge in demand for the Shares.

…In such circumstances, the Trust may suspend or restrict the issuance of Baskets.”

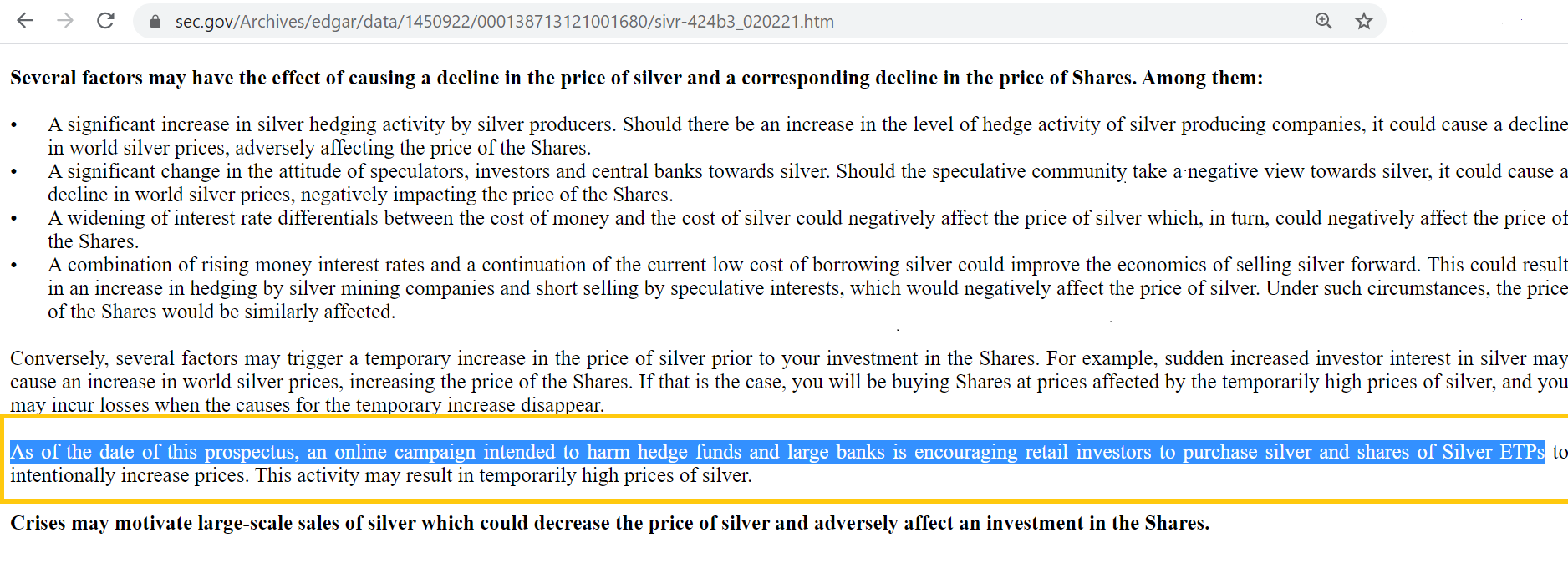

But as it turns out, as was to be expected, SLV was not the silver ETF to move to panic stations the week before last, for at the exact same time on 02 February, the Aberdeen Standard Physical Silver Shares ETF (SIVR), also using JP Morgan London as metal custodian and also traded on NYSE Arca, quietly amended it’s Prospectus to both sinister and comical effect, and in stealthy fashion uploaded a new version of it’s Prospectus to the SEC website, inserting the following wording on page 6:

“As of the date of this prospectus, an online campaign intended to harm hedge funds and large banks is encouraging retail investors to purchase silver and shares of Silver ETPs to intentionally increase prices. This activity may result in temporarily high prices of silver.”

Let the above sink in. You may need to read it a couple of times. For apart from showing panic about the effectiveness of the Reddit #SilverSqueeze forums such as r/WallStreetSilver, we would wager that never in the history of Wall Street has the author of a Prospectus shown it’s true colors more than the above.

For if you previously did not know whose side Aberdeen Standard Investments was on in the battle for silver, well, simply put, now you do. And if there was ever an award for Snitch of the Year in torpedoing its own client base, Aberdeen Standard would likely win this one hands down.

But it gets better, for Aberdeen Standard, operator of SIVR (which claims to hold 1140 tonnes silver in London) and whose very rationale is to offer investors exposure to the silver price, seems to have a fundamental problem with the very silver price rising. Why else would Aberdeen Standard be afraid of a market force that “intentionally increases prices”? Unless of course that’s not what the ETF operator actually wants to happen.

But it gets even better, for on page 7 of the amended SIVR Prospectus, Aberdeen Standard again confirms whose side it is really on and specifically why it is so scared of this online campaign to free the silver market from the clutches of the hedge funds and banks.

For on 02 February, in the amended text under a newly inserted heading of:

“A possible ‘short squeeze’ due to a sudden increase in demand of Shares that largely exceeds supply may lead to price volatility in the Shares."

The Prospectus also added that:

“As of the date of this prospectus, the Fund and other Silver ETPs are experiencing a sudden increase in demand of shares following an online campaign to harm hedge funds and large banks with substantial short exposures to silver.

The campaign encourages retail investors to purchase shares of Silver ETPs as well as physical silver in order to intentionally create a short squeeze. This activity could result in temporarily inflated prices of Shares and the difference between trading price and NAV per share may widen.“

So there you have it, one of the biggest silver-backed ETFs in the world apart from SLV, with a claimed 36.7 million ozs (1140 tonnes) of silver stored in London with custodian JP Morgan, is worried not about the interests of its investors, but about the outstanding short interest silver positions of the hedge funds and large banks. And out of concern for these entities that are short, Aberdeen Standard is fearful of market forces which will ‘intentionally increase silver prices’.

Those with a sharp eye may also ponder why Aberdeen Standard is worried about a divergence between the trading price of SIVR and its NAV. And why would that be? Maybe it’s because the date of 03 February is the last time SIVR added any new silver holdings, a date on which it’s claimed silver holdings rose from 35.6 million ozs to 36.6 million ozs. But no increase in silver holdings since then.

And also that none of the claimed SIVR silver is held in the vault of the infamous custodian JP Morgan in London, but all of the claimed silver is said to be held in the vaults of 3 SIVR sub-custodians, namely, Brinks, Malca-Amit and Loomis, the same 3 sub-custodians that SLV tapped in early February to pad out its bar list in the wake of a so called 3,400 tonnes increase in SLV silver allocations.

So after all, maybe the SIVR panic of 02 February is not so different to that of the iShares Silver Trust (SLV) of 03 February, which as a reminder and to come full circle, warned in its prospectus change that “The demand for silver may temporarily exceed available supply that is acceptable for delivery.”

Popular Blog Posts by Ronan Manly

How Many Silver Bars Are in the LBMA's London Vaults?

How Many Silver Bars Are in the LBMA's London Vaults?

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

ECB Gold Stored in 5 Locations, Won't Disclose Gold Bar List

German Government Escalates War On Gold

German Government Escalates War On Gold

Polish Central Bank Airlifts 8,000 Gold Bars From London

Polish Central Bank Airlifts 8,000 Gold Bars From London

Quantum Leap as ABN AMRO Questions Gold Price Discovery

Quantum Leap as ABN AMRO Questions Gold Price Discovery

How Militaries Use Gold Coins as Emergency Money

How Militaries Use Gold Coins as Emergency Money

JP Morgan's Nowak Charged With Rigging Precious Metals

JP Morgan's Nowak Charged With Rigging Precious Metals

Hungary Announces 10-Fold Jump in Gold Reserves

Hungary Announces 10-Fold Jump in Gold Reserves

Planned in Advance by Central Banks: a 2020 System Reset

Planned in Advance by Central Banks: a 2020 System Reset

Surging Silver Demand to Intensify Structural Deficit

Surging Silver Demand to Intensify Structural Deficit

Ronan Manly

Ronan Manly 29 Comments

29 Comments